A-Level Economics Theme 2 flashcards

1/152

Earn XP

Description and Tags

up to 2.2.4 - Government (G)

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

153 Terms

Ways to measure economic growth

Rate of change of real GDP

Gross National Income (GNI)

Rate of change of real GDP

the change in the gross domestic product

adjusted for inflation

Rate of change of real GDP = (change in gdp / original gdp) x 100

GDP

the value of all the goods and services a country produces added together

Economic growth

the percentage change in a countries real gdp from one period to the next

Gross National Income (GNI)

the GDP and net income from abroad added together (e.g. profits, dividends UK firms earn overseas subtracting the income paid to foreign firms here)

GNI equation

GNI = GDP + Net Primary Income + Net Secondary Income

Net primary income (NPI)

includes wages, salaries and other income earned by a countries residents working abroad as well as earnings from foreign investments such as dividends and interest

Net secondary income

the transfers of money between countries, such as remittances from foreign workers to their families in their countries or international aid

Nominal GDP

GDP measured in today's prices

if price rises nominal GDP doesn’t increase even if output doesn’t

Total GDP

the whole economy’s output (usually in billions of pounds)

GDP per Capita

GDP per person

GDP per capita = Total GDP / total population

Shows average income / wealth

Volume

refers to the quantity of goods/services produced ignoring price change

Closely linked to real GDP

Value

money terms

price x quantity

Unemployment

somebody without a job who is actively looking for work

Under-employment

have paid work, but fewer hours or lower skill use than you’d like, so you’re ‘partly employed’

Employment rate

employed people as a percentage of the working age population (usually 18-64)

Higher employment means more people earning and paying taxes, therefore stronger economic growth, lower welfare spending

Lower employment means lost output, therefore potentially ‘damaging’ effects on workers out of work too long (skills erosion)

Unemployment rate equation

Unemployment rate = unemployed people (ILO definition) / economically active population

Economically active population = employed + unemployed

Indicates spare capacity in labour market

High unemployment - lower consumer spending

Inflation

sustained rise in general price level

hyperinflation

an extreme rise in general price level, when prices skyrocket (double every month more)

Disinflation

inflation is still happening, but the pace is slowing

Deflation

sustained decrease in general price level

Inflation expectations

predictions of inflation in the future

Stagflation

stagnant economic growth paired with high inflation and high unemployment

Consumer price index (CPI)

tracks a fixed ‘shopping basket’ of goods and services

Calculating CPI

Basket Selection - ONS surveys families to see what people spend their money on

Price collection - each month prices for every item in the basket are gathered from supermarkets, online retailers, service providers, etc.

Indexing - each item gets a weight based on how much of household budgets it takes up

Formula - CPI today = (cost today / cost in base year) x 100

Limitations of CPI

substitution bias

quality changes

household differences

new goods

errors / inaccuracies

digital economy

Substitution bias (CPI)

consumers switch to alternatives when cost increases too much, but the CPI continues measuring the original, overstating true cost rises

Quality changes (CPI)

CPI counts a rise in cost as inflation, but does not account the improvement in quality compared to previous goods

Household differences (CPI)

different households in different areas have different spending habits and needs, with CPI being an average, it doesn’t account for everyone.

New goods (CPI)

takes time for a new good to enter the basket, therefore CPI may ignore its effect on modern spending patterns

Errors/inaccuracies CPI

sampling errors in data from surveys can affect CPI

Digital economy (CPI)

Many of the services in the digital economy do no have a price

Challenges in measuring inflation

quality adjustments

Basket of goods and services

substitution bias

subgroups and demographics

geographic variations

Quality adjustments (CPI)

CPI must make quality adjustments to account for quality changes, which can be subjective and challenging to quantify accurately

Basket of goods and services (CPI)

consumer preferences evolve over time and the basket may not always accurately reflect what people are buying

Substitution bias (CPI)

consumers tend to adjust their spening patterns in response to price changes

Subgroups and demographics (CPI)

CPI represents an average consumer, and the inflation experience can vary among groups, such as age, income, urban vs rural, etc.

Geographic variation (CPI)

the CPI is typically a national measure and may not capture regional variations in prices effectively

Measures of unemployment

claimant count

Labour force survey (ILO measure)

Claimant count

a headcount of people who are unemployed and claiming Jobseeker’s Allowance (JSA) or universal credit on grounds of unemployment

Labour force survey (ILO Measure)

survey based measure compiled by the UK’s ONS, asks for representative sample of the population, whether in the last four weeks they have been:

Without a job

Actively sought work in the last four weeks and ready to start work in the next two weeks

Claimant count pros

Quick

Available monthly

Easy to track short term changes

Claimant count cons

Excludes anyone not eligible for benefits (e.g. higher income previous earners, students)

Underestimates true unemployment

Labour force survey (ILO measure) pros

Includes a broader set of unemployed people whether or not they claim benefits

International standard

Labour force survey (ILO measure)

only comes out quarterly

With a lag

‘Noisier’ - sampling errors

Inactivity rate

the amount of people that are not employed and not actively seeking employment compared to the working age population

E.g students, retirees,

A rising inactivity rate can hide true joblessness - people may stop looking, drop out.

Inactivity rate equation

Inactivity rate = inactive population / working age population

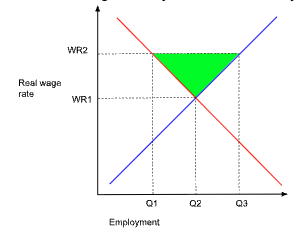

ideal real wage graph - labour market at equilibrium

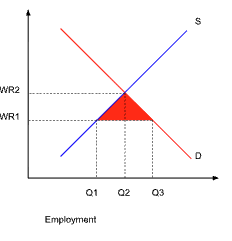

unideal real wage graph - labour market with minimum wage above equilibrium

Causes of unemployment

structural unemployment

frictional unemployment

seasonal unemployment

demand-deficiency unemployment (cyclical unemployment)

Hidden unemployment (disguised unemployment)

Real wage inflexibility

Structural Unemployment

long term mismatch between workers’ skills (or locations) and the jobs available

Happens when industries evolve or move (e..g automation, offshoring), leaving former workers without the right skills or too far from new job hubs

E.g coal mining towns hit by mine closures; miners’ skills don’t match new tech jobs

Frictional unemployment

Short term “between jobs” unemployment as people search or transition

Happens due to first job hunting and switching roles

E.g. graph design graduate spends three months applying, interviewing, and waiting to start their first position

Seasonal unemployment

regular, predictable unemployment at certain times of the year

Businesses whose demand fluctuates with seasons

E.g. farmworkers laid off after harvest

Demand-deficiency unemployment (cyclical unemployment)

Job losses when overall demand in the economy falls below firms needs

Happens due to recessions or downturns reduce consumer spending and business investment

Disguised unemployment (hidden unemployment)

where workers are employed in low productivity roles that do not enhance overall economic output

commonly occurs in developing nations with large labour surpluses in informal agricultural sectors

People who are visibly employed but are actually unemployed

Real-wage inflexibility

wages stay above the equilibrium, causing excess labour supply

Happens when minimum-wage laws, strong unions or firms’ reluctance to cut nominal wages - wages not adjusted for inflation

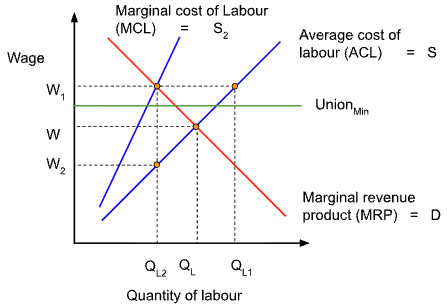

Real wage inflexibility graph (union minimum wage graph)

Migration significance

Boosts labour supply - can fill shortages

Alters unemployment rate - may temporarily raise local unemployment rates if migrants and locals compete for the same jobs; but often migrants create demand by spending incomes

Examples of migrant significance

healthcare, hospitality industries

eastern european migrants in EU expansion (2004)

Skills significance

Match quality - better trained workers fit roles more quickly and productively

Lifelong learning - upskilling reduces structural unemployment

Examples of skills significance

government funded apprenticeships in digital tech help displace manufacturing workers retrain for programming roles

Effect of unemployment on firms

Lower sales, leading to cost cutting, potential further layoffs

Lower wage pressures (bargaining power shifts towards employers)

Effect of unemployment on consumers

lower income - reduced spending and living standards

Increased financial stress and debt

Effect of unemployment on workers

scarring (loss of skills) if unemployed for a long period of time

Mental health issues

Reduced career progression

Effect of unemployment on government

higher welfare spending (benefits, retraining schemes)

lower tax revenues (income, sales tax)

potential budget deficits

Effect of unemployment on society

increased crime rates in areas of high unemployment

social exclusion family stress

political unrest or loss of trust in institutions

Balance of payments

a record of all financial dealings over a period of time between economic agents of one country and all other countries

Consists of current account and capital account and financial account

Current account

records payments for the purchase and sale of goods and services

Components in current account

Trade in goods

Trade in services

Primary income

Secondary income

Trade in goods (current account)

physical items (e.g. cars, phones oil)

Export of goods → money coming in

Imports of goods ← money going out

Trade in services

intangible things (e.g. tourism, banking or education)

Export of services → money coming in

Imports of services ← money going out

Primary income

earnings on investments and wages from abroad (e.g. a UK resident earning dividends on a US share)

→ money coming in

Secondary income

transfers like foreign aid or remittances (money sent home from workers abroad)

← money going out

Surplus

total money coming in is greater than total money going out

E.g. Saudi Arabia has a surplus on oil due to being a major oil exporter and sells more oil abroad than it buys

Deficit

total money coming in is less than total money going out

E.g. UK runs a deficit on goods, as it imports more manufactured products than it exports, though it might have a surplus on services

Deficits or surpluses affecting other macroeconomic goals

growth of jobs

inflation

exchange rates

debt and stability

deficit/surplus affecting growth of jobs

running a big goods deficit can mean fewer domestic factories and jobs, unless the deficit is offset by strong services export

deficit/surplus affecting inflation

if imports are high, currency might stay stronger (making imports cheaper, which helps keep prices down). But a weaker currency makes imports more expensive, feeding inflation

deficit/surplus affecting exchange rates

persistent deficits can weaken a currency over time; a weak currency can boost exports but make imports pricier

deficit/surplus affecting debt and stability

if you borrow from abroad to cover a deficit, that shows up in the financial account and can lead to rising foreign debt servicing that debt later can drag on income

Interconnectedness of economies

supply chains

trade agreements

currency moves

supply chains

a problem in any one place can cause a ripple to all (e.g. a factory shutdown).

This is because a car assembled in Britain may use steel from Germany, electronics from Japan and software from India

Trade agreements

Rules and tariffs can change who you buy from and sell to. If the EU raises a tariff on UK exports, that can cut Britain’s goods exports and deepen a deficit

Currency moves

a slump in one big economy can weaken its currency, making its exports cheaper and yours relatively more expensive shifting trade balances all around the world

Current account balance equation

Current account balance = (exports - imports of goods) + (exports - imports of services) + (net income) + (net transfers)

If current account balance is positive - it is a surplus

If current account balance is negative - it is a deficit

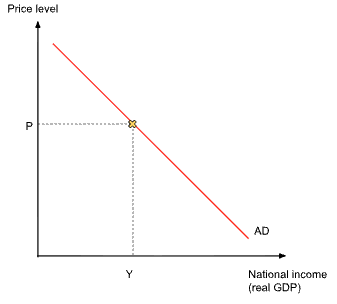

Aggregate demand (AD)

the total spending on a country’s goods and services at different price levels

Aggregate demand (AD) formula

AD = C + I + G + (X-M)

C - consumption

I - Investment

G - Government spending

(X-M) - net exports

X - exports

M - imports

Consumption (AD)

what households spend on goods and services (e.g. food, clothing, Netflix subscriptions)

Investment (AD)

what firms (and sometimes households) spend on things that will help produce in the future (e..g factories, machinery, new houses)

Government spending (AD)

what local and central government spend on schools, hospitals, roads and the armed forces

Consumption significance and effects

around 60-70% of AD, makes up the largest share, around ⅔ of GDP in advanced economies. Because consumption is so big, small changes in household confidence can more overall AD a lot

When people feel secure about their jobs and incomes, they buy more.

(e.g. Christmas, C surges as families spend on gifts and travel)

Investment significance and effects

around 10-15% of AD, more volatile, if businesses expect higher sales, they might build a new factory or upgrade equipment. Investment, although smaller, matters for long run growth, as it increases productive capacity

(e.g. 2020, UK firms delayed infesmtent because of brexit and Covid uncertainty, causing I to fall)

Government significance and effects

around 20-25% of AD, fairly stable, but can jump in a crisis

(e.g. furlough scheme in 2020-21 and road building projects)

Net exports significance and effects

around +5% to -5% depending on trade balance, can swing with the exchange rate and global demand. A stronger pound makes imports cheaper (M up), exports dearer (X down), so net exports fall; and vice versa.

Reasons for AD sloping down

interest rate effect

wealth effect

exchange rate effect

interest rate effect (AD)

At higher average price (AP) levels, there are likely to be higher interest rates. Higher interest rates reduce investment and are an incentive for households to save - and vice versa

Wealth effect (AD)

As average price (AP) increases, the purchasing power of households decreases and the AD falls - and vice versa

exchange rate effect (AD)

As AP falls, interest rates are likely to fall too. Lower interest rates lower the exchange rate. With a lower exchange rate, the economy's goods/services are more attractive abroad and exports increase, thereby increasing real GDP

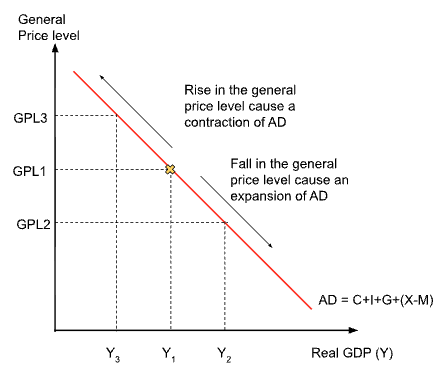

AD Graph

Downward sloping line shows that as the overall price level falls, people can buy more (Their money goes further), exports become more competitive and interest rates tend to fall, spurring investment and consumption

Movement along AD curve

happens when price level itself changes and spending adjusts