Looks like no one added any tags here yet for you.

DCM

play a pivotal role in allocating capital to finance solutions to environmental, climate change, and transition challenges.

Categories of DCM

organised guaranteed bonds

•These raise money for general purposes and are backed by the issuing organisation as a whole. Government (sovereign) bonds and corporate bonds are the main type of issuer (with some other issuers such as multilateral organisations like the world Bank). Use of the money raised (proceeds) of these may be linked to certain qualifying assets or purposes.

asset-backed securities

•These raise money for general purposes and are backed by the issuing organisation as a whole. Government (sovereign) bonds and corporate bonds are the main type of issuer (with some other issuers such as multilateral organisations like the world Bank). Use of the money raised (proceeds) of these may be linked to certain qualifying assets or purposes

organised guaranteed bonds

These raise money for general purposes and are backed by the issuing organisation as a whole. Government (sovereign) bonds and corporate bonds are the main type of issuer (with some other issuers such as multilateral organisations like the world Bank). Use of the money raised (proceeds) of these may be linked to certain qualifying assets or purposes.

ABS

•These raise money for general purposes and are backed by the issuing organisation as a whole. Government (sovereign) bonds and corporate bonds are the main type of issuer (with some other issuers such as multilateral organisations like the world Bank). Use of the money raised (proceeds) of these may be linked to certain qualifying assets or purposes.

factors affecting yield

prevailing IR (base IR)

characteristics of the bond

time to maturity (term structure)

type of issuer (credit worthiness)

state of the economy

risks associated with investing in bonds

IR risk

reinvestment risk

call risk

credit risk

inflation risk

exchange rate risk

liquidity risk

volatility risk

risk risk

relevance of sustianbility to bonds

ESG

factors influencing creditworthiness

credit risk indicators

Factors influencing creditworthiness

relevance of sustainability to bonds

ESG integration in bonds

research

security ad portfolio analysis

investment decisions

Is debt suited for sustainability?

Debt capital is particularly suited for financing many green and sustainable projects, particularly those involving renewable energy such as wind or solar and play a considerably more important role in financing renewables energy infrastructure projects than equity capital.

McKinsey (2016) found that the average debt-to-equity ratio of 3,700 renewable energy projects worldwide is 70 to 30 debt to equity

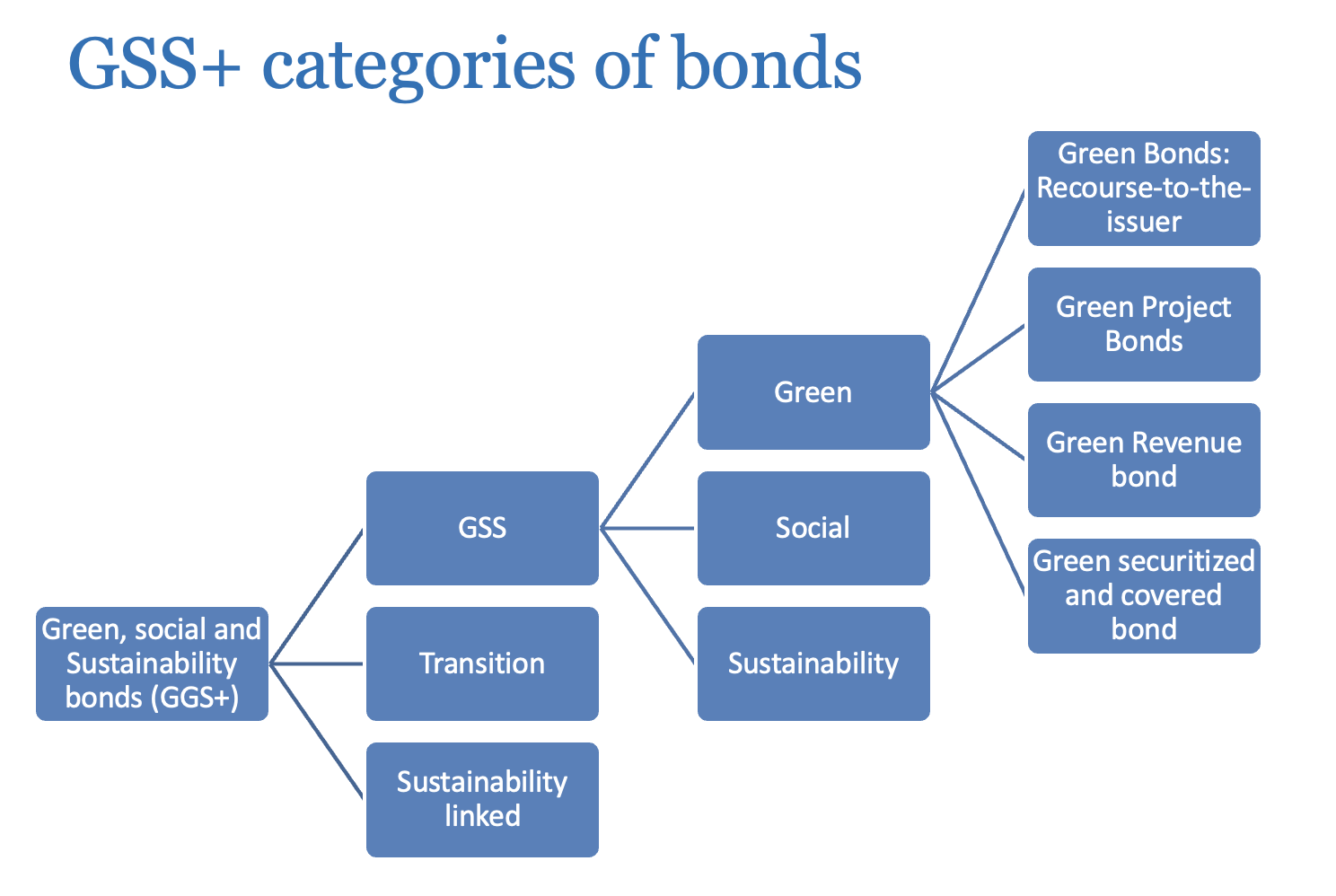

Categories of GSS bonds

Transition

Sustainability linked

GSS

social

sustainability

green

recourse to the issuer

green project bonds

green revenue bonds

green securitised and covered bonds

Green bonds

where proceeds raised are allocated to environmental projects or uses

majority issued to date are use of proceeds

speicific green projects and backed by entire balance hseet

4 Green bond principles

use of proceeds

dedicating funds to environmentally beneficial projects

project evaluation and selection

chosen based on enviro impact

management of proceeds

allocation of funds must be transparently managed and tracked

reporting

regular updates on environmental impact of funded projects are provided

recourse to the issuer debt obligation

green use of proceeds bond where capital raided for a specific green project and bond are backed by the issuers entire balance sheet

gives confidence to investors and ratings agencies by significantly reducing credit risk and risk of default

transition bonds

issuer’s climate change-related commitments and practices, aligning with the Paris Agreement’s ambitions.

To facilitate the transition, the climate transition finance handbook provides guidance to capital market members on the practices, activities and disclosures required for raising funds for climate transition-related instruments on the market.

There are two formats and key elements for this purpose:

1.Use of Proceeds instruments, as defined in the GBP, SBP, and SBG

2.General Corporate Purpose instruments aligned with the SLB principles

greenium

pirce differen e between green bonds when they trade at a premie to conventional bonds

questionable whether this exists or not

climate bonds

subcategory of green bonds

where proceeds are used to finance projects to mitigate or adapt the effects of climate change

blue bonds

designed to support sustainable marine and fisheries projects

green project bonds

not backed by whole glance sheet - only project assets

higher return to compensate for risk

•Many project bonds are issued, supported by and/or underwritten by national and multinational development banks

green revenue bonds

backed by pledged revenue streams from a project usually with no resource to issuer

green securitised bonds

a group of project into. single bond with bondholders having recourse to assets underlying complete set of projects

green covered bond

covered pool

investors have recourse to the issuer but if the issuer cat make debt payments then holders have recourse to covered pool

social bond

proceeds for projects with positive social outcomes (education or gender equality)

•The social Bonds principles

set out guidelines for use of proceeds for a bond to qualify as a social bond.

sustainability bond

aspects of green and social bonds with proceeds funding green as well as a wide range of projects intended to have positive social outcomes, often linked in SGDs

sustainability linked bond

do not finance particular projects

finance general functioning of an issuer that’s explicit sustainability targets

proceeds from the issuance are not ring-fenced to green or sustainable purposes (unlike “use of proceeds” green bonds or sustainable bonds) and may be used for general corporate purposes or other purposes.

5 components of a SLB

selection of KPIs

calibration of suitability performance targets

bond characteristics

reporting

verification

elements of transition bonds

issuers climate transition strategy and governance

business model environment al materiality

climate transitionstartegy to be science based

implantation transparency

What determines the choice between market lending through bonds and Bank lending?

•When uncertainty about the company’s cashflows is relatively small (the asymmetric information between the firm and the lender is limited), the company can borrow in the market.

•As the uncertainty increases, banks come into play as they have more possibilities than credit rating agencies to ask for information and intervene when necessary (private information)

•When the uncertainty becomes too great, a company cannot obtain finance

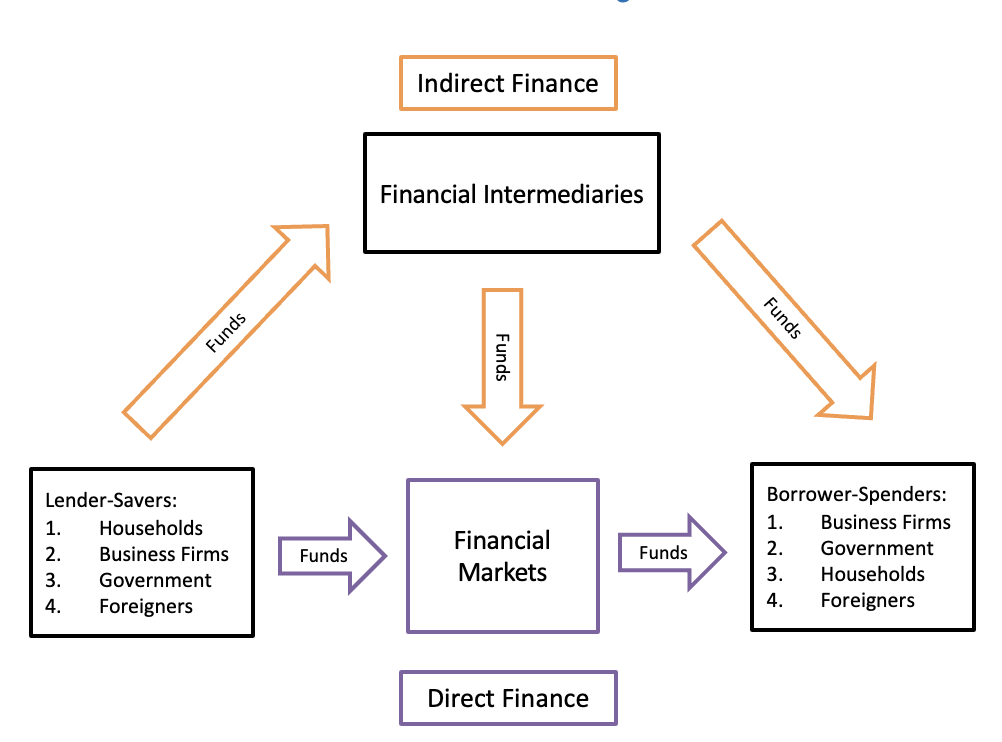

functions of the financial system

channel savings to real investments

risk transfer and diversification

liquidity and information

payment mechanism

timing of consumption

Banks role in financing

main credit provider

large role in CapM

investment decisions within banks have material consequences on the enviornemt and on society

reallocate credit and mobilise capital away from environmentally harmful actiivites towards green and sustainable project

•By continuing to finance high-carbon, environmentally damaging activities, banks contribute to the acceleration and impacts of climate change

•By supporting green and sustainable finance , banks have a key role to play supporting the transition towards a more sustainable low-carbon economy

lending business of banks

screens for creditworthiness (adverse selection)

monitors the borrower (moral Hazard)

types of lending

Corporate

SME, Cororpalte loans, interbank loans, syndicated loans, mortgages, credit lines

Government

loans, mortgages,c credit lines

social enterprises

loans mortgages credit lines

households

mortgages, consumer credit, Microfinance, overdraft

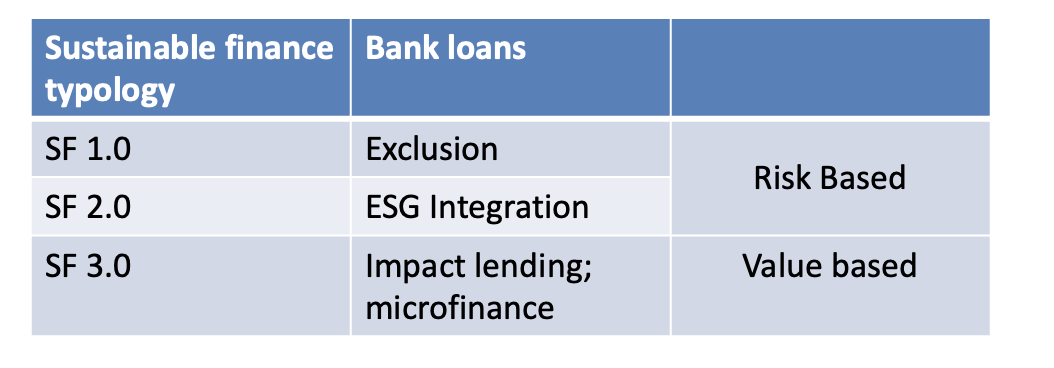

susitnability in lending

risk based approach - lending

various social and environmental factors and risks are included in credit risk

affecting probability of deaf an the loss given default

susutianbilty criteria should be used to determined the cost price of the loan

credit spread of risk permm

higher IR forces social and environmental business models

3 project finance risks

impact on environment and socieyt

impact materiality

income of projects may suffer from susutianbiity risks

financial materiality

repetitional risks

climate risks and banking

physicalal risks

from direct impact of climate hazard

transition risk

transition to a lower carbon economy

liability risk

arise from parties who have suffered loss and damage from effects of climate change and who seek compensation form this reeposnbile

new exposure indicators

Weighted average carbon intensity

Bank carbon footprint

carbon financing tilt

credit weighted emission intensity

taxonomy alignment

estimates the level of alignment of financial profits within EU taxonomy

concentrated emissions exposures

share of lending to certain sectors

expsoures to physical hazards

shift in return periods of river flooding ex

UN principles of responsible banking

2019, signed by 130 banks from 49 countries

unique framework for ensuring signatory bak’s strategy and practice aligns with SDGs

3 steps

impact analysis

identifying the most isngiicant impacts of products and services that the bank operates in

target setting

measurable targets in area of most significant impact

reporting

pulicaly report of progress being transparent

6 principles of responsible banking

alignent

impact and target setting

clients and cusotmers

stakeholders

governance and culture

transparency and accountability

green & sustainable banking pratices

mainstreaming sustainability factors across bank strategy and governance, risk management, culture and skills

risk management (price risk)

mobilising private capital for green investments

efficient allocation of capital

mainstreaming banking practices

credit and lending

enviro due diligence

emerging environmental risks

enhancing positive performance

savings

reducing enviro impacts of banking operations

capital markets

nitrating enviro risks into ER

mobilising branking pratcies

credit & lending

extending green credit to key sectors

savings

offering green products

capital markets

raising capital thru equity placements & IPOs

raise capital thru debt market

green loan principles core components

use of proceeds

process for project evaluation dn selection

management of proceeds

reporting

EU green loans = ~4.5% of Toal loans

value based banking

3 dimensional looking at return ris and impact

money for projects with positive societal impact in

economic resiliience

micro finance

social empowerment

education/healthcare/scoail inclusion/special needs housing

enviornetmtnal reugaltion

renewable energy

barriers to sustainable lending

account manager knowledge

status quo of client

mautorty of bank loans

myopic bankers

incentives for sustianbe banking

bans can choose to charge a higher rate for loans with ESG risk

Nudging theory of change

applying a bee lending rate for projects with no ESG risk and risk premia to those with esg concerns

guiding principles for a positive financial transition

from financial to integrated value

A first guiding principle is a financial institution’s measurement, targeting and reporting of integrated returns, rather than purely financial returns. This is embedded in a serious statement of purpose of what the institution’s value creation looks like and who it will benefit (linked to sustainability transition; SDGs). Effective systems are needed for transmitting information on social and environmental capital to and from corporates, citizens and governments. New mental models and new business school programmes will be based on integrated value creation;

stewardship based on a direct link between financiers and companies

For banks, it will again include a stronger role for relationship banking. For asset managers and asset owners, it will likely include more concentrated ownership stakes, deeper engagement, and shorter investment chains. This second guiding principle enables a direct dialogue between financiers and companies on targeting integrated value (aligned with the SDGs) without intermediary actors;

capital allocation based on long-term social value

. Quantified and accountable positive impact on ecological and social capital is obtained by financing sustainability transitions. The emerging nature-positive economy will be based on completely different financial logics of a circular, non-extractive and service and sharing-based economy. The market transitions in food, energy, production, mobility and so on need to be financed as well as they require a financial transition strategy.