P1 SEC D - Cost Management

1/40

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

41 Terms

Fixed Costs

Stay constant within the relevant range; per-unit cost decreases as volume increases. Ex. Rent

Variable Costs

Change proportionally with activity; per-unit cost remains constant. Ex. Sales commissions

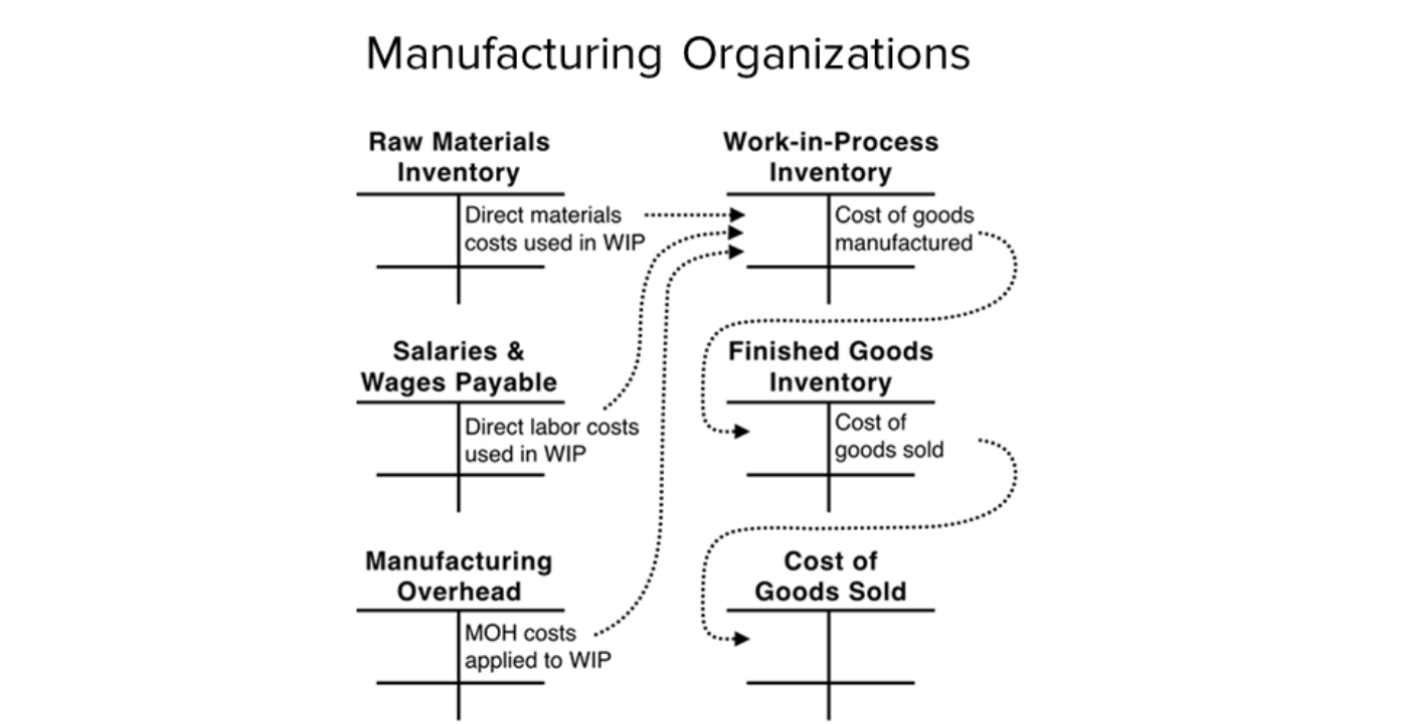

Manufacturing organization - Cost flow

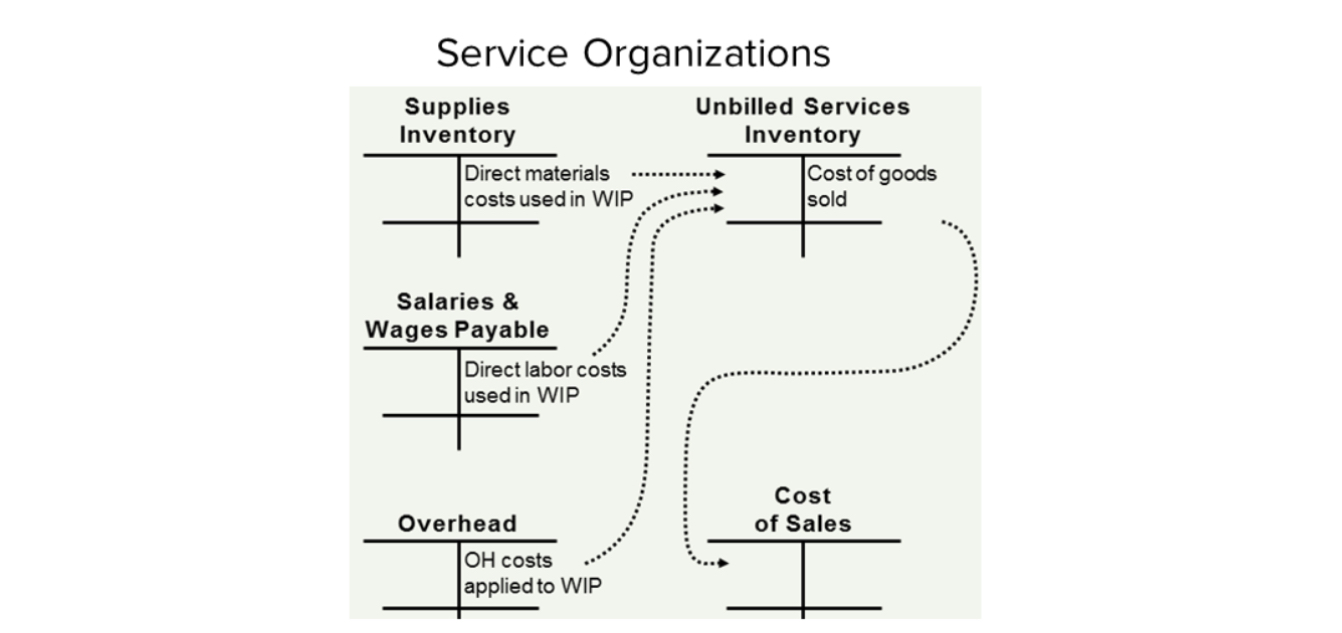

Service organization - Cost flow

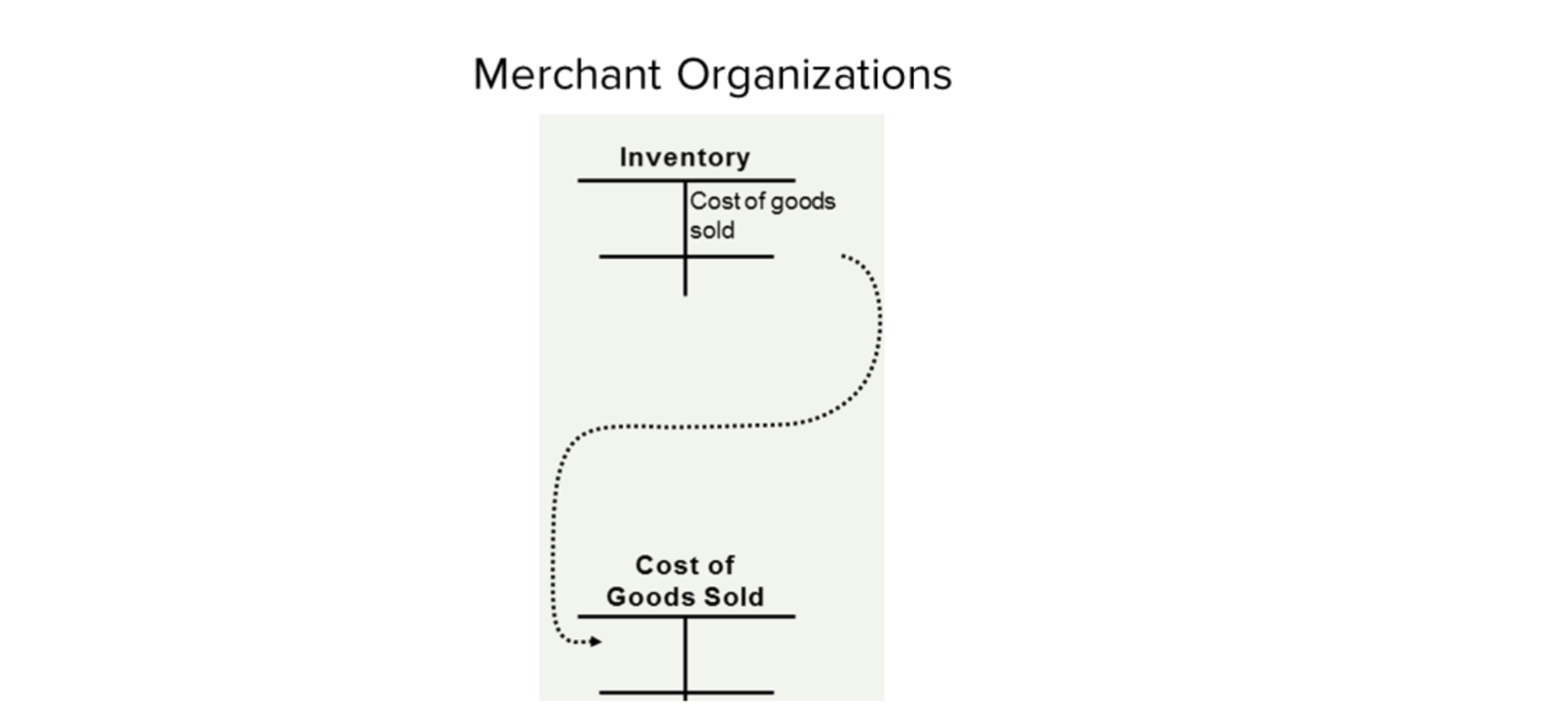

Merchant organization - Cost flow

Cost driver rate

Step 1:

Cost Pool Total / Cost Driver Volume

Assigned cost

Step 2:

Cost Driver Rate x Cost Object Activity

Mixed Costs

Contain both fixed and variable components; total cost = fixed + variable portion. Ex. Utilities

Many costs in organizations are not strictly variable or fixed but exhibit both variable and fixed characteristics. For most decisions, these costs need to be split out into a variable cost component and a fixed cost component. It's usually not possible to precisely split them into its variable cost and fixed cost components. The methods used to split out these costs provide at best an approximation.

Relevant Range

Period or range of activity over which cost behavior assumptions hold.

Cost Object

Any item requiring cost measurement (product, project, service, activity).

Cost Pool

Aggregates all costs for a specific activity; simplifies allocation to cost objects.

Cost Assignment Methods

Job-order costing, process costing, standard costing.

Cost Drivers

Factors that cause costs to be incurred. Tracks variable costs directly to cost object. Assigns fixed costs when no direct relationship exists.

Product Costs

Direct materials, direct labor, manufacturing overhead; capitalized in inventory.

Period Costs

Expensed as incurred; includes admin, selling, marketing costs.

Variable cost per unit

Cost behavior: Constant

Fixed cost per unit

Cost behavior: decreases as activity rises

Actual Costing

Uses actual DM, DL, OH; accurate but time-consuming; requires end-of-period calculation.

Normal Costing

Actual DM & DL; overhead applied using predetermined rate = Budgeted OH ÷ Estimated driver × Actual driver

Standard Costing

Applies predetermined rates for DM, DL, OH; highlights variances; reduces reliance on past inefficiencies; compares actual vs. standard costs.

Variable Costing

Only DM, DL, VMOH in inventory; FMOH expensed. Allows contribution margin analysis. Provides clearer insight into cost-volume-profit relationships → better for internal decision-making.

When units produced are less than units sold, Income is higher.

Absorption Costing

DM, DL, VMOH, FMOH are included in inventory; required for external reporting; can incentivize overproduction to boost reported income (inventory absorbs more fixed costs).

Inventory ↑ (produced > sold):

Inventory on balance sheet ↑

COGS ↓ (fewer fixed costs expensed)

Operating income ↑

Treatment of Fixed Manufacturing Costs

The only difference in variable and absorption costing.

Absorption Costing: They are included in inventory → only the portion of fixed costs for units sold hits COGS.

Variable Costing: They are expensed in the period incurred → included in operating expenses.

Joint Products

Products that share a portion of the production process and have relatively the same sales value.

By-Products

Products that share the same production process with a product or joint product but have relatively minor value in comparison to the main product.

Joint Costs

Costs incurred before split-off point.

Split-Off Point

The point at which products diverge and become separately identifiable.

Additional processing costs (separable costs)

Any costs that can be specifically identified with a product because the cost occurs after the split-off point.

Physical Measure Method

Uses a physical measurement to allocate joint costs to joint products (weight, number, and volume). Simple but may distort profit margins.

Sales value at split-off method

Allocates joint costs to joint products using their proportional sales value at the split-off point. This is the most widely used method because it is simple to calculate and allocates costs according to value.

Constant gross profit (gross margin) method

Allocates joint costs so as to provide the same gross margin percentage of profit for each joint product. An advantage for companies that wish to keep the same margin for each product, but it could lead to a distortion in the fairness of how costs are allocated.

Net realizable value method

Allocates joint costs according to the final sales value less additional processing costs. Used when the market price for one or more of the joint products cannot be determined at the split-off point, usually because additional processing is needed. The benefit of this method is it takes into account additional processing costs.

Sales of by-products

No joint cost allocation. Recorded either as separate by-product revenues or by offsetting the joint product costs that are allocated to the main products.

Cost pools

They are connected to cost objects based on cost drivers that are used to institute cost driver rates.

Work-in-process inventory account

Cost accounting systems flow the three product costs (DM, DL, MOH) to cost objects in the __________. In service org, it is described as the open invoice" or "unbilled services" account on the balance sheet. Represents the production area and it functions as an inventory asset.

Finished goods inventory account

When a product is completed, it flows out of the work-in-process inventory account into the ________.

Cost of goods sold account

When a product is sold, it flows out of the finished goods inventory account (and off of balance sheet) into the __________ in the income statement. At this point, the cost transforms from an asset (an unexpired cost) to an expense (an expired cost).

Consumption relationship

If the cost is variable with respect to the cost object, the cost driver represents a __________, which is to say the cost driver is how the cost object consumes the resources for which the cost pool is being spent.

Allocation method

If the cost is fixed with respect to the cost object, then the cost driver represents an ________ that is used to assign a burden of costs to a cost object.

Revenue objects

Cost objects are tied to the organization's income statement and can also represent the ____________ (i.e., what creates revenue) for the organization.

Complications in determining fixed, variable, and mixed costs

The distinction of cost behavior as variable or fixed is based on the cost object.

Fixed costs can shift in total as the organization moves between significant cost structures.

In very short horizons most costs are fixed. In contrast, over very long horizons most costs are variable.