chp 8 - cash & receivables

1/41

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

42 Terms

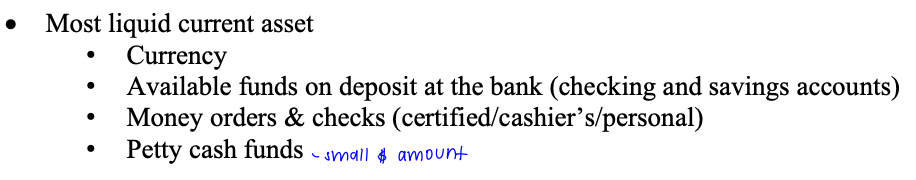

most liquid current assets

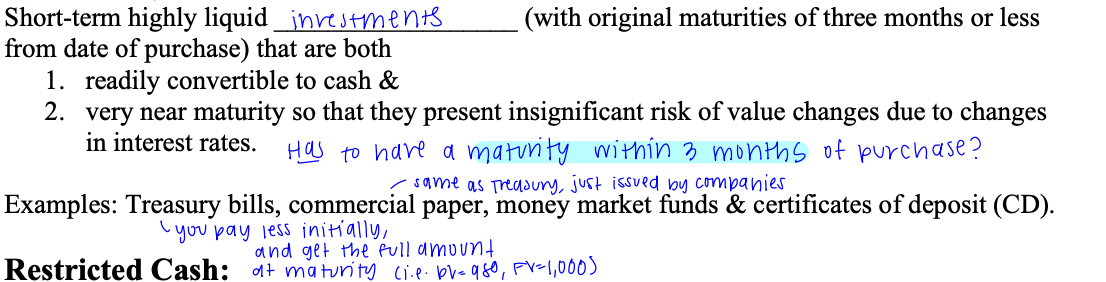

what are cash equivalents

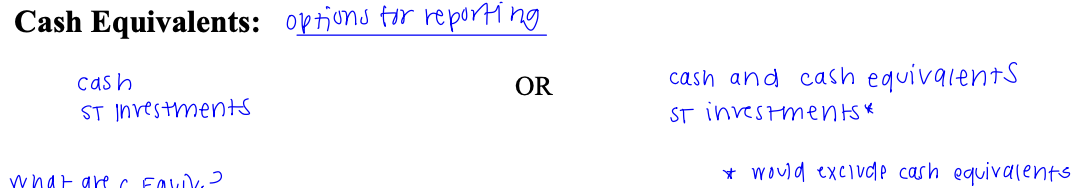

options for reporting cash equivalents

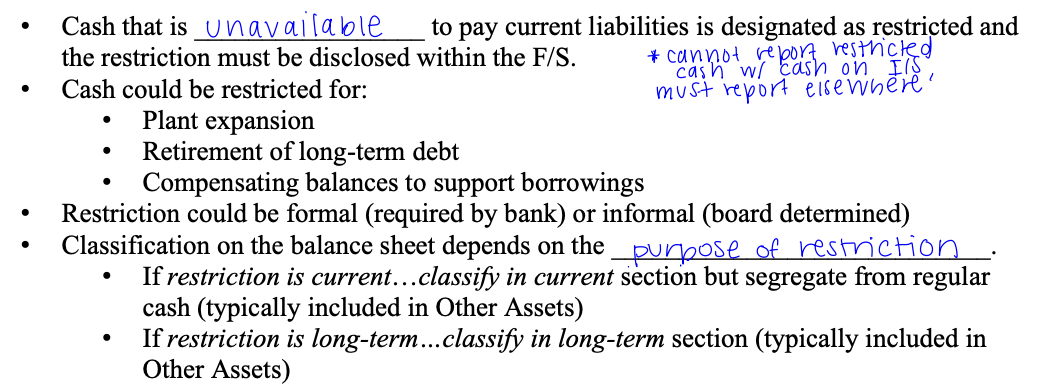

restricted cash

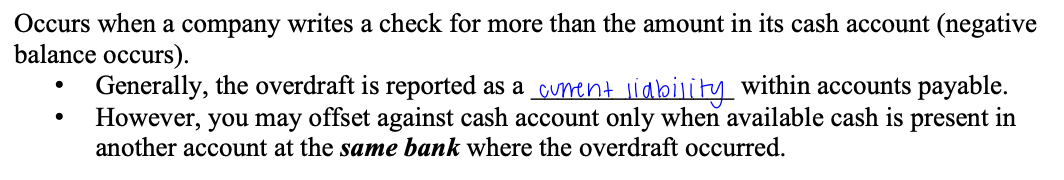

bank overdrafts

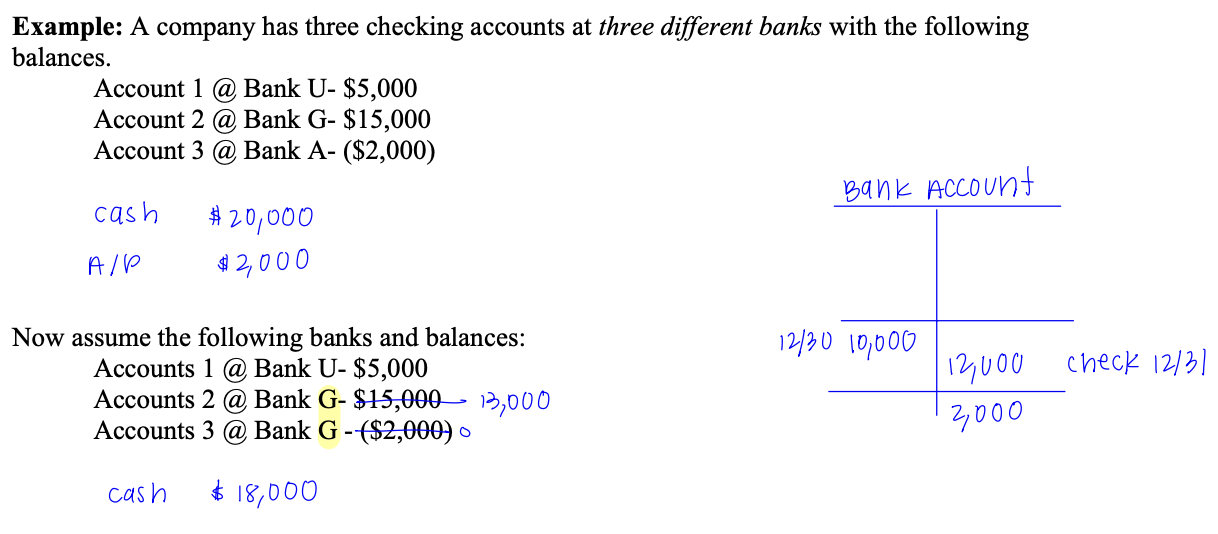

bank overdraft example

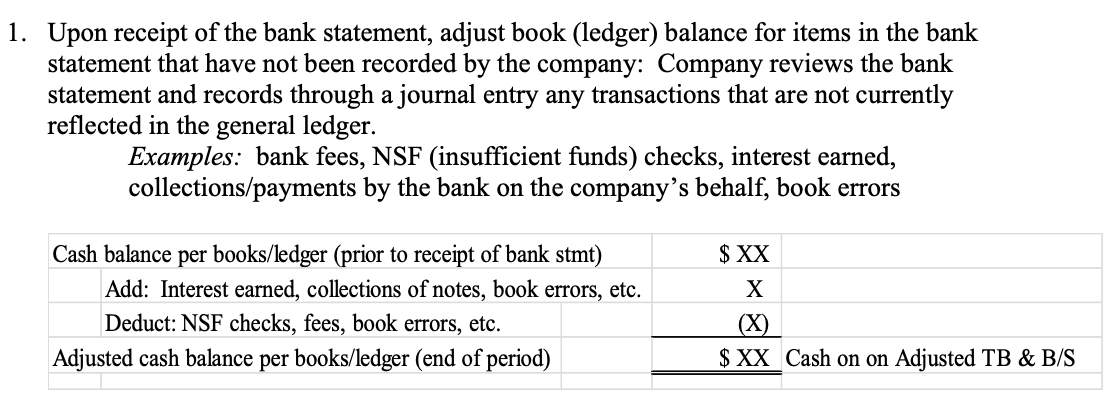

bank reconciliation: cash balance per books

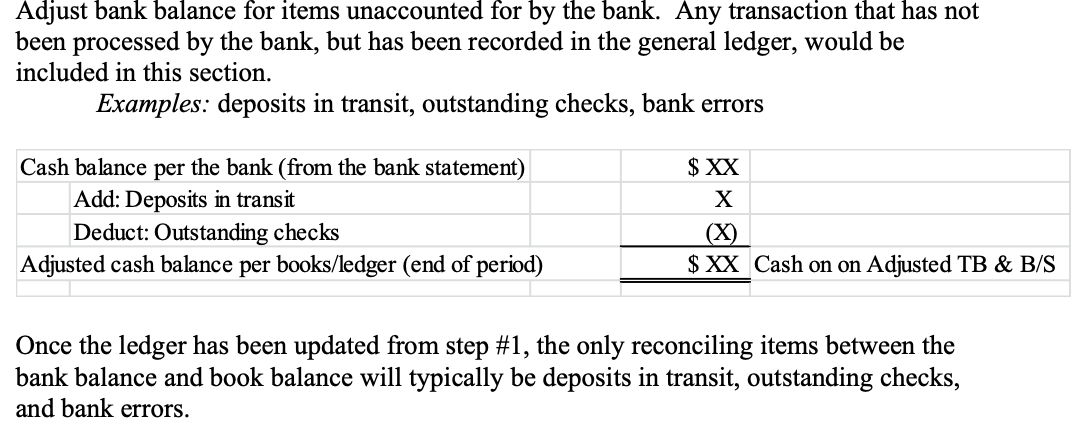

bank reconciliation: cash balance per bank

what are receivables

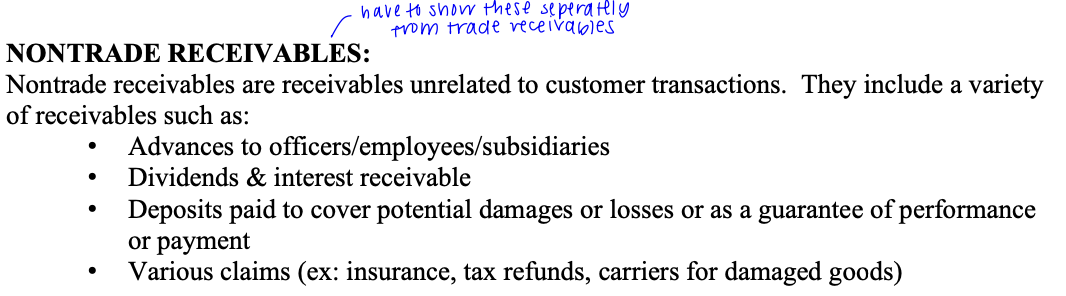

non-trade receivables

trade receivables

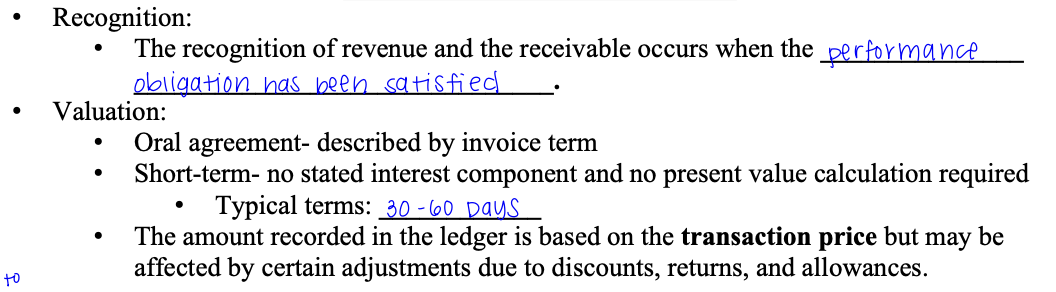

a/r (recognition and valuation)

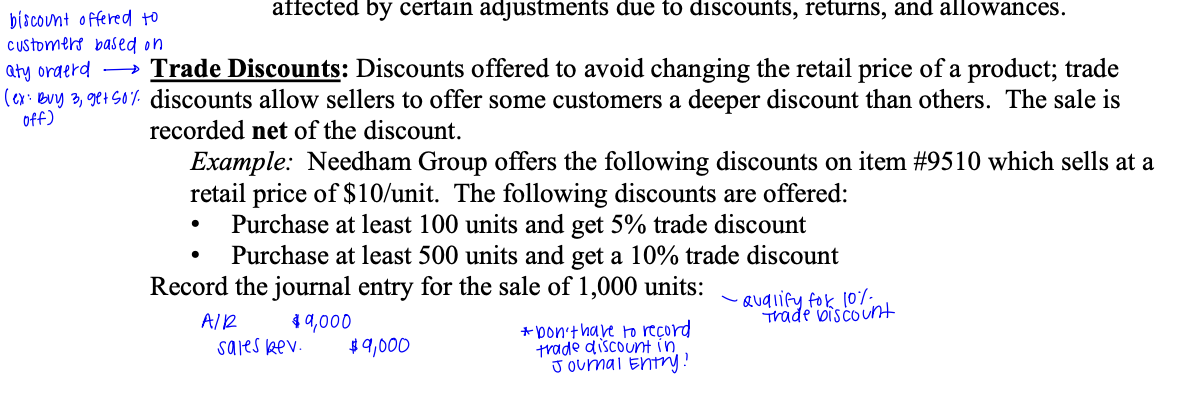

trade discounts

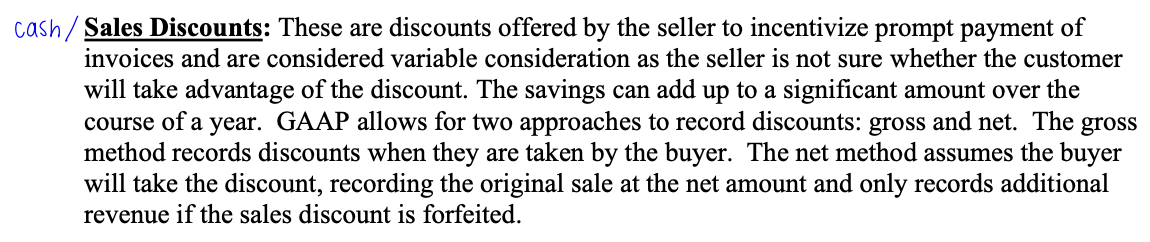

sales discounts

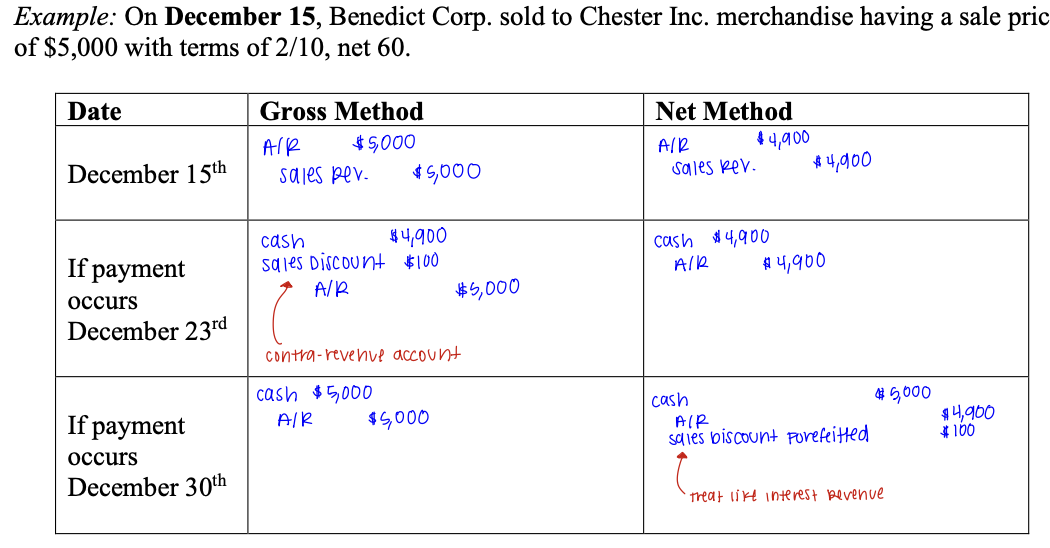

example of sales discounts (gross vs net method)

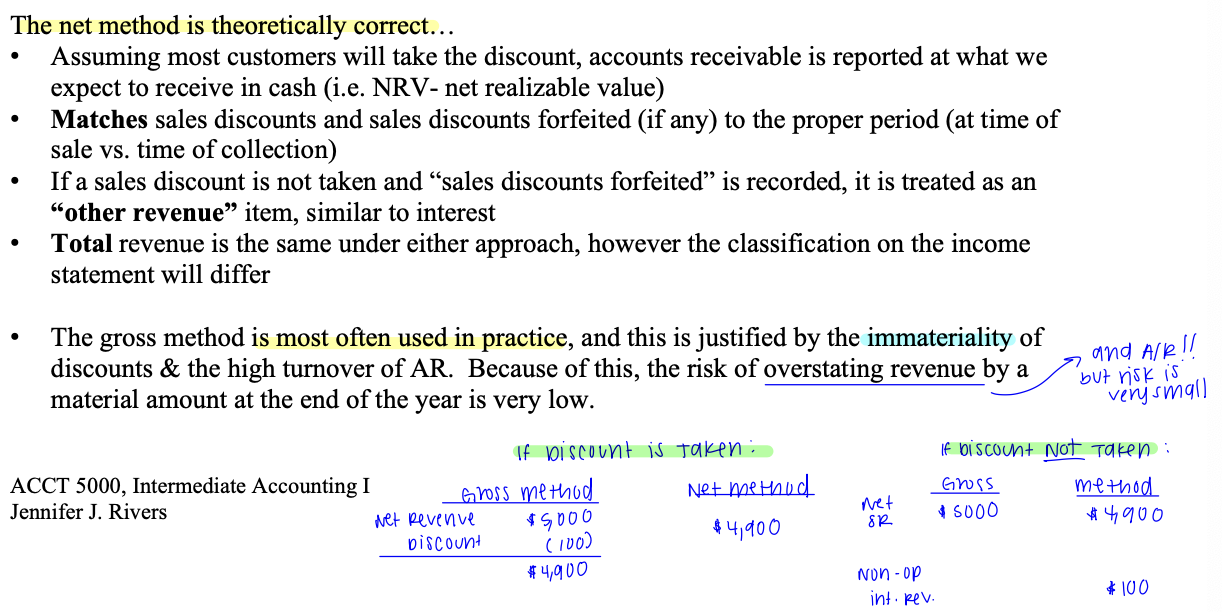

sales discounts & sales discounts forfeited accounts

net method vs gross method

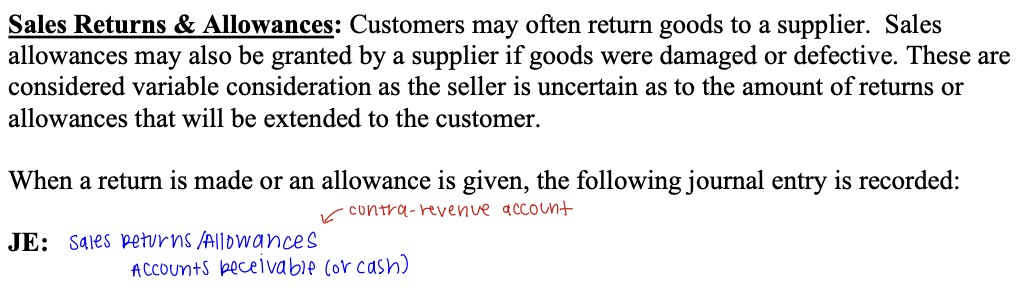

sales returns & allowances when customers return goods

sales returns & allowances if estimating before hand

what kind of entry is sales return and allowances

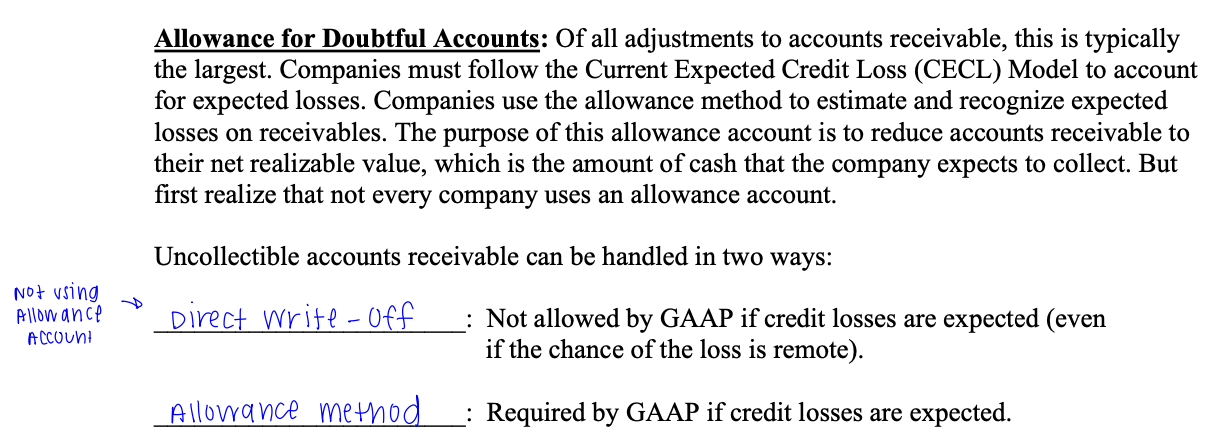

allowance for doubtful accounts (what are they and 2 methods to record)

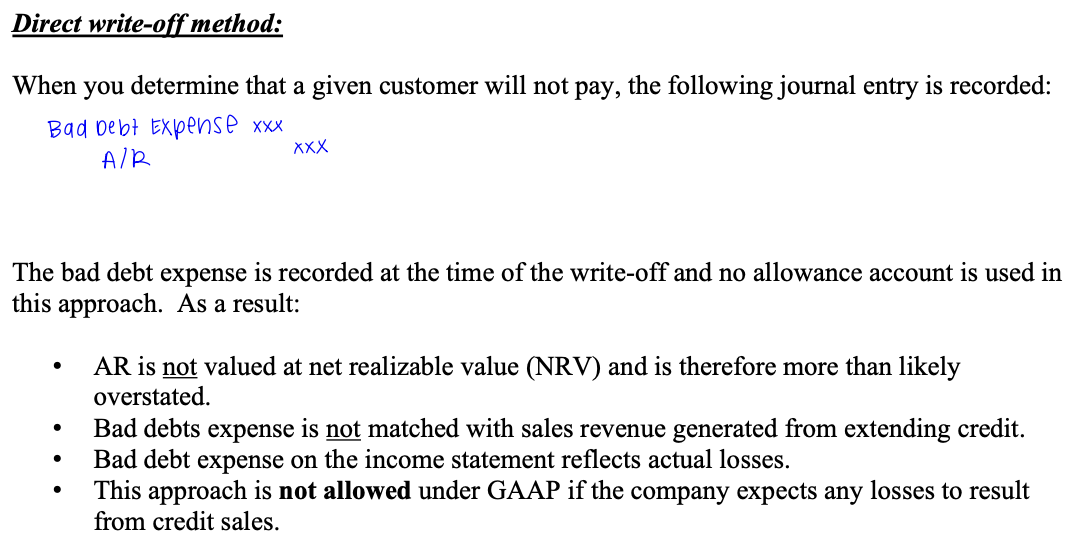

direct write off method

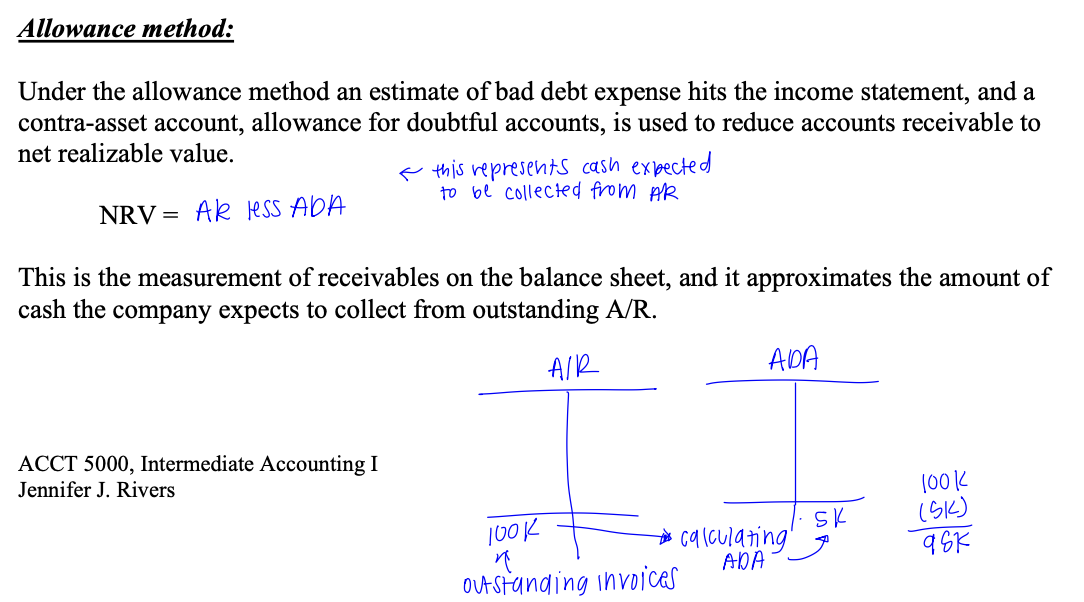

allowance method

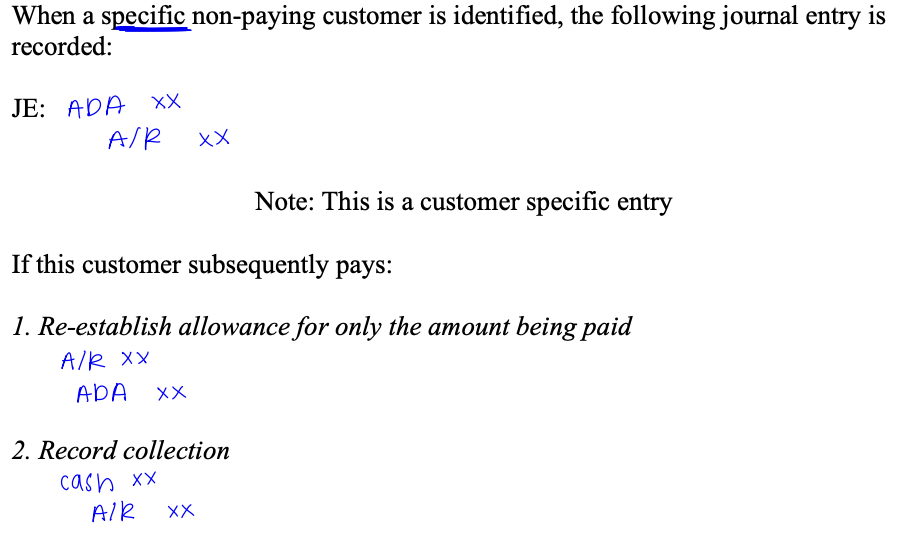

when a specific non-paying customer is identified, these journal entries are recorded

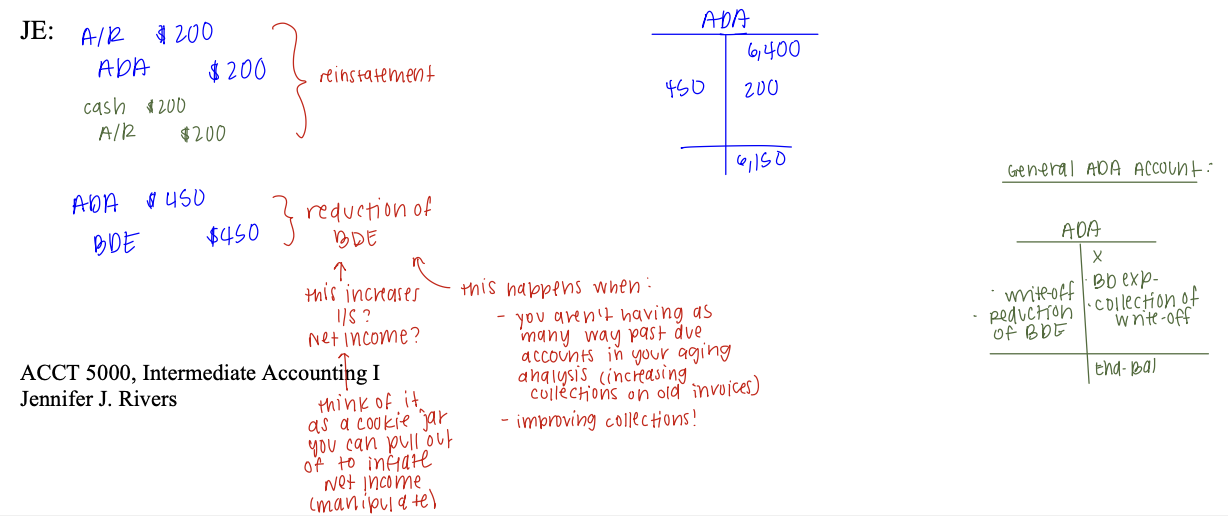

In 20x8, the customer whose account balance was written off, is able to pay $200. At year-end 20x8, the company determines the ending balance required in the ADA account should total $6,150. Record the journal entries to reflect the above activity.

notes receivable

besides lending, notes also result from the following:

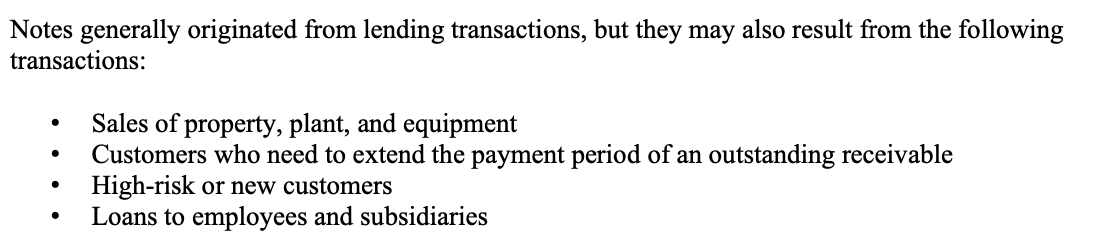

valuation on the balance sheet

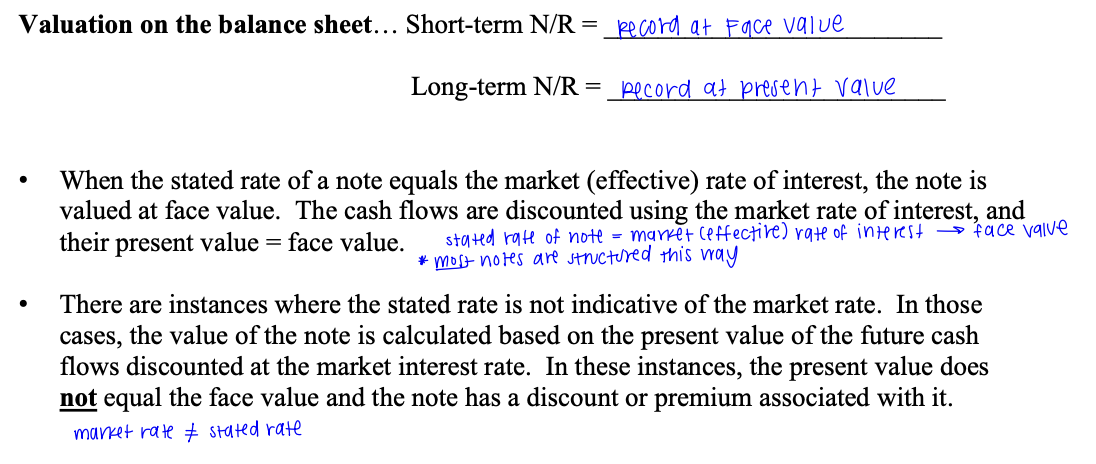

example of stated rate = market rate

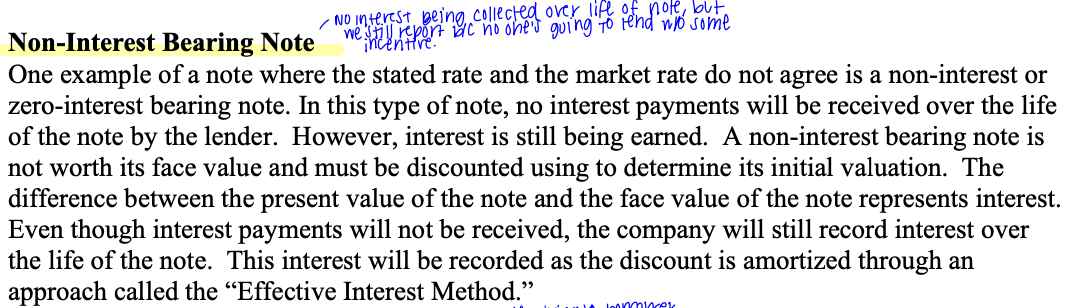

stated rate =/= market rate (non-interest bearing note)

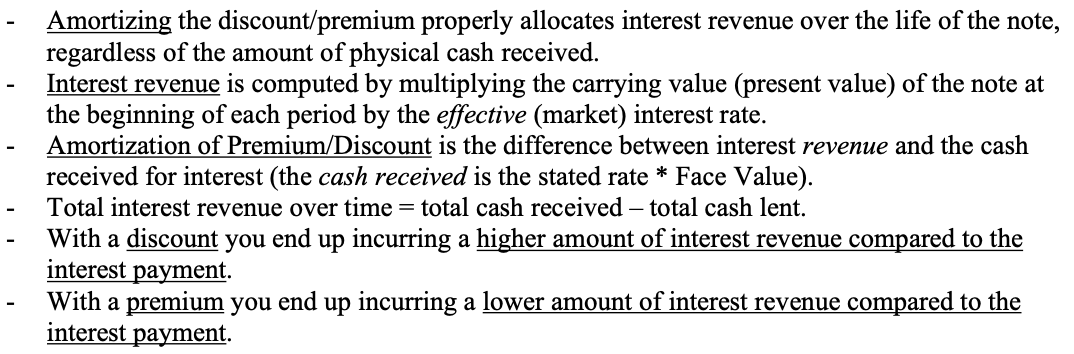

effective interest amortization of discount/premium

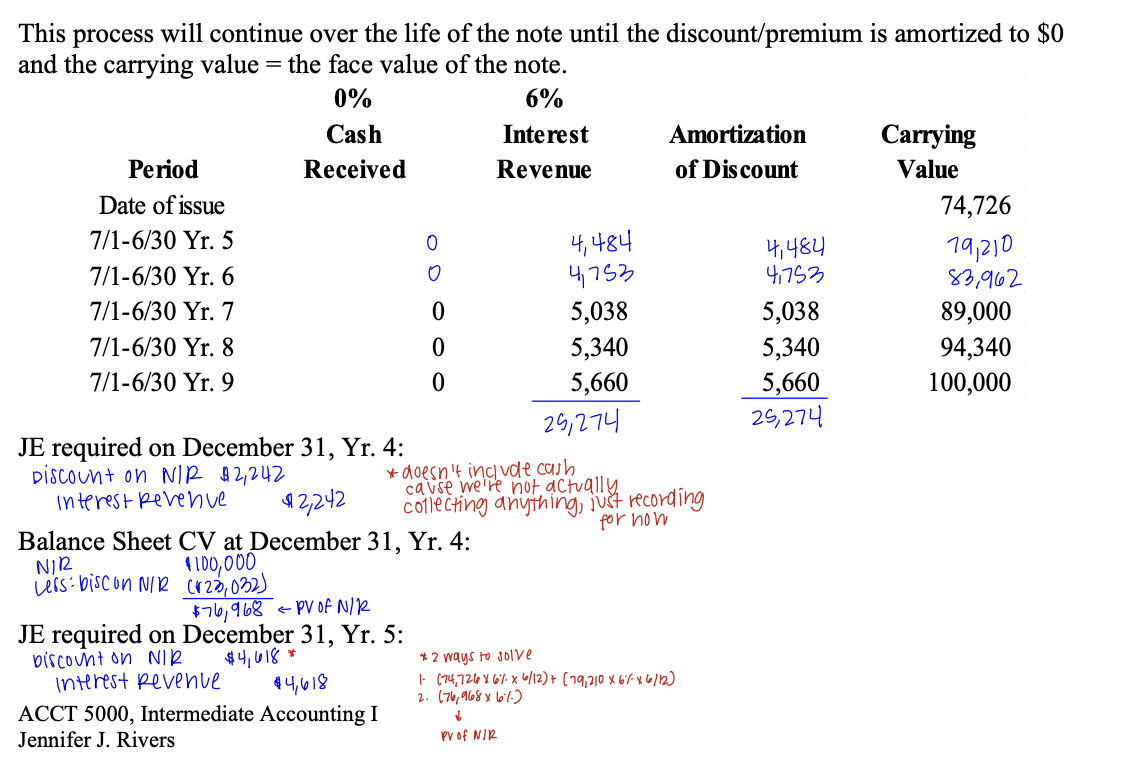

example of effective interest amort of discount/premium

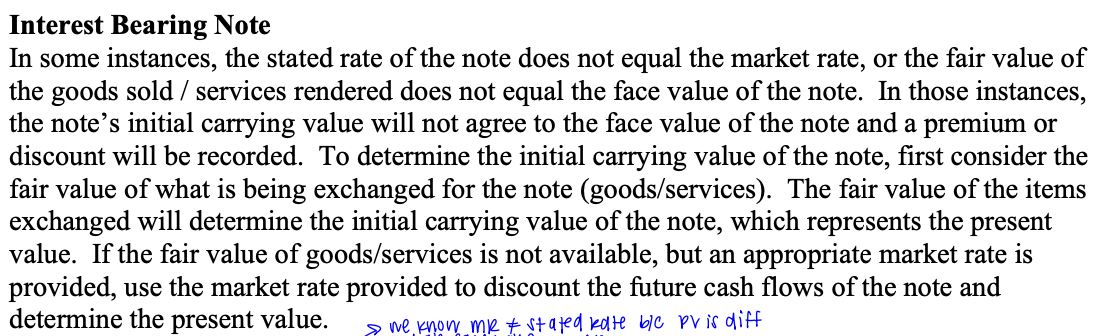

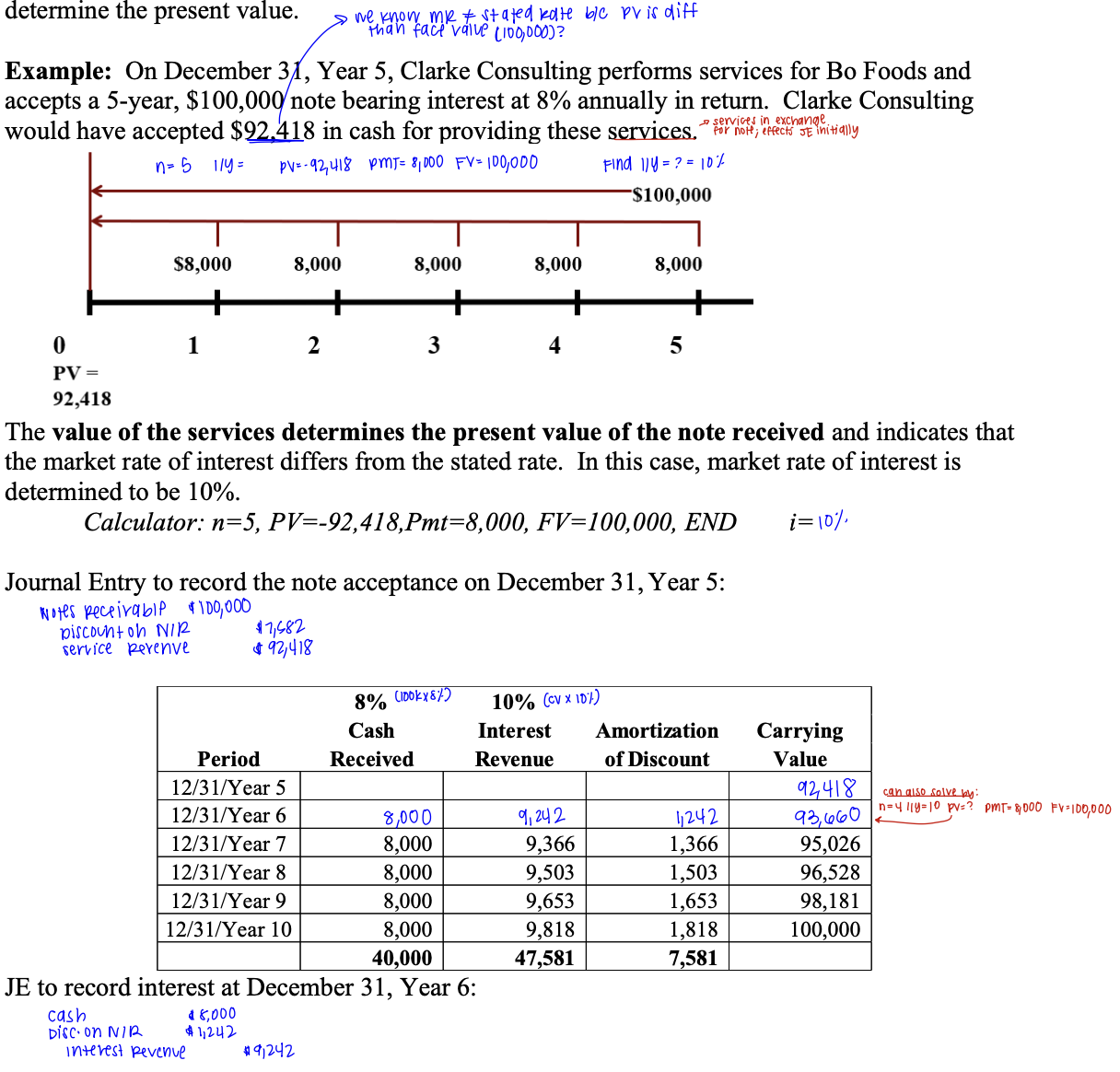

stated rate =/= market rate (interest bearing note)

example of interest bearing note

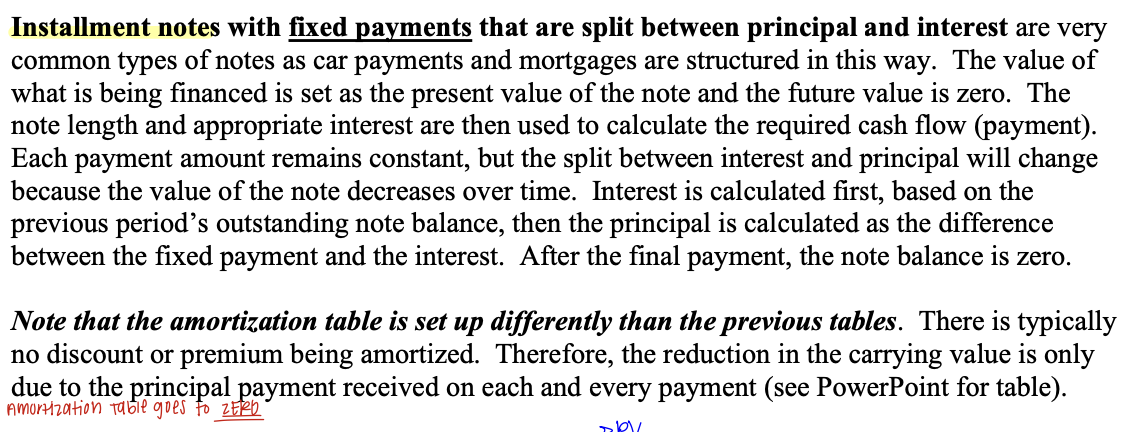

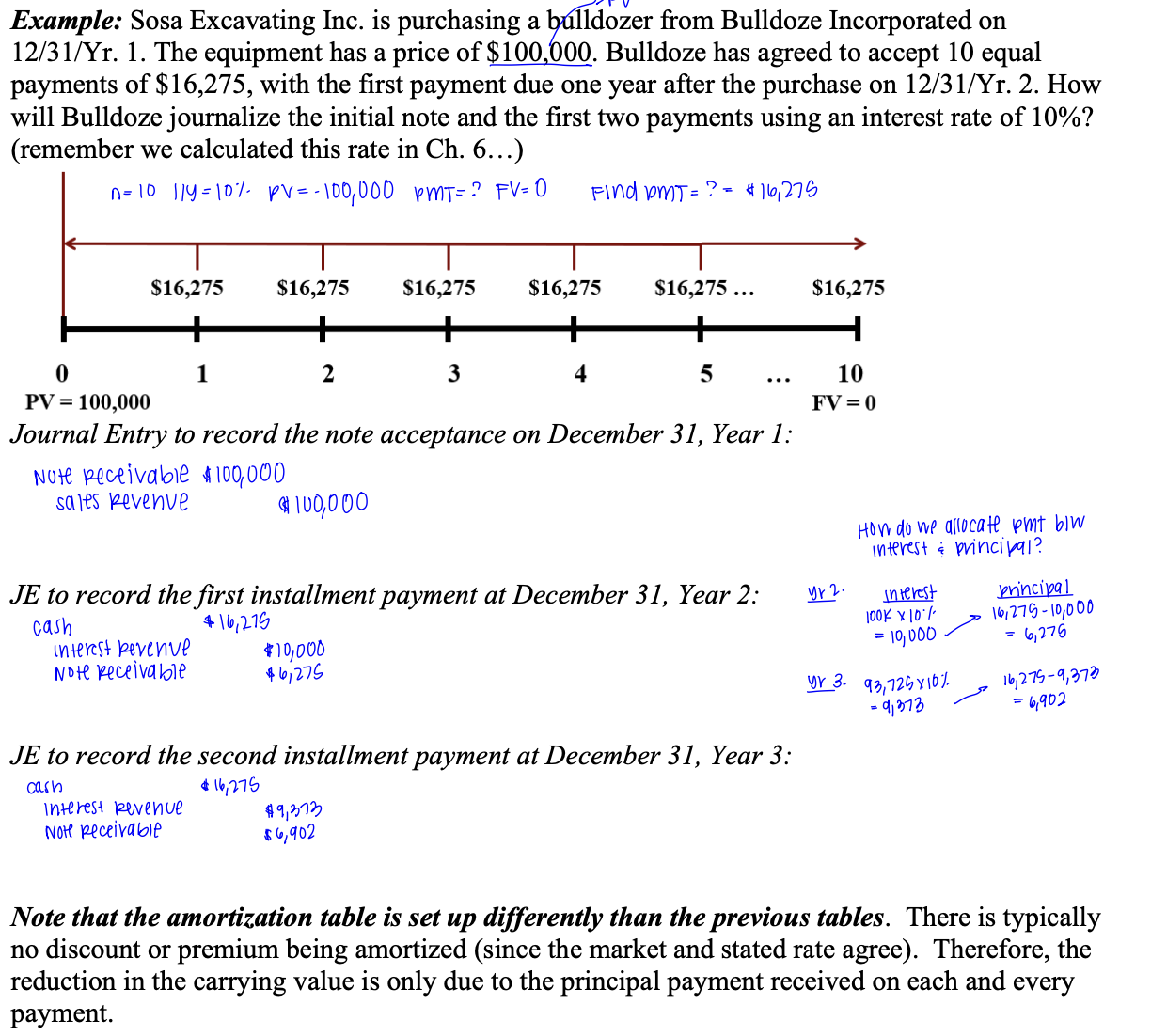

stated rate = market rate (installment notes with fixed payments)

example of installment loan

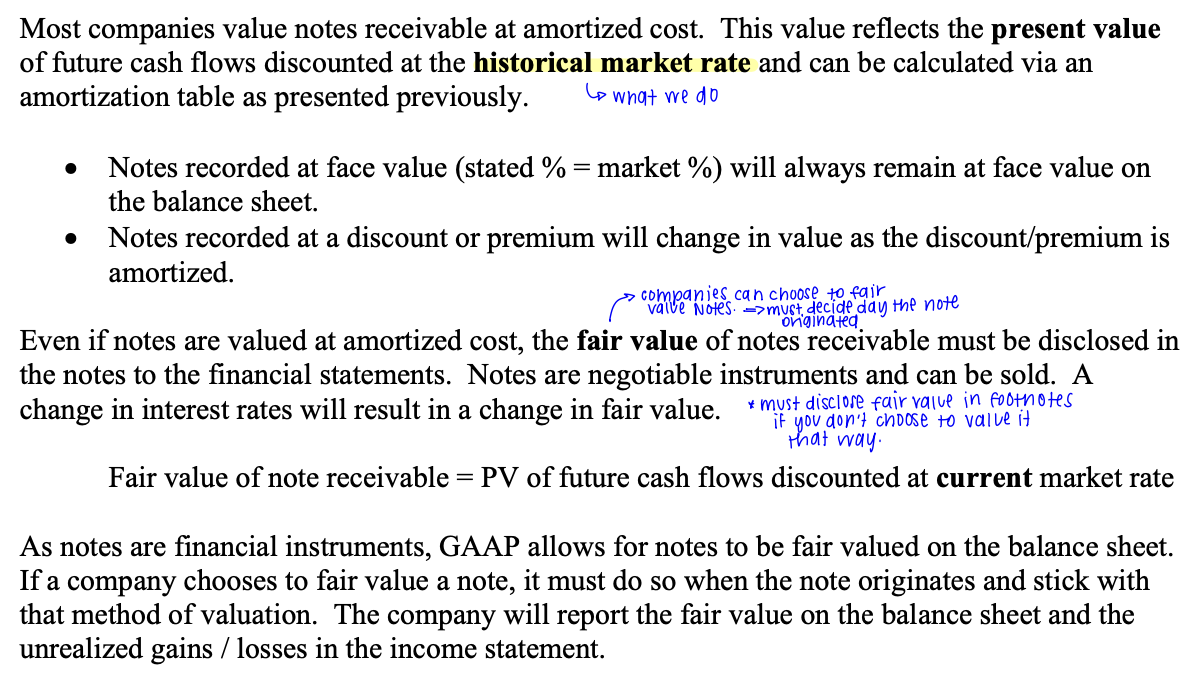

measurement on the b/s for n/r

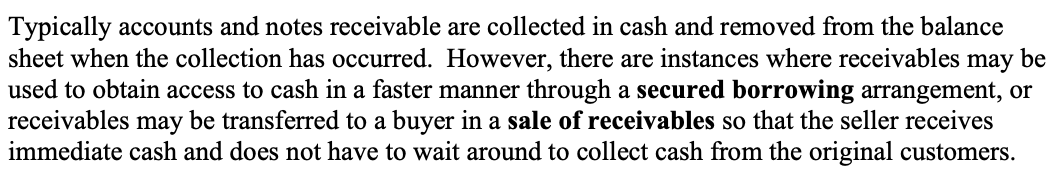

disposition of accounts and n/r

secured borrowing

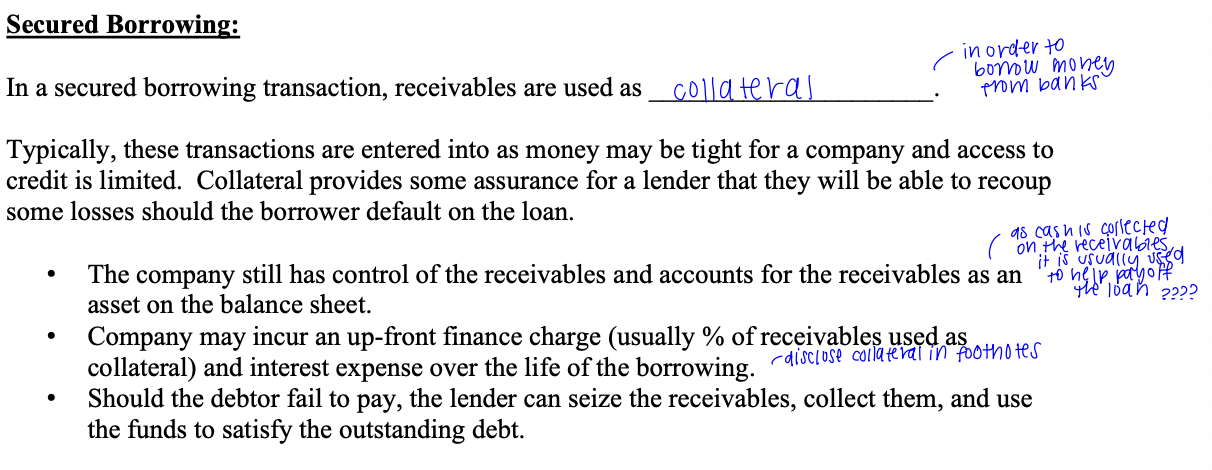

sale of receivables

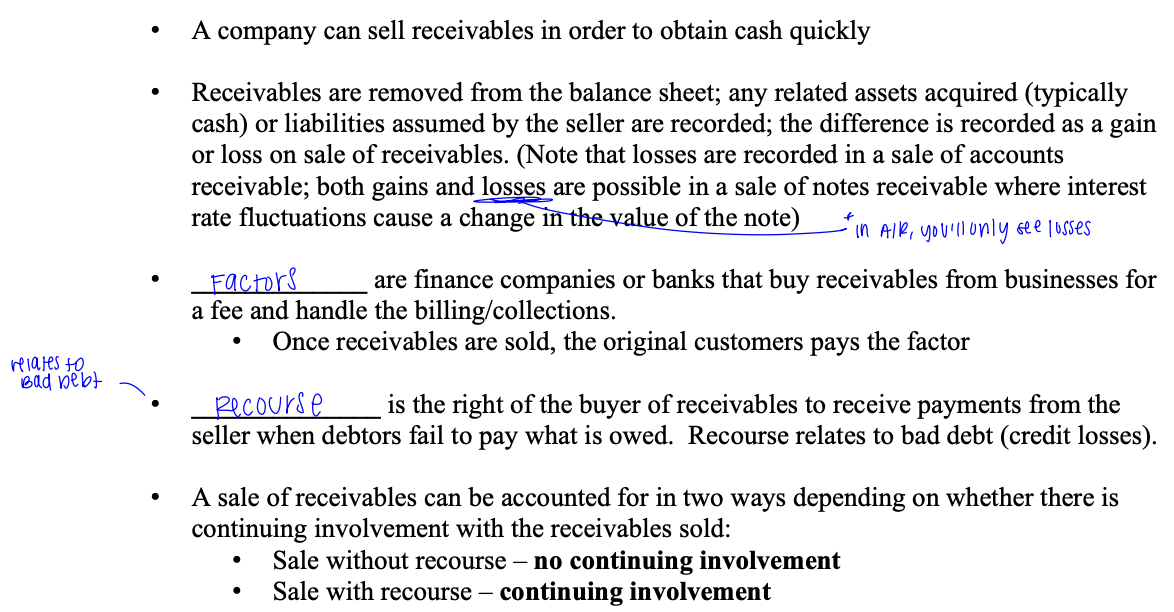

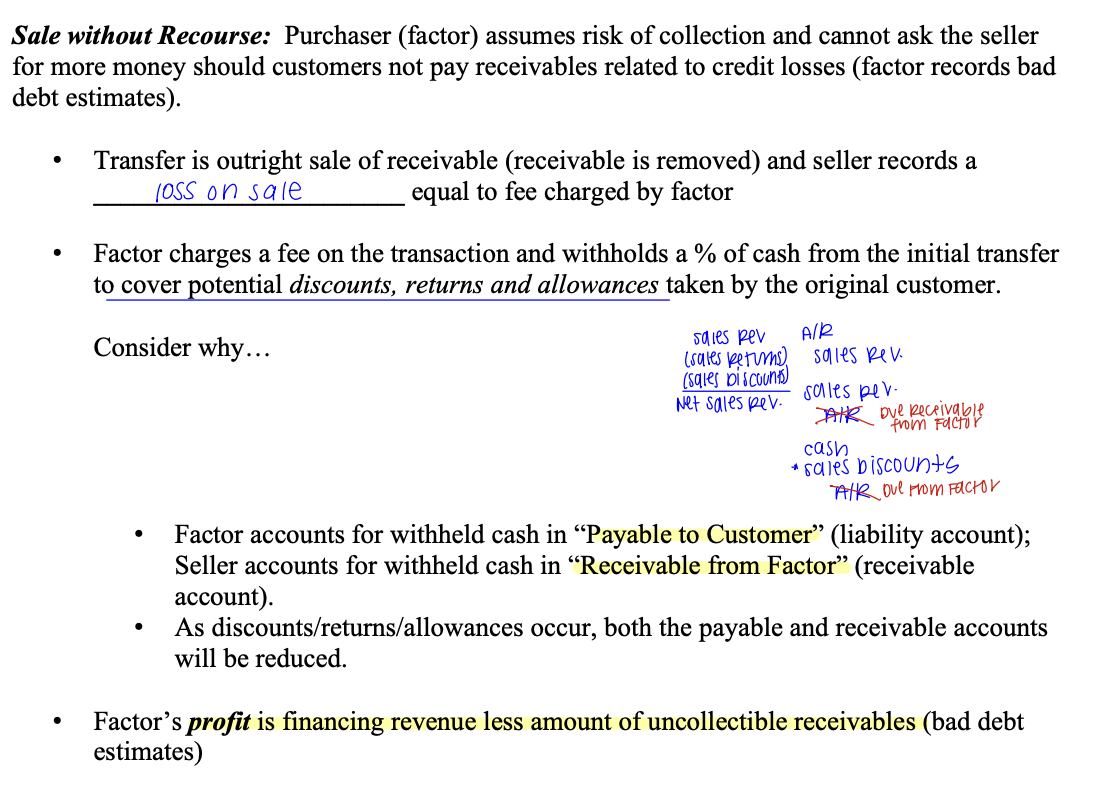

sale without recourse

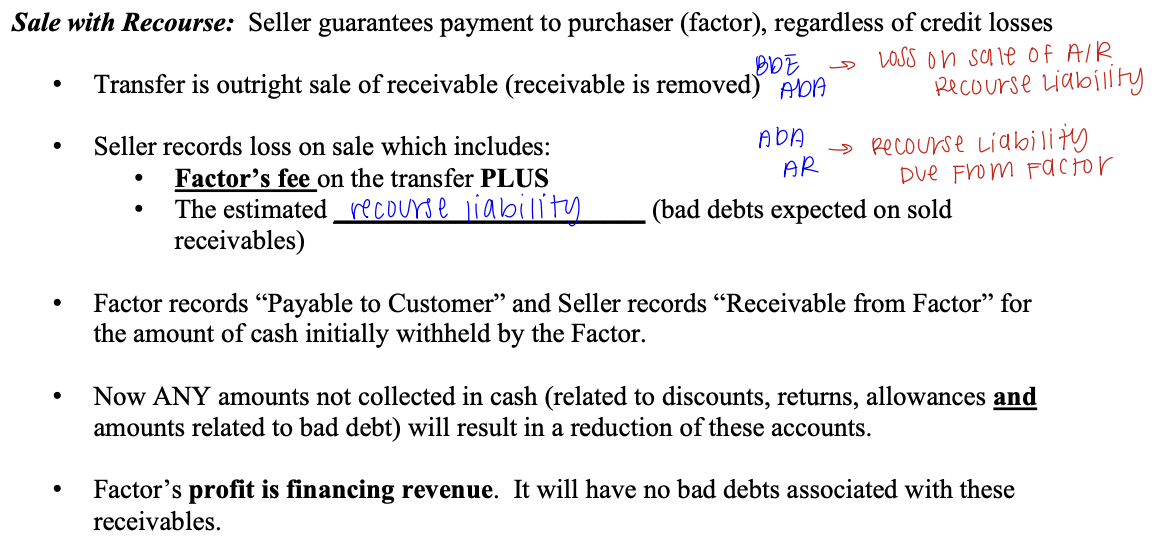

sale with recourse