Monetary Policy Midterm

1/258

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

259 Terms

what is the central Bank responsible for

controlling the availability of money and credit in a country's economy.

how does the central bank control the availability of money

monetary policy, primarily by adjusting short-term interest rates

what does adjusting short-term interest rates do

stabilize economic growth and inflation

what is a profitable business for the central bank

printing money is a profitable business for the central bank, as the cost of printing a bill is only a few cents.

what does the ability to create money mean for the CB

CB can make loans even when no one else can

what are the key roles of the CB today

1. To provide loans during times of financial stress,

2. To manage the payments system, and

3. To oversee commercial banks and the financial system

what does the fact that all banks have an account at the CB mean

it is the natural place for interbank payments to be made

what is the CB not?

does not control securities markets (might moniter and participate in stock/bond market)

does not control government’s budget (congress-fiscal policy)

only acts as treasury’s bank

what is the job of the CB

to improve general economic welfare by managing and reducing systematic risk

5 objectives of a modern CB

low, stable inflation

when high, growth is low

high stable growth

stable growth is higher than unstable growth

financial system stability

necessity for economy to efficiently operate

stable interest rates

volatility creates risk for lenders and borrowers

stable exchange rates

variable rates make revenues from foreign countries and cost of purchasing imported goods hard to predict

what is a time consistent policy

one where a future policymaker lacks the opportunity or the incentive to renege. A policy lacks time consistency when a future policymaker has both he means and the motivation to break the commitment

4 principles of CB design

independence

to keep inflation low, monetary decisions must be made free of political influence

accountability and transparency

policymakers must be accountable to the public they serve and clearly communicate their objectives, decisions, and methods

policy framework

must clearly state their policy goals and tradeoffs among them

decision making committee

pooling the knowledge of a # of people yields better decisions than by an individual

effective crisis response requires clear chain of command

what is the federal reserve system composed of

– 12 regional Federal Reserve Banks, distributed throughout the country

– A central governmental agency, called the Board of Governors of the Federal Reserve

System, in Washington, D.C.

describe the federal reserve banks

part public and private

federally chartered banks and private, nonprofit organizations

owned by the commercial banks in their districts

who oversees the federal reserve banks

their own board of directors and the Board of Governors

how many members are on the board of directors for each reserve bank

9

how are the 9 reserve bank board of directors elected

Six directors are elected by the commercial bank members of the Reserve Bank

Three directors representing the Reserve Bank

Three represent the public.

The Boards of Governors appoint the remaining three directors.

how is the president of each reserve bank appointed

for a 5-year term by bank board of directors with the approval of the board of governors

describe the makeup of the Board of governors

7 members called governors

appointed by the president and confirmed by the Senate

14-yr terms

long terms intended to protect the board form political pressure

staggered limiting any individual president’s influence over the membership

a chairperson and 2 vice chairpersons

appointed by president from 7 governors

4 year renewable term

what are the duties of the board of governors

Set the reserve requirement

Approve or disapprove discount rate recommendations

Approve changes in the interest rate paid on excess reserves (IOER rate)

Rule-writing agency for consumer credit protection laws

approve bank merger applications

supervise & regulate reserve banks

regulate & supervise banking system with reserve banks

invoke emergency powers (curtailed by Dodd-Frank Act) to lend to nonbanks

analyze financial and economic conditions

collect & publish detailed stats

describe the makeup of the federal open market committee (FOMC)

chair of the BoG chairs the FOMC

committee’s vice chair is president of Fed bank of NY

all participate in meetings

only 5 of 12 bank presidents vote at any one time

what does the FOMC choose to do

control the federal funds rate-influencing real growth

what does FOMC stand for

federal open market committee

what is the federal funds rate

rate banks charge each other for unsecured overnight loans on their excess deposits at the fed

-rate that banks lend reserves to each other overnight-determined in market, not controlled by fed

-influences other interest rates in economy, as well as, spending and investing made by consumers and producers

how many times does the FOMC meet

8 a year (can change policy over the phone in times of crisis)

what is the purpose of the FOMC meeting

to decide on the target range of the federal funds rate and scale and mix of assets to acquire

-agrees on how to communicate policies to the public, including any forward guidance

what is forward guidance

a monetary policy tool that central banks use to communicate their plans for interest rates. The goal of forward guidance is to influence market expectations of future interest rates

why does the FOMC not engage in financial market transactions required to keep the market FFR near the target or manage the fed’s portfolio

that’s the job of the SOMA (system open market account manager) who works for NY fed

describe a FOMC meeting

a formal proceeding that includes staff reports and discussion comments by all the meeting’s participants.

After adjournment, the chair holds a press conference to discuss the FOMC’s

assessment and policy plans.Three weeks after the meeting, detailed minutes summarizing the deliberations are released on the FOMC’s public website.

1. The chair is the voice of the Fed.

2. The governors make up a majority of the committee.

3. Aside from the quarterly projections of FOMC members, the most important information distributed to all committee members is the Tealbook

4. The chair sets the agenda for FOMC meetings, determines the order in which people speak, and proposes the FOMC policy statement.

5. Committee members observe a blackout period from a week prior to a week after the meeting.

who is the most important member of the FOMC

the chair

what are the checks on the FOMC chair

even 2 dissents on an FOMC votes are unusual

3 dissent would raise doubts about the chair’s leadership

describe the role of the chair of the Board of governors

most powerful person in the fed system

effectively controls FOMC meetings and monetary policy

appointed to 4 year term by US president (subject to senate confirmation)

must be a governor

elected as chair of FOMC

describe the role of the other members of the board of governors

supervise and regulate part of financial industry

all voting members of the FOMC

appointed by president to 14 yr terms subject to senate confirmation

2 vice chairs must be members of board of governors

one is designated for supervision

describe the role of the Federal Reserve Bank of NY

runs biggest and most important reserve bank

where monetary policy operations are carried out and much of fed’s work for treasury is done

provides services to commercial banks in district

appointed by nonbanking members of bank’s board of directors, with approval of BoG

5 yr term

vice char of FOMC

describe the role of the presidents of the 11 other federal reserve banks

provide services to commercial banks in their district

all participate in every FOMC meeting

serve 1 yr terms as voting members of the FOMC on rotating basis

describe the structure and organization of the federal reserve system

3 criteria for judging a CB’s independence

budgetary independence

irreversible decisions

long terms in office

what are the objectives set by congress for the fed

Maintain long run growth of the monetary and credit aggregates commensurate with

the economy’s long run potential to increase productionPromote effectively the goals of maximum employment, stable prices, and moderate

long-term interest rates.

purchases made in euros and monetary policy is who’s job

european central bank

european system of central banks (ESCB)

composed of national central banks (NCBs) in the 28 countries in the EU

eurosystem

The ECB and the NCBs of the 19 countries that participate in the monetary union make up

They share a common currency (euro) and common monetary policy (set by the ECB)

how does the eurosystem mirror the federal reserve system

– There is a six-member Executive Board of the ECB, similar to the Board of Governors

– The National Central Banks play many of the same roles as the Federal Reserve Banks

– The Governing Council formulates monetary policy as the FOMC does

–The Executive Board has a president and a vice president who play the same role as the

Fed’s Board of Governors

how are the ECB executive board members appointed

by a committee composed of the heads of state of the countries that participate in the monetary union

how do the ECB and NCB perform the traditional operations of a CB

– They use interest rates to control the availability of money and credit in the economy, and

– They are responsible for the smooth operation of the payments system and the issuance of currency.

• The National Central Banks continue to serve as bankers to the banks and governments in their countries

differences between the fed and the ECB

1. The implementation of monetary policy is accomplished at all the national central banks,

rather than being centralized as in the U.S.

2. The ECB’s budget is controlled by the National Central Banks, not the other way around.

3. The ECB still provides a large volume of reserves through collateralized lending to the

banks, in addition to sales and purchases of securities

describe the governing council of the eeurosystem

composed of the six Executive Board members and the governors

of the 19 central banks in the euro area.

• Meetings are held eight times a year.

• Decisions are made by formal votes of theCouncil but the specific votes are not

published.

– Ensure that Governing Council members focus onsetting policy for the euro area as a whole

how is the ECB’s independence assured

1. There are terms of office.

2. The ECB’s financial interests must remain separate from any political organization.

3. The treaty states explicitly that the Governing Council cannot take instructions from any

government, so its policy decisions are irreversible.

what are some of the information distributed by the ECB

– A weekly balance sheet

– A monthly statistical bulletin

– An analysis of current economic conditions

– Biannual forecasts of inflation and growth

– Research reports relevant to current policy

– An annual report

what does the governing council of the ECB target

a short term interest rate on interbank loans, providing forward guidance, and providing liquidity

what does the governing council do to be transparent

• Following each of the Governing Council’s monthly meetings, the president and vice president of the ECB hold a news conference.

• A transcript of their remarks is posted on the ECB’s website soon afterward

• In 2015, the ECB began issuing a written account comparable to the minutes published by the FOMC

– The ECB doe not detail the votes of the Governing Council, nor keep verbatim transcripts

the treaty of maastricht places a priority on what

price stability-including objective of sustainable and non-inflationary growth

2 parts

a numerical definition of price stability

the Governing council announces its intention to focus on a broad-based assessment of the outlook for future prices with money playing a prominent role

what does the ECB’s governing council define price stability as

inflation rate of close to, but less then 2% based on euro-area-wide measure of consumer prices

– This is the harmonized index of consumer prices (HICP) and is similar to the CPI.

– It is the average of retail price inflation in all the countries of the monetary union, weighted by the size of their gross domestic products.

describe the CB’s balance sheet

what is the primary asset of the CB

securities

explain the asset of securities

– Traditionally, the Fed exclusively held Treasury securities, which are virtually free of

default risk.

– During the 2007-2009 crisis, the central bank chose to acquire a variety of risky assets.

– The quantity of securities it holds is controlled through purchases and sales known as open

market operations

explain the asset of foreign exchange reserves

-central bank’s and government’s balances of foreign currency

– These are held in the form of bonds issued by foreign governments.

– These reserves are used in foreign exchange interventions when officials attempt to change

the market values of various currencies.

explain the CB asset of loans

-usually extended to commercial banks

– In 2008 and 2009, the Fed made substantial loans to nonbanks as well.

• Discount loans are the loans the Fed makes when commercial banks need short-term cash.

• Through its liquid securities holdings, the Fed controls the federal funds rate and the

availability of money and credit

-like note receivables

describe the CB liability of currency

-Nearly all CBs have monopoly on issuance of currency used in everyday transaction

– Currency circulating in the hands of the nonbank public is the principal liability of

most central banks.

describe the CB liability of the government’s account

-governments need bank account like the rest of us

– The central bank provides the government with an account into which the government

deposits funds (mostly tax revenue) and from which the government makes payments.

– By shifting funds between its accounts at commercial banks and the Fed, the Treasury

usually keeps its account balance at the Fed fairly constant

describe the CB liability of commercial bank accounts (reserves)

– Commercial bank reserves are the sum of two parts: Deposits at the central bank, plus the

cash in the bank’s own vault.

– In the same way that you can take cash out of a commercial bank, the bank can withdraw its

deposits at the central bank.

• Vault cash is part of reserves.

– Reserves are assets of the commercial banking system and liabilities of the central bank.

of the CB’s liabilities, which are the most important in determining the quantity of money and credit in the economy

bank reserves-CBs run their monetary policy operations through changes in these reserves

what are the 2 types of reserves

Required reserves that banks must hold

Excess reserves, which banks hold voluntarily

what is the importance of the disclosure of the CB’s own financial condition

• Every central bank publishes a statement of the bank’s own financial condition.

• Without public disclosure of the level and change in the size of foreign exchange reserves

and currency holdings, it is impossible for us to tell whether the policymakers are doing their

job properly.

• Publication of the balance sheet is an essential aspect of central bank transparency.

• A sign of trouble is misrepresentation of the central bank’s financial position

what is the monetary base

currency in the hands of the public and reserves in the banking system

privately held liabilities of CB

called high-powered money

the CB can control the size of the monetary base

when the monetary base increases by a dollar, the quantity of money typically rises by several dollars

can policymakers change the number of assets/liabilities without asking

yes-the CB can simply buy assets and create liabilities to pay for them-can increase the size of its balance sheet as much as it wants

what is the difference between a purchase you make and one the CB makes

– To pay for the bond, the central bank writes a $ 1 million check payable to the bond dealer.

– The dealer’s commercial bank account is credited with $1 million when the check is deposited.

– The commercial bank then sends the check back to the central banks.

– The central bank credits the reserve account of the bank presenting the $1 million.

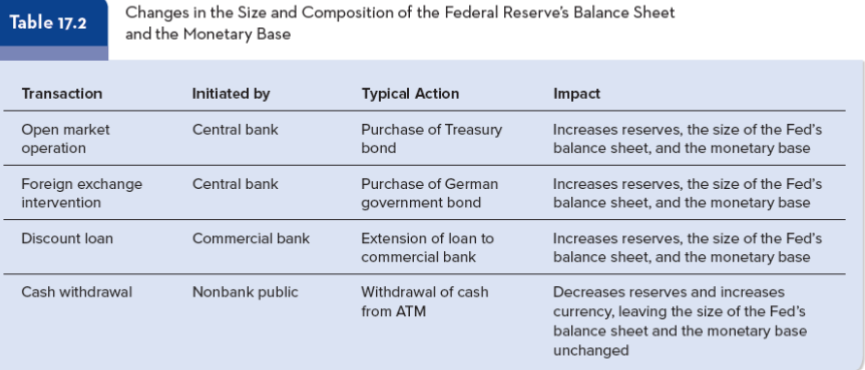

what 4 transactions taken by the CB change the size of its balance sheet

1. Open Market Operation

– Buying or selling a security initiated by the central bank.

2. Foreign Exchange Intervention

– Buy or sell foreign exchange reserves initiated by the central bank.

3. Extend a discount loan

– Initiated by commercial banks.

4. Decision by an individual to withdraw cash from their bank

– Initiated by the nonbank public

when the value of an asset on the balance sheet increases, 1 of 2 things happens so the net change can be 0:

the value of another asset decreases

the value of a liability rises by the same amount

what should the fed aim for in their balance sheet

minimal liquidity, maturity and credit risk

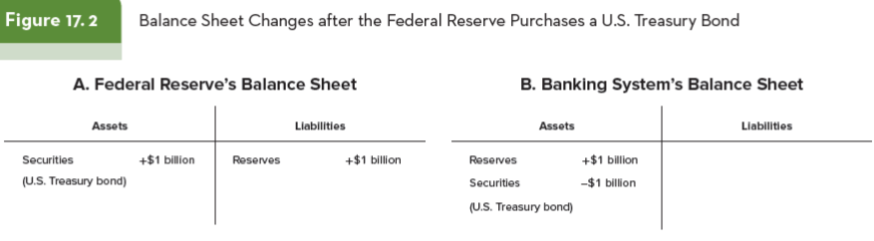

what are open market operations

when the fed buys or sells securities in financial markets

describe an example of open market operations

• The Fed transfers $1 billion into the reserve account of the seller, called a T-account.

• The Fed’s assets and liabilities both go up $1 billion, increasing the monetary base by the same amount.

• Both the $1 billion in securities and in reserves are banking system assets.

• Notice that the reserves are an asset to the banking system but a liability to the Fed.

– This is similar to the balance in your bank account is your asset, but it is your bank’s

liability.

• If the Fed sells a U.S. Treasury bond through an open market sale, the impact on

everyone’s balance sheet is reversed

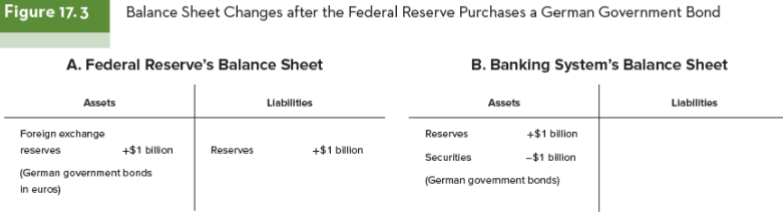

describe an example of foreign exchange intervention

• What if the U.S. Treasury instructs the Fed to buy $1 billion worth of euros.

– They buy German government bonds, denominated in euros, from foreign exchange departments of large commercial banks and pay for them with dollars.

• The $1 billion payment is credited directly to the reserve account of the bank from which the

bonds were bought.

– This has a similar effect on the balance sheet as the open market operation

• The Fed’s assets and liabilities both rise by $1 billion, and the monetary base expands with

them.

• In both cases, the banking system’s securities portfolio falls by $1 billion and reserves balances rise by an equal amount.

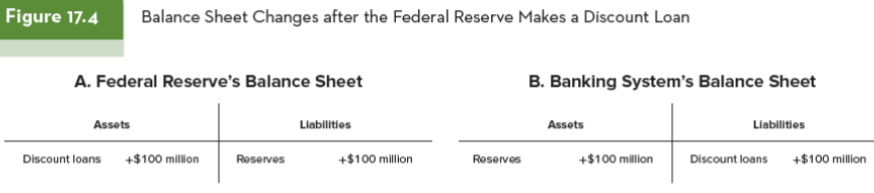

describe the balance sheet change of discount loans

• Commercial banks ask for loans, the Fed does not force them.

• A borrowing bank must provide collateral.

– This usually takes the form of U.S. Treasury bonds, but the Fed has been willing to accept a

broad range of securities and loans as collateral.

• This changes the balance sheet of both institutions.

• For the borrowing bank, it is a liability matched by an offsetting increase in the level of its reserve account.

• For the Fed, the loan is an asset that is created in exchange for a credit to the borrower’s reserve account.

• The extension of credit to the banking system raises the level of reserves and expands the monetary base

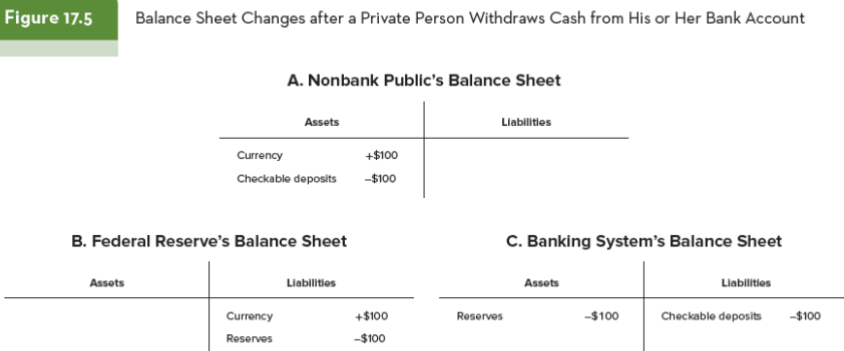

what three balance sheets does a cash withdrawal involve

the non bank public

the banking system

the central bank

explain the change in the CB’s balance sheet due to a cash withdrawal

• Because the Fed stands ready to exchange reserves for currency on demand, it does not

control the mix between the two.

– The nonbank public, those who hold cash, controls that.

• When you take cash from an ATM, you are changing the Fed’s balance sheet.

– By moving your own assets out of your bank and into currency, you force a shift from

reserves to currency on the Fed’s balance sheet.

• Your assets shift from checkable deposits to cash with no change in liabilities.

• Cash inside the bank, vault cash, counts as bank reserves.

– By withdrawing cash from your bank, you decreased the banking system’s reserves.

– This is a change in the bank’s T-account.

• For the Fed, the change comes in the composition of the Fed’s liabilities.

which changes in the balance sheet are done at the discretion of the central bank

open market operations and foreign exchange interventions

the level of discount borrowing is decided by who

the commercial banks

who decides how much currency to hold

the nonbank public

table of changes to CB balance sheet

who controls the monetary base

central bank

why is it called a monetary base

central bank liabilities form the base on which the supplies of money and credit are built

what are the multiples of the monetary base

M1 & M2 (broader measure of money)

what is m1 and m2

the money we think of as available for transactions

can the nonbank public create and destroy the monetary base

no only the fed can but the nonbank public can determine how much of it ends up as reserves in the banking system and how much in currency

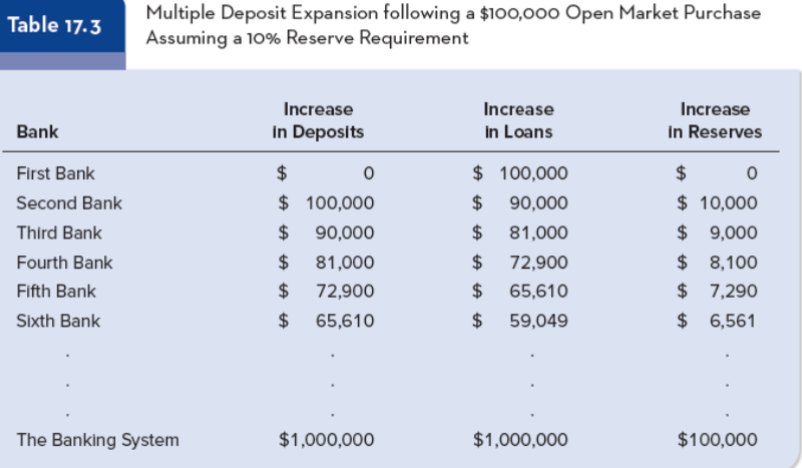

deposit expansion in a system of banks

deposit expansion multiplier

– That is the increase in commercial bank deposits following a one-dollar open market purchase.

– This continues to assume there are no excess reserves and no changes in the amount of

currency help by the nonbank public.

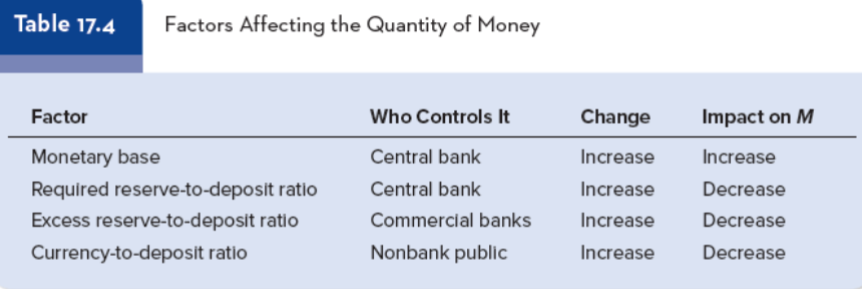

the quantity of money in the economy depends on

the monetary base (controlled by fed)

the reserve requirement (reserve amount in banks required by the fed)

bank’s desire to hold excess reserves

the nonbank’s public demand for currency (demand for cash withdrawals)

what is the impact on the quantity of money if the monetary base increases

quantity of money increases

what is the impact on the quantity of money if an increase in either the reserve requirement or bank’s excess reserve holding

reduces money

what is the impact on the quantity of money when an individual withdraws cash

they increase the currency in the public and decreases reserves

the decline in reserves creates a multiple deposit contraction

the money supply contracts

what are the factors affecting the quantity of money change over time

– Market interest rates affect the cost of holding both excess reserves and currency.

– As interest rates increase, we expect to see {ER/D} and {C/D} fall.

• This increases the money multiplier and the quantity of money

limits on the CB’s ability to control the quantity of money

• The money multiplier is just too variable.

• The relationship between the monetary base and the quantity of money is not something

that a central bank can exploit for short-run policy purposes.

• Interest rates have become the monetary policy tool of choice.

• In a financial crisis, other balance-sheet tools help address liquidity needs and market

disruptions more directly.

quantitative easing

massive expansion of reserves

what is the money multiplier

1/r where r is the reserve ratio (% of reserves mandated by fed for banks to keep)

conventional policy tools/instruments to steady the financial system

– The target range for the federal funds rate

– The interest rate on excess reserves (IOER rate)

– The rate for discount window lending (discount rate)

–reserve requirement

unconventional policy tools

– Massive purchases of risky assets in fragile markets

– Communicating its intent to keep interest rates low over an extended period (forward guidance)

prior to the financial crisis, what was the FOMC’s primary policy tool

target federal funds rate

target federal funds rate is set by what

the FOMC and the market federal funds rate where transactions between banks take place

what did discrepancies between actual and desired reserves do

-gave rise to market for reserves

-some banks can lend out excess reserves

-some banks will borrow to cover a shortfall

what would banks need to do without market for reserves

hold substantial quantities of excess reserves as insurance against shortfalls