Economics Theme 2 - Edexcel A

5.0(1)

Card Sorting

1/93

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

94 Terms

1

New cards

Actual Growth

Economic growth measured by changes in real GDP.

2

New cards

Aggregate Demand (AD)

The total level of demand in an economy at any given price level at any given moment in time. Consumer Spending + Investment + Government Spending + (Exports Value - Imports Value).

3

New cards

Aggregate Supply (AS)

The total amount of output in an economy at any given price at any given moment in time.

4

New cards

Animal Spirits

The level of confidence of business owners.

5

New cards

Balance of Payments

A record of all financial dealings over a period of time between economic agents of one country and all other countries.

6

New cards

Base Year

A year chosen as a good comparison in a series of data when building an index; it is automatically given an index figure of 100.

7

New cards

Boom

The peak of the business cycle, when growth is high.

8

New cards

Budget

Where the government lays out their spending and taxation plans.

9

New cards

Budget Deficit

When the government spends more money than it receives.

10

New cards

Budget Surplus

When the government receives more money than it spends.

11

New cards

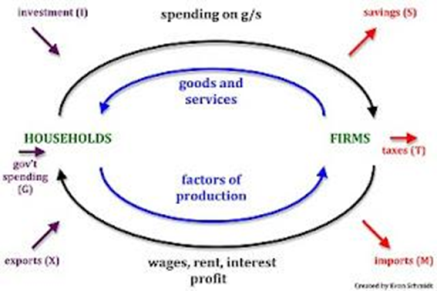

Circular flow

A model of the economy which shows the flow of goods and services, the factors of production and money around the economy.

12

New cards

Claimant Count

A measure of unemployment; the number of people receiving benefits for being unemployed.

13

New cards

Consumer Price Index (CPI)

Official measure used to calculate rate of inflation, using a weighted basket of goods.

14

New cards

Consumption

Consumer spending on goods and services.

15

New cards

Cost Push Inflation

Inflation caused by a decrease in AS.

16

New cards

Current Account

A record of the payments for the purchase and sale of goods and services as well as income and transfers.

17

New cards

Current Account Deficit

When more money leaves the country than enters, so the current account is negative.

18

New cards

Current Account Surplus

When more money enters the country than leaves, so the current account is positive.

19

New cards

Cyclical Unemployment

Unemployment caused by a lack of AD.

20

New cards

Deflation

A persistent fall in prices of goods and services. Inflation is negative.

21

New cards

Deflationary/Contractionary Policy

Fiscal or monetary policy which is aimed at reducing AD.

22

New cards

Demand Pull Inflation

Inflation caused by an increase in AD.

23

New cards

Depreciation

The reduction in the value of machinery over time.

24

New cards

Direct Tax

Taxes paid straight to the government by the individual taxpayer.

25

New cards

Disinflation

A reduction in the rate of inflation.

26

New cards

Disposable Income

The money consumers have left to spend, after taxes have been taken away and benefits added.

27

New cards

Economic Growth

An increase in the long term productive potential of the economy; an increase in the amount of goods and services which are produced, measured by an increase in real GDP.

28

New cards

Employed

Someone who does more than 1 hour of paid work a week or is temporarily away from work, on a government supported training scheme or does a minimum of 15 hours unpaid work for the family business. (International Labour Organisation (ILO) Definition).

29

New cards

Expansionary Policy

Fiscal or monetary policy which is aimed at increasing AD.

30

New cards

Exports

Goods and services sold to foreigners that bring income into the country.

31

New cards

Export-Led Growth

Economic growth arising from an increase in exports.

32

New cards

Fiscal Policy

The use of borrowing, government spending and taxation to manipulate the level of AD and improve macroeconomic performance.

33

New cards

Frictional Unemployment

Unemployment caused when people move between jobs and enter the job market.

34

New cards

Gross Domestic Product (GDP)

The value of goods and services produced in a country over a given period of time.

35

New cards

GDP Per Capita

Total GDP divided by the population.

36

New cards

Gross Investment

Investment both to replace old machinery that has depreciated and to create/buy new ones.

37

New cards

Gross National Income (GNI)

The value of goods and services produced by a country over a period of time plus net overseas interest payments and dividends.

38

New cards

Gross National Product (GNP)

The value of goods and services produced by citizens of a country, whether the live in the country or not.

39

New cards

Government Spending

Spending by the government on the provision of goods and services.

40

New cards

Imports

Goods and services bought from foreigners that takes income out of the country.

41

New cards

Inactive

Those neither employed nor unemployed; those not participating in the job market.

42

New cards

Income

A flow of assets

43

New cards

Index Number

Numbers allowing accurate comparisons to be made over time. The base year value is typically 100.

44

New cards

Indirect Tax

Tax where the person charged with paying the money to the government is able to pass the cost onto someone else.

45

New cards

Inflation

The general rise in prices of goods and services that erodes the purchasing power of money.

46

New cards

Injection

Spending power entering the circular flow of income resulting from investment, government spending and exports.

47

New cards

Interventionist Supply Side Policies

Policies designed to correct market failure, where the government intervenes in the market.

48

New cards

Investment

Spending by businesses on capital goods, which leads to the creation of real goods.

49

New cards

Labour Force Survey

A measure of unemployment which surveys people to class them as unemployed, employed or inactive under the ILO definitions.

50

New cards

Living Standards

The quality of life enjoyed by people in a country.

51

New cards

Long run

When all factors of production are variable.

52

New cards

Long Run Aggregate Supply (LRAS)

The total output an economy can produce when operating at full output

53

New cards

Long Run Trend Rate of Growth

The average sustainable rate of economic growth over a period of time.

54

New cards

Marginal Propensity to Consume (MPC)

The proportion of an increase in income spent on consumption. Change in Consumption/Change in Income.

55

New cards

Marginal Propensity to Import (MPM)

The proportion of an increase in income spent on imports. Change in Imports/Change in Income.

56

New cards

Marginal Propensity to Save (MPS)

The proportion of an increase in income that is saved. Change in Savings/Change in Income.

57

New cards

Marginal Propensity to Tax

The proportion of an increase in income that is taken away in tax. Change in Taxation/Change in Income.

58

New cards

Marginal Propensity to Withdraw (MPW)

\`The proportion of an increase in income that is withdrawn from the circular flow. MPW = MPS+MPT+MPM

59

New cards

Market-based Supply-side Policies

Policies which are designed to remove anything which prevents the free market system working efficiently.

60

New cards

Monetary Policy

The attempts of the central bank/regulatory authority to control the level of AD by altering base interest rates or the amount of money in the economy (QE).

61

New cards

Monetary Policy Committee (MPC)

9 Economists who meet monthly to set the Bank rate as well as other monetary instruments.

62

New cards

Monetary Supply

Stock of money in the economy.

63

New cards

Multiplier

An increase in an injection will lead to an even greater increase in national income. 1/(1-MPC).

64

New cards

National Expenditure

The value of spending by households on goods and services.

65

New cards

National Income

The value of money paid by firms to households in return for land, labour, capital and enterprise.

66

New cards

National Output

The value of the flow of goods and services from firms to households.

67

New cards

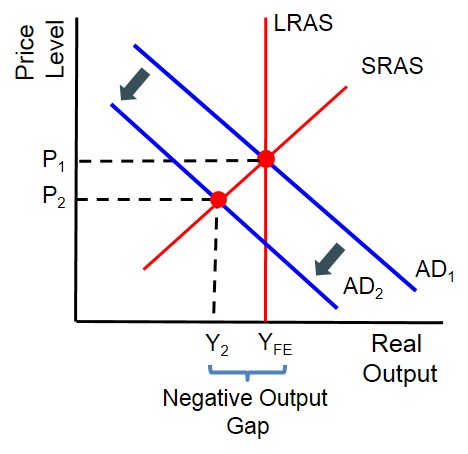

Negative Output Gap

When GDP is lower than predicted; the economy is producing below full output.

68

New cards

Net Exports

Exports - Imports

69

New cards

Net Investment

Investment adjusted for depreciation; gross investment minus depreciation.

70

New cards

Nominal GDP

GDP which does not take inflation into account; GDP at current prices.

71

New cards

Output Gap

The difference between the long term trend rate of growth and actual growth.

72

New cards

Positive Output Gap

When GDP is higher than predicted; the economy is producing above full output.

73

New cards

Potential Growth

A change in the productive potential of the economy.

74

New cards

Purchasing Power Parity

Exchange rate of one currency to another that compares the cost of living in different countries through comparing a typical basket of goods.

75

New cards

Quantitative Easing (QE)

When the central bank buys assets (bonds) from banks in exchange form money in an attempt to increase the money supply. The banks loan the money out.

76

New cards

Real GDP

GDP which strips out the effect of inflation.

77

New cards

Real Wage Unemployment

Unemployment caused when wages are set above the equilibrium wage rate.

78

New cards

Recession

The trough of the business cycle, when growth is low.

The government defines it as where real GDP falls in at least two successive quarters.

The government defines it as where real GDP falls in at least two successive quarters.

79

New cards

Retail Price Index (RPI)

An old measure of inflation which has lost its national statistic status. Includes housing costs and council tax.

80

New cards

Savings

The decision by consumers to postpone consumption.

81

New cards

Seasonal Unemployment

Unemployment caused when an industry only operates during certain times of the year.

82

New cards

Short Run

When at least one factor of production is fixed.

83

New cards

Short Run Aggregate Supply (SRAS)

Aggregate supply when at least one factor of production is fixed.

84

New cards

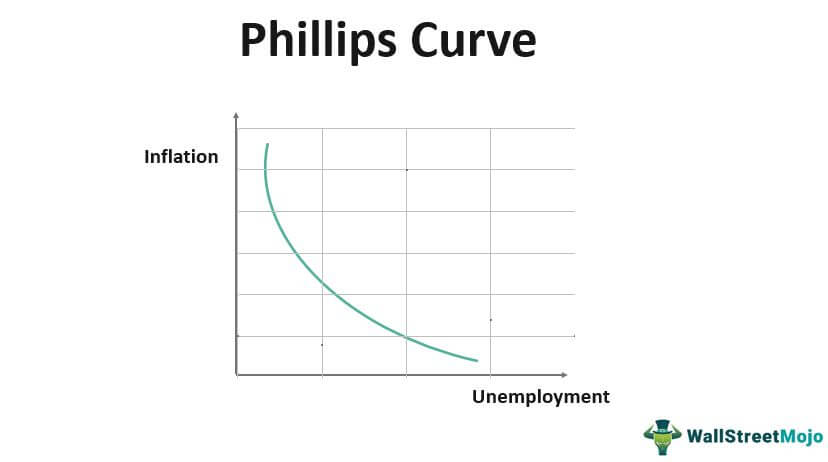

Short Run Phillips Curve

Shows the relationship between unemployment and inflation: higher levels of unemployment lead to lower levels of inflation.

85

New cards

Structural Unemployment

Unemployment caused by the long term decline of an industry.

86

New cards

Supply-Side Policies

Government policies aimed at increasing the productive potential of the economy and shifting LRAS to the right.

87

New cards

Total GDP

The GDP of the whole country.

88

New cards

Trade (Business) Cycle

The tendency of economic growth to rise and fall above the trend rate of economic growth, causing booms and busts.

89

New cards

Underemployment

Those who are working part time, on zero hour contracts or on government training schemes but would prefer to be fill time or those employed in areas below their skill level.

90

New cards

Unemployed

Those who are without work, able to start work in the next 2 weeks and have actively sought work for the last 4 weeks (ILO definition).

91

New cards

Value of GDP

Nominal values of GDP; GDP at current prices.

92

New cards

Volume of GDP

Real values of GDP; the size of the basket of goods.

93

New cards

Wealth

A stock of assets.

94

New cards

Withdrawal

Spending power leaving the circular flow of income resulting from savings, taxation and imports.