AP Macroeconomics Final Exam Cram Set (Read Description)

1/131

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

132 Terms

Economics

Term that describes behavior science concerned with how scarce resources are allocated among unlimited needs, wants, and desires

Factors of Production

Term that defines land, labor, capital, and entrepreneurship

Opportunity Cost

Term describing the highest value, foregone alternative to any decision made

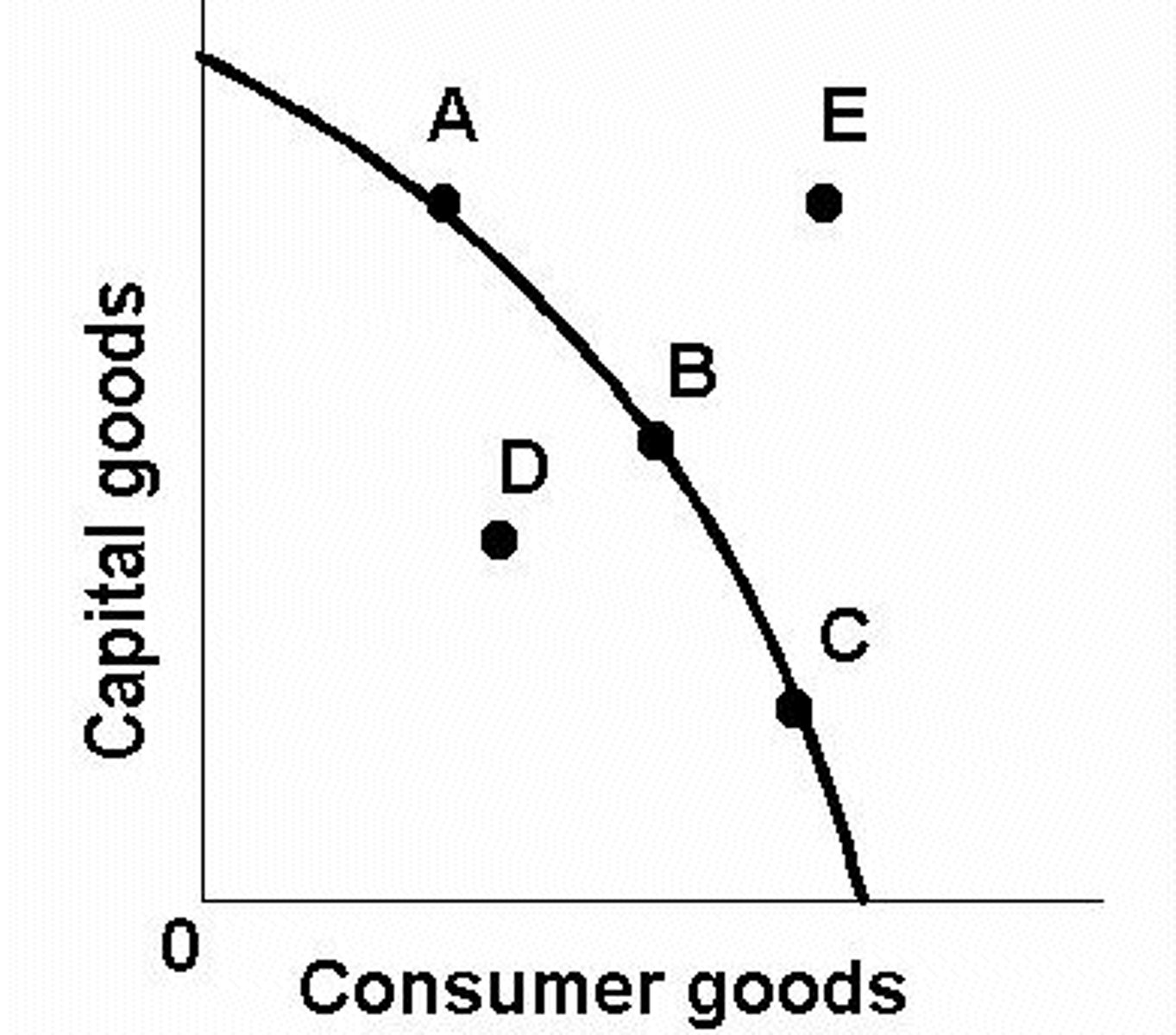

Production Possibilities Curve (PPC)

Graph describing a simplified model and economy producing only two goods or two categories of goods

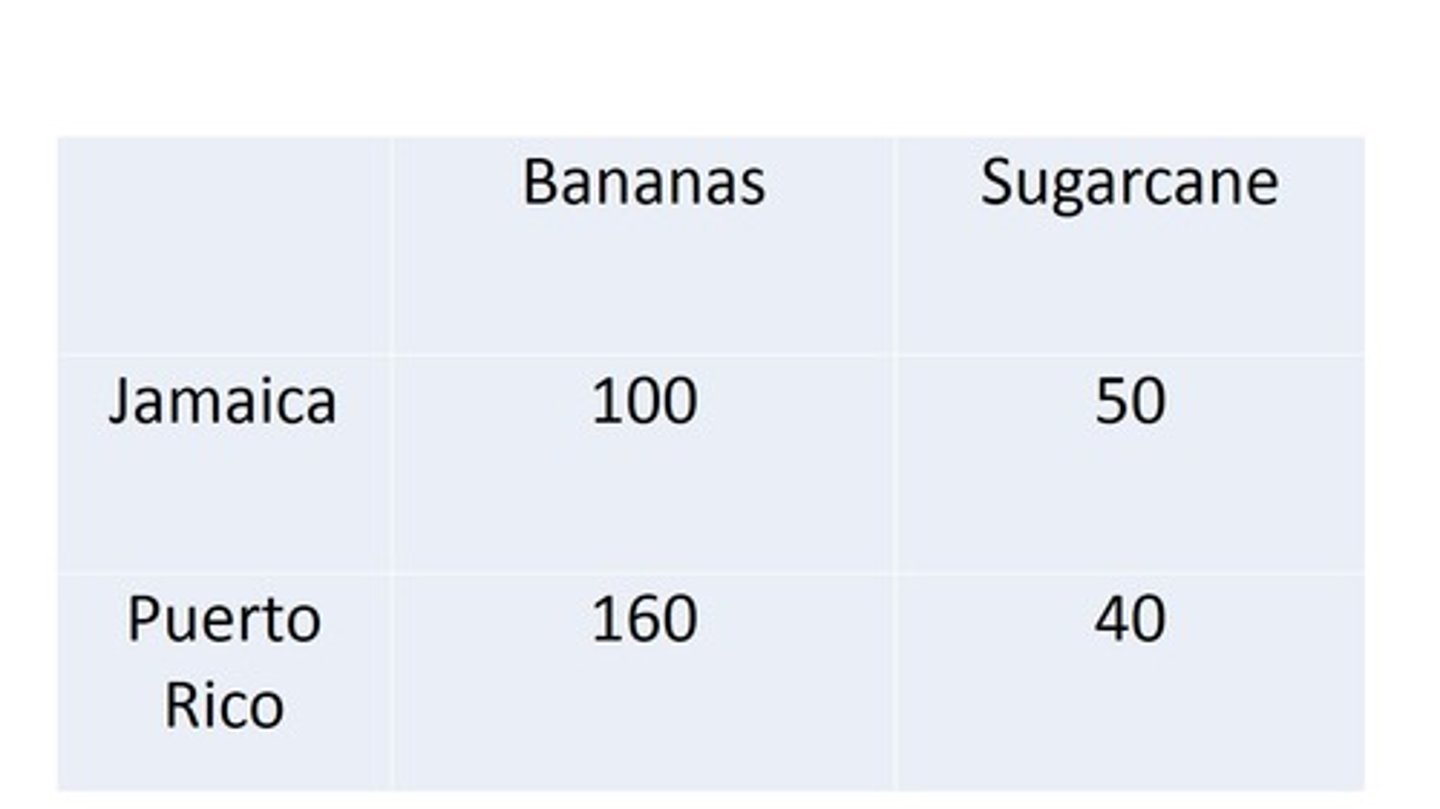

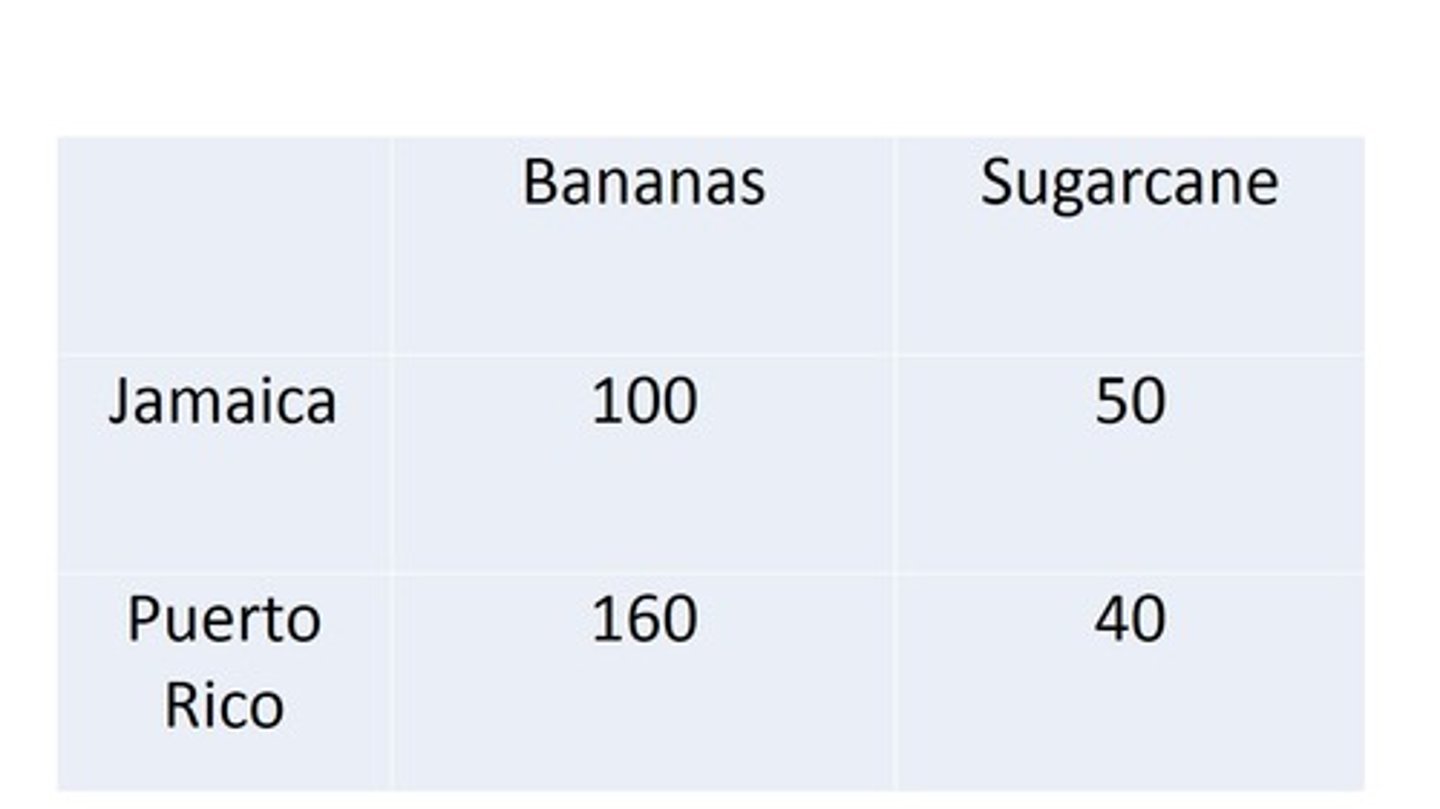

Absolute Advantage

Term for an advantage realized by the producer able to generate greater output with a given amount of time or resource

Comparative Advantage

Term for an advantage realized by the producer able to generate a given output at a lower opportunity cost

Jamaica

Who has absolute advantage in sugarcane?

Puerto Rico

Who has comparative advantage in bananas?

Terms of Trade

Term describing an agreed upon exchange rate of two goods between 2 producers

Competitive Market

Term for a market in which there are many buyers and sellers at the same good or service, none of whom can influence the price at which the good or service is sold

Law of Demand

Other things being equal, as the price increases the corresponding quantity demanded decreases

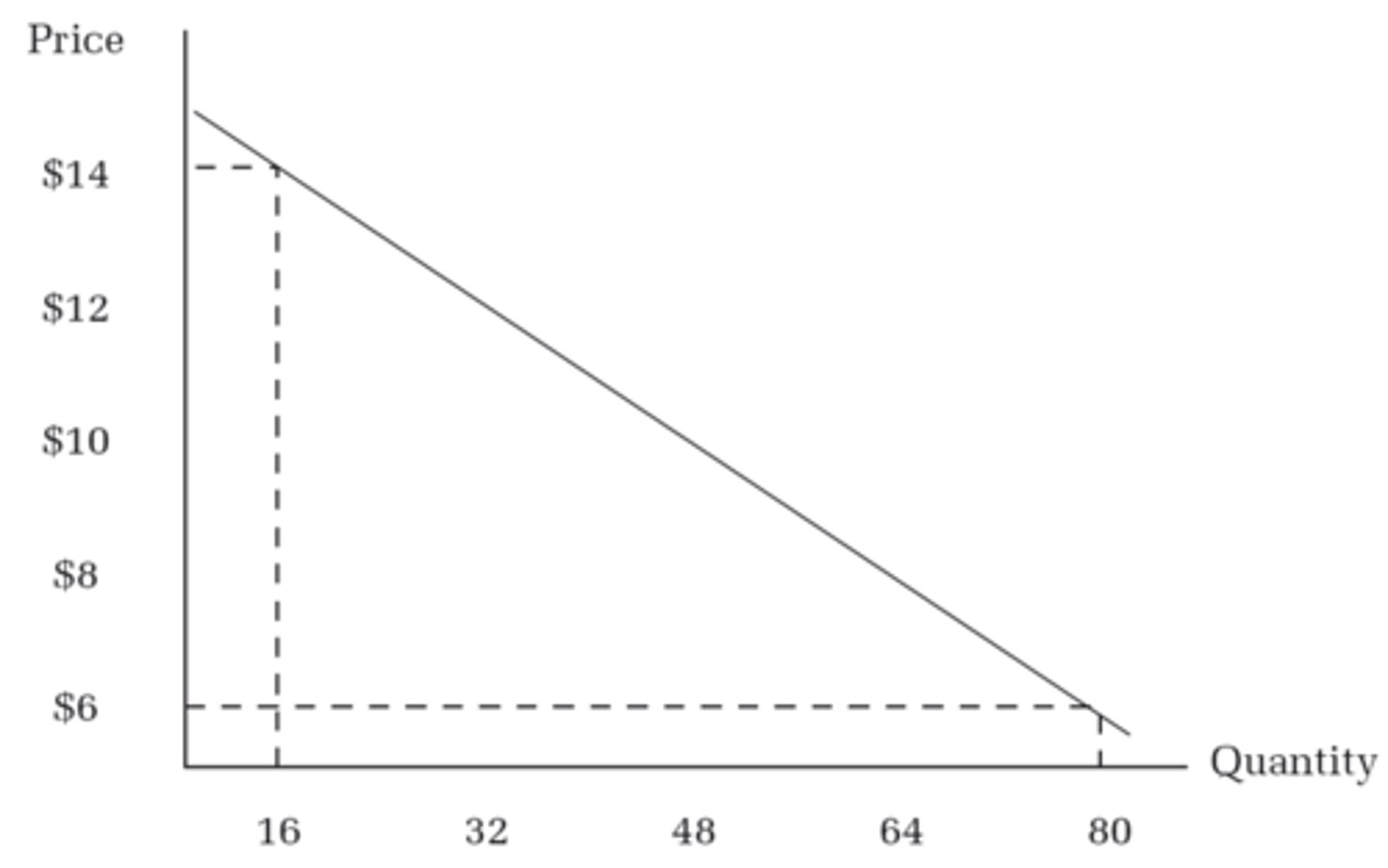

Demand Curve

Term describing a graphical representation of demand in the competitive market which shows the relationship between quantity demanded and price

Things that affect demand

Market size, expectations, related prices, income, and tastes are all...

The Income Effect

Term describing that: if real income increases then demand increases if real income decreases then demand decreases

Substitution Effect

Effect that states that if prices change for a substitute of a specific product then it will affect demand for that specific product

Elastic Demand

Demand in which changes in price have large effects on the amount demanded

Inelastic Demand

Demand in which changes in price have little or no effect on the amount demanded

Things that affect supply

Technology, related prices, input prices, competition, and expectations are all...

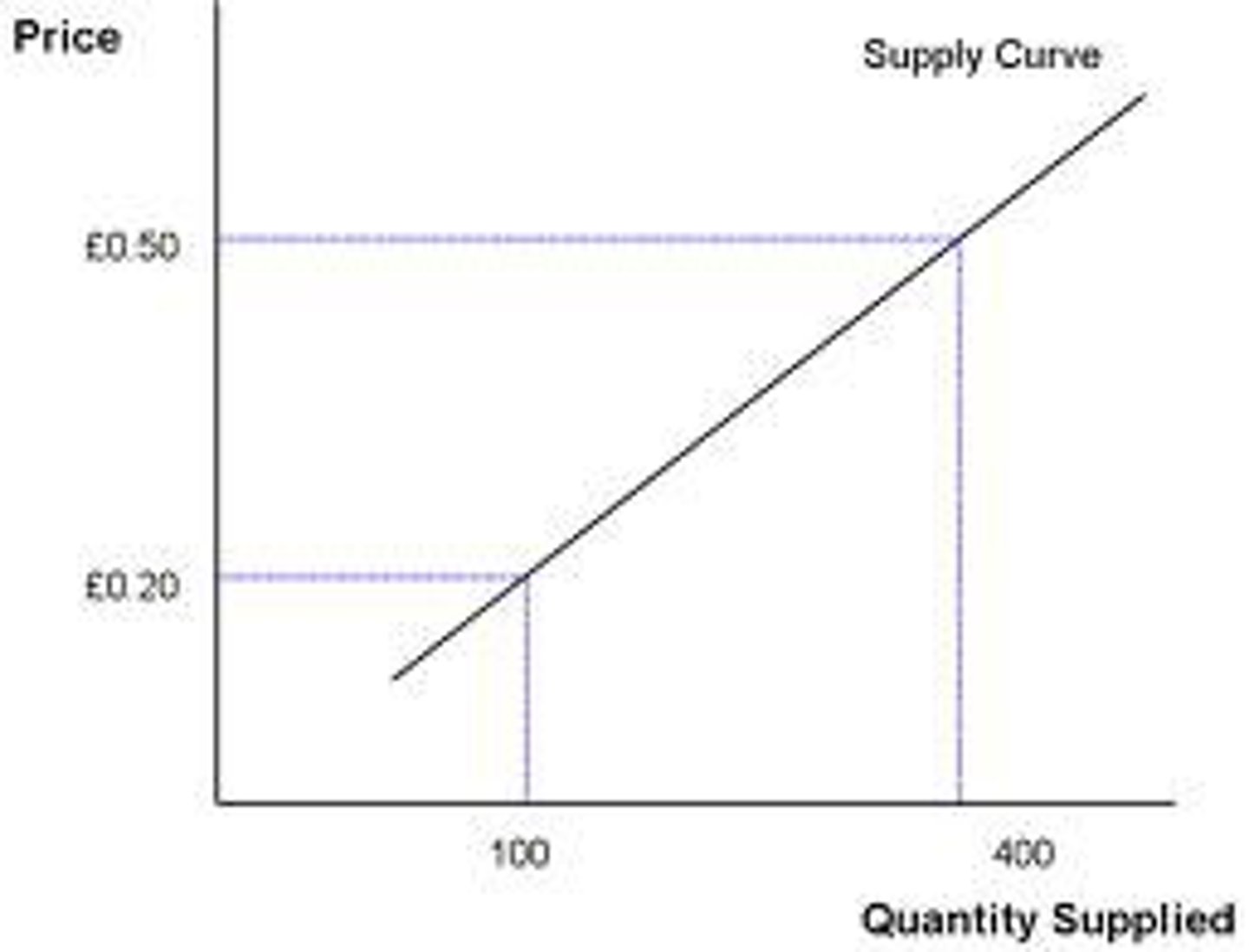

Law of Supply

Other things being equal, the price and quantity supplied of a good are positively related (the higher the price, the more will be supplied)

Supply Curve

Term describing a graphical representation of supply in a competitive market, which shows the relationship between quantity supplied and price

Surplus

Term describing what occurs when the price is above the equilibrium level

Price floor

A minimum price for a good or service

Shortage

Term describing what occurs when the price is below the equilibrium level

Price ceiling

Term describing a maximum price that can be legally charged for a good or service

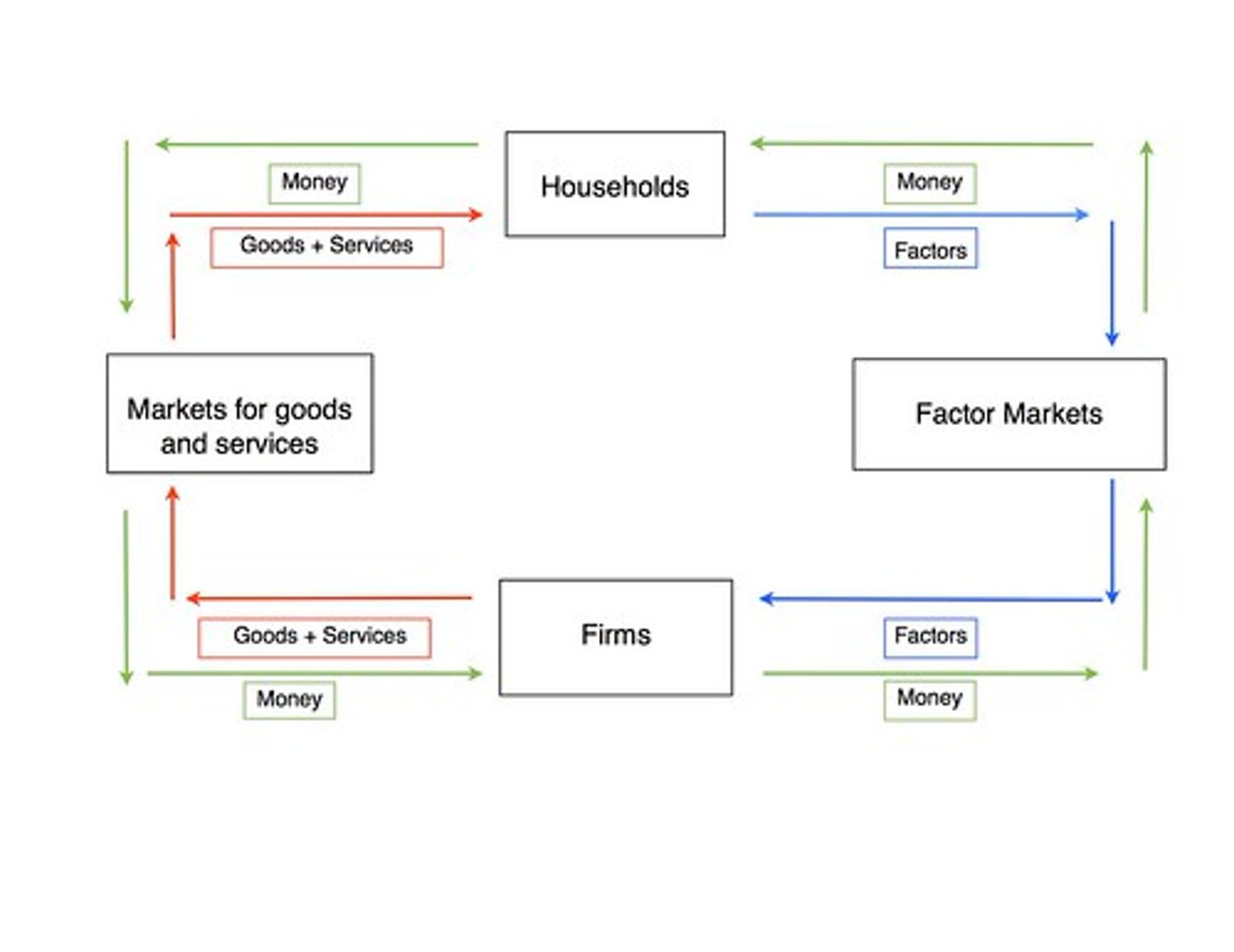

Circular Flow Diagram

Diagram describing how money flows through the economy

Gross Domestic Product (GDP)

Term describing the total market value of all final goods and services produced within the country in one year

Not included in GDP

Used or secondhand products, purely financial transactions, services provided for no money, intermediate goods and services, and foreign-produced goods and services are all...

Purely Financial Transactions

Term that describes transfer payments, such as social security, and stocks and bonds

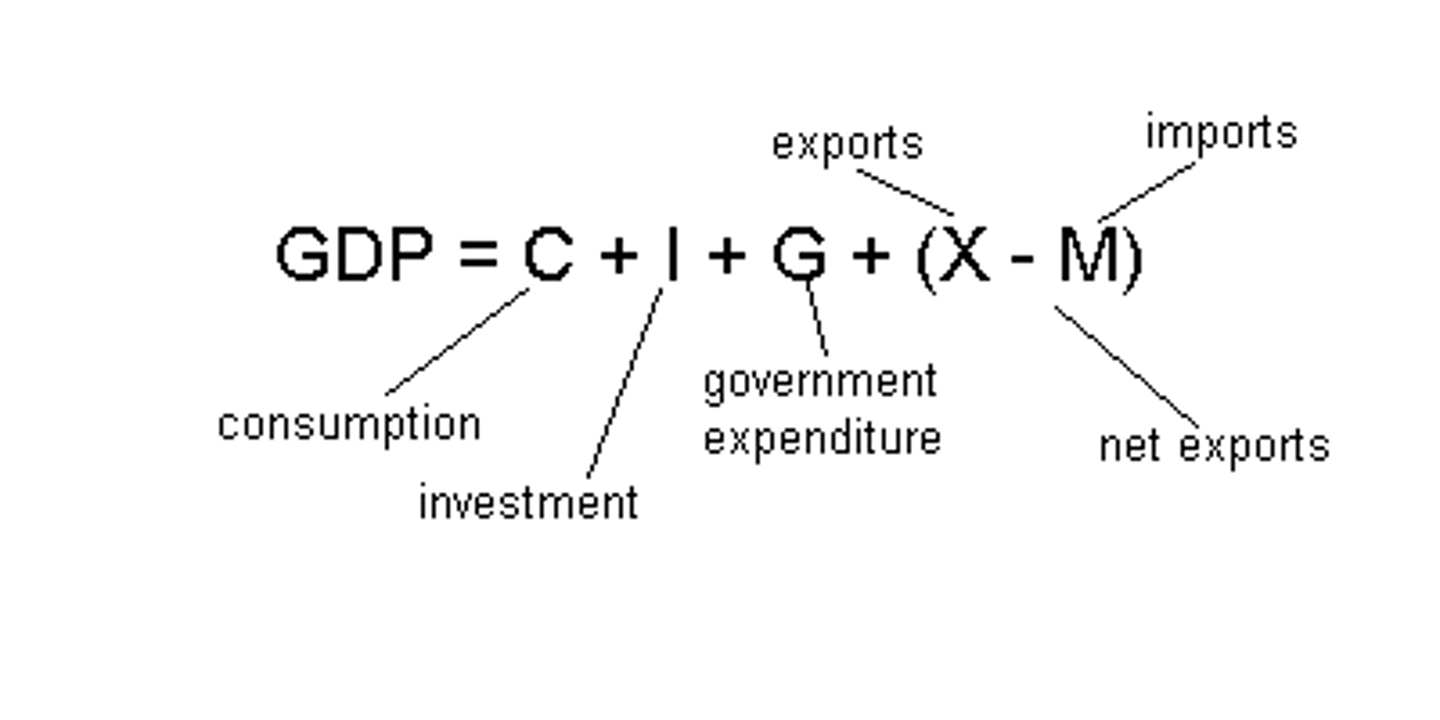

Expenditure approach of GDP

C + I + G + Xn

Employed

Term describing people who are currently holding a job in the economy, either full-time or part-time

Unemployed

Term describing people who are not working and looking for work

Labor Force

Term describing the sum of the employed and the unemployed - people who are currently working and people who are currently looking for work

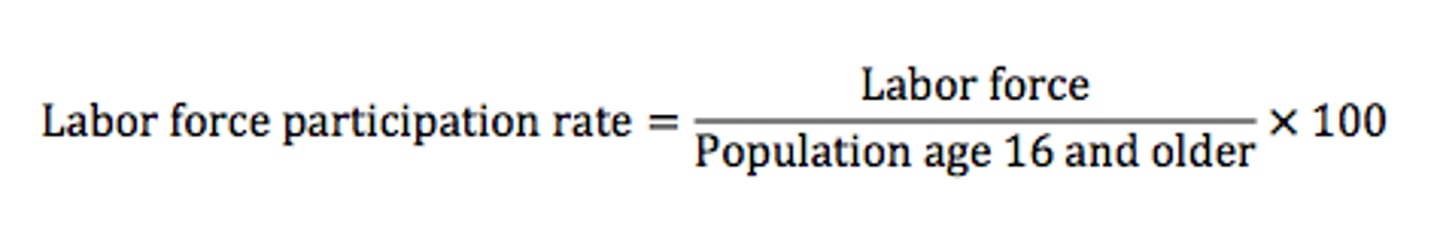

Labor force participation rate

The percentage of the population, aged 16 and older, that is in the labor force

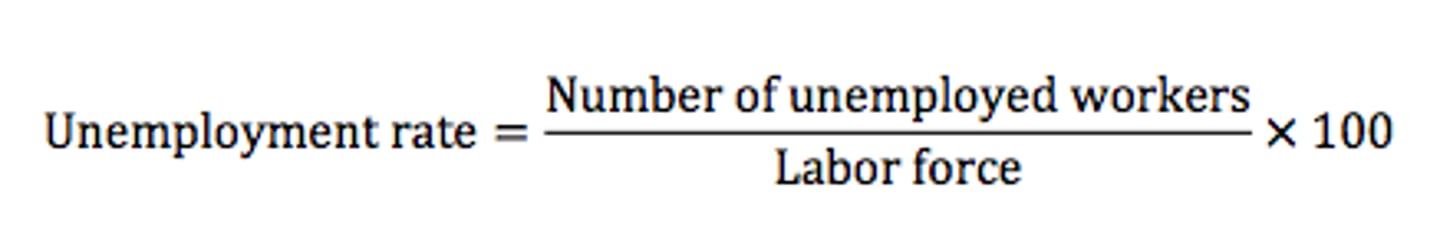

Unemployment rate

The percentage of the total number of people in the labor force who are unemployed

Discouraged workers

Term describing non-working people who are capable of working but have given up looking for a job due to the state of the job market, not included in the labor force nor the unemployment rate

Marginally attached workers

Term describing people who would like to be employed and have looked for a job in the recent past but are not currently looking for work, not included in the labor force nor the unemployment rate

Underemployed workers

People who work part-time because they cannot find full-time jobs

Frictional unemployment

Term describing unemployment due to the time workers spend in job search

Structural unemployment

Term for unemployment that occurs when workers' skills do not match the jobs that are available

Cyclical unemployment

Term describing unemployment caused by a business cycle recession

Natural Rate of Unemployment (NRU)

Frictional unemployment plus structural unemployment

Actual rate of unemployment

Natural rate of unemployment plus cyclical unemployment

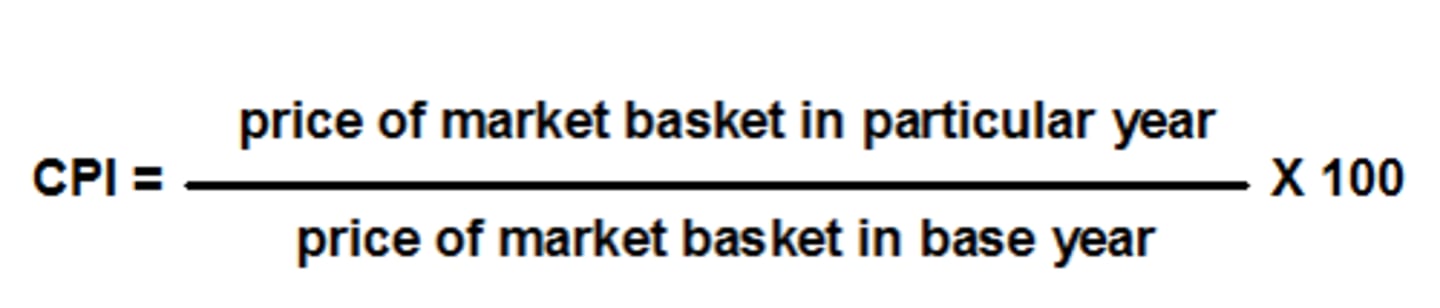

Consumer Price Index (CPI)

Term describing a measure of the average change over time in the price is paid by consumers for a fixed "market basket" of goods and services

Market Basket

Term that refers to the goods and services purchased by consumers

Consumer Price Index (CPI) formula

(Current Cost of Market Basket / Base Year Cost of Market Basket) x 100

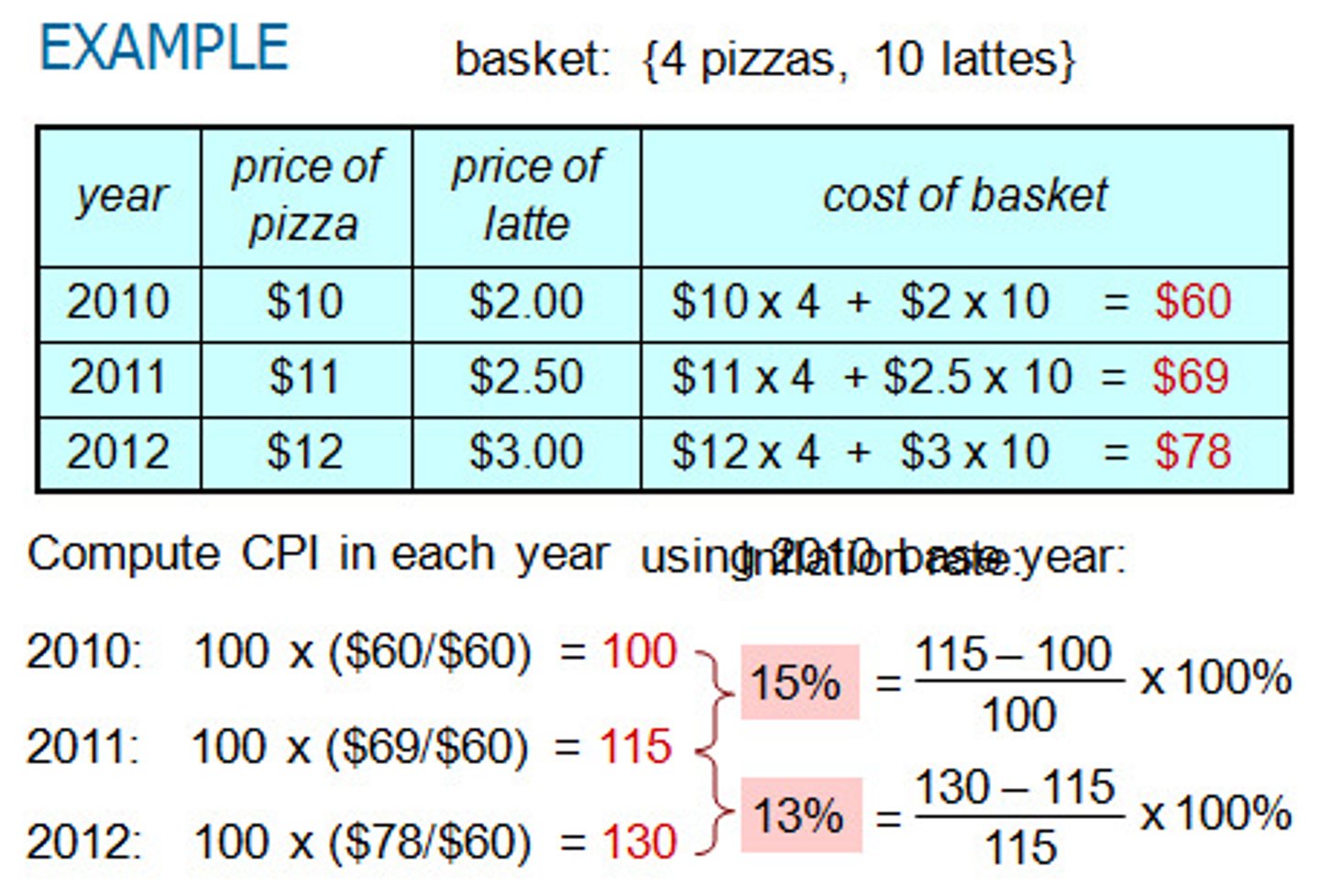

Sample Problem for CPI

Sample Problem for CPI

Nominal

Term describing variables that have NOT been adjusted for inflation

Real

Term describing variables that HAVE been adjusted for inflation

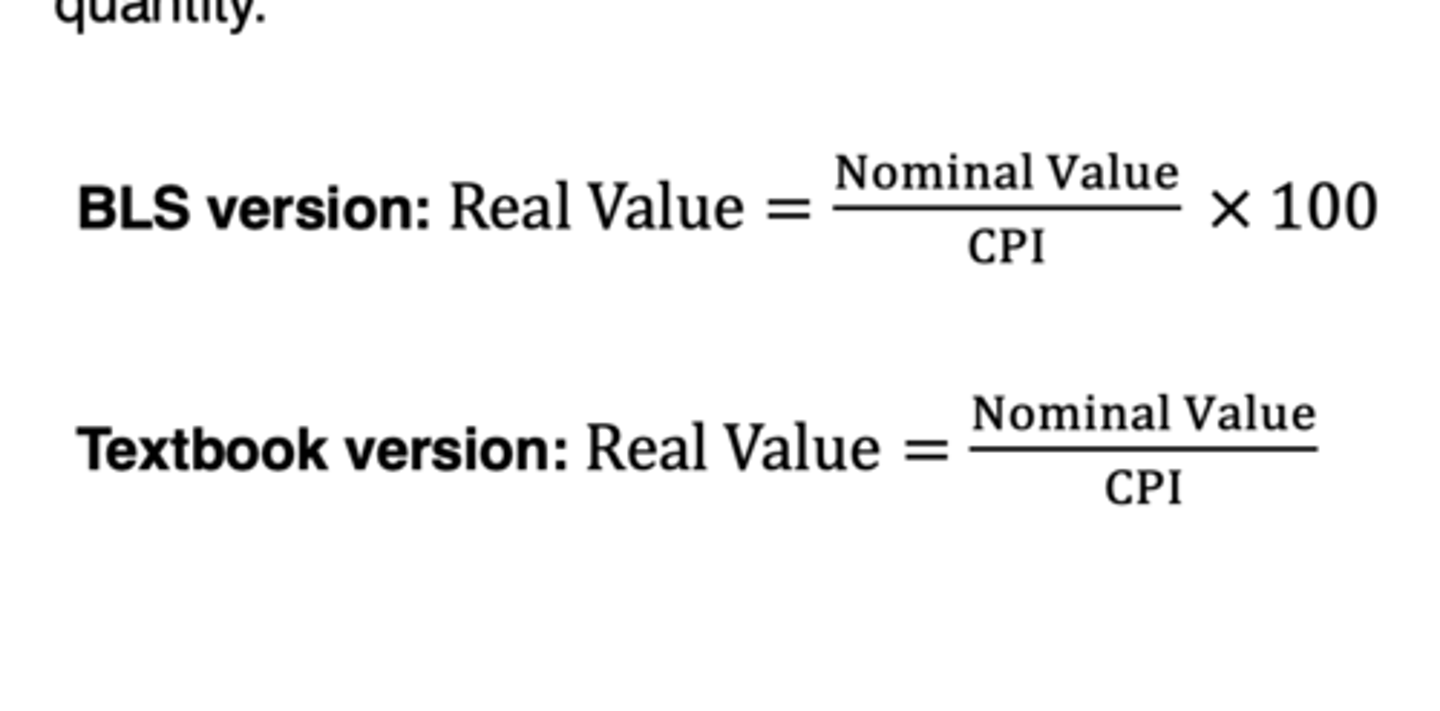

Real Value

Equation that describes how to deflate a nominal value using a price index

Shortcomings associated with the CPI

Substitution bias and introduction of new goods are both...

Unanticipated Inflation

Term describing that, when inflation is higher than expected the purchasing power of the given amount of money to be received in the future is lower than expected.

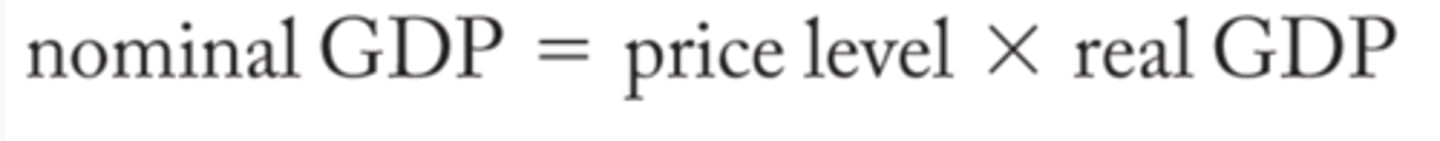

Equation for Nominal GDP

(PL * Y) where PL is price level and Y is Income

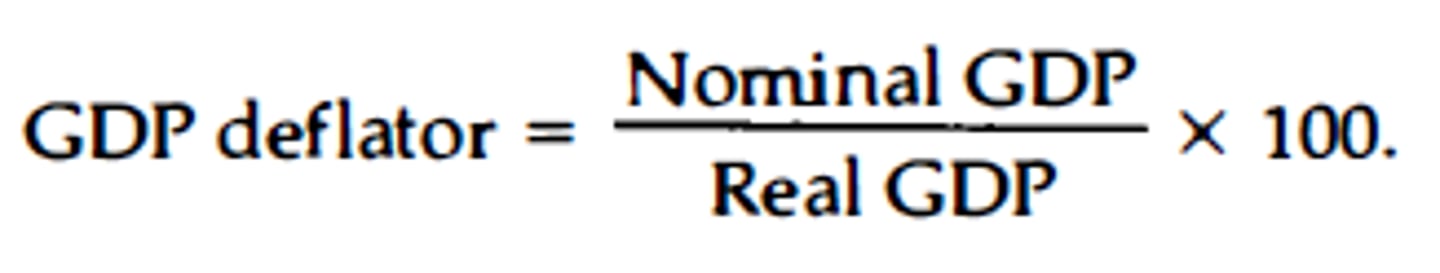

GDP Deflator

Term describing price index that measures the changes in prices for all goods and services produced in the economy in a given period, which tells us the aggregate price level

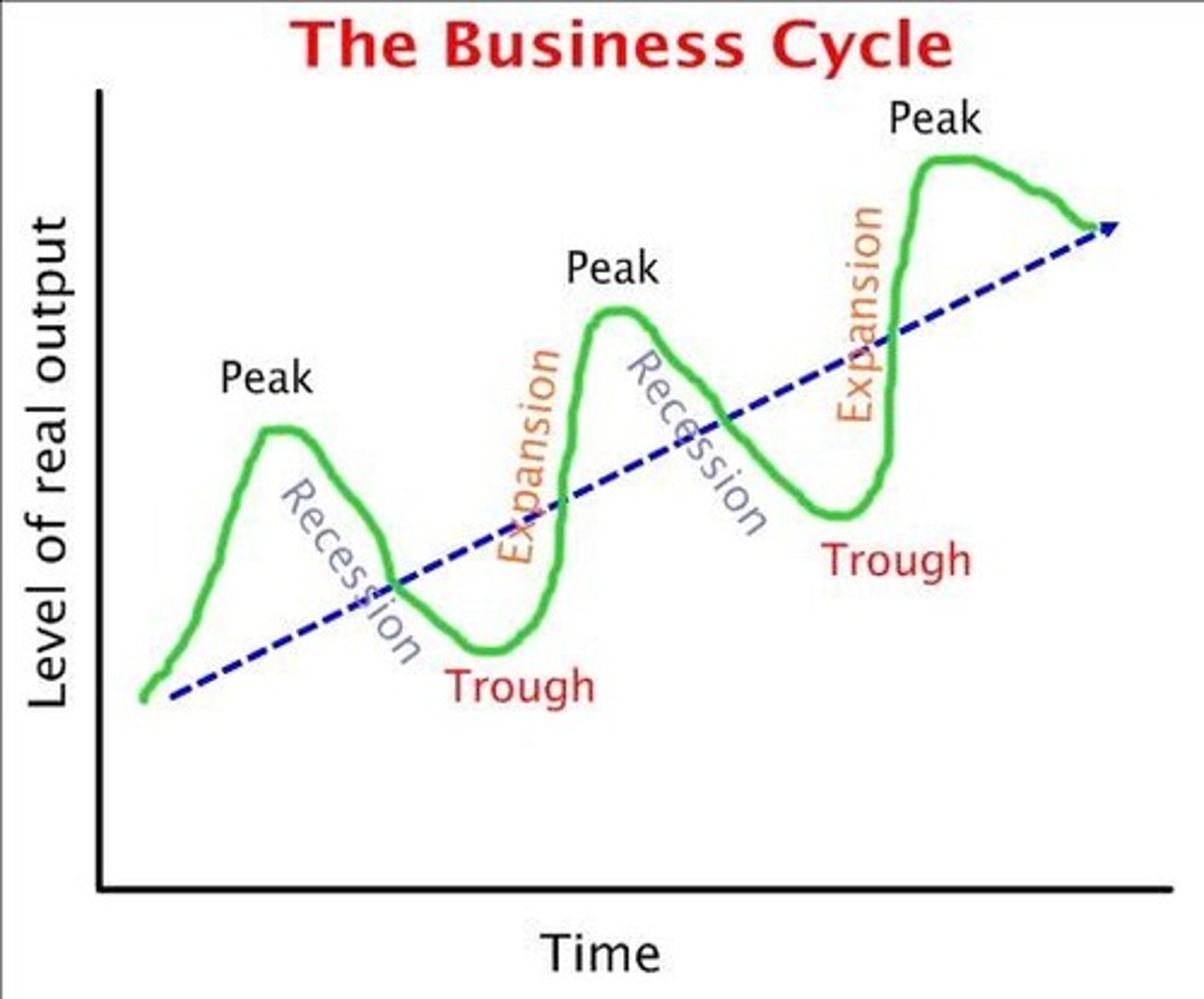

Business Cycle

Graph that shows the cycle the economy takes, where time is usually expressed in quarters

Aggregate

Term describing something added all together

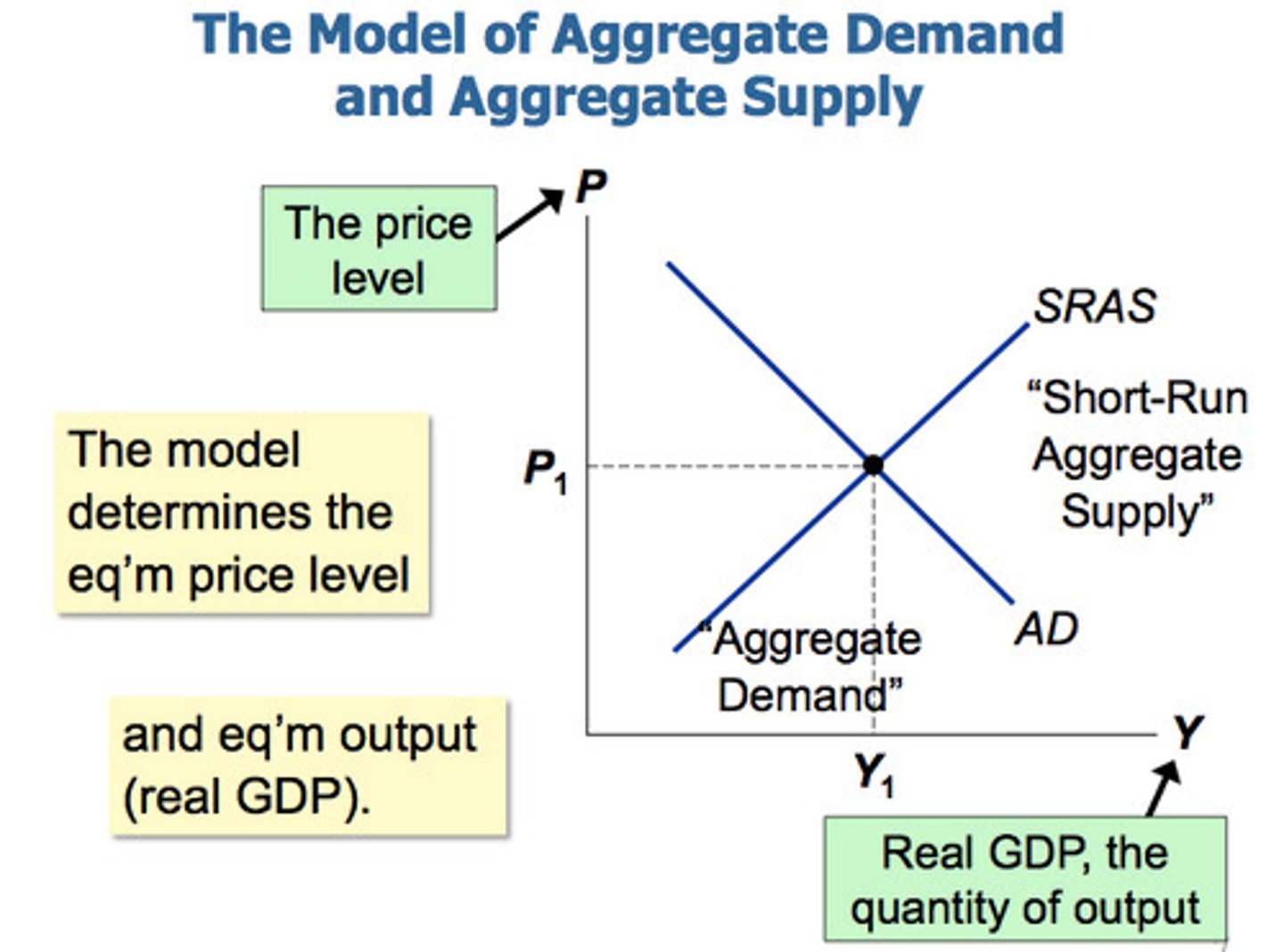

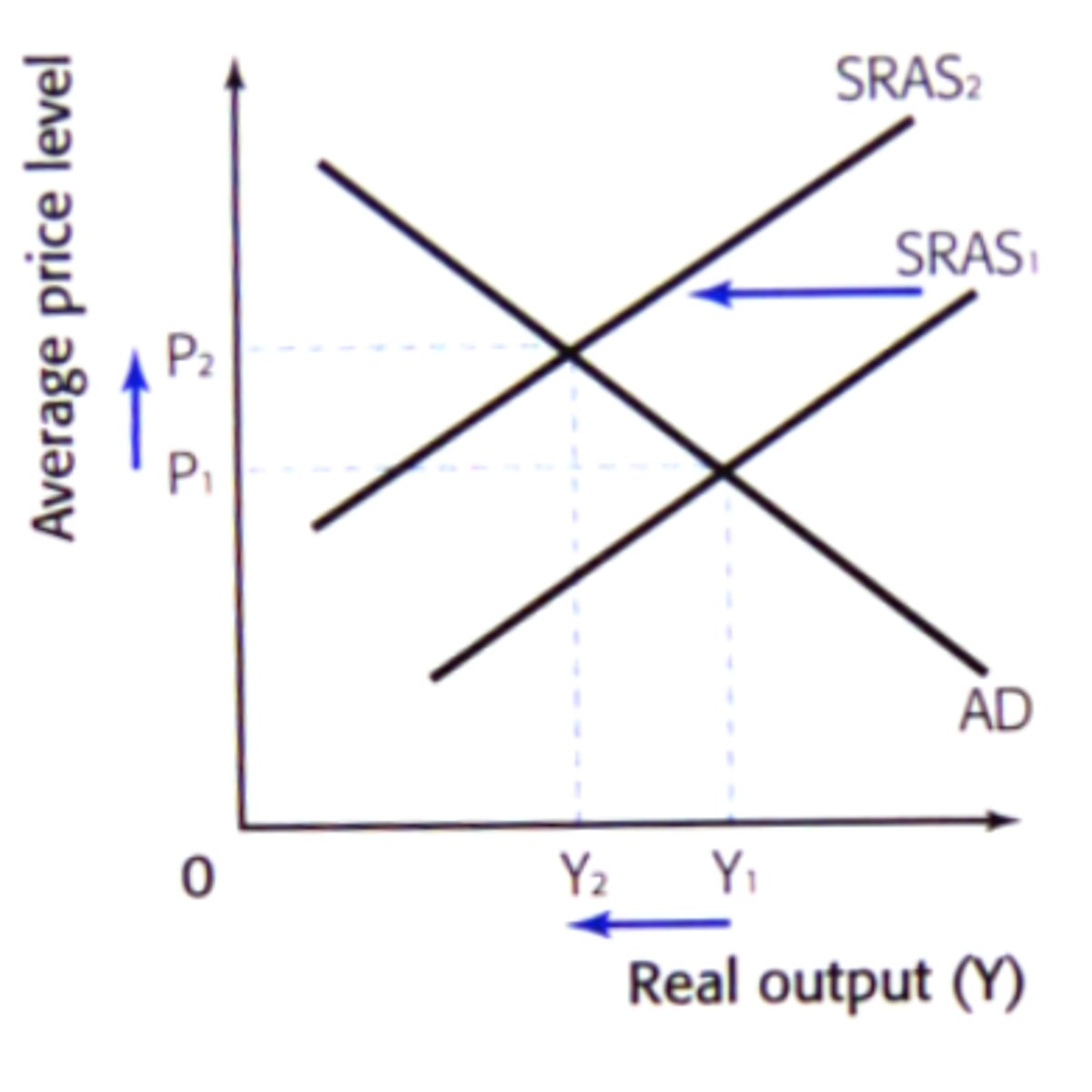

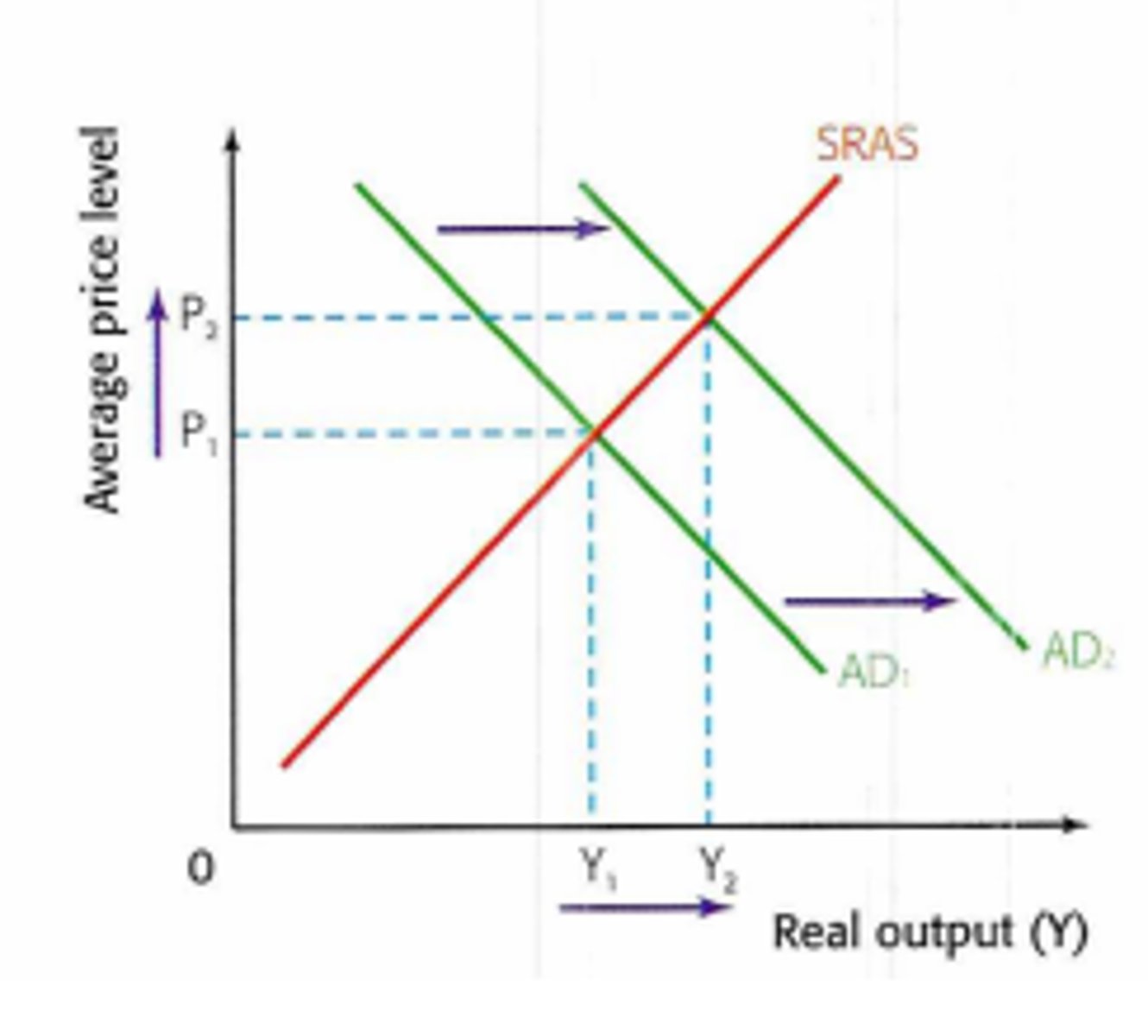

The AD/AS Model

The basic model used to understand fluctuations in aggregate output and the aggregate price level. It uses the aggregate supply curve and the aggregate demand curve together to analyze the behavior of the economy in response to shocks or government policy.

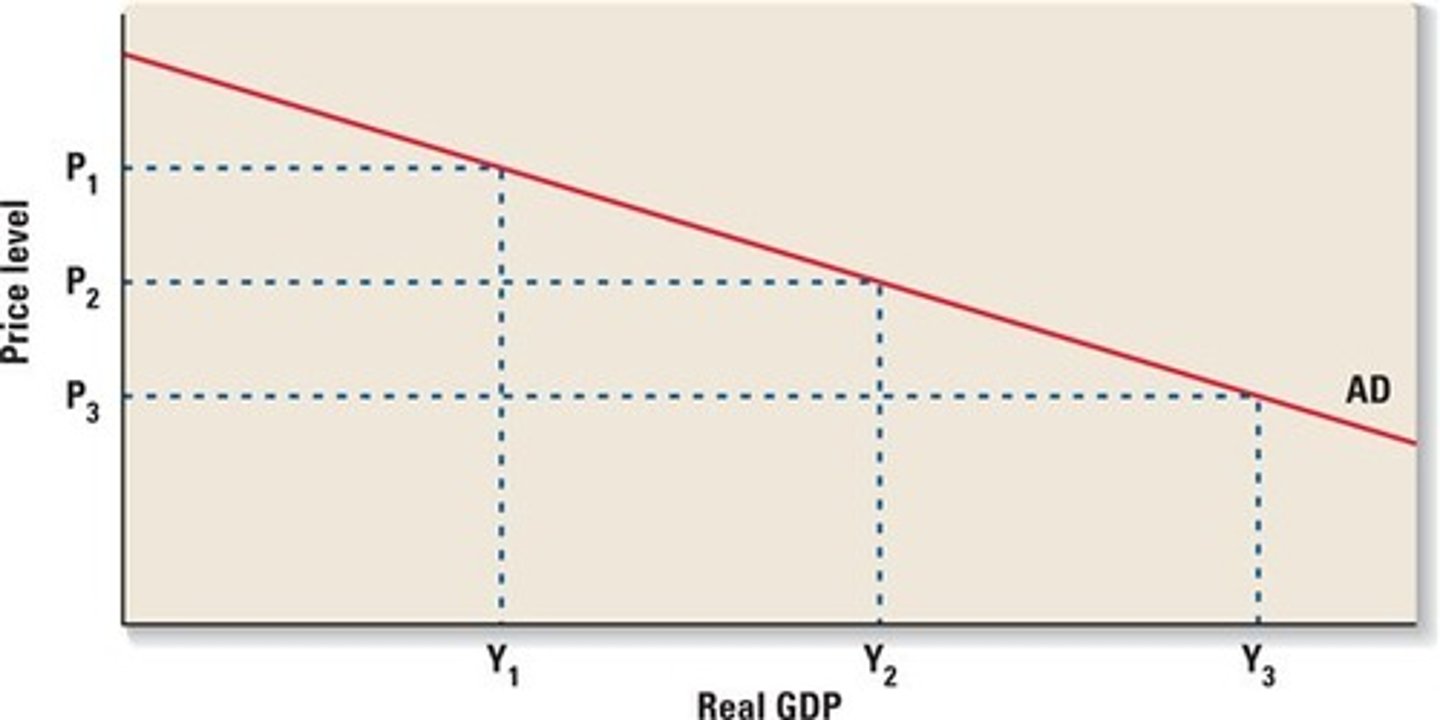

Aggregate Demand (AD) Curve

Graph describing the demand for all goods and services produced in product markets, for example using the expenditure model of GDP

ΔQD (Change in Quantity Demanded)

Term describing that a change in quantity demanded is a movement along a given demand curve and is ONLY caused by a change in price

ΔD (Change in Demand)

Term describing that a change in demand shifts the demand curve and is caused by a change in a non-price determinant of demand. Essentially saying that a change in demand is to change in quantity demanded at every price

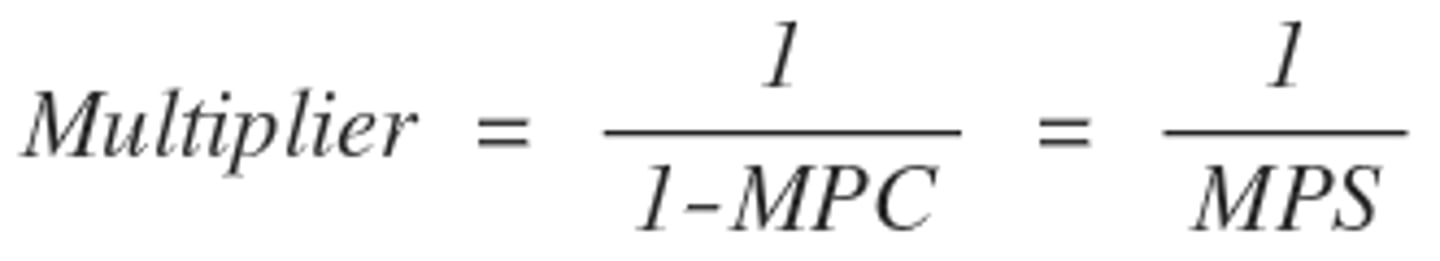

Marginal Propensity to Consume (MPC)

Term describing the tendency to take some of the money you are paid and spend it

Marginal Propensity to Save (MPS)

Term describing the tendency to take some of the money you are paid and spend it

MPC = 0.65

MPS = 0.35

If you get $100, spend $65 and save $35, what would your MPC and MPS mean?

Simple Spending Multiplier

Equation that describes how money that you spend is multiplied in the economy

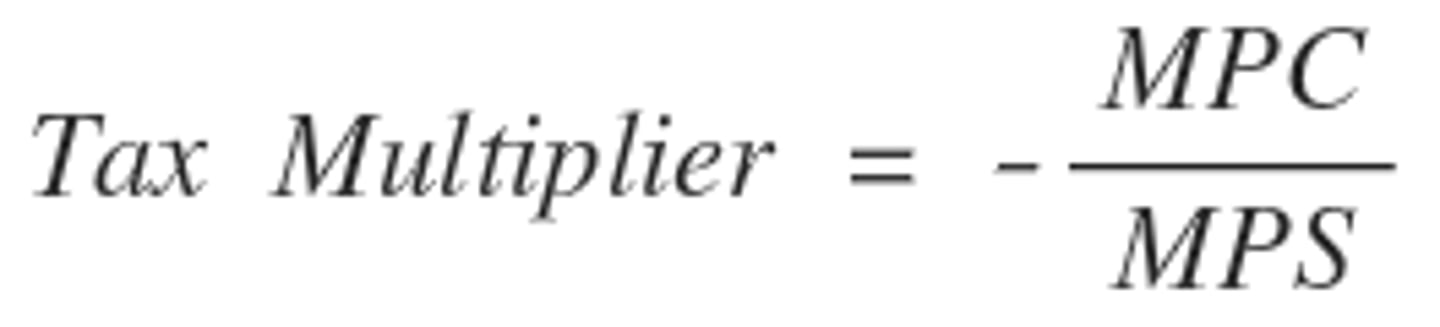

Tax Multiplier

MPC/MPS - Always 1 less than the spending multiplier

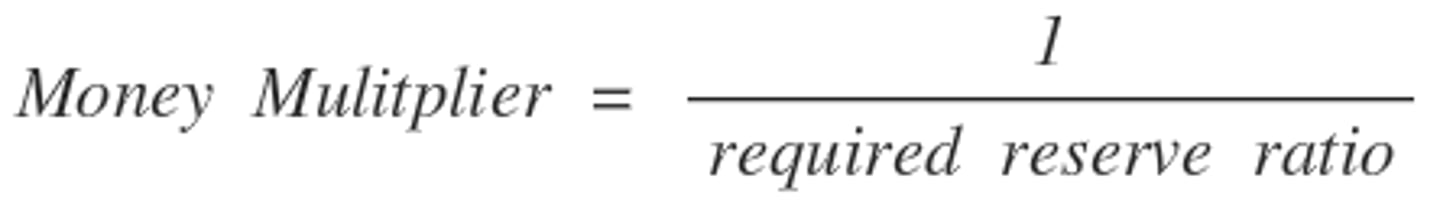

Money Multiplier

Equation that describes how modifications by the Fed change the money supply

Short Run

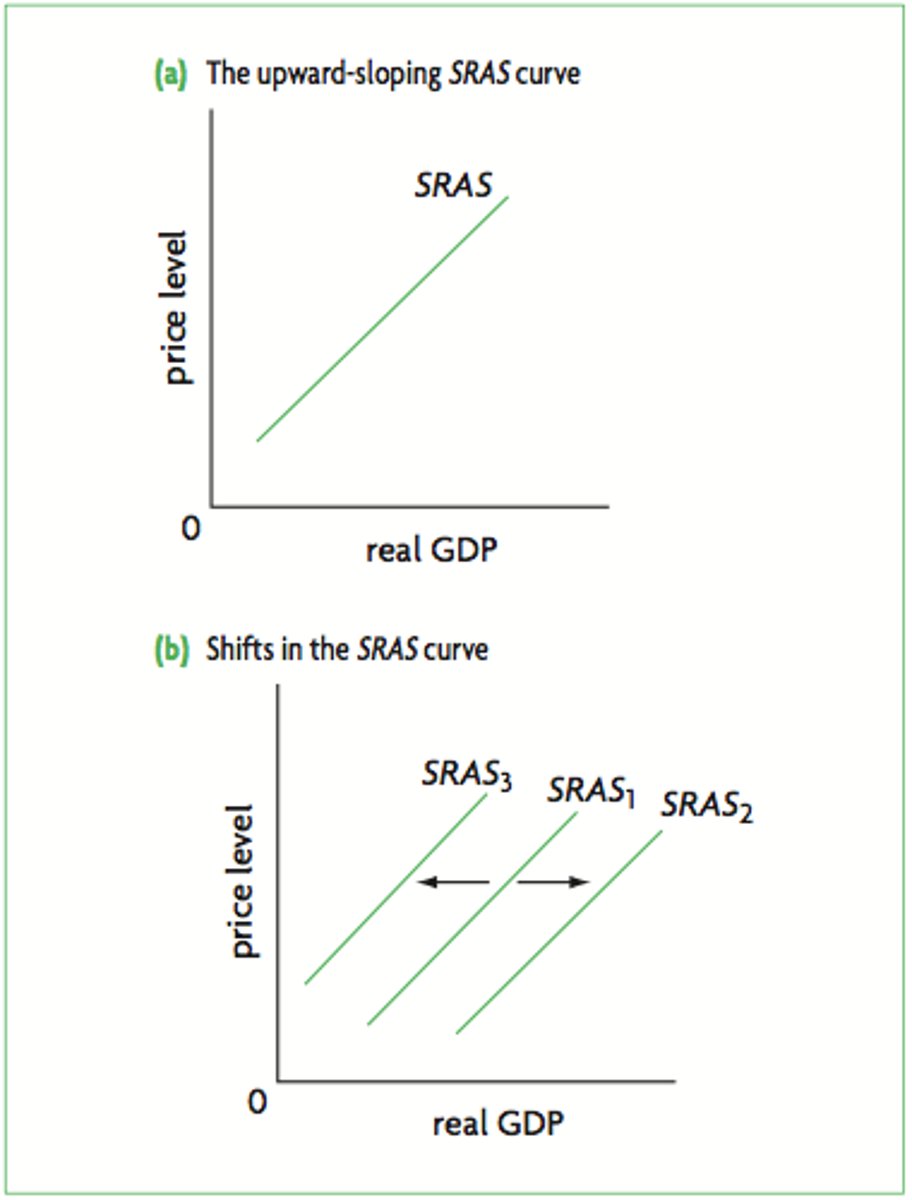

Term that refers to the time period in which at least one input price is fixed

Short Run Aggregate Supply (SRAS) Curve

Graph describing the ship between the price level and the quantity of aggregate output supplied in the short run

Total Profit Equation

Aggregate Price Level - Input Costs

Capital Stock

Term describing the accumulation of physical capital, like factories, tools, and equipment, used to produce goods and services

Negative Supply Shock

An unexpected decrease in the availability of a key resource that temporarily decreases productivity

Positive Supply Shock

An unexpected increase in the availability of a key resource that temporarily increases productivity

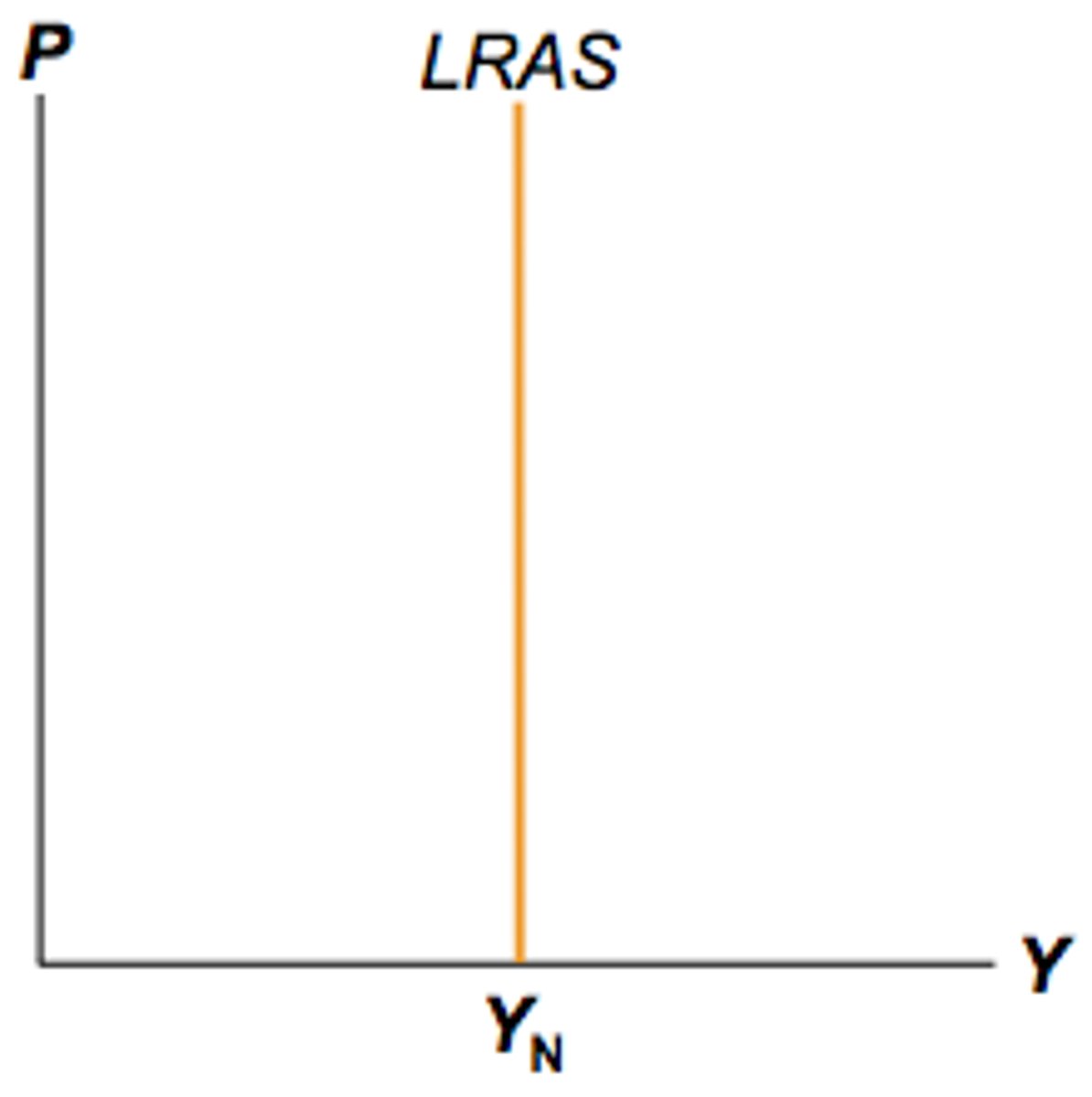

Long-Run Aggregate Supply (LRAS) Curve

Graph describing the normal level of aggregate demand and supply in the long run

Planned investment

Term describing the amount of business firms collectively intend to invest at each level of GDP

Stagflation

Term describing a scenario where higher prices at the same time as a slowdown in the economy happen, which is the worst possible scenario

Hyperinflation

A very rapid rise in the price level; an extremely high rate of inflation.

Cost-push inflation

When prices rise due to an increase in the cost of production

Demand-pull inflation

Inflation that is caused by an increase in aggregate demand

Open Market Operation

The purchase and sale of U.S. government bonds

Fiscal Policy

The use of government spending and tax collection to influence the economy

Monetary Policy

Managing the economy by altering the supply of money and interest rates

Automatic Stabilizers

Term describing policies that are already in place in an economy due to previously passed legislation, such as income and corporate taxes

Money

Term describing anything that can be used to purchase goods and services

Liquidity

Term describing how easily something can be converted into cash

Real interest rate equation

Real interest rate = nominal interest rate - inflation rate

Unit of account

Term describing that people commonly accept money as a way to set prices

Store of value

Term describing that money holds purchasing power over time

Medium of exchange

Term describing that money is used to exchange goods and services

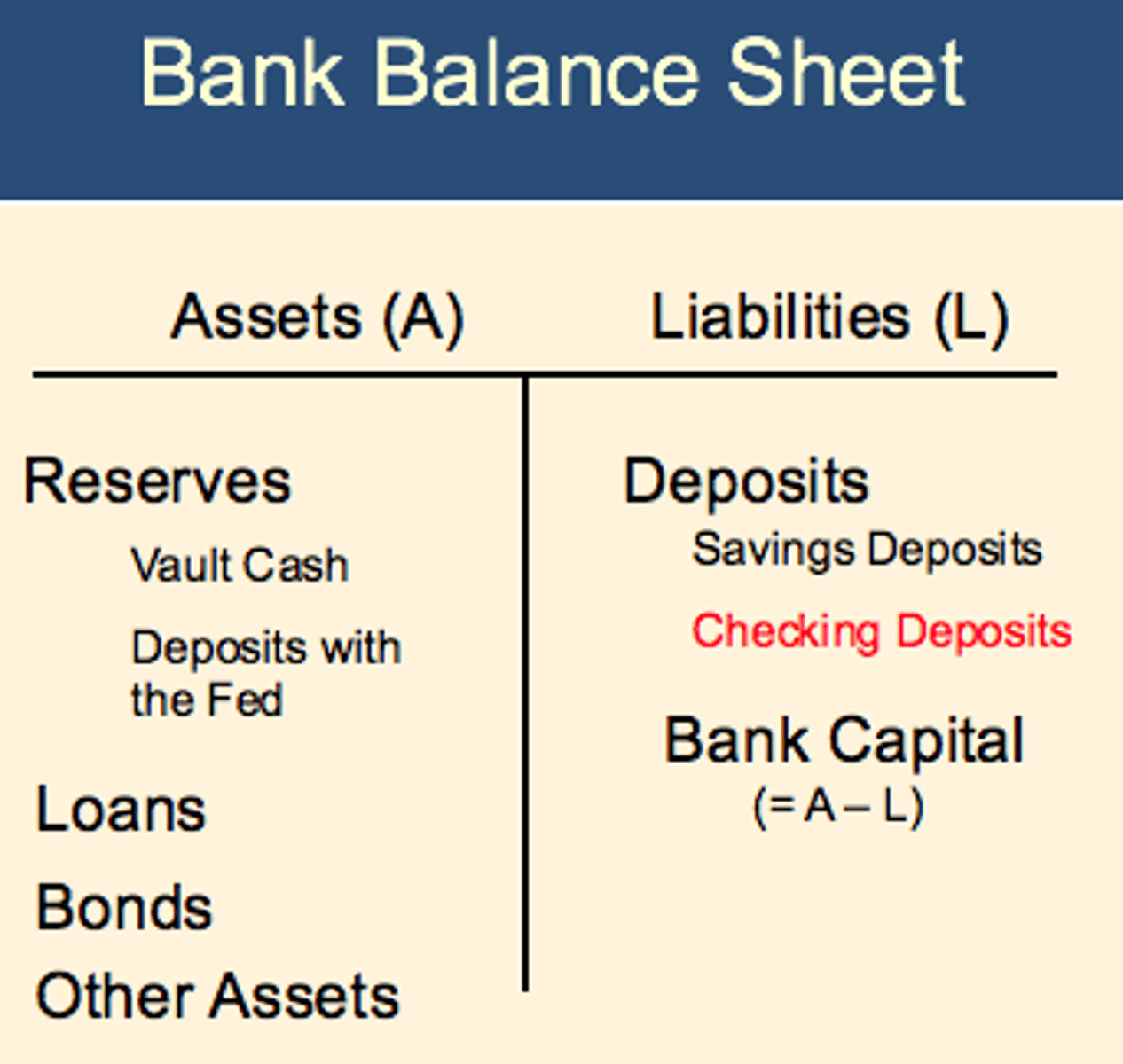

Bank balance sheet

Shows the amount of bank assets and bank liabilities each individual bank has, and both sides are equal to each other

M1 Money

The nearest definition of money which includes cash, traveler's checks, and checkable bank deposits and, as of 2020, savings accounts

Monetary base

Money held in reserves or in circulation, NOT deposits or savings

Shifters of money demand

The reserve requirement, the discount rate, and open market operations are all...

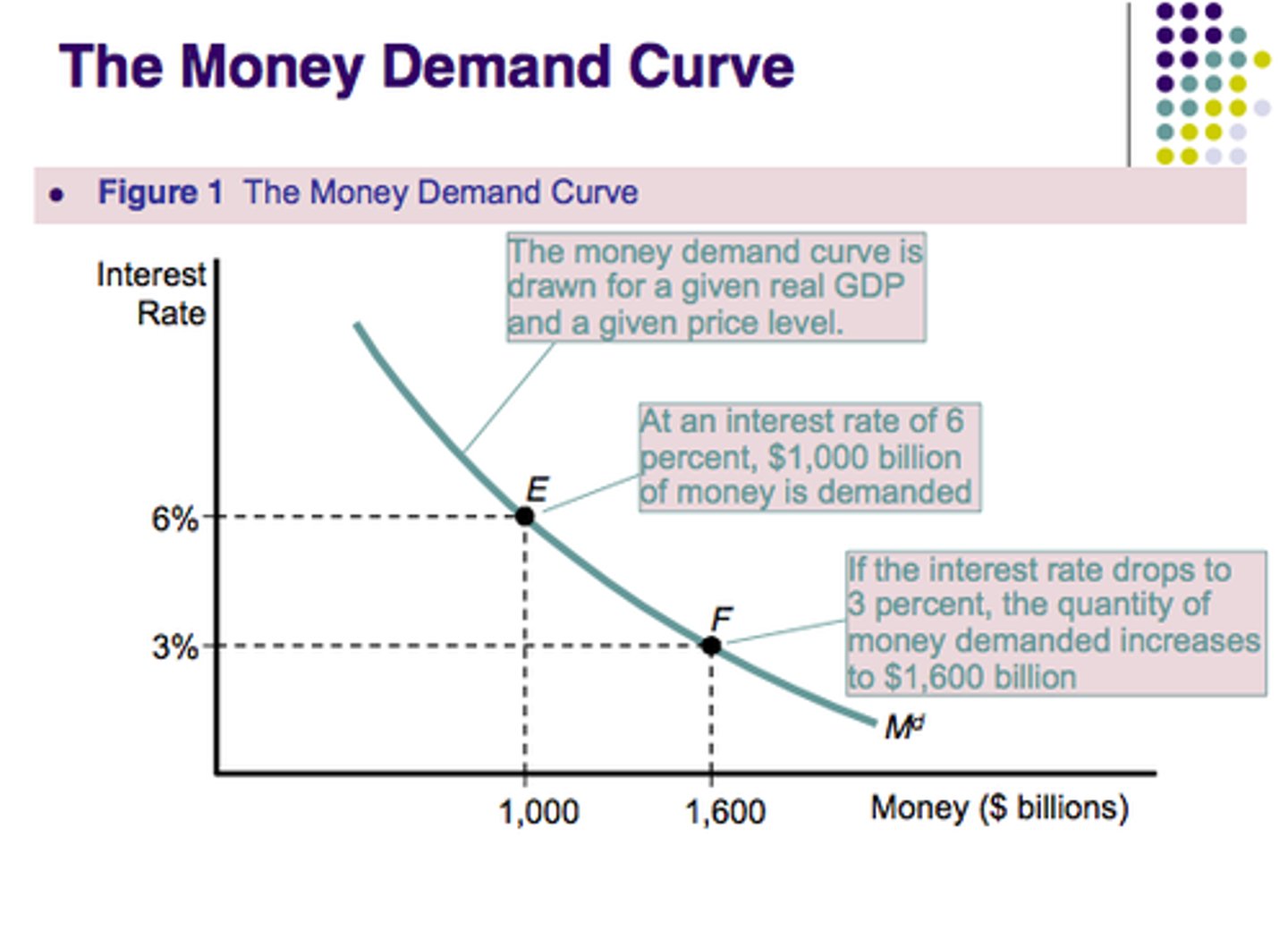

Money Demand Curve

Shows the relationship between the quantity of money demanded and the interest rate

Monetary Policy

Term describing a central bank's policies of influencing nominal interest rates to help achieve macroeconomic objectives

Policy Rate

Term describing the overnight interbank lending rate, also called the federal funds rate in the United States

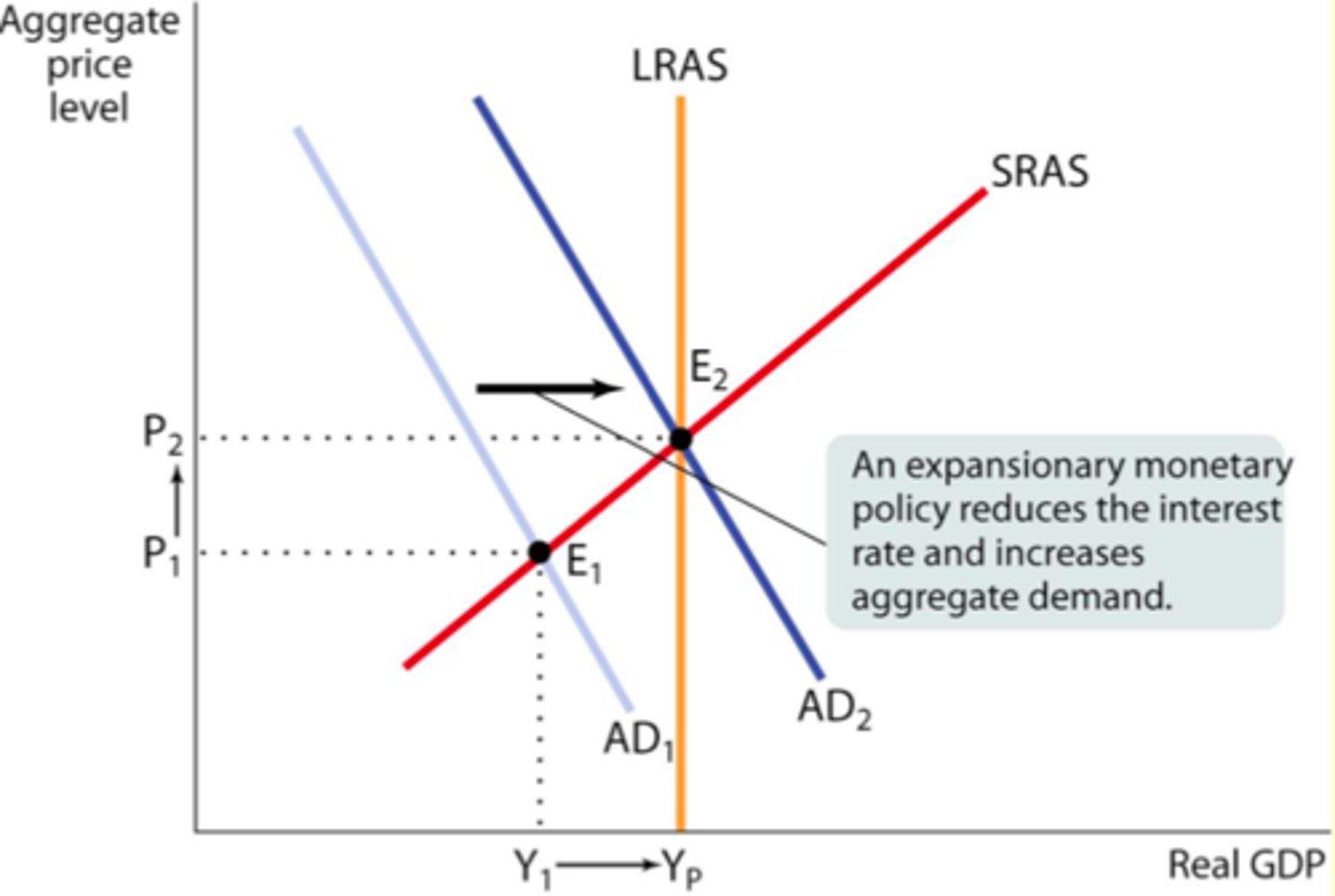

Expansionary Monetary Policy

The Federal Reserve's policy of decreasing interest rates to increase real GDP

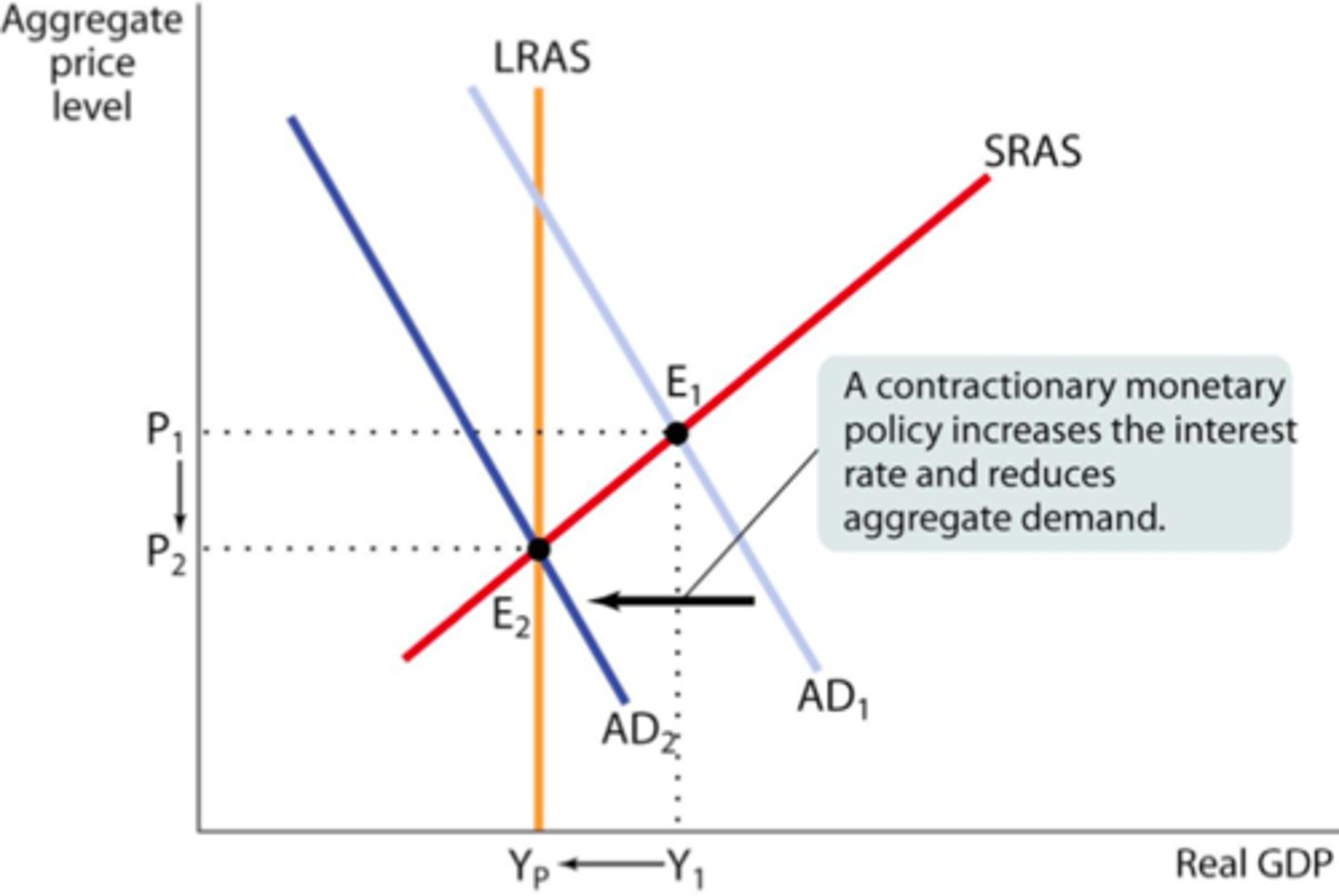

Contractionary Monetary Policy

A monetary policy that reduces the supply of money and loans to reduce inflation

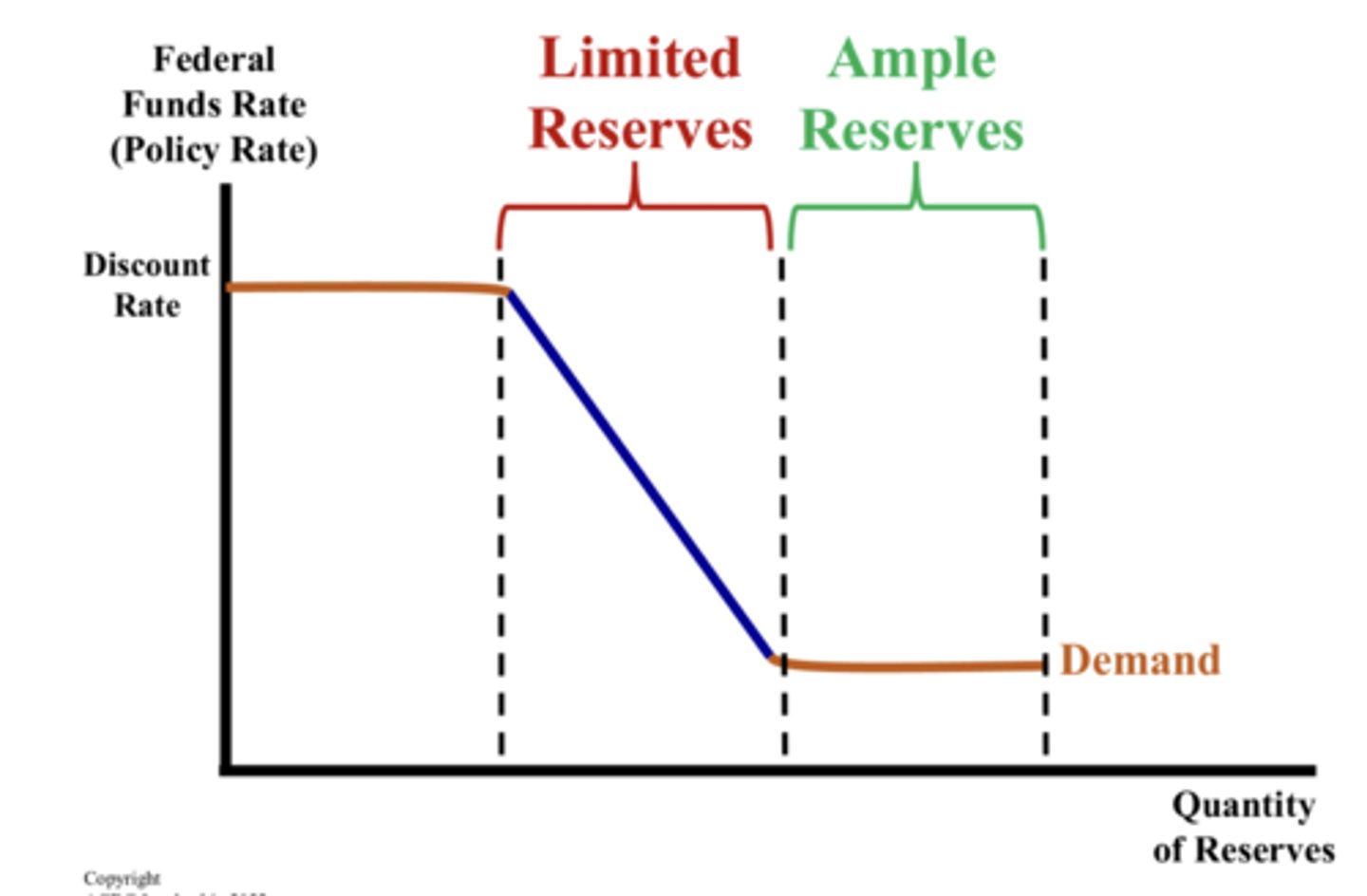

Limited Reserves

Term describing a banking system in which reserves are not overly abundant, there is a non-zero reserve requirement, and commercial banks hold required reserves and possibly also some excess reserves

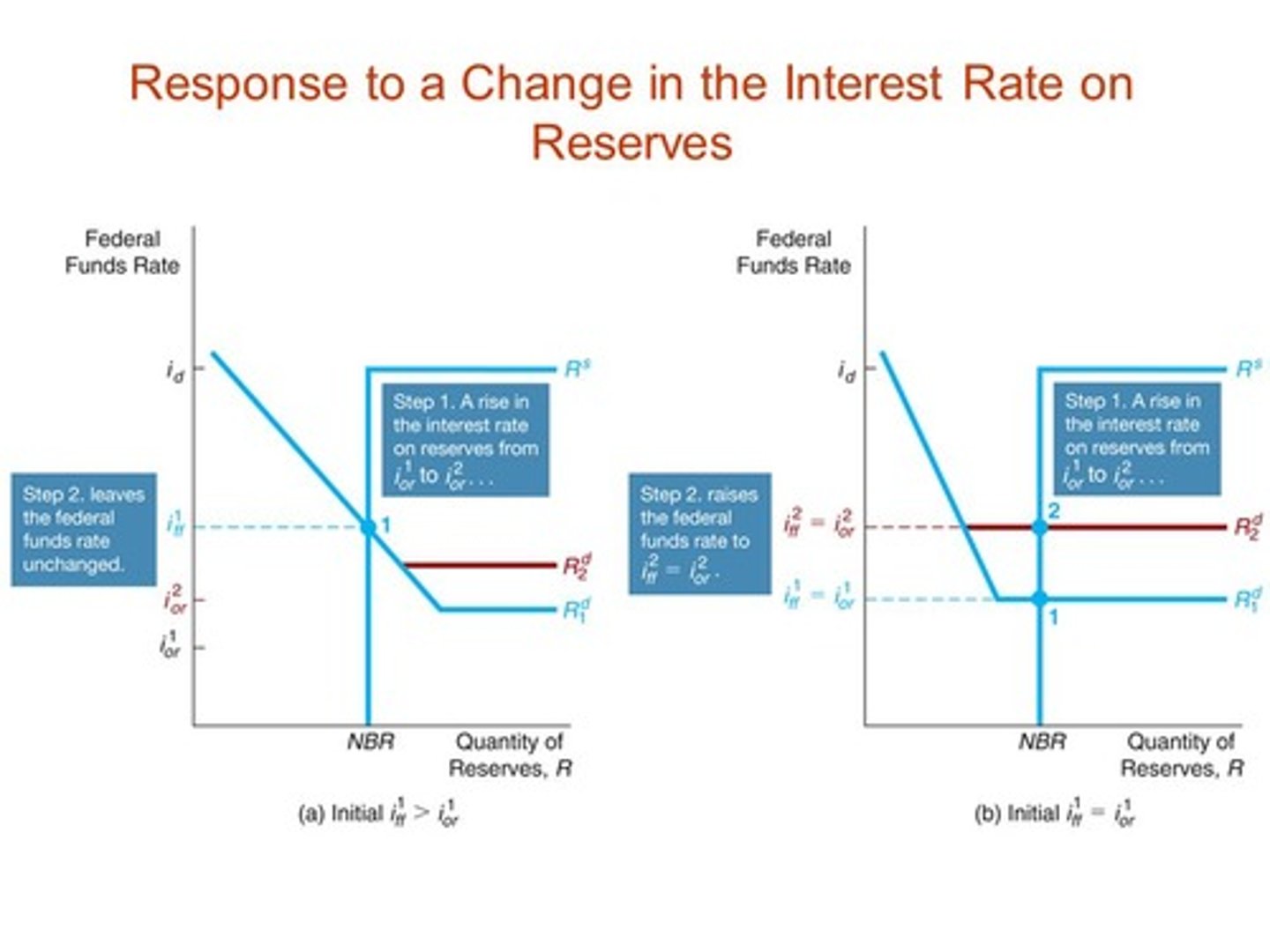

Ample Reserves

Term describing a banking system in which reserves are abundant, the required reserve ratio is zero, and changing the money supply does not change the nominal interest rate

Reserve Market Model Graph

Graph describing the market for bank reserves

Interest on Reserves

Term describing a monetary policy tool for an ample reserves system that describes the interest rate commercial banks earn on their funds and their reserve balance accounts with the Fed