2.2aggregate demand 2.3 aggregate supply

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

16 Terms

AD

the total planned expenditure on goods and services at a given price level

Components of AD

consumption- 60%

Investment- 17%

Government Spending- 20.9%

Net exports- -2.9%

Why is AD sloping downwards

The interest rate effect: At higher average price (AP) levels, there are likely to be higher interest rates. Higher interest rates reduce investment and are an incentive for households to save - and vice versa

The wealth effect: As AP increases, the purchasing power of households decreases and the AD falls - and vice versa

The exchange rate effect: As AP falls, interest rates are likely to fall too. Lower interest rates lower the exchange rate. With a lower exchange rate, the economy's goods/services are more attractive abroad and exports increase, thereby increasing real GDP

influences on consumption

changes to interest rates

Changes to consumer confidence

Changes to wealth

Investment

the total spending on capital goods by firms

Influences on investment

rate of economic growth

Interest rates

demand for exports

influence of government and regulations

influences of government expediture

Government expenditure is influenced by the trade/business cycle and spending linked to achieving policy aims

Social Protection (Welfare payments such as state pension, universal credit)

Health care services

Education

influence on net trade

Change in Condition | Effect on Exports | Effect on Imports | (X-M) |

|---|---|---|---|

UK real income increases | Little effect | Consumers purchase more | Trade balance weakens |

Real income increases abroad | Customers overseas purchase more UK products; exports increase | Little effect | Trade balance strengthens |

UK £ appreciates | Exports more expensive for customers overseas; exports decrease | UK consumers' money goes further abroad; imports increase | Trade balance weakens |

UK £ depreciates | Exports less expensive for customers overseas; exports increase | UK consumers' money is worth less abroad; imports decrease | Trade balance strengthens |

World economy booms | Increased demand for UK exports | Little effect | Trade balance strengthens |

World economy slows | Decreased demand for UK exports | Little effect | Trade balance weakens |

Protectionism increases | Depends on retaliation measures from other countries | Decreased demand for imports as they are more expensive | Trade balance strengthens |

Protectionism decreases | Likely to increase | Increased demand for imports as they are less expensive |

Aggregate supply

the total supply of goods and services available to a particular market from producers.

why SRAS is upwards sloping

The SRAS curve is upward sloping due to two reasons

The aggregate supply is the combined supply of all individual supply curves in an economy which are also upward sloping

As real output increases, firms have to spend more to increase production e.g. wage bills will increase

Increased costs result in higher average prices

SRAS

Influenced by changes in the costs of production

where at least one factor of production is fixed

LRAS

Influenced by a change in the productive capacity of the economy

changes in the quality and quantity of FoP

factors affecting SRAS

Change in Condition | Explanation | Impact on SRAS |

|---|---|---|

Increase in costs of raw materials/energy | As the price of input costs rise, fewer goods/services can be produced with the same amount of money | SRAS decreases - shifts left |

Decrease in costs of raw materials/energy | As the price of input costs decrease, more goods/services can be produced with the same amount of money | SRAS increases - shifts right |

Appreciation of E/R | Producers often import raw materials | SRAS increases - shifts right |

Depreciation of E/R | Producers often import raw materials | SRAS decreases - shifts left |

Decrease in tax rates | Taxes represent an additional cost for firms | SRAS increases - shifts right |

Increase in tax rates | Taxes represent an additional cost for firms | SRAS decreases - shifts left |

The classical LRAS view

LRAS is perfectly inelastic (vertical) at a point of full employment of all available resources

in the long- run, an economy will always return to this full employment level of output

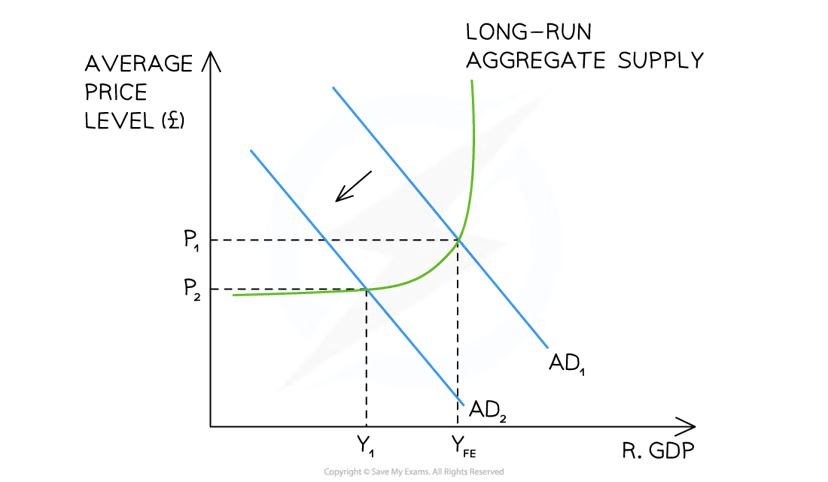

The Keynesian LRAS view

Supply is elastic at lower levels of output as there is a lot of spare production capacity in the economy

The Keynesian view believes that an economy will not always self-correct and return to the full employment level of output (YFE)

factors influencing LRAS

Technological advances: these often improve the quality of the factors of production e.g. development of metal alloys

Changes in relative productivity: process innovation often results in productivity improvement e.g. moving from labour intensive car production to automated car production

Changes in education and skills: over time this increases the quality of labour in an economy

Changes in government regulations: these can improve the quantity of the factors of production. e.g. deregulation of fracking (extracting oil from shale deposits) increased oil reserves

Demographic changes and migration: a positive net birth rate or positive net migration rate will increase the quantity of labour available

Competition policy: regulating industries so as to prevent monopoly power results in more firms supplying goods/services in an economy and this increases the potential output of an economy