Fixed Income

1/124

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

125 Terms

Tenor

Time remaining until maturity

Trustee

Financial institution representing an investor’s interest appointed by issuer

ensure company meets obligations and payments

takes action on behalf of bondholders

Floating Rate Notes

Variable market rate of interest + fixed margin

Bond indenture/ trust deed

Legal contract between bond issuer and bondholders

(Un)Secured Bond

Cash flows repaid from the operating cash flow of the company, with the added security of a legal claim when liquidating

Unsecured has no claim

Affirmative Covenants

Affirmative covenants are requirements the issuer must fulfill. These may include:

Providing timely financial reports to bondholders

Specifying the use of proceeds from the bond issue

Granting bondholders the right to redeem at a premium if the issuer is acquired in a merger or takeover

Cross-default/ Pari Passu

Cross-Default Clause:

If the issuer defaults on any other debt, it is also considered a default on this bond.Pari Passu Clause:

Ensures the bond has equal claim priority with the issuer’s other senior debt.

Negative Covenants

Negative covenants place restrictions on the issuer to protect bondholders by limiting risky actions. Examples include restrictions on:

Asset sales and leasebacks

Pledging the same collateral to multiple lenders

Issuing more senior debt (negative pledge clause)

New borrowings, share buybacks, or dividends — often subject to a financial ratio test (e.g., debt/EBITDA limits)

They prevent excessive risk-taking but shouldn’t overly restrict the issuer's flexibility.

Bullet Structure

Par paid back in a single payment at maturity

Partially Amortizing/Balloon Payment

Repayment of some principal at maturity.

Sinking fund provisions (pros/cons)

Repayment of principal through a series of payments over the life of a bond issue

Pros: less credit risk cuz get periodic payments

Cons: receiving cash flows early and only behind able to reinvest them at lower yields (when interest rates fall due to reinvestment risk)

Waterfall structure

pay bondholders in order of seniority

Floating-rate notes FRNs

Periodic interest depending on prevailing market rate of interest at the time future coupon payments are made

Market reference rate → variable market rate

Add credit spread with basis points

Step-Up Coupon Bonds

Coupon rate increases over time according to a predetermined schedule

leveraged loans/credit-linked note

if credit quality lowers

coupon increases

Leveraged/ Credit linked notes bonds

Both move with credit risk

Leverage

Low starting credit quality issuer

Credit linked

anyone can issue

Payment-in-kind bond PIK

Allows issuer to make the coupon payments by increasing the principal amount of the outstanding bonds

paying bond interest with more bonds

Index-linked bond

Coupon payments or a principal value that is based on a specified published index

Inflation-linked bonds (linkers) → increases cash flows with a specified inflation index

Inflation-indexed bonds

Interest-indexed bonds

Coupon rate adjusted for inflation, while principal value remains unchanged

Capital-indexed bonds

Treasury inflation-protected securities (TIPS)

coupon rate constant but principal value increased by inflation

PMT from new principal

Deferred coupon bond

coupon payments do not begin until a specified time after issuance

often traded below par to provide investors with the yields they demand

Contingency provision

An action that may be taken if an event actually occurs

embedded options

integral part of bond contract and are not a separate security

Callable, putable, convertible

Bermuda/ European/ American call provision

Bermuda

Many specific dates to exercise

European

One specific date to exercise

America

From a date onwards can exercise

Convertible Bond terms

Conversion price. This is the par amount per share at which the bond may be converted to common stock.

Conversion ratio. This is equal to the par value of the bond divided by the conversion price. If a bond with a $1,000 par value has a conversion price of $40, its conversion ratio is 1,000 / 40 = 25 shares per bond.

Conversion value. This is the market value of the shares that would be received upon conversion. A bond with a conversion ratio of 25 shares when the current market price of a common share is $50 would have a conversion value of 25 × $50 = $1,250.

Contingent convertible bonds CoCos

bonds that convert from debt to common equity automatically if a specific event occurs

if bank equity falls below a given level → automatically converted to common stock

decrease liabilities

increase equity

meets min equity requirement

Eurobond

bonds issued outside the jurisdiction of any one country and can b issued in any currency

global bond → eurobond in at least one domestic bond market and in eurobond market

REFERRED TO THE CURRENCY THEY ARE DENOMINATED IN

Old: bearer bond

New: Registered Bonds

Global Bond

Similar to Eurobond but can be issued in multiple different countries

Sukuk bonds

the holder has an undivided ownership right in a particular asset and is therefore entitled to the return generated by that asset

Original issue discount (OID) bonds

ZCB and other bonds solder at significant discounts to par when issued

tax liabilities even when no cash interest payment has been made

a portion of the discount from par at issuance is treated as taxable interest income each year

no capital gains but all in interest income

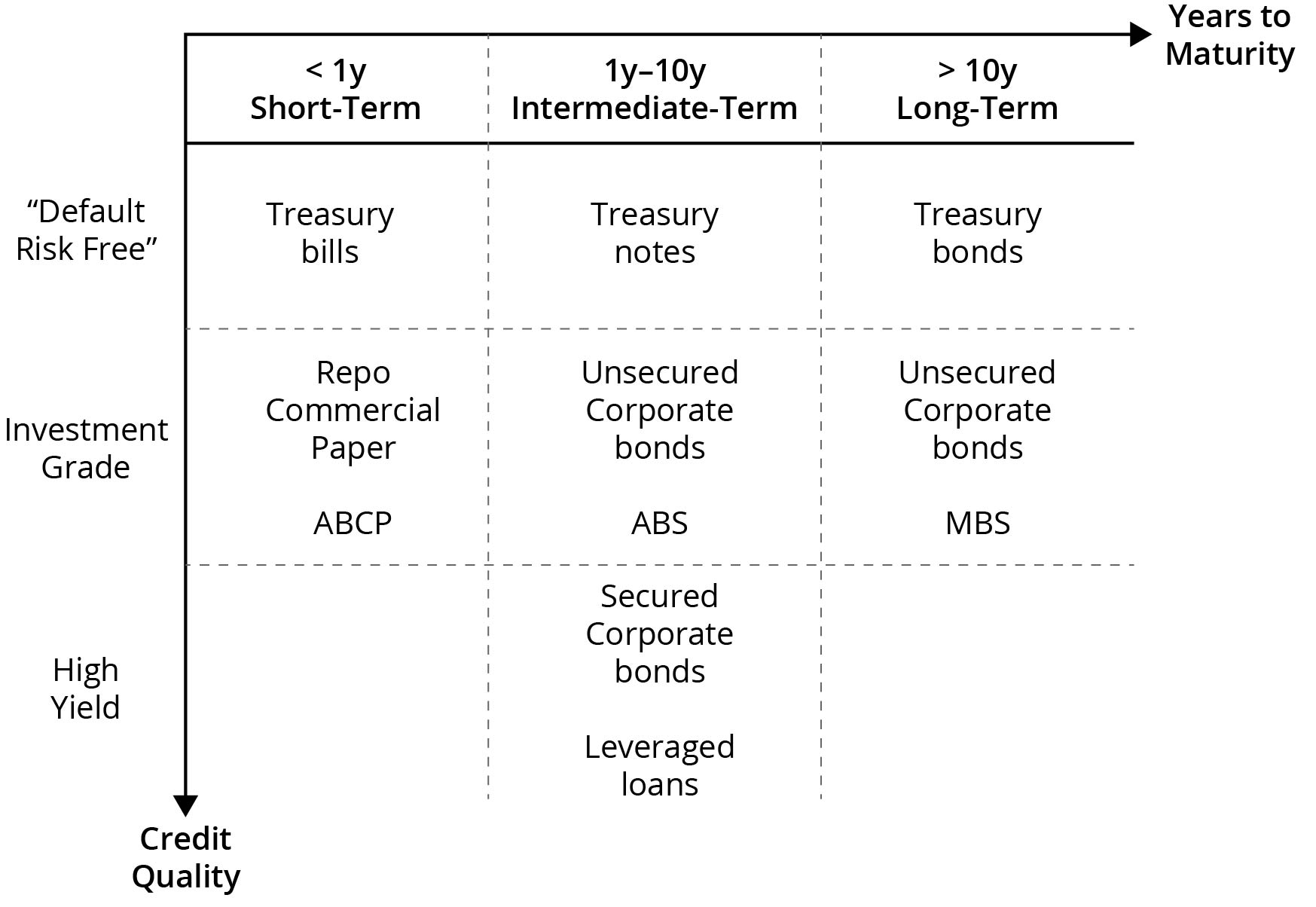

Bond Segments

Type of issuer (or sector)

Governments, corporates, SPE

credit quality

BBB or higher investment grade bonds

BB+ or lower “junk bonds”

time to maturity

Issuer Credit Maturity Spectrum

Secured Corporate Bonds investment grade or high yield

High yield because lass reliable operating cash flows needs to offer security

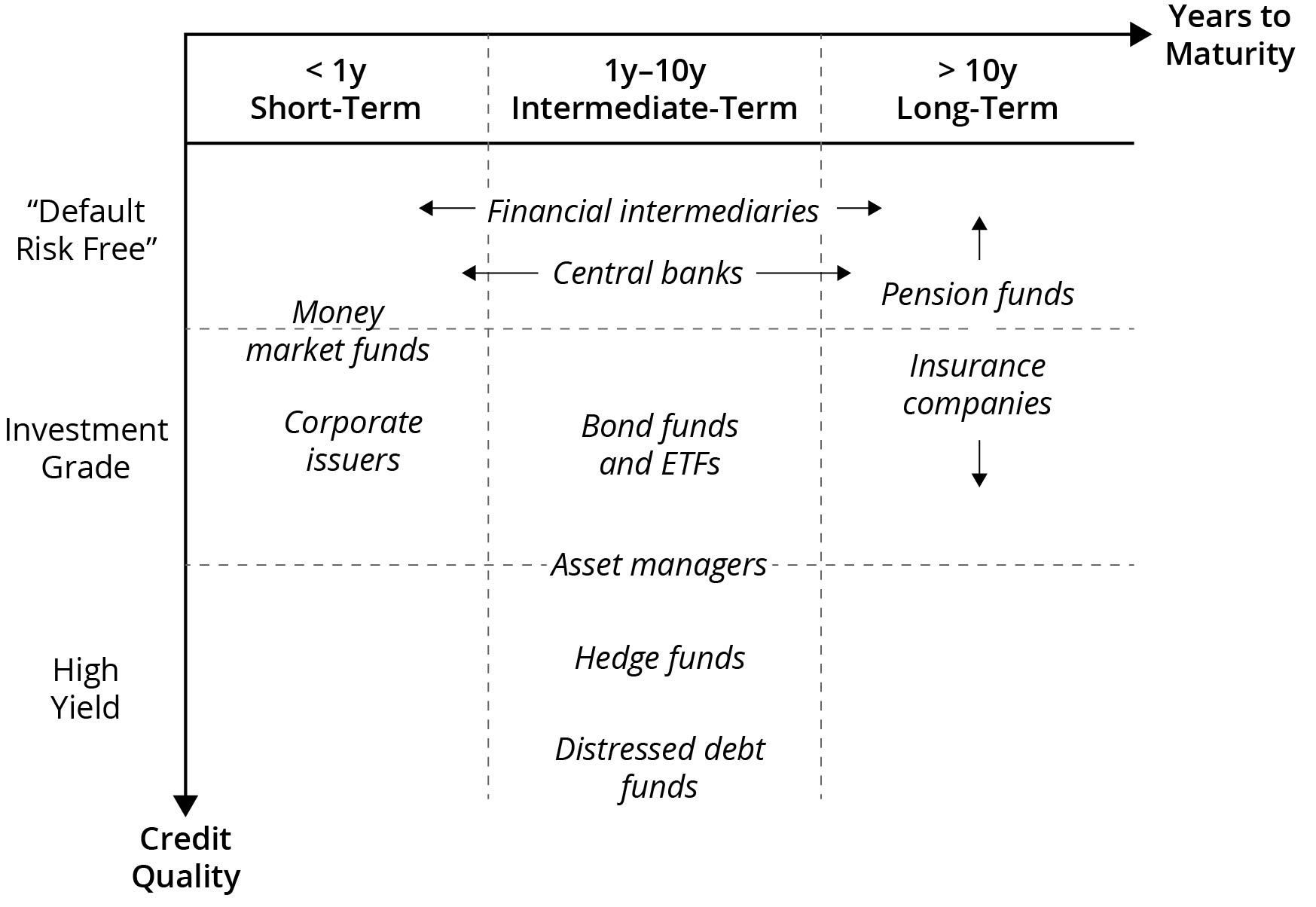

Investor positioning in Credit/Maturity Spectrum

Fixed income index vs Equity index

Fixed-income indexes have more constituents than equity indexes because companies issue many bonds, while they typically have only a few share classes.

Use sampling techniques to buy a representative subset of the index.

This aims to closely match the index’s performance while keeping costs and complexity down.

Bonds mature and are issued frequently, causing higher turnover in bond indexes compared to equity indexes.

Broad bond indexes are heavily weighted toward government (sovereign) bonds, and their composition shifts with changes in issuance trends like maturity and credit quality.

Debut Issuer

An issuer that is offering its first ever–bond is referred to as a debut issuer and is typically a growing and maturing firm that is replacing bank loans in its capital structure with the proceeds from the bond issue.

Distressed debt profit

A distressed debt investor might buy the debt from other institutions that are prohibited from owning securities with low credit ratings, and aims to profit from the issuer's fortunes reversing, higher–than–expected recovery rates in liquidation, or value-enhancing restructuring of the issuer.

Private Placement

Newly issued debt BUT for specific investors

mainly for newer companies with less predictable cash flows

Bank lines of credit

Uncommitted Line: Bank may refuse to lend; flexible; no fees except interest; may be unsecured.

Committed Line: Bank must lend for a set time; commitment fee (~50bps); renewal risk at maturity.

Regulators requires banks to holder higher reserves

Revolving Line ("Revolver"): Most reliable; longer-term; restrictive covenants; similar fees/rates to committed lines.

Syndicates can be formed for committed/revolving to minimize capital requirement

Factoring

Actual transfer of credit granting and collection of receivables to a lender at a discount from their face value

Discount depends on creditworthiness of firm’s customers and collection costs

usually sold to a third party

Bridge financing

Temporary debt until permanent financing can be secured

Rollover risk

Risk that a company will not be able to sell new CP to replace maturing paper

Backup lines of credit

liquidity enhancement where lenders agree to provide funds to make repayments if needed

Checking accounts/Operational Deposits/Saving deposits

Checking account

provide transaction services and immediate availability of funds

no interest

Operational deposits

larger customers who require cash management, custody, and clearing services

Savings deposits

stated term and interest rate

(Non)negotiable CDs

Nonnegotiable CANNOT be sold before maturity, and early withdrawals of funds incurs a penalty

Central bank funds market

Excess reserves lent to other banks at central bank funds rate

Asset-backed commercial paper

Financial institution transfers collateral to an SPE in return for cash

SPE sells ABCP to investors

Funding for financial institutions

Checking account

Operational deposits

Saving deposits

CD

interbank fund

REPOS

Central bank funds market

Repurchase agreement

One party sells a security to a counterparty with the commitment to buy it back at a later date at higher price

Repo rate

interest rate implied by the difference between the 2 prices

Purchase price/ initial margin/ variation margin

Purchase price

amount to receive for the collateral

Initial margin

amount of collateral needed for lender

Variation margin

change in MV of collateral leads to more/less collateral

General collateral repo

collateral using specific security of general type of security

Any high-quality securities

Regular collateral

Specific security the lender wants

Main uses of repurchase agreements

Borrowers: Financial institutions use repos to finance securities holdings.

Lenders: Banks/investors use repos to earn short-term interest on extra cash.

Central banks: Use repos to control money supply (lend to ease, borrow to tighten).

Short sellers: Hedge funds use repos to borrow securities, sell short, and profit if prices fall.

Repo Risks and Mitigation

Default risk: Borrower fails to repurchase at the end.

Collateral risk: Value of collateral drops in case of default.

Margining risk: Incorrect or untimely margin calculations.

Legal risk: Issues with enforceability of contracts.

Netting & settlement risk: Problems with payment netting or settling cash and collateral.

Mitigation:

Tri-party repos (using a third-party intermediary like a custodian or clearinghouse) improve efficiency and collateral management but don't reduce credit risk.

Bilateral repos are directly between two parties, without a third party.

Public vs private accounting

Public sector accounting relies more on cash transactions and less on accruals (e.g., depreciation, unfunded liabilities) than private sector accounting.

When assessing government financial statements, an analyst should consider an "economic balance sheet" that includes:

Implied assets (e.g., expected future tax revenues)

Implied liabilities (e.g., promised future expenditures)

in addition to the reported financial assets and liabilities.

Analyst considerations forecasting government debt

The government's fiscal policy (e.g., tax cuts, spending increases to manage the business cycle)

The cyclicality and inflation sensitivity of revenues and spending

Debt features (e.g., floating rates, inflation indexing)

Any guarantees of non-sovereign debt

Nonsovereign Debt

Issued by states, provinces, counties, and entities created to fund and provide services

Agency/ quasi-government bonds

Issued by national governments ENTITY FOR SPECIFIC PURPOSES

infrastructure

mortgage

General Obligation bonds

Local and regional government authorities may issue debt for public

Revenue bonds

Debt for specific project

repayment from revenue of project

Supranational bond

Issued by international institutions (World Bank, IMF) to promote economic cooperation, trade or economic growth.

Auction debt workflow

Noncompetitive bids: Guaranteed allocation at the auction's final price.

Competitive bids: Set the price; ranked by highest price (lowest yield) first.

Cut-off yield: Yield of the lowest-price successful competitive bid.

Single-price auction: All pay the cut-off price.

Multiple-price auction: Winners pay the price they bid.

What are the roles of primary dealers in sovereign bond markets?

Primary dealers:

Submit competitive bids in government debt auctions

Submit bids on behalf of third parties

Act as counterparties to the central bank in open market operations (buying/selling securities)

How do noneconomic investors affect sovereign bond yields?

Noneconomic investors (e.g., central banks, foreign governments, regulated institutions):

Buy government bonds for purposes like monetary policy, reserves, or regulation compliance

Their demand lowers sovereign bond yields compared to non-sovereign issuers

Direct/ Indirect risk

Direct

Direct currency exposure of holding foreign denominated debt

Indirect

Risk exposure from default

Need to raise bond currency through international transactions

Types of day count methods

actual/actual convention

actual number of days between coupon payments and actual number of days between the last coupon date and the settlement date

government bonds

30/360 convention

assumes each month has 30 days and year has 360 days

corporate bonds

Flat/Full Price

Flat/ Clean/ Quoted

bond’s quoted price

imagine the previous price at previous payment

Full/ Dirty/ Invoice

sum of its flat price and accrued interest

Flat = Full - accrued interest

Price and specific bond features

At a point in time, a decrease (increase) in a bond's YTM will increase (decrease) its price. That is, there is an inverse relationship between yield and price.

Other things equal, the price of a bond with a lower coupon rate is more sensitive to a change in yield than is the price of a bond with a higher coupon rate.

Other things equal, the price of a bond with a longer maturity is more sensitive to a change in yield than is the price of a bond with a shorter maturity.

The percentage decrease in value when the YTM increases by a given amount is smaller than the increase in value when the YTM decreases by the same amount (the price-yield relationship is convex).

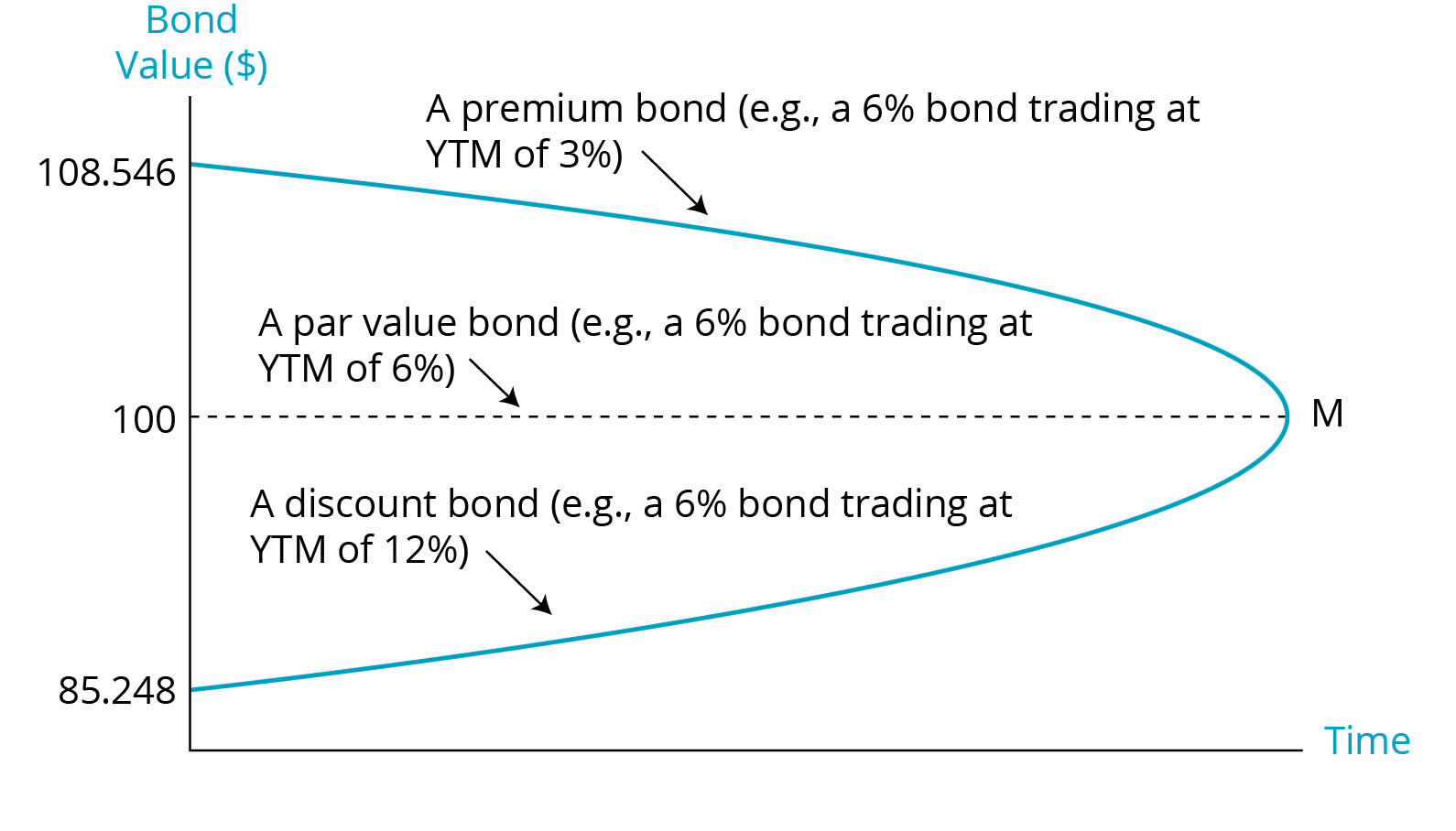

Constant-yield price trajectory

“Pull to par”

Matrix pricing

Estimating required YTM of bonds that are currently not traded, or infrequently

Periodicity

Number of bond coupon payments per year

Street convention/ True Yield

Street convention

Bond yields calculated using the stated coupon payment dates

True Yield

Yield calculated using the actual coupon payment dates

payments can be paid later due to weekends or holidays

True Yield are usually slightly lower

Current Yield/ Income Yield/ Running Yield

Looks at bond’s annual interest income

does not consider capital gains or losses or reinvestment income

Yield to Call/ Yield to Worse

Yield up to the callable date for callable bonds

Yield to Call

Yield up to a call date

Yield to Worse

Lowest yield of the Yield to Calls

Option Adjusted Price/Yield

Straight bond = Callable bond value + call option

Straight bond price can reflect option adjusted yield

useful to compare the yields of bonds with various embedded options

G-Spread

Yield spread in bp over a government bond

Interpolated spreads (I-spread)

Extra return of a bond in excess of the interbank market reference rates (MRRs) used in swap contracts

Quoted/ Required/ Discount Margin/ Deficiency

Quoted Margin

fixed margin above MRR in coupon

Quoting FRNs

Required/Discount

margin required to price FRN at par

Valuing FRNs

Deficient

Bond traded at discount DM > QM

Reset Frequency FRNs

Allows price of bonds to adjust more object thus more fluctuations

Add-on-Yield/ Discount Yield

Add-on-Yield

Annualized interest over period

Discount Yield

Annualized discount from par

Bond-Yield Equivalent

Add-On Yield in 365 day term

Par Yields

Reflect the coupon rate that a HYPOTHETICAL bond at each maturity would need to have to be priced at par, given a specific spot curve.

What period bond basis are yield curves quoted as?

Semiannual

US treasury bonds pay semiannually

Taxation/Illiquidity

Can cause distortions from realistic intrinsic price

Par yield curves vs Spot curves vs Forward Curves

Par yield curves are less reactive/slower than spot

Spot curves are less reactive/slower than forward curves

Curve Type | Based On | Main Use | Typical Behavior |

|---|---|---|---|

Spot Curve | Zero-coupon (spot) rates | Pricing, discounting | Smooth; lags forward curve |

Par Curve | YTMs of par-priced bonds | Yield benchmarks | Close to spot; slightly below/above |

Forward Curve | Implied future short-term rates | Rate forecasting | Most volatile; leads spot curve |

Yield Curve | YTMs of coupon bonds | General interest rate reference | Varies; depends on bond data |

Yield volatility

relationship between yield volatility and time to maturity

Which curves with an arbitrageur use?

Spot curve

SPECIFIC discount rates for each individual cash flow

Macaulay Duration

average time it takes for you to get your money back (from a bond) in present value terms.

Bond Return Scenarios – YTM, Reinvestment, and Holding Periods

Hold to maturity, YTM unchanged:

✅ Return = Original YTM (e.g., 5%)Sell before maturity, YTM unchanged:

✅ Return = Original YTMHold to maturity, reinvestment rate increases:

✅ Return > Original YTM (e.g., 5.09%)Sell shortly after purchase, YTM increases:

❌ Return < Original YTM (e.g., 3.07%)Hold long-term, reinvestment rate decreases:

❌ Return < Original YTM (e.g., 4.96%)

Duration Gap

Duration Gap = Macaulay Duration – Investment Horizon

It tells investors how aligned your bond’s cash flows are with when you actually need the money.

Situation | Duration Gap | Main Risk | Explanation |

|---|---|---|---|

Duration > Horizon | Positive duration gap | Price Risk | You might sell early, and price drops will hurt you more. |

Duration < Horizon | Negative duration gap | Reinvestment Risk | Coupons come early, but you may have to reinvest at lower rates later. |

Duration = Horizon | Zero duration gap | Balanced / Immunized | Price and reinvestment effects cancel out. Stable return. |

Modified Duration

ModDur = MacDur/ (1 + YTM)

Estimate for the % change in a bond’s price given 1% change in YTM

ModDur = 3.5 → if +0.5%, then price decrease ~1.75%

Money Duration

Estimate $ change given change in interest rates

Price Value of a Basis Point (PVBP)

Money change in the full price of a bond when its YTM changes by one bp

Longer Maturity: Factors and its effect on duration/ interest rate risk

Usually increases duration and risk (but not always for discount bonds_

Time Passes: Factors and its effect on duration/ interest rate risk

Duration decreases gradually, jumps up slight at coupon dates

Higher coupon: Factors and its effect on duration/ interest rate risk

Decrease duration and risk

ZCB

Highest duration for given maturity and YTM

Floating-rate note (FRN): Factors and its effect on duration/ interest rate risk

Low price risk; duration ~~ time to next reset

Higher YTM: Factors and its effect on duration/ interest rate risk

Decreases duration (flatter price-yield curve)

Limitation of portfolio duration and convexity to estimate value changes?

Assumes parallel shift in yield curve — the YTM of every bond in the portfolio changes by the same amount

Key Rate/ Partial Duration

Impact of nonparallel shift measurement

Sensitivity of the value of bond or portfolio to changes in the benchmark yield for a specific maturity, holding other yields constant.

Sum of all key durations = effective duration

Shaping Risk

Effect of a nonparallel shift in the yield curve on a bond portfolio

using KDRs

Bottom-Up Credit Analysis Factors

Capacity. The borrower's ability to make their debt payments on time.

Capital. Other resources available to the borrower that reduce reliance on debt.

Collateral. The value of assets pledged to provide the lender with security in the event of default.

Covenants. The legal terms and conditions the borrowers and lenders agree to as part of a bond issue.

Character. The borrower's integrity (e.g., management for a corporate bond) and their commitment to make payments under their debt obligations.

Top-Down Credit Analysis

Conditions. The general economic environment that affects all borrowers' ability to make payments on their debt.

Country. The geopolitical environment, legal system, and political system that apply to the debt.

Currency. Foreign exchange fluctuations and their impact on a borrower's ability to service foreign-denominated debt.

Illiquid or Insolvent

Illiquid

Unable to raise cash to service debt

Insolvent

Assets of an issuer fall below the value of its debt

Recovery Rate/ Loss Severity

Recovery Rate

proportion of a claim an investor will recover if the issuer defaults

Loss Severity

Unrecoverable proportion