7a. Government failure

0.0(0)

Card Sorting

1/4

Earn XP

Description and Tags

Last updated 1:07 PM on 4/18/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

5 Terms

1

New cards

Law of unintended consequences

Government intervention can have negative unintended consequences.

E.g. a tax on cigarettes can create a black market where cigarettes are sold without tax.

E.g. a tax on cigarettes can create a black market where cigarettes are sold without tax.

2

New cards

Administration costs

The miscellaneous costs of government intervention.

E.g. paperwork, legal fees, secretaries, managers.

E.g. paperwork, legal fees, secretaries, managers.

3

New cards

Information gaps

When the government lacks the information needed to intervene most efficiently.

E.g. the government doesn’t know what size to set for its carbon tax.

E.g. the government doesn’t know what size to set for its carbon tax.

4

New cards

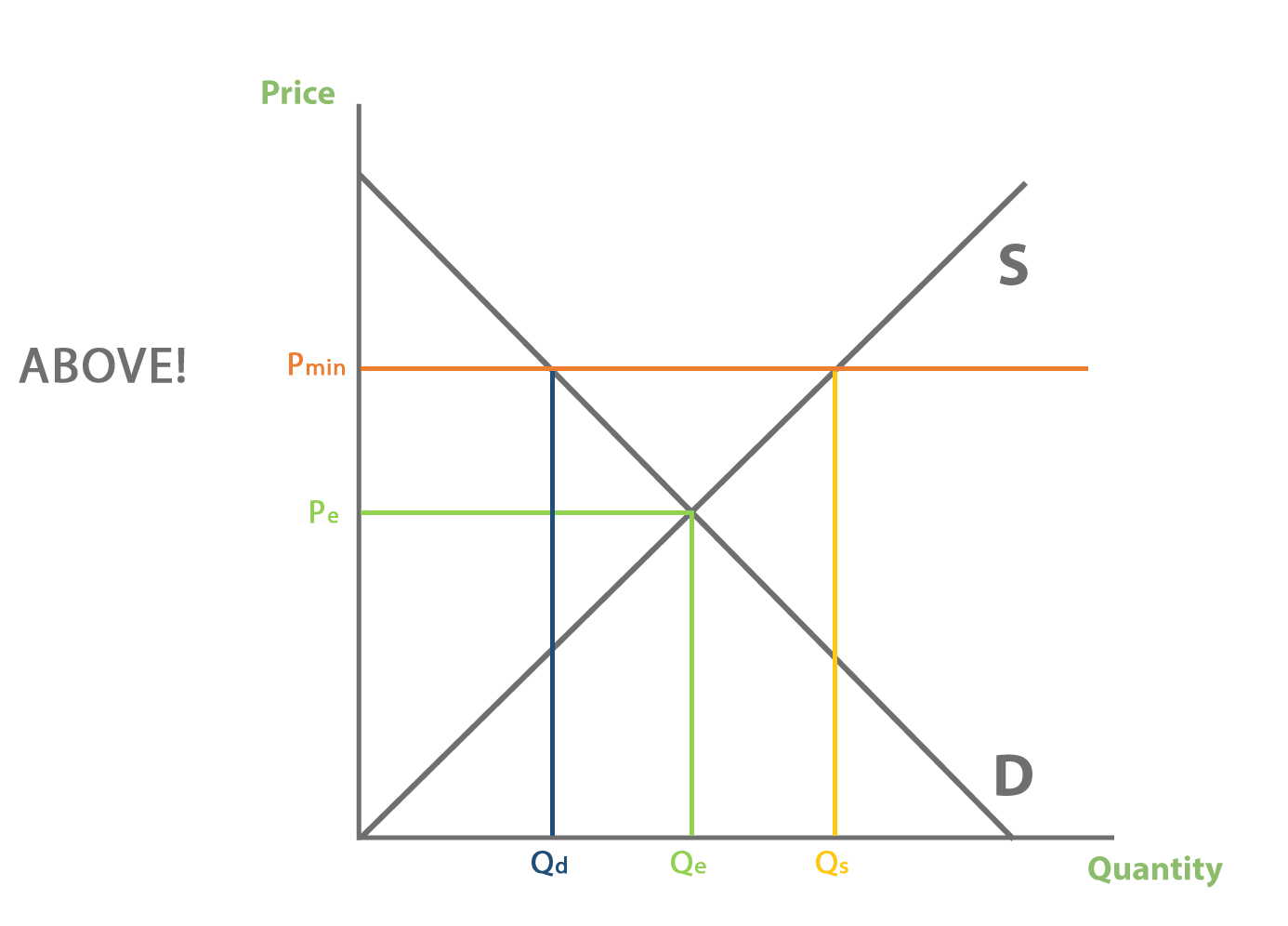

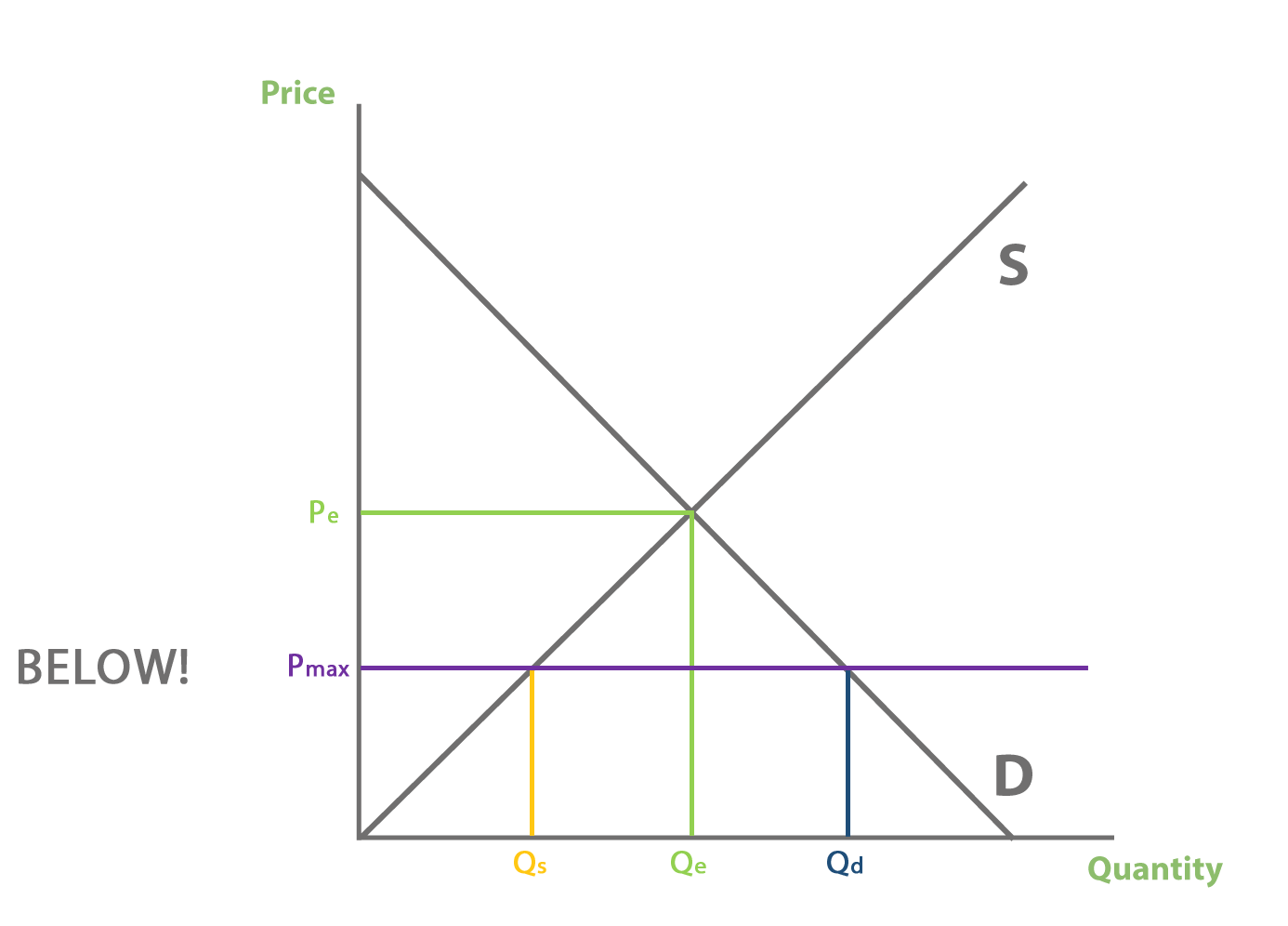

Distortion of the price mechanism

Government intervention can distort the price mechanism.

E.g. a minimum price will create excess supply between Qd and Qs:

*at front*

E.g. a maximum price will create excess demand between Qs and Qd:

E.g. a minimum price will create excess supply between Qd and Qs:

*at front*

E.g. a maximum price will create excess demand between Qs and Qd:

5

New cards