6.2: Externalities

1/14

Earn XP

Description and Tags

These flashcards cover key concepts related to market failures, externalities, and the government's role in economic policies.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

15 Terms

What is an externality?

A third-person side effect that results in external benefits or external costs to someone other than the original decision maker.

Why are externalities considered market failures?

Because the free market fails to include external costs or external benefits.

What example illustrates a common negative externality?

Smoking cigarettes is an example of a negative externality where the costs, such as health issues from second-hand smoke, affect others.

What is a negative externality or “spillover cost”?

A situation that results in a cost for a different person other than the original decision maker, that “spills over” to other people or society.

What might the government do regarding a firm producing too much product due to a negative externality?

The government might limit the firm's production to address the negative externality.

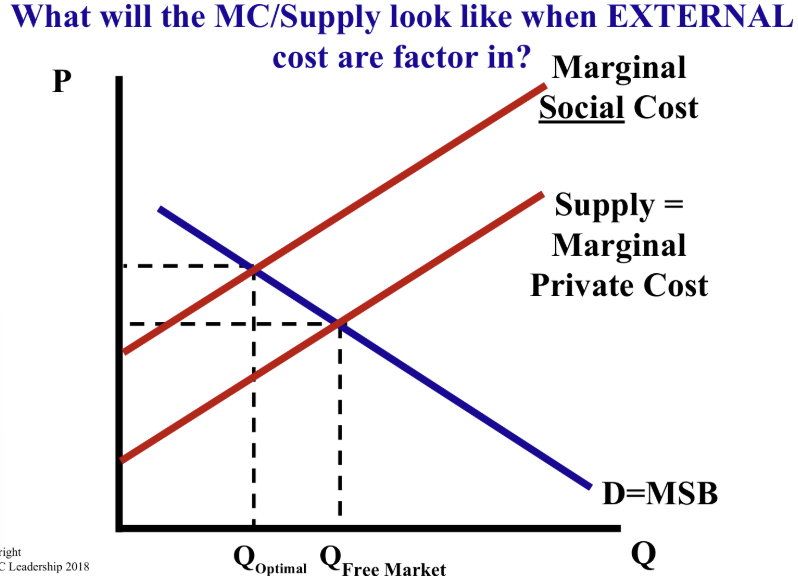

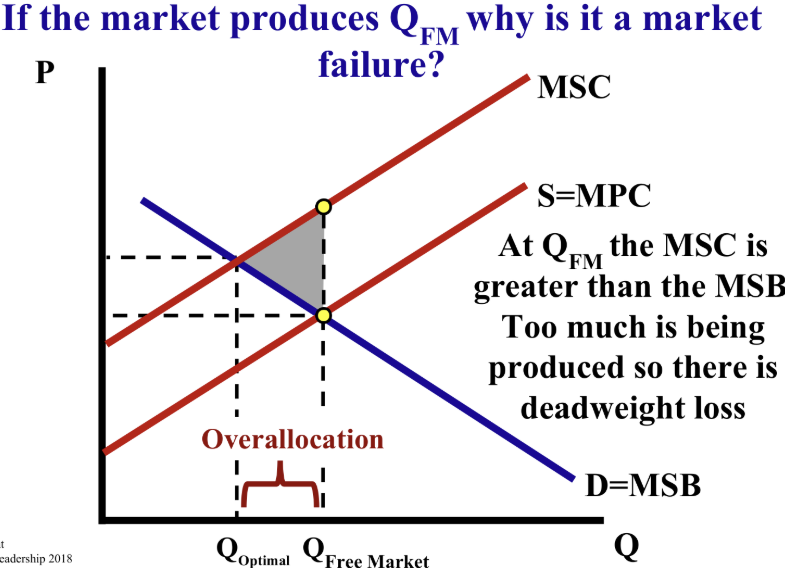

What does deadweight loss (DWL) indicate in a market with excess production?

DWL indicates that too many units are being produced, where the marginal social benefit is less than the marginal social cost.

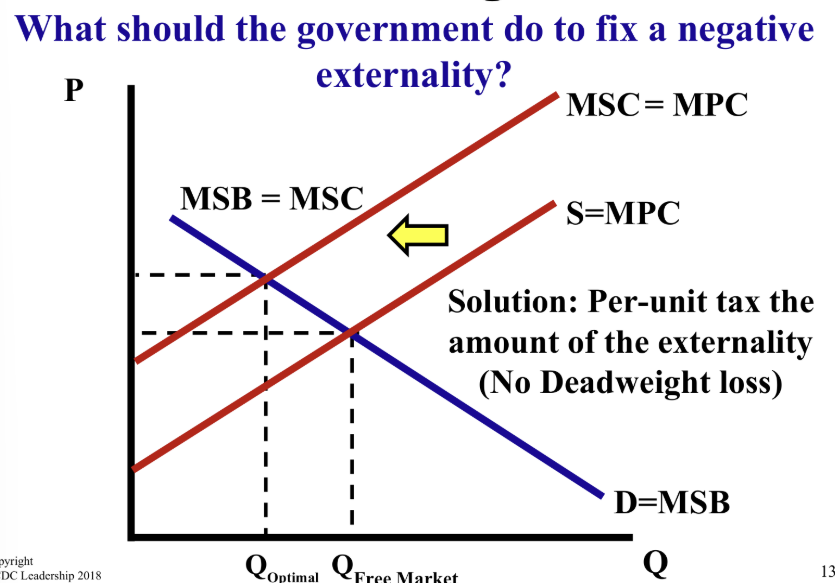

How can the government fix a negative externality in markets such as cigarettes?

The government can implement a per-unit tax to account for the externality and reduce overproduction, resulting in no deadweight loss.

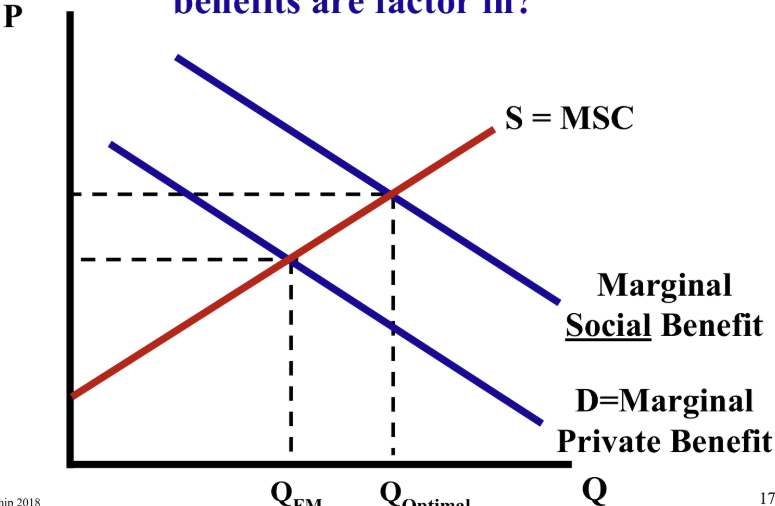

What is a positive externality or “spillover benefit”?

A positive externality is a situation that results in a benefit for someone other than the original decision maker, where the benefits “spillover” to other people/society.

What example illustrates a positive externality?

Flu vaccines are an example of a positive externality, where a healthier vaccinated individual provides benefits to society.

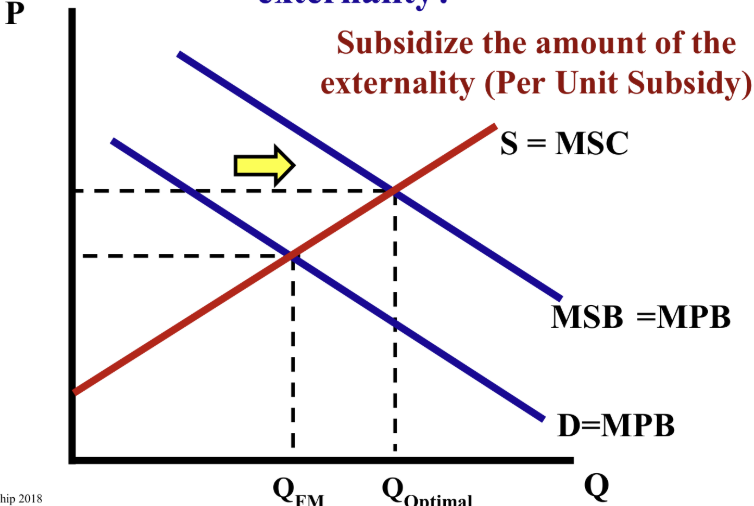

How does the government address positive externalities?

The government may subsidize the provision of goods or services that generate positive externalities, such as flu shots.

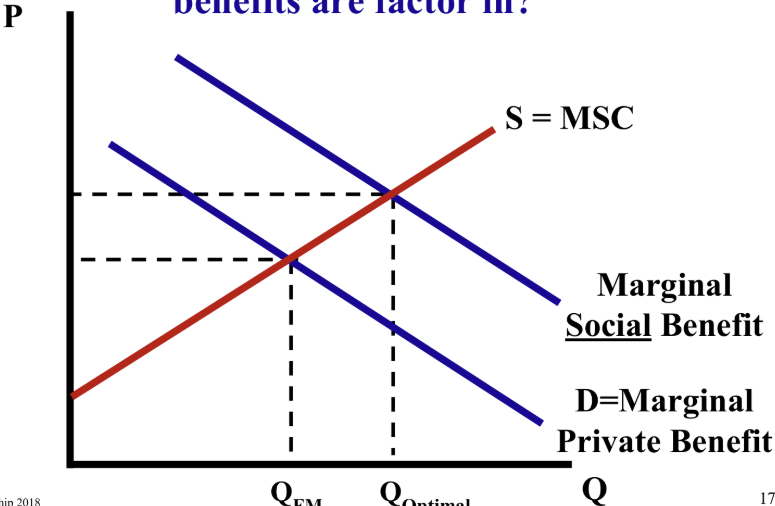

What are the two cost curves for a negative externality, and the two cost curves for a positive externality?

Private and social

In a market for flu shots (positive externality), what happens at QFM?

At QFM, the marginal social cost is less than the marginal social benefit, indicating too little is being produced.

What is the tragedy of the commons?

It refers to the overuse and degradation of resources available to all, resulting in pollution and depletion because there is no monetary incentive to use them efficiently/keep them clean. This results in high spillover costs.

To stop perverse incentives (e.g. inspecting a firm twice to ensure polluting goes down causing polluting the first time to increase), what can the government do?

The government can sell the right to pollute.

Describe what “internalizing the externality” is.

The altering of incentives so that people take account of the external effects of their actions (e.g. $1/gallon tax on sellers OR buyers makes the sellers’ costs = social costs, so supply curve shifts left)