unit 4 production cost curves and revenue

1/48

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

49 Terms

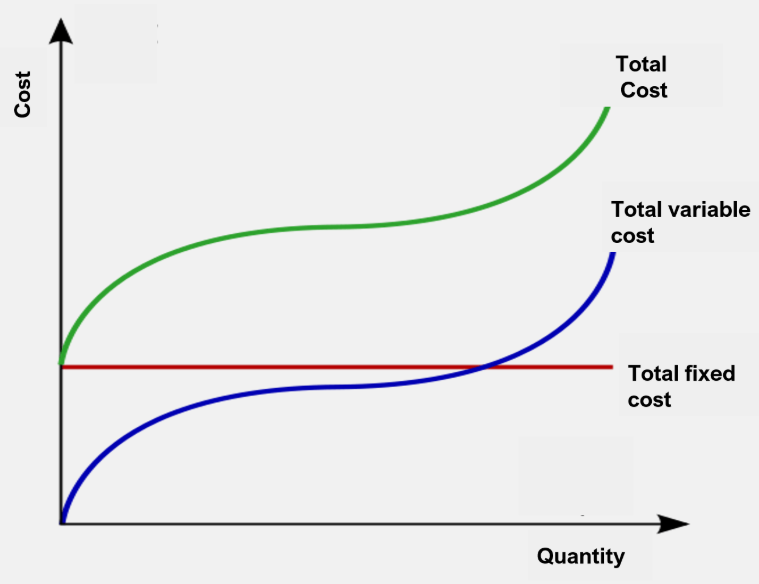

fixed, variable, total costs

fixed - costs don’t vary with output

variable - vary directly with the level of output - output increases more than costs at the start because of underutilised capital - productivity is rising - a further increase in workers means fixed FOP (land, capital) become a constraint on production, workers productivity falls - costs rise (law of diminishing returns)

total - the sum of fixed and variable costs

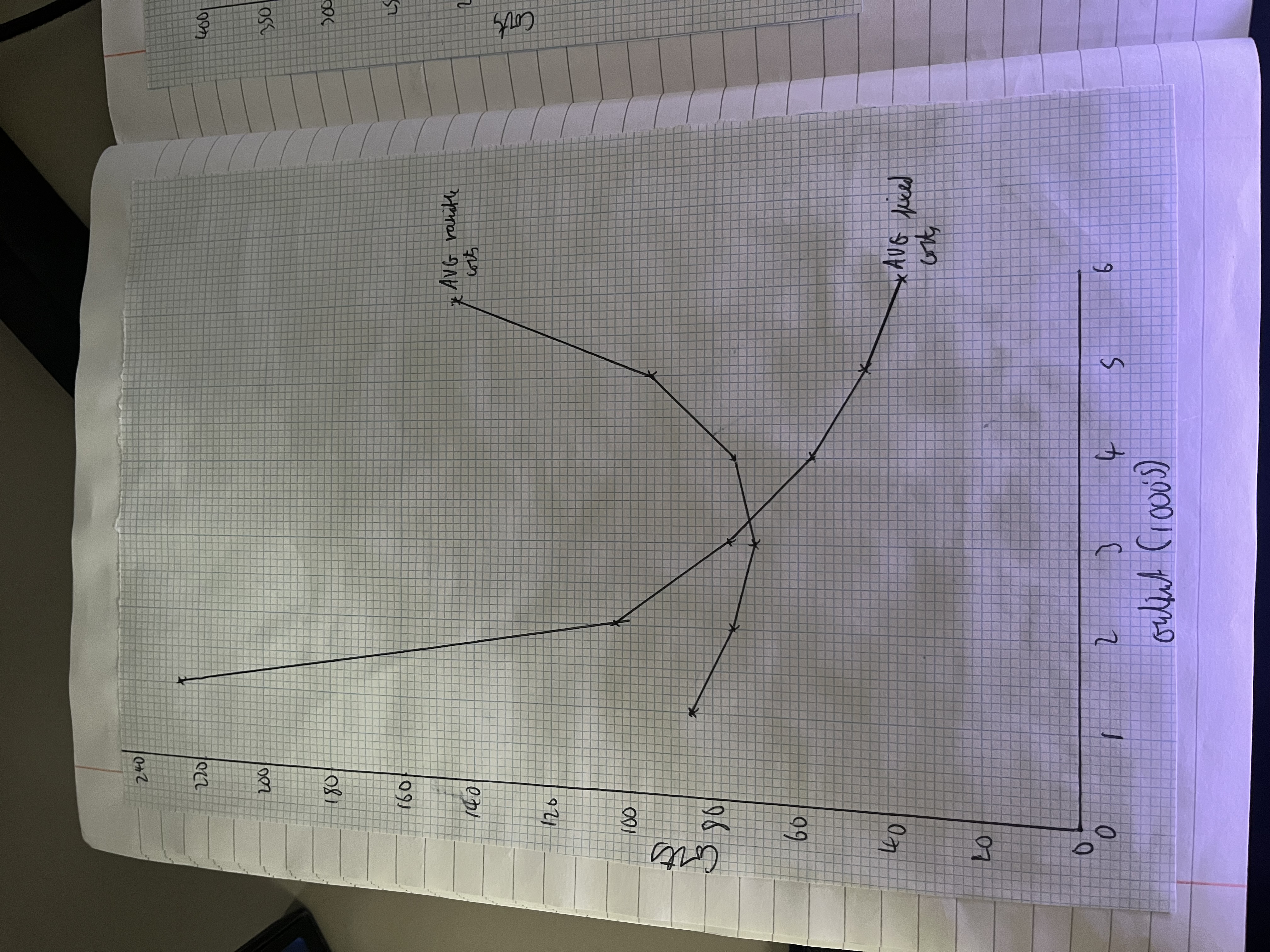

average variable and fixed costs

average - total costs divided by output

sunk costs

costs required to start up/run the firm which cant be recovered

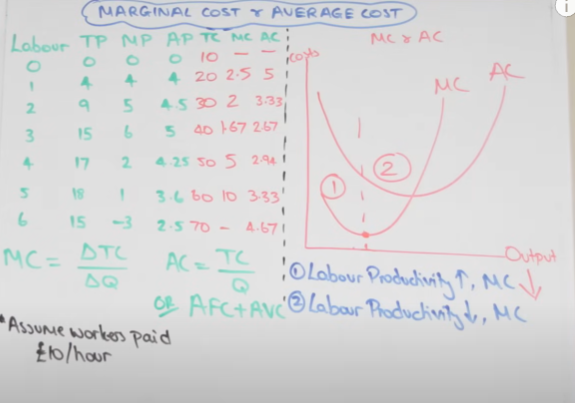

marginal and average costs in the short run

marginal - the cost of producing 1 additional unit of output

AC = total cost / quantity

MC = change in TC / change in Q

in stage 1 there is increasing labour productivity and marginal product because of specialisation and underutilisation of fixed FOP

in stage 2 the law of diminishing returns kick in as fixed FOP become a constraint on production so labour productivity and marginal product falls

marginal cost rise

labour productivity

measures outpour per worker

total outpour / units of labour

capital productivity

measures output per capital

total output / units of output per capital

specialisation

the concentration of production on a narrow range of goods and services

advantages of specialisation

higher output - efficient use of resources - trade increases - growth increases - better living standards - more jobs

wider range of goods and services - within a narrow focus, firms produce a wide range of products

allocative efficiency - resources go to the firms / country’s that are the most efficient at producing

higher productivity - workers become more skilled band are used to their maximum productive potential

lowers unit cost - passed onto consumers

quality improvements

issues with specialisation

finite resources

overspecialised firms or country’s can become over reliant on certain resources

what if other firms become more efficient at producing that good

what if fashion or trends change

de-industrialisation

if another firm is more efficient - the other firm will shut down

national interdependence

international issues can block trade and stop the benefits of specialisation

division of labour

the separation of a work process into a number of tasks , with each task preformed by a separate version or worker, allowing for increased efficiency and specialisation

advantages of division of labour

high productivity

workers preform the same task - lower cost of production - lower costs - output maximised - lower prices - high profits

capital can improve productivity

lower prices, high quality and choice

problems with division of labour

preforming the same task can demotivate workers - lower productivity

high employee turnover

workers are at risk of long term unemployment is technology advances

highly standardised goods and services

short run

at least 1 FOP is fixed

long run

all FOP are variable

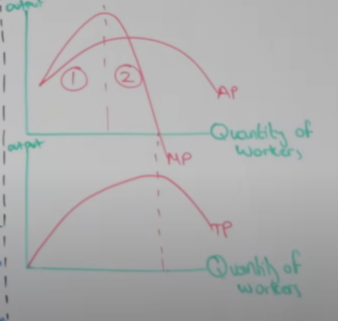

law of diminishing returns

effects firms in the short run

when variable factors of production are added to a stock of fixed factors of production, total / marginal product will initially rise then fall

stage 1 - increasing returns to labour - marginal product is rising

why, labour productivity is rising

specialisation

under utilisation of fixed FOP

stage 2 - law of diminishing marginal returns sets in - marginal product falls

why, labour productivity decreases

fixed FOP become a constraint on production

not enough FOP

TP is maximised when marginal product is 0

marginal product

change in total product / change in Q of workers

average product

total product / Q of workers

increasing returns to scale

an increase in all factors of production causes returns (output) to increase proportionally more

50% increase in FOP causes a 100% increase in output

constant return to scale

the increase in FOP causes an equal proportional increase in output

decreasing returns to scale

an increase in all factors of production leads to a less than proportional increase in output

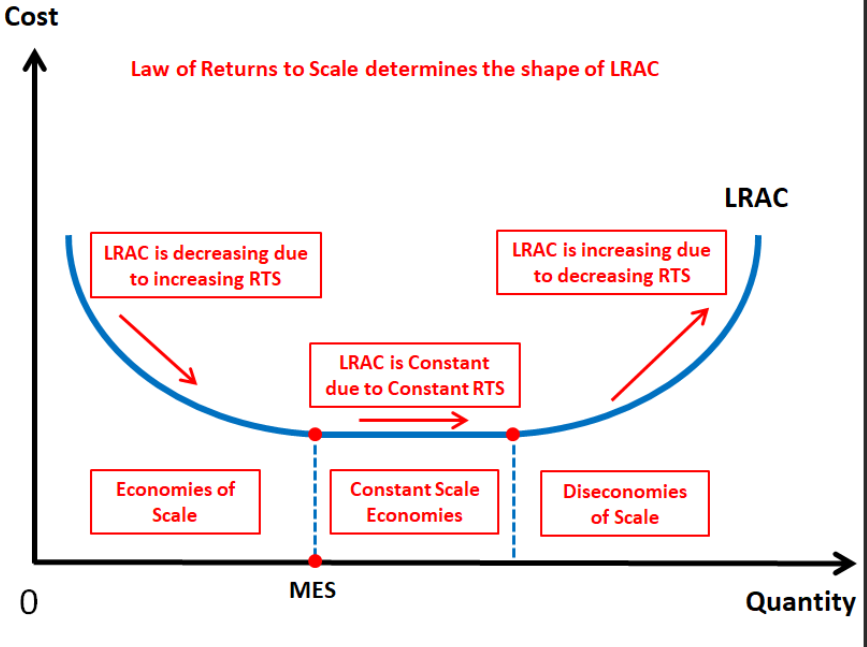

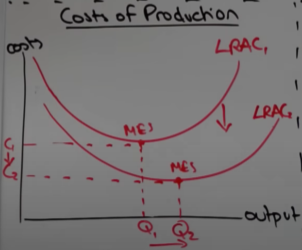

LRAC - returns to scale

economies of scale

falling long run average costs as output increases

minimum efficient scale

lowest level of output required to fully exploit economies of scale and the firm achieves productive efficiency

internal economies of scale

arise from the increased output of the business itself leading to lower avg costs - spread costs over a wider range of output

financial - banks lend at lower interest rates - less risk

managerial - as a firm gets larger they can employ specialist managers - increase in productivity - higher output

technical - specialist machinery boosts productivity

marketing - discount on advertising - bulk buying

purchasing - firms can bulk buy as they grow - discount

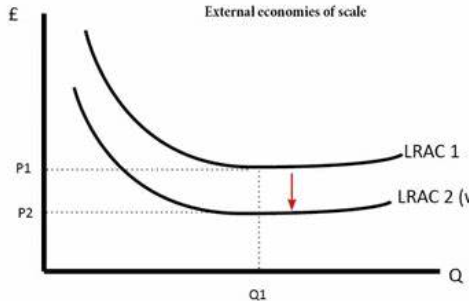

external economies of scale

occur within an industry, all firms benefit

better transport infrastructure

component suppliers move closer

R and D firms move closer

agglomeration

the clustering of businesses in a specific area to share resources and benefit from shared infrastructure, leading to lower costs and improved efficiency

diseconomies of scale

an increase in LRAC as output increases - total costs rise faster than output

internal diseconomies of scale

control - harder to manage - lower productivity

communication - harder to spread messages through the company - lower productivity

coordination - difficult to coordinate different parts of the business

motivation - each worker feels less valued as the business grows reducing motivation and productivity

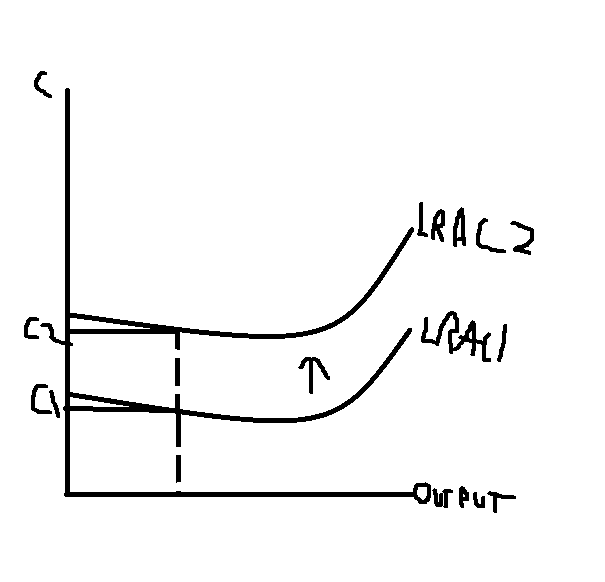

external diseconomies of scale

increased demand for raw materials - price rises - costs rise

local labour becomes scarce - increased demand - wages rise

revenue

income generated from sales of goods or services

average revenue = price per unit

total revenue / output

marginal revenue

the change in revenue from selling one extra unit of output

total revenue

price per unit X quantity

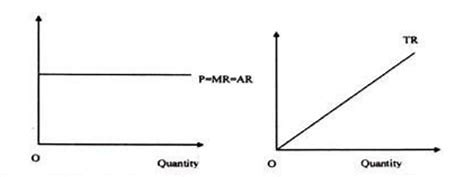

revenue curve in perfect competition

price takers - all units sold at the same price

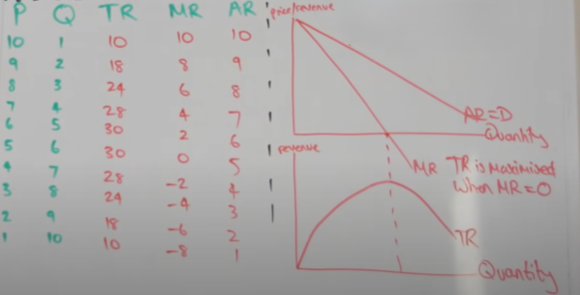

revenue curve in imperfect competition

price makers - different prices being charged by the firm

governed by law of demand

high price = low quantity

low price = high quantity

MR twice as steep at AR

when a firm drops its price, it drops it price on all units sold not just units sold beforehand, so MR drops faster than AR

TR is maximised when MR = 0

profit formula

TR - TC (explicit costs and implicit cost (opportunity cost))

supernormal profit

profit exceeding normal profit, typically occurring when total revenue exceeds total costs, including both explicit and implicit costs

AR > AC

normal profit

minimum level of profit required to keep FOP in their current use

AR = AC

subnormal profit

profit that is below normal profit, occurring when total revenue is less than total costs, indicating the firm is not covering all opportunity costs and is incurring an economic loss

AC > AR

economic profit

the difference between total revenue and total costs, including both explicit and implicit costs, indicating the firm's ability to cover all opportunity costs and earn a return on investment

invention

creation of a new idea without it necessarily becoming a commercial reailty

innovation

transforming an invention into commercial reality

create destruction

process by which existing products or services are replaced by new and improved ones, leading to changes in market dynamics and often resulting in the obsolescence of older technologies or business models

methods of production with technological change

can lead to more capital intensive production

machines replacing labour

can lead to more labour intensive production

need to operate capital

technological change

the overall advancement in technology that enhances production efficiency and alters methods of production

technological advancements affect on cost of production

LRAC fall

specialist capital can be brought it

division of labour - increases efficiency and reduces unit costs

MES takes place at a greater level of output as EOS are being exploited more with improvements in technology

can improvements in technology improve efficiency

productive - costs of production are lower

allocative - lower costs passed on as lower prices

dynamic - innovation

technological improvements effects on market structures

lower barriers to entry

number of firms - more if there are lower barriers to entry - more competitive outcomes

if barriers increase could lead to a monopoly

less homogenous goods - more choice

more knowledge for consumers and producers

MC connection with supply curve

Profit-Maximizing Rule

A competitive firm maximizes profit where P=MC

This condition ensures the firm supplies the quantity where its cost of producing the last unit equals the market price

Shut-Down Condition

In the short run, the firm will only supply output if the price is at least as high as average variable cost

So, the firm's short-run supply curve is the portion of the MC curve that lies above the AVC curve

Long-Run Supply

In the long run, the firm must cover all costs, including fixed costs. The supply curve becomes the portion of the MC curve that lies above the average total cost (ATC) curve