ECO 202 Module 10: Perfect Competition

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

18 Terms

perfect competition

many sellers and buyers

identical products/services

“perfect information” for each customer

no barriers to entry or exit

market structures

models of how the firms in a market will interact with buyers to sell their output

perfectly competitive markets

monopolistically competitive markets

oligopolies

monopolies

ordered from most competitive to least competitive

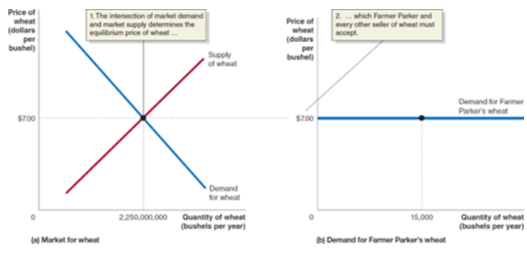

price takers

buyers or sellers that are unable to affect the market price because they are tiny relative to the market and sell exactly the same product as everyone else

feature in perfectly competitive markets

demand curve is horizontal

actions of one consumer or firm don’t affect the market price, but their collective actions do

maximizing profit in a perfectly competitive market

profit = total revenue - total costs

in PCM, price = average revenue = marginal revenue

P = TR/Q = change in TR/ change in Q

in PCM, demand curve = marginal revenue curve

average revenue

total revenue divided by the quantity of the product sold TR/Q

marginal revenue

change in total revenue from selling one more unit of a product

deltaTR/deltaQ

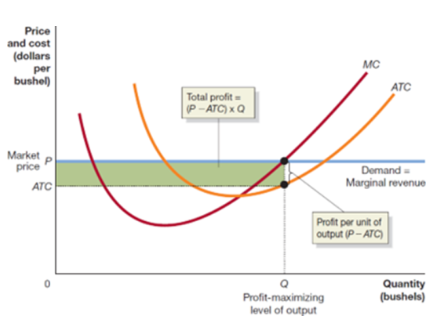

rules for profit maximization

the profit-maximizing level of output is where the difference between total revenue and total cost is the greatest

the profit-maximizing level of output is also where marginal revenue = marginal cost

profit is maximized by producing as long as marginal revenue>marginal cost or until MR=MC

the profit-maximizing level of output is also where price = marginal cost

only true for perfectly competitive firms

profit

profit = (price - average total cost) * quantity

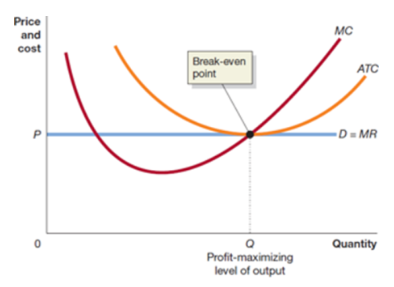

Can the firm make a profit?

at MC = MR, if:

P>ATC, the firm is making a proft

P=ATC, the firm is breaking even

P<ATC, the firm is making a loss

holds true at every level of output

produce or shut down in the short run

if the firm shuts down, it will still need to pay fixed costs, so the firm needs to decide to incur only fixed costs or produce and incur some variable costs but also obtain some revenue

fixed costs should be ignored becuase they are sunk costs, so shut down decision is based on variable costs:

if total revenue < variable costs, firm should shut down

(TR< VC = (P*Q)<VC = P<AVC

if price >/= AVC, then MC=MR rule applies and firm should produce

shutdown point

the minimum point on a firm’s AVC curve. if price falls below this point, the firm shuts down production in the short run

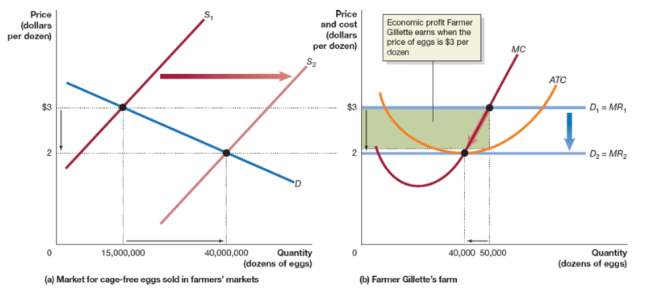

economic profit

a firms’s revenues minus all of its implicit and explicit costs

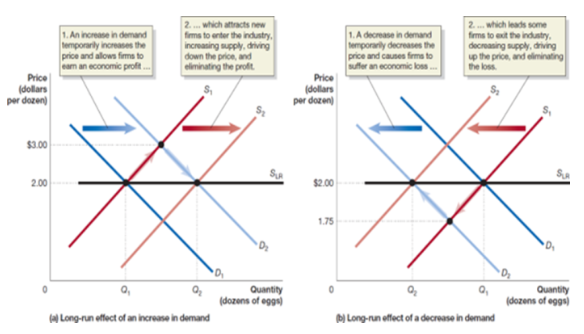

leads to entry of new firms - supply curve will shift right, decreasing the market price and economic profit

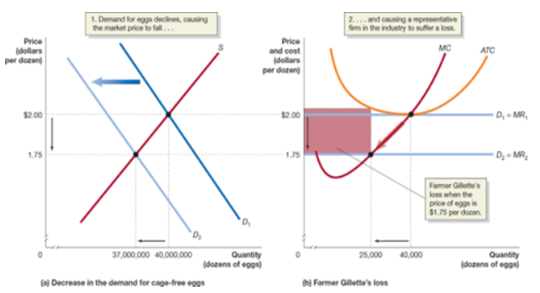

economic loss

firm’s total revenue is less than its total cost, including all implicit costs

causes firms to leave, causing supply curve to shift left, increasing price again

long-run equilibrium in PCM

situation in which the entry and exit of firms has resulted in the typical firm breaking even

in the long run, the market will supply any demand by customers at a price equal to the minimum point on the typical firm’s average cost curve

long-run supply curve is horiztonal at this price

constant cost industries

industries where the production process is infinitely replicable, modeled by the horizontal supply curve

increasing cost industry

cost of inputs rise as industries expand, have an upward-sloping supply curve

decreasing cost industry

costs may fall as industry expands, have downward-sloping supply curve

efficiency in PCM

PCM are productively efficient because goods and services are produced at the lowest possible cost

PCM are allocatively efficient because they produce in line with consumer preferences, to the point where MB=MC