AP Macroeconomics Vocabulary

1/121

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

122 Terms

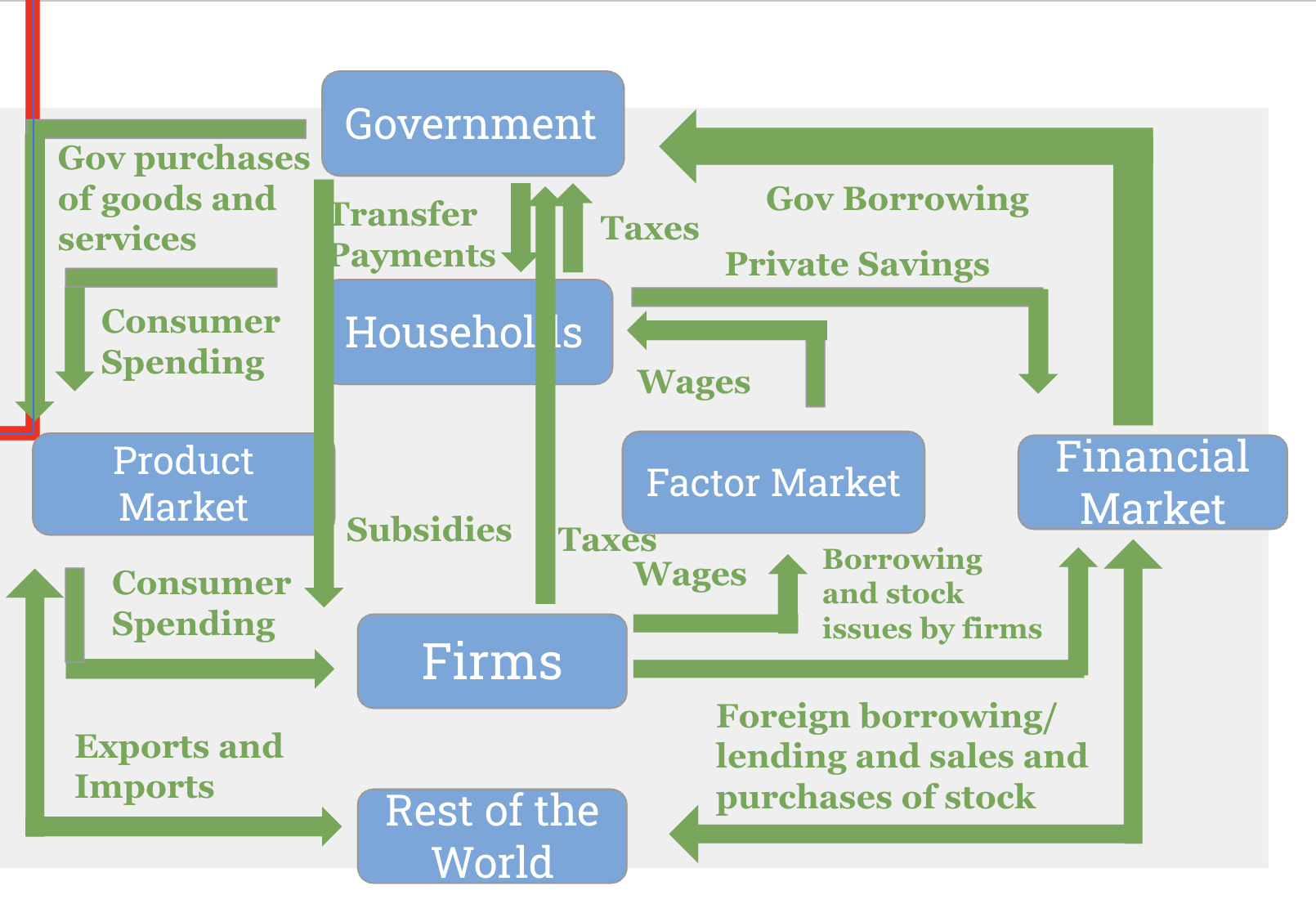

Circular Flow Model

Gross Domestic Product (GDP)

The total market value of all final goods and services produced in a nation’s economy during a given year

Intermediate Goods and Services

Goods and services bought from one firm by another firm to be used as inputs in the production of final goods and services

Aggregate Spending Approach

C + G + I + (X-M)

Personal Consumption Expenditures

Includes durable goods, non-durable goods and services

Domestic Investment

All final purchases of machinery, equipment, and tools by businesses; construction; and changes in business inventories

Government Spending

Includes all direct government purchases of resources (labor in particular)

Income Approach

Rent + Wages + Profit + Interest

National Income

All income earned by American-supplied resources, whether here or abroad

Value-Added Approach

The value of a producer’s sales minus the value of its purchases of inputs

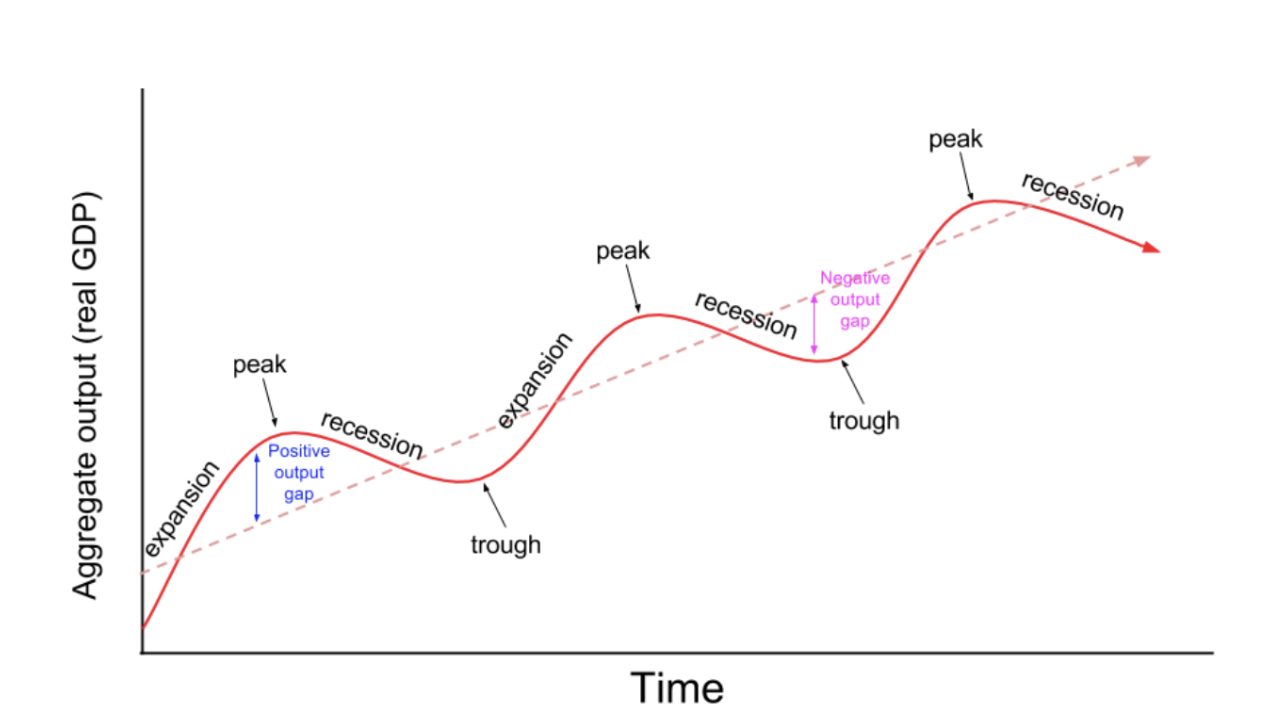

Business Cycle

Expansionary Gap

Output is rising and unemployment is declining

Recessionary Gap

Output is declining and unemployment is rising

Peak

When business activity reaches a temporary maximum with full employment and near capacity output; unemployment is at its lowest

Trough

The bottom of the recessionary period; unemployment is at its highest; output is at its lowest

Aggregate Output (Y)

The economy’s total production of goods and services for a given time period, usually a year

Labor Force (LF)

Those who are working and those not working who are actively seeking work; must be 16 or older to be included; employed + unemployed

Employed

Those who:

Work at a job with pay for at least one hour or

Without pay for at least 15 hours

All who were temporarily absent from their regular jobs due to illness, vacation, bad weather, industrial dispute, or various personal reasons

Unemployed

Has no job, or is temporarily laid off but is actively looking for work in the 4-week period prior to the reference week

Labor Force Participation Rate (LFPR)

(Labor Force/% of pop. 16 or older) (100)

Unemployment Rate (UR)

(Unemployed/Labor Force) (100)

Economic Growth

An increase in the maximum possible output of an economy

Discouraged Workers

People who have been unemployed for more than 4 weeks and have stopped seeking employment; not part of LF

Marginally Attached Workers

Employees who would like to be working, are available for work, but have given up looking in the recent past (within the 4 weeks); part of LF

Underemployed Workers

Part-time workers who would like to have full-time jobs; part of LF

Frictional Unemployment

Unemployment due to the time workers spend in job search

Structural Unemployment

When there are more people seeking jobs in a labor market than are available at the current wage rate, often due to being replaced by technology or skills becoming obsolete

Cyclical Unemployment

The share of unemployment that arises from the business cycle

Natural Rate of Unemployment (NRU)

Structural + Frictional

Actual Unemployment Rate

NRU + Cyclical

Price Stability

Avoiding prolonged inflation and prolonged deflation

Inflation

Reduces our ability to purchase goods and services

Deflation

A decrease in the overall price level; causes consumers to hold onto their dollars, waiting for lower prices

Consumer Price Index (CPI)

A measure of the average change over time in purchasing power for a fixed “market basket” of goods and services; drawbacks include:

Substitution bias

New Goods bias

Quality change bias

Disinflation

The process of bringing the inflation rate down; inflation is increasing at a diminishing rate

Nominal Interest Rate (NIR)

The interest rate actually paid for a loan; Fisher Equation: RIR + expected inflation

Real Interest Rate (RIR)

NIR - Expected Inflation

GDP Deflator

Used to determine how output has changed over time; reflects all goods and services produced in an economy; (Nominal GDP/Real GDP) (100)

Real Value

Nominal Value/(Price Index/100)

Shoe Leather Costs

The increased costs of transactions caused by inflation

Menu Costs

The real costs of changing listed prices for producers

Unit-of-Account Costs

The costs that arise from the way inflation makes money a less reliable unit of measurement

Nominal GDP

PL * Y

Real GDP

(PBY1 Q CY1) + (PBY2 Q CY2) + (PBY3 * Q CY3) + . . .

Inflation Rate (IR)

(GDP Deflator CY - GDP Deflator Base Year) / GDP Deflator BY

Disposable Income (Yd)

Income left after a person pays taxes; C + S

Marginal Propensity to Consume (MPC)

ΔC/ΔYd

Marginal Propensity to Save (MPS)

ΔS/ΔYd

Autonomous Expenditures

Spending that occurs regardless of income

Consumption Function

C = a + MPC x Yd

Spending Multiplier

The ratio of the total change in real GDP caused by an autonomous change in aggregate spending to the size of that autonomous change; 1/MPS or 1/(1-MPC)

Tax/Transfer Multipliers

-MPC/MPS; MPC/MPS

Automatic Stabilizer

Government spending and taxation rules that cause fiscal policy to adjust according to an inflationary or recessionary turn in the economy

Inventory Investment

The value of the change in total inventories held in the economy during a given period of time

Unplanned if higher than intended

Aggregate Supply (AS)

It shows the relationship between the aggregate price level and the quantity of aggregate output supplied in the economy

Sticky Wages

Nominal wages that are slow to fall even in the face of high unemployment and slow to rise even in the face of labor shortages and high inflation

Potential Output (Yf) (a.k.a. Marginal Productive Capacity)

The level of real GDP the economy would produce if all prices, including nominal wages, were fully flexible; at full employment

Demand Shock

An event that shifts the aggregate demand curve

Supply Shock

An event that shifts the short run aggregate supply curve

Demand Pull Inflation

Inflation caused by an increase in AD; output and employment increase

Stagflation (a.k.a. Cost-Push Inflation)

Inflation caused by a decrease in supply; prices are higher, but output and employment are lower

Money

Anything that can be used to purchase goods and services

Wealth

Accumulation of savings that occurs over time

Income

Money received on a regular basis for work or through investments

Financial Asset

Paper claim that entitles the buyer to future income from the seller

Physical Asset

Claim on a tangible object

Liquidity

How easily an asset can be turned into cash

Liability

A requirement to pay money in the future

Loan

A lending agreement between an individual lender and an individual borrower

Bond

The seller promises to pay a fixed sum of interest each year and to repay the principal (the value stated on the face) to the owner on a particular date

Stocks

A share in the ownership of a particular company

Financial Intermediary

An institution that transforms funds gathered from many individuals into financial assets

Mutual Funds

A financial intermediary that creates a stock portfolio by buying and holding shares in companies and then selling shares of the stock portfolio to individual investors

Banks

A financial intermediary that provides liquid assets in the form of deposits to lenders and uses their funds to finance the illiquid investment spending needs of borrowers

Commodity Money

An item that has value of its own and also can be used as money

Representative Money

Money that has value because it can be exchanged for a fixed amount of a valuable commodity

Fiat Money

Money that has been declared by the government to be legal tender, but is not backed by any commodity (i.e. USD)

Unit of Account

Function of money as a way to set prices

Store of Value

Ability of money to hold purchasing power over time

Medium of Exchange

Function of money as a way to trade goods and services

M0

Currency

Bank reserves

M1

Currency in Circulation

Demand Deposits

Savings Accounts

M2

M1

Money Market Deposit Accounts

Certificates of Deposits under $100,000

M3

M2

Certificates of Deposits over $100,000

Repurchase Agreements

Eurodollars

Reserve Requirement

% of customer demand deposits that a bank must hold in reserves

Total reserves

All the monetary funds that the bank has

Excess Reserves

Monetary funds that a bank chooses to hold onto after the rr

Securities

Bonds that the bank owns that earn the bank interest

Transaction Demands

The money people want to hold onto to buy goods and services as part of everyday life

Precautionary Demand

Money people hold onto in case of an emergency

Asset (a.k.a. Speculative) Demand

Money people hold onto in case of a good investment opportunity

Dual Mandate

Responsibility of the Federal Bank to influence the NIR to ensure:

Maximum employment

Stable Prices

Discount Rate (DR)

Interest rate banks pay when they borrow from the Fed

Policy (a.k.a. Federal Funds) Rate

The interest rate banks pay when they borrow from other commercial banks

Expansionary Monetary Policy

Targets a lower NIR

Contractionary Monetary Policy

Targets a higher NIR

Recognition Lag

Period during which central banks collect and analyze the data needed to identify problems in the economy

Impact Lag

Period during which the economy adjusts after policy action is taken by the Federal Reserve

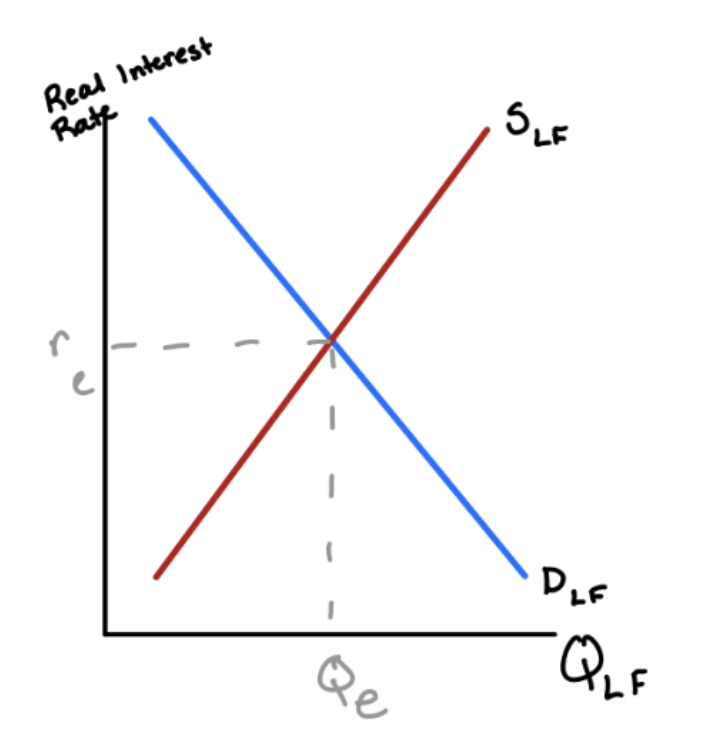

Loanable Funds Graph

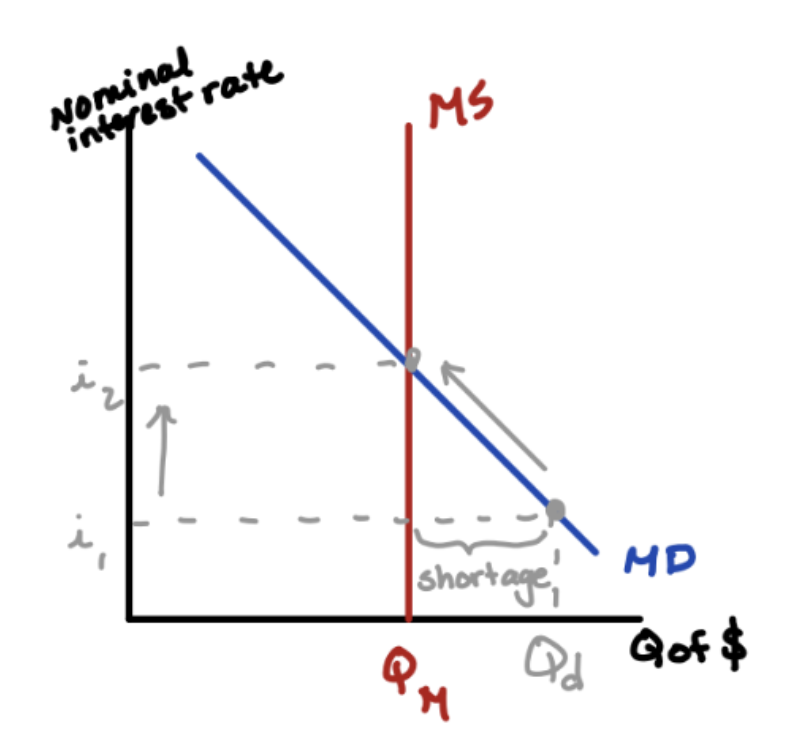

Money Supply Graph