Monetary policy

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

15 Terms

What is monetary policy?

Used to control money flow in an economy - uses interest rates and QE to influences levels of consumer spending and inflation

aim of monetary policy

low inflation and stable economic growth

What is expansionary monetary policy? (3)

increases economic activity by reducing I/r which increases consumption and AD

Increases investment

decreases exchange rate - increases exports - increased growth and AD

What is deflationary monetary policy?

decreases economic activity

increases MPS - decreases consumption

decreases investment

appreciation of exchange rate - increases imports - decreases AD

Effects of interest rates on the housing market

lower = lower mortgage payment = increased demand = increased consumption = increases AD = inflation

Evaluation example of monetary policy

covid decreased confidence and I/r were already near 0% so it was still not enough to stimulate demand

2008/9 deep recession - cut i/r from 5 to 0.5%

2007-11 cost pull inflation over 5% and recession

What is a liquidity trap?

when I/r are very low and monetary policy becomes ineffective

What is QE?

central banks increase money supply and use these electronically created funds to buy government bonds and other securities - used when I/r ineffective

increased supply of money to encourage banks to lend at a lower interest rates

money used to buy financial assets like from buying government bonds (maybe from commercial banks)

This increases the demand for bonds

increases price of bonds

decreases yield (I/r on bonds)

I/r for mortgages etc decrease

AD, C, I increase

Possible disadvantage of QE

cheaper mortgages increases house prices → wealth effect → increased wealth inequality

What type of policy is QE?

expansionary monetary policy

Role of the central bank

Monetary function - policy

financial stability

Lends to commercial banks/ manages liquidity

Debt management - gov debt

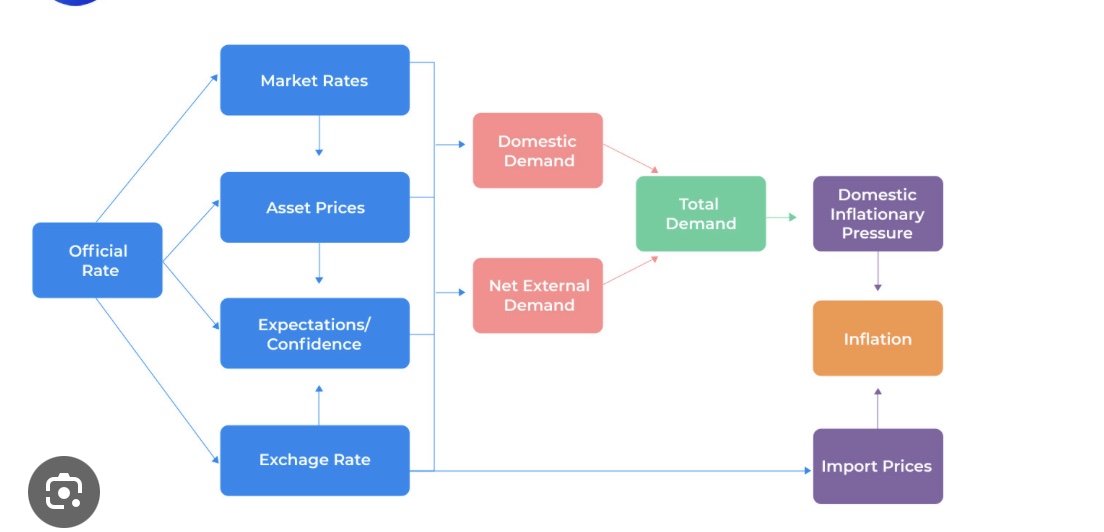

The transmission mechanism

Change in the base rate influences 4 primary factors

Market rate - mortgages and the bank lend rate

asset prices - house

Confidence - investment and spending

Exchange rate - SPICED

These all secondarily effect Net external and domestic demand which affects AD creating domestic inflationary pressures and inflation

Exchange rate effects import prices and therefore inflation

What is forward guidance?

Only in the SR there is an announcement for future plans of interest rate change to influence market expectations.

Thinking is that if commercial banks can be convinced that they can borrow overnight from BoE at a lower interest rate for a period of time then they may be willing to lend out money for the longer term at also a lower interest rate

Good and bad forward guidance

could lose credibility if promises are not kept

Helps influence LR interets rates

could reduce inflation expectations

Evaluate monetary policy

Time lags

Consider fiscal policy also - they may work against each other

QE depends on interest rates - must be close to 0