ECON 3330 Test 3

1/54

Earn XP

Description and Tags

Bowes

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

55 Terms

With direct finance, high transaction costs occur mainly because

Savers and borrowers have to take the time and effort to find each other

The asymmetric information issue between savers to borrowers

Means that borrowers have better information than savers

If Dave buys stock from Carnival Cruise Lines Company, which uses the funds to build new cruise ships, then in macroeconomic terms

Carnival is investing (I), and Dave is saving

In one year you will receive a $100 bill. If the interest rate today rises from 5% times 10%, the $100 bill. You will receive one year from now becomes worth

less today (lower present value)

Based on the BOnd Market model, interst rates will rise during an economic expansion because

The supply of bonds increases more than the demand for bonds

Which has NOT been observed about interest rates?

Longer maturity interest rates are always higher than shorter maturity rates

During a recession

Firms have fewer investment opportunities, so the supply of bonds decreases

Today’s interest rate for an Aaa-rated bond is 4.35%, while a Baa rated of the same maturity pays a rate of 5.03%. The difference in these two rates

occurs because the Aaa rated bond is less risky

Why was the Federal Reserve created?

To provide the nation with a more stable and flexible financial system

The Federal Reserve System is overseen by a governing board based in Washington, D.C. What is the official name of this board?

The Board of Governors

Who controls the Federal Reserve?

The Board of Governors, which acts as an independent government agency

What is the Fed’s primary Monetary policy-making body?

The Federal Open Market Committee (FOMC)

The Fed has a dual mandate. What are its two primary goals?

Achieve maximum employment and maintain price stability

Who owns Federal Reserve Banks?

They are privately held by their member commercial banks.

Which of the following is the most frequently used tool of U.S. monetary policy by the Fed?

Conducting Open Market Operations (buying and selling government securities)

If the Fed wants to slow down the economy and fight inflation, it will typically do what?

Raise the target range for the Federal Funds Rate

What is the term for the interest rate that commercial banks charge each other for overnight loans?

The Federal Funds Rate

What is one of the key services the Federal Reserve Banks provide to commercial banks?

Acting as a lender of last resort

If the Required Reserve Ratio= 20%, what is the Deposit Multiplier?

1/0.2= 5

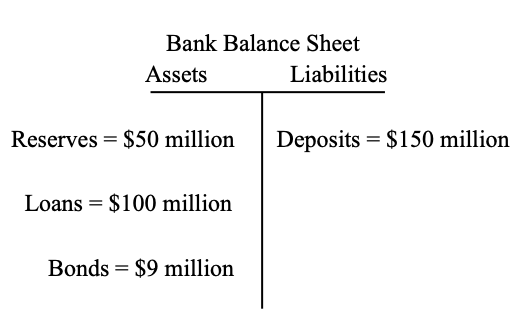

Given the bank balance sheet below, if the Required Reserve Ratio is 20%, calculate the amount of new loans that the bank can create.

Max. Deposits= Reserves x Deposit Multiplier = $50M x 5 = $250M

New Loans= Max. Deposits – Current Deposits = 250M – 150M= 100M

If the required reserve ratio is 25%, and the Fed buys $2 million in bonds from a bank, what will be the change in the money supply?

Deposit Multiplier: 1 0.25=4

Change in Money Supply: $2M x 4 = $8M increase

Fed policy tools

Required Reserve Ratio

Open Market Operations

Discount Rate & Target Federal Funds Rate

How would the Fed use its policy tools to increase the Money Supply?

Reserve ratio: lower it

Open Market: buy securities

Discount/TFFR: lower them

How would the Fed use its policy tools to decrease the Money Supply?

Reserve ratio: raise it

Open Market: sell securities

Discount/TFFR: raise them

Primary goals of Monetary Policy

Economic Growth (reduce unemployment)

Price Stability (reduce inflation)

Why is it impossible to pursue both goals of monetary policy at the same time?

They have a negative relationship. The goals require policies that move in different directions (Phillips curve)

Expansionary policy

Increase money supply and growth in GDP

lowers borrowing costs & encourages Investment and Consumption, increcreases GDP, and creates growth in output and employment

Contractionary policy

Decreases the money supply and reduces inflation

intended to raise borrowing costs, discourage investment and consumption, slow down growth of GDP and reduce inflation

Reserve ratio determines the deposit multiplier

Multiplier is less effective when banks hold more excess reserves and/or people hold more currency

Ex. reserve ratio at 25% (multiplier= 4) If fed buys $2 Mil in securities, money supply increases by

$8 Million (4×2)

Open Market changes _______ and creates ______

Reserves; new loans

Change in reserve ratio

Changes multiplier

Ex, Change from 25% to 20%, multiplier goes from 4 to 5

Discount/Federal Funds rate change

Either encourages or discourages bank lending

Fed is responsible for Monetary Policy = changing the money supply

M1= currency in circulation + demand deposits

Fed does not directly control M1

The Fed controls the relationship between Bank Reserves and Demand Deposits

Fed Reserve Bank

Central bank for the U.S.

Created by the Federal Reserve Act in 1913

The Fed is responsible for

Bank supervision,

Monetary Policy,

Services to Banks and the Government

Fed Reserve Bank Structure and Organization

12 regional banks (decentralized & flexible)

Regional banks headed by Presidents chosen by private board

Governor (headed by chairperson) chosen by President of U.S. and Senate

Federal Open Market Committee

Policy making group

12 members (Board of Governors, President of NY Fed, 4 others)

Fed is independent

Controls their own budget & pays for their operations

Regional presidents chosen by private citizens

Governors chosen for 14-year terms, non-renewable or removable (not subject to political threats/favors

Good things about Fed’s independence

Avoid political business cycle,

able to focus on long term

those controlling money supply are different from those that spend money

Fed policy strictly economic (bankers and economists not lawyers)

Bad things about Fed’s independence

policy-makers are un-elected and unnaccountable

may pursue policies that benefir their own business (banking)

economic policy affects everyone

The Fed is not completely unaccountable

Congress can change laws and take over budget

Characteristics of a good central bank

Accountability

Transparency of policy decisions

Decisions by committee,

Independence,

Good policy framework

Fractional Reserve System

Banking system in US

Reserve ratio

Fraction of deposits set aside

How do banks create money?

By making loans which create new deposits

Only a fraction of each new deposit must be set aside as required reserves

That lending is repeated until all reserves are held as required reserves

Total amount of lending found by using

Using Deposit mulitiplier= 1/reserve ratio

Maximum total deposits

Total reserves x deposit multiplier

T/F: The independence of the Fed leaves it completely unaccountable for its actions

False, not completely. Congress can change/eliminate if necessary

Why was the Fed set up with Reserve banks rather than a single central bank?

To avoid too much central authority

Flexibility with regional issues

What is the difference between Monetary Policy and Fiscal Policy?

Monetary policy: implemented by a central bank, allows Fed to change the volume of money and credit and their priceinterest rates, and has a goal to influence inflation, employment, and output.

Fiscal policy: conducted by the national government, involves changes in taxes and government spending, and its goals are to influence economic activity through taxation and public budgets

Which type of policy, Fiscal or Monetary, takes effect more quickly?

The fiscal policy

Given that the Federal Open Market Committee meets and makes a policy decision in 2 days, which policy is most likely implemented more quickly

The Monetary policy