ib business - finance 3.1,3.2,3.3

1/41

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

42 Terms

what is capital expenditure

money spent on fixed assets that a business will use for a long time

key features of capital expenditure

helps the business in the long term, long term investement, high cost equipment , collatoral for loans, helps the business grow and expand

examples of capital expenditure

buildings, machinery, computers, printers

revenue expenditure

money spent on the day to day running of the business

key features of revenue expenditure

short term, keeps the buisness operating, needs to be paid immediately w working capital

examples of revenue expenditure

stock/raw materials, delivery costs, wages and salaries, rent, insurance

why does revenue expenditure matter

impacts profit levels, poor control levels of revenue expenditure can conclude to irregular cash flow

why does capital expenditure matter

often serves as collatoral, influence deppreciation and invesement decisions

why does a business need finance

launch the business

required for day to day operations

expansion and growth

purchased fixed assets

dealing w a crisis

research

marketing + promotion

3.2

next slide

what is the definiton of sources of finance

refers to where or how businesses obtain their funds

Personal funds

Personal funds (owner's capital), business start-ups, short term

Retained profit

Retained profit is the value of profits that a business keeps after paying taxes and dividends

used for capital expenditure

kept in a contingency fund in case of emergencies

both long and short term

The sale of assets

Existing businesses can sell their dormant assets (unused assets), obsolete machinery

sale of land and buildings

selling subsidiaries due to a major liquidity threat short term

what are external sources of finance

external sources of finance refer to money that come from outside the busine

Share capital

Share capital is the money raised from selling shares, main source of finance for most

can provide a huge amount of finance.

ownership becomes diluted

involves many legalities and administrative procedures

loss of ownership

best for expansion and long term

Loan capital

money borrowed from a bank or financial insitiutions and repaid over time w interest

large sums available

predictable repayment schedule

interest increases cost

requires collateral

risk if cash flow is weak

best for buying machinery, equipment, long term

overdraft

a short term arrangement where a bank allows a buisness to withdraw more money than it has in its account.

very flexible + quick access to cash

ideal for temporary cash flow problems

high interest rates

can be withdrawn at any time

short term, buying stock before sales revenue arrives

trade credit

suppliers allow the business to receive goods now and pay later

imrpoves cash flow

no interest if paid on time + helps businesses

late fees for missed payments

best for retailers, cafes/restaurants both short and long term

crowdfunding

raising finance from a large number of small investors via online platforms (gofundme)

good for start ups

no trad loan/interest

builds a community + customers

not guaranteed to succeed

strong marketing

time consuming

best for start up products, creative projects and tech innovations both long and short term

leasing

renting an asset

low upfront cost

asset maintenance often included

keeps cash flow healthy

more expensive long term

business over owns the asset

best for expensive machinery, vehicle, equipment for start ups, long term

microfinance providers

organizations provide very small loans to entrepeuners who cannot access trad bank loans

helps invids w no collateral

encourages entrepreneurships

flexible and accessible

small loans amounts

higher interest rates

not suitable for large investements

best for small start up business w low capital needs

business angels

wealthy individuals who invest their own money into start ups in exchange for equity

investor brings expertise and industry contacts

no interest

useful when banks refuse loans

loss of ownerships

potential for investor influence over decisions

best for: high growth potential start ups long term

what is dilution of control means

loss of ownership percentage when new shares are issued

cost of debt

interest payment on loans or bonds

ownership remains

mandatory repayments

cost of equity

dividends payed to shareholders

no repayments obligatory

cost of dividends

3.3

next slide

fixed cost

cost a business pays regaardless of output. it does not change w output in the short run. eg rent,insurance, salaries, adv, security, matters bc of break even and long term planning, impact on business

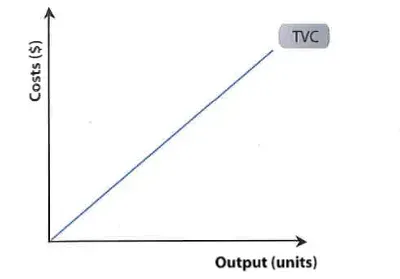

variable cost

costs that change in proportion with the level of output or sales eg hourly wages, raw materials, packaging utilities

formula for tvc

vc per unit x quantity or vc also is tc - fc

total costs

sum of variable and fixed

determines profit and break even

formula fixed costs

fixed costs and variable costs

Direct costs

direct cost is related to an individual project or the output of a particular product; without which the costs would not be incurred- Not necessarily related to the level of output

For example, the direct costs of purchasing a commercial building include consultancy costs, solicitor's fees, telephone bills

Indirect costs (overheads)

Indirect costs cannot be clearly traced to the production or sale of any single product- Not necessarily related to the level of output

For example, rent and lighting costs can be associated with all areas of a business rather than being directly related to the output of a particular product

revenue

Revenue refers to the money coming into a business, usually from the sales

revenue streams

revenue streams are the sources of revenue from the sale of goods and services and others

revenue streams examples

advertising revenue - Google, Twitter and Facebook

Transactions fees - credit card commission

Franchise costs and royalties - McDonald's, Burger King and KFC

Sponsorship revenue - Sponsorship whereby the sponsor financially supports an organization in return for prominent promotional display

Subscription fees - charges on customers who use or access a good or service

Merchandise - entertainment industry

Interest earnings - positive cash balance can earn interest on their cash deposits

Dividends - a share of the net profits distributed to shareholders

Donations - financial gifts from individuals or other organizations

Subventions - subsidies offered from the government to certain businesses to help reduce their costs of production

average cost formula + what

total cost divided by quantity shows cost per unit helps managers compare efficiecny low ac = economies of scale

break even

where total revenue = total costs shows minimum output to prevent losses helps in financial planning and pricing

total revenue formula

price x quantity sold

margincal cost

the change in total production costs that comes from making or producing 1 additonal unit important for profit maximisation