Rational Producer Behaviour

1/44

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

45 Terms

Maximising Behaviour

Where firms all behave as rationally as possible and maximise profits

Economic Costs

Explicit + Implicit Costs

Explicit Costs

Costs that arise from firms purchasing FOPs

Implicit Costs

Opportunity costs that arise from using FOPs in a certain way

Theoretical revenue theory

Perfectly elastic demand (perfect competition)

So firms do not have to lower prices to attract more customers

Realistic revenue theory

In reality firms must lower prices to attract more customers

Depends on PED though

PED varies along the curve so at first it is elastic and firms will decrease the price

Eventually though the extra revenue gained from the increase in demand is outweighed by the revenue sacrificed from the units that were being sold at higher prices.

Normal Profit

TR = TC

Abnormal Profit

TR > TC

Losses

TC > TR

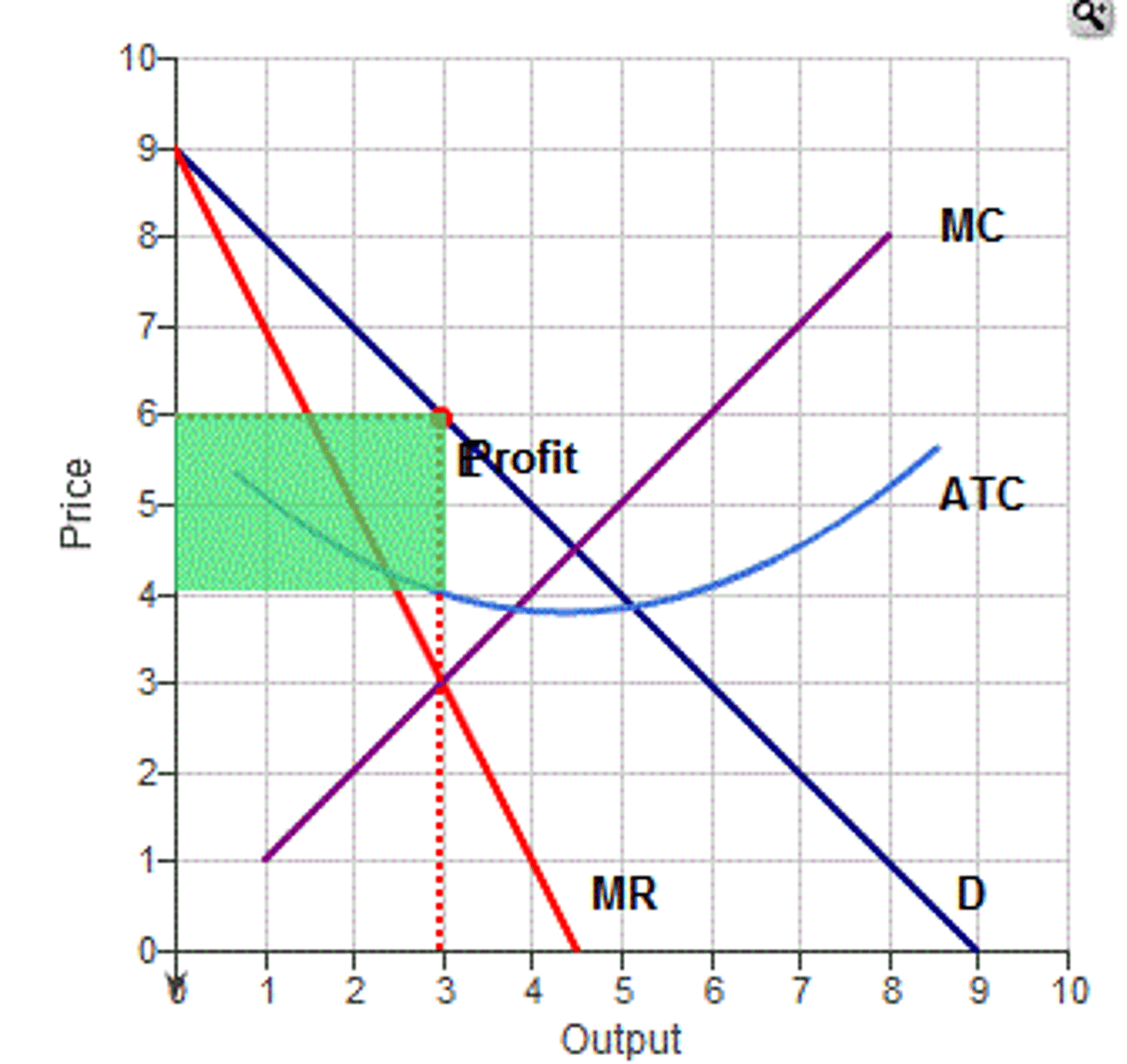

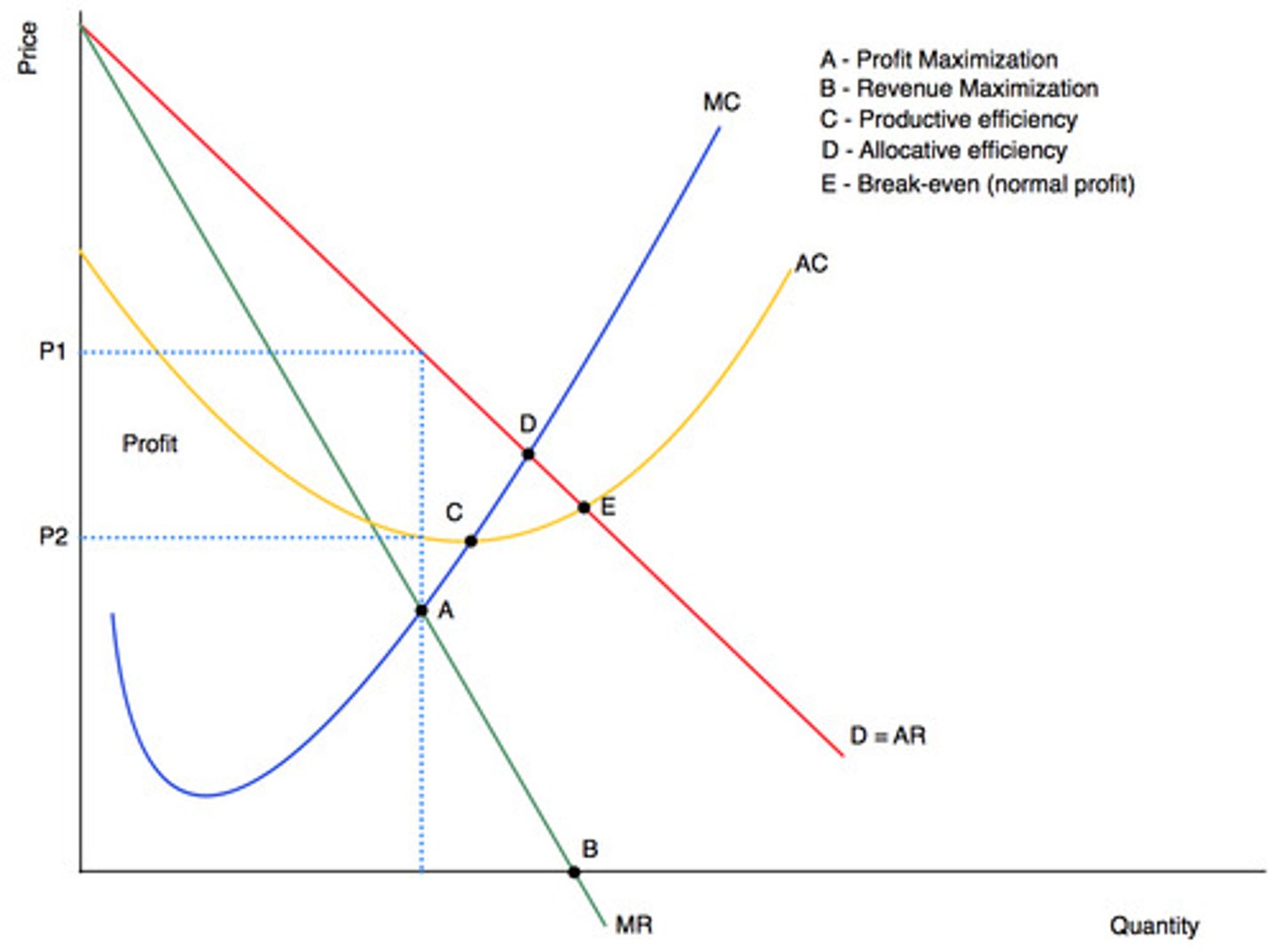

Point of profit maximisation

MC = MR

Point of allocative Efficiency

MC = AR

Point of productive efficiency

MC = AC

Other goals of a firm

Corporate Social Responsibility

Satisficing

Growth Maximization

Revenue Maximization

Market Structure

Identifies how a market is made up in terms of:

Number and size of firms

Control over price and output

Barriers to enter and exit

Nature of product (Degree of homogeneity)

Characteristics of Perfect Competition

Large number of firms

Products are homogeneous

No barrier to enter or exit

Firms are price takers

Each producer has very little market share

Perfect information

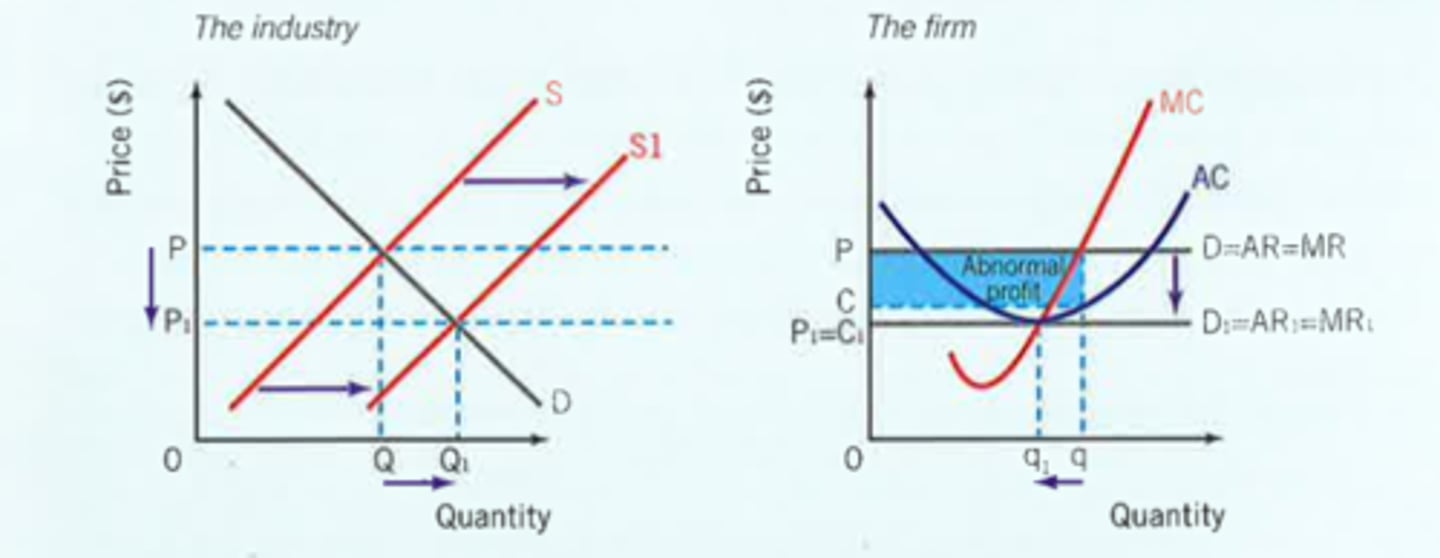

Perfect Competition (Short run abnormal Profits to Long run normal profits)

Abnormal profits made in short run

No barriers to entry and perfect knowledge causes supply to shift right causing market price to decrease

Demand then decreases for all firms and AR will decrease. This will continue until all firms are producing normal profit.

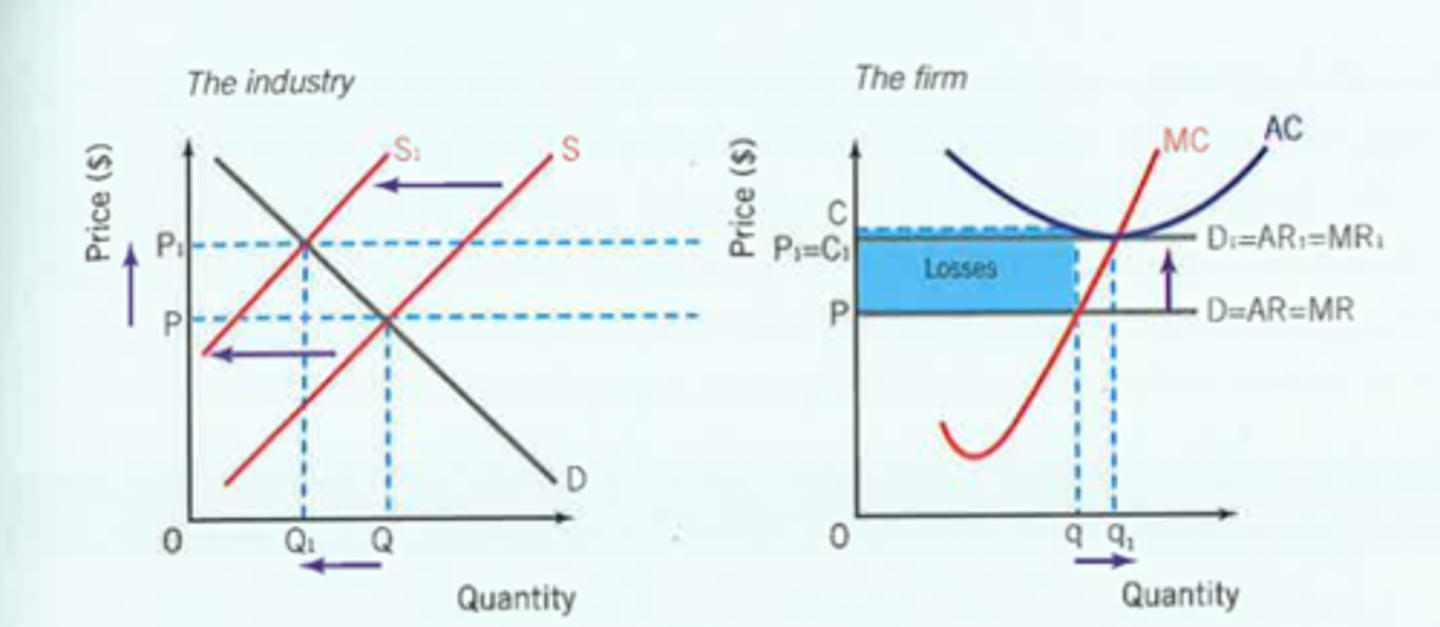

Perfect Competition (Short run losses to Long run normal profits)

Losses are made in the short run

No barriers to exit and perfect knowledge causes supply to shift left causing market price to increase

Demand then increases for all firms and AR will increase. This will continue until all firms are producing normal profit.

Efficiency in perfect competition

SR: MC = MR, MC = AR

LR: MC = MR, MC = AR, MC = AC

Advantages of Perfect Competition

Allocative Efficiency

Productive Efficiency

Low prices for consumers

Competition leads to shutting down of inefficient producers

Lack of market power leads to no market failure

Disadvantages of Perfect Competition

Unrealistic assumptions

Limited possibilities to gain economies of scale due to long run normal profits

Lack of product variety

Limited ability to engage in RnD

Characteristics of Monopolistic Competition

Large number of firms

Low barriers to entry or exit

Product differentiation

Firms still have low market share

Firms are price makers

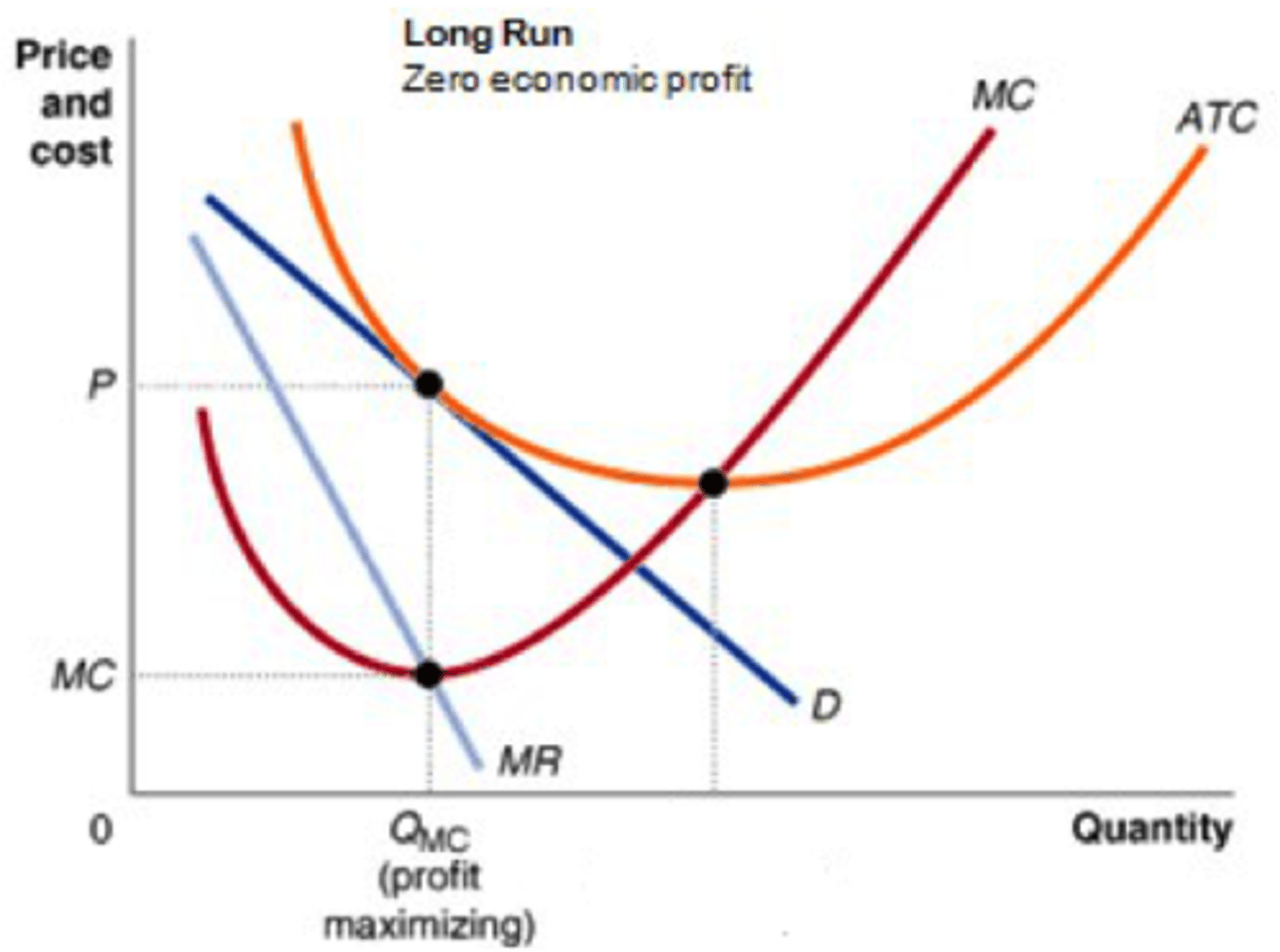

Monopolistic Competition (Short-run abnormal profits to Long Run Normal profits)

Firms are attracted to the abnormal profits and enter the market

Demand is now competed away from existing firms causing demand curve to shift left.

Demand shifts until firms are making normal profits

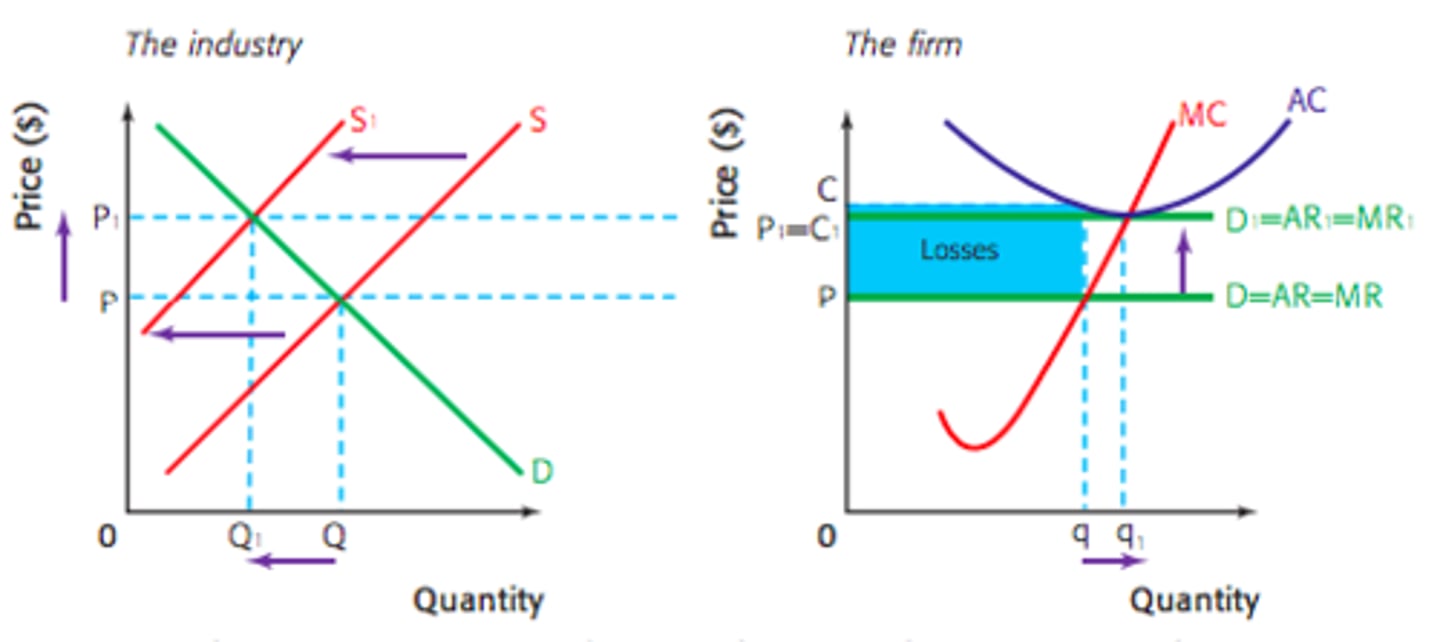

Monopolistic Competition (Short-Run losses to long run normal profits)

If losses are being made, firms will start to leave

Remaining firms see an increase in demand

Demand curve shifts right until firms are making normal profits

Firms compete through non-price competition e.g product differentiation

Efficiencies in Monopolistic Competition

SR: MC = MR

LR: MC = MR

Little bit of market fialure as firms are not allocatively efficient

This is because of the consumers desire for variety which makes them better off

Government will choose not to intervene however as firms do not dominate the market

Monopolist

Industry that consists of a firm that dominates the market with a very large market share

Natural Monopolies

A firm that has economies of scale so large that it is possible for the single firm alone to supply the entire market at a lower average cost

Characteristics of a Monopoly

Only one firm produces the product so the firm is the industry

High barriers to entry

Could earn abnormal profits in the long run

Reasons monopolies have so much power

Economies of Scale

Legal Barriers

Brand Loyalty

Anti-competitive Behaviour

Economies of Scale

Increasing output leads to lower long run average costs

Types of Economies of Scale

Specialisation

Bulk Buying (Transport too)

Financial Economies

Large Machines

Promotional Economies

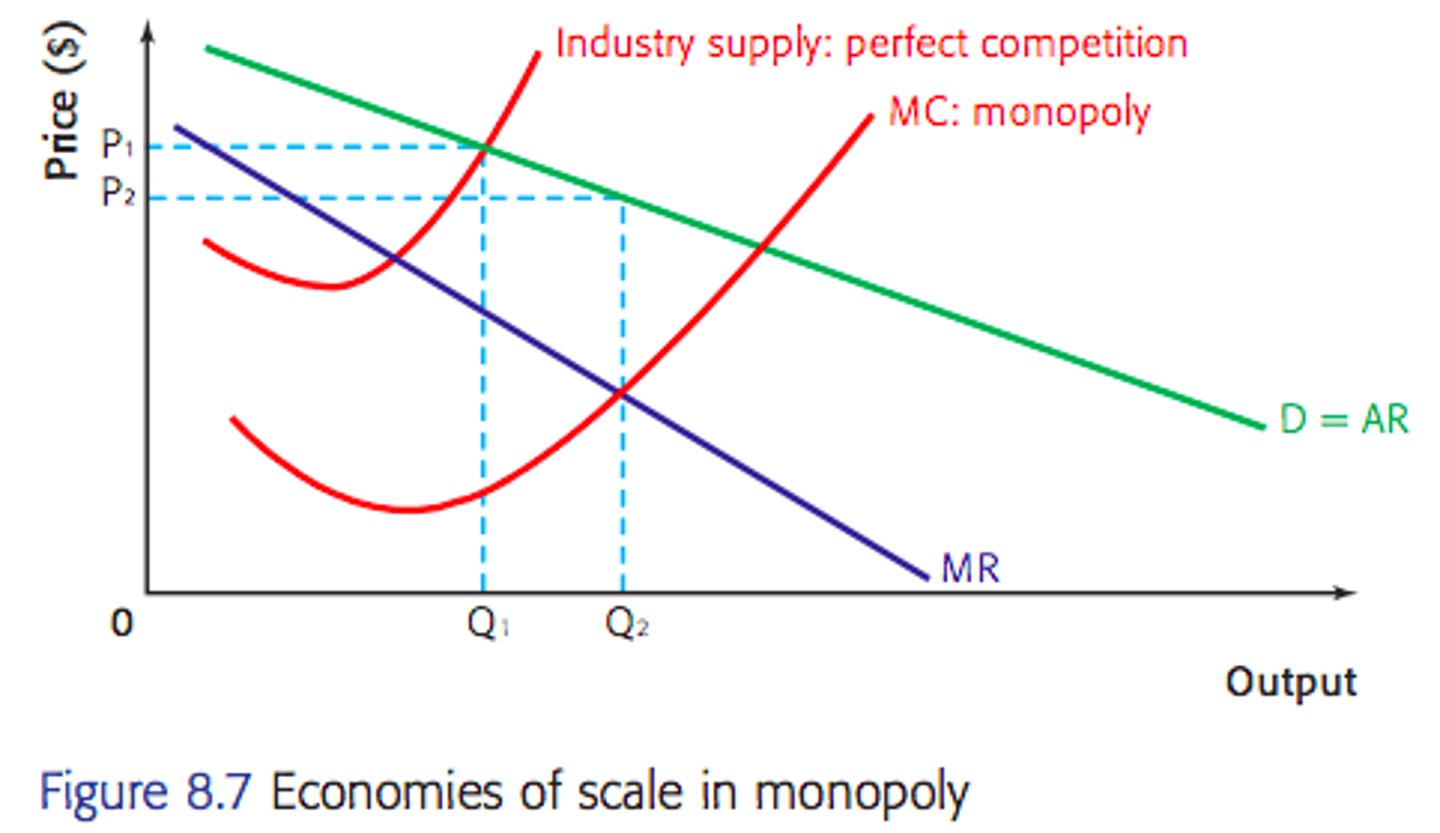

Natural Monopoly Graph

A natural monopoly occurs when there are only enough economies of scale to support one company

The firm is the industry so there is only one graph.

If another firm enters the market the demand of the original firm is competed

Monopolist Graph

Monopolist demand curve tends to have very low elasticity as there are very few (or no) substitutes

Firm will produce at MC = MR

They earn abnormal profits

If firms enter monopolies can employ predatory pricing

Advantages of a monopoly in comparison to perfect competition

Marginal Cost of the monopoly will be lower than the marginal cost of a firm in competition as they can achieve economies of scale

P.C produces at MC = AR but Monopoly produces at MC = MR

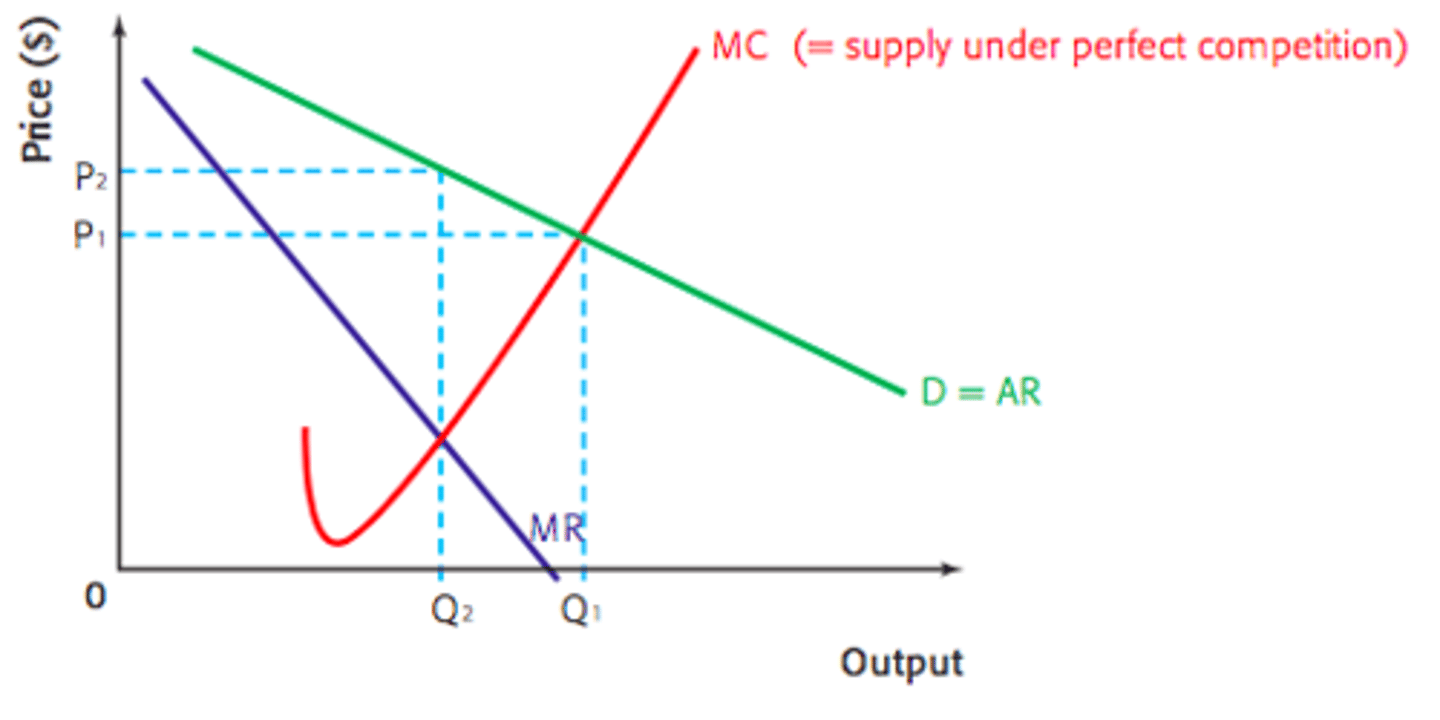

Disadvantages of a monopoly in comparison to perfect competition

Monopolies don't take advatnage of E.O.S

P.C produces at MC = AR but Monopoly produces at MC = MR

Regulating natural monopolies through marginal cost pricing

Brings market to allocative efficiency and solves market failure

Government must pay for the firms fixed costs as they only generate enough revenue for their variable costs

Regulating natural monopolies through average cost pricing

Improves market failure but doesn't solve

Oligopoly

A market dominated by a few producers, each of which has control over the market

High Market Concentration

Concentration ratio

The extent to which a market or industry is dominated by a few leading firms

Characteristics of an Oligopoly

No single theory of how firms determine price and output

Product Branding

Significant Barriers of entry

Interdependent Decision Making

Non-Price Competition

Mutually Interdependent

Price competition makes them worse off

Collusive Oligopoly

When firms in the market collude to fix prices and act like a monopoly

Also known as formal collusion or cartel

Governments often ban this type of behavior

Informal Collusive Oligopoly (Tacit Collusion)

Price leadership is when one firm has a clear dominant position in the market

Firms will often follow their pricing strategies which can influence the market

Non-Collusive Oligopoly

When they do not collude in any way and each firm behaves independently

However, they do try and predict what the other firms will do.

This causes prices to be rigid as it will make them worse off

Advantages of Oligopolies

Economies of scale can be achieved

Product innovation can be pursued due to high abnormal profits

Technological innovations can occur

Production innovation results in higher choice

Disadvantages of Oligopolies

Welfare loss, allocative inefficiency and market failure

Higher prices and low quantities of output compared to perfect competition and monopolistic

Loss of consumer surplus

Higher production costs

Possibly less innovation

Difficult to determine if firms are colluding

Importance of non-price competition for Oligopolies

Better quality of service

Longer opening hours

Extended warranties

Discounts on product upgrades

Contractual relationships with suppliers