Economic fluctuations

1/13

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

14 Terms

What defines the start/end of a recession according to NBER

Start → Business cycle peak

End → Business cycle trough

Old rule of thumb was that two consecutive quarters of falling real GDP = recession, but NBER uses broader judgement considering personal income, employment, retail sales, industrial production

How does real GDP growth behave over time on average

Fluctuates on average around 3% per year

Which GDP component is more volatile: consumption or investment?

Investment is far more volatile and it’s high sensitivity makes it a major driver of business cycle fluctuations

Okun’s law

There is a relationship between unemployment and real GDP

Higher unemployment = fewer workers producing goods/services = lower GDP - negative relationship

States that for every 1% increase in unemployment a countries GDP falls by 2%

Although short-run fluctuations in GDP are associated with unemployment, but long-run growth is driven by tech progress not unemployment trends.

Classical dichotomy - long run

States that real variables e.g. output, employment, real interest rates and nominal variables e.g. money supply, rate of inflation can be analysed separately.

Can be seen from LRAS diagram - vertical line - so all changes/shifts of AD curve ONLY affect prices not real variables e.g. output because long-run output is fixed, known as full-employment level of output

Short vs long run

Short run: prices are sticky, adjust slowly, money supply affects real variables but not prices

Long run: prices are flexible, adjust to supply/demand, prices affected by money supply, but real variables are unchanged

AS-AD model

Resembles supply-demand model for a single good, but incorporates interactions across many markets, e.g. capital labour, tech (AS) and confidence, investment expectations, monetary and fiscal policy (AD)

Quantity theory - AD

MV = PY

M = Money supply, V = Velocity of money (number of time money changes hands), P = price level, Y = output

If velocity is constant (implies constant money demand per unit of output) money supply determines nominal value of output (AD) - shifts AD - if M increases AD shifts right and vice versa - IN MODEL

If V is constant and M is fixed by central bank then new equation:

Y = MV/P - implying negative relationship between price level and output which is the basis of the AD curve

if P goes UP and MV is fixed (fixed amount of money) then Y HAS to go DOWN (can carry out fewer transactions so D and Y decrease) and vice versa

Real money balances equation

M/P = kY → real money supply(M/P) = real money demand (kY)

where k = 1/V

SRAS vs LRAS

SRAS - perfect elasticity if we assume complete price rigidity - so a shift in AD changes output only (with upward-sloping SRAS change shift in AD changes output AND price)

LRAS - perfectly inelastic due to fully-flexible prices - long run output doesn’t depend on price level, productive capacity determines output so LRAS is drawn as a vertical line

Intersection of AD with either determines Eq. in each horizon

Effects of a decrease in M: SHORT AND LONG RUN

Reduction in money supply shifts AD curve left(downward), in the short run prices are sticky, so output falls, unemployment rises, economy enters recession, wages lower, firms sell less and as prices are fixed they cut production by laying off workers.

But then over time, low demand leads firms to cut prices gradually, nominal wages reduced, then economy moves down the second AD curve, reaching a new long-run Eq. on the LRAS curve now, output and employment returns to natural level/rate, price level permanently lower than before decrease in M

Shocks and stabilisation

Shocks = exogenous events that shift AD and AS curves, push output/employment away from their natural level, and stabilisation policy (often come with balancing costs of output fluctuations against cost of inflation) are actions aimed at reducing the severity of shocks/short-run fluctuations

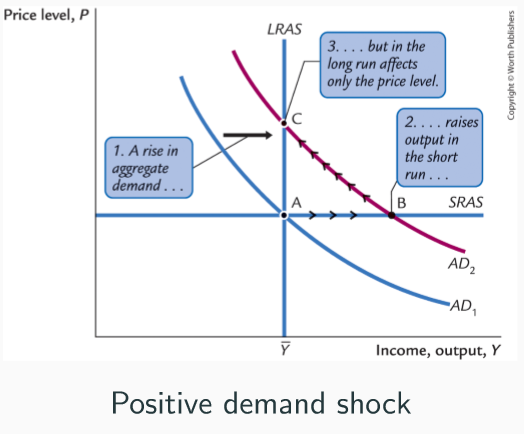

Positive demand shock e.g. introduction of credit cards

Reduces desired money holdings - supply M fixed so higher V - raises nominal spending - AD shifts outward, in the short run firms sell more at existing prices, output rises above natural level, firms have to hire more workers, extend hours, utilise capital more intensively, experience a boom, but over time high demand pushes up wages and prices, which then decreases D, economy returns gradually to natural level of output but at higher price level.

Central bank can counteract this, and neutralise demand shocks by reducing money supply.

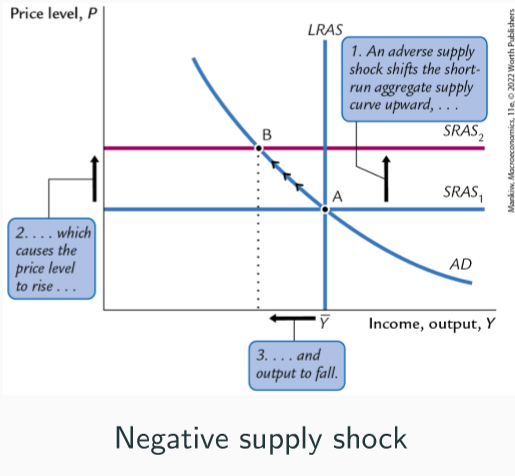

Negative supply shock e.g. formation of international oil cartel e.g. OPEC

Directly affect price level, can shift SRAS

Increased world oil prices, in US caused inflation to rise AND unemployment - STAGFLATION

Raises firms production costs, shift SRAS curve upward, higher price level and output falls, stagflation.

Over time, this creates downward pressure on wages and prices, so firms cut wages and reduce prices as contracts adjust, falling costs = SRAS shifting downward gradually, price level returns to initial value, and output and employment return to natural levels

Supply shock has no long-run effect on output

Also, central bank can expand money supply to shift AD outward and offset supply shock effect - new Eq. where new AD curve meets SRAS2 curve, where price level is still high but output returns to original level.