Unit 7.2 - Financial ratio analysis

1/49

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

50 Terms

Balance sheet

Financial statement recording the assets and liabilities of a business on a particular day at the end of an accounting period (a snapshot). May also be called a statement of financial position

Main features on a balance sheet

Non-current assets

Current assets

Current liabilities

working capital

non-current liabilities

net assets

total equity

can also calculate capital employed by adding total equity and non-current liabilities

Current assets

Assets that companies expect to convert to cash or use within one year.

Non-current assets

Items owned by the business for more than one year

Current liabilities

Debts that a business will have to pay back within a year

Non-current liabilities

Debts a business pay back for more than a year

Working capital

current assets - current liabilities (sometimes called net current assets)

Net assets

total assets - total liabilities

Shows the overall worth of a business

Capital employed

Total equity + non current liabilities

Total equity

The funds put into the business by shareholders and owners

Share capital + retained profit + reserves

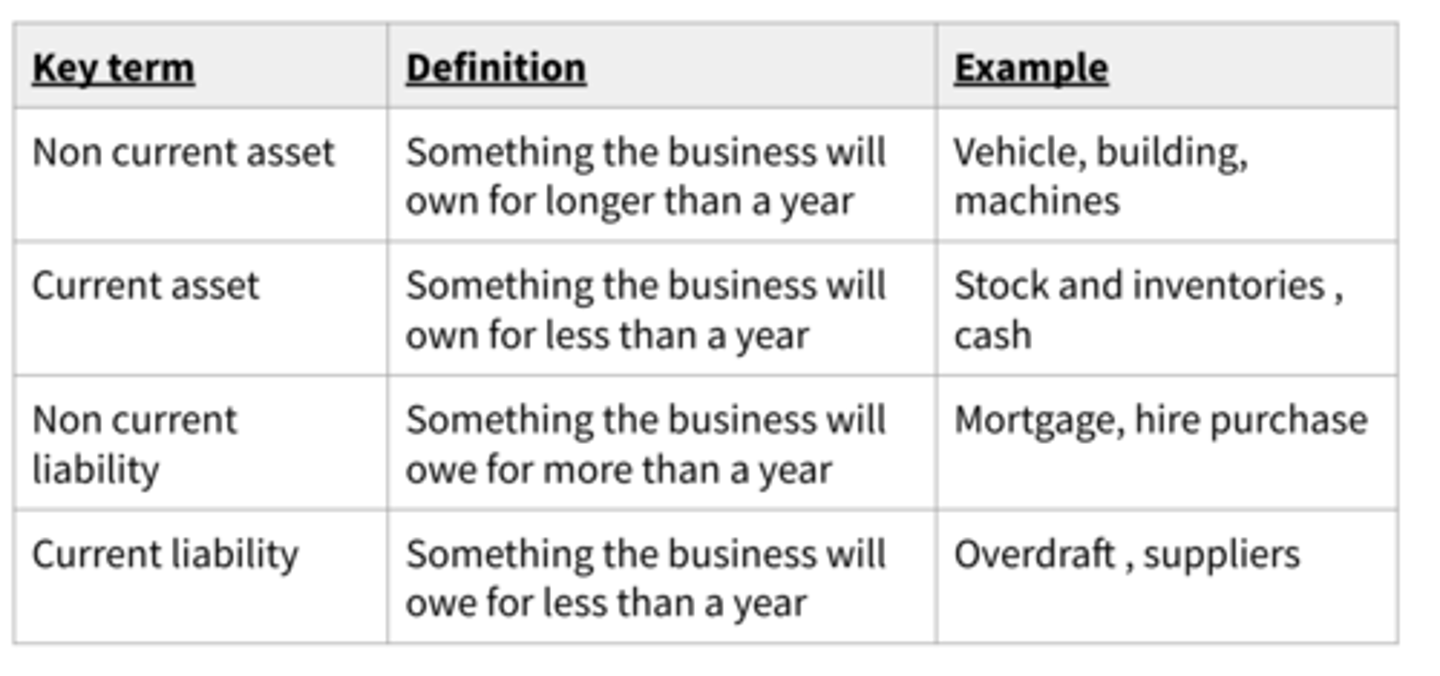

Different types of assets and liabilities (table)

Liquidity

How easily ans asset can be converted into cash, a business with more current assets is considered to be more liquid

Short term interpretations from the balance sheet

Net current assets/working capital: Measures the amount of money a business has available to pay for its day to day expenses

What might the issue be if a business doesn’t have enough working capital? what is the issue if they have too much?

Too little = they may not be able to cover their costs and have cash flow issues

Too much = Inefficient use of resources

Influences on level of working capital held

- Volume of sales

- Amount of trade credit offered by the business

- Whether or not the firm is growing

- The length of the operating cycle - time between paying for - raw materials and receiving payment from customers

-The rate of inflation

- Inventory management system (JIT or JIC)

Purposes of the balance sheet

- Help stakeholders assess financial strength of the business

- Recognise the scale of the business (Capital employed)

- Calculate net assets showing value of business

- Understanding of the nature of the business by the types and amounts of assets it holds

- Show liquidity position

- Show source of capital

- Recognise changes overtime and address any concerning trends

Benefit of the balance sheet to different stakeholders

Shareholders - value of the business, level of assets and potential for future return

Suppliers - Short-term position and liquidity (working capital) as they want to ensure credit is paid on time

Managers - capital employed and success of investment + possibility of raising future funds

Depreciation

Decrease in the value of assets overtime

Income statement

A financial statement showing all a firm's revenue over a trading period and the cost incurred to earn that revenue

Note: figures on the income statement (revenues and types of profit) take into account regular trading activities and ignore one off activities, non-trading activities like investments or joint venture profits

Components of an income statement

1) Revenue (from sales)

2) Direct costs (or cost of sales)

3) Gross profit

4) Indirect costs (or expenses)

5) Operating profit

6) Tax and interest

7) Net Profit

Revenue

earnings or income generated by firms as result of its trading activities

Formula - Selling price x Units sold

Direct costs (cost of goods sold)

spending that can be clearly allocated to a particular product or area of the business includes fuel and raw materials

Gross profit

Revenue - Direct costs

Indirect costs

spending that relates to all aspects of a business's activities includes building maintenance costs and salaries

Operating profit

Gross profit - Indirect costs

Financial surplus from business's normal trading before tax and interest

Net profit

Operating profit - tax and interest

Exceptional items

large transactions, in the usual trading activities

Extraordinary items

large transactions, outside the normal trading activities

Interpreting the income statement

- Assess the level of revenue the business is generating

- Compare the gross profit figure to revenues and operating profit to see how efficient the business is at achieving a high added value

- See which areas of the business present the most significant cost (indirect or direct)

- Can see the nature of the business and product by balance of costs

- Assess ability for business to pay dividends or fund expansion using retained profits through net profit

What may different stakeholder be interested in from the income statement

Managers: Cost of sales and expenses, revenue and operating profits, one off expenses

Shareholders: Operating and net profits to see if investment to see if there will be a return on investment

Employees: Expense such as wages, net profit (should they be getting paid more)

Financial ratio analysis

Method of assessing a firm's financial situation by comparing two sets of linked data

4 types of financial ratio

Profitability

Liquidity

Gearing

Efficiency

Profitability ratios

Compare the profits with the size of the business to see of efficiency a firm is at converting revenue and resources into profit

Include:

- Gross, operating and net profit margins

- Return on capital employed (ROCE)

Gross profit margin

Gross profit/sales revenue x 100

Shows us how much was spent on direct costs such as raw materials and direct wages to generate each £ of revenue.

Operating profit margin

Operating profit / sales revenue x 100

Considered the best measure for financial performance as it considered all costs that are incurred in generating revenue

Net profit margin

Net profit/sales revenue x 100

Will take into account interest payments or could show an improvement in debt financing, may be important indicator to show whether increasing dividends can be paid

Return on capital employed

(Operating profit / capital employed) x 100

Considered main performance ratio - shows how efficiently a business has used resources to generate returns

Liquidity ratios

Measure the ability for a business to remain solvent (pay its liabilities) in the short term

Includes:

Current ratio

Solvency

Firms ability to pays its debts on time, needs enough cash or current assets to remain solvent

Current ratio

Current assets/current liabilities

- Measures liquidity by expressing current assets as a ratio to current liabilities

i.e £500,000 current assets, £250,000 current liability

= £500,000/£250,000 - 2:1

Gearing

(non-current liabilities/capital employed x 100)

analyses capital structure of a firm showing how much of their capital has been raised through external sources

High gearing

Above 50% - shows a business has borrowed a significant amount of money

Low gearing

25% or below - shows a firm has raised most of its money through shareholders in the form of share capital and retained profits

Benefits of high gearing

- Less capital required to be invested by shareholders

- Debt can be a relatively cheap source of finance compared with dividends

- Easy to pay interest if profits and cash flows are strong

- Interest payment will be lower than dividend payments when profits are high so owner would rather borrow then have to sell more shares

Benefits of low gearing

- Less risk of defaulting on debts

- Avoid interest payments

- Business has the capacity to add debt if required

Financial efficiency ratios

Concentrates on how well a business managers certain assets and liabilities - internal operations

includes:

Payable days

Receivable days

Inventory turnover

Payable days

(Payables / cost of sales) x 365

- Shows the number of days it take to pay back any payable (trade credit from suppliers) - want this figure to be higher then receivable days

Receivable days

Receivables / revenue x 365

- Shows the number of days it takes for receivables to be converted in cash (credit extended to customers to be paid) - want this figure to be lower then payable days

Inventory turnover

cost of goods sold/average inventory

Shows how quickly stock is converted into sales.

i.e a business has inventory turnover of 26 times meaning it converts inventories into cash every 14 days (2 weeks)

- Higher the better

Factors influencing rate of inventory turnover

- nature of the product (perishable or not)

- importance of holding inventory

- length of product life cycle

- inventory management systems (e.g JIT will have low inventory levels)

- Quality of management

- Variety of products

Effective ways to analyse data from financial statements and ratios

- Overtime: comparing changes to data over year on year offers valuable insight into the changing performance of the business

- In comparison with other businesses: This will allow a benchmark for performance and can provide ways to enhance competitiveness

- Must apply context and qualitative information to numerical data to ensure data can be interpreted correctly, reason applied and appropriate plan put place going forward i.e impact of external factors, what is important to the business (corporate objectives)