Lecture 5- quantity theory of money

1/61

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

62 Terms

What is the relationship between the money supply and the price level

Causal proportional relationship

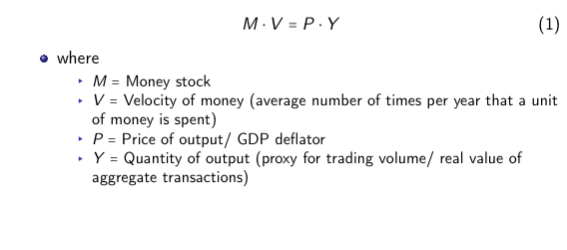

What is the fundamental equation of exchange

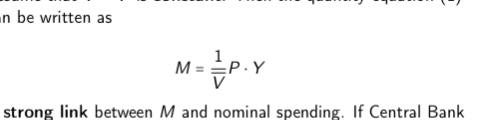

What do you assume about V And what does this mean about the equation

Assume that V=V dash

What does the strong link between ,M and nominal spending mean

In the long run and short run

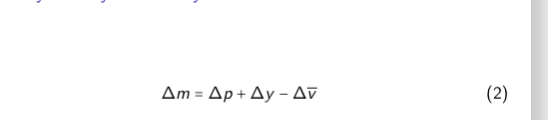

How would you interpret this equation

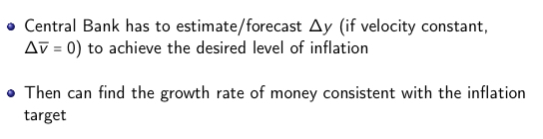

The growth rate of money stock consistent with a particular inflation target

What therefore does the central bank have to do

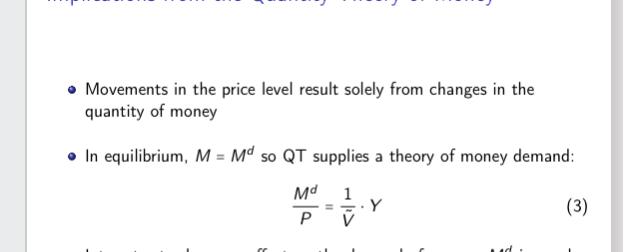

What are the implications from the Quantity theory of money

What is the effect of interest rates on the demand of money

No effect. Md is purely a function of income

What are the three motives for holding money

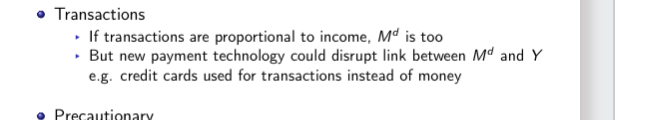

Transactions

Precautionary

Speculative motive

Explain transactions

Explain precautionary

Explain speculative motive

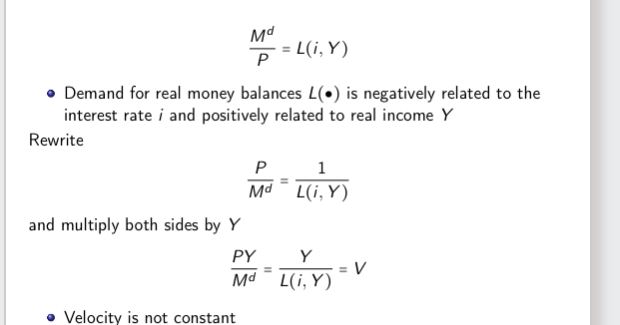

What is the equation you get when you put all three motives together

Why is veolcity not constant

The pro-cyclical movement of interest rates should induce pro-cyclical movements in velocity

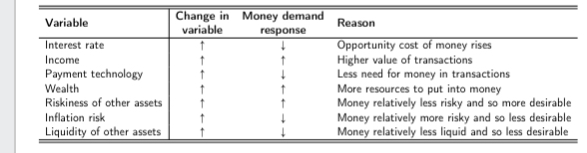

What are other factors affecting the demand for money according to Portfolio Theory

Wealth

Risk

Liquidity and other assets

What is the theory of portfolio choice consistent with

The Keynesian liquidity references function, as demand for real money balances is

-positively related to income

And negatively related to the nominal intrest rate

Overall table show in factors that determine the demand for money and why

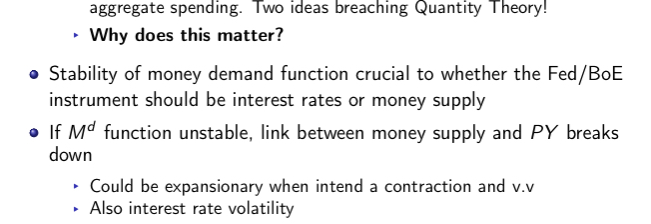

What if Md is sensitive to Change in i

If not- velocity is more likley to be constant or at least predictable

This is consistent with Quantity theory view that aggregate spending is determined by the quantity theory of money

What does more sensitivity of Md to intrest rates molies

More unpredictable velocity

Less of a clear link between Money supply and aggregate spending

Support for liquidity theory

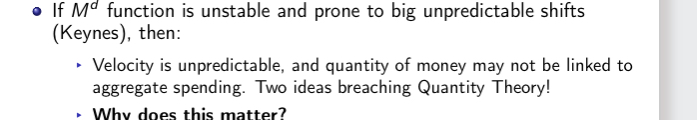

What if Md function is unstable and prone to big unpredictable shifts(KEYNES) then:

Velocity

Why does this matter

What does setting interest rate target provide

More information about stance of monetary policy than setting level for M(which becomes endogenous)

What is planned expenditure(E)

Total spending on domestically, produced goods and services that households, business, government, and foreigners want to make

Aggregate demand

C+I+G

Total output demanded in closed economy

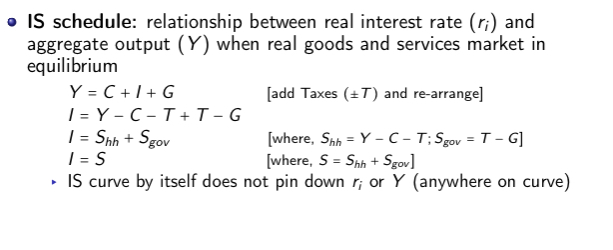

What is the IS schedule

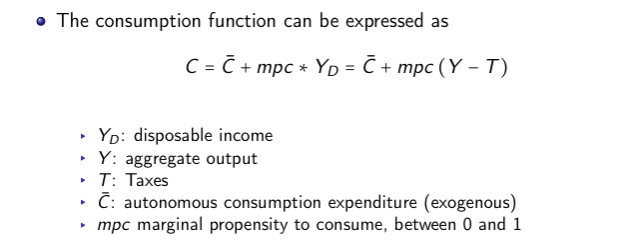

What is the consumption function equation

How is consumption expenditure positively related to disposable income

YD= Y-T

Positively related to disposable income

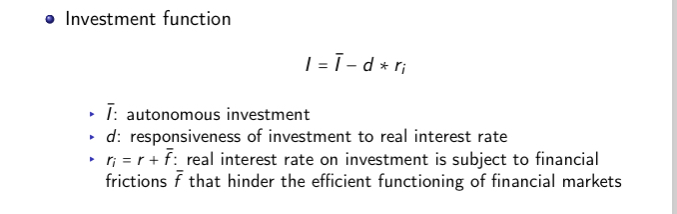

What is the investment function

What is fixed investment and what is inventory investment

Fixed is always planned

Inventory is unplanned

What does planned investment spending depend on

Interest rates and expectations

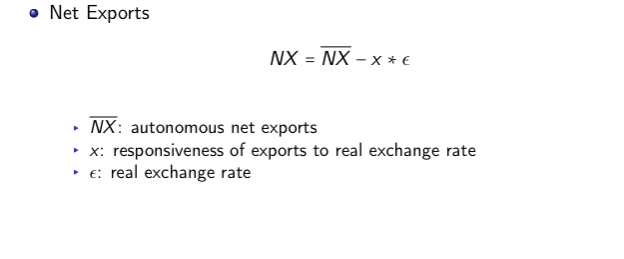

What is the equation for net exports

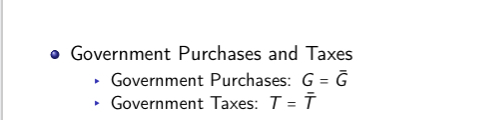

What are the signs for government purchases and tax

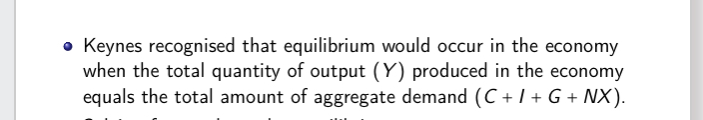

What is the goods market equilibrium

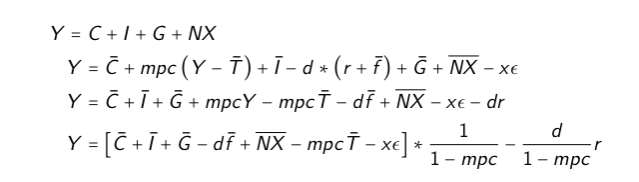

How would you solve for the goods market equilibrium

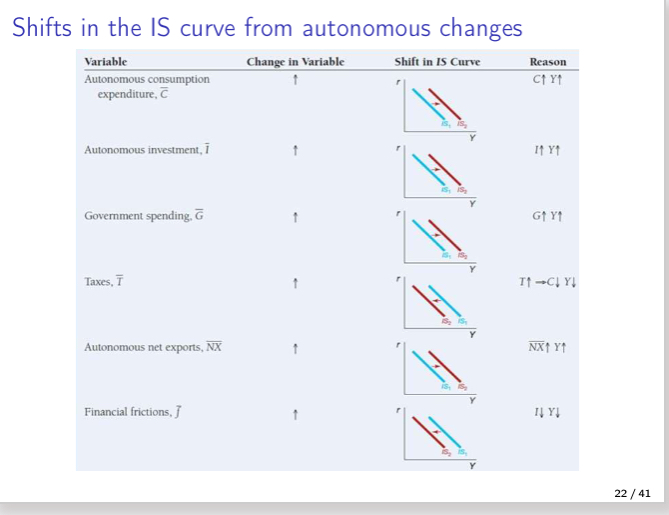

What factors shift the IS curve and what factors change the slope of the IS curve

What does the IS curve tell us and examine

What does the IS curve assume

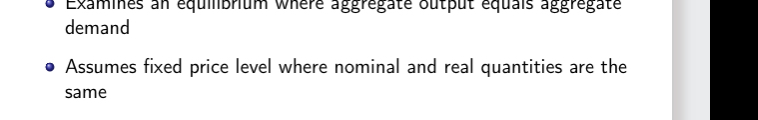

What relationship is the is curve and show graph

Relationship between equilibrium aggregate output and the interest rate e

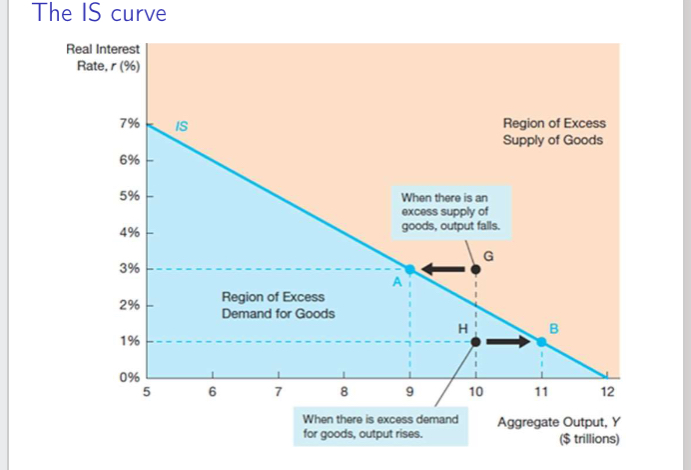

Effect of an increase in G at a given interest rate

Shifts in the IS curve from autonomous changes

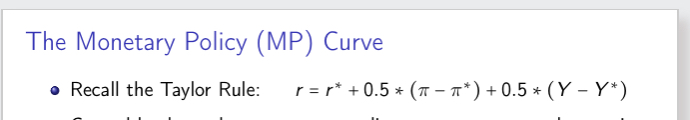

What is the Taylor rule

What is the equation for the central bank conducting monetary policy as a response to changes in output and inflation

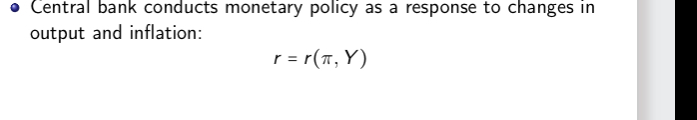

What happens when output rises and when there is an increase in inflation

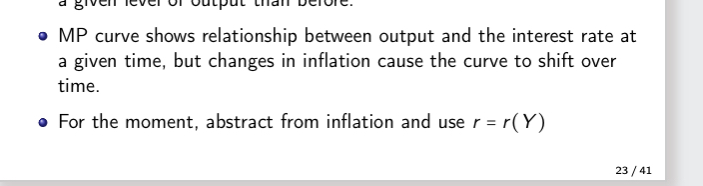

What does the mp curve show

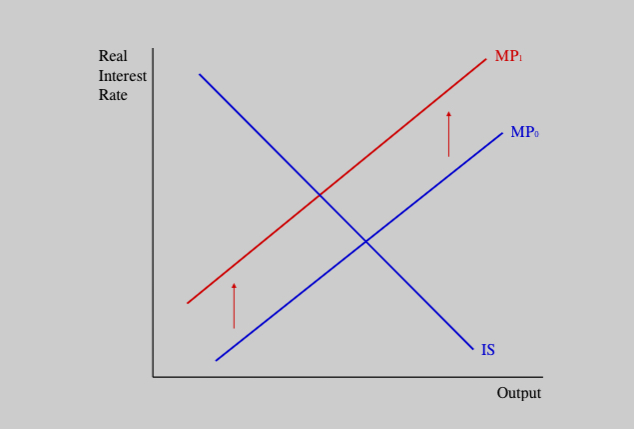

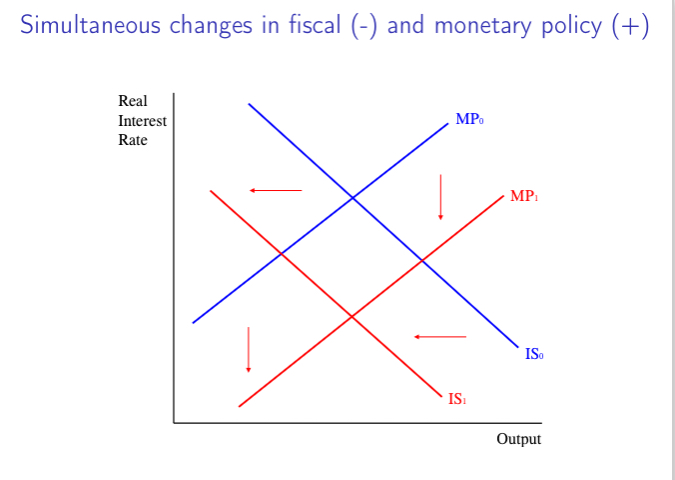

Increase in government spending

Shift to tighter monetary policy

Simultaneous changes in fiscal(-) and monetary policy

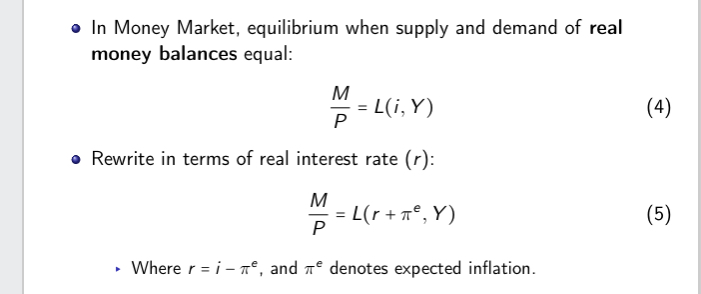

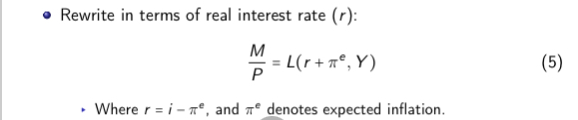

What is the equation in the money market equilibrium and rewrite in terms of real interest rate

How the central bank controls intrest rates

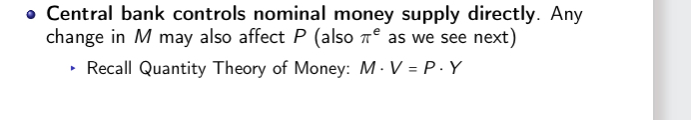

What may changes in M also effect

Directly controlled by the bank

May also affect P

Also expected inflation

M.V=P.V

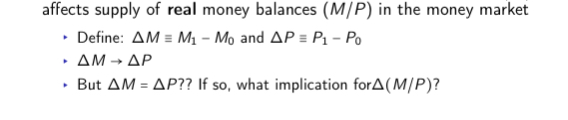

What may change in nominal money supply also affect

Supply of real money balances(M/P) in the money market

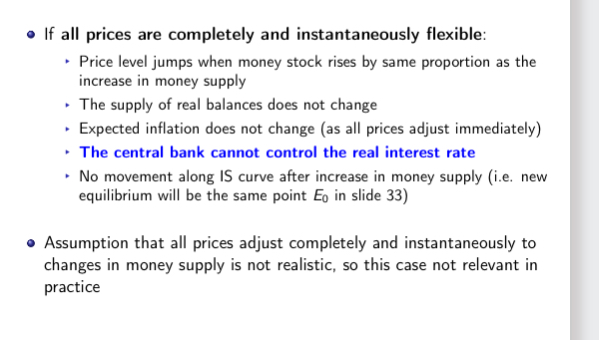

What is key to understanding how CBs control the real intrest rate and what are the two scenarios

Price adjustments dynamics

Rewrite this equation assuming prices are fixed

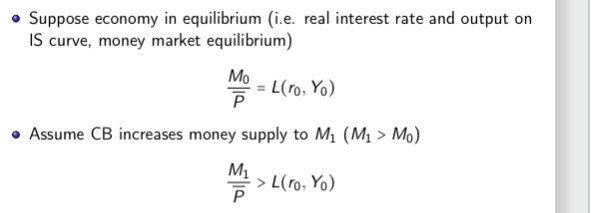

Hope to bring back the equilibrium

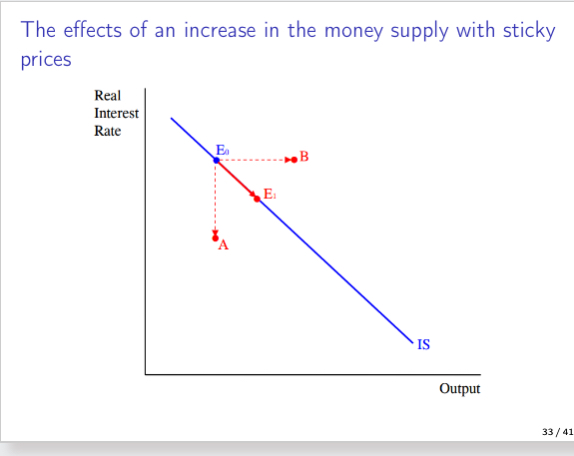

The effects of an increase in the money supply with sticky rices graph

The effects of an increase in the money supply with sticky rices Explanation

How do prices adjust in practise - flexible

Assuming full sticky prices Changes in nominal supply(M) cause changes in real intrest rate

If prices are flexible they jump up at time of money supply increase Lessing rise in real money supply

How do prices adjust in practice - sluggish

rise slowly to their new long-run equilibrium level after money supply increase

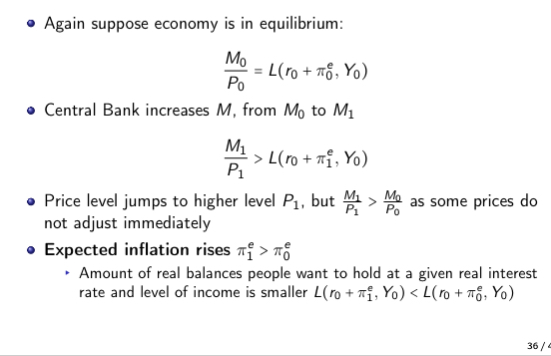

Equations showing the effect of an increase in the money supply with flexible prices and what appends to expected inflation

Effect of an increase in the money supply with flexible prices

imbalance between supply and demand of real balances

Effects of an increase in the money supply if all prices are completely and instantaneously flexible