12 financial markets and monetary policy

1/58

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

59 Terms

functions of money

medium of exchange

unit of account - can compare values

store of value

standard of deferred payment - loans

characteristics of money

durable

divisible

transportable

hard to counterfit

money supply

total amount of money circulating in the economy

narrow money

notes and coins, money on demand, can be withdraw straight away

board money

includes narrow money but also includes bank deposits which may require notice to withdraw and other liquid assets - cant be used directly on the highstreet

financial markets

money markets - short term lending

capital market - long term lending

foreign exchange market (FOREX)

financial market

money and capital markets are used as sources of finance for the individuals demanding funds and a way for financial institutions to lend their funds

money market

borrowing/lends in the short term (less than a year)

liquid funds

includes inter bank lending

includes short term government borrowing

treasury bills

treasury bils

issues by the treasury each week to ensure the government has enough cash for its day to day running

treasury bills are normally issued for 3, 6 or 12 moths

low risk as they are loaned tot he UK government - safe investment

sold at a discount to face value (e.g. buy for £970, get £1,000 at maturity)

interbank loans

banks in the UK provide loans to each other so that they aren’t short of cash

interest rate paid on there is determined by the interbank lending rate

the capital market

where financial securities like shares and bonds are issued to raise medium to long term finance (over a year)

split into 2 sections

primary market

new issues of shares and bonds

secondary market

reading existing shares and bonds

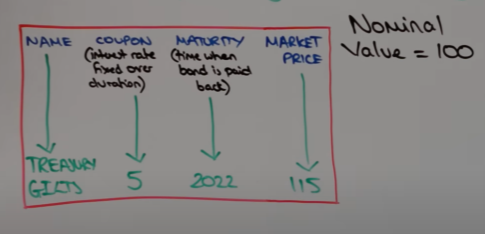

bonds

financial securities issues by governments and companies (corporate bonds) with the aim of raising capital for repayment over the medium to long term

bonds have different values, GILT bond = $100

if an investor wants to buy a GILT then they may purchase a 3 year GILT for $100 with a coupon rate of 4% ($4 per year)

the coupon rate is fixed

bond yeild

coupon rate / market price X 100

although the coupon rate says the same as the yield, the yield can fluctuate due to changes in the bond's market price

therefore, bond yield provides a measure of the return an investor can expect based on current market conditions

yield and bond prices have an inverse relationship, meaning when bond prices rise, yields fall, and vice versa

why, coupon rate is fixed so as the price rises the coupon rate will be divided by a large number resulting in a small yield

inverse relationship between bond prices and interest rates

government will set coupon rates as the same as market interest rates - substitutes

if yields are higher than market interest rates, demand will increase as investors look to purchase bonds

this drives up the market price of bonds and therefore lowers the yields

until they reflect market interest rates

price of bond = coupon / yields X 100

debt

money borrowed that must be repaid, usually with interest

form: loans, bonds, or credit

repayment: fixed repayments over time, regardless of business performance

ownership: lenders do not own any part of the business

risk: lower for lender (secured), but borrower must repay even if business fails

return: interest payments

priority: debt is repaid before equity if a business is liquidated

equity

ownership in a business issued shares or retained earnings

no obligation to repay, but shareholders expect dividends

ownership interest in a company, represented by shares

holders are entitled to vote on company matters and receive dividends

return is not guaranteed and depends on company performance

equity holders face higher risk but have the potential for greater profit

risk: higher for investors—returns depend on business performance

return: dividends and capital gains

priority: equity holders are paid after all debts are settled

the foreign exchange market

a global marketplace for the trading of currencies, where foreign exchange rates are determined

it involves participants such as banks, businesses, governments, and investors buying or selling currencies

liquidity

the availability of liquid assets to a market or company, reflecting how easily assets can be converted into cash without affecting their price

high liquidity indicates that an asset can be quickly sold in the market, while low liquidity might imply that selling the asset will take longer or require a discount

role of financial markets in the wider economy

facilitate the allocation of resources, enabling capital flows among various sectors, which promotes economic growth

provide mechanisms for price discovery, risk management, and liquidity, contributing to the overall efficiency and stability of the economy

commercial banks

financial institutions that accept deposits from the public and make loans, crucial to the banking system and economy

retail banks

oligopoly, low risk

functions of commercial banks

accept deposits

provide current and savings accounts

advancing loans, overdrafts, mortgages

provide credit cards

provide insurance

share dealing - bonds and shares

investment bank

a financial institution that specialises in more risky financial activities

functions of investment banks

assisting governments and businesses to raise capital

advising businesses on mergers and takeovers

trade in financial securities

organise new share issues - will guarantee to buy unsold shares

loan money for riskier business ventures

systemic risk

the collapse of the entire banking system causes by inter linkages within the financial system

why did the banking system struggle in 2007/2008

banks lent to riskier household groups

many traditional banks took on investment banking services

banks started banking on inadequate capital reserves and faced significant losses from mortgage-backed securities

problems with banks failing

if commercial banks fail many people would lose the money in their savings accounts

businesses would lose money banked with them

these are direct implications, it would be likely that confidence in the banking system would be 0, people and businesses would take their money out of all banks

investment would then be less in the future and AD and AS would reduce

governments prevent colapse

government put 850bn to ensure they dont collapse

they took ownership of some main banks

they allowed mergers

lower the consequence of an investment bank failing

the government introduced ring fencing which will ensure that a banks commercial activities are separated from their investment activities, reducing risk and protecting consumers

commercial bank balance sheet

financial statement recording

assets - bank loans - advances

liabilities - bank owes - deposits

capital - bank has invested

retained profit, selling shares

banks main assets

most liquid

cash

deposits at the BOE

short term securities - T-bills

long term securities - bonds and shares

loans and mortgage (advances)

fixed assets - land

least liquid

liquidity current ratio

requires banks to hold sufficient high quality liquid assets to exceed the net cash outflows of the next 30 days

banks loans out 10000, bank has less money but more assets

liquidity worsens but profitability increases

how banks create credit

savers deposit money in banks and gain a rate of return back from banks as a result

banks will then create loans from those savings to lend to borrowers and charge an interest rate, IR greater than rates given to savers

fractional reserve banking

saver deposits $100

the bank then decides how much of that saving needs to stay in the bank, knowing that its unlikely the saver will demand all that money back at once

bank keeps 10 of 100 (10%)

90 is then leant out to borrowers

spending generates income for other people meaning the 90 will end up back in the bank meaning the bank has created credit as there is now 190 in the bank

this process then repeats

banks artificially create money in the economy by making loans on fractional reserve banking

money multiplier

1 / reserve ratio

limits of the central bank to create credit

the demand for credit from banks, the major influence is the price of the credit (IR on loans)

the lower the IR, the greater the demand for credit and thus a higher credit multiplier

confidence of businesses and consumers

regulations prevent the bank from creating credit freely

cash ration of the bank

objectives of commercial banks

maintaining surficial liquidity

liquidity measures the ease with which tassets can be turned into cash, bank holds assets to meet LCR

profitability

profits demanded by shareholders, banks need to maximise returns

security

CBs must ensure they have sufficient capital

retained profit to cover losses

commercial bank objective conflicts

liquidity vs profitability

liquid asses such as cash help at BOE tend tyo be less profitable as they are low risk compared to certain illiquid assets which are high risk, high return

banks need to ensure they are profitable while also ensuring they are liquid

profitability vs security

banks need to hold a certain amount of capital however, there is an opportunity cost involved as this capital is not doing anything and thus costing the banks potential profit

central bank

The national institution responsible for managing a country's currency, money supply, and interest rates, often overseeing commercial banks and implementing monetary policy - BOE

functions of the central bank

regulating the money supply

managing inflation through interest rates

overseeing the banking system

providing financial stability

serving as a lender of last resort to commercial banks

monetary policy

action that a countries central bank can take to influence how much money is in the economy and how much it costs to borrow

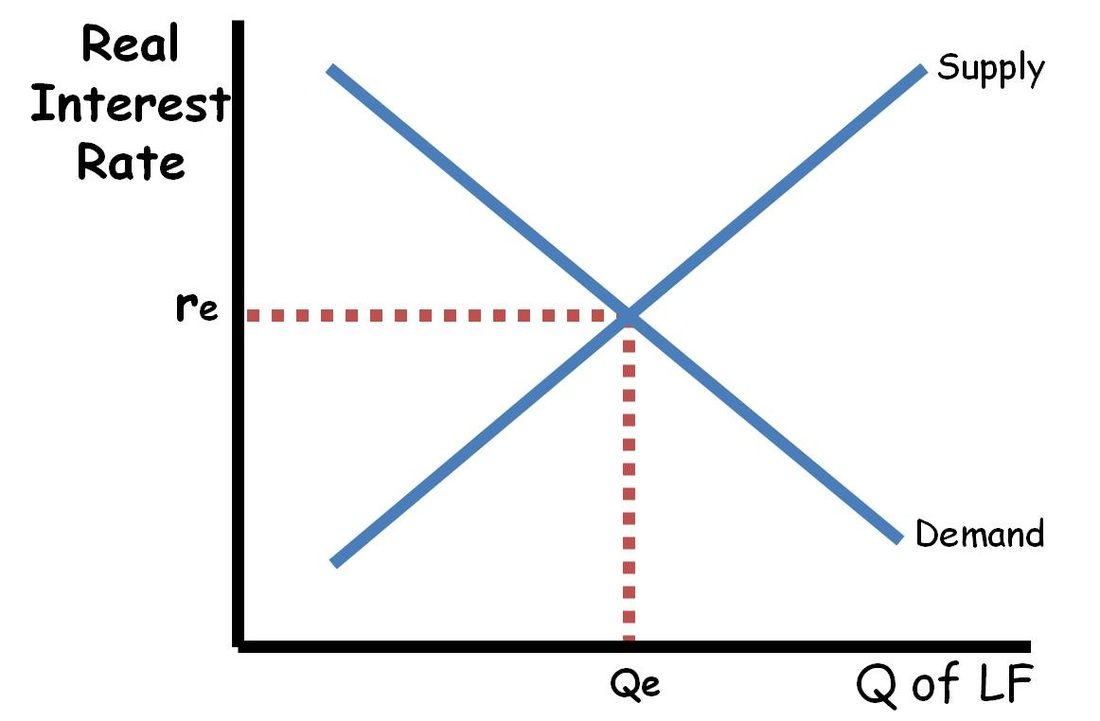

market interest rates - loanable funds theory

the loanable funds model explains the determination of IRs through the relationship between supply and demand for loanable funds in an economy

thee supply of loanable funds comes from savings (households, firms), while the demand for funds comes from consumers, firms and the government

increase supply of loanable funds comes from

confidence falls - people start to save

people have more money - save more

banks loan that money out

increase demand for loanable funds comes from

business expansion

government borrowing

an increase in consumer spending or investment incentives

monetary policy objectives

control inflation (2%)

economic growth and macroeconomic stability

def - absence of excessive fluctuations in the economic cycle

constant output

low and stable inflation

monetary policy instruments

interest rates

affect demand for credit

quantitative easing

affect amount of money in circulation

changing cash reserve ratio

affect banks ability to supply credit

exchange rate

affect the cost of out imports and so can affect inflation

forward guidance

monetary policy committee ad IRs

hawk - keeping inflation on target

dove - someone who looks at the economy as a whole

transmission mechanism of monerary policy

BOE increase IR

commercial banks increase rates as it costs more to borrow from BOE

households cut back on consumption as it costs more to borrow and they save

firms reduce investment as it costs more

households are encourages to save rather then spend

government expenditure falls as the government is paying back more on debt interest payments

AD falls

wealth affect - decrease is wealth as high IR make other assets less attractive

less inflation as businesses lower prices due to lack of demand

as IR rise, ER increase causing hot money

decrease in demand for exports

imports become cheaper

less cost push inflation

problems with monetary policy

time lags - BOE estimates it can take up to 2 years for IR change takes effect

liquidity trap

a situation in which prevailing interest rates are low and savings rates are high, rendering monetary policy ineffective

people are reluctant to spend even with very low IRs

people saving in a recession due to a lack of confidence (savings ration goes up)

people weren’t borrowing because banks are unwilling to lend, leading to a stagnation in economic growth

why

expectations of economic uncertainty causing job insecurity

expectations that IR will rise

quantitative easing

central banks create money electronically to buy financial assets such as government bonds

price of government bonds increases as there is more demand and so yield falls

IR falls as they are substitutes

financial institutions loan money out or invest it in riskier corporate bonds or shares

causes business to invest

create more jobs and stimulate consumption

AD and LRAS increase

forward guidance

central bank announce to certain markets that it plans to keep interest rates low for an extended period, providing signals about future monetary policy to influence economic decisions

this can boost economic activity and investment

issues with forward guidance

a commitment to keep IRs low for a long time is an admission that the economy is deeply depressed and tis could actually knock confidence and expectations

governor changes his mind

why might a bank fail

borrowing short, lending long

can lead to a liquidity mismatch, causing insolvency if deposits are suddenly withdrawn or if the bank faces losses on long-term loans

systemic risk

trading with insufficient capital and liquidity

capital doesn’t need to be repaid so can be used to mitigate losses

liquid assets are important so banks can access cash when needed

engaging in risky banking activities

many banks choose to hold assets which have higher returns but are also higher risk and less liquid

there can often be asymmetric information

regulators of the financial system

prudential regulation authority (PRA)

financial conduct authority (FCA)

financial policy committee (FPC)

PRA

prudential Regulation Authority

responsible for the regulation of banks and financial institutions to ensure their safety, ensures they successfully manage risk and have enough capital as security

part of BOE

FCA

financial conduct authority

sperate from BOE

responsible for ensuring that the conduct of firms in financial markets is acceptable and meets standards

FPC

financial policy committee

part of BOE

exists to identify, monitor and take action to remove or reduce systemic risk

macro advice to the government on managing financial markets

powers include, set LCR, set cash reserve ratio

stress testing

examines the potential impact of an imaginary adverse scenario on the entire banking system and individual firms

designed to inform regulators about resilience to economic shocks and ensure financial stability

scenarios

house prices fall by 30%

GDP falls

unemployment rises

chine enters recession

liquidity coverage ratio (LCR)

banks need enough high quality liquid assets to meet 30- days worth of cash outflows

core tier one capital

baseline minimum requirement for a bank's capital; it includes common equity and is crucial for financial stability

4.5%

banks assets are 100m, it must hold capital of 4.5m

moral hazard

when one person or organisation takes greater risks because third partiers carry the burden

banks take risk because the government bails them out

loanable funds

the money available for borrowing in the financial system, determined by the supply of funds from savers and the demand for funds from borrowers