ECON 3330 Test 2

1/69

Earn XP

Description and Tags

Bowes

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

70 Terms

Why do interest rates change over time?

Bond market, equilibrium changes due to a change in supply/demand

Interest rates are deteremined by

The demand for and supply of bonds

Interest rates increase in what direction?

Downward

Demand for bonds depends on…

Income (wealth)

Expected return

Liquidity

Risk

Expected inflation

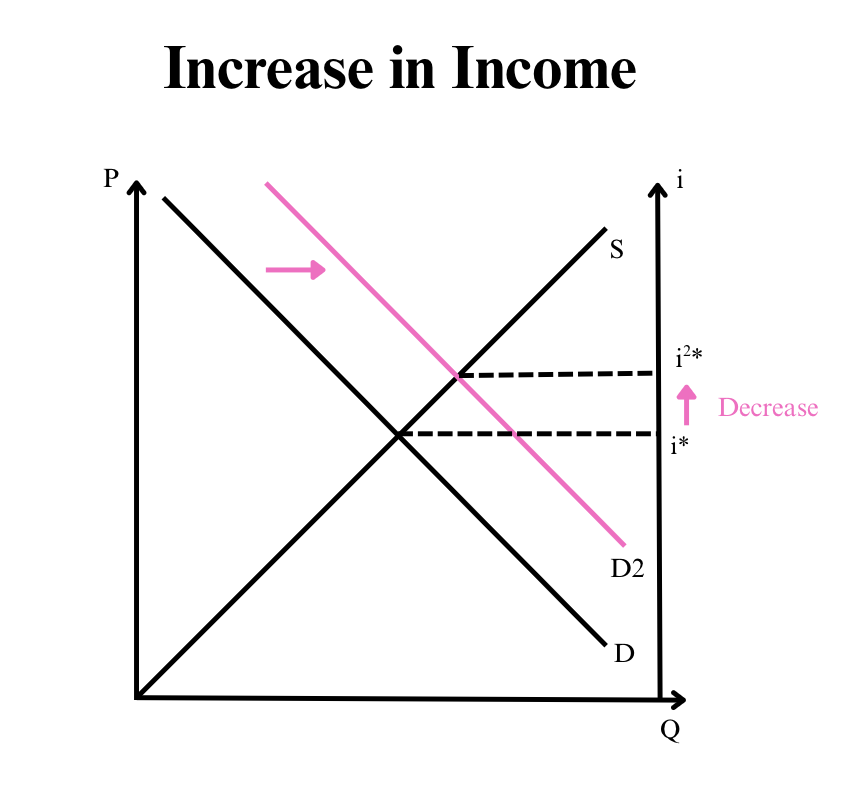

How does an increase in income affect demand?

Increase in income,

Increase in demand,

Decrease in interest rate

(positive relation)

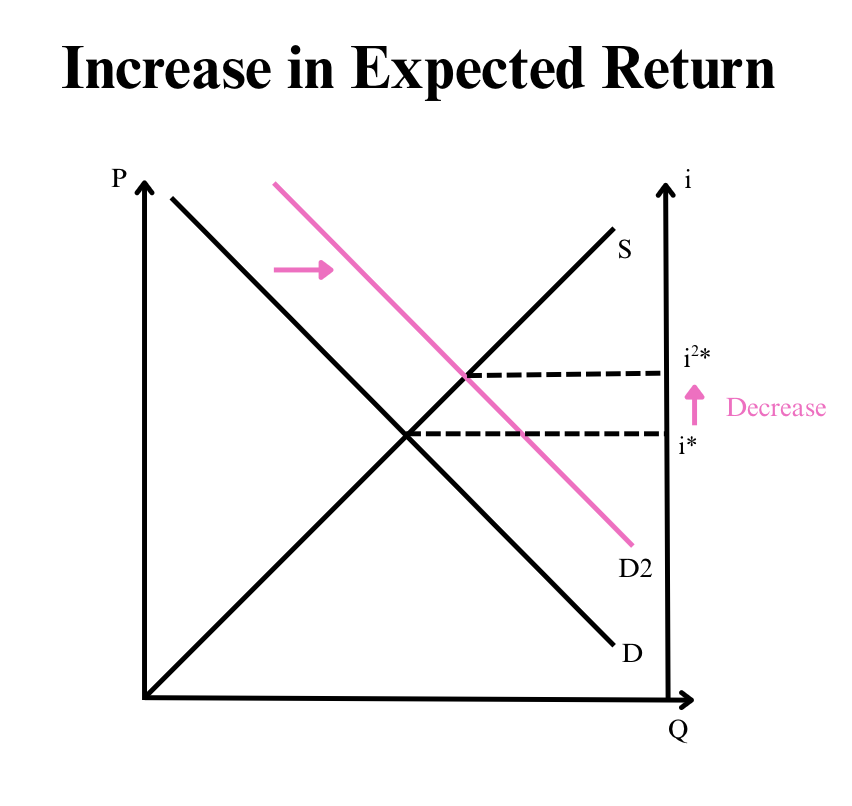

How does an increase in expected return on bonds affect demand?

Increase in expected return,

Increase in demand,

Decrease in interest rate

(positive relation)

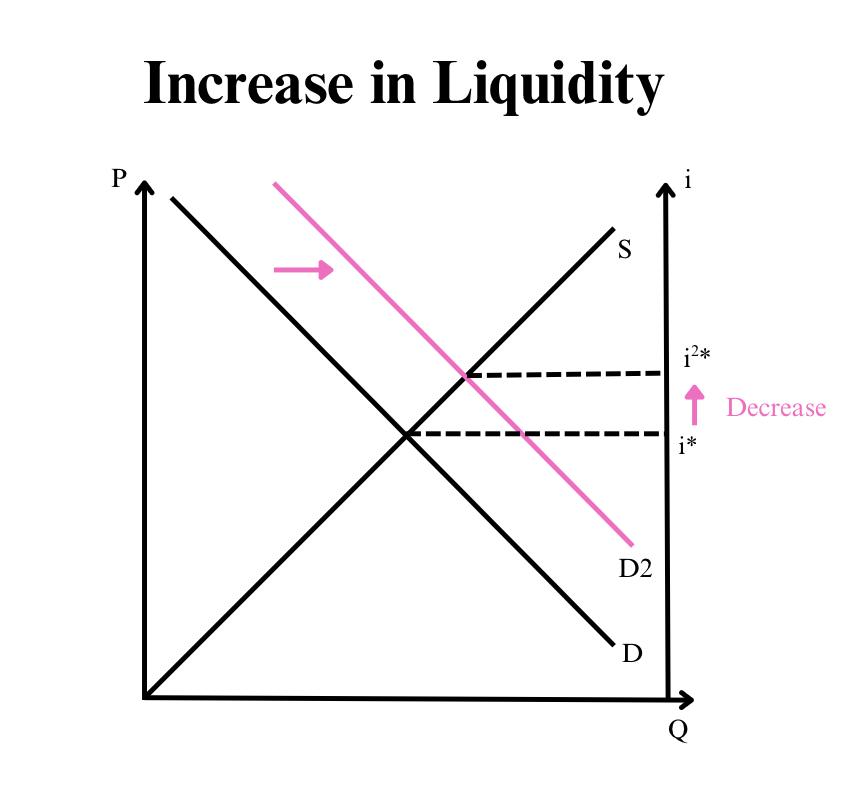

How does liquidity of bonds affect demand?

Increase in liquidity,

Increase in demand,

Decrease in interest rate

(positive relation)

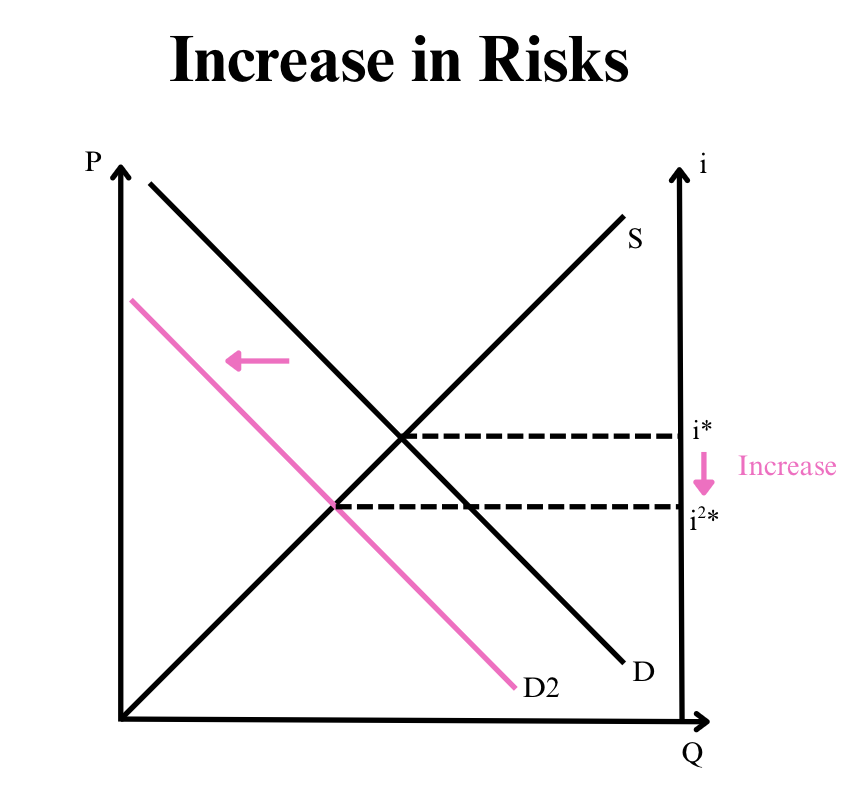

How does the risk of bonds affect the demand?

Increase in risks,

Decrease in demand,

Increase in interest rate

(negative/opposite relation)

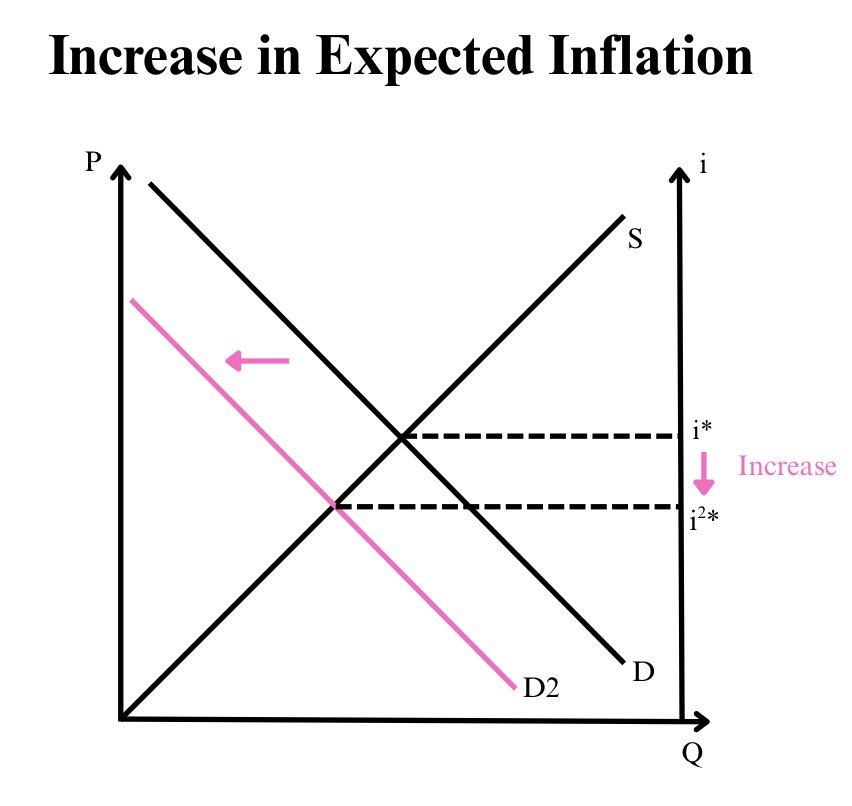

How does a increase in expected inflation affect demand?

Increase expected inflation,

Decrease in demand

Increase Interest rates

Supply of bonds depends on…

Business Conditions (number and profitability of investment opportunities)

Government deficit spending

Expected inflation

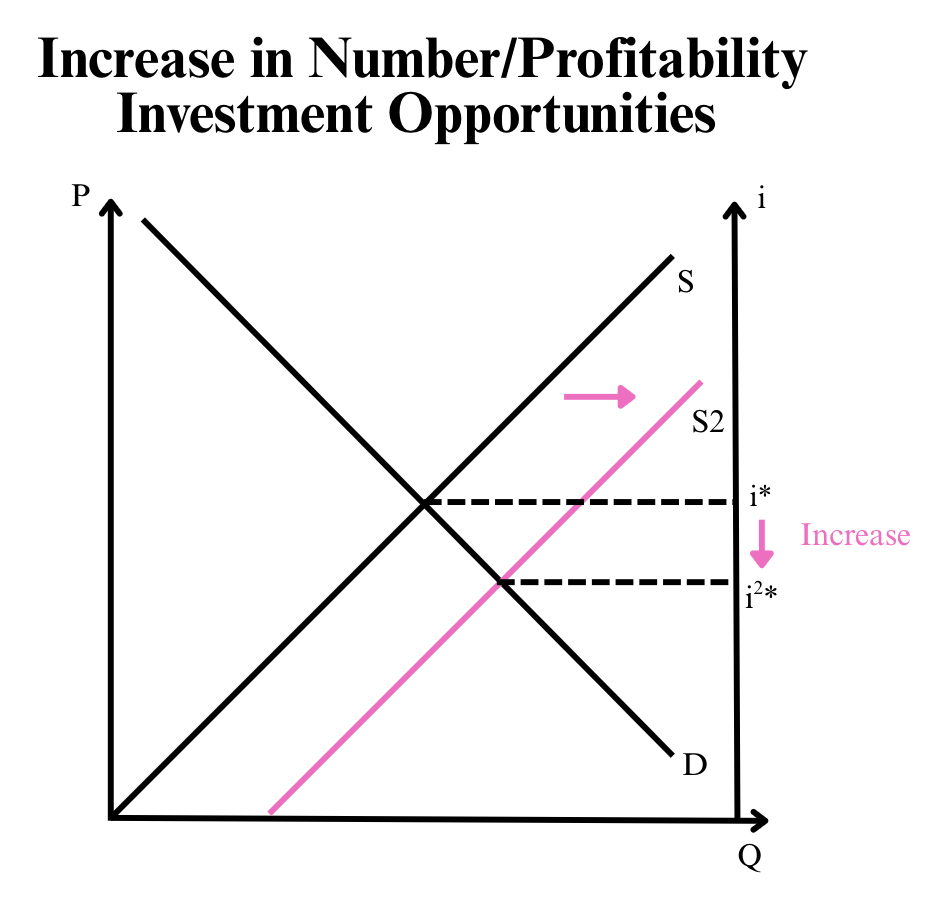

How do the number and profitability of investment opportunities affect supply of bonds?

Increase in number/profitability,

Increase in supply,

Increase in interest rates

(positive relation)

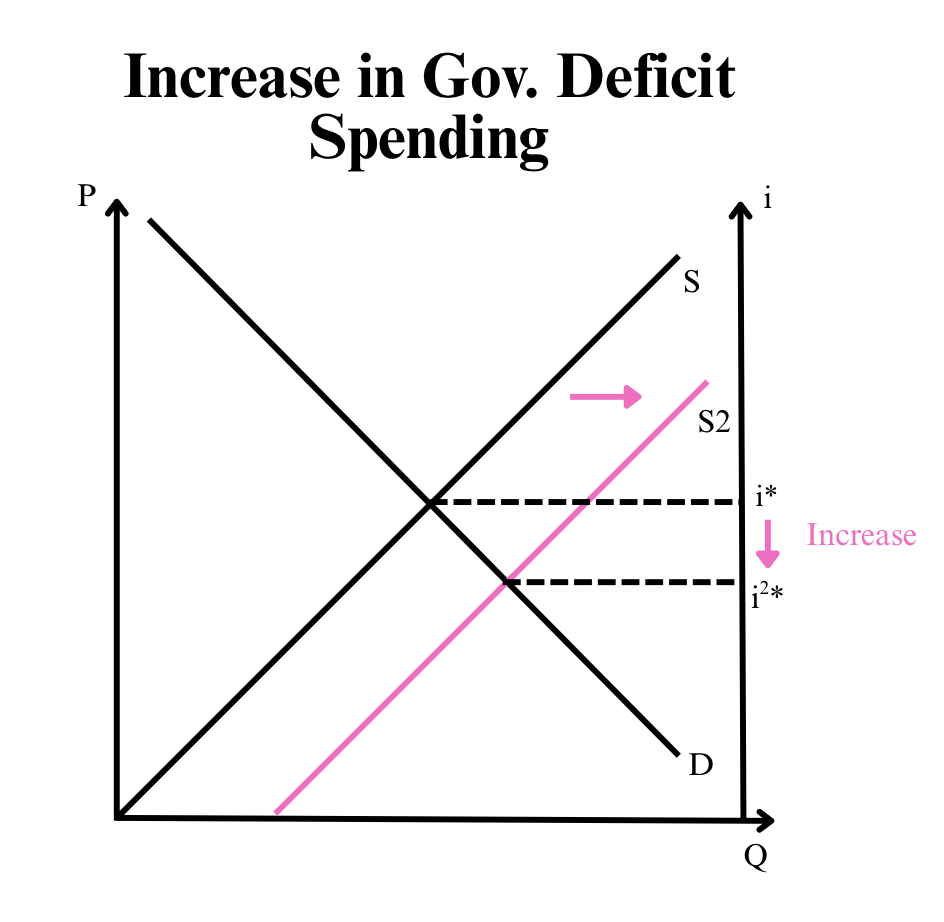

How does an increase in government deficit spending affect the supply of bonds?

Increase in gov. deficit spending,

Increase in supply,

Increase in interest rates

(positive relation)

Crowding out

Occurs when the government sells bonds, raising interest rates and discouraging private investment

*not good*

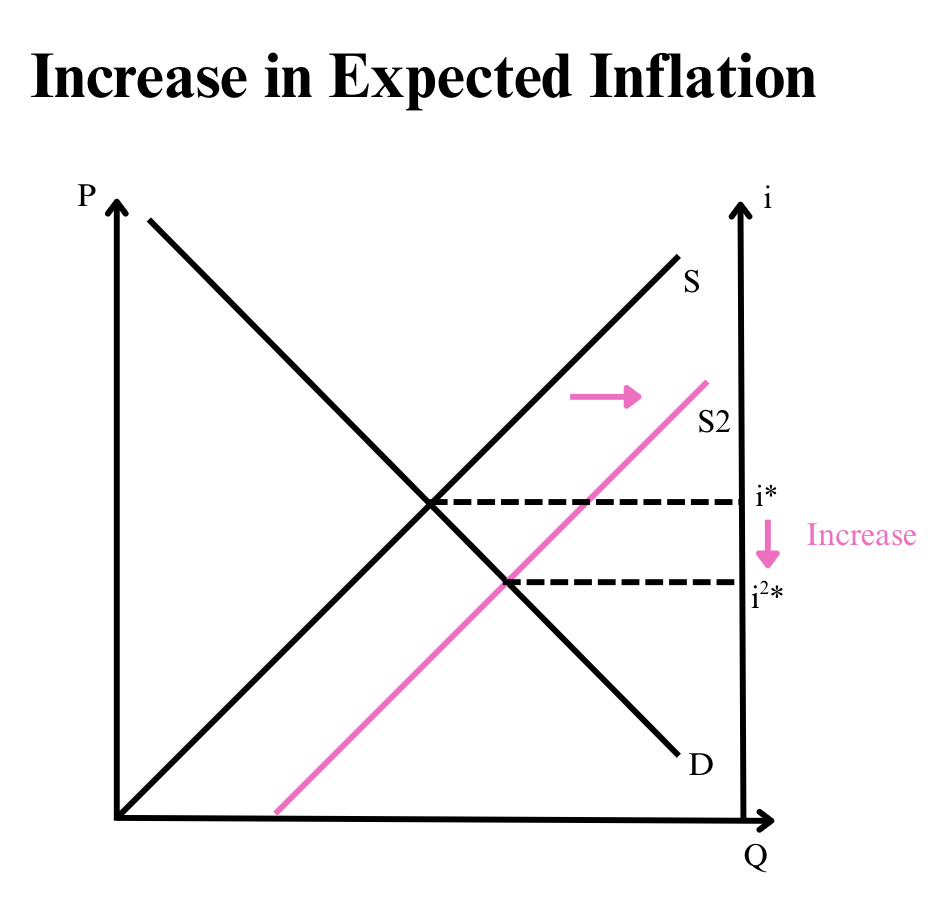

How does an increase in expected inflation affect the supply of bonds?

Increase in expected inflation

Increase in supply

Increase in interest rates

Fisher effect

Higher expected inflation results in higher market (nominal) rates, supply and demand changes reinforce each other

Interest rates are pro-cyclical

Go up during expansion & fall during reces

Why are interest rates different for different securities?

Differences in risk

Risk structure

Describes the difference in interest rates for bonds of similar maturity, but different risk.

For bonds of the same maturity, riskier bonds will have a higher interest rate

Risk premium

Bond interest rate - risk-free rate

Risk free rate in practice

Treasury rate of the same maturity

Bond ratings

Illustrate risk structure

Term structure

Describes the difference in interest rates for bonds of similar risk but different maturity

Term Structure theories

Expectations hypothesis and Liquidity preference/premium

Expectations hypothesis

Today’s long-term rates are average of expected short-term rates;

Helps explain why rates for all maturities move together and short-term rates are more volatile

Liquidity premium/preference

Must add a liquidity premium to the rate for longer maturities;

Helps explain why long-term rates are usually higher. Swings the yield curve up

What does the yield curve show graphically?

The difference in interest rates for bonds of different maturities.

Yield curves can be an indicator

What can an inverted yield curve can signal?

A recession coming

19th century characterized by conflict between

Rural farmers & urban bankers

Mistrust in centralized authority

Bank of North America 1782

1st Bank of the United States 1791

Second Bank of the United States 1816

Conflicts that sunk the first attempts at a central bank in U.S.

Bank of North America 1782 &

First Bank of United States

created central authority for banks in U.S.

private institution controlled by wealthy urban bankers

Why did Bank of North America and First Bank of United States fail?

Mistrust of central authority

Conflict between rural farmers and rich bankers

Who was the Second Bank of the United States (1816) eliminated by?

President Andrew Jackson

Most banks in the 19th century were…

Local, state banks, printed thier own money

18th century was characterized by frequent bank failures also known as

Panics, contaigions, and bank runs

The National Bank Act 1863

Created national charters and a national currency

to stabilize the banking system, and pay for civil war

Still have a dual banking system

Federal Reserve Act 1913

Created the Federal Reserve System and the first true central bank in the U.S

McFadden Act 1927

Prohibited interstate banking and limited branching

banks had to be small, local, and numerous

Bank failures in 1930

Started in 1920s, banks used savers’ money to buy corporate stocks

Stock markets crashed, banks lost savers’ money and closed

Glass-Steagall Act 1933

Prohibits banks from owning risky assets

FDIC Act 1933

Created deposit insurance

Eliminated bank runs/panics

S&L crisis in 1980s resulted from

Differences in interest rates on deposits and fixed-rate mortgages

began relaxation of restrictions from Glass-Steagall

Bank crisis 1980s simplified

banks charged low rates for mortgages (rates were their income)

high inflation forced banks to pay high rates for deposits

with low-rate income and high rate expenses, banks lost tons of money

Riegle–Neal Interstate Banking & Branching Efficiency Act 1994

Eliminated McFadden Act

Technology made McFadden obsolete

Gramm–Leach–Bliley Act 1999

Eliminated Glass-Steagall

lasted until 2008

Because of the elimination of the Glass-Steagall and McFadden Act, today’s U.S. banks are characterized by

Consolidation

Today’s U.S. Banking Consolidation

Fewer and larger banks

Due to relaxation of interstate restrictions

Larger banks may take advantage of economies of scale/scope

Economies of scale

Larger banks have lower costs

Ecnoomies of Scope

Cheaper for one firm to do multiple things than multiple firms each doing something different

Bad things about large bank taking over small local bank

may close branch

charge higher fees/have worse rates

riskier (Too-Big-To-Fall)

bad customer service

Benefits of large bank taking over small local bank

more locations/ATMs

Lower fees/better rates

less risky (absorb local losses)

more services

Why are banks increasing international operations?

expanding international trade

multi-national operations

international investment activity

Who do U.S. firms overseas want to deal with?

U.S. based banks

Regulating agencies

Federal Reserve

Comptroller of Currency

State agencies

FDIC

SEC

Why are banks regulated?

stability of system required to help move money from savers to borrowers (important to economy)

prevent monopoly (not really a realistic problem)

promote trust and protect savers (form asymmetric info, moral hazard & adverse selection)

Types of bank regulation

Asset Restrictions

Capital Requirements

Disclosure requirements

Supervision and Examination

Restrictions on competition

Safety net

Asset restrictions

Prohibit banks from owning risky assets (Glass-Steagall)

Capital requirements

Reduce banks’ incentive to buy risky assets by making use their own money

Disclosure requirements

Banks must provide information to depositors about the bank’s assets

Supervision and Examination

Regulating agencies set rules & standards, periodically send teams to examine banks to make sure rules are followed

Restrictions on competition

Ex. McFadden Act

Safety Net

Deposit insurance

Purchase and assumption

Lender of Last Resort

Problems with safety net

Makes moral hazard worse

“Too-Big-To-Fall” issue (gov having to give money to banks to “bail them out”)

Issues in bank regulation

International regulation

Regulatory competition vs. Regulatory consolidation

Regulatory competition

Multiple regulating agencies with overlapping functions

Benefits to regualtory competition

Check on each other (outdo each other)

Focus on different areas of banking system

Issues with regulatory competition

Expensive

Banks can seek out “easiest” regulator

Potential regulatory forbearance

Regualtory consolidation

Merge all bank regulating agencies into a single “super regulator”

Benefits to regualtory consolidation

More cost-efficient

Can’t expect others to do the job

Issues with regulatory consolidation

No one to check on mistakes

May overlook small, local banks

International regulation

business spread around the world

banks follow them

when banks operate in multiple countries, follow both regualtions and resolve the conflicts between