Personal finance SUCKS bruh so annoying

1/50

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

51 Terms

budget deficit

spending more than you take in (debt)

budget surplus

the government cullects more money than it spends

shriking economy

high unemployment, low GDP, low CPI

expanding economy

low unemployment, high GDP, high CPI

ecomonmic growth/ GDP ideal rate

2.5 - 3.5%

unemployment ideal rate

3.5 - 4.5%

Consumer Price Index/ CPI ideal rate

2%

expansionary policy

dececrease percentages, decrease unemployment

contractionary policy

increase percentages, increase unemployment

3 purposes of the Fed

Regulate payment system, regulate banks, set monetary policy

what is the FOMC

fed. open market committee - implements monetary policy. made up of 7 BOG, new york bank president, and 4 other bank presidents

San Francisco

Regional bank #12

BOG

7 board of governers, 14 yr terms

Who appoints the BOG?

Appointed by president, approved by senate

4 ways monetary policy is implemented

adjust the resrve requirement, adjust discount rate, OMO, adjust intrest rate

What is OMO

The Fed buys/sells govt. securities (like bonds)

What is the Federal Reserve?

the US central bank/ lender of last resort

3 parts of the Fed

7 BOG, 12 banks, FOMC

What does GDP stand for

Gross Domestic Product

Jerome Powell

current fed. chairman

Janet Yellen

current secretary of treasury

what is fiscal policy

governments policies to influence the economy

CPI meaning

consumer price index (measure of inflation)

Who’s the father of macroeconics

John Maynard Keynes

What is bank #2

New York, New York

What is M1

the narrowest measure of money supply

what is the federal funds rate

the rate banks charge each other (CANNOT be directly influenced by Fed. reserve)

when was the fed. reserve created

1913 (federal reserve act)

2 goals of monetary policy

limit employment & control inflation

what is money supply

the total amount of currency & liquid assets in circulation at a specific time

what is the MAIN way the FOMC implements monetary policy

adjusts the IROB & RRP to raise/lower the FFR target range

the Fed dual mandate

Maximum employment & price stability

what interest rates are raised/lowered by the Fed?

IORB, ON RRP, Discount rate (in turn affects the FFR)

what is arbitrage

the act of buying and selling simultaneously for profit

what is reservation rate

the lowest rate a buyer would accept

money multiplier equation

1 divided by Reserve requirement

what is reserve requirement

the amount of $ a bank must have in supply

Inflation is…

…too much money chasing too few goods

official name for US dollar

Federal Reserve Note

what manufactures coins

The US Mint

what prints dollar bills

The Bureau of Engraving & Printing

what is the majority of US revenue from

Individual Income Taxes

3 categories of expenditures

Mandatory, Discretionary, Interest

Nominal GDP vs real GDP

nominal is w/o adjustments, real gdp adjusts for inflation

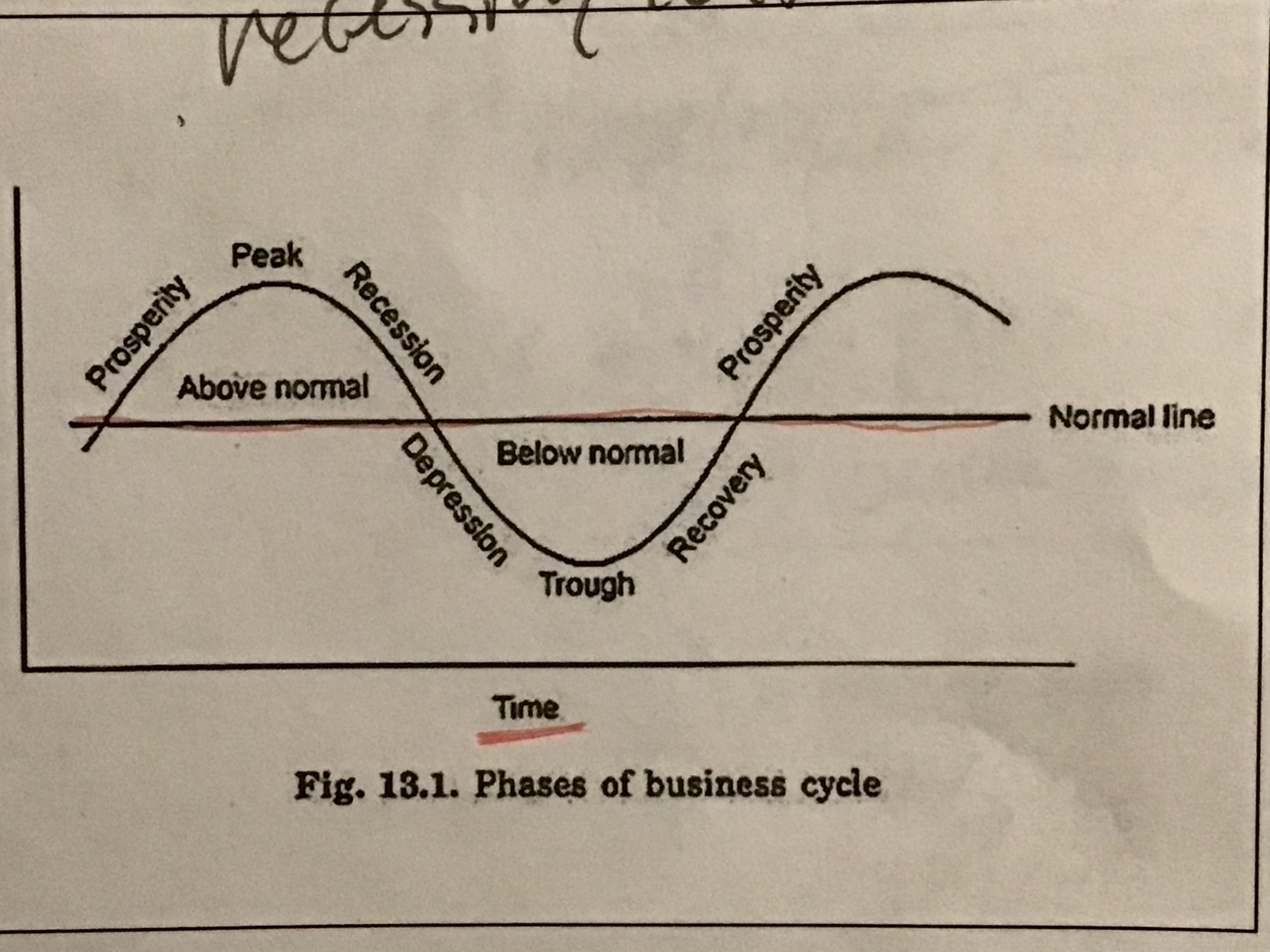

Business cycle

money is 3 things…

medium of exchange, unit of account, a store of value

6 characteristics of money

Divisible, Portable, Acceptable, Scarce, Durable, Stable

what is fractional reserve banking?

when the bank keeps a portion of each deposit then loans out the rest

what is FIAT money?

money backed by the people’s confidence. not by gold/silver

what is legal tender?

any currency declared legal by a government

how does the FFR influence us consumers?

it influences interest rates and borrowing