Chapter 5: Variance analysis

1/40

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

41 Terms

The following cards test the summary of variances sheet, theory will follow.

Sales Variance

What are the 3 key calculations for sales variances and when compared, what do the variances show?

Sales

Actual quantity sold * Actual price

Actual quantity sold * Standard price

Budgeted quantity sold * Standard price

1 vs 2 = Price variance

2 vs 3 = Volume variance

1 vs 3 = Total variance

Materials Variance

What are the 3 (there is an extra calculation for the 3rd) key calculations for materials variances and when compared, what do the variances show?

Materials

Actual quantity purchased * Actual price

Actual quantity purchased * Standard price

Standard quantity * Standard price

Standard quantity = Actual units * Standard kg/unit

1 vs 2 = Price variance

2 vs 3 = Usage variance

1 vs 3 = Total variance

How is closing inventory calculated?

Actual quantity purchased * Standard price

Actual quantity used * Standard price

Difference between 1 and 2 = closing inventory

Labour Variance

What are the 4 (there is an extra calculation for the 4th) key calculations for labour variances and when compared, what do the variances show?

Labour

Actual hours paid * Actual rate

Actual hours paid * Standard rate

Actual hours worked * Standard rate

Standard hours * Standard rate

Standard hours = Actual units * Standard hours/unit

1 vs 2 = Price/rate variance

2 vs 3 = Idle time variance

3 vs 4 = Efficiency variance

1 vs 4 = Total variance

Variable Overheads Variance

What are the 3 (there is an extra calculation for the 3rd) key calculations for variable overheads variances and when compared, what do the variances show?

Variable Overheads

Actual hours worked * Actual rate

Actual hours worked * Standard rate

Standard hours * Standard rate

Standard hours = Actual units * Standard hours/unit

1 vs 2 = Expenditure variance

2 vs 3 = Efficiency variance

1 vs 3 = Total variance

How is fixed overheads expenditure variance calculated under marginal costing?

Actual fixed overheads

Budgeted fixed overheads

Difference between 1 and 2 = expenditure variance

Fixed Overhead Variances under Absorption Costing

Units:

What are the 3 key calculations for fixed overheads variances (units) under absorption costing and when compared, what do the variances show?

Units

Actual fixed overheads

Budgeted units * Standard FOAR/unit

Actual units * Standard FOAR/unit

1 vs 2 = Expenditure variance

2 vs 3 = Volume variance

Hours:

What are the 4 key calculations for fixed overheads variances (hours) under absorption costing and when compared, what do the variances show?

Hours

Actual fixed overheads

Budgeted hours * Standard FOAR/hr

Actual hours * Standard FOAR/hr

Standard hours * Standard FOAR/hr

1 vs 2 = Expenditure variance

2 vs 3 = Capacity variance

3 vs 4 = Efficiency variance

Define standard costs (predetermined)

Define ‘standard price’.

Describe the 4 main types of standard:

Attainable standard

Basic standard

Current standard

Ideal standard

Elaborate on some of the following criticisms of the appropriateness of standard costing:

Standard costing was developed when business environments were more stable.

Attainment of the standard used to be judged as satisfactory.

Emphasis on labour variances.

Many modern products are digital.

What is variance analysis?

Explain the difference between cost variances and sales variances

When do favourable and adverse variances occur?

What are the 3 main variance groups? What variances come under variable cost variances?

What effect does the sales price variance show?

What is sales volume variance a measure of?

What are some potential causes of sales price variances?

What are some potential causes of sales volume variances?

What is direct material total variance the difference between?

A total material variance actually conveys very little useful information. It needs to be analysed further. It can be analysed into two sub-variances:

Direct material price variance

Direct material usage variance

Define them

What is direct material price variance the difference between?

What happens if raw materials are valued at standard cost or actual cost?

What does direct material usage variance show?

What are some potential causes of material price variances?

What are some potential causes of material usage variances?

Direct labour total variance is the difference between:

the actual cost of direct labour and

the standard direct labour cost of the actual production.

A total labour variance can also be analysed further. It can be analysed into the following sub-variances:

Direct labour rate variance

Direct labour efficiency variance

Define them

What happens to labour efficiency variance when idle time occurs?

how is the direct labour idle time variance defined?

How is the idle time variance calculation different if an organisation experiences idle time on a regular basis?

What are some of the possible causes of labour rate variances?

What are some of the possible causes of labour efficiency variances?

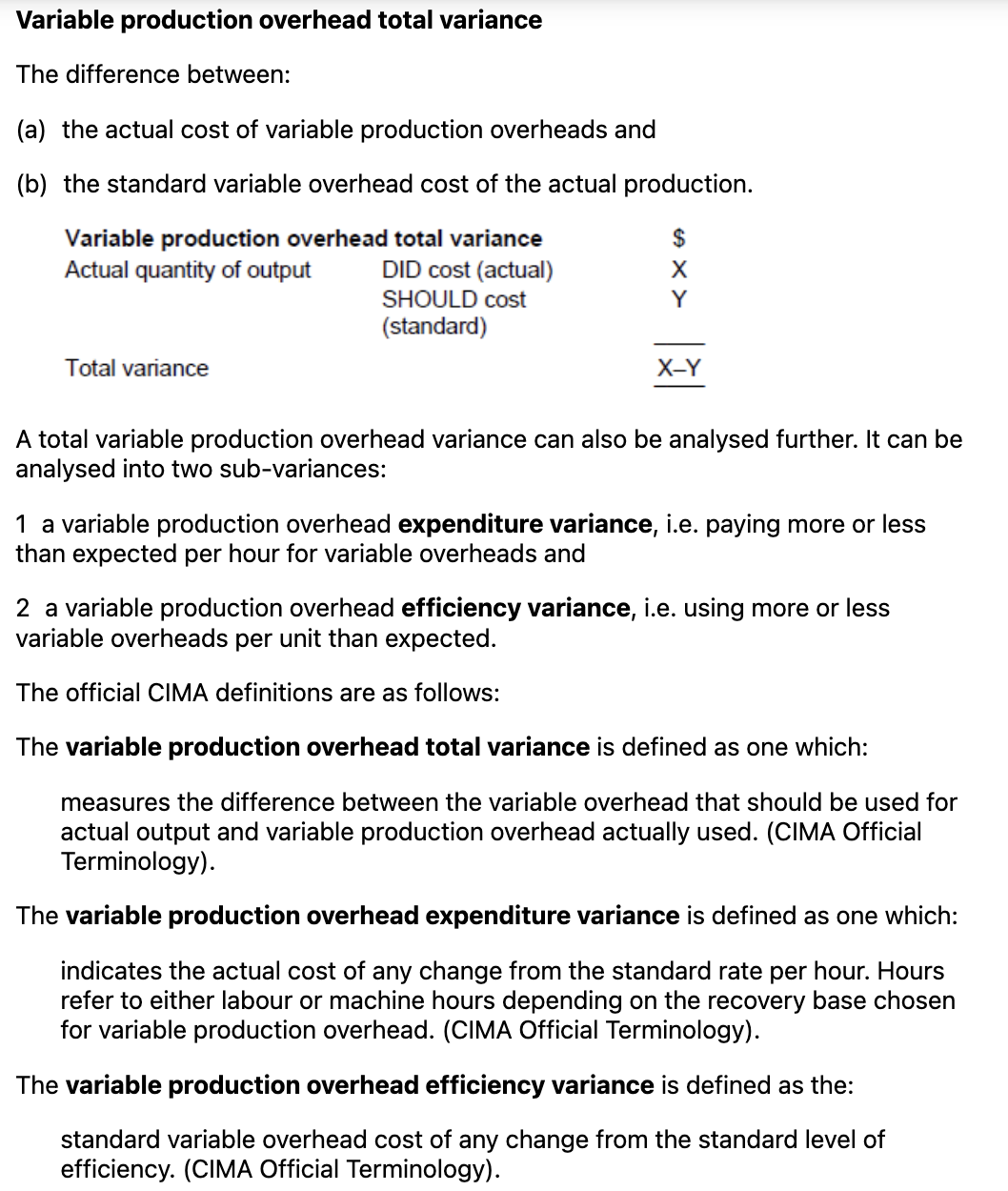

Define the following:

variable production overhead total variance

variable production overhead expenditure variance

variable production overhead efficiency variance

What is assumed with variable production overhead variances?

What the sentence means

Variable production overhead (VOH) (power, small supplies, etc.) only happens when machines/people are actually working.

Idle time = hours paid but no production (breakdowns, no materials, etc.).

So, when we analyse VOH variances, we should treat VOH as incurred on active hours only, not on idle hours.

Why this matters: if you include idle hours in the VOH calculations, you’ll create fake “inefficiency” in overheads, even though nothing was being used.

Quick example

Standard VOH rate (SR) = $3 per hour

Standard hours for the output (SH) = 100 hours

Actual hours paid = 110 hours, of which 10 are idle → active hours = 100

Actual VOH rate (AR) = $3.20 per active hour

Actual VOH cost = 100 × $3.20 = $320

Correct (active-hours-only) treatment

VOH spending (expenditure) variance

= (AR − SR) × Active hours

= (3.20 − 3.00) × 100 = $20 AVOH efficiency variance

= SR × (Active hours − SH)

= 3.00 × (100 − 100) = $0

Idle time doesn’t show up in VOH variances (because no VOH should be incurred while idle). The cost of idle time is analysed in labour variances instead.

If you (wrongly) used total hours paid (110)

Spending variance = (3.20 − 3.00) × 110 = $22 A

Efficiency variance = 3.00 × (110 − 100) = $30 A

Now VOH looks “inefficient” by $30 just because there were 10 idle hours—even though VOH wasn’t used during that time. That’s misleading.

Bottom line

Assume VOH is driven by active production hours. Analyse idle time in labour variances, not VOH; otherwise you’ll blame overheads for time when nothing was running.

What is the variable production overhead expenditure variance the difference between?

Does the fixed production overheads variance occur in the marginal costing system?

What do fixed overhead capacity and efficiency variances measure?

What are some potential causes of fixed and variable overhead variances?

Explain interdependence between variances, give 1 or 2 examples.

what is an operating statement?

How often should variances be reported and what may a typical hierarchy of control reports look like?