IB Economics Review (Macroeconomics)

1/52

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

53 Terms

National Income Accounting

Methods for measuring the size of an economy

1) Expenditure

2) Income

3) Output

Gross Domestic Product

Total values of all final goods and services produced in a country

Gross National Income

The total value of all final goods and services produced by people of a country

Real GDP/GNI

Total value of all final goods and services produced (adjusted for inflation)

Real GDP/GNI per capita

Average income, adjusted for inflation

Real GDP/GNI per capita PPP

Average income, adjusted for inflation and cost of living comparison

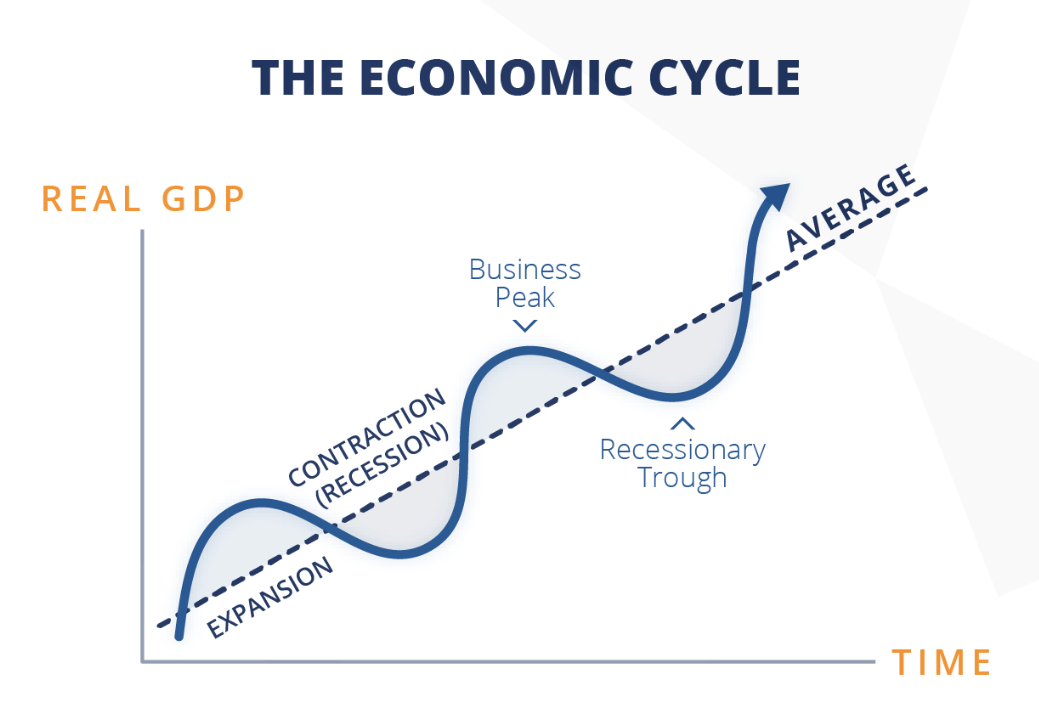

Business cycle

Increase and decrease of GDP over time

Contraction

Decrease of GDP

Economic Growth / Expansion

Increase of GDP

Recession

Contraction lasting 2+ quarters

OECD Better Life Index

Composite quality of life measure

Happiness Index

Compares reported life satisfaction

Happy Planet Index

Includes life satisfaction and carbon footprint

Aggregate Demand (AD)

Demand for all goods and services / Total spending in an economy

C + I + G + (X-M) = AD

Determinants of AD

Income, wealth, interest rates, business and consumer confidence

Aggregate Supply (AS) / Short Run Aggregate Supply (SRAS)

Supply of all goods and services / Total production in an economy

Determinants of AS

Factors of Production, technology, government regulations

Full employment

Maximum number of people working

Natural unemployment

~ 3%

Consistent level of unemployment

Includes structural, seasonal and frictional

Unemployment rate

people looking for work / total labor force

Cyclical unemployment

increase in unemployment as a result of contraction/recession in a business cycle

Structural unemployment

Results from skills gaps / Mismatch between workers and the available jobs

Frictional unemployment

Between jobs, holding up for something better

Seasonal unemployment

Periods that have more unemployment

Summer/winter layoffs

Consumer Price Index

Measures inflation, market “basket” of goods

2% inflation is good!

Demand-pull Inflation

Increasing spending drives up prices

Cost-push inflation

Supply-side inflation

Increase costs of factors of production

Deflation

Falling prices on average, not good!!

Disinflation

Decreasing rate of inflation, 6% → 2%

Good!!

Distribution of income

Difference between income of different groups

REdistribution of income

Government changes the distribution, takes money from rich and gives it to the poor

Gini Coefficient

Measures income inequality in a country

Absolute Poverty

Internation poverty line ($2.15 / day)

Relative Poverty

Compared to national cost-of-living or median income

Multidimensional Poverty Index

Directly measures material deprivation

Access to clean water, schools, etc.

Progressive tax

More tax on the rich than poor

Proportional tax

Everyone pays the same rate

Larger impact on the poor

e.g. sales tax

Regressive tax

More tax on poor than rich

e.g. fees for licenses, parking, admission to museums and parks, and tolls for roads, bridges, and tunnels.

Human Capital

Labor force skills and abilities

Gets better with each generation

Transfer payment

Government redistributing money

e.g. social security

Universal basic income

Government provides transfer payments to all residents

Interest Rates

Amount paid to the bank on a loan

Price of borrowing

Expansionary monetary policy

Lowering interest rates to boost AD and increasing employment

Contractionary monetary policy

Raising interest rates to limit AD and decrease inflation

Real Interest Rate

Interest rate - rate of inflation

Expansionary fiscal policy

Using government spending to boost AD

Contractionary fiscal policy

Reducing government policy to limit AD

(This never really happens)

Inflationary gap

Inflation above the target rate

Recessionary gap

Economic growth below zero

Market based supply-side policy

Reaganomics → low gov involvement, low taxes

Privatization

Reducing government programs over to private companies or corporations

Deregulation

Reducing government regulations on industry

Interventionist supply-side policies

Using government programs to support firms. Investings in education, infrastructure and training