Strategic Management Exam 2

1/158

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

159 Terms

Unicorns

Private firms with a valuation of $1 billion at IPO

Public Stock Company Benefits

Limited liability for investors

Transferability of investor ownership

Has it’s own legal personality

Separation of legal ownership and management control

Issues with Public Companies: Responsibility

Some believe that “the social responsibility of business is to increase its profits” - Milton Friedman, Others (Michael Porter) believe companies should create shared value.

Shared Value

Economic value (for shareholders) + Social value (address society’s needs and challenges)

Issues with Public Companies

Responsibility?

Principal-Agent Problem

Principal-Agent Problem

When there’s a separation of legal ownership and management control, and the agent doesn’t act in the principal’s best interest.

Principle = Shareholders, Agent = Executives

Shared Value Creation Framework

Provides guidance to managers

Helps reconcile:

Gaining and Sustaining competitive advantage with corporate social responsibility

Creates a larger “pie” to benefit shareholders & stakeholders

ESG Criteria

A set of standards beyond mere financial results on which companies are evaluated. (Environment, Social, Governance)

Shareholder Capitalism

The social responsibility of business is to increase its profits - Milton Friedman

Competitive Advantage

A firm that achieves superior performance relative to other competitors in the same industry or the industry average. Always relative, not absolute

3 Ways to assess performance

Accounting profitability

Shareholder value creation

Economic value creation

Accounting Profitability

Accurately assess firm performance using standardized accounting metrics

Compares firm performance to competitors/industry average

Available through

Standardized accounting metrics

10-K statements

Profitability Ratios

Return on invested capital (ROIC)

= Net income/invested capital

Return on Equity (ROE)

= Net income/total shareholders equity

Return on Assets (ROA)

= Net income/total assets

Limitations of Accounting Data

Historical and thus backward-looking

Does not consider off-balance sheet items, such as:

Pension obligations

Leasing obligations

Focuses mainly on tangible assets

May not be the most important in explaining firms performance

E.g., innovation, quality, customer experience.

Shareholder Value Creation

An assessment of how much value a firm creates for its shareholders

Shareholders

Owns shares of stock in a company

The legal owners of public companies

Return on Risk Capital

= total returns to shareholders

Money provided for an equity share in a company

Cannot be recovered if the firm goes bankrupt

Measures of Shareholder Value Creation

Market Capitalization

Dollar value of total shares outstanding

= (Number of shares outstanding) x (Share Price)

Total Return to Shareholders (return on risk capital)

Stock price appreciation plus dividends

Limitations of Shareholder Value Creation

Stock prices can be highly volatile

Makes it difficult to assess firm performance

Macroeconomic factors affect stock price

Economic growth or contraction

Unemployment, interest, and exchange rates

Stock prices can reflect the mood of investors

Can be irrational

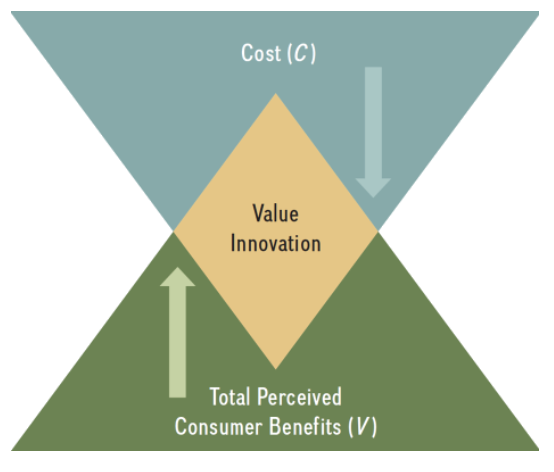

Economic Value Creation

The difference between:

A buyer’s willingness to pay for a product/service

And the firm’s total cost to produce it

The difference between value (V) and cost (C)

Competitive advantage can be based on:

Economic value creation because of superior product differentiation

Or a relative cost advantage over rivals

Reservation Price

= Total perceived consumer benefit + Maximum willingness to pay

Value

The dollar amount a consumer attaches to a good or service; the consumer’s maximum willingness to pay; also called reservation price.

Producer Surplus

The difference between the price changed (P) and the cost to produce (C)

Consumer Surplus

The difference between what you were willing to pay (V) and what you paid (P)

Both parties

_____ capture some of the value created. (Economic Value Created: Producer and Consumer surplus)

Limitations of Economic Value Creation

Determining value for consumers is not simple

The value of a good in the eyes of consumers changes.

Based on income, preference, time, and other factors

To measure firm-level competitive advantage, we must estimate the economic value created for all products and services offered by the firm.

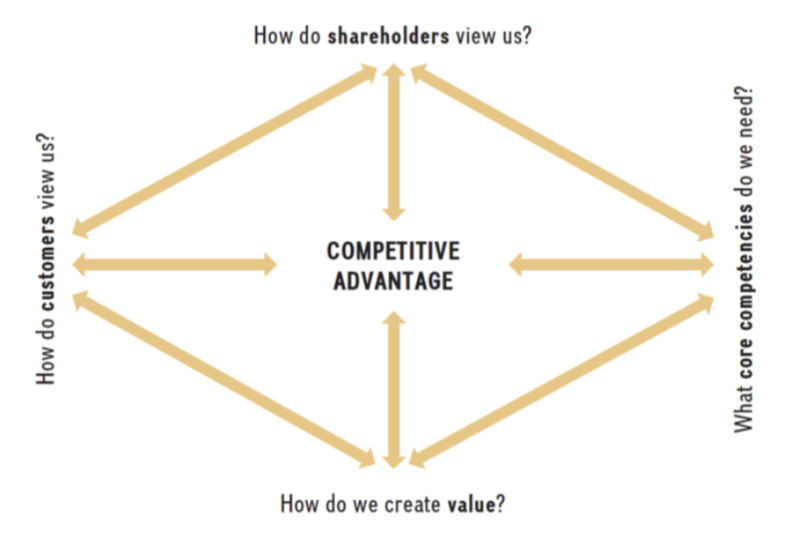

2 main holistic frameworks to measure firm performance

The balance scorecard

The triple bottom line

The balanced scorecard

Helps managers achieve their strategic objectives more effectively

Uses internal and external performance metrics

Balances both financial and strategic goals

Questions for Balanced Scorecard

How do customers view us?

How do we create value?

What core competencies do we need?

How do shareholders view us?

How do customers view us?

Metrics → Revenue, profit, customer stisfaction

How do we create value?

Metrics → Competitiveness, innovation, organizational learning

What core competencies do we need?

Metrics → Core competencies, supporting business processes

How do shareholders view us?

Metrics → Cash flow, operating income, ROIC, ROE, total returns to shareholders

Advantages of the Balanced Scorecard

Links the strategic vision to responsible parties

Translates the vision into measurable goals

Designs and plans business processes

Implements feedback and organizational learning

Alerts to needed strategic goal adaptation

Disadvantages of the Balanced Scorecard

Focused on strategy implementation

Not formulation

How to get back on track if deviations occur.

Limited guidance:

Which metrics to use?

How to address setbacks?

The Triple Bottom Line

Three dimensions fundamental to sustainable strategy:

Profits: The economic dimension [The business must be profitable to survive]

People: The social dimension [Emphasizes the people aspect]

Planet: The ecological dimension [Emphasizes the relationship between business and the natural environment]

![<p>Three dimensions fundamental to sustainable strategy:</p><ol><li><p>Profits: The economic dimension [The business must be profitable to survive]</p></li><li><p>People: The social dimension [Emphasizes the people aspect]</p></li><li><p>Planet: The ecological dimension [Emphasizes the relationship between business and the natural environment]</p></li></ol><p></p>](https://knowt-user-attachments.s3.amazonaws.com/e0fd569e-79dc-437e-8b97-2de2a800bafb.png)

What is business level strategy?

Goal-directed actions managers take

To achieve competitive advantage

In a single product market

How should we compete?

How should we compete?

Who: which customer segments will we serve?

What: customer needs will we satisfy?

Why: do we want to satisfy them?

How: will we satisfy out customers’ needs?

Strategic Position

A strategic profile based on value creation and cost in a specific product-market

Firms attempt to stake out a valuable and unique position, which:

Meets customer needs

Maximizes product value

Lowest possible product cost

Strategic Trade-offs

Choices between a cost or value position

There is tension between:

Value creation and Pressure to keep cost in check

Purpose to maximize the firm’s:

Economic value creation

Profit Margin

Generic Business Strategies

Differentiation and Cost Leadership

Focused Business Strategies

Narrower competitive scope

Focused differentiation

Focused cost leadership

Differentiation Strategy

Unique features that increase value, so that consumers are willing to pay a higher price

The focus of competition(drivers):

Unique product features

Customer Service

New product launches

Marketing & promotion

Competitive advantage achieved when:

(Value - Cost) > competitors

Product features

Increases perceived value

Turns commodity products into differentiated products

Strong R&D capabilities are often needed

Unique features » Higher price

Customer Service

Increases perceived value

Offers things like free shipping

Representatives do not use scripts, etc.

Complements

Add value to a product/service when consumed in tandem

Cost Leadership Strategy

Goals:

Reduce cost below competitors

Offer adequate value

Reduce prices for customer

Optimize the value chain to achieve low-cost

Can achieve a competitive advantage as long as its economic value created (V - C) is greater than that of its competitor

4 cost drivers that help keep costs low

Cost of input factors

Economies of scale

Learning-curve effects

Experience-curve effects

Cost of Input factors

Input factors such as:

Raw materials

Capital

Labor

IT services

Economies of Scale

Decreases in cost per unit as output increases, allow firms to:

Spread fixed costs over a larger output

Employ specialized systems and equipment

Take advantage of certain physical properties.

Learning curve effects

Learning drives down costs

It takes less time to produce the same output

We learn how to be more efficient

People learn from cumulative experience

Writing computer code

Developing new medicines

Building submarines

First noted shortly before WWII (aircraft manufacturing)

When production doubled, per-unit cost dropped 20%

Experience Curve Effects

When technology is changed while output is constant

Process facilitated with advanced tech

Differentiation Strategy Benefits

Can contribute to low threat of entry & low threat of substitutes

Customer loyalty

Differentiation Strategy Risks

When differentiated products are commoditized, lose competitive advantage

Need to be careful not to overshoot its differentiated appeal (can increase costs, not perceived value)

Cost Leadership Strategy Benefits

Strengths when a price war ensues

Economies of scale allows to further lower prices.

Cost Leadership Strategy Risks

High risk of replacement if a potent substitute emerges due to innovation

Potential to lose competitive advantage when the focus shifts from price to non-price attributes

Successful Business Strategy

A ___________:

Leverages the firm’s internal strengths

Mitigates internal firm weaknesses

Exploits external opportunities

Avoids external threats

There is no single correct business strategy for a specific industry

Choose a strategy that:

Provides a strong position that attempts to maximize economic value creation

Is effectively implemented

Blue Ocean Strategy

Successfully combining differentiation and cost-leadership activities

Uses value innovation to reconcile trade-offs

The metaphor of ______ means:

Untapped market space

The creation of addition demand

The opportunity for highly profitable growth

Value Innovation

Accomplished through the simultaneously pursuing differentiation (V /\) and low cost (C \/)

Lowering Cost Questions

Eliminate: which of the factors that the industry takes for granted should be eliminated?

Reduce: Which of the factors should be reduced well below the industry’s standards?

Increasing perceived consumer benefits questions

Raise: Which of the factors should be raised well above the industry’s standards?

Create: Which factors should be created that the industry has never offered?

Stuck in the middle

Blue Ocean gone wrong, when no one wants a slightly differentiated, slightly cost leadership product. (Also think Red Ocean of strong competitors)

The Strategy Canvas

Graphical depiction of a company’s performance

Relative to its competitors

Shows focus of divergence

Viewed across the industry’s key success factors

The value curve

Horizontal connection points

Located on the strategy canvas

Helps strategists determine courses of action.

Industry Effects

Industry Attractiveness

5 forces model

Complements

Within Industry

Strategic Groups

Firm Effects

Value Position

Relative to competitors

Cost Position

Relative to competitors

Business Strategy

Cost leadership

Differentiation

Blue Ocean

Economies of Scope

A proportionate saving gained by producing two or more distinct goods, when the cost of doing so is less than that of producing each separately.

Minimum efficient scale (MES)

The lowest point on a long-term average cost curve where a company can produce a product as a competitive price

Waves

Innovation often comes in _________.

Foundational

Initial Innovations are _________ for other rapid innovations.

The four I’s of the innovation process

Idea

Invention

Innovation

Imitation

Idea

Abstract concepts or research findings

Invention

Transformation of an idea into a product

The modification and recombination of products

Patents in invention is useful, novel, and non-obvious

Double edged sword - some firms use trade secrets

Innovation

Commercialization of an invention

First-mover advantages

Doesn’t have to be high-tech; firms can achieve innovation through other tactics

Imitation

Copying a successful innovation

Entrepreneurship

The process by which change agents undertake economic risk to innovate

Create new products, processes, and organizations

Create value for society

Commercialize ideas and inventions

Strategic Entrepreneurship

Pursuit of innovation using strategic tools and concepts

Combining entrepreneurial actions

Creating new opportunities

Exploiting existing opportunities

Social Entrepreneurship

Pursuit of social goals while creating profitable businesses

Evaluate performance by financial, ecological, and social contribution metrics

Triple-bottom-line approach

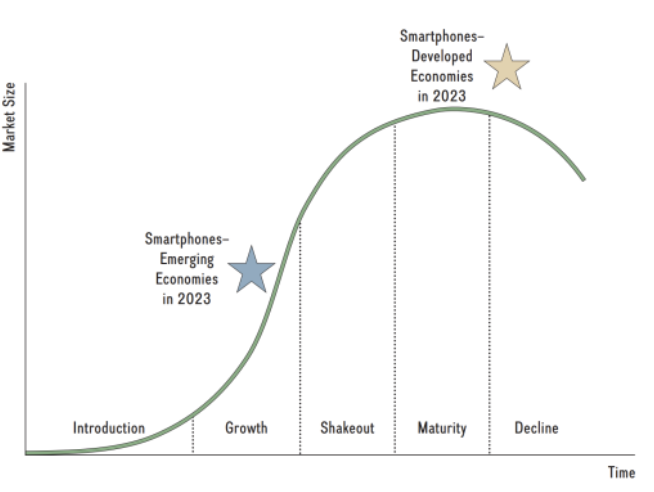

The industry Lifecycle Over time:

The number of size of competitors change

Different types of consumers enter the market

The supply and demand sides of the market change

Different competencies are needed for the firms to perform well

The industry lifecycle

Introduction → Growth → Shakeout → Maturity → Decline

Introduction Stage

When an entrepreneur can transform an invention to an innovation, a new industry emerge.

Core competency: Research and development (R&D)

Necessary to create a product category that will attract customer.

Can be very capital-intensive (high costs).

Barriers to Entry are high.

Emphasize unique product features rather than price

Strategic objective: market acceptance & future growth

Growth Stage

Demand increases rapidly

First-time buyers rush to purchase.

Proof of concept has been demonstrated

Product/service standard emerge

A common set of features and design choices

Emerges from competition, government, or agencies

Product innovation

New or recombined knowledge embodied in new products, Higher in the beginning of an industry life cycle

Process Innovation

New ways to produce existing products, higher in the middle section of a product life cycle

Shakeout Stage

The rate of growth declines

Firms begin to intensely compete

Weaker firms are forced out

Industry consolidation

Only the strongest competitors survive

Price is an important competitive weapon

Maturity Stage

Only a few large firms remain (oligopoly)

They enjoy economies of scale

Process innovation has reached a maximum

Demand: replacement or repeat purchases

Market has reached maximum size

Industry growth is zero or negative

Decline Stage

Demand falls rapidly

Innovation efforts cease

If a breakthrough emerges, it leads to a new industry or resets the life cycle

Strong pressure on prices

Crossing-the-chasm framework

Different customer groups responding to innovation/the different customer groups at each stage of a life cycle.

Technology Enthusiasts

Entering the market in the introduction stage.

Pursue new technologies proactively

Seek new products before they are officially introduced

Provide feedback and suggestions to companies

Often pay a premium price to have the latest gadget.

Early Adopters

Entering the market in the growth stage

Eager to buy early into a new technology or product concept

Early Majority

Entering the market in the shakeout stage

Practicality drives them

Weigh the benefits and costs carefully before adopting a new product

Winning them over is critical to the commercial success of the innovation.

Late Majority

Entering the market in the maturity stage

Not confident in their ability to master the new technology

Prefer well-established firms with a strong brand image

Laggards

Entering in the declining stage.

Don’t want new technology, generally not considered worth pursuing

Increment Innovation

Existing market, existing technology

Radical Innovation

New market, new technology

Architectural Innovation

Leverages existing technology into a new market

Disruptive Innovation

Leverages new technologies in existing markets

Exploration

Searching for new knowledge that may enhance a firm’s future performance (risk-taking, experimentation, search)

Related to radical changes

Exploitation

Applying current knowledge to enhance firm performance in the short term (refinement, execution, implementation)

Related to incremental changes

Ambidexterity

Balancing exploration with exploitation