AP Econ Unit 4

1/53

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

54 Terms

financial sector

network of institutions that link borrowers and lenders

includes banks, mutual funds, pension funds & other financial intermediaries

3 tasks of financial system

reduce transaction cost

reduce risk

provide liquididy

assets

anything tangible or intangible that has value

interest rate

the amount a lender charges borrowers for money, the price of a loan or cost of money

interest-bearing assets

assets that earn interest over time eg bonds

investment

always refers to businesses increasing capital stock (machinery & tools)

liquidity

the ease with which an asset can be converted to cash

stocks

aka “equities”

represent ownership of a corporation

stockholder hopes value of equity rises & they can make a capital gain (sell for more than they purchased it for)

bonds

aka “securities”

loans issued by gov, business, or individual

issuer of debt must repay to the lender for a specific period of time

the bond holder has no ownership of the company & is paid interest on the bond

a bond is issued at a specific interest rate that doesn’t change throughout the life of the bond

higher liquidity than stocks

investors always consider new interest rates to older bonds

bond prices & interest rates are inversely related

savings account

bank/credit union keeps your $ safe while sometimes paying low variable interest rate

sometimes have min balance requirement

aka “demand deposits because depositor can claim $ at any time

Certificate of Deposit

type of savings account that pays a fixed interest rate on your set deposit for a set period of time

*lower liquidity & higher interest rate than savings account

Nominal interest rates

% increases in $ that the borrower pays (not adjusted for inflation)

nominal = real interest rate + inflation

real interest rates

the % increase in purchasing pwr that a borrower pays (adjusted for inflation)

real=nominal interest rate - expected inflation

first form of money

barter system

goods & services traded directly no “medium of exchange”

problems

double coincidence of wants necessary (both parties must want what the other has)

some goods cannot be split

what is money

anything that is generally accepted in payment for goods & services or in the repayment of debts

wealth

accumulation of assets over time

income

flow of earnings per unit of time

functions of money

medium of exchange

unit of account

store of value

medium of exchange

used to buy goods & services with no complications of barter system

a medium of exchange must be

standardized

accepted

divisible

portable

long lasting

unit of account

used to measure value in the economy

store of value

allows you to store purchasing power for the future

evolution of money

commodity money: item performs the function of money & has intrinsic value

fiat money: something that serves as money due to government decree but has no other value or uses

M1

most liquid assets - $ used in everyday transactions

currency in circulation

checkable bank demand deposits (checking account)

savings deposits (ex money market account)

M2

less liquid- short term savings vehicles

M1

time deposits (Certificate of deposits)

terms >7 days $<100000

money market funds

money market accounts

type of bank account that earns higher interest than a savings account & allows checks/debit card options

usually limits # of withdrawals per month

money market funds

type of mutual fund (pools investors money together)

invests in short-term bonds

not FDIC insured

monetary Base (M0)

all physical currency in circulation & the reserves held by commercial banks @ the federal reserve

M0 grows when the federal reserve buys bonds from banks or when more ppl hold cash/coins

assets

what a bank owns

required reserves

excess reserves

loans

securities/bonds

physical assets

liabilities

what a bank owes

demand deposits

other deposits

debts/liabilities

owner equity (profit owed to bank’s owners)

balance sheet

a record of a bank’s assets liabilities & net worth

reserves

the portion of deposits that banks have not lent out

required reserves (rr)

% of deposits banks must hold by law

excess reserves

the amount the bank can loan out

fractional-reserve banking

a system in which banks hold a fraction of their deposits as reserves

money multiplier

1/rr

Why do ppl demand money?

transaction demand for money

asset demand for money

transaction demand for money

ppl hold money for everyday transactions

asset demand for money

ppl hold money since its less risky than other assets

money demand shifters

changes in aggregate price level

if inflation increases…

changes in real GDP

if someone gets more $…

changes in tech

ATM’s affect on society

changes in banking institutions

invention of interest bearing checking account

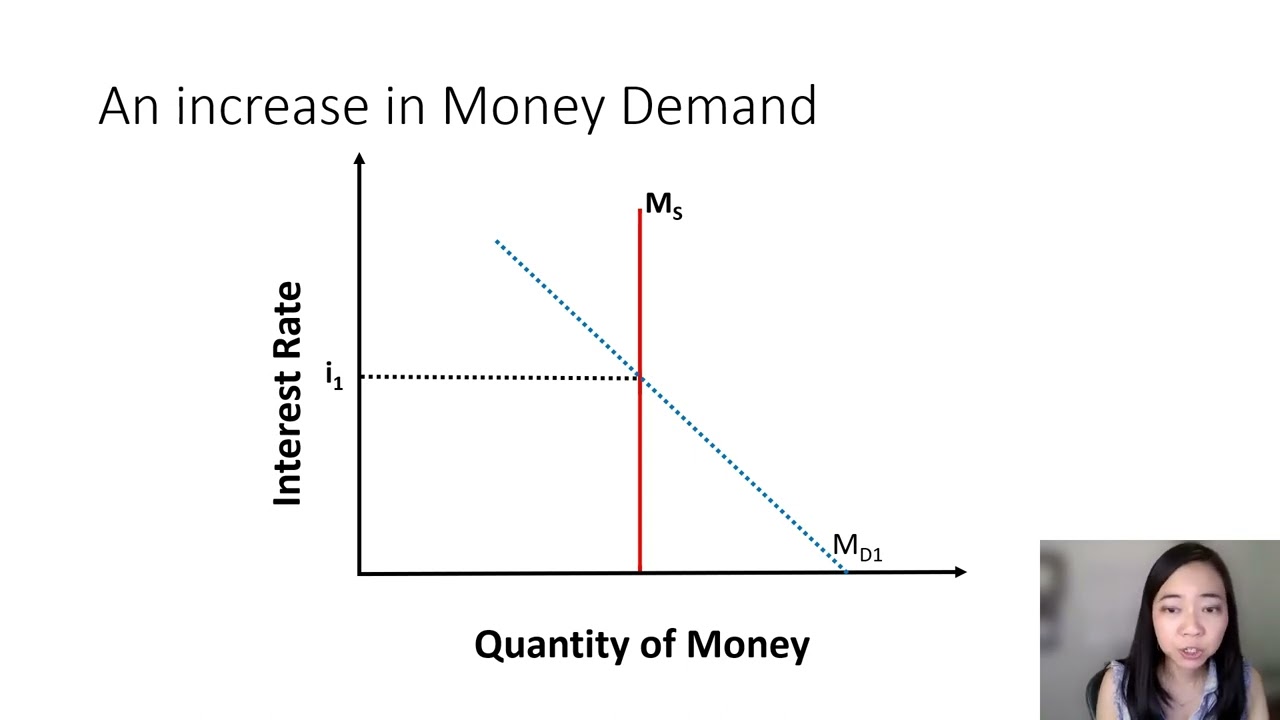

demand for money graph

supply of money is…

set by central bank independent from the interest rate

Money supply ~

monetary base

*monetary policy

when MS increases…

interest rates decrease → investments increase → AD, GDP, & PL increase

when MS decreases…

interest rates increase → investments decrease → AD, GDP, & PL decrease

federal reserve

created in 1913 as 12 regional banks spread across US

independent of gov & w/o a single bank controlling all policies

structure of the fed

board of governors

chairman

12 federal reserve districts

board of governors

7 members appointed for 14 year terms

governors guide the fed’s policy actions

chairman

1 member of the board is selected by the president to serve as chairman for a 4 year term

12 federal reserve districts

1 federal reserve bank per district which reports economic activity in its district

3 Shifters of Money Supply

reserve requirement

discount rate

open market operations

reserve requirement

the % of deposits banks must hold in reserve

discount rate

the interest rate the fed charges commercial banks

to increase money supply the fed should decrease the discount rate

to decrease money supply the fed should increase the discount rate

open market operations

the fed buys or sells government bonds (securities)

to increase the money supply the fed should buy bonds

to decrease the money supply the fed should sell bonds

*buy→big sell→small

Federal funds rate

the interest rate banks charge each other for one-day loans of reserves (if a bank has insufficient funds to meet the fed’s reserve requirement")