1.4 competitive and concentrated markets

1/94

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

95 Terms

what are the four market structures

perfect competition, monopolistic competition, oligopoly and monopoly

which market structure is the most competitive

perfect competition

what are market structures characterised by

number of firms, product differentiation, barriers to entry, barriers to exit

what is a concentration ratio and what does a higher concentration mean

a concentration ratio is a combined share of a specified number of firms. a higher concentration ratio means fewer competitors and reduced competition

what is the typical CR of a monopoly

25%

how to calculate a CR

adding the top 5 market share percentages

what is a HHI

used by regulators to evaluate the effects of mergers on market competition

how to calculate HHI

summing the squares of the firm shares

what is an incumbent firm

firm that already operates in a market

what is an entrant

a firm that is trying to enter a market

are costs higher for incumbents or entrants

higher for entrants

what does homogeneity mean to price

entrants must compete on a price

examples of barriers to exit

high sunk costs like advertising, closure costs, redundancy costs

link between perfect competition and price

firms have no influence on price

what types of profits are earned

supernormal and normal

how do you calculate a firms profit

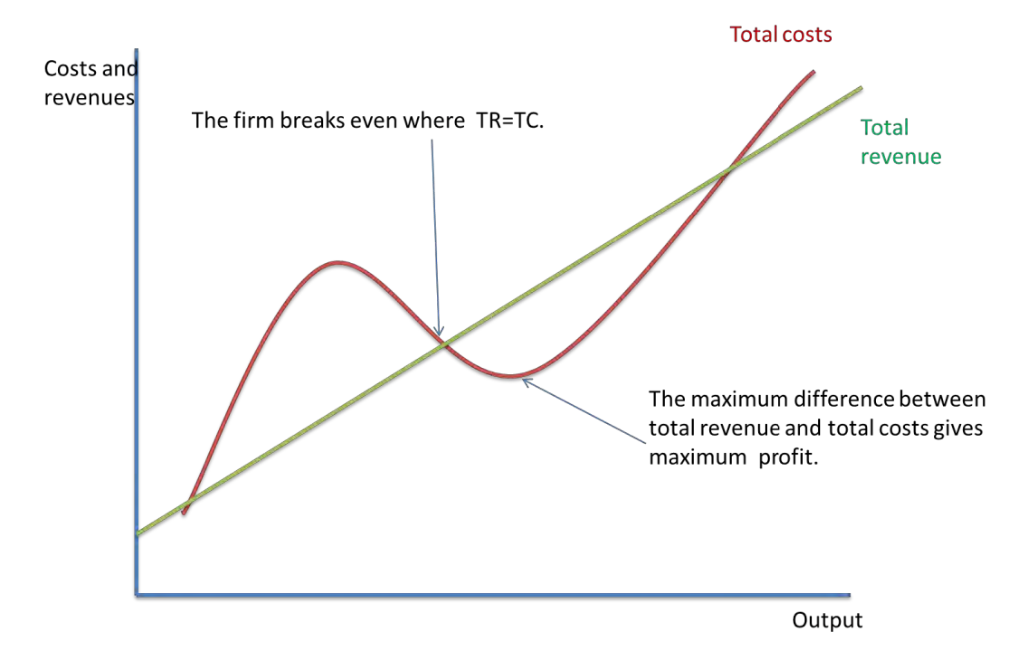

the difference between total revenue and total costs

where does profit maximisation occur

marginal cost (mc) = marginal revenue (mr)

what does profit maximisation mean

each extra unit produced gives no extra loss or revenue. net zero

graph for tc and tr

when does profits increase

when mr is less than mc

why do firms profit maximise

greater wages, retained profits which saves paying high interest rates

why do firms profit maximise in the short run

the interests of the owners and shareholders are most important since they aim to maximise their gain from the company

why do firms profit maximise in the long run

consumers do not like rapid changes in the short run, so it provides a stable price and output

what is the principal agent problem

theory of asymmetric information-the agent makes decisions for the principal, but the agent is inclined to act in their own interests rather than the principal’s

consequences of a divorce of ownership from control

when an owner of a firm sells shares, they lose some of the control they had over the firm

other objectives of a firm

survival, growth, increasing their market share, quality

when does revenue maximisation occur

when MR=0

what is sales maximisation

when a firm aims to sell as much of their goods and services without making a loss

what is the satisficing principle

when a firm is earning just enough profits to keep its shareholders happy

when does the satisficing principle occur

when there is a divorce of ownership and control

characteristics of perfect competition

sellers are price takers, free entry to enter and exit the market, perfect knowledge, many buyers and sellers

how is price determined in perfect competition

by the interaction of demand and supply

profits in a competitive market

lower with only a few large firms because each firm has a very small market share

what is the effect of a new entrant in a perfectly competitive market

enter due to low barriers and an increase in supply, which lowers the average price. Existing firms will be competed away

what profits are made in the short run/long run in perfectly competitive markets

SR- supernormal profits

LR- normal profits

what is a price taker

a firm that has no control over the market price

what is a price maker

firms that set the market price

what profit is made in the long run in competitive markets and why

normal profits- supernormal profits have been competed away

advantages of a perfectly competitive market

in the long run there is a lower price, productive efficiency and increased dynamic efficiency in the short run

disadvantages of a perfectly competitive market

LR dynamic efficiency is limited, few or no economies of scale, model rarely applies in real life (often competition is imperfect)

characteristics of a monopoly

profit maximisation

sole seller in a market

high barriers to entry

price maker

price discrimination

what is monopoly power influenced by

barriers to entry- high

number of competitors- fewer firms= lower barriers to entry

advertising- increases consumer loyalty

product differentiation- more unique= more the product can be differentiated

when do monopolies earn supernormal profits

in the long and short run

at what point is the profit maximisng equllibrium in a monopoly

when MC= MR

diagram for profit maximisation- monoplies

disadvantages of a monopoly

higher prices and profits and inefficiency may lead to a misallocation of resources

can exploit consumers by charging high prices = leads to good being under consumed

no incentive to become more efficient

loss of consumer surplus and a gain of producer surplus

advantages of a monopoly

earn significant supernormal profits - more dynamically efficient in the long run so more innovation

more likely to innovate

generate export revenue

high profits could be a source of government revenue through taxation

what is dynamic efficiency

a firm’s ability to adapt and improve its productivity over time

what is productive efficiency

ability of a firm to produce goods or services at the lowest possible cost

what is a price mechanism

determines the market price

referred to as ‘the invisible hand of the market’

resources are allocated through the price mechanism in a free market economy

price moves resources to where they are demanded or where there is a shortage and removes from a surplus

functions of a price mechanism

signalling, incentive, rationing, allocating resources

what is rationing in the price mechanism

there are scarce resources so prices increase die to the excess of demand

increase in price discourages demand and rations resources

what is incentive in the price mechanism

encourages a change in behaviour of a consumer or producer

e.g. a high price would encourage firms to supply more to the market

what is signalling in the price mechanism

price acts as a signal to consumers and new firms entering the market

price changes show where resources are needed in the market

a higher price signals to firms to enter the market because it is profitable

how are market structures characterised

number of firms in the market

degree of product differentiation

ease of entry into the market

how does the number of firms affect markets

the more firms there are, the more competitive the market is. this also includes the extent of competition from abroad

how does product differentiation affect markets

The more differentiated the products, the less competitive the market

In a perfectly competitive market, products are homogenous where products can be differentiated using price, branding and quality.

this affects cross price elasticity of demand.

how does ease of entry into a market affect markets

this is the number and degree of barriers to entry

barriers to entry are designed to prevent new firms entering the market profitably

how do barriers affect markets

Barriers to entry are designed to prevent new firms entering the market profitably.

This increases producer surplus.

The higher the barriers to entry, the less competitive the market

examples of entry into a market

economies of scale

brand loyalty

controlling technologies

reputation

backwards vertical integration

how does brand loyalty affect demand

demand becomes more inelastic as it is hard for new firms to gain consumer loyalty with a more known brand name

what is backwards vertical integration

this controls supply and means firms can control the price they pay suppliers. this makes it hard for new firms to compete on price which is a barrier to entry

what are the different types of barriers to entry

structural- different production costs

strategic- firms use different pricing policies

statutory- patents protect a franchise

what is a main objective of firms

profit

calculation for profit

difference between total revenue and total cost

what is profit to firms

the reward that entrepreneurs yield when they take risks

when does profit maximisation occur

when marginal cost = marginal revenue

what does profit maximisation result in

employees having higher wages

shareholders holding larger dividends

how can retained profits be useful

cheap source of finance

if firms want to invest in the future, they can use their profits rather than taking out a loan, which could potentially be expensive and have high interest rates

what is a plc

private limited company

why do PLCs profit maximise

they could lose their shareholders if they do not receive a high dividend

more likely to have short run profit maximisation as an object to keep shareholders happy

what are other objectives of firms

survival, growth and increasing their market share

what is survival as an objective

short term- survive in the market especially if they are a new firm entering a market

firms might have survival as their objective until there is economic growth again

firms might aim to sell as much as possible to keep their market position

what is growth as an objective

some firms may aim to increase the size of their firm

This could be to take advantage of economies of scale, such as risk-bearing or technological

this would lower average costs in the long run and make them more profitable

how can firms grow as an objective

expanding their product range

merging or taking over existing firms

large firms may participate more in research and devlopment

how do market shares affect a firms objective

helps to increase their chance of surviving in the market to maximise sales

how do objectives affect a firm

influence the firm’s behaviour

characteristics of a perfectly competitive market

many buyers and sellers

sellers are price takers

free entry to and exit the market

perfect knowledge

homogenous goods

firms are short run profit maximisers

how is price determined in a perfectly competitive market

determined by the interaction of demand and supply

how are profits in a competitive market

likely to be lower than a market with a few large firms

each firm has a small market share

market power is small

how do new firms affect competitive markets

If the firms make a profit, new firms will enter the market, due to low barriers to entry, because the market seems profitable.

new firms will increase supply in the market, which lowers the average price.

existing firms’ profits will be competed away

In the short run, firms will be able to make a lot more profit, than in the long run where profits are competed away.

what is a pure monopoly

there is one seller in the market

what is monopoly power

when one firm has a market share of over 25%

when can monopoly power be gained

when there are multiple suppliers

can also refer to two large firms in an oligoboly having over 25% market share

factors that influence monopoly power

Some Naughty Boys Always Eat Large Oreo Packs

sunk costs

number of competitors

brand loyalty

advertising

economies of scale

limit pricing

owning a resource

product differentiation

how do economies of scale affect monopoly power

As firms grow larger, the average cost of production falls because of economies of scale.

existing large firms have a cost advantage over new entrants to the market, which maintains their monopoly power.

It deters new firms from entering the market, because they are not able to compete with existing firms

how does limit pricing affect monopoly power

involves the existing firm setting the price of their good below the production costs of new entrants, to make sure new firms cannot enter profitably

what are sunk costs

unrecoverable costs such as advertising

how does product differentiation affect monopoly power

The more the product can be differentiated, through quality, pricing and branding, the easier it is to gain market share. This is because the more unique the product seems, the fewer competitors the firm faces

what is a concentration ratio

the combined market share of the top few firms in a market

what are some drawbacks of monopoly power

higher prices and profits and inefficiency may result in a misallocation of resources

monopolies can exploit consumers by charging higher prices

this means the good is under-consumed so consumer needs and wants are not fully met

the loss of allocative efficiency is a form of market failure

monopolies have no incentive to become more efficient, because they have few or no competitors so production costs are high

loss of consumer surplus and gain of producer surplus

what are benefits of a monopoly

they can exploit economies of scale so they have lower average costs of production

high profits results in more investment in research and development

yields positive externalities making it more dynamically efficient in the long run

more invention and innovation

how is price controlled in a competitive market

firms do not compete on price

firms try to distinguish their products and gain market share using non-price competition

what are ways firms try to stand out in a competitive market

improve products

reduce costs

improve quality of the service provided

why are consumers charged more in a monopoly

consumers have little choice where to purchase their goods and services since there are few firms in the market

consumer surplus falls