Income Taxation

1/48

Earn XP

Description and Tags

General Principles and concept of Taxation

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

49 Terms

Inherent Power of State

Taxation

Power of Eminent Domain

Police power

Taxation (inherent powers of state)

power by which the sovereign raises revenues to defray the necessary expenses of the govt.

Power of Eminent Domain (inherent powers of state)

refers to the power of the government or those to whom the power has been delegated to take private property and convert it into public use upon paying the owners a just compensation to be ascertained by law.

Police power (inherent powers of state)

enact laws in relation to persons or property to promote public health, public morals, public safety and general welfare of the people

Inherent Powers of State (Similarities)

They are inherent in the state

They exist independently of the Constitution

They constitute the three methods by which State interferes with private rights and property

They are legislative in nature and character

Each presupposes equivalent compensation

Distinctions Among 3 Inherent Powers (as to purpose)

Taxation

Support of govt

Police Power

General welfare

Eminent Domain

Public Purpose

Distinctions Among 3 Inherent Powers (as to Authority who exercises the power)

Taxation

Govt only

Police Power

Govt only

Eminent Domain

Govt and Public Service companies or public utilities

Distinctions Among 3 Inherent Powers (as to persons affected)

Taxation

Community of class of Individuals

Police Power

Community of class of individuals

Eminent Domain

Individuals as owners of property

Distinctions Among 3 Inherent Powers (as to benefits received)

Taxation

In form of protection/benefit

Police Power

No direct benefit

Eminent Domain

MV of property taken compensation

Distinctions Among 3 Inherent Powers (as to effect)

Taxation

Taxes become public funds

Police Power

Regulated rights/property

Eminent Domain

Transfer of ownership

Distinctions Among 3 Inherent Powers (as to imposition)

Taxation

No limit

Police Power

Limited to cost of license or regulation

Eminent Domain

No imposition. Owners is paid by Govt

Distinctions Among 3 Inherent Powers (as to relationship to NON IMPAIRMENT of Obligation Clause of Constitution)

Taxation

Inferior to the clause

Police Power

Superior

Eminent Domain

Inferior to the clause

Taxation

is a process or act of imposing a charge by the government authority on property, individuals or transactions to raise money for public purposes

it is also defined as the act of levying a tax, i.e. the process or means by which the sovereign, through its law-making body, raises income to defray the necessary expenses of government. It is a method of apportioning the cost of government among those who, in some measure, are privileged to enjoy its benefits and must therefore bear its burdens.

Purposes of taxation

Revenue or fiscal

Non-revenue or regulatory

Revenue or fiscal

the primary purpose of taxation on the part of the government is to provide funds or property with which to promote the general welfare and the protection of its citizens and to enable it to finance its multifarious activities.

Non-revenue or regulatory

taxation may also be employed for purposes of regulation or control

a. Imposition of tariffs on imported goods to protect local industries.

b. The adoption of progressively higher tax rates to reduce inequalities in wealth an income.

c. The increase or decrease of taxes to prevent inflation or ward off depression.

Theory and basis of taxation

Necessity theory

The basis of taxation is found in the reciprocal duties of protection and support between the State and its inhabitants. In return for his contribution, the taxpayer received benefits and protection from the government. This is the so-called “benefits received principle.”

Life blood theory

Benefit-received principle

Necessity Theory

the power of taxation proceeds upon the theory that the existence of government is a necessity; that it cannot continue without means to pay its expenses; and that for these means, it has a right to compel all its citizens and property within its limits to contribute.

Life Blood Theory

this constitutes the theory of taxation, which provides that the existence of government is a necessity; that government cannot continue without means to pay its expenses; and that for these means it has a right to compel its citizens and property within its limits to contribute.

Benefit-received principle

this principle serves a the basis of taxation and is founded on the reciprocal duties of protection and support between the state and its inhabitants. Also called “symbiotic relation” between the state ans its citizens.

Essential elements of a tax

it is an enforced contribution

it is generally payable in money

it is proportionate in character

it is levied on persons, property, or the exercise of a right or privilege

it is levied by the state which has jurisdiction over the subject or object of taxation

it is levied by the law-making body of the state

it is levied for public purpose or purposes

Principles of sound tax system

Fiscal Adequacy

Equality or Theoretical Justice

Administrative Feasibility

Fiscal Adequacy

it states that sources of revenues of govt must be sufficient to meet the demand of public expenditures regardless of business condition

Equality or Theoretical Justice

states that tax burden must be proportionate to taxpayers ability to pay. In accordance with constitutions mandate that application of taxation should be equitable

Administrative Feasibility

tax laws must be convenient, uniform and effective in their administration

Non-observance of the canon of administrative feasibility will not render a tax imposition invalid “except to the extent that specific constitutional or statutory limitations are impaired.

Non-observance of these principles will not automatically render a tax law unconstitutional or invalid.

A tax law will continue to be valid even if it does not observe the principles of fiscal adequacy and administrative feasibility since the Constitution does not expressly require so. However, a tax law may be held unconstitutional if it runs afoul of the principle of theoretical justice since the Constitution expressly requires that tax laws should be uniform and equitable.

Stages of Taxation

Levy/ Imposition

Assessment

Collection

Scope of Power of Taxation

the power of taxation is comprehensive, plenary, unlimited and supreme.

strongest among the inherent powers of state

Limitation of power to tax (Nature of the power of taxation)

It is inherent in sovereignty; hence, it may be exercised although it is not expressly granted by the Constitution.

It is legislative in character; hence, only the legislature can impose taxes (although the power may be delegated).

It is subject to Constitutional and Inherent limitations; hence, it is not an absolute power that can be exercised by the legislature anyway it pleases.

Inherent Limitations

Purpose must be public in nature- a tax must always be imposed for a public purpose, otherwise, it will be declared as invalid.

Prohibition against delegation of the taxing power- General rule- the power to tax is exclusively vested in the legislative body, hence, it cannot be delegated. (Delegata potesta non potest delegari)

Exceptions to the non-delegation rule:

a. Delegation to the President

b. Delegation to local government units

c. Delegation to administrative agencies

Exemption of government entities, agencies and intrumentalities- except gov’t entities performing proprietary functions such as PNR

Rationale: If the government taxes itself or if Local Government Units tax the national government, it would be akin to taking money from one pocket to the other.

Entities or agencies exercising sovereign functions (acta jure imperii) are tax exempt, unless expressly taxed, agencies performing proprietary functions are subject to tax unless expressly exempted.

Government owned and controlled corporation performing proprietary functions are subject to taxes, except those exempted under Section 27(C) of RA 8424 as amended by RA 9337 and RA 10963, namely: GSIS, SSS, PHIC and local water district.

International comity- A state must recognize the generally accepted tenets of international law, they must accord each other as sovereign equals. This limits the authority of a government to effectively impose taxes on a sovereign state and its instrumentalities, as well as on its property held, and activities undertaken, in that capacity. (Vitug) For example, a property of a foreign State or government may not be taxed by another State.

Limitation of territorial jurisdiction

What government entities are exempt from income tax?

Government Service Insurance System (GSIS)

Social Security System (SSS)

Philippine Health Insurance Corporation (PHIC)

Philippine Charity Sweepstakes office (PCSO)**

Local water district

**Under the TRAIN law (effective Jan 1, 2018), PCSO is removed from tax exempt GOCCs

Constitutional limitations

NOTE: A tax law that violates the constitution has no legal force.

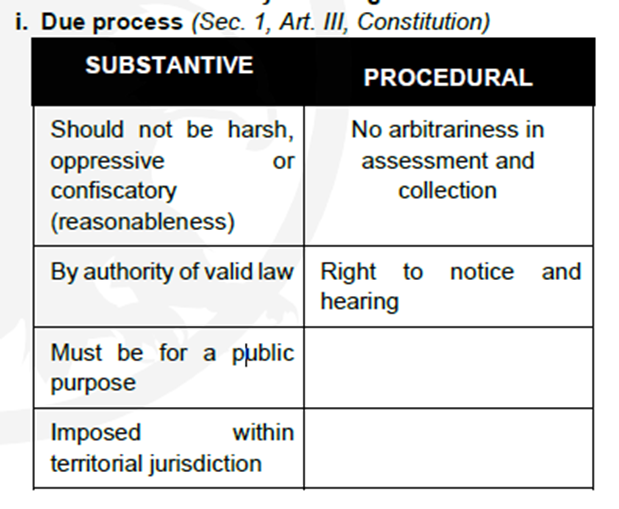

1. Due process of law- Art III Section: No person shall be deprived of life, liberty, or property without due process of law”..

Deprivation of life, liberty and property is with due process of law when: a).when it is done under the authority of law that is valid b). After compliance with fair and reasonable methods or procedures prescribed by law.

2. Equal protection of laws- All person subject to legislation shall be treated alike under circumstances and conditions both in the privileges conferred and liabilities imposed. No violation of equal protection when there is proper classification made

Classification is allowed: Classification is valid when: a)there is substantial distinction b).classification is germane to the issue or purpose of law c). Classification does not applies not only to existing conditions but future conditions as well d). Classification is applicable to all members of same class.

3. Rule of uniformity and equity in taxation: Article VI Sec 28; The rule of taxation shall be uniform and equitable”.

A tax is considered uniform when it operates with the same force and effect in every place where the subject may be found.

Under the Constitution, Congress to evolve progressive system of taxation; meaning, that tax shall place emphasis on DIRECT rather than INDIRECT taxation (regressive system) with ability to pay as principal criterion.

4. Prohibition against imprisonment for non-payment of poll tax (Example is Community tax)

Due process (Sec. 1, Art. III, Constitution)

uNo state may tax anything not within its jurisdiction without violating the due process clause; the taxing power of a state does not extend beyond its territorial limits, but within such it may tax persons, property, income, or business (Manila Gas v. Collector, G.R. No. L-24780, 1936)

Constitutional limitations (continuation 2)

5. Prohibition against impairment of obligation of contracts

6. No public money shall be appropriated for religious purposes

uBased on principle that taxes are for public proposes AND on principle of Separation of church and State.

7. Prohibition against appropriation of proceeds of taxation for the use, benefit, or support of any church

8. Prohibition against taxation of religious, charitable and educational entities-

uArt VI Sec 28, par 3 of the Constitution provides that Charitable institutions, churches, parsonages or convents appurtenant thereto, mosques and non profit cemeteries and all lands and buildings and improvements actually, directly and exclusively used for religious , charitable and educational purposes shall be exempt from taxation

uExemption from property taxation only (RPT only).

uThus, sale of land by a religious institutions is subject to CGT.

9. Prohibition against taxation of non-stock, non-profit educational institutions

uArt XIV, Sec 4, Provides that all revenues and assets of non stock, non profit educational institutions used actually, directly and exclusively for educational purposes shall be exempted from taxes and duties.

uExemption covers income, real estate tax, donor’s tax, and customs duties (distinguished from the previous provision, (Sec. 28[3], Art. VI, Constitution), which pertains only to real property tax exemption granted to real properties that are used for religious, charitable, or educational purposes)

Constitutional limitations (continuation3)

uNOTE:

uProprietary educational institutions (Preferential tax rate of 10%); WHILE

uGovernment educational institutions (Tax-exempt, e.g., UP)

10. Others

a. Grant of tax exemption- Majority of all members of Congress shall grant tax exemption

b. Veto of appropriation, revenue, tariff bills by the President

c. Non-impairment of the SC jurisdiction

d. Revenue bills shall originate exclusively from the House of Representatives

e. Infringement of press freedom

f. Judicial power to review legality of tax

11. Prohibition on use of tax levied for special purpose

12. President’s veto power on appropriation, revenue, and tariff bills - The President shall have the power to veto any particular item or items in an appropriation, revenue, or tariff bill, but the veto shall not affect the item or items to which he does not object.

13. Flexible tariff clause (Sec. 28 [2], Art. VI, Constitution)

The Congress may, by law, authorize the President to fix within specified limits, and subject to such limitations and restrictions as it may impose, tariff rates, import and export quotas, tonnage and wharfage dues, and other duties or imposts within the framework of the national development program of the Government.

Doctrines in taxation

Prospectivity of Tax laws

Imprescriptibility of taxes

Double taxation

Escape from taxation

Prospectivity of Tax laws

This principle provides that a tax law must only be applicable and operative prospectively, except when expressly provided by law to be imposed retroactively.

Imprescriptibility of taxes

Although the NIRC provides for the limitation in the assessment and collection of taxes imposed, such will only be applicable to those taxes where a tax return is required. Unless otherwise provided by the tax law itself, taxes in general are imprescriptible

Double taxation

Two types:

a. Indirect Duplicate taxation

b. Direct Duplicate taxation- This is double taxation in strict sense. It is prohibited because it comprises imposition of tax to –same property/person- same period-same purpose- same tax rate- and same taxing authority

uIndirect Double taxation (Broad sense)

uThe SC held that there is no constitutional prohibition against double taxation in the Philippines. (Villanueva v. City of Iloilo, G.R. No. L-26521, 1968) Therefore, it may not be a valid defense against the validity of a tax measure. (Pepsi-Cola v. Tanauan, G.R. No. L-31156, 1976) What is prohibited is direct double taxation.

Tax treaties as relief from double taxation

uModes of eliminating Double Taxation

ui. Provide for exemptions or allowance of deduction or tax credit for foreign taxes;

uii. Enter into treaties with other states (e.g., former Phil-Am Military Bases Agreements as to income tax); or

uiii. Apply the principle of reciprocity.

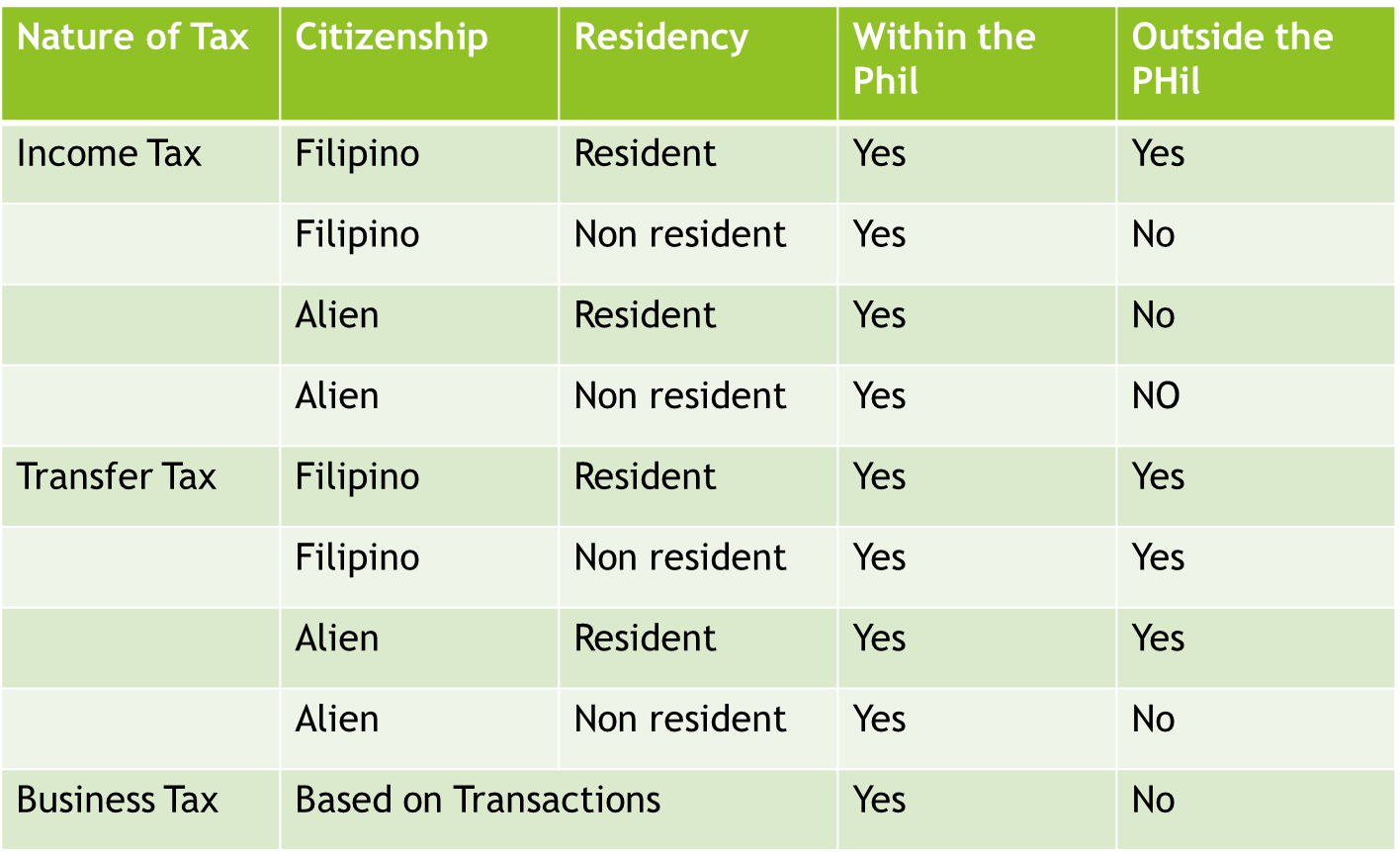

Situs of Taxation (Income)

is the place of taxation; power to tax is limited to the territorial jurisdiction of the taxing state. It is the place or authority that has the right to impose and collect taxes.

GENERAL RULE ON TAX SITUS

Classification of Taxes (As to subject matter or object)

Personal, poll or capitation tax

tax of a fixed amount imposed on persons residing within a specified territory, whether citizens or not, without regard to their property or the occupation or business in which they may be engaged, i.e. community tax.

Property tax

tax imposed on property, real or personal, in proportion to its value or in accordance with some other reasonable method of apportionment. Example: Real estate tax

Excise tax

A charge imposed upon the performance of an act, the enjoyment of a privilege, or the engaging in an occupation. This is different from the excise tax of title VI of the NIRC. Example: Income tax, VAT, estate tax, donor’s tax

Classification of Taxes (As to purpose)

General/fiscal/revenue tax

is that imposed for the purpose of raising public funds for the service of the government

Special/regulatory tax

is imposed primarily for the regulation of useful or non-useful occupation or enterprises and secondarily only for the purpose of raising public funds

Classification of taxes (as to who bears the burden)

Direct tax

is demanded from the person who also shoulders the burden of the tax. it is a tax which the taxpayer is directly or primarily liable and which he or she cannot shift to another

Indirect tax

is demanded from a person in the expectation and intention that he or she shall indemnify himself or herself at the expense of another, falling finally upon the ultimate purchase or consumer. A tax which the taxpayer can shift to another

Classification of taxes (as to scope of the tax)

National tax

is imposed by the national government

Local Tax

is imposed by municipal corporations or local government units (LGUs)

Classification of taxes (As to the Determination of amount)

Specific tax

is a tax of a fixed amount imposed by the head or number or by some other standard of weight or measurement. It requires no assessment other than listing or classification of the objects to be taxed.

Ad valorem tax

is a tax of a fixed proportion of the value of the property with respect to which the tax is assessed. It requires the intervention of assessors or appraisers to estimate the value of such property before the amount due from each taxpayer can be determined.

Classification of taxes (as to gradation or rate)

Proportional tax

tax based on a fixed percentage of the amount of the property receipts or other basis to be taxed. Example: real estate tax.

Progressive or graduated tax

tax the rate of which increases as the tax base or bracket increases. Example: income tax

Digressive tax rate: progressive rate stops at a certain point. Progression halts at a particular stage

Regressive tax

tax the rate of which decreases as the tax base or bracket increases. There is no such tax in the Philippines.

NOTE: Regressive tax is different from regressive Tax system (Regressive tax system = more indirect taxes is imposed than direct taxes.

Requisites of a valid tax

Must be for a public purpose

should be uniform and equitable;

Either the person or property taxed is within the jurisdiction of the taxing authority;

Complies with the requirements of due process;and

Does not infringe any constitutional or inherent limitations

Interpretation and application of tax laws

Nature of internal revenue laws

Internal revenue laws are not political in nature

Tax laws are civil and not penal in nature

Income tax systems

uINCOME TAX - A tax on all yearly profits arising from property, professions, trades, or offices, or as a tax on a person’s income, emoluments, profits and the like. Income tax is a direct tax.

1. Global - The total allowable deductions are deducted from the gross income to arrive at the net taxable income subject to the relevant income tax rate. All items of gross income and deductions are reported in one income tax return and a single tax is imposed on all income received or earned by a person irrespective of the activities which produced the income (i.e. compensation income, net income from business, trade or profession.)

2. Schedular - Different types of income are subjected to different sets of graduated or flat income tax rates. The applicable tax rates will depend on the classification of the taxable income and the basis could be gross income or net income (i.e. capital gains tax).

3. Semi-Schedular or Semi-Global Tax System – The compensation income, business or professional income, capital gain and passive income not subject to final tax, and other income are added together to arrive at the gross income and after deducting the sum of allowable deductions, the taxable income is subjected to the relevant income tax rate.

Philippine income taxation is a combination of both systems but is more schedular for individuals while more global for corporations.