Theme 6 II D: Firms and Decisions

1/12

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

13 Terms

Describe Firms may wish to maximise profits but are unable to do so due to lack of information

Firms may wish to maximise profits but are unable to do so due to lack of information

Firms do not know their exact revenue and cost functions because they operate in a dynamic environment (demand and cost conditions change continuously over time)

Firms unable to maximise profits as they are unable to accurately estimate the MR and MC due to unavailable or imperfect information

Difficult for firms to estimate their demand curves because of the difficulty of estimating the actions and reactions of other firms and their effects

Even in stable conditions, firms do not have precise information about price elasticities

In such situations, firms may resort to simpler pricing models such as cost-plus pricing

Firms put a mark-up on top of the average cost of their goods and adjust the mark-up based on how well the goods are selling to arrive at a selling price

Firms may also aim for profit satisficing, rather than profit-maximising, due to a lack of precise information

Constraints of changing price in price sticky oligopoly

Describe firms have other goals and do not aim to maximise profits in the short run

Firms have other goals and do not aim to maximise profits in the short run

A firm may possess profit-maximising or alterfnative objectives which would form the basis for firms in deciding what strategy they should pursue in accordance with their objective

If a firm prioritises short-run profits:

Utilise pricing strategies to maximise profits such as producing where MC=MR or practising price discrimination

Use non-price strategies to increase demand or reduce price elasticity of demand for its goods and to reduce costs

If a firm prioritises long-run profits:

Engage in strategies to drive its competitors out of the market or to deter new firms from entering

Such strategies would mean sacrificing some short run profits in exchange for higher profits or greater market dominance in future

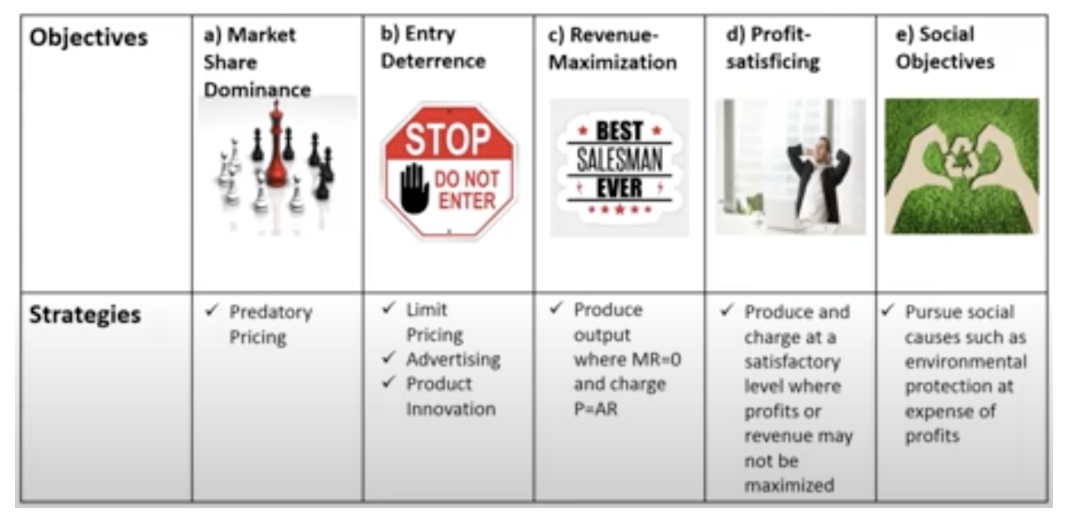

Describe 5 general alternative objectives and their strategies

Define and describe predatory pricing (how it will increase profits LR)

Predatory pricing (Def.): attempt by a firm to undercut its competitors by lowering its price in order to drive its competitors out of business

Firms are willing to charge a price that is below their own AC and earn subnormal profits temporarily in hopes of driving out their competitors and recuperating their losses in the future by charging higher prices

Assuming AC of both firms is the same, all firms will make losses

Smaller competing firms (who make normal profits at prevailing market price) will make subnormal profits if they try to match the price or suffer a fall in demand for their product -> If the subnormal profit persists, they will exit the market in the long run

If predatory pricing is successful: the firm would then be able to increase its market share and market power as its competitors leave the market -> raise prices to increase profits in the long term

If it is unsuccessful: firms earn subnormal profits which they are unable to sustain and exit the market in the long run

Describe the trigger for predatory pricing

Triggered by poor business conditions (economic downturn or recession) where the overall market demand is declining for the industry

One of the firms will most probably have to initiate a price cut to clear its stock, which may spark off a price war -> use the recession as an ideal opportunity to force its rivals into bankruptcy

In a price war, all firms would suffer lower profits as prices are slashed

Firms with lower costs or deeper reserves from past profits earned are better able to survive a price war as they can sustain losses for a longer period of time and outlast their competitors

Describe impact of predatory pricing on other firms and consumers

Other firms |

|

Consumers |

|

Describe impact of predatory pricing on governments

Government objectives |

|

Describe limitation of predatory pricing

Imperfect information -> main firm may be unable to lower prices sufficiently, such that the lower price is below the rival firm's average cost

Other firms still able to match the lower prices to prevent loss of market share while still making normal profits -> other firms will survive without shutting down -> strategy is ineffective

Evaluation: Extent to which a firm has imperfect information depends on type of market structure. In oligopoly, there is heavy degree of imperfect info -> greater uncertainty regarding rival’s cost and limitation is more severe

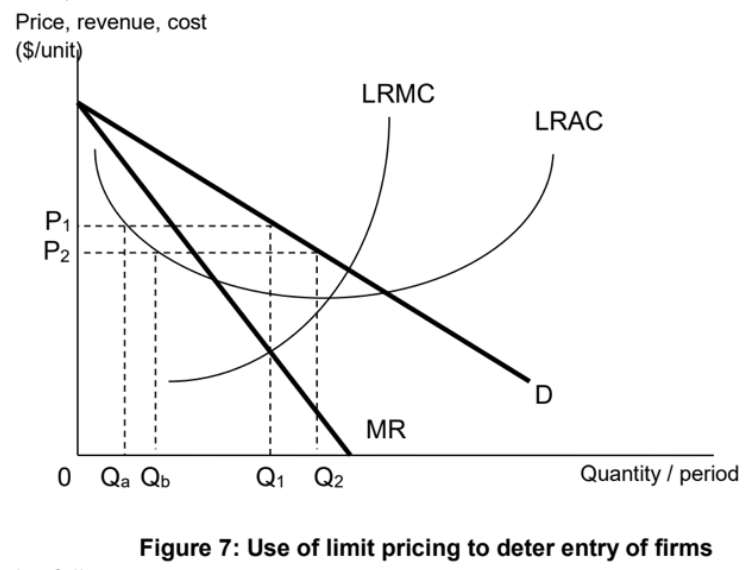

Define and describe limiting pricing

(Def.): Limit price is the minimum price that an incumbent firm can charge in order to make an acceptable level of profit whilst also deterring entry of new firms in the market

Firms can charge the limit price that is below the short run profit maximising price but above the average cost (to make normal profits at least)

Firms who wish to enter the industry when the oligopolist sets the profit maximising price of P1 can successfully do so if they produce at a relatively small scale of output Qa

At Qa, the new firm's average cost will be equal to P1-> earns normal profits and is able to survive

BUT, a threat of entry of a new firm will cause an oligopolist to opt to produce at Q2 and charge a lower price of P2 instead of P1 -> total profits are not maximised

New firms would have to produce Qb to achieve sufficient economies of scale so as to compete (can charge a price of P2 and survive)

There is greater risk involved in starting out with a larger scale of operation -> artificial BOE

NOTE:

Limit pricing - reduce price below AC of new entrants (Create artificial BOE)

Predatory pricing - reduce price below AC of current rivals (firms assume AC of rival firms is same as theirs) (To kick out current firms to gain market share)

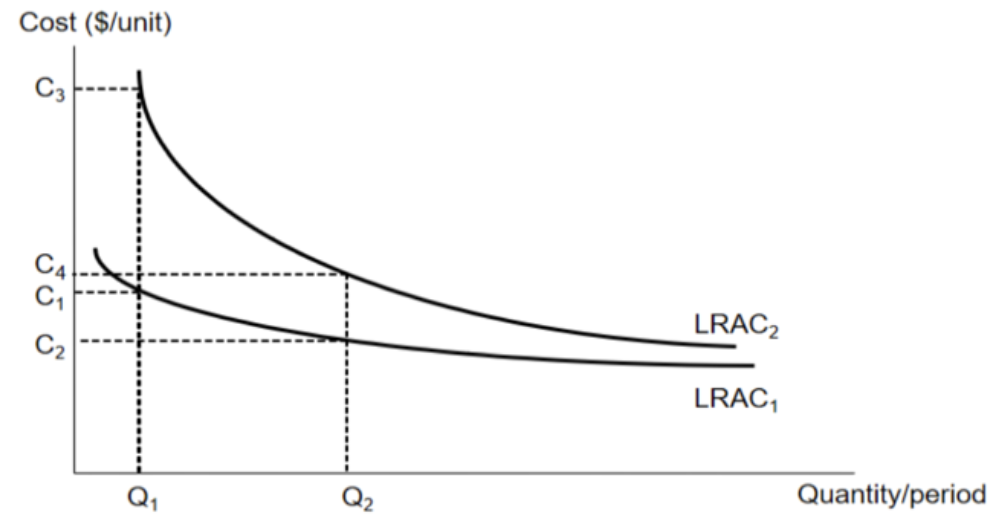

Explain how advertising deter potential entrants from entering market

Advertising creates strong brand loyalty

Deter potential entrants as consumers would be less likely to purchase the new entrant’s product since they are unfamiliar with the new product

Entrants would then potentially face the need to spend extensively on advertising in order to get consumers to try their product, which deters new firms from entering the market

Advertising creates a barrier to entry by raising market penetration costs (through costly mass media advertising) -> raise AC

Without advertising, the cost structure of the firm is illustrated by LRAC1

A larger incumbent firm produces at output Q2 with average cost being C2 while a potential entrant may decide to enter the market at a smaller scale producing output Q1 but with a higher average cost of C1

If the incumbent firms were to engage in massive mass media advertising -> shift LRAC1 to LRAC2 for all incumbent and new entrants as they all have to engage in advertising to attract customers

Explain shape of graph:

At low levels of output: LRAC2 is much higher than LRAC1 because advertising costs are spread over very little output

At high level of output: LRAC2 converges towards LRAC1 because the contribution of advertising cost to average costs becomes less significant as it is spread over a greater of output

After advertising, the incumbent firm producing output of Q2 will now have average cost of C4, a potential entrant intending to produce output of Q1 has an average cost of C3

The cost difference between a larger incumbent firm and a smaller potential entrant has increased from C1C2 to C3C4

Smaller potential entrant will find it more difficult to compete against the larger incumbent firm because it has a higher cost disadvantage -> deter potential entrants from entering the market

Describe impact of advertising on other firms, consumers and governments

Other firms |

|

Consumers |

|

Government objectives |

|

Describe revenue maximisation

Clue: Firm A is mainly run by the manager, who aims to maximize revenue instead of profits due to his commision-based rewards

At MR = 0, no additional unit will lead to higher revenue