Macroeconomics 1 The Short Run

1/32

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

33 Terms

short run

A period of time extending over a few years at most.

In the short run (e.g., a few years), year-to-year movements in output are primarily driven by movements in demand.

interactions among demand, production, and income

▶ Changes in the demand for goods lead to changes in production.

▶ Changes in production lead to changes in income.

▶ Changes in income lead to changes in the demand for goods.

GDP

GNP

GDP vs. GNP

GDP and GNP is a measure of aggregate output in the national income and product accounts.

GDP is the market value of the final goods and services produced by labor and property located in a domestic country. GDP is the sum of value added or the sum of final goods and services or the sum of incomes.

GNP is the market value of the final goods and services produced by labor and property supplied by residents of a domestic country.

GDP measures value added domestically. GNP measures value added by domestic factors of production.

Nominal GDP

Real GDP

Nominal GDP (GDP in current dollars) is the sum of the quantities of final goods produced times their current price. Increase: the production and the price of most goods increases over time.

Real GDP (GDP in terms of goods, in constant dollars, adjusted for inflation) is the sum of quantities of final goods produced in an economy times their price in a base year. The current measure of real GDP in the US is called GDP in chained 2012 dollars.

Components of GDP

• GDP is the sum of consumption, investment, government spending, inventory investment, and exports minus imports.

• Consumption (C) is the purchase of goods and services by consumers. Consumption is the largest component of demand.

• Investment (I) is the sum of nonresidential investment—the purchase of new plants and new machines by firms—and of residential investment—the purchase of new houses or apartments by people.

• Government spending (G) is the purchase of goods and services by federal, state, and local governments, excluding government transfers. Government transfers - payments made by the government to individuals that are not in exchange for goods and services (e.g. Social Security Payment) or interest payments on the gov. debt.

• Exports (X) are purchases of US goods by foreigners. Imports (IM) are purchases of foreign goods and services by domestic consumers, firms, and the government.

• Inventory investment is the difference between production and purchases. It can be positive or negative.

value added

The value a firm adds in the production process, equal to the value of its production minus the value of the intermediate inputs it uses in production.

intermediate good

A good used in the production of a final good.

fixed investment

inventory investment

fixed investment is the purchase of equipment and structures (as opposed to inventory investment). When firms are optimistic about future demand, they expand capacity: machines, buildings, equipment. This increases fixed investment.

Inventory investment is the difference between production and purchases.

If demand turns out higher than expected, inventories fall - Inventory investment becomes negative.

If demand turns out lower than expected, unsold goods accumulate - Inventory investment becomes positive.

Fixed investment is planned and deliberate.

Inventory investment is mostly unplanned and absorbs demand shocks.

nonresidential investment

residential investment

Spending by firms on structures, equipment, and intellectual property.

The purchase of new houses or apartments by people.

trade balance

trade surplus

trade deficit

trade balance (net exports (X − IM)) - The difference between exports and imports.

trade surplus - A positive trade balance, that is, exports exceed imports X-IM > 0

trade deficit - A negative trade balance X-IM < 0

income

disposable income (YD)

income - The flow of revenue from work, rental income, interest, and dividents.

disposable income (YD) - The income available to consumers after they have received transfers and paid taxes. Disposable income is: YD ≡ Y −T

total demand for goods (Z)

Z ≡ C + I + G + X−IM

In a closed economy (X = IM = 0):

Z ≡ C + I + G

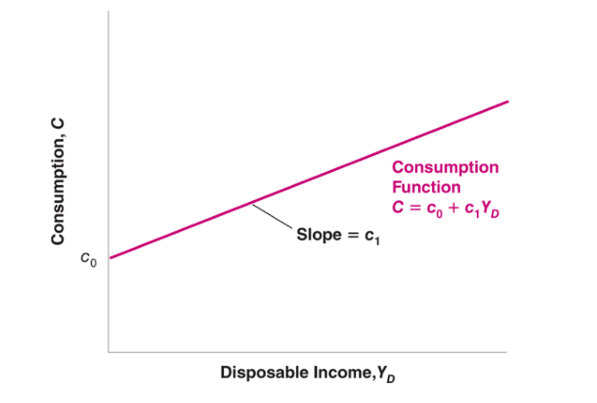

consumption function

Consumption (C) is a function of disposable income (YD), which is the income that remains once consumers have received government transfers and paid their taxes.

C = C(YD)

C =c0+c1YD = c0+c1(Y −T)

C(YD) is called the consumption function. This is a behavioral equation that captures the behavior of consumers.

Changes in c0 reflect changes in consumption for a given level of disposable income.

Disposable income is: YD ≡ Y −T

consumption when disposable income = 0 (c0)

propensity to consume (c₁)

propensity to save (1-c1)

multiplier

c0 - What people would consume if their disposable income equals zero.

autonomous spending - The component of the demand for goods that does not depend on the level of output. [c0 + I + G − c1T]

Autonomous spending is positive because if T = G (balanced budget) and c1 is between 0 and 1, then (G −c1T) is positive, and so is autonomous spending.

propensity to consume (c₁) - The effect of an additional dollar of disposable income YD on consumption.

propensity to save (1-c1) - The effect of an additional dollar of disposable income YD on saving.

multiplier - The ratio of the change in an endogenous variable to the change in an exogenous variable (e.g. the ratio of the change in output to the change in autonomous spending)

![<p>c<sub>0 </sub>- What people would consume if their disposable income equals zero.</p><p>autonomous spending - The component of the demand for goods that does not depend on the level of output. [c<sub>0</sub> + <u>I</u> + G − c<sub>1</sub>T] </p><p>Autonomous spending is positive because if T = G (balanced budget) and c<sub>1</sub> is between 0 and 1, then (G −c<sub>1</sub>T) is positive, and so is autonomous spending.</p><p></p><p>propensity to consume (c₁) - The effect of an additional dollar of disposable income Y<sup>D</sup> on consumption.</p><p></p><p>propensity to save (1-c<sub>1</sub>) - The effect of an additional dollar of disposable income Y<sup>D</sup> on saving.</p><p></p><p>multiplier - The ratio of the change in an endogenous variable to the change in an exogenous variable (e.g. the ratio of the change in output to the change in autonomous spending)</p>](https://knowt-user-attachments.s3.amazonaws.com/018487bf-f166-44ae-9856-372d69fc797e.png)

endogenous / exogenous variables

Endogenous variables: variables depend on other variables in the model

Exogenous variables: variables not explained within the model but are instead taken as given I = I

fiscal policy

T and G describe fiscal policy– the choice of taxes and spending by the government. G and T are exogenous because:

▶ Governments do not behave with the same regularity as consumers or firms.

▶ We are trying to assess the effect of changing G and T by the government on output within the model

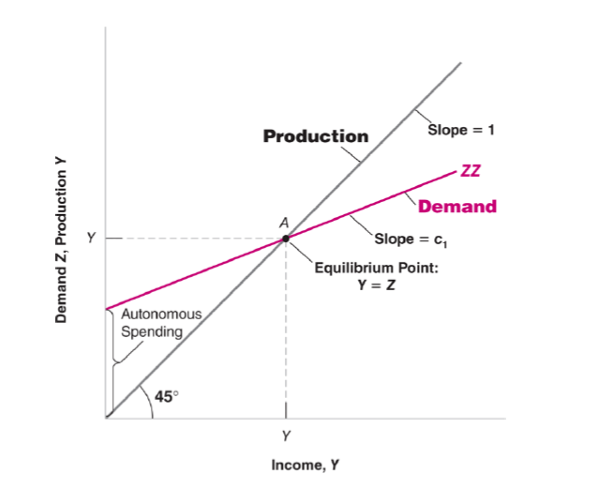

equilibrium in the goods market

In a closed economy X = IM =0, so Z ≡ C+ I +G

Equilibrium in the goods market requires Y =Z

Z = Y = c0 + c1(Y −T)+¯I+G

In equilibrium, production (Y) is equal to demand, which in turn depends on income (Y), which is itself equal to production

IS-relation

An equilibrium condition stating that the demand for goods must be equal to the supply of goods, or equivalently that investment must be equal to saving. The equilibrium condition for the goods market.

S = I + G −T

S =−c0+(1−c1)(Y −T)

I = S + (T −G)

I =−c0 +(1−c1)(Y −T)+(T − G)

Investment equals Saving

dynamics

The adjustment of output over time is called the dynamics of adjustment. How long the adjustment takes depends on how and when firms revise their production schedule.

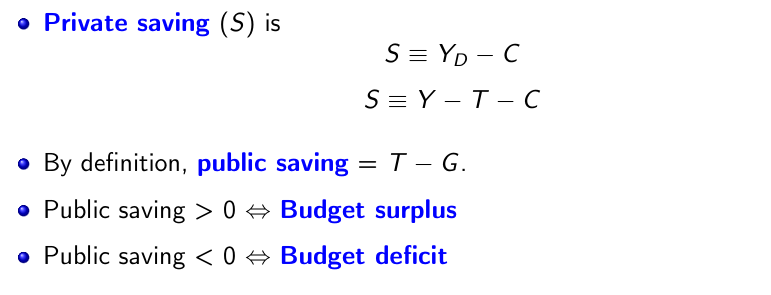

private saving

public saving (budget surplus)

public dissaving (budget deficit)

balanced budget

saving

private saving (S) - Saving by consumers and firms.

S ≡ YD − C

S ≡ Y −T−C

public saving (T − G) (budget surplus) - Saving by the government; equal to government revenues minus government spending.

Budget deficit - The excess of government expenditures over government revenues.

balanced budget (T=G) - A budget in which taxes are equal to government spending

saving - The sum of private and public saving

paradox of saving (paradox of thrift)

The result that an attempt by people to save more may lead both to a decline in output and to either unchanged or even lower saving

The Goods Market Summary

• In the short run, demand determines production. Production is equal to income. Income in turn affects demand.

• The consumption function shows how consumption depends on disposable income. The propensity to consume describes how much consumption increases for a given increase in disposable income.

• Equilibrium output is the level of output at which production equals demand. In equilibrium, output equals autonomous spending times the multiplier. Autonomous spending is that part of demand that does not depend on income. The multiplier is equal to 1/(1 − c₁), where c₁ is the propensity to consume.

• Increases in consumer confidence, investment demand, government spending, or decreases in taxes all increase equilibrium output in the short run.

• An alternative way of stating the goods-market equilibrium condition is that investment must be equal to saving—the sum of private and public saving. For this reason, the equilibrium condition is called the IS relation (I for investment, S for saving).

money and bonds

Money is used for transactions, but it pays no interest.

Two types of money: currency and checkable deposits.

Bonds pay a positive interest rate, i (the rate of interest), but cannot be used for transactions.

The holding of money and bonds depends on:

▶ Your level of transactions

▶ The interest rate on bonds

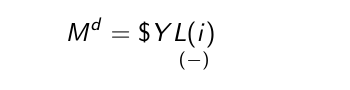

Demand for money (Md)

is equal to nominal income $Y (a measure of level of transactions in the economy) times a decreasing function of the interest rate i

An increase in the interest rate decreases the demand for money, as people put more of their wealth into bonds.

Eq. means that the demand for money:

▶ increases in proportion to nominal income

▶ depends negatively on the interest rate.

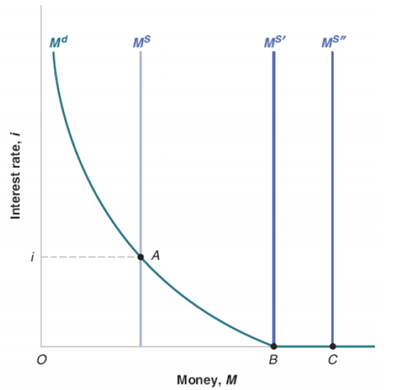

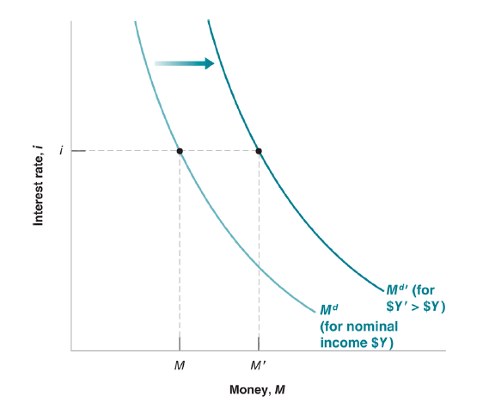

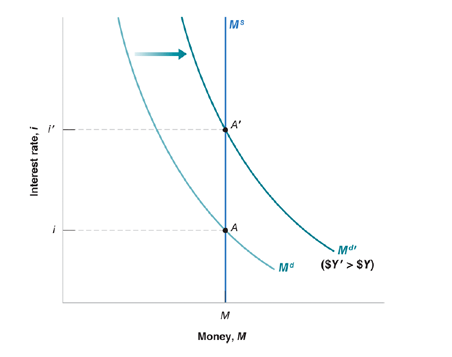

Md curve

The relation between the demand for money and the interest rate for a given level of income $Y is represented by the Md curve.

For a given level of nominal income, a lower interest rate increases the demand for money.

At a given interest rate, an increase in nominal income shifts the demand for money to the right.

Equilibrium in financial markets

requires that Ms = Md = M

The interest rate must be such that the supply of money (which is independent of the interest rate) is equal to the demand for money (which does depend on the interest rate).

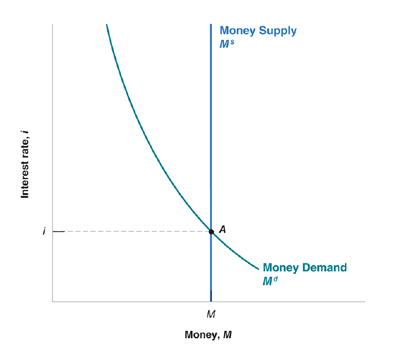

An increase in the supply of money

leads to a decrease in the interest rate.

Given the money supply, an increase in nominal income

leads to an increase in the interest rate.

For a given money supply, an increase in nominal income

leads to an increase in the interest rate.

An increase in the supply of money by the central bank

leads to a decrease in the interest rate

open market operation

Central banks typically change the supply of money by buying or selling bonds in the bond market through open market operations.

Expansionary open market operation: the central bank expands the supply of money by buying bonds.

Contractionary open market operation: the central bank contracts the supply of money by selling bonds

Suppose a bond such as a Treasury bill, or T-bill, promises to pay $100 a year from now. If the price of the bond today is $PB, then the interest rate on the bond is: i = $100−$PB/$PB

The higher the price of the bond, the lower the interest rate.

The higher the interest rate, the lower the price today

central bank

Rather than the money supply, the central bank could have chosen the interest rate and then adjusted the money supply so as to achieve the interest rate it had chosen.

Choosing the interest rate, instead of the money supply, is what modern central banks, including the Fed, typically do.

The Liquidity Trap

Zero lower bound: The interest rate cannot go below zero.

The economy is in a liquidity trap when the interest rate is down to zero, monetary policy cannot decrease it further.

When the interest rate is equal to zero, and once people have enough money for transaction purposes, they become indifferent between holding money and holding bonds. The demand for money becomes horizontal.

This implies that, when the interest rate is equal to zero, further increases in the money supply have no effect on the interest rate, which remains equal to zero.