Chapter 10 : Flexible Budgets and Performance Evaluation

1/26

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

27 Terms

Companies can ‘decentralize’ or split their operations into different operating segments. Typically they decentralize based on :

• Geographic Lines

• Product Lines

• Responsibility Center

Responsibility Center - Cost Center

Manager is responsible for controlling costs.

• Actual costs are compared to budgeted costs using performance reports.

Responsibility Center - Revenue Center

Manager is responsible for generating revenue.

• Actual revenues are compared to budgeted revenues using performance reports

Responsibility Center - Profit Center

Manager is responsible for generating revenue AND controlling costs.

• Actual revenues, expenses, and profits compared to budgeted revenues, expenses, and profits using performance reports and segmented income statements

Responsibility Center - Investment Center

• Can use performance reports and segmented income statements to assess revenues, costs, and profits.

• Determine if assets were used efficiently to generate profit using Return on Investment, and Residual Income

Static Budgets

prepared with a set activity level in mind

Flexible Budgets

• Represents the budget the managers would have prepared had they anticipated the exact sales volume for the period.

• This provides better insight, giving us an “apples to apples” comparison between budget and actual.

• Flexible Budgets are used in the planning phase to plan for “best case” and “worst case” scenarios

For flexible budget, the cost formula DOES NOT CHANGE. What does?

JUST THE SALES VOLUME

A performace report compares actual revenues and expenses against budgeted revenues and expenses to calculate ___

a variance ; a variance is the difference

Using a flexible budget we can calculate the following three differences :

• Master Budget Variance

• Comparison of the Master Budget (Static Budget) against actual results.

• “Apples to Oranges” comparison due to difference in sales volume (X).

• Can be broken down into two additional variances.

• Flexible Budget Variance

• Volume Variance

Flexible Budget Variance

• This is the most meaningful of our variances

• We “flex” our budgeted volume to match actual volume

• This shows us the variance due to changes in prices or costs, not units sold.

• We are given an “apples to apples” comparison

Volume Variance

• Results solely from the difference in budgeted and actual volume.

• This variance is normal and typically doesn’t result in any surprises.

• Fixed costs will NEVER have a volume variance.

Breaking out the Master Budget variance into Flexible Budget Variance and Volume Variance isolate differences in

• Sales Volume

• Actual Operational Differences (sales price per unit, cost per unit, total fixed cos

Variances are labeled as Favorable or Unfavorable. How are they categorized?

On how it impacts operating income.

Variance is favorable is operating income > budget

Variance is unfavorable is operating income < budget

Materiality Threshold

Variances are analyzed by management to determine if they really matter.

• Material vs. Immaterial

• This helps management focus on what is most important to the business.

• An acceptable range of outcomes is established (calculated by management).

• If a variance falls within/below the materiality threshold

• It is immaterial and doesn’t require explanation.

• If a variance falls outside/above the materiality threshold

• It is material and does require explanation

Performance Reports are prepared to easily see variances between

• Master Budget

• Flexible Budget

• Actual Results

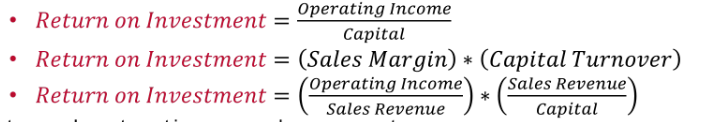

Return on Investment

Measures the amount of income an investment center earns relative to the size of its assets.

• Used to determine how to invest excess funds

• Used to compare a division’s performance across period

ROI is calculated in a couple of ways.

Return on Investment is expressed as a

percentage

Sales Margin is expressed as

a percentage

Capital Turnover is expressed as

a ratio

Residual Income determines whether

the division has created excess income beyond the expectations of management.

this helps align goals across all investment centers because it factors in the expectations of management

expectations of management are seen in the target rate of return specified by the company

Calculation of Residual Income

RI = Op. Income - Target Rate * Total Assets

Target Rate of Return can also be called

Hurdle Rate

Minimum Acceptable Rate of Return

Cost of Capital

Total Assets can also be called

Total Capital

Total Investment

If RI is positive, the proposed project yields

a greater ROI than required by management - TAKE THE PROJECT!

If RI is negative, the proposed project yields

a lesser ROI than required by management - DON’T TAKE THE PROJECT!!!