Chapter 2 AP Micro

1/26

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

27 Terms

economic systems

a particular set of institutional arrangements and a coordinating mechanism to respond to the economizing problem

differences of economic systems

who owns the factors of production (resources)

the method used to coordinate, motivate, and direct economic actively

Laissez-Faire Caplitalism

very limited government involvement

limited to: protecting private property and establishing a legal government (enforce contracts, market interactions)

proponents argue

government will be corrupter by special interest if it is involved in the economy: benefits special interests

government should only prevent people and firms from coercing one another; protection only; leads to mutually beneficial transactions

never been tried: every government has been more involved

Command System (Communism or Socialism)

government owns most resources

central economic plan set and enforced by the government

production goals, resource distribution, consumer vs. capital balance

not as prevalent anymore

market system (capitalism or mixed economy)

private sector: private ownership of resources, uses markets, businesses make individual decisions for their own benefit, participants act in their own self-interest, profit motivates innovation

government: economic initiatives (unemployment/inflation), rules for economic activity, provides goods and services, modifies income

private property

characteristic of the market system

private (non-governmental) ownership of resources

can do what they want with them

encourages cooperation (mutually agreeable transaction), investment, innovation, exchange, maintenance of property, economic growth

intellectual property (patents and copyrights)

freedom of enterprise and change

characteristic of the market system

enterprise: private sector can obtain and use resources to produce what they want and sell products as they want

choice: entities can use or dispose of resources and money as they want

can by anything you’re qualified to be

can spend on what you want

self-interest

characteristic of the market system

each country pursues its own goal

maximize profit

directs economy

competition

characteristic of the market system

2+ entities pursuing the same goal or resource

diffuses economic power: limits abuse of power

free to enter or leave market

markets and prices

characteristic of the market system

any mechanism that brings buyers and sells together

prices are determined by a combination of firms and consumers: dollar voting

technology and capital goods

characteristic of the market system

new innovations produce profit for the innovator

inspires new technology and capital: keep what you make

specialization

characteristic of the market system

use of resources to make a particular or a few things

exchange them for other goods/services

division of labor

uses different abilities: promotes efficiency

fosters learning by doing: develops skill and technique

saves time: no shifting from one task to another

geographic specialization: use particular land resources efficiently

use of money

characteristic of the market system

medium of exchange: buys what’s needed/wanted and simplifies trade: no bartering

can be anything agreed upon

active, but limited, government

characteristic of the market system

government is active but within prescribed limits

five fundamental questions

what will be produced?

whatever makes a profit: consumers ultimately decide →dollar voting, directs resources to successful products/industries

how will the goods and services by produced?

combination of resources that produces a lowest cost per unit: maximizes profit, promotes efficiency

who will get the output?

whoever is willing and able to pay: dependent on income and prices

how will the system accommodate change?

self-interest will direct firms towards profit: moves resource allocation, ultimately consumers decide

how will the systems promote progress?

desires: more output, higher standard of living

technological advance: creative destruction- new methods will wipe out companies that don’t change

capital accumulation: companies dollar vote for resources, including capital

dollar voting

consumers have full power to choose

consumer purchasing decisions act as "votes," determining which products and firms succeed or fail in a market economy

by buying specific goods, consumers signal demand, prompting firms to produce more of what is favored, thus dictating resource allocation and shaping corporate behavior

Adam Smith’s “The Wealth of Nations”

the individual self-interest of firms and resource provides will promote public welfare: new products, technologies, techniques

competition makes businesses responsive to consumers

efficiency: meets the wants of society, new was equals more profit

incentives: profit as a motivator

freedom: can do what you want

Demise of the Command Systems

why didn't they work

coordination problem: tried to make decisions for entities, too much or too little produced, failure to meet targets in one industries effects others, lack of variety

quality was success gauge: often at an economic loss, changed by how things were produced (weight vs. number)

incentive problem: meeting quota was all that mattered (shortages or surpluses), no reward for success/punishment for “failure”

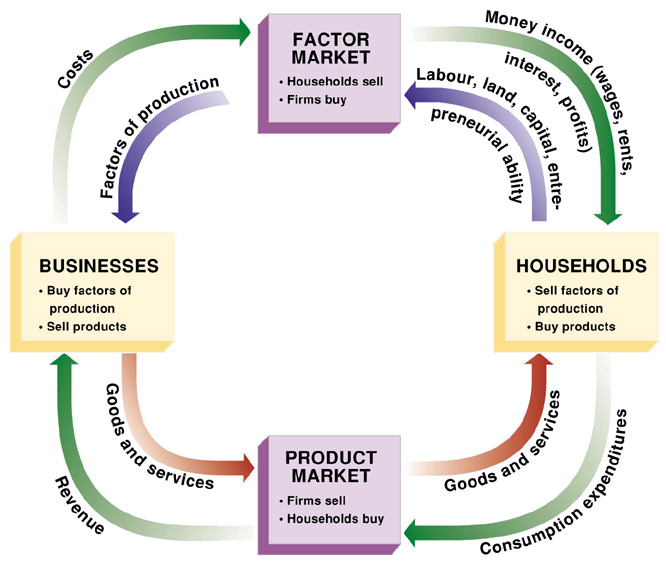

households

part of the circular flow model

one or more people occupying a unit of housing

buy goods and services

provide resources

businesses

part of circular flow model

buy resources

provide goods and services

sole proprietorship business

owned and operated by one person

+: decision making control

-: limited funding; unlimited liability

partnership business

two or more individuals own and operate business

+: increased funding; some specialization

-: still limited funding; unlimited liability; shared decision making

cooperation business

legal entity that can acquire resources, own assets, produce and sell products, incure debts, extend credit, sue and be sued

+: limited liability; funding

-: principle-agent problem

produce market

part of circular flow model

mechanisms selling goods and services

resource market

part of circular flow model

mechanisms selling land, labor, capital, and entrepreneurial skill

circular flow diagram

how the market deals with risk

profit system: the desire for profit and the fear of loss pushes people and firms to manage risk

shielding employees and suppliers from business risk: contracts with employees and other businesses must be honored (even if you’re operating at a loss)

dealing with losses: cannot choose if losses continue, don’t have to share profits

benefits of restricting businesses risk to owners:

attracting inputs- resource providers sell resources without worrying about profits

focusing attention- attention is paid to managing risk: avoid losses