EOC Economics Review

1/142

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

143 Terms

Scarcity

Unlimited Wants, limited resources (the basic problem of economics)

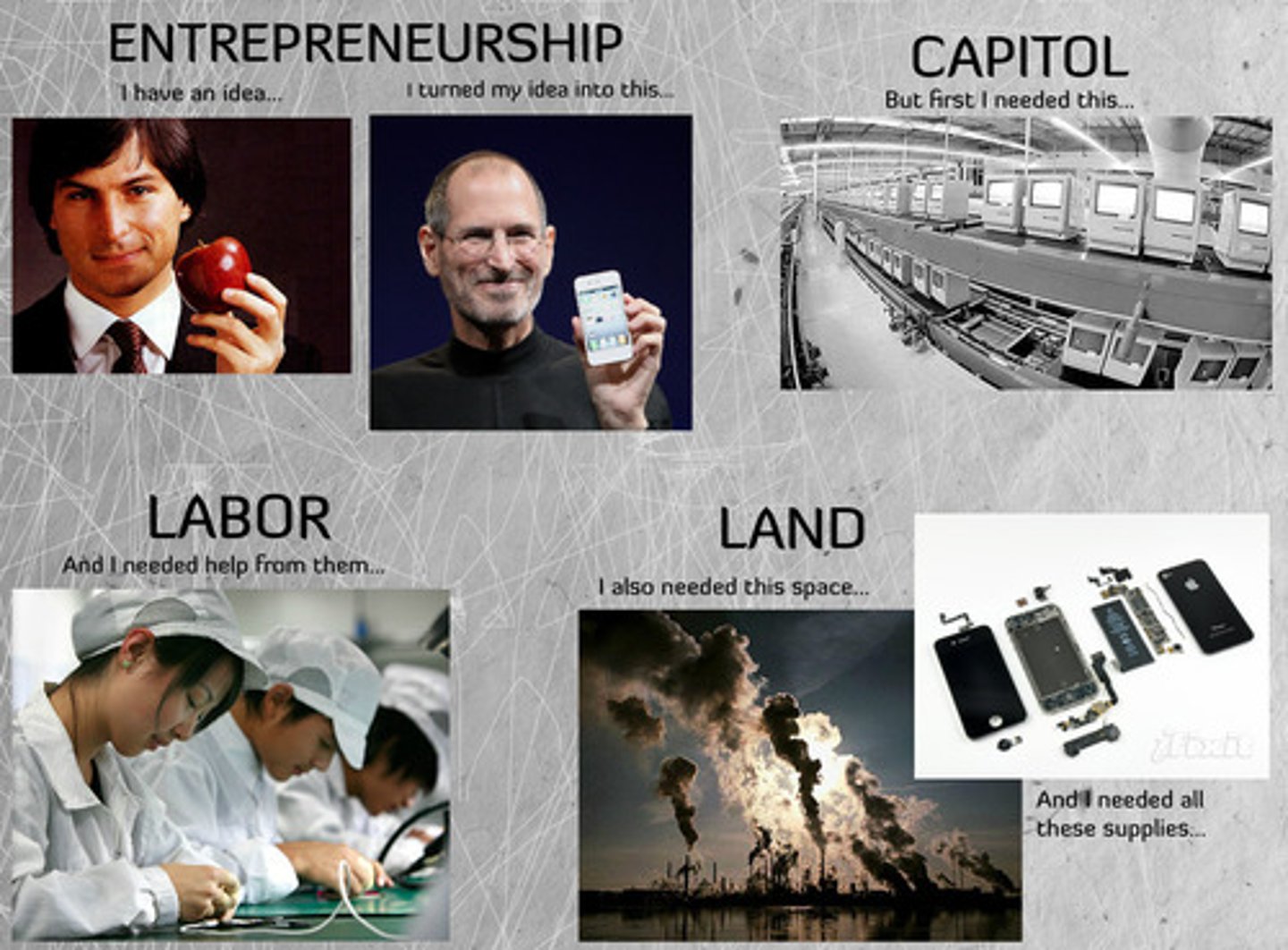

Factors of Production

Land, Labor, Capital, Entrepreneurship

Entrepreneurship

An individual, motivated by profit, who chooses to open their own business

Human Capital

Human knowledge to perform a task (ex: Brain surgeon having the knowledge to preform surgery)

Physical Capital

Man-Made Tool (part of the factors of production)

Opportunity Cost

Second best alternative given up

Marginal Cost

The cost of creating an additional item

Marginal Benefit

What you gain from creating an additional item/ preforming a certain task

Rational Decision

When Marginal Benefit exceeds the Marginal Cost

Positive Incentive

Benefits that are offered to individuals to get them to behave a certain way (offering rewards)

Negative Incentive

Avoiding a situation to escape punishment

Specialization

To become very skilled in one particular task/job (Ex: Teaching specifically Economics)

Voluntary Exchange

Exchanging money for a good at a benefit for both parties

Three Economic Questions

What to produce, How to produce, For whom to produce it for

Profit Motive

Motivated towards making a profit (money)- The reason why entrepreneurs usually enter into business

Government Regulation

Government laws/rules (usually make products more expensive in order to comply)

Economic Security

Providing safety from economic hardship (Welfare, social programs, etc.)

Economic Efficiency

Being efficient/productive with scarce resources

Economic Sustainability

Sustaining Economic Growth

Public good/service examples:

Parks, sidewalks, schools, roads (paid for by tax dollars)

Market Failure

When a third party is harmed by the failure of the government to regulate an industry (ex: pollution)

Regulation

Creating a law involving a business (usually results in price increases)

Deregulation

The lifting of government restrictions on business, industry, and professional activities.

Productivity

Not wasting resources/time

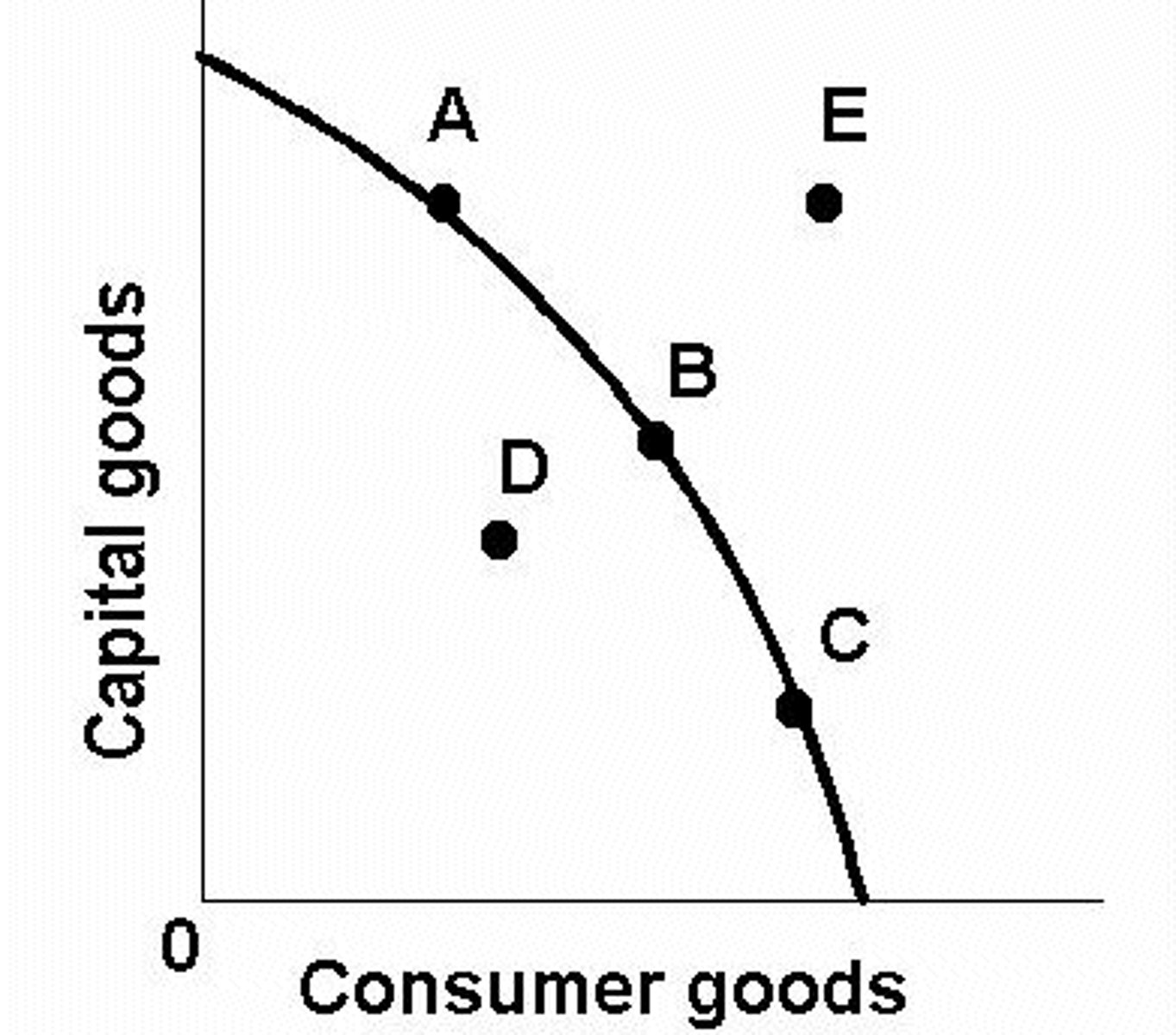

Production Possibility Curve

a graph that shows alternative ways to use an economy's productive resources

Product Market

the market in which households purchase the goods and services that firms produce

Factor Market

market in which firms purchase the factors of production from households

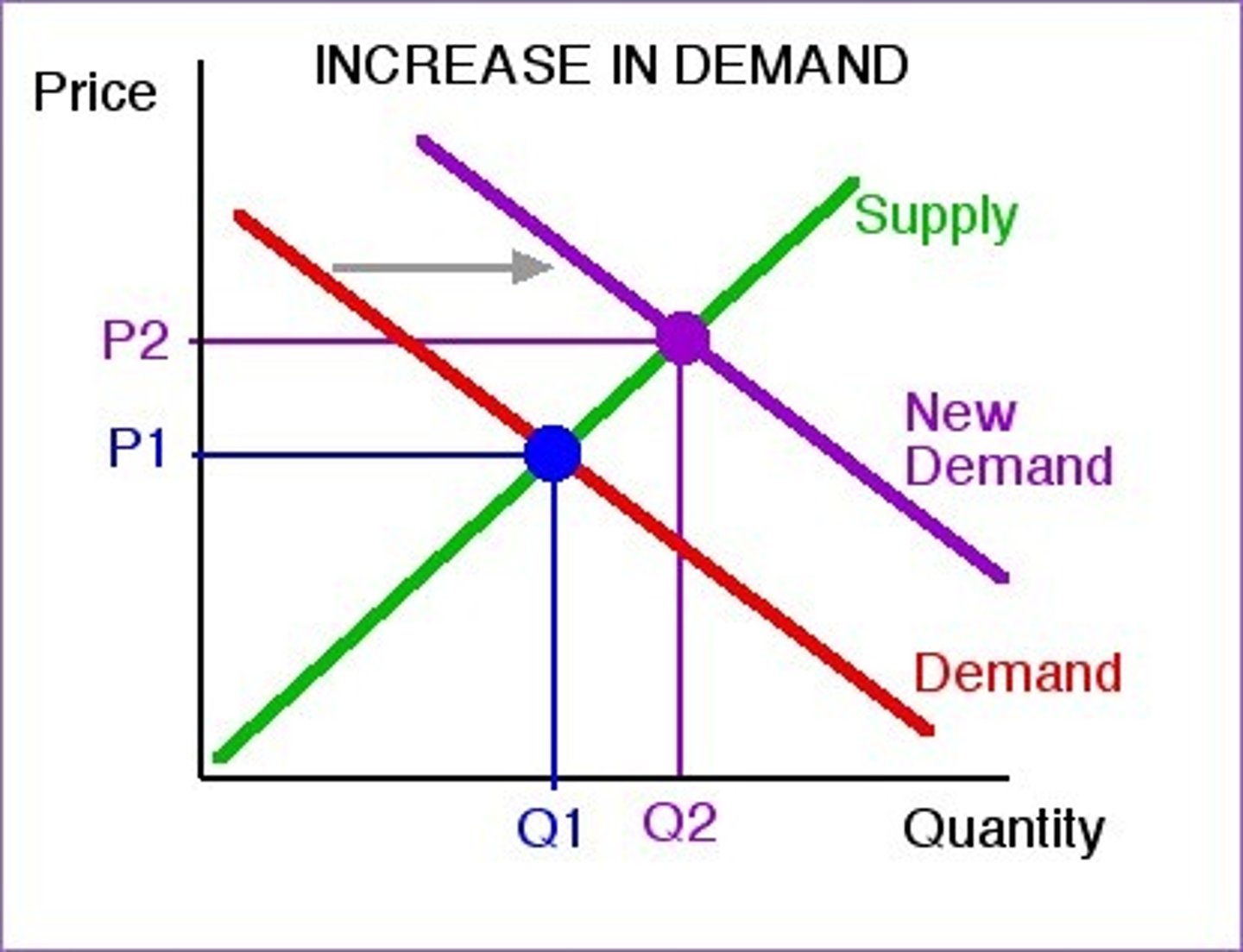

Law of Demand

consumers buy more of a good when its price decreases and less when its price increases

Law of Supply

Produces make more of a good when its price increases, and less when its price decreases

Demand

Amount willing and able to bought of an item at all price levels

Aggregate Demand

Total amount demanded in the whole economy

Supply

Amount willing and able to be produced of an item at all price levels

Aggregate Supply

Total amount produced in the whole economy

determinants (shifters of demand)

Population

Expectation of future price

popularity/preferences

Substitutes (related goods)

Income

Complements (related goods)

Substitutes

Items bought in place of each other (Coke and Sprite)

Complements

Items bought typically together (milk and cereal)

Increase in demand: Shift to the __________

RIGHT

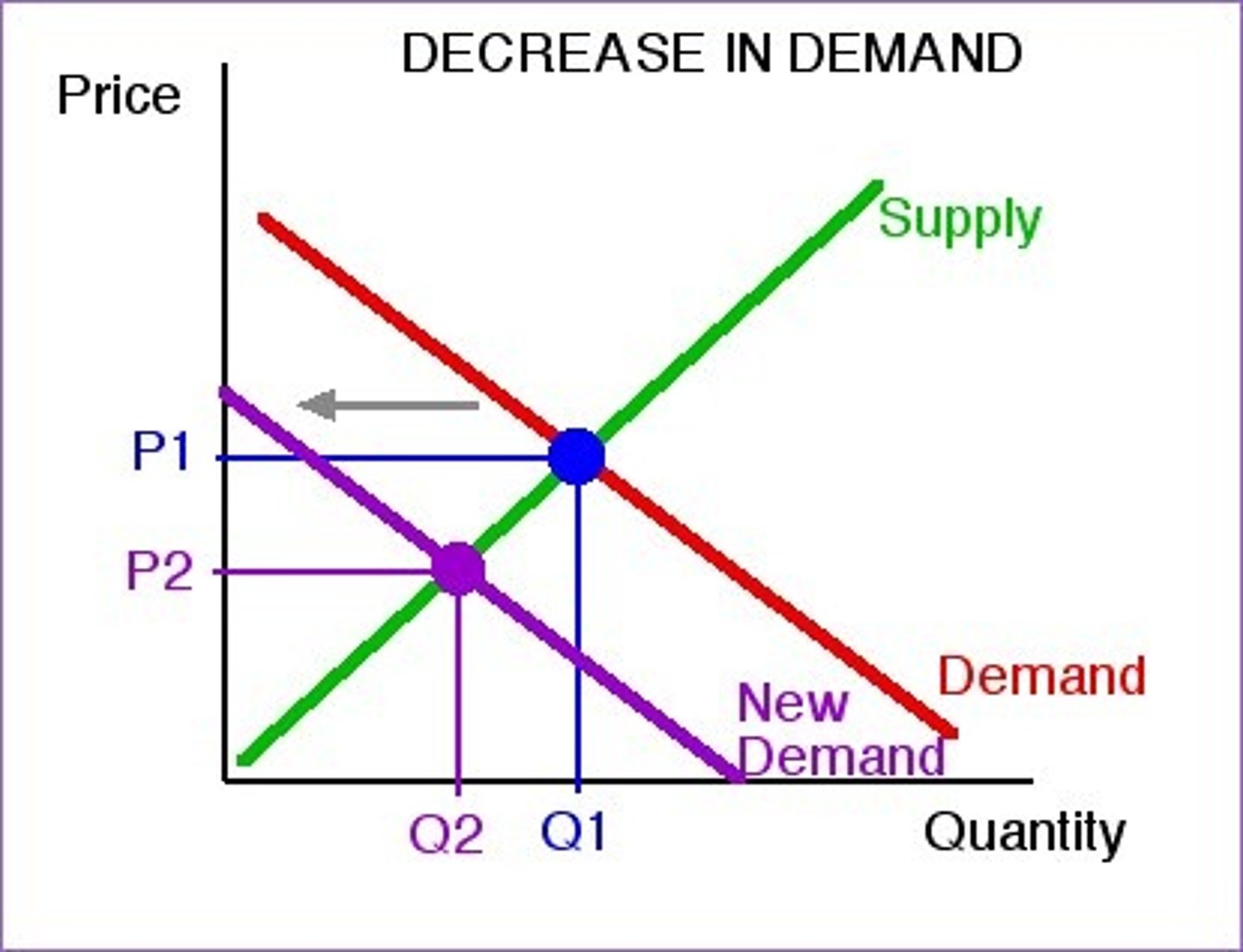

Decrease in demand: shift to the ___________

LEFT

Increase in supply: Shift to the __________

RIGHT

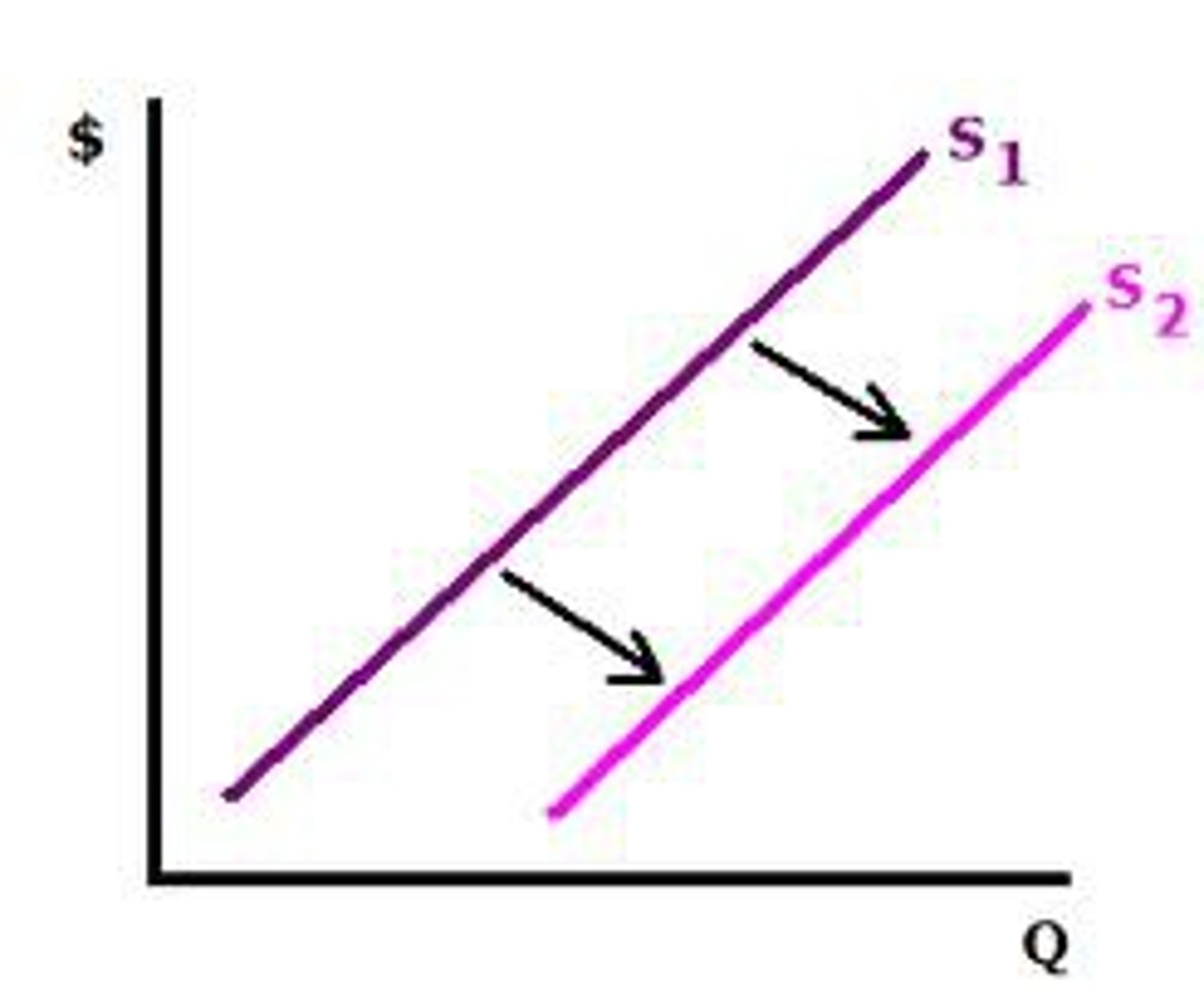

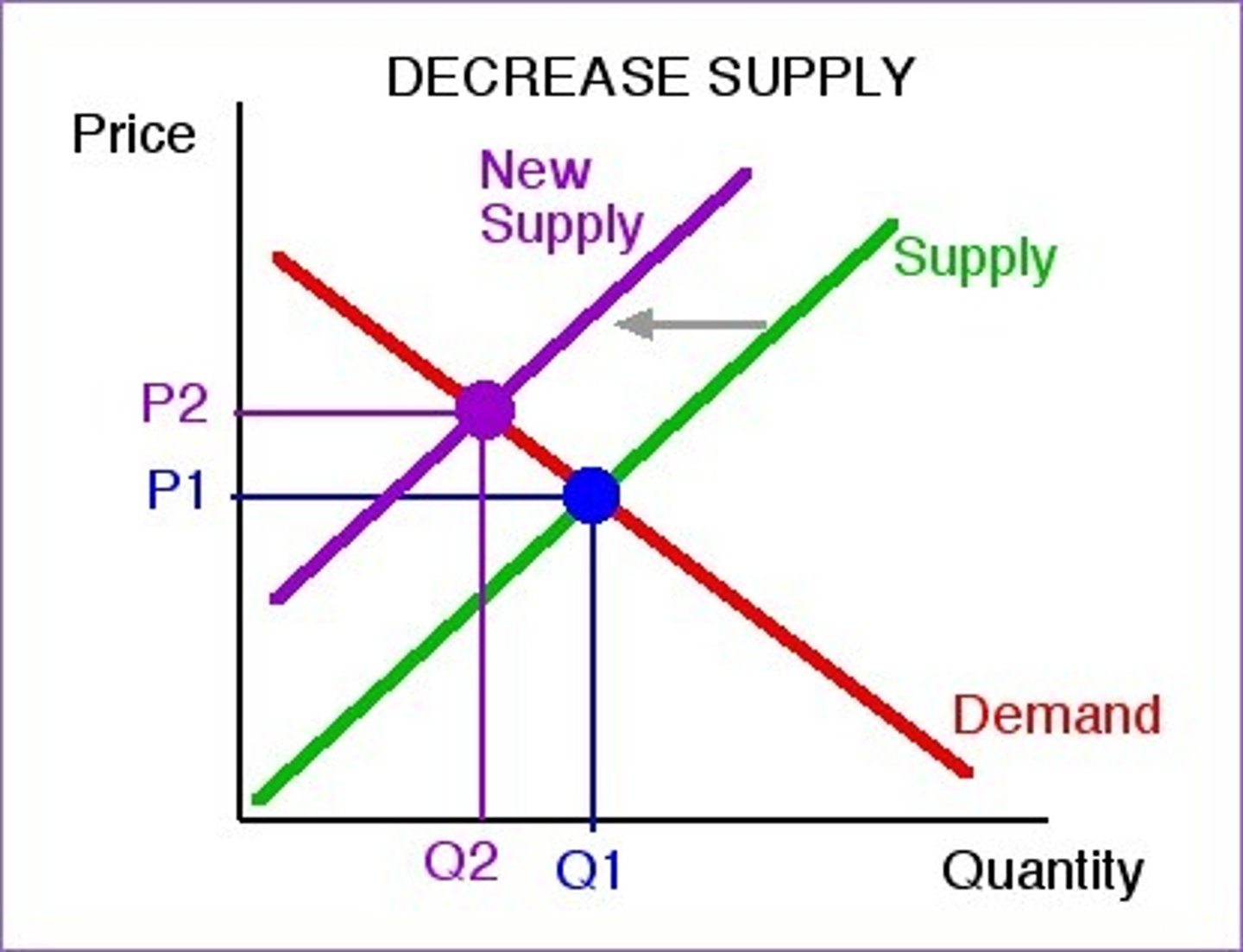

Decrease in supply: Shift to the ________-

LEFT

Determinants (shifts) of Supply:

# of sellers

Technology

Government regulation

Cost of Inputs

Future Price/expectation of future profit

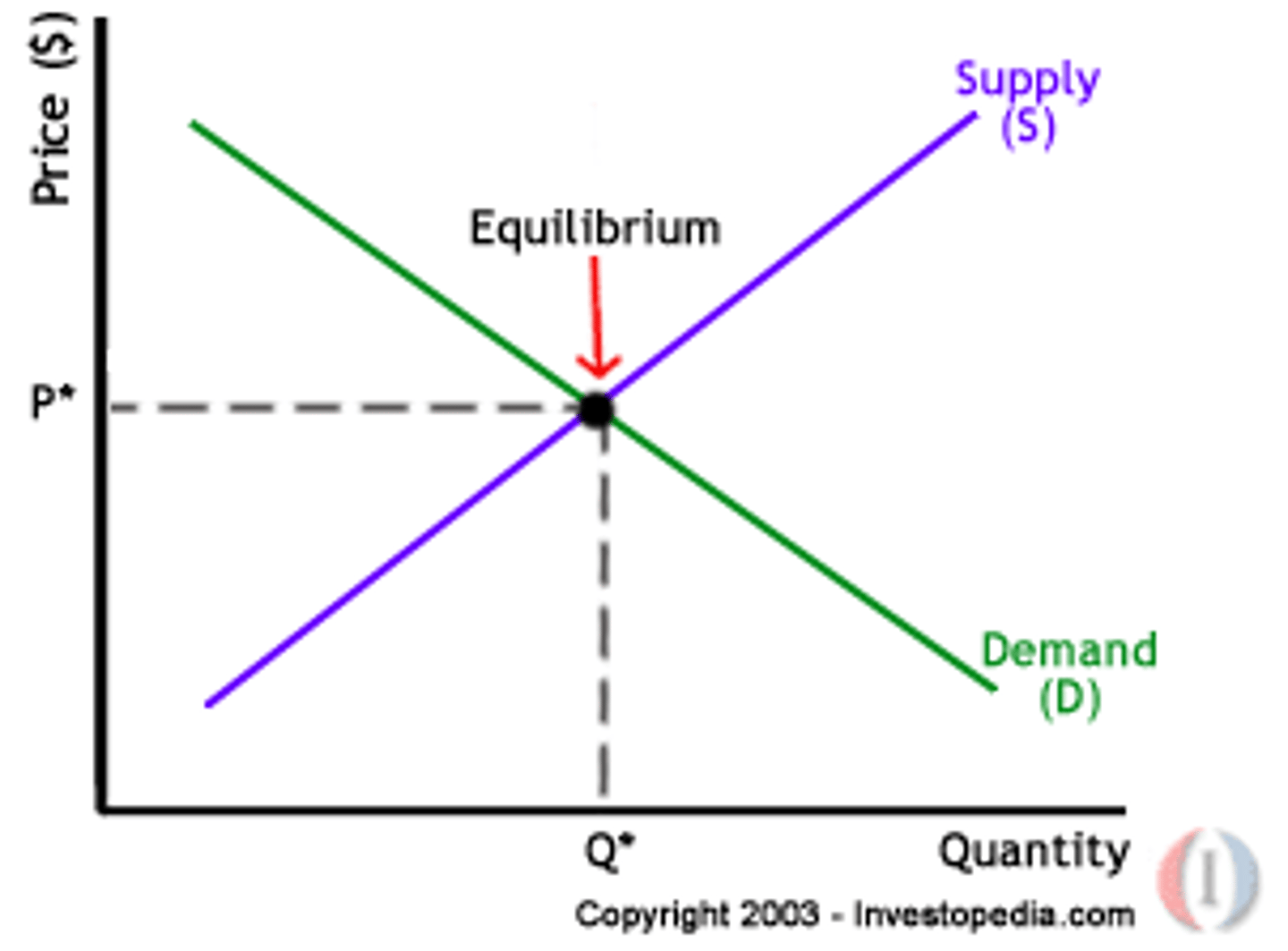

Market Clearing Price

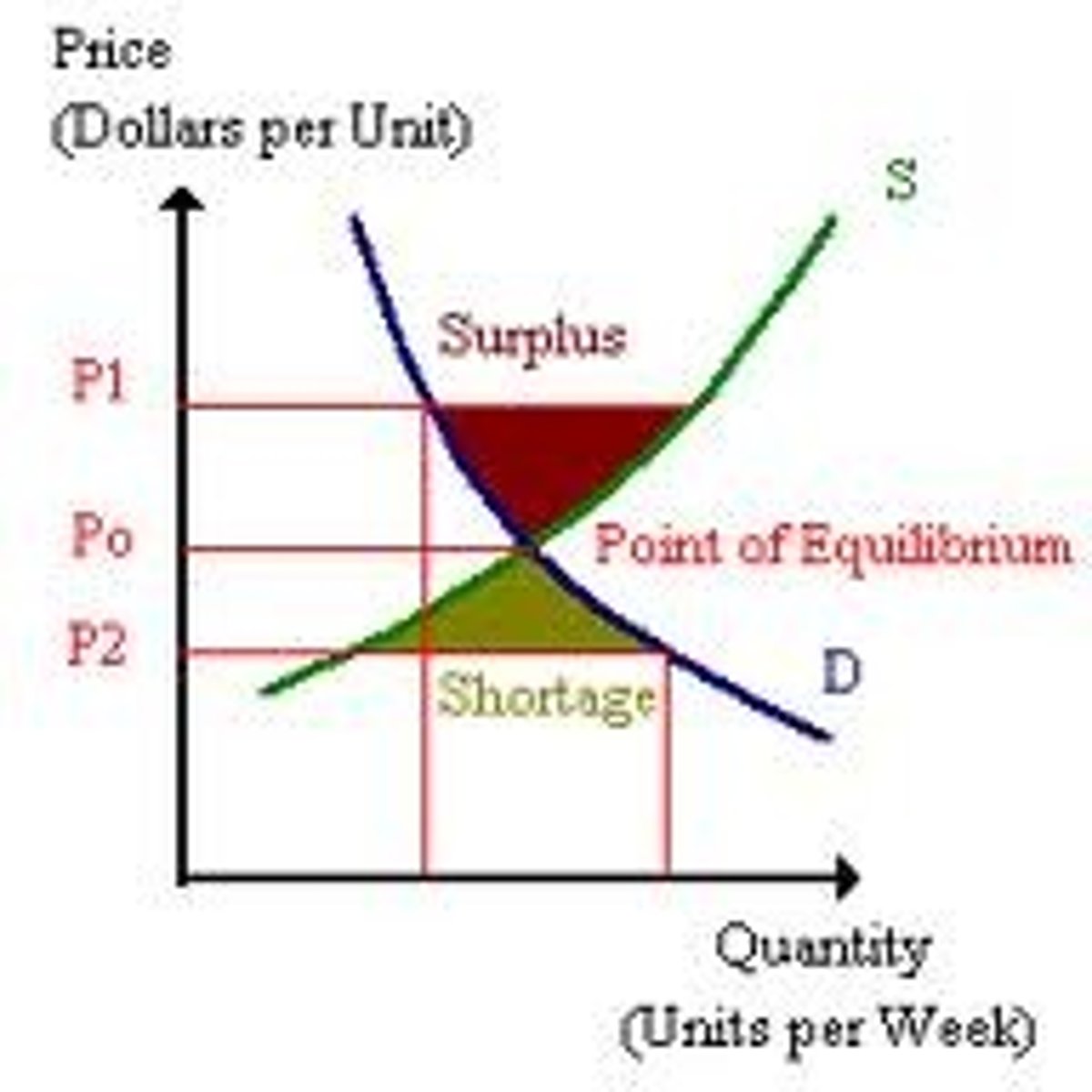

Price where the amount supplied in a market matches exactly the amount demanded.

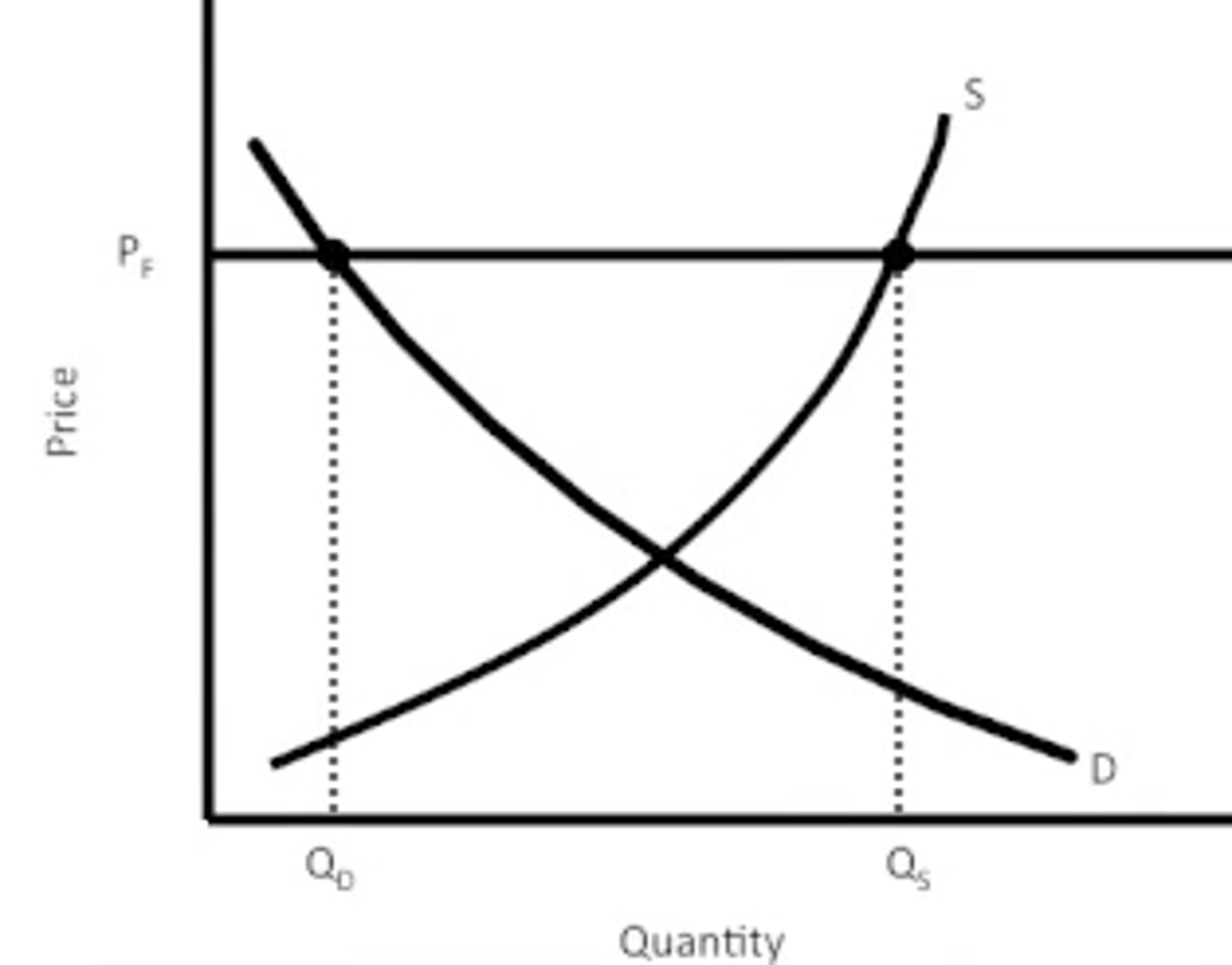

Price Floor

A legal minimum on the price at which a good can be sold (Ex: minimum wage)

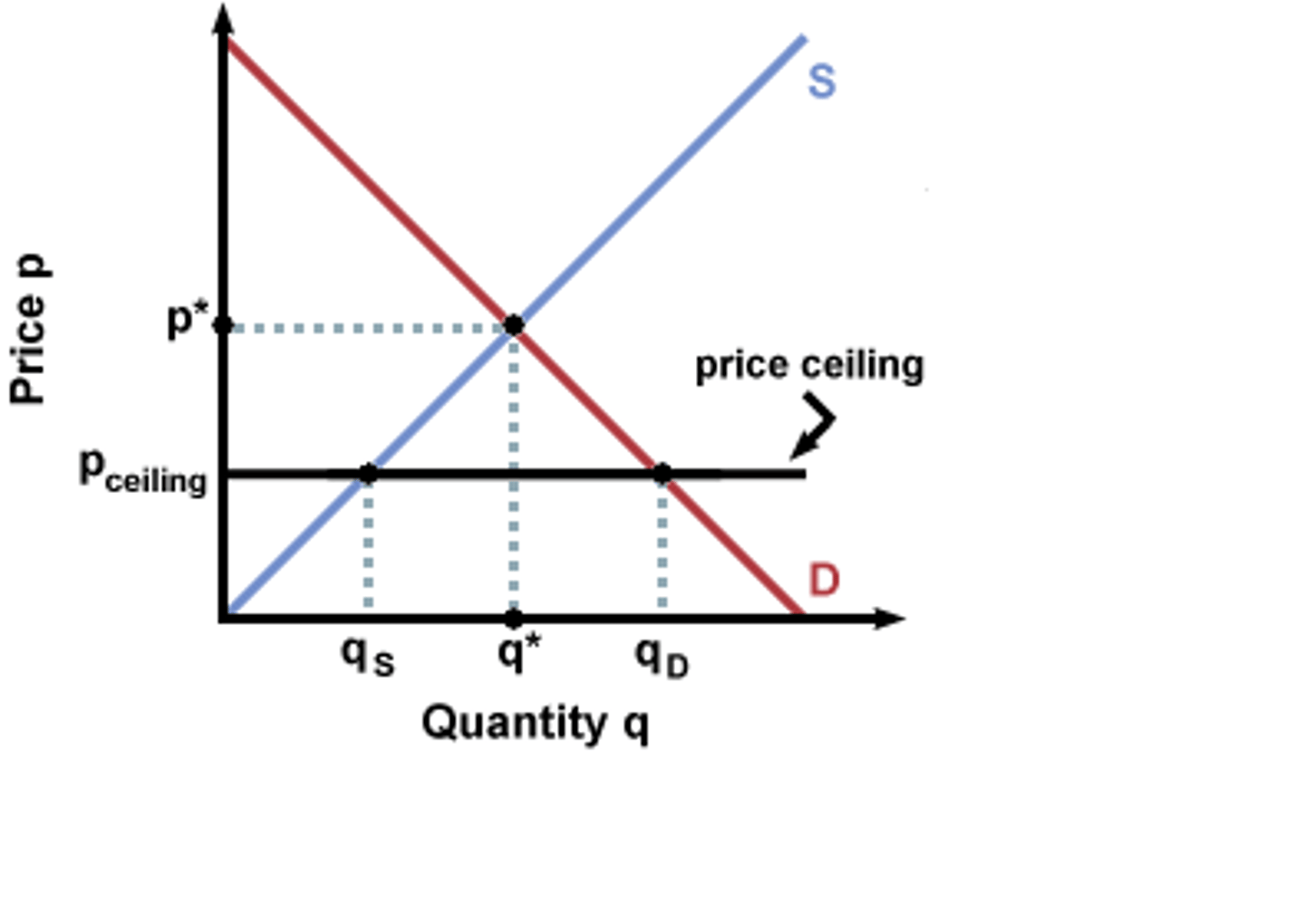

Price Ceiling

A legal maximum on the price at which a good can be sold (Ex: Rent Control)

Surplus

A situation in which quantity supplied is greater than quantity demanded

Shortage

A situation in which quantity demanded is greater than quantity supplied

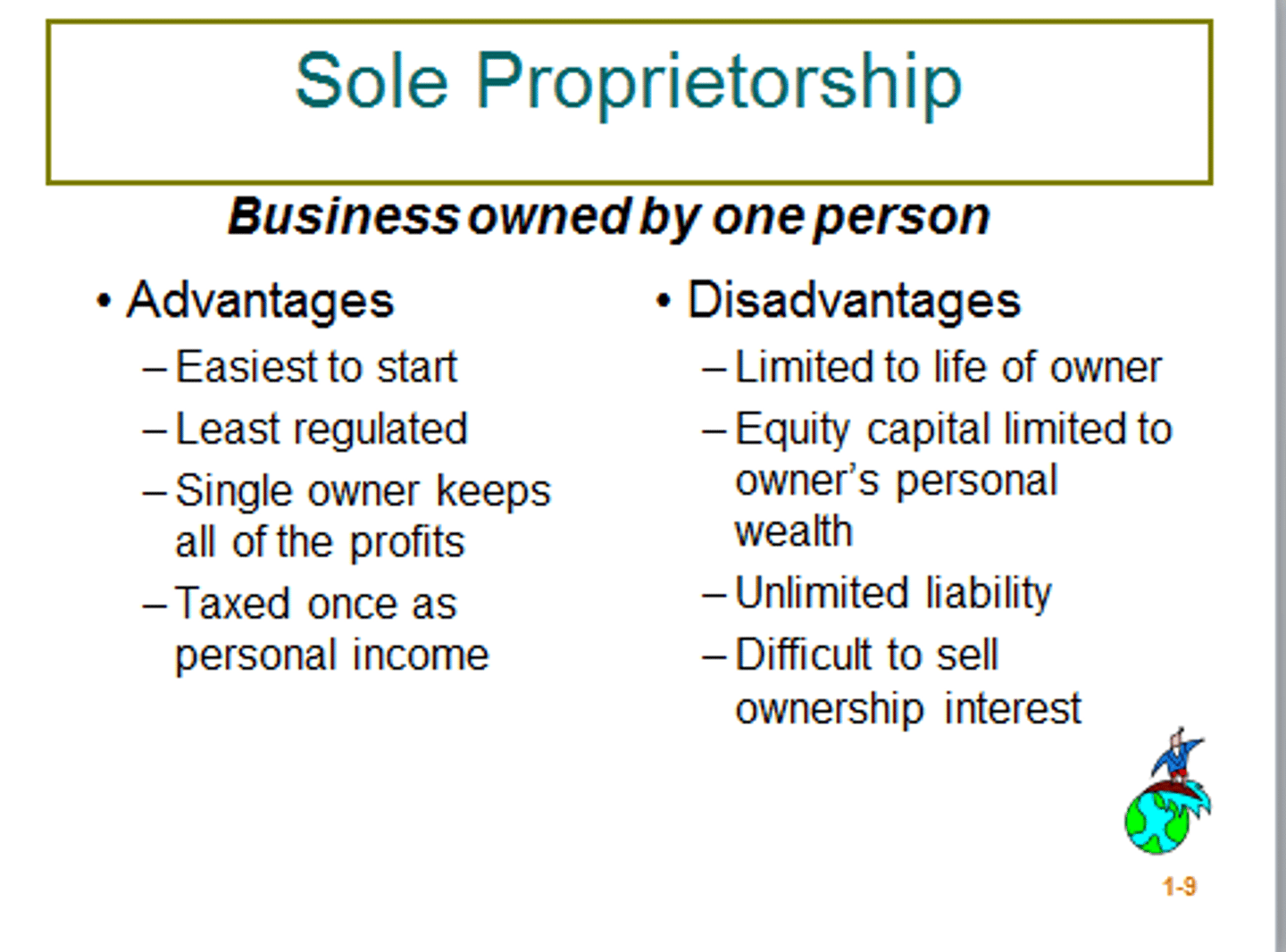

Sole Proprietorship

A business owned by one individual

Has unlimited liability

Complete control over business

Most numerous type of business

Easiest to start/shut down

Partnership

A business owned by two or more individuals

Unlimited (usually shared) liability

Can disagree over business decisions

Corporation

A business owned by shareholders (stock holders)

Run by a board of directions

limited liability

double taxed (income + dividends)

Limited Liability

Cannot lose personal belongings due to business debt

Unlimited Liability

The owner is personally and fully responsible for all losses and debts of the business

Perfect Competition

A large amount of businesses compete with identical products (fruits/vegetables)

Have no control over price

Easy barriers to entry

Monopolistic Competition

A large number of firms compete with similar products (fast food/clothing/etc.)

Have some control over price

Easy barriers to entry

Compete using non-price competition (advertising)

Non Price Competition

a way to attract customers through style, service, or location, but not a lower price

Oligopoly

A market structure in which a few large firms dominate a market

High barriers to entry

Can set own prices

Cannot collude (come together to set prices)

Monopoly

A market in which there are many buyers but only one seller.

High barriers to entry

Sets own price and people have to pay

Gross Domestic Product

The sum total of the value of all the goods and services produced in a nation in one year

*must be brand new *

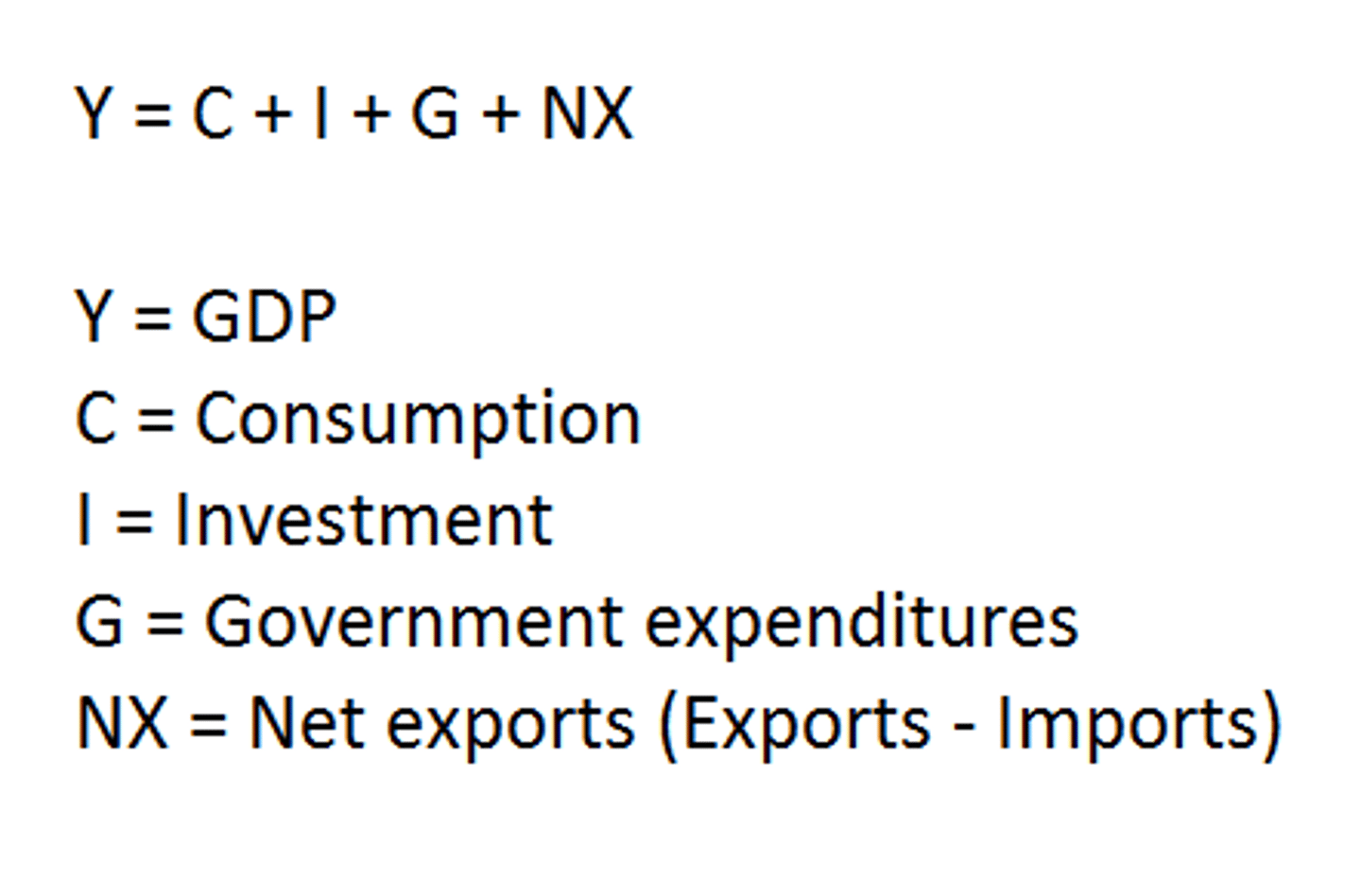

GDP: Formula

C + I + G + Xn

Consumption Goods

Investment Goods (business spending)

Government

Imports-Exports

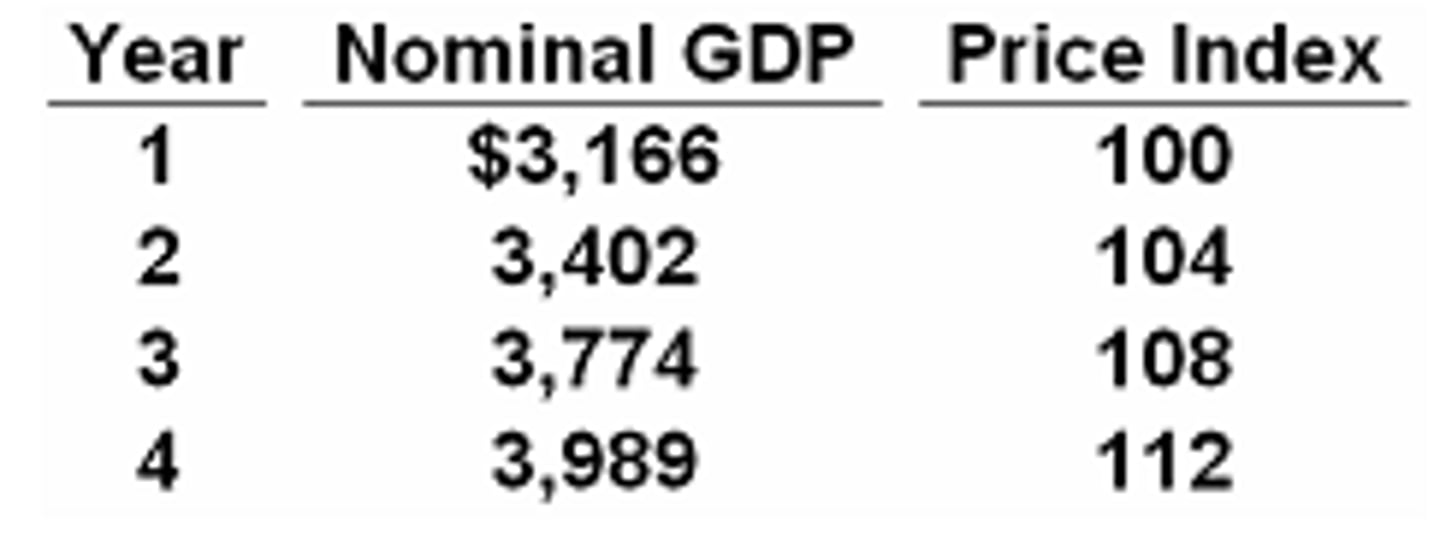

Real GDP

GDP which has adjusted for inflation over time

Unemployment

When an individual does not have a job who is willing and able to work

-Above the age of 16

-Not a full-time student

-Has to be looking for work

Discouraged Worker

An individual who has given up looking for work

Seasonal Unemployment

Unemployment caused by seasonal changes in the demand for certain kinds of labor

Frictional Unemployment

unemployment that occurs when people take time to find a job (first job, quit, fired)

Structural Unemployment

unemployment that occurs when workers' skills do not match the jobs that are available

Cyclical Unemployment

unemployment that rises during economic downturns and falls when the economy improves

Consumer Price Index (CPI)

Measures the rate of inflation

Inflation

General rise in prices

Market Basket

representative group of goods and services used to compile the consumer price index (typical goods bought by a household)

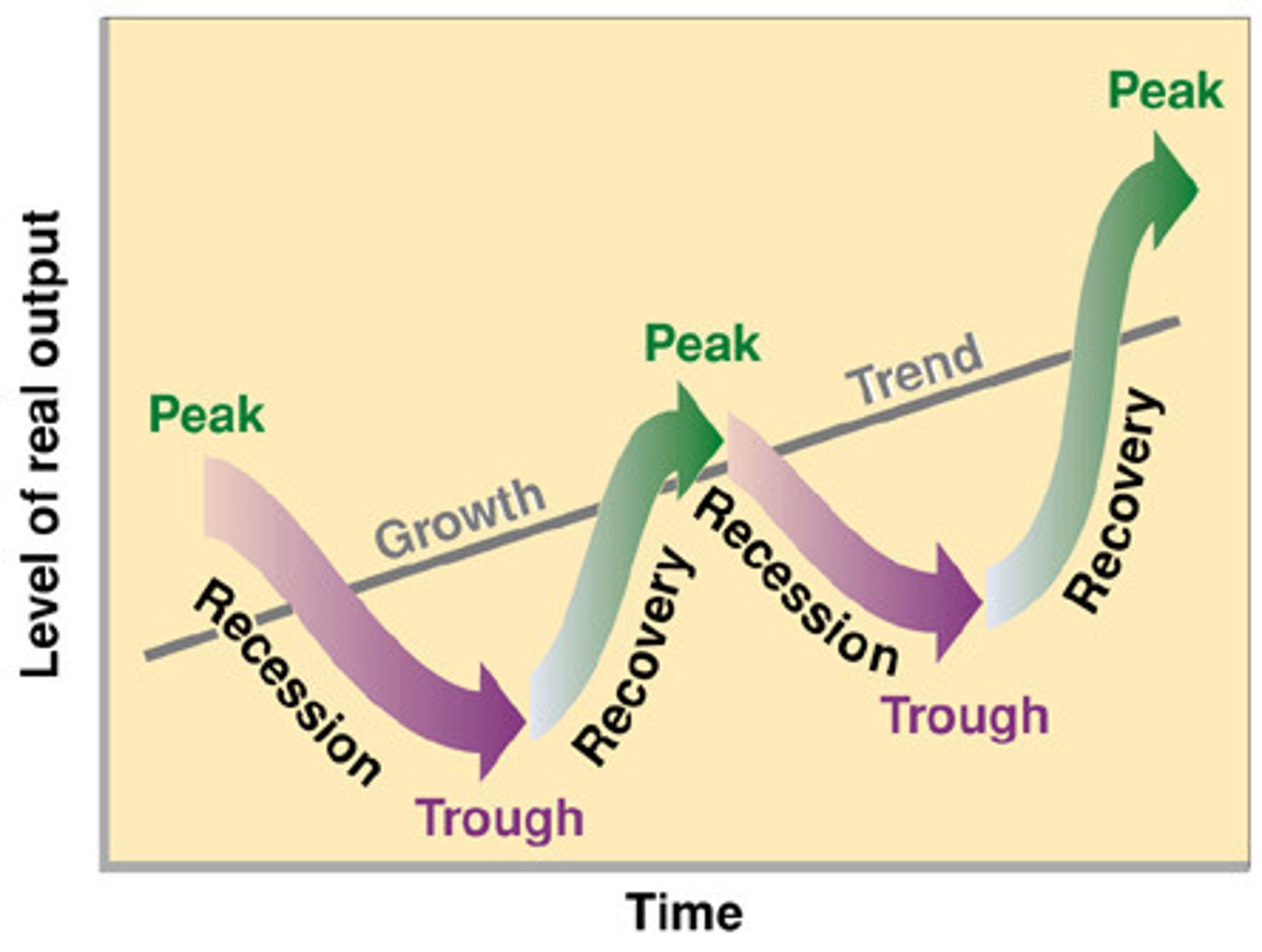

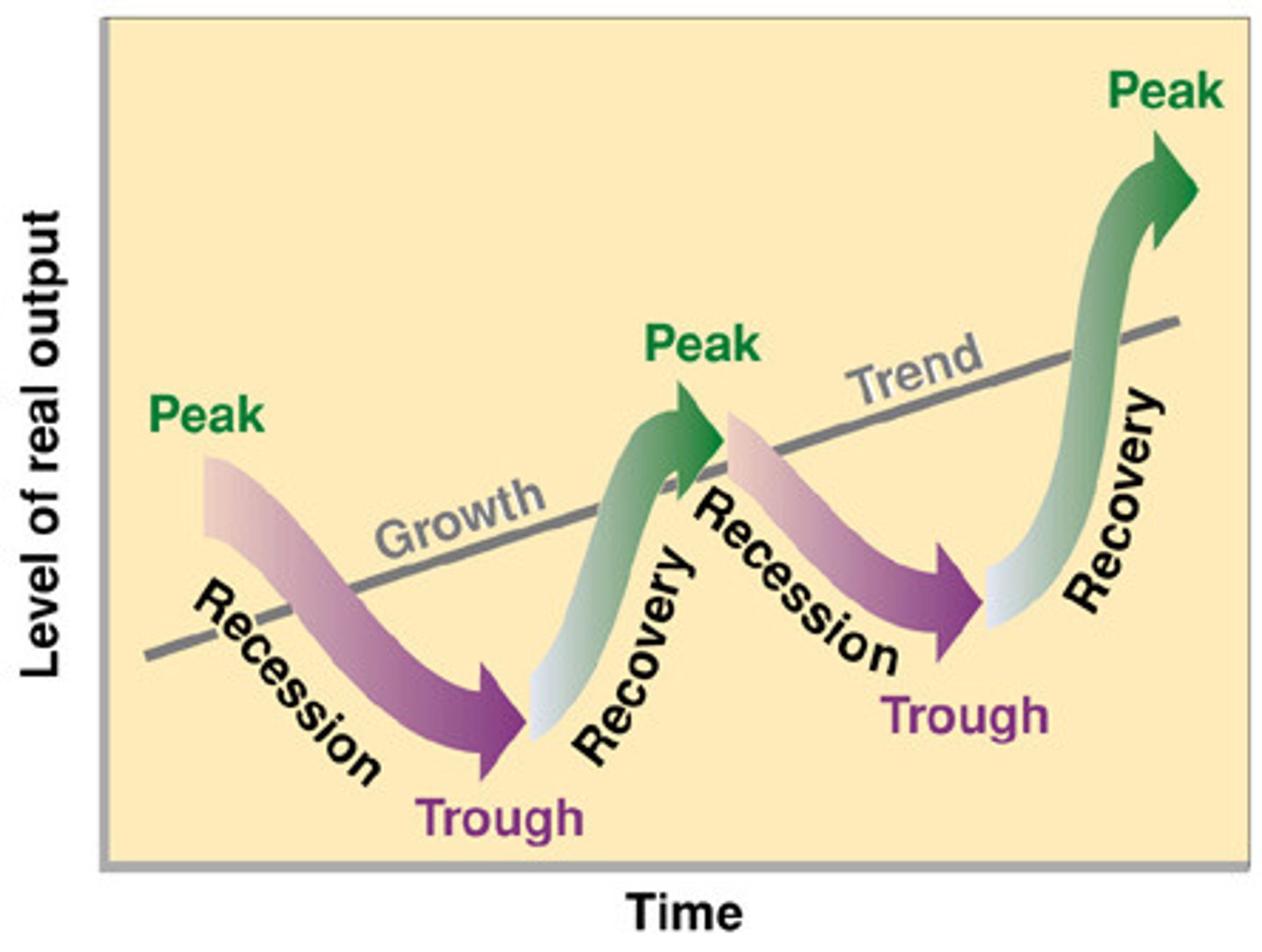

Business Cycle

Alternating periods of economic expansion and economic recession

Expansion

A period of economic growth as measured by a rise in real GDP

Peak

the height of an economic expansion, when real GDP stops rising

Contraction

a period of economic decline marked by falling real GDP

Trough

Lowest point of economic contraction, when real GDP stops falling

Recession

A period of declining real GDP, accompanied by lower real income and higher unemployment. 6 months or more

Depression

A period of low economic activity (recession) and rising unemployment. Record levels of unemployment and inflation

Medium of Exchange

anything that is used to determine value during the exchange of goods and services (dollars in the US)

Store of Value

Something that keeps its value if it is stored rather than used

Unit of Account

A means for comparing the values of goods and services (price tags)

Monetary Policy

Managing the economy by altering the supply of money and interest rates

Organization of the Federal Reserve

Board of Governors: 7 (run by the chairman)

FOMC: Board of governors + bank presidents

District Banks: 12

Member Banks: 25,000+

Federal Open Market Committee

Oversees the buying and selling of bonds

Open Market Operations

Buying & selling government securities (bonds) to change the supply of money

Required Reserve Ration

The ratio of reserves to deposits that banks are obligated by regulation to hold.

Discount Rate

The interest rate on the loans that the Fed makes to banks

Interests on Reserves

The Fed pays banks interest to hold money in reserve

Contractionary Monetary Policy

the federal reserve's adjusting the money supply to increase interest rates to reduce inflation

Increase RRR

Increase DR

Increase IOR

Sell Bonds

Expansionary Monetary Policy

the federal reserve's increasing the money supply and decreasing interest rates to increase real GDP

Decrease RRR

Decrease DR

Decrease IOR

Buy Bonds

Fiscal Policy

Government policy that attempts to manage the economy by controlling taxing and spending.

Expansionary Fiscal Policy

An increase in government spending or a reduction in taxes

Contractionary Fiscal Policy

A decrease in government spending or an increase in taxes

National Debt

The sum of government deficits over time.

Government Deficit

The dollar amount that a country is over budget within a given fiscal year

Budget Surplus

An excess of tax revenue over government spending (government makes money- takes away from debt)

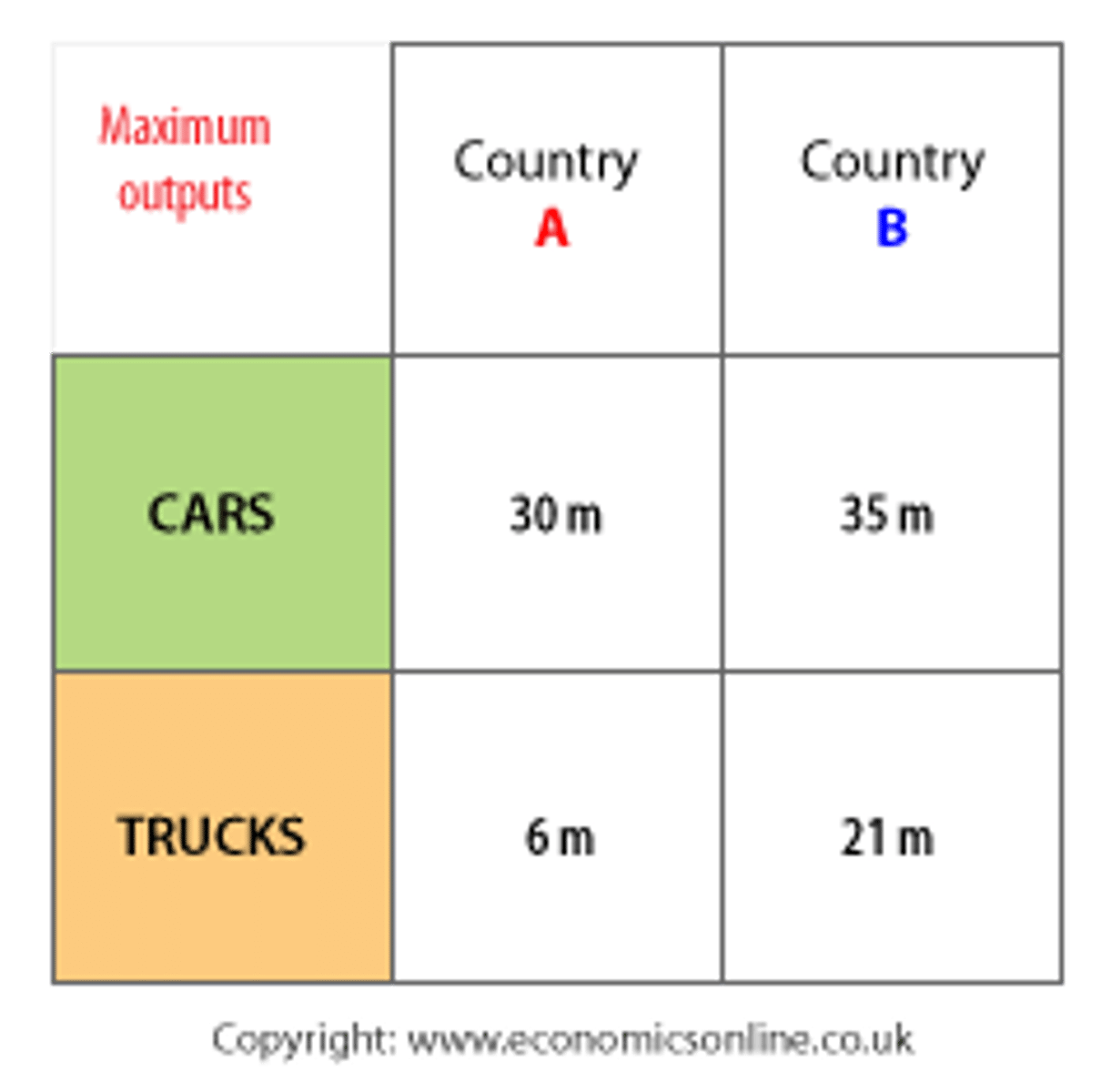

Absolute Advantage

the ability to produce more of a given product using a given amount of resources

Comparative Advantage

The ability of a country to produce a good at a lower cost than another country can.

Trade Surplus

when a country exports more than it imports

Trade Deficit

An excess of imports over exports

Balance of trade

the difference between a country's total exports and total imports

Trade Barriers

Taxes, quotas, and other restrictions on goods entering or leaving a country.

Tariff

A tax on imported goods (makes items more expensive)