Ap Macro AP Test Review

1/145

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

146 Terms

scarcity

unlimited wants but limited recourses

opportunity cost

the most desirable alternative given up when making a choice

absolute advantage

the producer that can produce the most output or requires the least amount of input

comparative advantage

the producer with the lowest opportunity cost

PPC

shows differing options of how an economy could spend all their resources

productive efficiency

producing the largest number of products and services based on the available resources

allocative efficiency

the products being produced are the most desired by society

demand

different quantity of goods and services that consumers are willing and able to buy at different prices

law of demand

there is an inverse relationship between price and quantity demanded

supply

different quantity of goods and services that businesses are willing and able to supply at different prices

law of supply

there is a direct relationship between price and quantity supplied

when demand goes up what happens to equilibrium price

PL goes up

when demand goes down what happens to equilibrium price

PL goes down

when supply goes up what happens to equilibrium price

PL goes down

when supply goes down what happens to equilibrium price

PL goes up

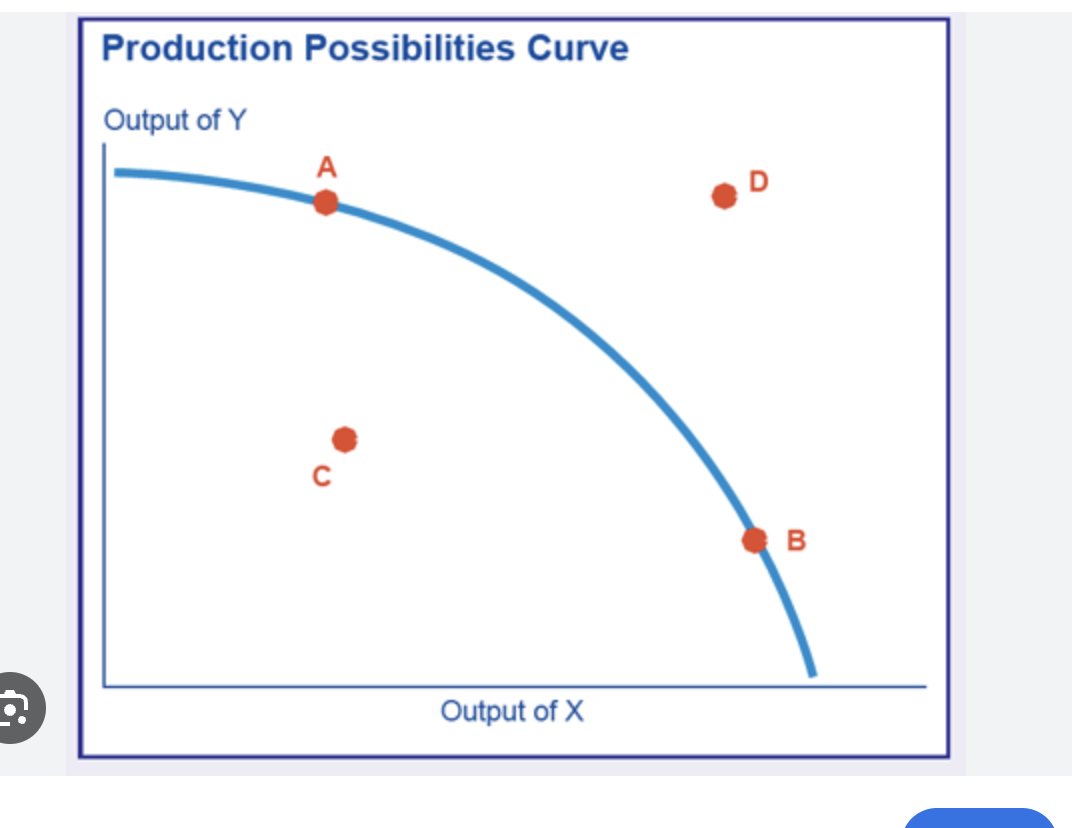

which is a PPC in a negative output gap

point C

which is a PPC at full employment

point A or B

which is a PPC in a positive output gap

point D

the production of which good causes long run economic growth

capital goods because they are used to make consumer goods

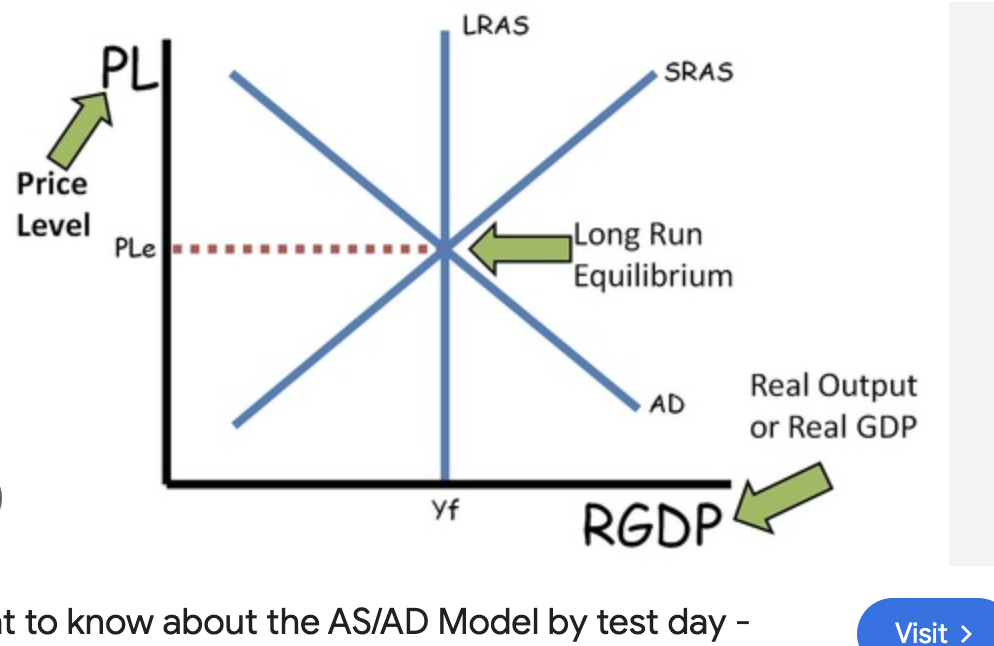

which is an AS/AD curve is in equilibrium

the circular flow model

demonstrates how money moves from producers to consumers and back in an endless loop

product market

where final goods and services are sold to households and foreign sector

factor market

resources that businesses use to purchase, rent or hire what they need to make goods and services

leakage

parts of income earned and currently spend on goods and services

gross domestic product

dollar value of all final goods and services produced in a ciuntry in a year

GDP per capita

GDP divided by the total population, it identifies on average how many products each person makes and it is the best measurement of quality of life)

standard of living

average quantity/quality of goods and services people in a country can afford to consume

factor payments

payments made by businesses for the factors for production

unemployment

people that are actively looking for a job but not working

natural rate of unemployment

frictional + structural unemployment

full employment

the r-GDP when there is no cyclical unemployment

inflation

rising general prices, reduces the purchasing power of money

inflation rate

% change in price level from year to year

price indices

index number assigned to each year to show how price level changes relative to specific base year

CPI

most commonly used measurement of inflation for consumers

labor force participation formula

civilian LF total/everyone x 100

unemployment rate formula

# unemployed/# in CLF x 100

% change in GDP formula

year 2- year 1/year 1 × 100

CPI formula

price of market basket/price of MB in base yr x 100

GDP deflator formula

nominal GDP/real GDP x 100

expenditures approach

C+I+G+(X-M)

C= consumer spending

I= investment spending

G= government spending

(X-M)= net exports

income approach

W+R+i+Pr

W= wages

R= rent

i= interest

Pr= profit

what are the 3 macroeconomic goals of all countries

promote economic growth

limit unemployment

keep prices stable (limit inflation)

what are the items not included in GDP calculations

intermediate goods

non production transactions

non market transactions

illegal transactions

frictional unemployment

temporary unemployment or being in between jobs

structural unemployment

changes in labor force make skills obsolete (technological unemployment)

cyclical unemployment

unemployment caused by a recession

who is helped by inflation

borrowers and businesses because the money they pay backs worth less than the money they borrow

who is hurt by inflation

lenders and savers because the money they get paid back has less purchasing power than the money they lent out

nominal GDP

GDP not adjusted for inflation

real GDP

GDP that is adjusted for inflation

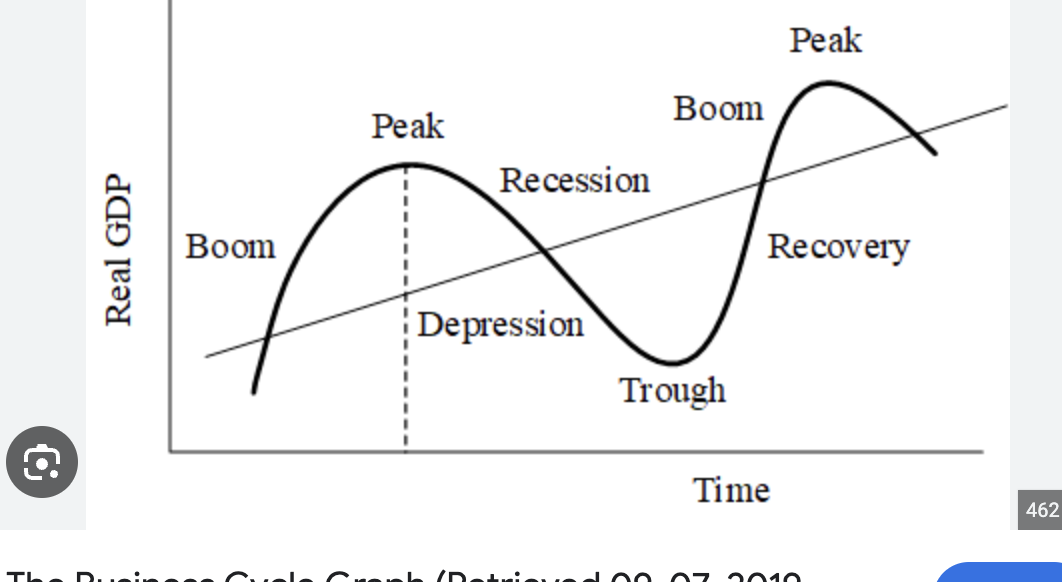

business cycle graph

aggregate demand

all the goods and services that buyers are willing and able to buy at differing price levels (same as GDP)

shifters of aggregate demand

C+I+G+Xn

C= consumer spending

I= investment spending

G= government spending

Xn= net exports

investment

an attempt to stimulate economic production by means of creating or acquiring capital goods

short-run aggregate supply

shows when wages and resource prices are sticky and WILL NOT change as price levels change

shifters of short run aggregate supply

RAP

change in resource prices

change in actions of the government

change in productivity

long run aggregate supply

shows when wages and resource prices are flexible and WILL change as price level changes

stagflation

the combination of high consumer price inflation with stagnant economic growth

the multiplier effect

says that an initial change in spending will set off a spending chain that is magnified in the economy

marginal propensity to consume

how much people consume rather than save when there is a change in their disposable income

marginal propensity to save

how much people save rather than consume there is a change in their disposable income

autonomous consumption

says consumers will spend a certain amount of money no matter what regardless of their income

fiscal policy

actions by the congress that stabilize the economy through government spending or taxation

automatic stabilizers

part of the government budget that offsets fluctuations in aggregate demand

discretionary fiscal policy

when congress creates a new bill that is designed to change the aggregate demand through government spending or taxation

non-discretionary fiscal policy

permanent spending and taxation laws enacted to work counter cyclically to stabilize the economy

MPC formula

1-MPS or change in consumption/change in disposable income

MPS formula

1-MPC or change in savings/change in disposable income

spending multiplier formula

1/MPS or 1/1-MPC

tax multiplier formula

MPC/MPS or the spending multiplier-1

when consumer spending increases what happens to real GDP

it increases

when interest rates increase what happens to investment

it decreases

when inflation increases what happens to real wages

they decrease

when aggregate demand increases what happens to price level

it increases

when short run aggregate supply increases what happens to price level

it decreases

when government spending increases what happens to real GDP

it increases

when taxes increase what happens to disposable income

it decreases

when MPC increases what happens to MPS

it decreases

shifters of long run aggregate supply

same as PPC shifters

change in resource quantity or quality

change in technology

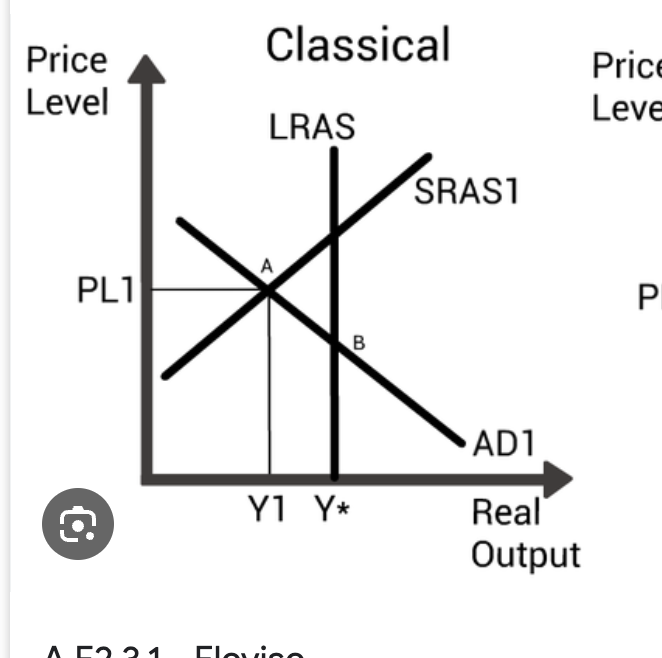

which shows negative output gap on AS/AD graph

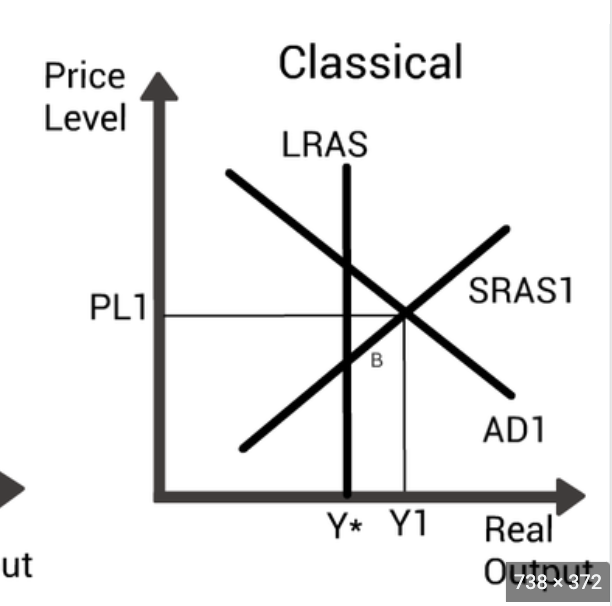

which shows positive output gap on AS/AD graph

demand pull inflation

when demand for goods and services rises faster than the supply

cost push inflation

when there is a decline in the supply of goods and services and the demand remains unchanged

what are the 3 main causes of inflation

demand pull

cost push

inflationary expectations

what are the 2 tools of fiscal policy

contractionary and expansionary fiscal policy

what are the 3 time lags of fiscal policy

recognition lag

administrative lag

operational lag

expansionary fiscal policy

laws that reduce inflation and decrease GDP by decreasing spending or increasing taxes

contractionary fiscal policy

laws that reduce unemployment and increase GDP by increasing spending or decreasing taxes

financial sector

network of institutions that link borrowers and lenders

assets

anything tangible or intangible that has value

liabilities

financial obligations that a bank must pay to a consumer and they must be repaid when requested

interest rates

the amount a lender charges a borrower for borrowing money

stocks

represent ownership of a corporation and the holder is often entitled to a portion of the profit

bonds

loans or IOUs that represent debt that the government, businesses, or an individual must repay to the lender

nominal interest rate

the percent increase in money that the borrower pays not adjusted for inflation

real interest rate

the percent increase in money that the borrower pays adjusted for inflation

commodity money

something that performs the function of money and has intrinsic value

fiat money

something that serves as money but has no other intrinsic value

purchasing power

amount of goods and services one unit of money can buy