Sources of Finance- Unit 3

1/95

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

96 Terms

Short- term finance?

Money borrowed for one year or less

Long-term finance

money borrowed for more than one year

Start-up Capital?

Money needed to set up a business

Expansion?

Money needed for a business to grow

Working Capital?

Money needed for daily expenses

Emergency

Money needed for unexpected situations

Internal finance

finance generated by the business from its own means

Retained profit?

Profit kept in the business after paying all costs, expenses.

Advantages of retained profit?

does not have to be repaid

No interest needs to be paid

Readily available

Disadvantages of retained profit?

profits may be too low

A new business won’t have

Keeping more profits will reduce return to shareholders

Selling assets?

Selling unwanted assets like property to raise finance

Advantages of selling assets?

Uses capital tied up in the business

Does not become a debt for the business

Disadvantages of selling assets?

Takes time and the expected amount may not be gained

A new business will not have assets to sell.

Personal savings?

Finance the owner invests directly from their sacings

Advantages of personal savings?

Will be available fast

No interest has to be paid

Disadvantages of personal savings?

increases risk taken by owners.

Overdraft?

can spend more than whats in their bank accounts

Advantages of overdraft

flexible as it can change

interest is only on amount withdrawn

Disadvantages of overdraft

interest rates can vary

may have to be repaid fast

Trade payable

when a business delays paying their suppliers (30-90) to improve their cash position

advantages of trade payables

cheap because no interest

disadvantages of trade payables

may damage the relationship with supplier

Credit cards

can borrow money within a limit

advantages credit cards

no charge of money is paid on time

disadvantages of credit cards

interest rates are high

bank loan

money borrowed from banks and repaid with an interest

advantages of bank loan

fixed rate of interest

flexible

disadvantages of bank loan

needs to give a bank collateral security

needs to pay interest periodically

Mortgage

a long term goal used for buying land or property

advantage of mortgage

long time to repay the loan

disadvantage of mortgage

total amount paid can be very high

debenture

loans made to business and investors are given a certificate

advantages of debenture

used to raise very long term finance

control is not lost

disadvantages of debenture

interest has to be paid on time

assets cannot be used freely

hire purchase

a business pays specific goods with a loan from a finance house and then the business pays for it in monthly instalments

advantages of hire purchase

does not need a large sum of cash to acquire so cash flow is improved

disadvantage of hire purchase

cash deposit needs to be paid

interest can be high

raw materials

sales of shares to limited companies to raise money

advantages of raw materials?

no interest rates

large amount of money can be raised

disadvantages of raw materials

need to pay dividend

high admin costs

venture capitalists

investors who provide money to small/medium businesses for a share of the business

advantages of venture capitalists

support with business contracts

can provide expertise and guidance

disadvantages of venture capitalists

share of profitt

may want more control

crowd funding

a large number of people who can invest in a business using an online platform

Cash flow forecast?

A financial document that predicts of money coming in and out of the business

Importance of cash?

Business cannot survive without cash

to pay suppliers

to pay overheads

to pay employees

Cash flow?

the flow of money in and out of a business

cash inflow

they money coming into a business

cash outflow

money going out of a business

net cash flow

the difference between cash inflow and outflow

Purpose of cash flow?

identifying cash shortages- identifying in advance so a business knows when to borrow cash

Supporting application for funding- to show investors and bankers

Helps when planning the business- helps clarify aims and performance planning

Monitoring cash flow- to see the accuracy of the cash flow forecast

Advantages of cash flow forecast?

Helps businesses plan for times when they might run out of money.

A clear picture of cash coming in and leaving. Decision making.

Easier to get loans or investments, and banks often see forecasts

Disadvantages of cash flow forecast?

based on predictions- can lead to wrong choices

unexpected events may occur

time-consuming and needs to be updated

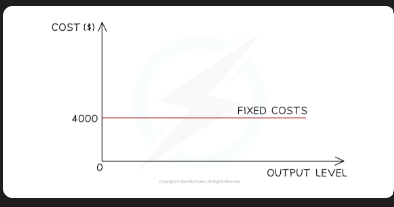

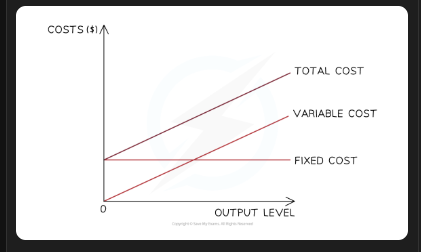

Fixed costs?

costs that don’t change with the level of output (rent, bills, payments)

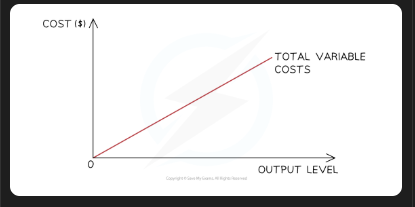

Variable costs

costs that change based on the level of output (raw materials, wages, fuel)

Total costs formula?

TC= fixed costs + variable costs

Average costs formula?

AC= total costs/quantity produced

Total revenue formula?

TR= quantity sold x price

Profit formula?

P= Total revenue - costs

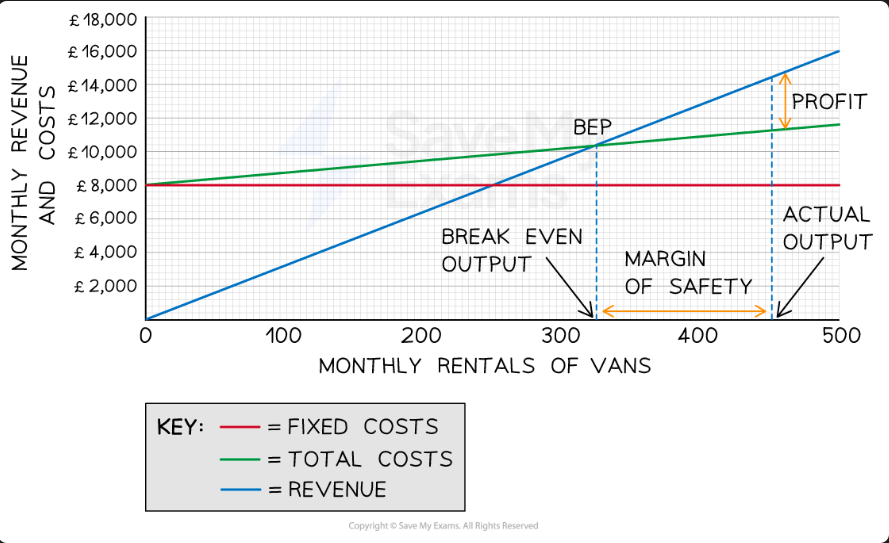

Break-even point?

when total costs and total revenue are the same

neither a profit or loss is made

profit = 0

Break-even point formula?

BEP = Fixed costs/ (Selling price-Variable cost per unit)

break-even chart?

Limitations of the break-even chart?

Costs do not always increase in direct proportion to units sold.

bulk-buying reduces variable costs per unit and increases output

fixed costs might increase due to more staff or equipment

Some output may remain unsold

businesses may keep stock to cope with any changes in demand

some stock could also be sold at a lower price

Statement of comprehensive income (SOCI)?

A financial document that records all the income generated by the business. (Profit and loss statement)

Cost of sales (direct costs) formula?

Opening inventory of finished goods - closing inventory of finished goods

Gross profit formula?

Sales revenue - cost of sales

it’s the profit made before expenses are taken away.

Net/ operating profit formula?

Gross profit - expenses?

what are expenses?

All INDIRECT costs like rent, wages, bills, marketing.

What does the SOCI include?

Revenue

Cost of Sales

Gross profit

Operating profit

Finance costs

Profit for the year

Profit for the year after tax

Retained profit?

profit that is invested back into the business

Distributed profit?

a portion of the net profit distributed to stakeholders.

How can SOCI be used for decision making?

investment decisions

a rise in profit- more funds for investment

Cost analysis

an increase in cost of sales- reduces COP

Future forecasts

increase in profit- further increase in the future

Statement of Financial position?

A financial document which provides a summary of a firm’s assets, liabilities and capital. (Balance sheet)

Assets?

resources owned by a business (items of value)

Non-current/ fixed assets?

Assets that remain in the business for more than a year (land, vehicles, buildings)

Can also be intangible (copyrights and patents) that add to the value of a business

Current/ Short assets?

Assets that can be changed into cash within a year- liquid assets (inventory, cash ‘in hand’)

Liabilities?

debts owed by the business to its creditors

Non-current liabilites?

Business debts which don’t need to be repaid within a year. (loans, debentures)

Current liabilites?

Business debts that do need to be repaid within a year. (Trade payables, overdrafts)

Net current assets formula?

Current assets - current liabilites

Net assets formula?

Total assets - total liabilities

Interpreting the SOFP

Financing its activities- long-term liabilities are share capital- application for loans may be declined

What a business owes

What a business owns

Ratio analysis?

Extracting information from financial accounts to assess business performance. This is compared over time to determine how well financial objectives are being achieved.

Profitability ratios?

Measures the performance of a business and focuses on profit, revenue and amount invested into the business. SOCI is used.

Liquidity ratios?

Measures how easily a business can pay its short-term debts

Gross profit margin?

proportion of a revenue turned into gross profit

Gross profit margin formula?

GPM= (Gross profit/sales revenue) x 100

Operating profit margin?

An accurate reading on how much profit is made.

the higher the number the better

Operating profit margin formula?

OPM= (Operating profit/Sales revenue) x 100

Mark up?

Profit made per item sold.

Mark up formula?

(Profit per item/Cost per item) x 100

Current ratio?

quick way to measure liquidity

answer is shown as a ratio

Current ratio formula?

Current assets/current liabilites

Acid test ratio formula?

ATR= Current assets-Stock/ Current liabilites

stock- inventory ( goods)

How can financial documents be used to assess the performance of a business?

Managers and employees- looking at strategies to improve business performance and job security (wage negotiations)

Owners and shareholders- Profitability or risk.

External stakeholders- Financial history.

Using financial documents for decision making

funding decisions- Sources of finance

Reducing costs- production process

Increasing profitability- can become more competitive

Investment decisions- can attract shareholders to a business by having good financial records.