3.3 Revenues, Costs and Profits

1/89

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

90 Terms

production

process that converts inputs into outputs

productivity

increasing outputs from existing inputs

short run

a time period in which at least one factor of production is fixed

long run

a time period in which the scale of all factors are variable

factors of production

land, labour, capital and enterprise

the law of diminishing returns

short run concept - as more and more of a variable factor (labour) is added to a fixed factor (land/capital), eventually the marginal returns of the variable factor begin to fall

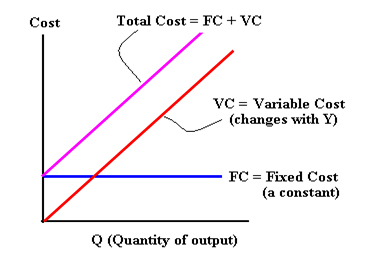

fixed costs

costs that dont change depending on output

variable costs

costs that change depending on output

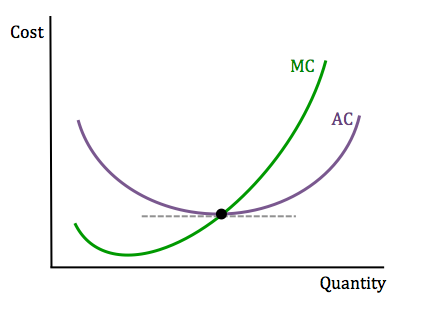

average costs

total costs/output

marginal costs

cost of producing one more good

change in costs/ change in quantity

total costs, variable costs and fixed costs graph

marginal costs and average costs short run graph

why is the graph a curve

due to the law of diminshing returns

productive efficieny

when marginal costs = average costs

why does marginal costs hit average costs at its lowest point?

because of the relationship between them:

when marginal costs are below average costs it brings the average down

when marginal costs are above average costs it brings the average up

therefore the point of intersection is the minimum point of the curve

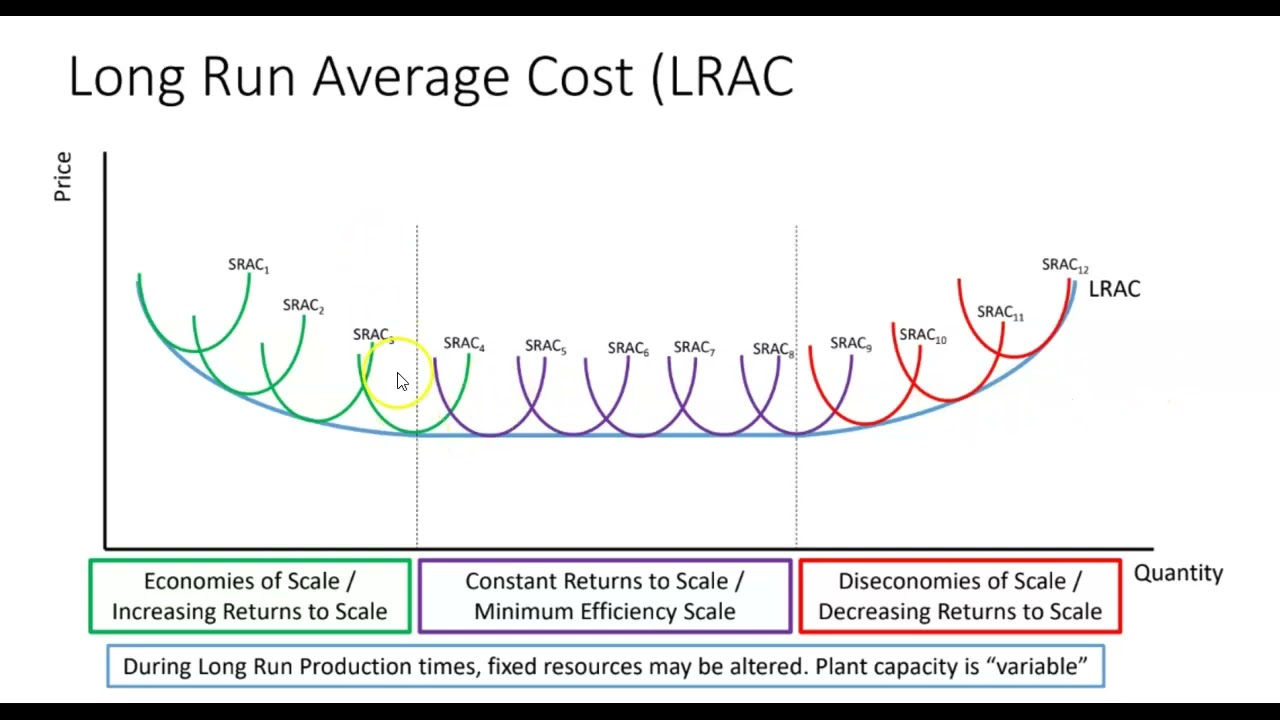

returns to scale

how a firm's output changes when all inputs are increased proportionally

increasing returns to scale

a situation where output increases by a greater proportion than the increase in inputs

constant returns to scale

a situation where output increases by the same proportion than the increase in inputs

decreasing returns to scale

a situation where output increases by a smaller proportion than the increase in inputs

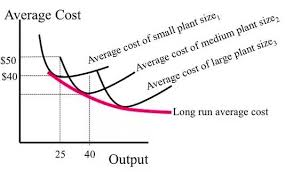

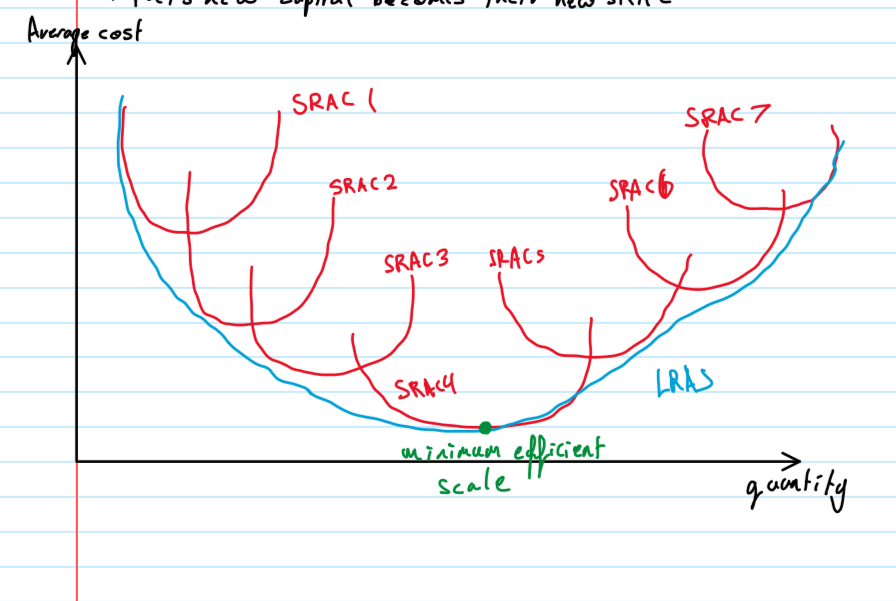

average costs long run graph

what is the long run curve made up of

small short run curves which represent a paticular size of the firm

economies of scale

fallling averge costs of production that result from an increase in level of output

internal economies of scale

arise from the increased output of the business itself

technical economies of scale

large firm could use computers and technology to replace workers on the production line

able to trasnport bulk materials

mass production means that unit costs are lower

using technology

purchasing (commercial) economies of scale

large businesses can employ specialist/expert staff - the most talented buyers know where to get the best deals

Bulk buying - being able to buy goods in bulk lower the unit price, large firms have warehouses to store the goods in

marketing economies of scale

advertising costs can be spread across many stores - as the cost of a television becomes cheaper “per store” you can “bulk buy” adverts

large business can employ expert staff

financial economies of scale

easier for large firms to raise capital, better lending terms

risk is spread over products

greater potential finance

managerial economies of scale

more specialised management can be employed

best workers want to work for large firms

external economies of scale

occure within an industry: all competitors benefit as the industry gets larger, all firms in an industry will benefit from lower average costs

diseconomies of scale

rising average costs of production that result from an increase in levele of output

examples of diseconomies of scale

difficult communication

cost of adminestration and co-ordination

alienation and low productivity

regulatory differences in different country

growth of corporate bureaucracy - excessive layers of management

loss of focus from core objectives

increase demand for raw materials - D.pull inflation

labour becomes scarce → increase wages to attract labourers

LRAC for a firm with a strong incentive to grow

the firm experiences productive efficiency at high output, therefore are likely to become larger

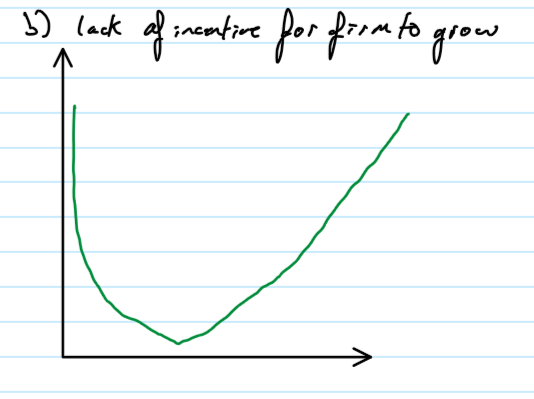

LRAC for a firm with a lack of incentive to grow

the firm experiences productive efficientcy at low output, therfore diseconomies fo scale are likely to occur sooner so less likely to grow

minimum efficient scale

the output of a business in the long term where the economies of scale have fully been exploited

it corresponds to the lowest point on the LRAC curve

how to change quantity produced in the short run vs the long run

in the short run, you would have to operate at maximum output i.e turn your machine (capital) up or down

this is because capital is fixed in the short run

however in the long run capital is not fixed, therfore the can purchase new capital to produce more.

this new capital becomes their new SRAC

productive efficiency

the ability of a firm to produce goods or services at the lowest possible cost, given the level of output and the available technology

where MC = AC

allocative efficiency

when resources are allocated in a way which maximises consumer satisfaction (utility)

on a diagram this is where MC = price

marginal costs curve

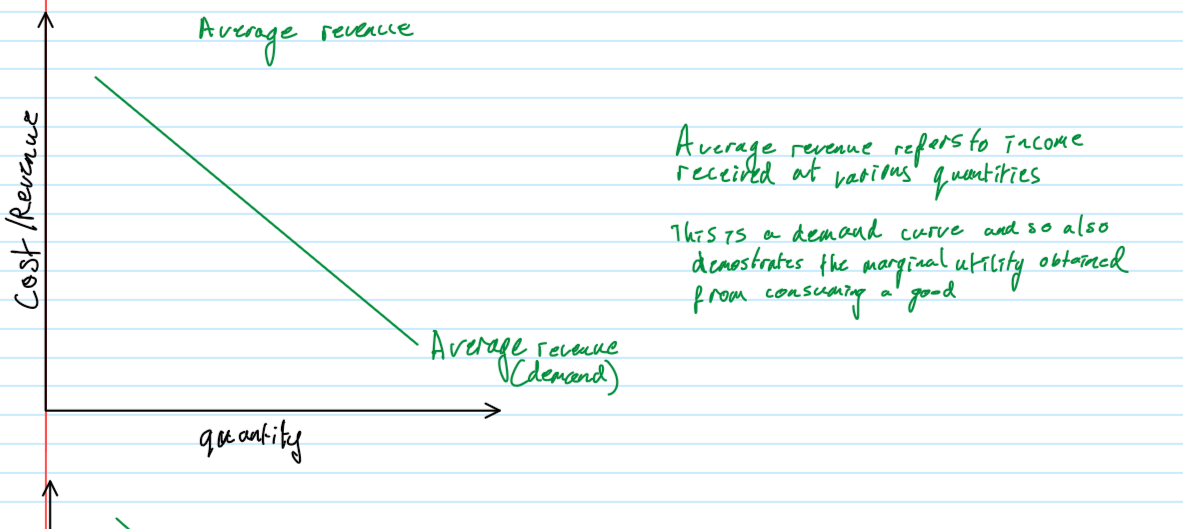

average revenue curve

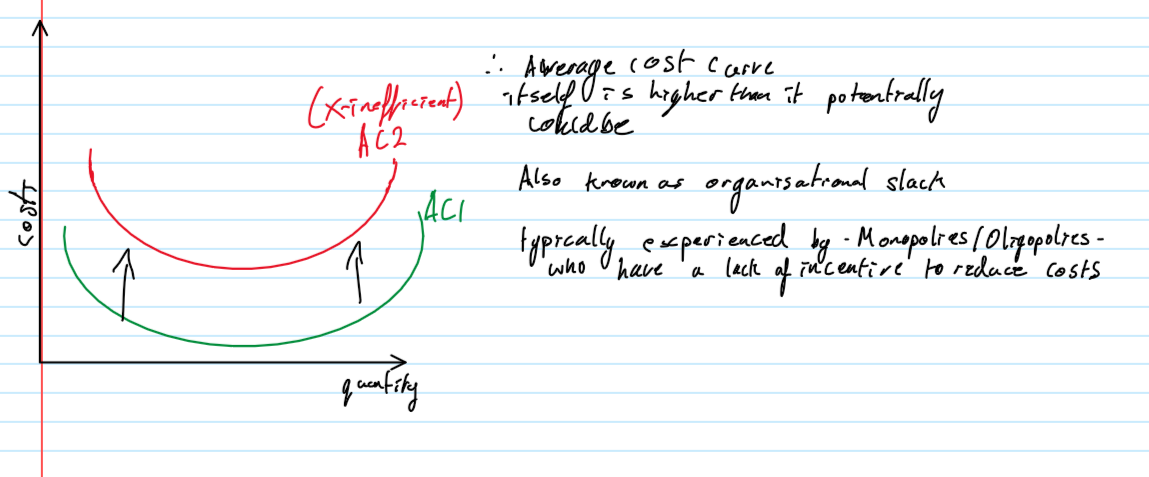

X-inefficiency

the economic concpet that a firms costs are higher than they should be due to factors like mismanagement, lack of competitiveness and poor motivation, preventing it from operating at maximum efficiency

Dynamic efficiency

as a firm grows they can access more resources

paticularly access to technology e.g. AI,apps,driverless cars

its about reducing costs and improve quality over time

sunk costs

costs that are required to start-up the firm and cannot be recovered if the firm closes down

revenue

money received from selling your products

price x quantity sold

marginal revenue

revenue from the sale of an additional unit

average revenue

total revenue / quantity sold

price makers

businesses that have enough influence in the market to set their own price

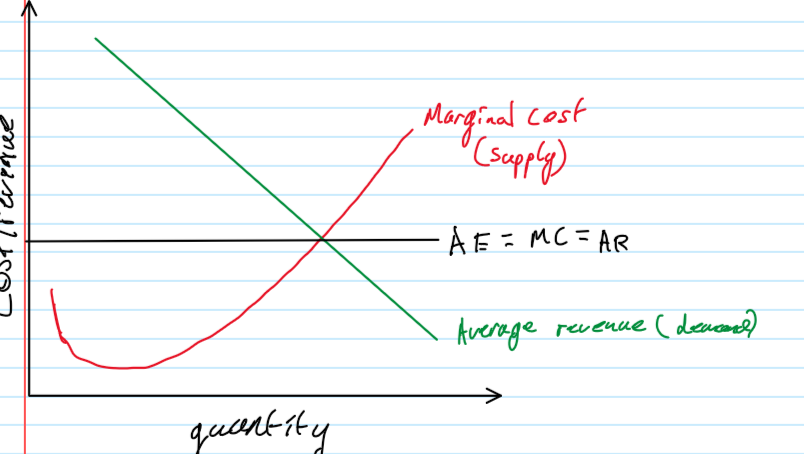

price takers

businesses that dont have enough influence in the market and have to accept the market price

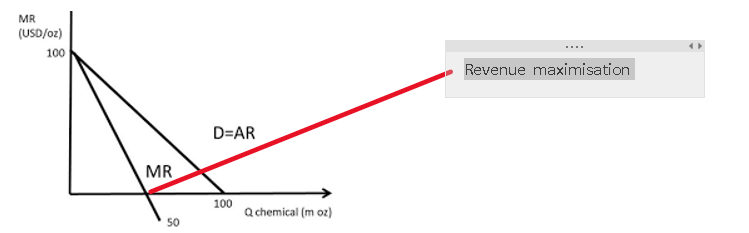

how will the MR curve look compared to AR curve for a price maker

will be 2x as steep

how does the MR curve look for price takers

firms who have no influence over price would have a constant MR received from each additional unit of output

MR and AR curve

the point where MR hits the x axis is revenue max

sales maximisation

a business objective where a firm aims to sell as many units of a product or service as possible without making a loss

AC = AR

profit maximisation

the default quantity in which we assumer firms operate unless told otherwise

where MC = MR

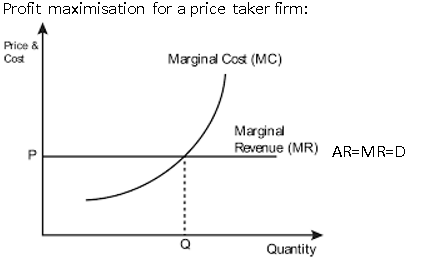

profit maximisation for a price taker

where the 2 curves intersects sets the firm quantity, then the price is set by demand (AR/D)

what happens if the firm produces profit less than Q

the marginal revenue from selling an additional unit is higher than the marginal cost of producing it, so the firm could generate even more profit by increasing quantity

what happens if the firm produces more than Q

the marginal revenue from selling an extra unit fails to cover the cost of producing the unit, so the firm could generate more profit by reducing quantity

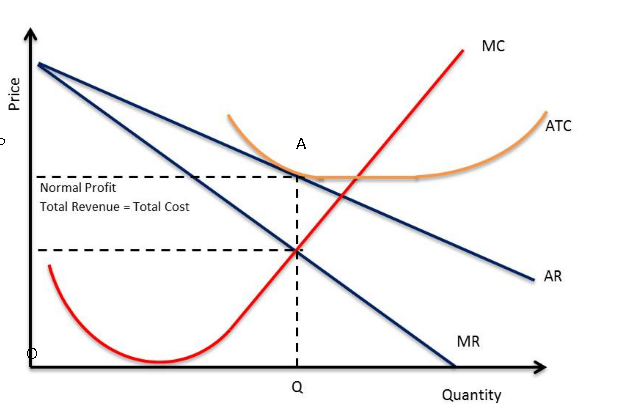

normal profit

the minimum level of profit necessary to incentivise a firm to remain in the market

it is not break even

this level of profit covers all the costs required to stay in business, plus a level of profit deemed satisfactory to continue trading.

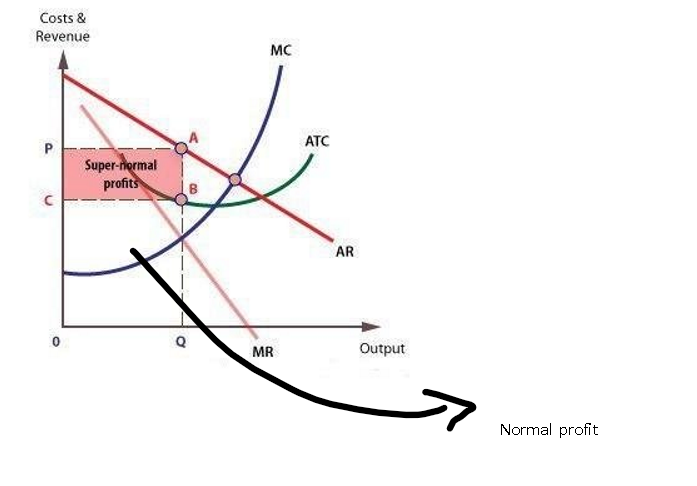

normal profit on a diagram

occurs where AR = AC, after the quantity has been established from MC = MR

The area OQAP = normal profit

Q is profit max

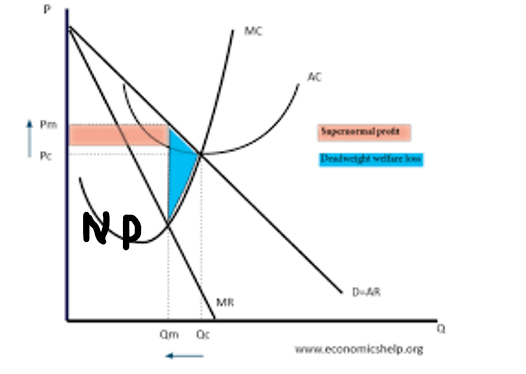

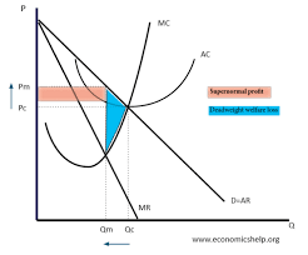

supernormal profit

extra profit above the level of normal profit, occurs where AR>AC

also sometimes known as abnormal profit

means there is an incentive for other firms to enter the market

supernormal profit for price makers

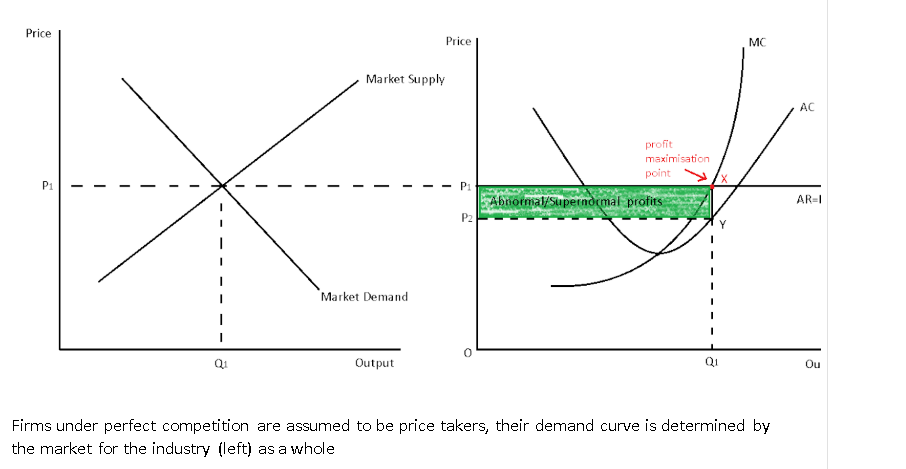

supernormal profit for price takers

perfectly competitive market assumptions

firms are profit maximisers MC=MR

many buyers and many sellers

homogenous (identical) products

free from barriers to entry or exit

perfect information for all buyers and sellers

firms are price takers - firms are a perfectly elastic demand curve

there is no ideal real life example of a perfectly competitive market

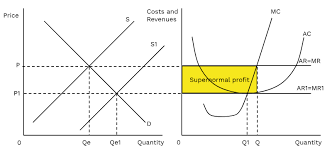

short run equilibrium under perfect competition acheiving supernormal profit

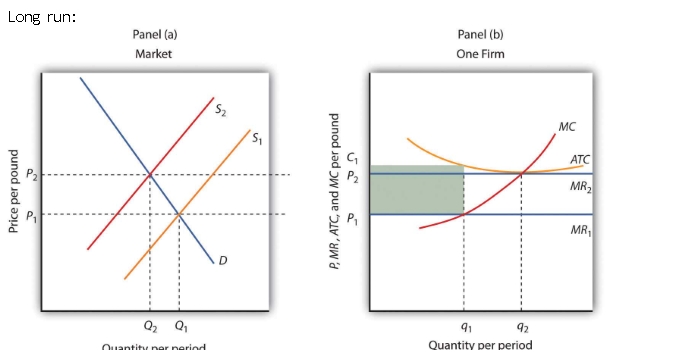

what happens due to supernormal profit in a market in the long run

due to supernormal profits made by incumbent firms, this attracts new firms to enter the market to take advantage of this opportunity, consequently, the additional firms means there is a greater supply in the market therefore leading to a lower market price, since the firms are price takers means that each firm has a lower price.

new firms will keep entering the market until the firms make normal profit

long run supernormal profit under perfect competition

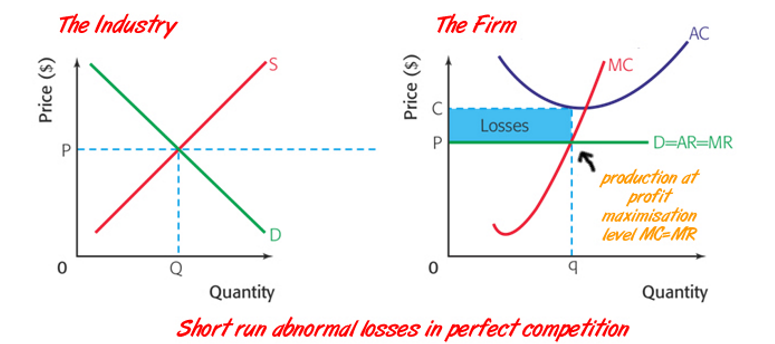

short run loss making firms in perfect competition

what happens due to loss in a market in the long run

as the firms make losses in the short run will leave the industry (no barriers to exit) and so supply will decrease. therefore the incumbent firm’s D/AR/MR curve will rise and so once again leaving the remaining firms to make normal profit in the long run

long run loss making under prefect competiiton

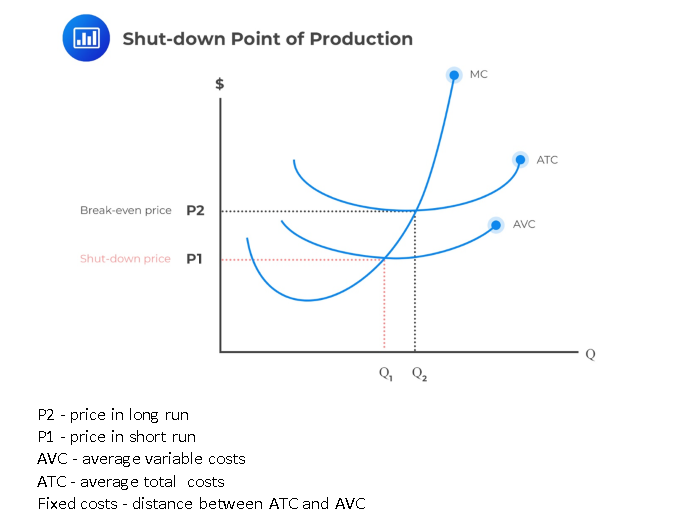

shut down point

for the firm to stay in business in the short run the price needs to be at least P1 to cover the costs of production (variable costs)

however the firm to stay in business in the long run the price needs to be at least P2, so the fixed costs are also covered remember ATC = (variable costs + fixed costs)/quantity produced

monopoly

a market structure where a single seller dominates the market with no close subsitutes for its product

legal definition: a firm that has a market share of at least 25% only a pure or natural monopoly will have 100% of the market which is a rare occurence

assumptions of monopoly markets

few sellers (maybe few buyers)

high entry and exit barriers

assymetric information

differentiating products

profit maximisers

price makers (to some extent)

supernormal profit

what profit does a monopoly make in the short run and the long run

supernormal profit in short run and due to high entry barriers it makes supernormal profit in the long run aswell

do monopolies operate at productive efficiency

(minimum point of cost curve): this is unlikely for monopoly, since they are not pressured by competition to minimize costs and operate at their lowest possible average cost

do monopolies operate at allocative efficiency

(producing what customers want, price = marginal cost): given that MR is below AR the price will always be above marginal costs and so is not allocatively efficient

why is the demand curve not perfectly inelastic

monopolies cannot charge whatever price they want

perfectly inelastic implies that no matter how high the price is that the monopoly could charge whatevery they want and the QD wouldnt change.

which isnt true

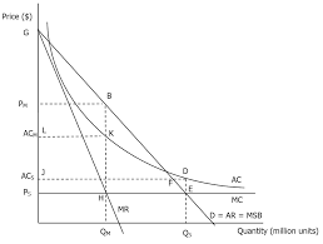

natural monopolies

where 1 firm dictates the whole markete.g. united utilities

an industry in which in order to reach productive efficiency, it is better for production ot be dominated by a single firm, rather than contested by several firms.

diagram for a natural monopoly

there is room for only one firm to fully exploit all the available internal economies of scale so one firm can supply a price lower than if there were 2 firms

MES can only be acheived at large output (likely to be 90-100% of market demand) thus LRAC curve is constantly falling

regulatory bodies in privatised monopolies

competition authorities will encourage competition to ensure low prices and higher quality, but in natural monopolies this isnt possible

regulatory bodies (Ofwat, Ofgem, ORR etc) monitor natural monopoly industries such as water, electricity, rail and telecommunications

key terms

PE - lowest point of AC

AE - where MC = AR

PM - where MR = MC

RM - where MR = 0

SM - where AR = AC

monopolistic competition

many firms that are selling products that are slightly differntiated therfore not perfect

Assumptions of monopolistic market

Many producers and many consumers

Slightly differentiated products - both actual (function and aesthetics) and artificial (branding)

Producers have some control over price

Barriers to entry and exit are low

Profit maximisers

Examples of monopolistic markets

Fast food

Restaurants

Clothing

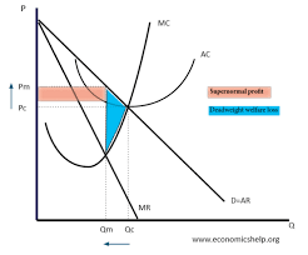

Diagram for monopolistic firms in short run achieving supernormal profit

Just like the monopoly diagram but more elastic demand curve, allocatively and productively inefficient in both short run and long run, firms achieve supernormal profit

Diagram for monopolistic firms in long run

As a result of low barriers to entry, the supernormal profits attract other firms to enter the market which shifts the demand curve to the left as a result of the extra competition into the market, firms achieve normal profit

Diagram for monopolistic competition in the long run

Eventually long run firms will leave market making firms achieve normal profit

Contestability

How easy it is to enter and exit a market, refers to barriers to entry and sunk costs

Market that has low contestability

Difficult for new firms to enter an industry

Market that has high contestability

Easier for new firms to enter an industry

How can incumbent firms deter new entrants to the market With supernormal profit

Supernormal profit provides an incentive to firms, to stop this firm may choose to lower prices to where AC = AR (limit pricing), thus removing the incentive (firm making normal profit)

Mere threat of competition reduces price and increase output

Assumptions of Oligopolies

Dominated by a few, large firms (known as oligopolists)

Many firms in the market but the concentration ratio is high (maybe 100 firms but oligopolists have the majority of market share)

Product differentiation amongst firms - engaging in non-price competition

High barriers to entry

High risk of collusion

Firms are interdependent

Diagram for incumbent firms in monopoly

Operate at P1 Q1

Any action will lead to a reaction by the other oligopolists therefore all decisions must factor in potential reactions, due to this interaction the demand curve is elastic before p1