Unit 4: Price Controls

1/6

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

7 Terms

indirect taxes

taxes imposed on spending goods & services

paid partly by consumers & to the gov’t by producers

Types of Ind. Taxes

excise taxes: taxes imposed on particular goods n’ services

ie. gas, cigarettes, + alcohol

taxes on spending on (almost) all goods n’ services

ie. general sales taxes, value-added taxes

Types of Excise Taxes

specific taxes: fixed amount of tax/unit of a good or service sold

ad valorem taxes: fixed percentage of price of a good or service

amount of tax incr. as price of good incr.

direct taxes

taxes w/ a payment of them by taxpayers to gov’t

Why Gov’ts Impose Ind. Taxes

source of gov’t revenue

as PED decr., gov’t revenue incr; therefore, more taxes = more gov’t revenue

method to discourage consumption of goods harmful for the individual

consumption of goods (ie. cigarettes/alcohol) can be reduced via ind. taxes

use of redistributing income

taxes w/ focus on luxury goods can be taxed against high-income earners

payment of a tax on purchase = decr. post-tax income = lower class difference

method to improve allocation of resources via correcting negative externalities

market imperfections (form of neg. externalities) are remedied via ind. taxes

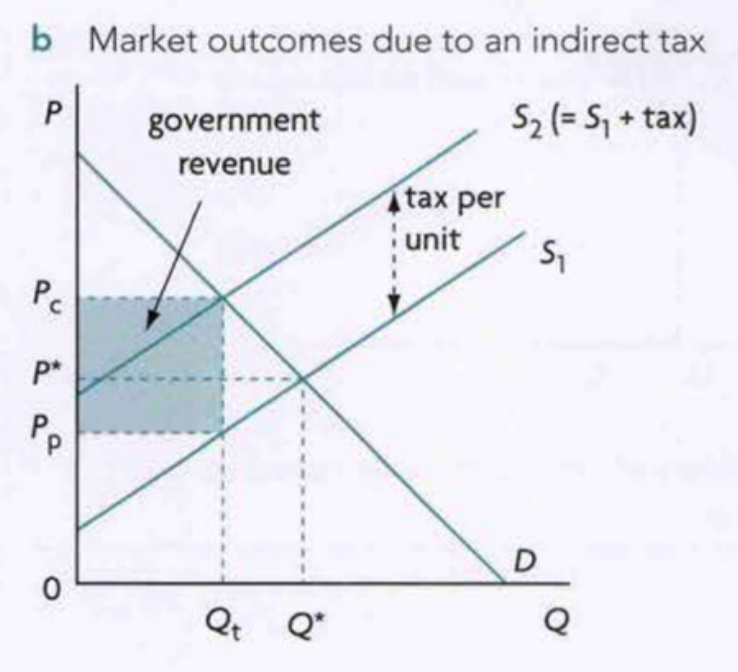

Market Outcomes w/ Ind. Taxes

Qeq. decreases (Q* → Qt)

Peq increased (P* → Pc)

consumer expenditure changes (P* x Q* → Pc X Qt)

price received by firms decreases (P* → Pp)

firm revenue decreases (P* x Q* → Pp X Qt)

gov’t receives tax revenue (Pc-Pp)Qt

under allocation of resources (Qt <Q*)

Consequences of Ind. Taxes

Consumers

increase Pgood

decrease Qbought

Producers (firms)

decrease in Preceives

decrease in Qoutput-sold

decrease in Revenue

Gov’t

revenue gained (Pc-Pp)Q

Workers

decrease in output (Q*→ Qt)

fewer workers needed = unemployment

Society as a Whole: Consumer + Producer Surplus

under allocation of resources

recudes consumers and produer surpluses

some to gov’t, some to welfate loss

Society as a Whole: Welfare Loss

received from consumer & producer surpluses

result of underproduction (MC>MC)