Chapter 4 - Economic Efficiency, Surplus, and Market Failures

1/23

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

24 Terms

Laissez-faire

Refers to the concept of freely functioning markets without government intervention.

Market Failure

Occurs when a free market does not produce a socially desirable price or quantity. Caused by:

Lack of Competition

Asymmetric Information

Externalities

Existence of Public Goods (nonrivalry and nonexclusivity)

Lack of Competition

When a market lacks competition, inefficient production and higher prices are more likely.

Externalities

External benefits or external costs generated by the actions of others. They can lead to a market equilibrium that is not socially optimal.

Asymmetric information

Occurs when one party in a transaction has more information about a product than the other. This can lead to prices being set too high or too low.

Nonrivalry

Means that one person's consumption of a good does not reduce the amount available for others to consume.

Nonexclusivity

Means that once a good is provided, it is impossible to prevent others from enjoying it.

Public Goods

Goods that one person can consume without diminishing what is left for others. They exhibit nonrivalry and nonexclusivity. Private markets do not provide them in sufficient quantities.

Willingness to Pay (WTP)

Is the maximum amount a consumer is willing and able to pay for a good or service, representing the highest value they believe it is worth.

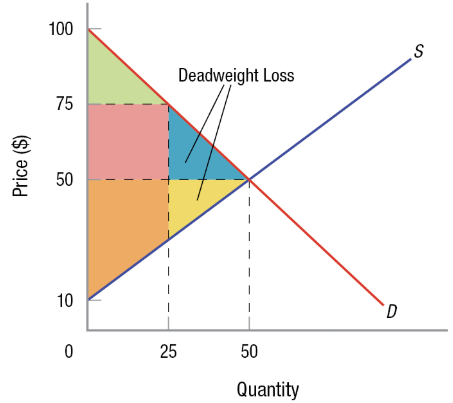

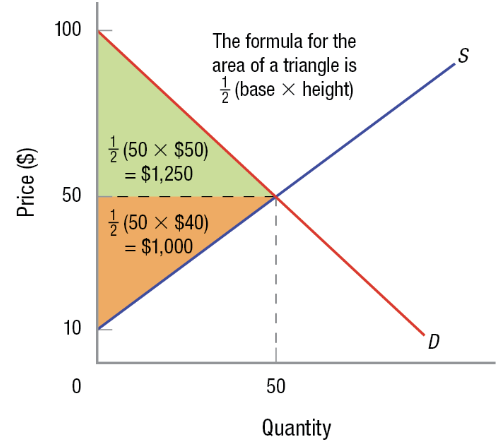

Consumer Surplus

Is the net benefit a consumer receives from purchasing a good or service, calculated as the difference between their willingness-to-pay (WTP) and the actual price. It represents a form of savings for consumers.

Willingness to Sell (WTS)

Is the minimum amount a producer is willing and able to sell a good or product, representing the lowest value they believe it is worth.

Producer Surplus

Is the net benefit a producer receives from selling a good or service, measured as the difference between the price they receive and their willingness-to-sell (WTS). It represents a form of earnings for producers.

Total Surplus

Is the sum of consumer surplus and producer surplus, representing the total net benefit to society from market transactions. It is maximized when the market is in equilibrium.

Consumer Surplus on a Graph

Represented below the demand curve and above the price. (In green)

Producer Surplus on a Graph

Represented above the supply curve and below the price. (In orange)

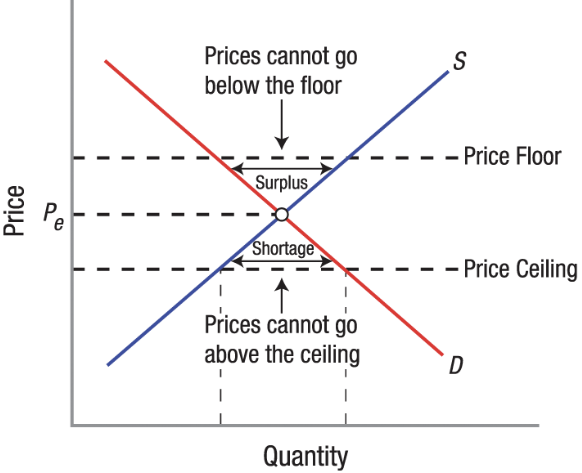

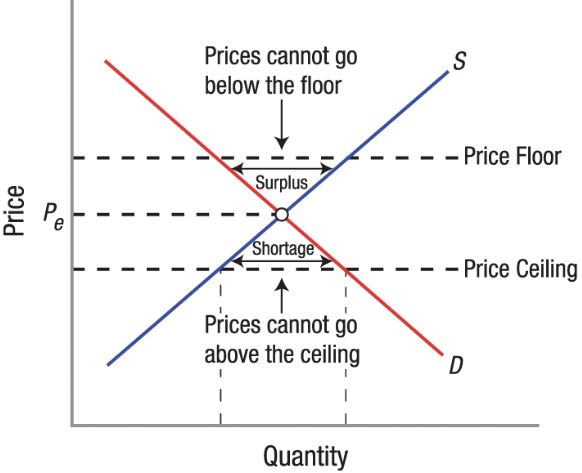

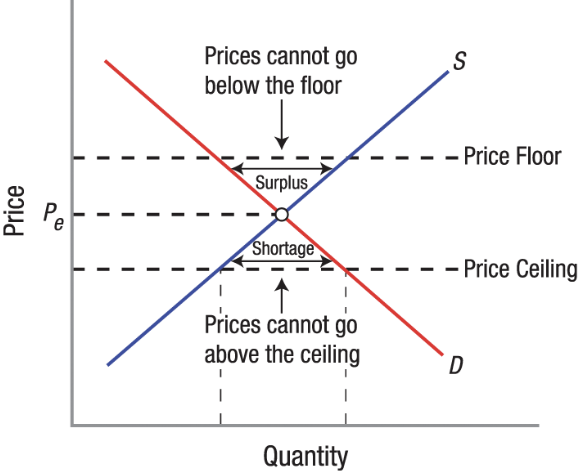

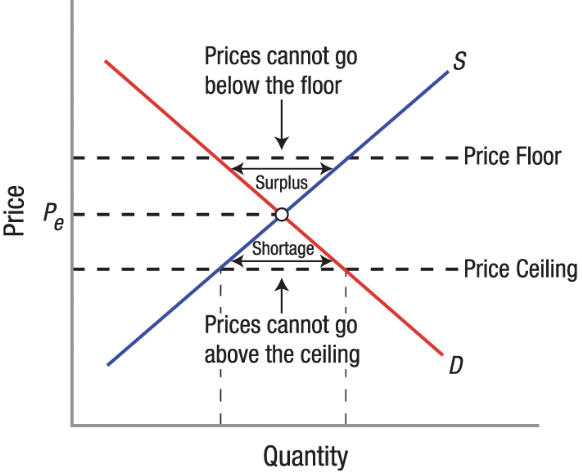

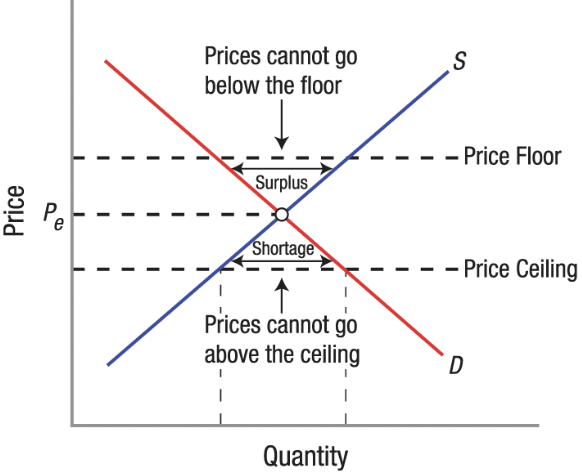

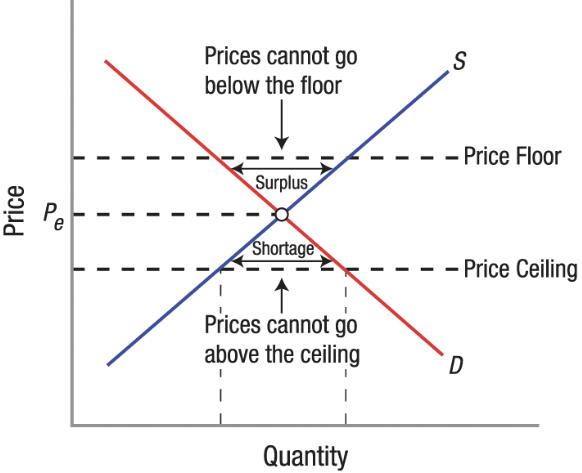

Price Floor

Price Ceiling

A government-mandated maximum price that can be charged for a good or service.

Binding Price Ceiling

Price ceilings set below the equilibrium price.

Effects of Price Ceilings

Creates Shortage

Increases consumer surplus and decreases producer surplus

Can lead to misallocation of resources, opportunity costs, and deterioration of quality.

Price Floor

A government-mandated minimum price that sellers must charge for a good or service.

Binding Price Floor

Are price floors set above the equilibrium price, which cause surpluses.

Effects of a Price Floor

Creates Surplus

Decreases consumer surplus and increases producer surplus

Reduces quantity sold

Deadweight Loss

The loss of total surplus that occurs when a market is not operating at equilibrium, representing potential gains from trade that are not realized. It is caused by inefficiencies in the market, such as prices deviating from equilibrium.