BDAs - Revenues and Expenses

1/6

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

7 Terms

List the BDAs

Prepaid expenses- A

Unearned revenue- L

Unearned sales revenue- L

Accrued expenses- L

Accrued revenues- A

Bad debts- E

Allowance for doubtful debts- A-

Depreciation- E

Accumulated depreciation- A-

Cash Flow Statement: categorise relevant BDAs

Operating

Prepaid expenses outflow (paid for )

Unearned sales revenue inflow (deposit )

Accrued expenses outflow (ONLY if we’ve paid for it for the previous month)

Accrued revenues (only if we’ve received money)

** ONLY include cash received or paid. So if it was Wages $7500 but there’s $500 of accrued expenses we HAVEN’T paid for yet, then only record $7000 Wages.

However, if the next period we paid $7500 of Wages, we have to separate into $500 Accrued Wages and the rest as normal Wages.

Income Statement: categorise relevant BDAs

Other Expenses

Bad debts- E

Depreciation- E

Expenses from Accrued expenses- L

Revenues from Accrued revenues- A

Balance sheet: categorise relevant BDAs

CA

Prepaid expenses- A

Allowance for doubtful debts- A-

Accrued revenues- A

NCA

Accumulated depreciation- A-

CL

Accrued expenses- L

Unearned revenue- L

Unearned sales revenue- L

Purpose of recording BDAs for Accrued expenses with reference to an assumption.

Accounting assumption: Accrual basis (good)

Explanation

Under Accrual accounting, all revenues earned, and expenses incurred in this period should be recognised so to aid calculating accurate profit. Balance day adjustments adjust revenue and expense accounts such as wages so the $1200 of Accrued Wages is still recognised as Wages expense for this period, so net profit is not overstated.

Recognition as a current liability for accrued expenses? -1 mark

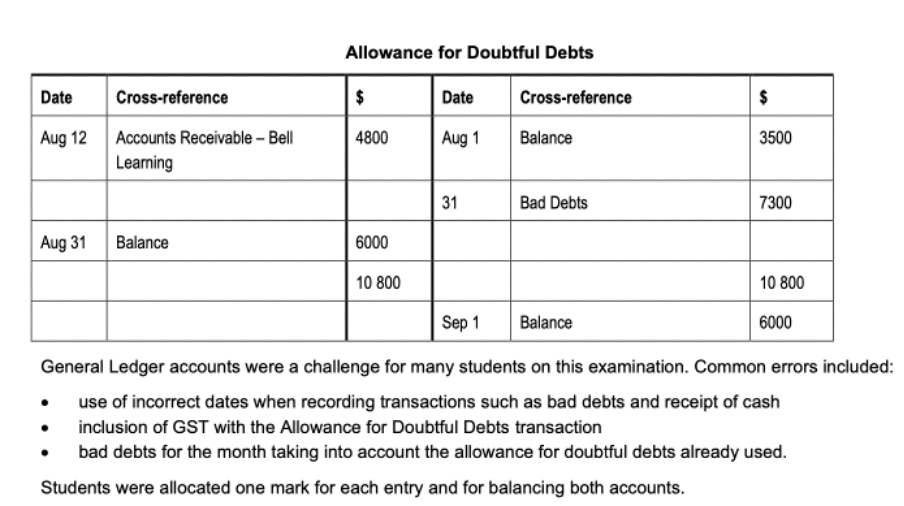

Creating an Allowance for Doubtful Debts at the end of the period

Start with opening balances.

Find the end balance of Allowance= % of net credit sales minus gst = $6000.

Record all other entries such as the recognition of the bad debt aka Accounts Receivable of $4800 (exclude gst).

THEN balance to find bad debts= $7300.

We recognised $4800 AR with astarting balance of $3500 (so $1300 extra). This extra $1300 is added to our balance of $6000=$7300 for Bad Debts.