Theme 2 - full textbook notes (b)

1/142

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

143 Terms

Gross Domestic Product (GDP)

GDP is the total market value of the goods and services produced in a country in a year.

It does not include earnings by its residents while outside the country.

Actual economic growth

An increase in real incomes or real gross domestic product (RGDP)

Potential ecomonic growth

An increase in the productive capacity in a country.

This could be caused by an increase in the labour supply, investment, or productivity.

What’s the difference between real and nominal values?

Real values have been adjusted to remove the effects of inflation, whereas nominal values are the current incomes that are unadjusted for changes in average prices.

What is Gross National Income (GNI)

GNI is GDP plus net income paid into the country by other countries

How is ‘net income’ calculated for GNI

profits and income earned overseas from locally owned firms minus profits and income that goes abroad from foreign-owned companies

What are Purchasing Power Parities (PPPs)

PPPs are when values are expressed in accordance with the amount that the currency will buy in the local economy

What are some limitations of using GDP to compare living standards between countries/over time?

Subsistence, barter, and the hidden economy.

If farmers consume their own output

If goods are traded without price (e.g. barter)

goods paid for without being declared for tax purposes

The informal economy

Some output is not recorded as its not bought or sold

Currency values

When comparing countries, it is difficult to know whether to use the official value of a currency (the exchange rate), or the purchasing power of that currency

Income distribution

Size of the public sector

Consumer and capital spending

Spending on investment goods might mean standard of living increases in the future, but at the expense of living standards today

What is the Easterlin paradox

The idea that happiness rises with average incomes, but only up to a point

What is the public sector

The public sector is the part of the economy controlled by the government

What is inflation

Inflation is a sustained rise in the general price level over a period of time

What is deflation

Deflation is a fall in the general price level

What is disinflation

Disinflation occurs when prices rise more slowly than they have done in the past

What is the reason for using an index such as the Consumer Prices Index (CPI)

Percentage changes can be shown easily, making effective comparisons possible

Problems with deflation

Problem for people with debts

The real payments (adjusted for lower prices) will become larger

Stops any firm from wanting to invest in a country from abroad as the value of output is likely to fall relative to the initial costs

What are limitations of using the Consumer Price Index (CPI) as a measure of inflation

Does not include housing costs such as mortgage interest repayments or rent

Average mortgage payments costing 15-20% of income

CPI measures the cost of living only for an average household

Top 4% and bottom 4% income brackets not included, and neither are pensioners

Sampling problems - in 2017, less than 50% of households responded to the survey

The list of 650 items is changed once a year, but tastes and fashions change quicker than this

Does not take into account a change in the quality of goods - buying a more expensive phone this year might not be because of inflation but because of the higher quality of the new phone

Despite these limitations, CPI is the measure used to make international comparisons of the rate of inflation

What does CPIH stand for, and what is the main difference from CPI

CPIH - Consumer Price Index including owner-occupiers’ housing costs

The main difference from CPI is that CPIH includes changes in residential rents across the UK, and includes council tax in its calculations.

What is the Retail Price Index (RPI) and the limitations

It includes housing costs

Limitations:

Unreliable for international comparison as the statistical method of basing the data is unique to the UK

It includes the cost of mortgage interest repayments. These will rise when interest rates are raised, and any interest rate rise implemented to tackle inflation will have a one-off effect of making inflation appear worse, making policy-makers look incompetent

What are the two types of inflation

Demand-pull: rightward shift in the AD curve, caused by C,I,G,(X-M)

Cost-push: leftward shift in AS, caused by increased production costs such as rise in wages or fall in the exchange rate (more expensive raw material imports)

Effects of inflation on consumers

Real value of savings falls as prices rise

Purchasing power of those on fixed incomes falls as prices rise - e.g. pensioners will have their standard of living decline when there is more inflation

Those with high levels of debt benefit from inflation, as the real value of the debt falls

Effects of inflation on firms

Good:

Increased prices might mean firms can make more profits

A little inflation means that real wage differentials can be changed without actually cutting wages in nominal terms

Bad:

Loss of international competitiveness: Exports become relatively expensive and imports relatively cheap

Increased uncertainty: If firms think costs are rising and fear increases in interest rates, they might stop Investing

Investment from abroad might decrease: Inflation erodes the value of money = noones buying into a currency thats falling in value

Effects of inflation on the government

Inflation reduces the real interest rate, so cost of borrowing falls

A little inflation provides a cushion against the perils of deflation - when prices are falling, the economy can enter a vicious cycle of underinvestment and reduced spending

Undermines government income redistribution - people on fixed incomes will find their incomes fall in real terms while those with index-linked incomes won’t miss out.

Why does inflation disproportionately affect lower income groups?

Already buying the cheapest possible version of a good, so cannot cut costs

Usually spend most of income on necessities such as food and gas which are usually the most highly hit by inflation

Lack the ability to bulk buy or wait and save, so waste money

Effects of inflation on workers

Might mean that some workers expect higher wages but firms do not feel confident paying higher costs

Trade-off between wage inflation and unemployment: if there is high wage inflation, it is easier for people to find work because firms are raising wages only because they cannot choose other workers at lower wages

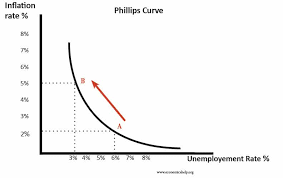

The short-run Phillips curve

What is the short-run Phillips curve?

Phillips curve shows the inverse relationship and the trade-off between unemployment and inflation, suggesting higher inflation can lead to lower unemployment.

What is the level of employment

The number of people in work

What is the employment rate

The number of people who have a job as a percentage of the working age population

What is the labour force

A measure of the people who are of working age and are willing and able to work

Define unemployment

A situation in which someone is willing and able to work, but is not currently employed

Who are the economically inactive

People without a job but who are not classed as unemployed because they have not been actively seeking work within the last 4 weeks and/or they are unable to start work within the next 2 weeks.

This includes students, early retirees, and very sick people.

How does the ILO measure unemployment

The International Labour Organisation uses the Labour Force Survey, which is now the official measure used in the UK

What is the Labour Force Survey?

A measure of unemployment calculated using surveys of those out of work in the last 4 weeks and ready to start in the next 2 weeks.

Made up of about 40,000 responding UK households and 100,000 individuals per quarter.

Yay:

The questions relate to anyone over 16 years old so is more inclusive]

Nay:

The survey data are 6 weeks out of date by the time they are published, which happens every month

What is the claimant count

A measure of unemployment using the number of claimants of JSA (Jobseeker’s Allowance)

Advantages/limitations of using the claimant count as a measure of unemployment

Yay:

Quick to obtain data

Cheap to obtain data

Useful measure of hardship - you are unlikely to claim JSA if you dont need the money between jobs

Nay:

Stigma attached to claiming benefits so some people may be eligible yet not claim

Stringent criteria: you can’t have resigned from your previous job within the last 6 months or refused 3 jobs that you have been offered

What is underemployment

A situation in which a worker is employed but wants to work more hours

What affects the rate of employment

The school or compulsory training leaving age - in the short term, people in education are not counted as economically active, but in the long term, school leavers become more employable

Number of school leavers entering higher or further education

Number of people who continue to work beyond the state requirement age

In the UK, number of people working over the age of 65 quadrupled between 2007 and 2017

Likely this will continue due to state pension being low relative to other developed economies

Level of net migration - most immigrants come to the UK to study but the second most common reason is related to work

Availability of jobs - more jobs likely to mean more employment

Level of taxes and benefits - high income taxes or high out-of-work benefits are a disincentive for people to work

What is the classical view of unemployment?

There are only unemployed people who are not able and willing to work at the going rate.

The best solution is ‘lassez faire’ - leave it to the market forces which will eventually ensure that the problem of unemployment will disappear.

If people accept lower wages, the cost of living will fall as firms do not need to charge such high prices, so workers will find the lower wages are acceptable once they start working. For this reason, it is called real wage unemployment or real wage inflexibility because wages have been forced above the market-clearing wage.

Define real wage unemployment

A measure of people who are unwilling to work at the going wage rate

What is the Keynsian view of unemployment?

That people can be unemployed even in the long run, because there is insufficient aggregate demand in the economy.

This is demand-deficient employment, in which if people spend too little and save too much, there will be less demand for goods and services which will result in fewer job opportunities

Define demand-deficient / cyclical unemployment

Caused by a lack of aggregate demand in an economy such as during a recession.

Reasons for demand-deficient unemployment:

Saving too much

A lack of business confidence

An increase in the value of a currency, making a country’s goods less internationally competitive

Slow rates of productivity growth relative to other countries

External shocks such as oil price rises for countries that are net oil-importers (oil is imported and demand is price-inelastic)

Increased consumption of imports from low wage economies

The economy is undergoing structural change and so different types of labour are required

Define structural unemployment

A measure of the workers who lose jobs in a declining industry and do not have the skills to work in other industries

The higher the level of skills in the labour force, the more flexible workers will be if there is a change in the requirements in the labour market

Define frictional unemployment

Referring to people who are unemployed between jobs or beginning the search for a job after entering the workforce

Define seasonal unemployment

Refers to people who are unemployed at certain times of the year

How can the implications of immigration for employment differ?

If immigrants come into a country to fill vacancies, employment rate rises.

If immigrants are looking for work and don’t find it or displace other people from work, employment rate may be stable or decrease

Costs of unemployment to consumers

Lower incomes mean living standards will fall

People out of work may become demoralised and their skill sets can quickly become obsolete

Effects of unemployment on firms

People spend less → lower prices → less profit

However, people may be more willing to stay in their jobs for fear of unemployment, so work harder and accept lower pay

Cost of unemployment to government

As unemployment rises, the government has to pay more in social benefits

Will recieve less in tax revenues, from income tax and expenditure taxes such as VAT

Cost of unemployment to society

Unemployed resources represent an opportunity cost

The economy could produce more without anything being given up = we could all have better standards of living

What is the balance of payments

A record of payments between one country and the rest of the world. It comprises the current, financial and capital account

What does the Current account do?

Records trade in goods, trade in services, investment income and current transfers

What is the balance of trade.

Part of the current account

The difference between the value of goods and services exported and the value of goods and services imported

What is investment income

Part of the current account

A measure of interest, profit and dividends that are rewards for capital investments in another country.

E.g.: A British company builds a factory in Poland, the investment does not appear on the current account, but any dividends appear as a positive figure on the UK current account

What are current transfers

The movement of funds for which there is no corresponding trade in goods and services

e.g. taxes paid to the EU, remittances

Define a current account surplus

Where inflows on the current account of the balance of payments are greater than outflows

What does the financial account do

It records money flows for investment purposes: Foreign Direct Investment (buying out assets and ownership of companies in other countries) and foreign portfolio investment (hot money) which is the speculative movement of money between countries as exchange rates and interest rates rise

What does the capital account do

Puts the other two accounts in balance by recording the changes in net assets in each country, as well as errors

What is the problem with a balance of payments deficit on the current account

Not a problem as long as it can be funded: can be a sign that living standards are rising

It becomes a problem when reserves of foreign currency start to run low

This may mean that the currency falls in value, which is inflationary (imports become more expensive)

Might be a sign that the country is becoming uncompetitive and costs are rising relative to trading partners, which can cause unemployment in the domestic economy

Higher taxes and cuts in government spending might solve the current account deficit but are likely to cause a slowdown in economic growth

What does international trade mean

That countries become interdependent, relying on each other both for income (through exports) and for resources and goods and services (through imports). This reliance means that economies are increasingly connected.

Define Aggregate Demand

The total planned expenditure on goods and services produced in an economy over a period of time

Define Aggregate Supply

The total planned output of goods and services in an economy over a period of time

Why is the AD curve downward-sloping?

Lower prices in an economy mean increased international competitiveness, so there are more exports and fewer imports. In other words, net exports are higher at lower prices

Total expenditure by the economy remains much the same along the AD curve

e.g. a fall in the price level → people spend the same amount but buy a larger amount of goods and services. This is called the real balance effect

At higher price levels, interest rates are likely to be raised by the monetary authorities. This means that investment - a component of AD - falls and savings increase

Define consumption

Spending by households on goods and services

What are some determinants of consumption?

The higher the income after tax (disposable income), the more people are likely to spend. However they might spend at a slower rate as they earn more

Consumer confidence, influenced by things such as job security and future income prsopects

Interest rates - higher = less spending money after mortgage payments but also less able to borrow money

The housing market: when house prices increase, home owners can extract more equity from their houses (wealth effect)

Define investment

Investment is an increase in the capital stock (the value of the total stock of capital inputs (shares in a company) in an economy)

What are the two types of investment?

Gross investment: The total amount of investment before any account is taken of depreciation of assets.

Net investment: Total investment minus the fall in value of capital assets. It is more significant for changes in the productivity of an economy and its productive potential. Capital loses value as it wears out or becomes less efficient

What factors influence investment?

Interest rates: an inverse relationship between investment and interest rates. This is because increases in the capital stock have to be financed and there is an opportunity cost to that finance

Profits of businesses - many businesses finance their investments from retained profits

Taxation - If the corp. tax rate is high, this might limit the funds which companies have available for investment

Government policy - if the gov is following a reflationary economic policy, for example by increasing government expenditure and cutting taxes, then this could stimulate investment

Low exchange rate = more competitive exports so increase in demand

Easiness of access to credit

Technological developments: firms will be more likely to invest if there is new technology that will improve productivity and reduce costs

Business confidence - e.g. economic growth - anything that determines future sales

Define animal spirits

The forces that make markets move in large booms and busts, as people buy and sell impulsively rather than calmly, using purely rational behaviour

What is the accelerator effect?

It suggests that an increase in demand or output in an economy will lead to a proportionately larger increase in investment.

E.g. if demand increases, firms have to invest in some way to increase output, and then might invest further to meet the expectations of what a future rise in demand will be

What is fiscal policy?

The deliberate manipulation of government spending and taxation in order to influence the level of AD in the economy.

What are the main influences on the net trade balance?

Changes in real incomes - if UK real incomes rise more rapidly than other countries, there is likely to be an increase in consumer expenditure and therefore imports relative to other countries

Changes in the exchange rate

Changes in the global economy - e.g. if Spain in a recession will import less from the UK

Degree of protectionism in country / country’s trade partners

Non-price factors e.g. quality of goods

Define Aggregate Supply

the total quantity of goods and services that all firms in an economy are willing and able to produce and sell at a given price level during a specific time period

What factors influence the SRAS?

Changes in costs of raw materials and energy - most developed countries import majority of raw materials

Changes in exchange rate - costs of imported goods for firms will fall if exchange rate strengthens

Changes in tax rates - higher taxes will increase costs for all firms

What is the classical view of the LRAS curve

In the long run, an economy will operate at full capacity and there will be no unemployed resources in the economy. If there are any unemployed resources, the prices of these factors will fall until the surplus dissapears.

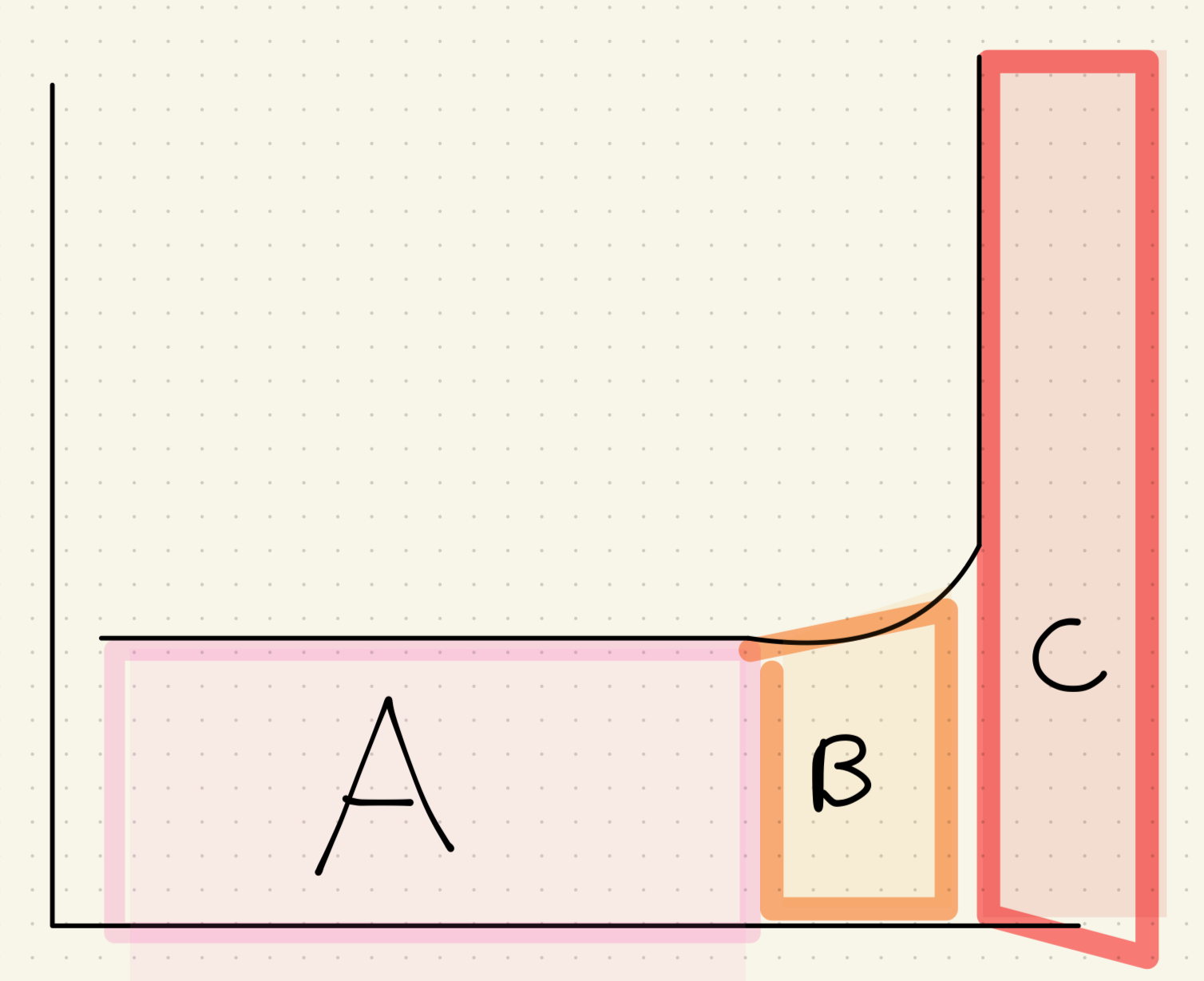

What is the Keynsian view of the LRAS curve

That the equillibrium level of output can occur below the full employment level of output.

The assumption is that an economy can be at equlibrium when it is not at full employment - so demand deficiency may mean that unemployed resources (e.g. labour) will not find work if the economy is left to its own devices

What occurs in each of the three sections of the Keynsian LRAS curve

Section A: There is spare capacity here.

The economy can increase output without any cost pressures

There are unused resources such as factories not working at full capacity

Here, AD might increase, and equilibrium real output would increase but the price level would stay the same

An example is Japan in the 1990s and 2000s, where there was much scope for increased production but unemployment persisted in the long run

Section B: The ‘bottlenecks’ section

Some constrictions in the supply chain cause cost and wage pressures to build up in some areas of the economy.

This usually involves a shortage of a particular type of labour which would cause a rise in wages

Example: The limited availability of construction workers associated with the HS2 rail link. If AD expands here, there will still be growth, but also some inflation

Section C: Full capacity

All resources are fully employed. If a firm wants to take on more workers it will have to offer higher wages to entice them away from other jobs. Here, if AD increases, there may be some extra spending in the short run, the long-term effect will be increased inflation and the same output

Define productivity

Output per unit of input

What factors influence the LRAS in the labour market?

Changes in relative productivity

Changes in education and skills - increased spending on education and training = higher value of potential output. HOWEVER not all education achieves this, e.g. BSc in Surf Science won’t have a major impact on costs of production in the UK

Demographic changes and migration - e.g. higher birth rates, life expectancy, migration = higher supply of labour

What factors influence the LRAS in the product market

Technological advances - e.g. buying a book is cheaper now with internet because fewer expensive retail outlets to maintain

Changes in government regulation - e.g. many regulations in the UK removed for postal and telecommunications service have been reduced over the past two decades to increase competition, so parcel postage and phone services (costs faced by all firms) have reduced in real terms

Competition policy and reduction in barriers to international trade - As a country opens up to more trade, competition drives down prices and inefficient domestic firms give way to overseas firms with a comparative advantage = AS shifts out

What causes shifts in the SRAS vs LRAS

Shifts in the SRAS occur because there is a change in costs of production, but the overall productive capacity remains unchanged

Changes in the quantity or quality of factors of production feed through into a shift in the LRAS curve

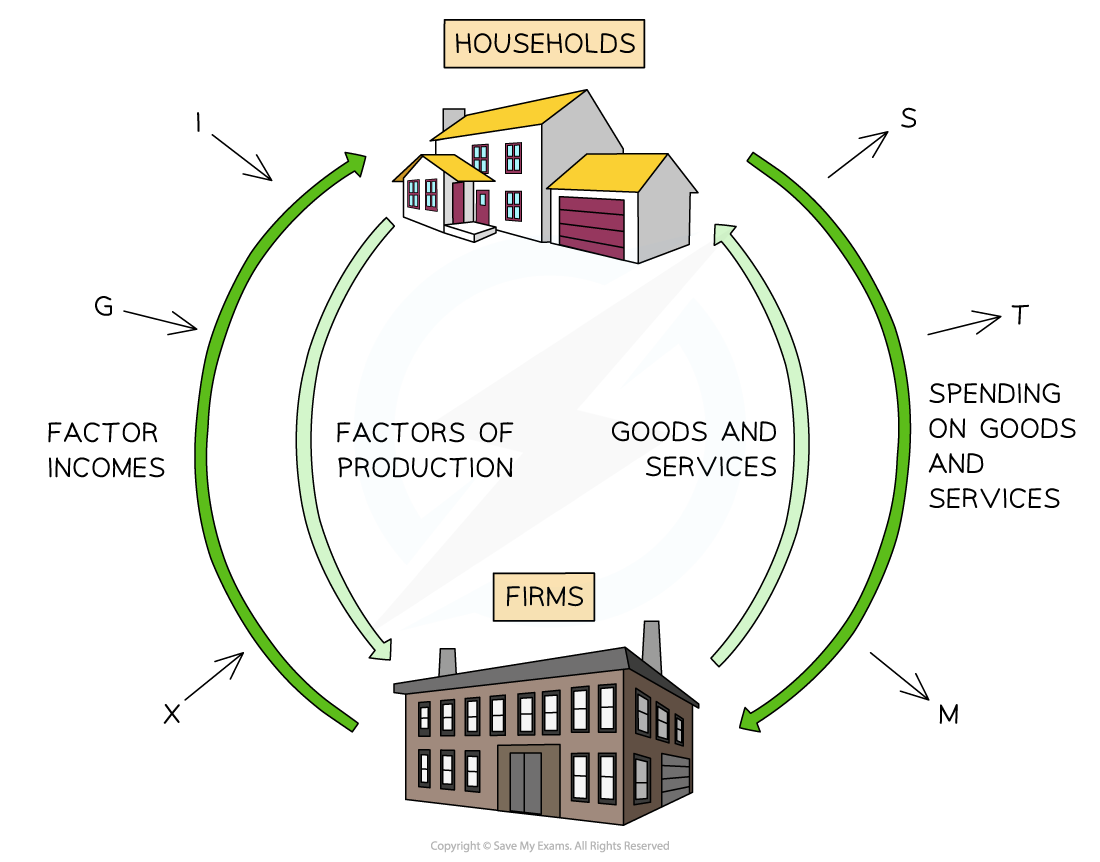

How does the circular flow of income look?

Stock v Flow concept

Stock concept - A quantity measured at a specific point in time, a ‘snapshot’

Flow concept - A variable measured over a period of time, representing activity/movement

Define wealth

The sum of all the assets in an economy. It is a stock concept.

Define income.

Refers to the amount of income earned during a period of time. It is a flow concept.

What is the wealth effect?

The effect on incomes or spending when asset values change

If you live in a property that increases in value, you might feel more confident about spending.

What are injections?

Flows into the circular flow of income, comprising: Investment, Government spending, Exports

What are withdrawals?

Flows out of the circular flow of income, comprising: Savings, Tax, Imports

What is an equlibrium point?

A balancing point where there is no tendency for the price level or real output to change

What is the multiplier ratio?

The ratio of a change in equilibrium real income (GDP) to the autonomous change (the injection) that brought it about.

It is the number of times a change in GDP exceeds the change in net injections that caused it

E.g. a multiplier of 3 means a $10 million injection into the economy will cause a $30 million increase in incomes in total

What is the most important factor in determing the size of the multiplier, and how is the multiplier calculated?

The size of the withdrawals from the circular flow: what proportion of the additional income is saved by households, which proportion is spent on imported goods, and what proportion is paid to the government in taxes.

So, the multiplier is inversely proportional to the marginal propensity to withdraw:

1

—-

MPW (MPS + MPT + MPM)

OR

1

——————

(1 - MPC)

What is MPW AND MPC

MPW: A measure of how much of any extra pound earned is saved, taxed, or spent on imports

MPC: A measure of how much of any extra pound earned is spent within the economy

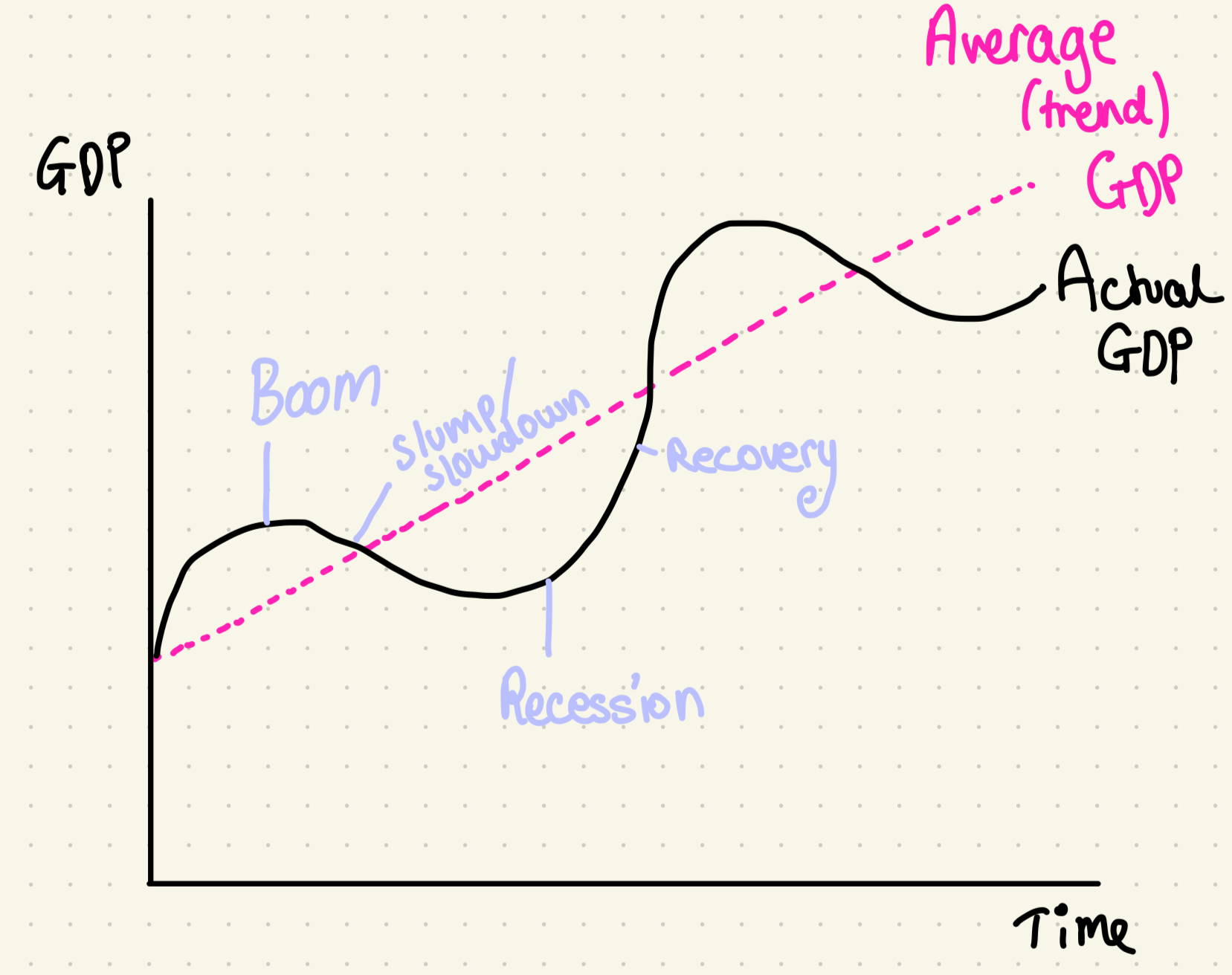

What is the distinction between actual and potential growth?

Actual economic growth: An increase in a country’s real GDP over time. Real GDP tends to fluctuate over the course of an economic cycle.

Potential economic growth: An increase in the productive capacity in the economy

What causes actual economic growth?

An increase in one of the components of AD: C, I, G, (X-M)

An increase in AS

However, on the keynsian LRAS, if AD increases on the vertical part of LRAS, no change in rGDP. If LRAS shifts out and AD is on the horizontal part, no change in rGDP.

What causes potential economic growth?

PEG only occurs when the vertical part of the AS curve shifts out

Discovery of new natural resources

Increased investment by the public or the private sector

Increased size of labour force - higher birth rates or higher immigration

Increased productivity - new technology or more highly skilled workforce

What is the problem with export-led growth?

Export-led growth is when the driver of growth is an increase in the export component in AD.

The exporters are vulnerable to changes in demand in other countries, or changes in exchange rates - both factors outside their control.

Example: China’s exports can often account for more than 50% of their AD. In the 2008 financial crisis China intervened to keep it’s currency from rising against other countries.

What are some constraints on economic growth

Labour market problems

As countries get richer, birth rates tend to fall, so long run labour supply falls.

Best way to fix this is allow a higher level of immigration

Cost of / ability to access credit

High interest rates = less consumption and investment = less growth

If banks are unwilling to lend money = subdued growth

Deficiencies in infrastructure

Poor energy, water, transport, communication networks will limit economic growth

E.g. frequently interrupted electricity will lead manufacturing output to be lower than potential output

External factors

Volatility in exchange rate markets = uncertainty

What is the output gap

The distinction between actual output and the trend/potential output.

An output gap means the counrty is not growing at the trend rate of economic growth or the potential output

Classical economists believe that output gaps do not exist in the long run, Keynsians believe a negative output gap can exist in the long run

What happens if there is a positive / negative output gap?

Positive: Pressures will grow in the economy, e.g. tight labour markets, wage pressures, and shortages of raw materials

Inflationary pressures likely to be evident

Negative: There is prob spare capacity in the economy, so there’s scope for a cut in interest rates

What can a negative output gap do to potential economic growth over time?

The non-use of resources (esp. labour) makes them less usable in the future so the productive potential of an economy tends to fall when there are high levels of long-term unemployment

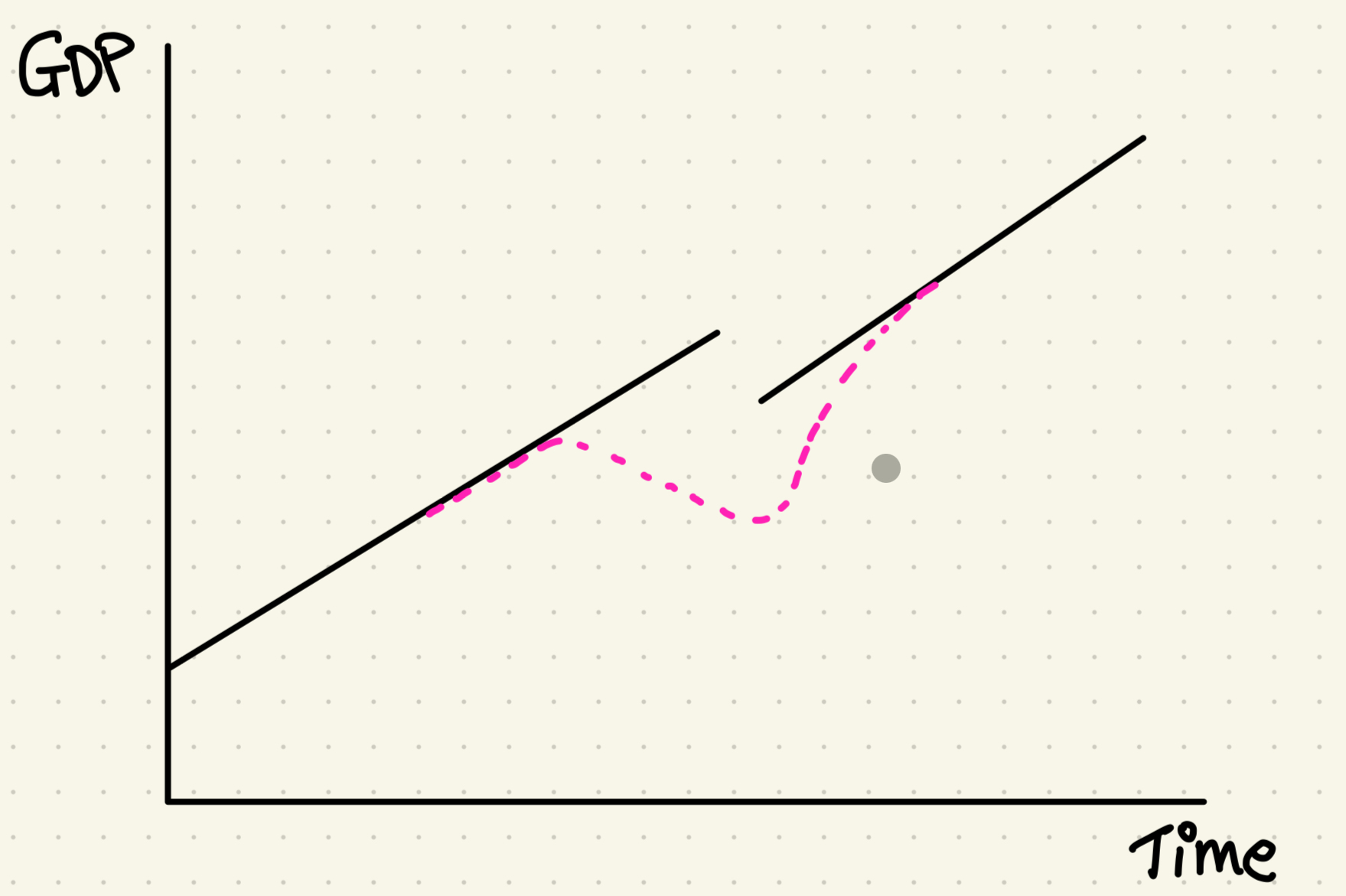

What is the trade cycle (/business cycle / economic cycle) on a diagram?