Unit 4 - Chapter 16

Everyone agrees that the government must play an important role in guiding the economy.

The United States has a capitalistic economic system, in which individuals and corporations own the principal means of production and compete in a free market to reap profits, with this competition determining the amount of production and prices.

American economic system was never one of pure capitalism. Instead, from the beginning, the country has had a mixed economy.

mixed economy: capitalism coexists with and is tempered by government involvement in the economy.

Social welfare policies: Policies that provide benefits, cash or in-kind, to individuals, based on either entitlement or means testing.

Who gets these benefits and what level of support is provided are issues that must be resolved by the political system. How America resolves these issues depends on how its leaders, political parties, interest groups, and citizens view the nature and distribution of poverty, the role of government, and the effectiveness of various social welfare programs.

ECONOMIC POLICYMAKING

The two parties have different economic centers of gravity. There is often a choice to be made between two basic aims of government economic policy—fighting unemployment and fighting inflation—and when there is, the two parties have different priorities.

Democrats: Stress the importance of keeping unemployment low.

Appeal particularly to working-class voters concerned about employment.

Republicans: Prioritize the battle against inflation.

Appeal particularly to voters with more money to save and invest who worry that inflation will erode their savings.

TWO MAJOR WORRIES: UNEMPLOYMENT AND INFLATION

Unemployment rate: As measured by the Bureau of Labor Statistics, the proportion of the labor force actively seeking work but unable to find jobs.

The official unemployment rate actually underestimates how many Americans are suffering in the job market because it leaves out those who have given up their job search or have only been able to obtain a part-time job.

Underemployment rate: As measured by the Bureau of Labor Statistics, a statistic that includes (1) people who aren’t working and are actively seeking a job, (2) those who would like to work but have given up looking, and (3) those who are working part-time because they cannot find a full-time position.

Inflation: a rise in prices for goods and services.

Consumer price index: The key measure of inflation—the change in the cost of buying a fixed

basket of goods and services.

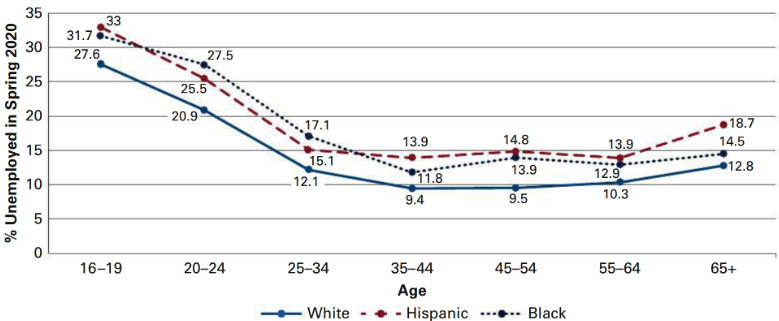

UNEMPLOYMENT RATES BY AGE AND RACE/ETHNICITY

The unemployment rate is one of the nation’s most important economic indicators and a political issue as well. Although Americans sometimes think of unemployment as mainly a problem for middle-aged people, in actuality unemployment rates are much higher for young Americans age 16 to 24. Young Black and Hispanic Americans face a double whammy in their search for a job, as you can see by their high unemployment rates shown in the graph. Because these numbers are from Spring 2020, when many people had lost their jobs due to the coronavirus pandemic, they are much higher than normal for all groups. But the general patterns shown here have been true in both good and bad economic times

POLICIES FOR CONTROLLING THE ECONOMY

Laissez-faire: The principle that government should not meddle in the economy.

Since the New Deal, both Democratic and Republican policymakers have recognized that capitalism must be at least somewhat regulated by the federal government.

The American political economy offers two important tools to steer the economy: monetary policy and fiscal policy.

Monetary policy: Government manipulation of the supply of money in private hands—one

of two important tools by which the government can attempt to steer the economy.

Monetarism: An economic theory holding that the supply of money is the key to a nation’s economic health, with too much cash and credit in circulation producing inflation.

Federal Reserve System (Fed.): The main instrument for making monetary policy in the United States. It was created by Congress in 1913 to regulate the lending practices of banks and thus the money supply.

Intended to be formally beyond the control of the president and Congress.

Its policymaking body, the Federal Open Market Committee (FOMC), meets eight times a year and, taking into consideration a vast amount of economic data, sets a target for the “federal funds rate,” the interest rate banks can charge each other for overnight loans.

WHY IT MATTERS TODAY - INTEREST RATES

Interest rates are the amount you pay to borrow money for a house or a car, for example. The lowest interest rate that a bank or credit card company can afford to charge you is strongly influenced by the decisions of the Fed. Even a great credit rating cannot get you a low-interest rate if the Federal Reserve Board is keeping the money supply tight.

Fiscal Policy: Use of the federal budget—taxes, spending, and borrowing—to influence the economy; along with monetary policy, fiscal policy is the main tool by which the government can attempt to steer the economy. Fiscal policy is almost entirely determined by Congress and the president.

Keynesian Economic Theory: Named after English economist John Maynard Keynes, the theory emphasizing that government spending and deficits can help the economy deal with

its ups and downs. Proponents of this theory advocate using the power of government to stimulate the economy when it is lagging.

Republicans have frequently criticized Keynesian economic policies as promoting the idea that the government can spend money more wisely than the people—a view they usually reject.

Supply-side economics: An economic theory, first applied during the Reagan administration, holding that the key task for fiscal policy is to stimulate the supply of goods, as by cutting tax rates.

WHY IT MATTERS TODAY - KEYNESIAN VERSUS SUPPLY-SIDE ECONOMICS

Supply-side economic theory, as advocated by presidents Ronald Reagan, George W. Bush, and Donald Trump, represents a great departure from Keynesian economic theory, which has guided Democratic economic policymaking ever since the New Deal. Whereas Keynesian theory recommends government spending to combat economic downturns by increasing demand, supply-side economics advocates tax cuts in order to stimulate the supply of goods. The scope of government expands when Keynesian policies are enacted but contracts when supply-side economics is put into effect.

Tariffs as an Economic Tool: Donald Trump came into office as a harsh of critic of free trade policies, arguing that other countries had taken advantage of the United States and disproportionately benefited from the deals negotiated by previous presidents.

In President Trump’s view, American jobs and businesses were being protected from foreign competition by the expansion of tariffs during his administration.

Tariffs: Fees for importing goods into the United States from other countries.

By taking in revenues via tariffs, the federal government can support some businesses and groups over others.

This cartoon portrays extreme versions of Keynesian and supply-side economic policies

TYPES OF SOCIAL WELFARE POLICIES

No area of public policy causes more confusion or stimulates more argument than does social welfare. One common misperception is to equate social welfare with government aid to poor people. In fact, these programs distribute far more money to the non-poor than to people below the poverty line.

Entitlement programs: Government programs providing benefits to qualified individuals regardless of need.

Social Security and Medicare are the largest and most expensive social welfare programs in America. These programs have had a positive effect on the health and income of older Americans, who receive more and better medical treatment as a result of Medicare and in many cases are kept out of poverty by Social Security payments.

Means-tested programs: Government programs providing benefits only to individuals who qualify based on specific needs.

Generate much political controversy, with the positions taken depending largely on

how people see the poor and the causes of poverty.

WHY IT MATTERS TODAY - PERCEPTIONS OF POVERTY

Some people see poor people as lazy; others believe that most of the people who are poor are victims of circumstance. These perceptions of poor people affect the kinds of social welfare policies they favor. Conservatives tend to believe that means-tested welfare programs only discourage people from working. Liberals are more likely to see these programs as helping people weather difficult circumstances.

INCOME, POVERTY, AND PUBLIC POLICY

Income distribution: The way the national income is divided into “shares” ranging from the poor to the rich.

Increasing inequality in the distribution of income can contribute to a situation known as relative deprivation, a perception by an individual that he or she is not doing well economically in comparison to others.

Income: The amount of money collected between any two points in time.

Wealth: The value of one’s assets, including stocks, bonds, bank accounts, cars, houses, and so forth.

THE INCREASE IN INCOME INEQUALITY AND THE RISE OF THE TOP 1 PERCENT

The following graph demonstrates how much income for various groups rose cumulatively from 1979 to 2016, adjusting for inflation. People below the 80th percentile saw their real income rise by about a third during this period. Those in the 81st through 99th percentiles did significantly better, with their income rising about 75 percent. The major gains were reserved for just the top 1 percent, which saw its real income go up a whopping 218 percent by 2016. Economists expect that the gains in the stock market since 2016 should result in this figure’s continuing to increase once data from the post-2016 period become available.

This change in income distribution has come about because very rich people have gotten much richer while others, especially poor people, have seen their incomes improve only marginally.

Poverty line: The income threshold below which people are considered poor, based on what a family must spend for an “austere” standard of living, traditionally set at three times the cost of a subsistence diet.

POVERTY RATES FOR PERSONS WITH SELECTED CHARACTERISTICS: A COMPARISON OF THE OFFICIAL AND SUPPLEMENTAL MEASURES

In the following chart, you can see the poverty rates for various groups as determined by surveys conducted by the Census Bureau in 2019, based on both the traditional, official measure of poverty and the relatively new supplemental measure. The differences between the two measures are due to two extra considerations that the new measure takes into account. First, the new measure takes into account the benefits from government programs such as food stamps and the National School Lunch Program; this explains why it finds a significantly lower level of poverty among children. Second, it takes into account differences between groups in various cost of living factors, such as medical care; this explains why the new measure finds a much higher percentage of poverty among the elderly.

Poverty rates are substantially above the national average for African Americans, Latinos, unmarried women, children, and people without any college education. The relationship between poverty and education is especially pronounced in the United States compared to other prosperous democracies.

Today, poverty is particularly a problem for unmarried women and their children.

Feminization of poverty: The increasing concentration of poverty among women, especially unmarried women and their children.

Progressive tax: A tax by which the government takes a greater share of the income of the rich than of the poor—for example when a rich family pays 50 percent of its income in taxes, and a poor family pays 5 percent.

Proportional tax: A tax by which the government takes the same share of income from everyone, rich and poor alike.

Regressive tax: A tax in which the burden falls relatively more heavily on low-income groups than on wealthy taxpayers. The opposite of a progressive tax, in which tax rates increase as income increases.

Earned Income Tax Credit: Also known as the EITC, a refundable federal income tax credit for low- to moderate-income working individuals and families, even if they did not earn enough money to be required to file a tax return.

The second way in which government can affect personal income is through its expenditures.

Transfer payments: Benefits given by the government directly to individuals—either cash transfers, such as Social Security payments, or in-kind transfers, such as food stamps and low-interest college loans.

THE MAJOR SOCIAL WELFARE PROGRAMS

Summarizes the major government social welfare programs that affect our incomes, both programs providing cash benefits and those providing in-kind benefits.

HELPING THE POOR? SOCIAL POVERTY AND THE NEEDY

Social Security Act: A 1935 law intended to provide a minimal level of sustenance to older Americans and thus save them from poverty.

“Aid to Families with Dependent Children”: This program brought various state programs

together under a single federal umbrella to help poor families that had no breadwinners and had children to care for.

Temporary Assistance for Needy Families: Replacing Aid to Families with

Dependent Children as the program for public assistance to needy families, TANF requires people on welfare to find work within two years and sets a lifetime maximum of five years.

Personal Responsibility and Work Opportunity Reconciliation Act: The welfare reform law of 1996, which implemented the Temporary Assistance for Needy Families program.

provided that (1) each state would receive a fixed amount of money to run its own welfare

programs; (2) people on welfare would have to find work within two years or lose all their benefits; and (3) there would be a lifetime maximum of five years for welfare.

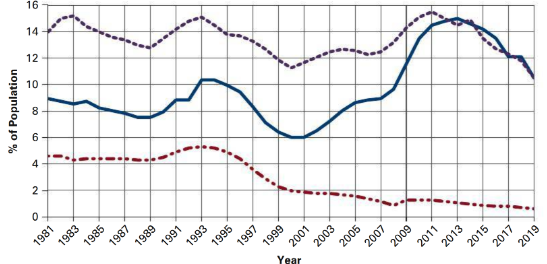

HOW WELFARE REFORM DRASTICALLY REDUCED THE WELFARE ROLLS

Prior to the adoption of the welfare reform bill of 1996, the percentage of the population receiving welfare and food stamps fluctuated in sync with the poverty level. Whenever more people were in poverty, more people qualified for them and hence received benefits; the reverse was of course true whenever times were good and the poverty rate declined. However, once welfare reform was enacted, the fact that states now had only a fixed amount of money to dole out under Temporary Aid to Needy Families (TANF) restricted their ability to expand the distribution of welfare benefits during economic hard times. Thus, even during the severe recession that began in 2008, the percentage of the population receiving welfare increased only slightly. In contrast, the percentage receiving food stamps went up markedly, as there were no such restrictions on this program.

WHY IT MATTERS TODAY - THE 1996 REFORM OF WELFARE

WHY IT MATTERS TODAY - THE 1996 REFORM OF WELFARE

Because, since the reform, the states have been faced with fixed amounts to spend on welfare and individuals limited in terms of how long they can receive benefits, the percentage of poor people who receive welfare assistance has declined markedly. Many liberals are concerned that a hole has been opened in the safety net; conservatives tend to be pleased that incentives for poor people to find gainful employment have been increased.

SOCIAL SECURITY: LIVING ON BORROWED TIME

Social Security Trust Fund: The “account” into which Social Security employee and employer contributions are “deposited” and used to pay out eligible recipients.

The Social Security system is going to face challenges in the foreseeable future as the average lifespan lengthens and the typical retiree draws Social Security benefits for longer than ever before.

SOCIAL WELFARE POLICY ELSEWHERE

Most industrial nations tend to be far more generous with social welfare programs than is the United States. This greater generosity is evident in programs related to health, child care, unemployment compensation, and income maintenance for the elderly.

PARENTAL LEAVE POLICY: A COMPARISON

All established democracies, except for the United States, provide for at least 10 weeks of paid leave for a two-parent family to care for a new child, and most allow unpaid leave that greatly exceeds what American law provides for.

The provisions of the American Family and Medical Leave Act (FMLA) are relatively meager.