Chapter 16 + Unsafe havens: Exchange Rate Regimes and Gold Market Dynamics

1/49

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

50 Terms

What is a floating exchange rate?

A regime where a nation's currency price is determined by supply and demand in the foreign exchange market, not subject to government controls.

What are the advantages of floating exchange rates?

Simplicity, automatic stabilization, and reduced need for large foreign currency reserves.

What are the disadvantages of floating exchange rates?

Erratic fluctuations, potential reduction in trade and investment, and risk of fostering inflation.

What is a managed floating exchange rate system?

Fluctuates on the open market but allows central bank intervention to maintain a certain range.

What techniques do governments use to manage exchange rates?

Buying or selling local currency in the open market and adjusting interest rates.

What is a fixed exchange rate system?

A regime where a country's official exchange rate is tied to another currency or gold.

Which countries typically use fixed exchange rates?

Developing nations whose currencies are anchored to a key currency like the U.S. dollar or euro.

What is a soft peg?

A system where a currency is tied at a fixed rate to another currency but can fluctuate within narrow limits.

What is an example of a soft peg?

The Danish krone, which is tied to the euro within 2.25%.

Who established the four-way classification of exchange rate regimes?

The IMF, created by the Bretton Woods agreement.

What was the gold standard?

A fixed exchange rate system where currencies were defined in terms of a fixed quantity of gold.

What led to the demise of the gold standard?

Suspension during WWI and difficulties in maintaining fixed exchange rates post-war.

What was the Bretton Woods Agreement?

Aimed at preventing competitive devaluations and fostering economic growth from 1944 to 1971.

What type of exchange rate system did the Bretton Woods Agreement use?

A fixed exchange rate system where currencies were pegged to the U.S. dollar.

What factors led to the termination of the Bretton Woods Agreement?

Economic pressures and the inability to maintain fixed exchange rates.

What type of exchange rate system is used by eurozone countries?

Managed floating exchange rates.

How does the managed floating exchange rate system operate in the eurozone?

The euro's exchange rate fluctuates in response to market forces, but the European Central Bank can intervene using foreign exchange reserves.

How did George Soros 'break' the Bank of England in the early 1990s?

Soros borrowed billions of pounds to short the pound, predicting its depreciation, which led to a crash after the Bank of England's unsustainable interventions.

What is currency manipulation?

A policy by governments to artificially lower their currency's value to reduce export costs and gain competitive advantage.

How do countries manipulate their currency?

By selling their own currency and buying foreign currency, making their currency cheaper.

What is the motivation behind currency manipulation?

To make exports cheaper and imports more expensive.

Who is Lawrence Summers?

A well-known economist, former Treasury Secretary, and President of Harvard.

Why has Lawrence Summers been in the news recently?

He resigned from his positions after asking Jeffrey Epstein for advice on an extramarital affair.

What is dollarization?

The adoption of U.S. dollars as a domestic currency by foreign countries.

Which countries have dollarized their economies?

Panama, Cambodia, and Argentina.

What are the advantages of dollarization?

Avoiding hyperinflation.

What is a disadvantage of dollarization?

Loss of independent monetary policy.

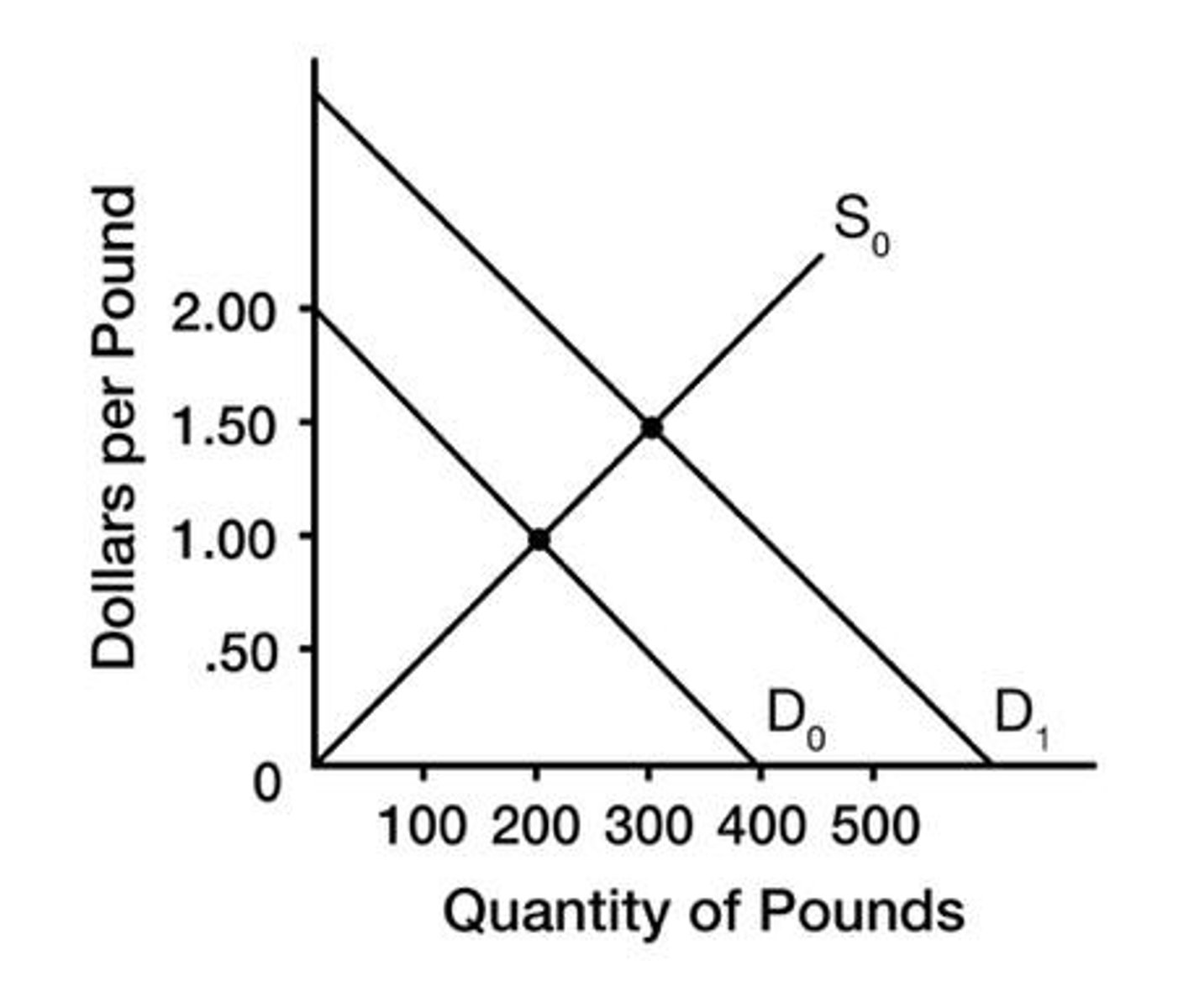

What happens to the exchange rate for the franc if it is flexible at $1.50?

The exchange rate will be $1.50 per franc.

How many francs will be purchased in the market at $1.50?

300 francs.

What will be the dollar cost of purchasing 300 francs at $1.50?

$450.

If the U.S. government wishes to peg the price of the franc at $2, how many francs must it buy?

200 francs.

What is the total dollar cost for ******* the franc at $2?

$400.

What is the equilibrium exchange rate for the pound with flexible rates?

$1 per pound.

What is the equilibrium quantity of the pound with flexible rates?

200 pounds.

If the demand for the pound increases, what happens to the dollar against the pound?

The dollar will depreciate against the pound.

What happens to the exchange rate if the demand curve for the pound increases?

It will increase to $1.50 per pound.

What can the U.S. government do to keep the exchange rate at $1 per pound if demand increases?

Increase the supply of pounds or decrease the demand for pounds.

What is the exchange rate for the pound if the demand curve shifts from D0 to D1?

$1.50 per pound.

When did the price of gold peak?

$4,380 per ounce on October 20, 2025.

What has happened to the price of gold since its peak?

It has dropped to about $4,100 and is back up to about $4,200 on Nov. 27.

Why might institutions want gold?

They look for a good store of value.

When has gold performed particularly well?

During the dotcom bubble (2000), subprime mortgage crisis (2008), and Covid (2020).

Does the author explain why institutional investors demand gold now?

No, he states we are not going through a crisis.

Why might central banks want gold?

They might be swapping dollar-denominated assets for gold due to concerns about the Fed's independence.

Does the author support the explanation for central banks wanting gold?

No, he argues that swapping would depreciate the dollar and raise interest rates, which is not observed.

Why is the gold's share in reserves rising?

The value of gold is increasing faster than other components of central bank reserves.

What is a long position in gold futures?

If you own something, you have a long position; in gold futures, it means you are obliged to buy gold in the future.

Why might speculators want gold?

They believe the price will rise, so they buy it now or at a guaranteed price in the future.

How does the article explain the recent gold price run-up?

Central banks may have pushed the price up early in the year, but speculators have moderated their purchases since then.

What has been the behavior of hedge funds regarding gold recently?

Hedge funds have sold gold on net.