CAPE May/June Paper 3 2011

1/8

Earn XP

Description and Tags

Answers to the written questions

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

9 Terms

Explain what is meant by the term “the entity concept”.

The entity concept views a company as an independent economic entity that is not related to its owner or other stakeholders. This indicates that the owner(s)' personal finances are kept apart from the company's financial records.

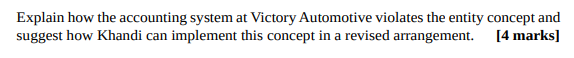

Because Khandi does not keep her personal and business finances separate, Victory Automotive is in violation of the entity concept. She pays employees and covers business expenses with the money she deposits into her personal bank account. Khandi should open a distinct business bank account for all Victory Automotive transactions in order to put the entity concept into practice. This account should be used to pay all business expenses and to receive all business income.

State four benefits of implementing an effective internal control system in a business.

Prevents fraud and theft

Improves accuracy and reliability of financial reporting

Enhances operational efficiency

Ensures compliance with laws and regulations

State four control measures a business could implement to safeguard and effectively control its inventory.

Create inventory tracking and recording systems

Implement physical inventory counts

Restrict access and grant it to authorized personnel

Establish minimum and maximum stock levels

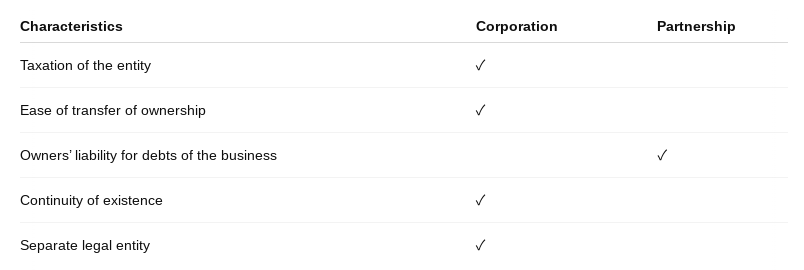

State 2 advantages and disadvantages of a partnership.

Advantages of a partnership include, shared risk/responsibility and flexibility in management. Disadvantages include potential conflicts between partners and unlimited liability for debts.

State 2 advantages and disadvantages of a limited liability company.

Advantages of a limited liability company include limited liability protection for its owners and easier access to capital through shareholder investments. Disadvantages include more regulation and increased operational costs.

What is the difference between the bonus method and the goodwill method?

The bonus method involves a capital contribution from a new partner, causing redistribution between partners, while the goodwill method records the business's value above its book value, with each partner having their own capital accounts.

Contingent liability refers to a potential obligation that may arise depending on the outcome of a future event.

The business should record a provision in the financial statements in line with IAS 37 since it is likely that it would have to pay damages and the amount can be expected.

The liability should be stated as a contingent liability in the financial statements' notes with sufficient details if it is not recognised for any reason (for example, due to uncertainty regarding its extent).

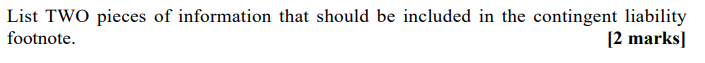

A description of the nature of the contingency.

An estimate of the financial effect