(SOLVING) 2 - Financial Statements Analysis

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

34 Terms

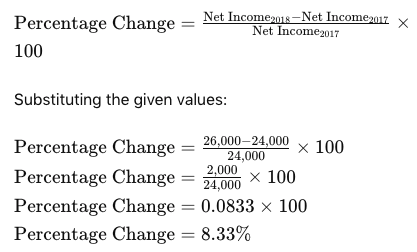

D) 8.33%

A company reported P18,000 of net income for 2016, P24,000 for 2017, and P26,000 for 2018. The percentage change in net income from 2017 to 2018 was:

A) 20.00%

B) 30.00%

C) 10.00%

D) 8.33%

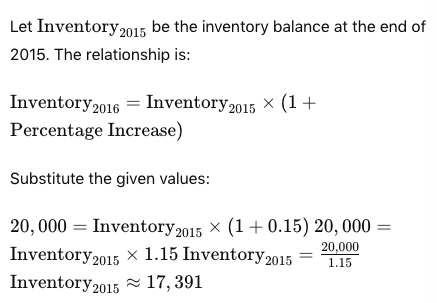

D) P17,391

Assuming the inventory balance at the end of 2016 is P20,000 and it has increased by 15% since the end of 2015, the balance at the end of 2015 (rounded to the nearest whole peso) was:

A) P17,000

B) P18,000

C) P16,364

D) P17,391

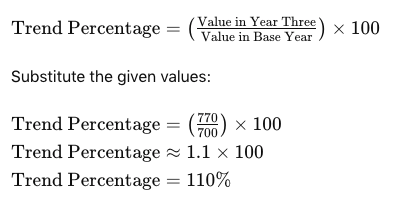

A) 110%

If year one equals P700, year two equals P742, and year three equals P770, the percentage to be assigned for year three in a trend analysis, assuming that year one is the base year, is

A) 110%

B) 106%

C) 91%

D) 100%

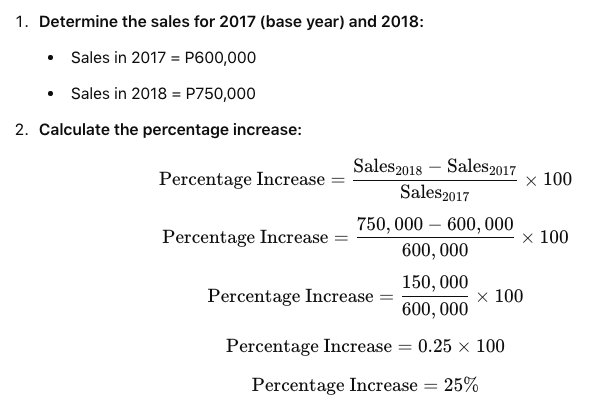

C) 25%

If 2017 is the base year, what is the percentage increase in sales from 2017 to 2018?

A) 125%

B) 167%

C) 25%

D) 20%

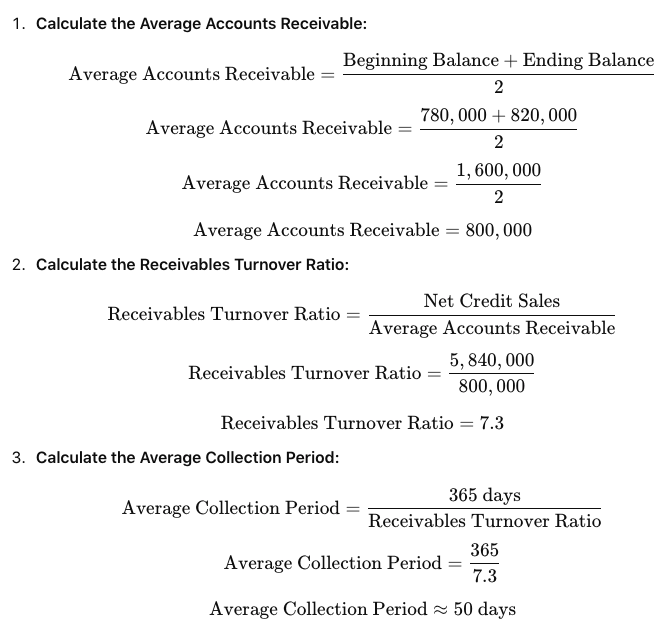

D) 50 days

A company had a balance in the Accounts Receivable account of P780,000 at the beginning of the year and a balance of P820,000 at the end of the year. Net credit sales during the year amounted to P5,840,000. The average collection period of the receivables in terms of days was

A) 30 days

B) 365 days

C) 100 days

D) 50 days

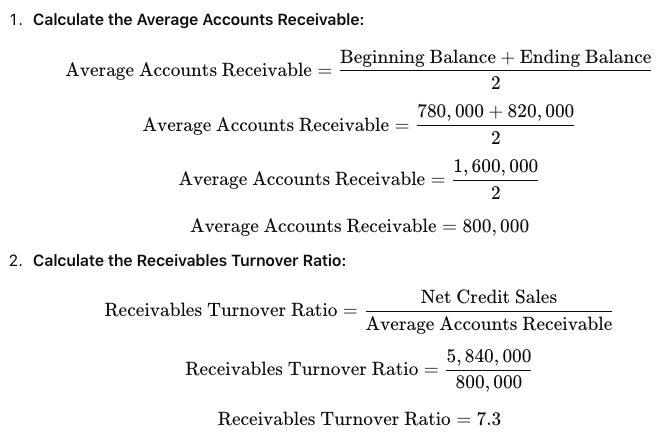

B) 7.3 times

A company had a balance in the Accounts Receivable account of P780,000 at the beginning of the year and a balance of P820,000 at the end of the year. Net credit sales during the year amounted to P5,840,000. The receivable turnover ratio was

A) 7.1 times

B) 7.3 times

C) 7.5 times

D) 7 times

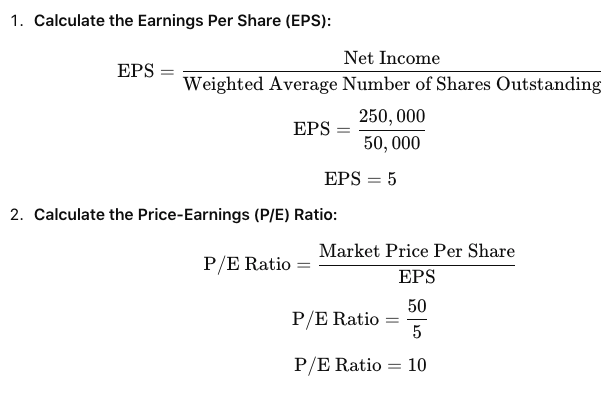

C) 10 times

Banner Corporation had net income of P250,000 and paid dividends to common stockholders of P50,000 in 2020. The weighted average number of shares outstanding in 2020 was 50,000 shares. Banner Corporation's common stock is selling for P50 per share on the Makati Stock Exchange.

The company's price-earnings ratio is

A) 2 times

B) 8 times

C) 10 times

D) 5 times

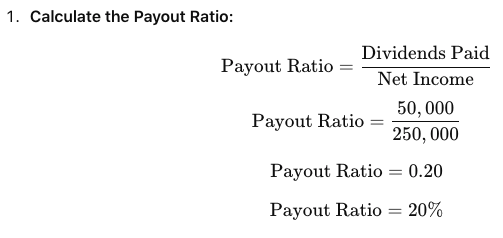

C) 20%

Banner Corporation had net income of P250,000 and paid dividends to common stockholders of P50,000 in 2020. The weighted average number of shares outstanding in 2020 was 50,000 shares. Banner Corporation's common stock is selling for P50 per share on the Makati Stock Exchange.

The company’s payout ratio for 2020 is

A) P5 per share

B) 25%

C) 20%

D) 12.5 %

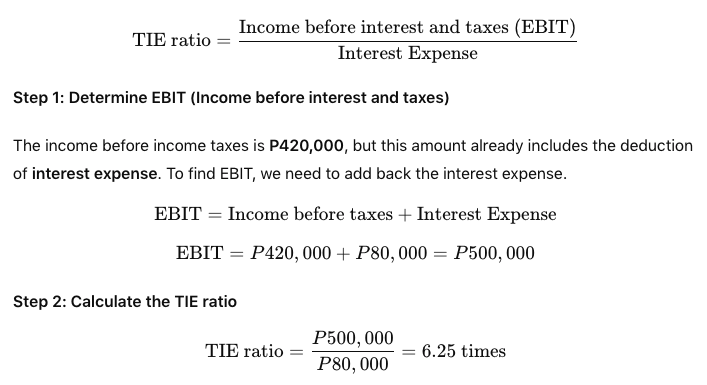

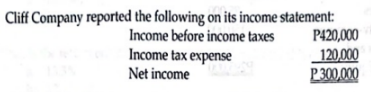

C) 6.25 times

An analysis of the income statement revealed that interest expense was P80,000. The company's times-interest-earned ratio was

A) 8 times

B) 5.25 times

C) 6.25 times

D) 5 times

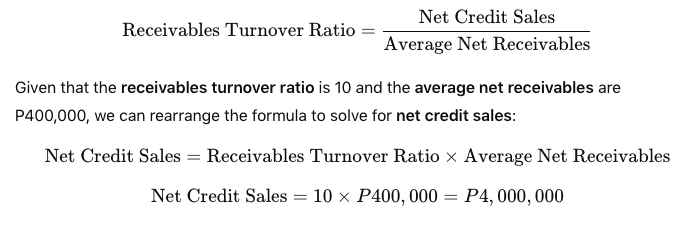

B) P4,000,000

A company has a receivables turnover ratio of 10. The average net receivables during the period are P400,000. What is the amount of net credit sales for the period?

A) P40,000

B) P4,000,000

C) P480,000

D) P520,000

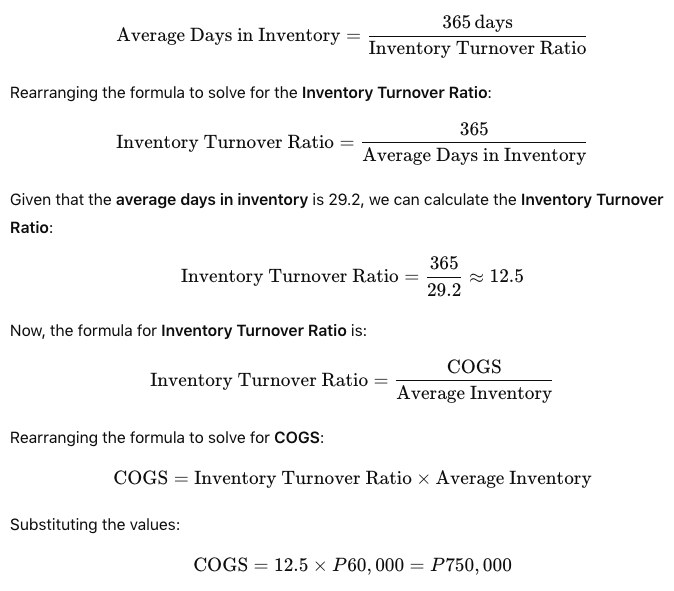

A) P750,000

A company has an average inventory on hand of P60,000 and its average days in inventory is 29.2 days. What is the cost of goods sold?

A) P750,000

B) P1,752,000

C) P1,680,000

D) P876,000

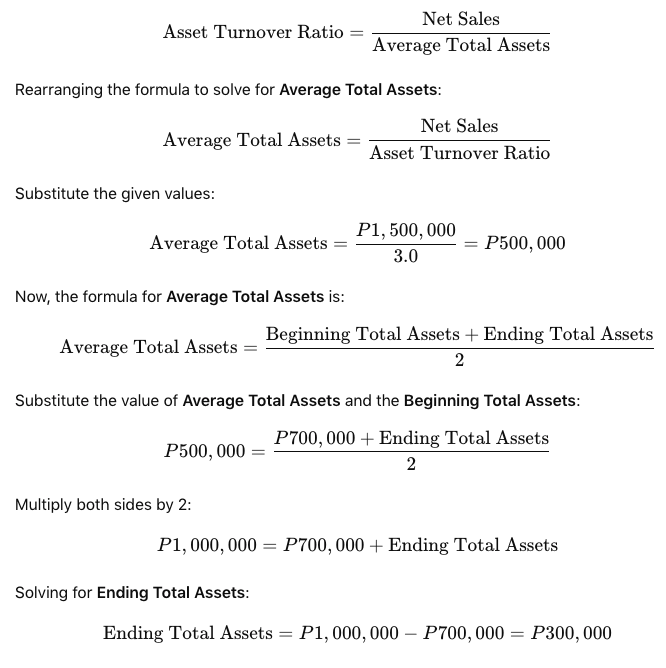

B) P300,000

Net sales are P1,500,000, beginning total assets are P700,000, and the asset turnover is 3.0. What is the ending total asset balance?

A) P500,000

B) P300,000

C) P700,000

D) P400,000

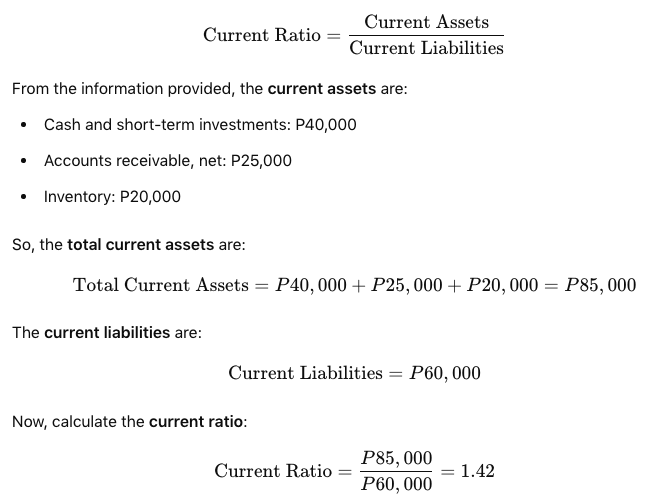

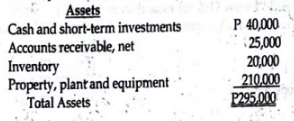

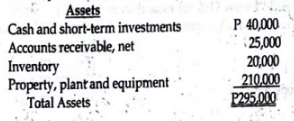

A) 1.42

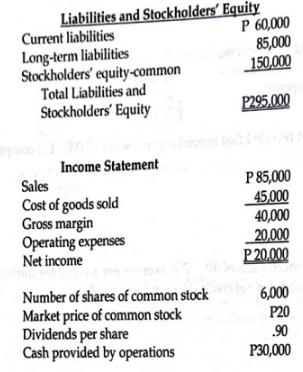

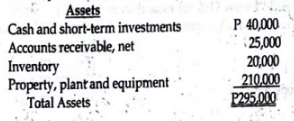

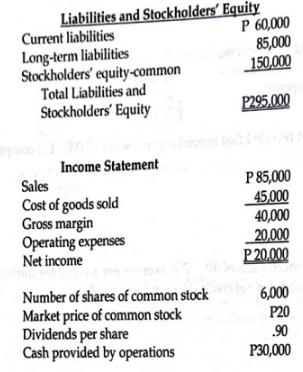

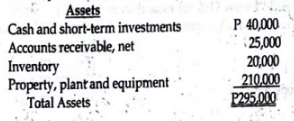

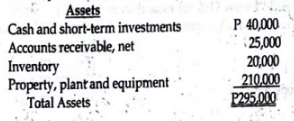

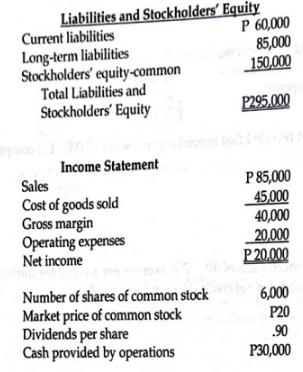

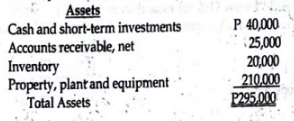

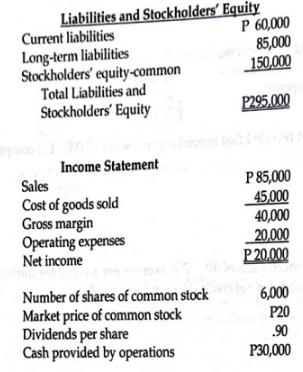

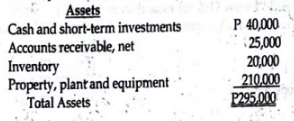

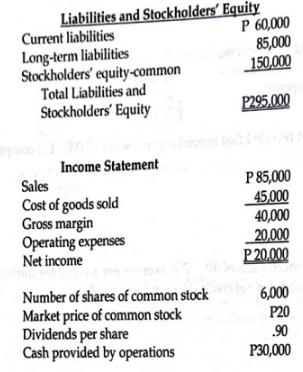

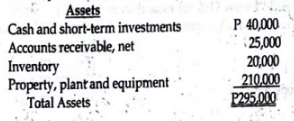

The following information pertains to Greenwich Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit.

What is the current ratio or this company?

A) 1.42

B) 0.80

C) 1.16

D) 0.60

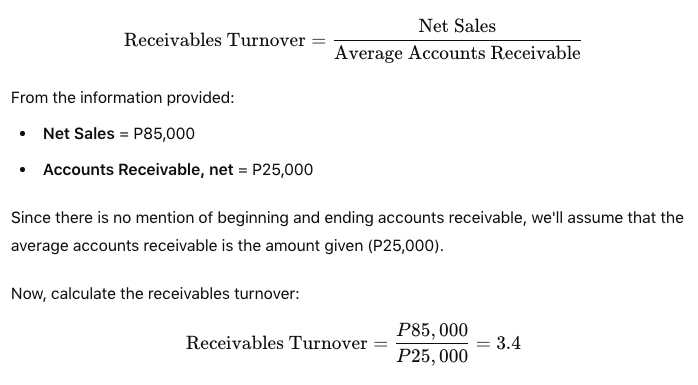

C) 3.4 times

The following information pertains to Greenwich Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit.

What is the receivable turnover for this company?

A) 2.8 times

B) 2 times

C) 3.4 times

D) 3 times

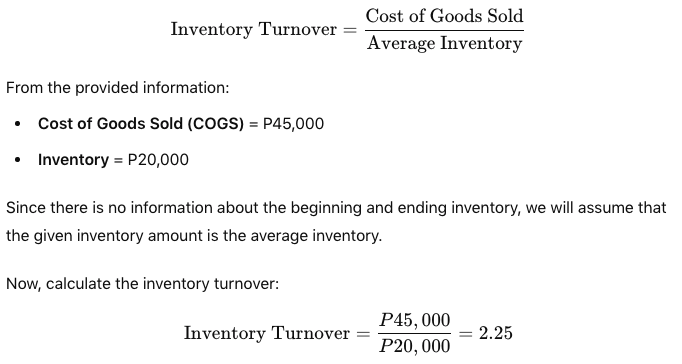

B) 2.25 times

The following information pertains to Greenwich Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit.

What is the inventory turnover for this company?

A) 2 times

B) 2.25 times

C) 1 time

D) 0.44 time

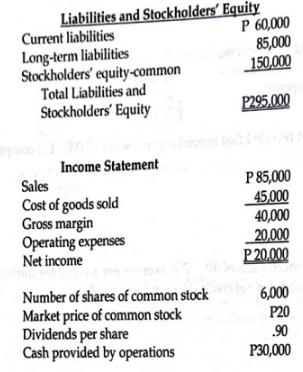

A) 6.8%

The following information pertains to Greenwich Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit.

What is the return on assets for this company?

A) 6.8%

B) 10.5%

C) 11.7%

D) 26.7%

C) 23.5%

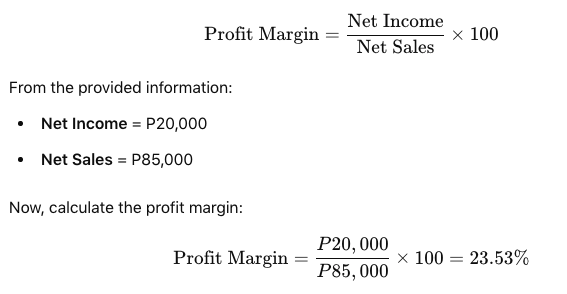

The following information pertains to Greenwich Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit.

What is the profit margin for this company?

A) 42.86%

B) 18.75%

C) 23.5%

D) 15.0%

A) 13.3%

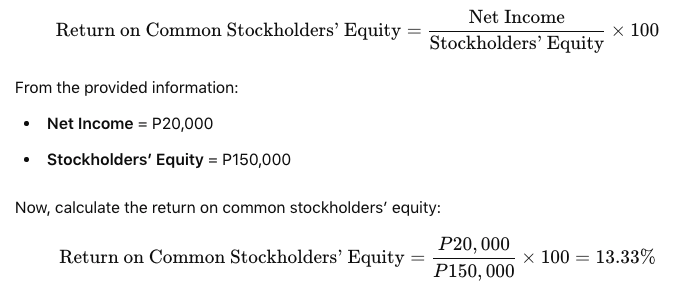

The following information pertains to Greenwich Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit.

What is the return on common stockholder’s equity for this company?

A) 13.3%

B) 5%

C) 23.3%

D) 53.5%

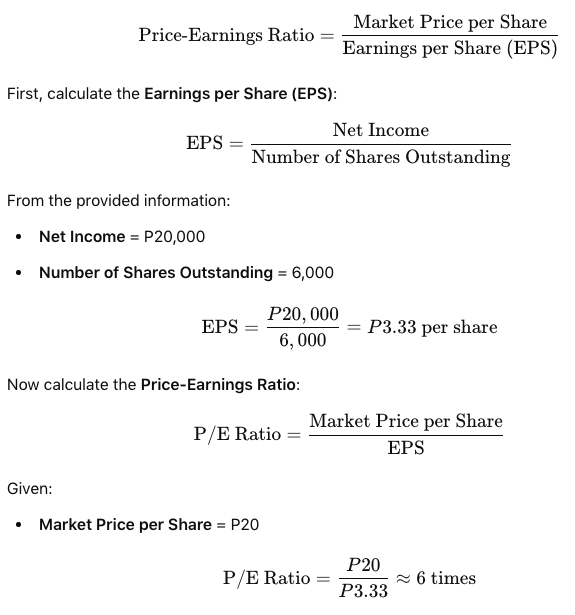

A) 6 times

The following information pertains to Greenwich Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit.

What is the price earnings ratio for this company?

A) 6 times

B) 2.5 times

C) 8 times

D) 4 times

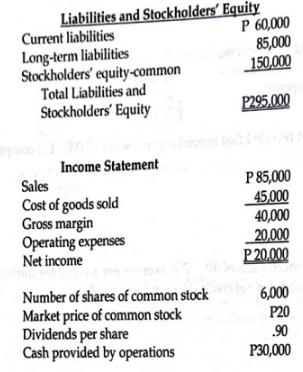

A) 0.5 times

The following information pertains to Greenwich Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit.

What is the current cash debt coverage ratio for this company?

A) 0.5 times

B) 3 times

C) 0.33 times

D) 0.14 times

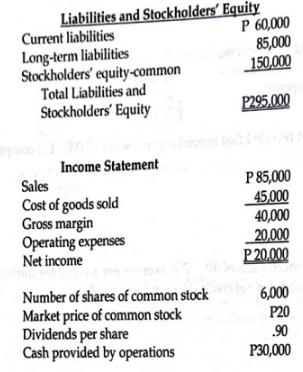

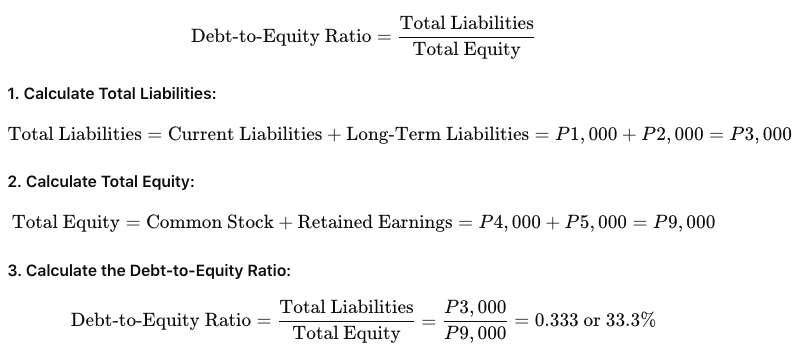

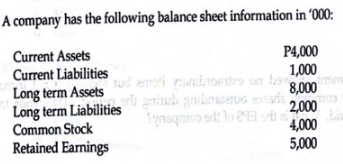

D) 33%

There was no interest expense and no dividends were declared. What is the debt/equity ratio at year-end?

A) 400%

B) 75%

C) 300%

D) 33%

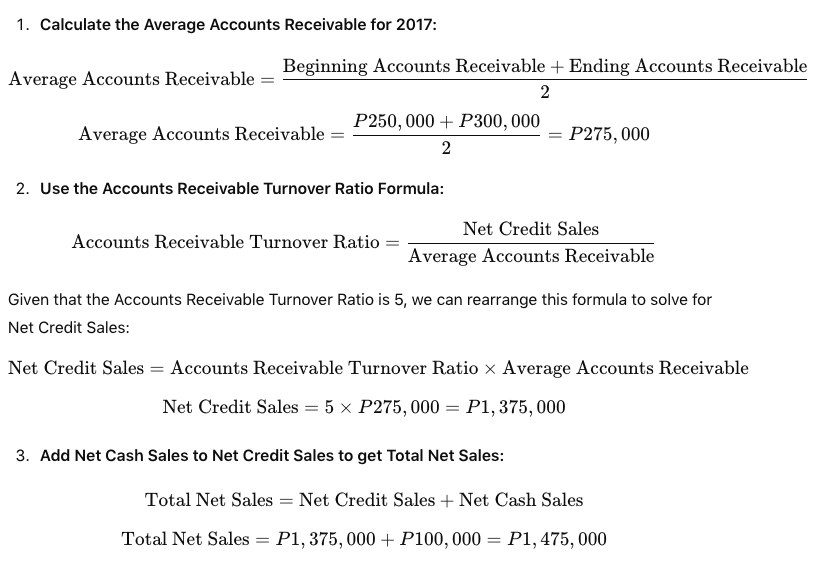

B) P1,475,000

A company’s net accounts receivable were P250,000 at December 31, 2016 and P300,000 at December 31, 2017. Net cash sales for 2017 were P100,000 and the accounts receivable turnover ratio for 2017 was 5. What were the company’s total net sales for 2017?

A) P1,350,000

B) P1,475,000

C) P1,375,000

D) P1,500,000

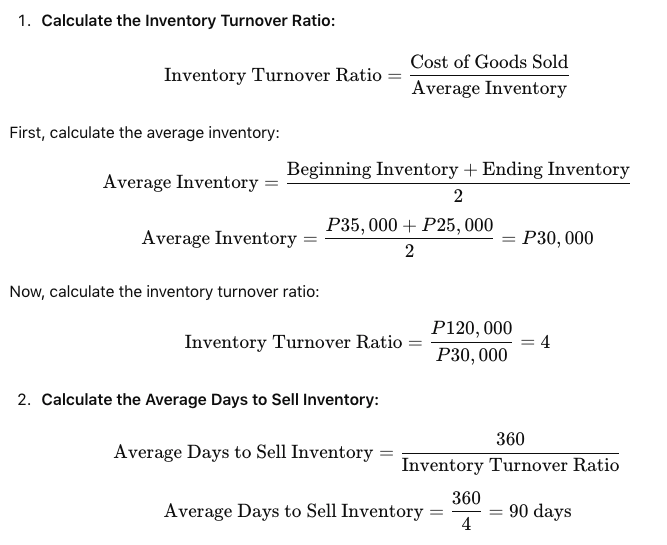

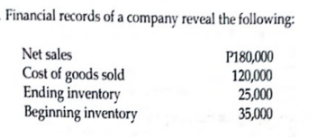

D) 90 days

Assuming a 360-day year, what was the average days to sell inventory?

A) 60 days

B) 75 days

C) 70 days

D) 90 days

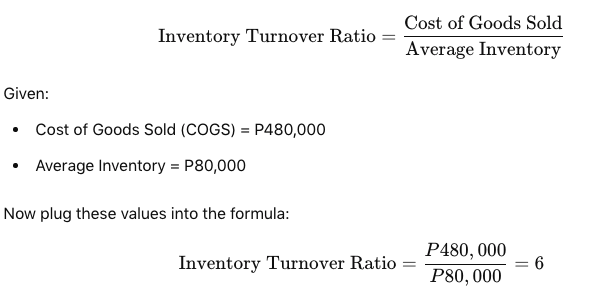

B) 6

Assuming that the company has an average inventory of P80,000 sales of P560,000 and a cost of sales of P480,000. What is the inventory turnover ratio?

A) 13

B) 6

C) 7

D) 1

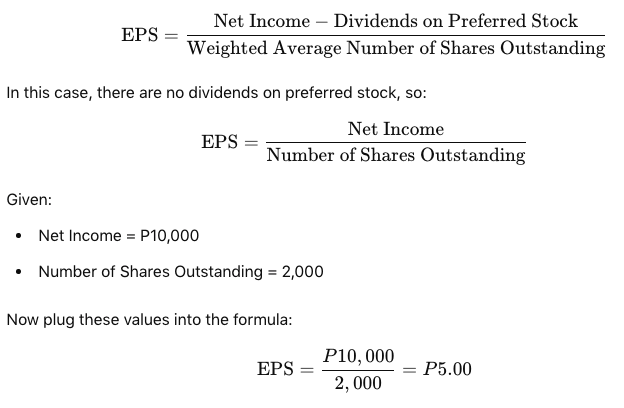

A) P5.00

A company reported net income of P10,000 and paid cash dividend on common stock of P2 per share on each of 2,000 shares outstanding. What is the EPS?

A) P5.00

B) P3.00

C) P4.00

D) P2.00

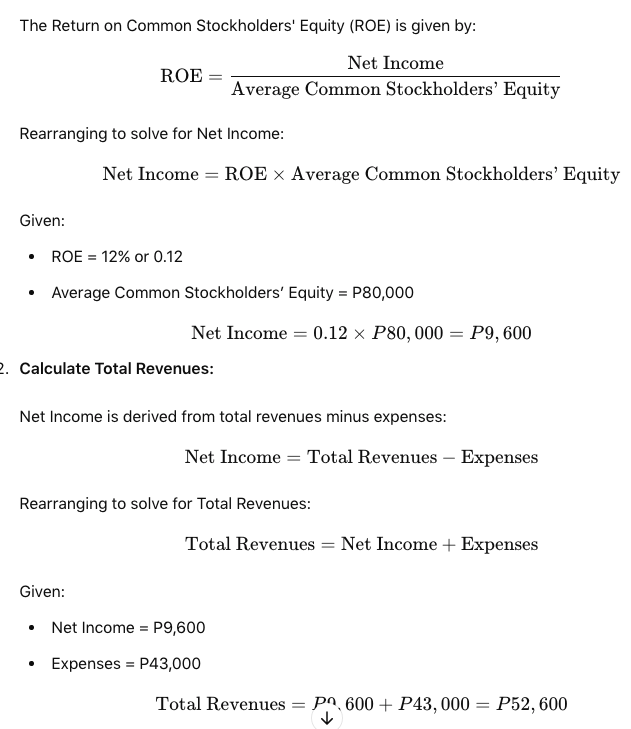

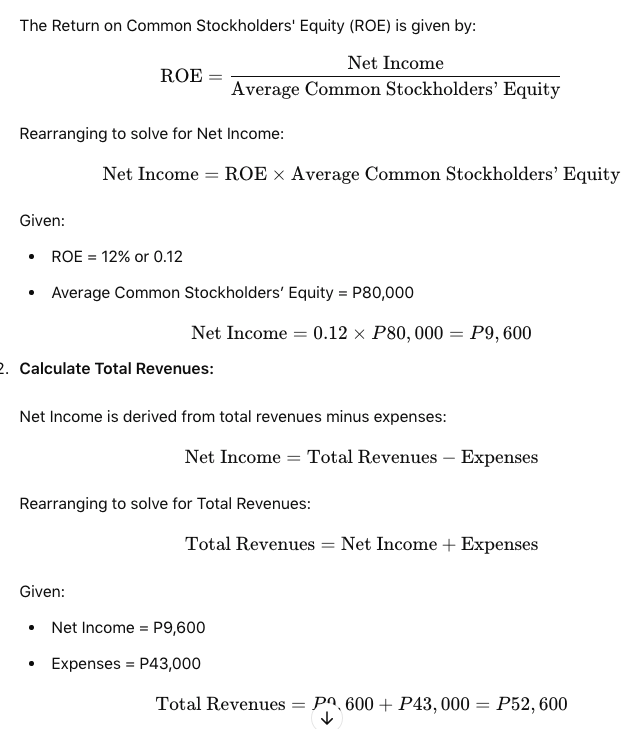

B) P52,600

Assume liabilities total P25,000, average common stockholders’ equity totals P80,000; expenses total P43,000 and return on common stockholders’ equity is 12%. Total revenues earned for the period is

A) P9,600

B) P52,600

C) P33,400

D) P 77,600

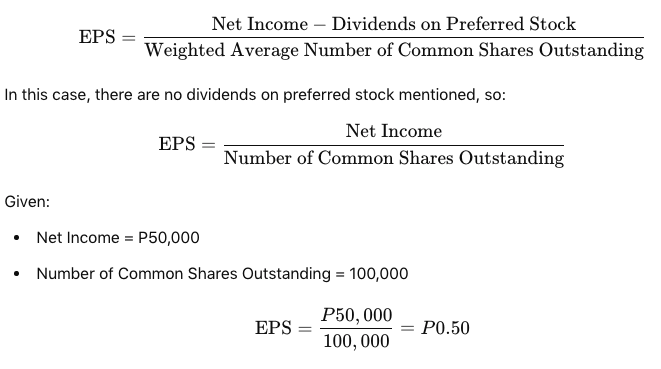

B) P0.50

A company’s income statement showed no extraordinary items but showed a net income of P50,000. There are 100,000 common shares outstanding during the period. Dividends totaled P20,000 was declared and paid. What is the EPS of the company?

A) P5.00

B) P0.50

C) P3.00

D) P0.30

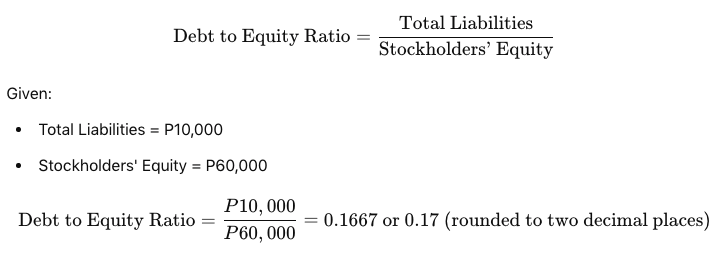

B) 0.17 to 1

A company has a total assets of P80,000 and stockholders' equity of P60,000. liabilities is P10,000. The debt to equity ratio is:

A) 0.75 to 1

B) 0.17 to 1

C) 0.33 to 1

D) 13 to 1

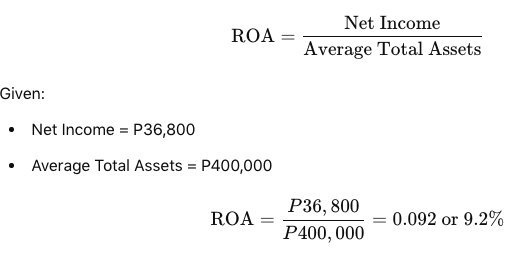

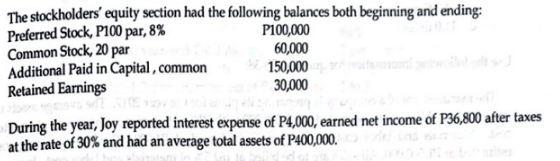

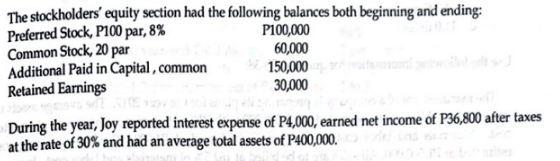

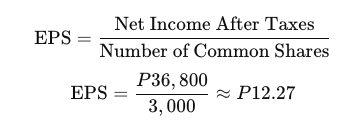

D) 9.2%

The return on total assets during the year is

A) 10.2%

B) 9.5%

C) 9.9%

D) 9.2%

IDK THE ANSWER

The return on common stockholders equity is

A) 61%

B) 15.3%

C) 48%

D) 12%

A) P12.27

The earnings per share is

A) P12.27

B) P9.60

C) P10.4

D) P7.20

IDK THE ANSWER

The company uses the allowance method for bad debts. During the year, the company charged P30,000 to bad debts expense, and wrote-off P25,000 of uncollectible accounts receivable. These transactions resulted in a decrease in working capital of

A) P0

B) P25,200

C) P4,800

D) P30,000

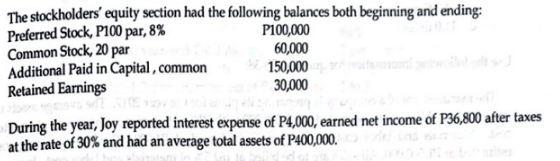

A) P2,950,000

The company's net accounts receivable were P500,000 at December 31, 2016 and P600,000 at December 31, 2017. Net cash sales for 2017 were P200,000. The accounts receivable turnover for 2017 was 5.0. What was the company's net sales for 2017?

A) P2,950,000

B) P3,200,000

C) P3,000,000

D) P5,500,000

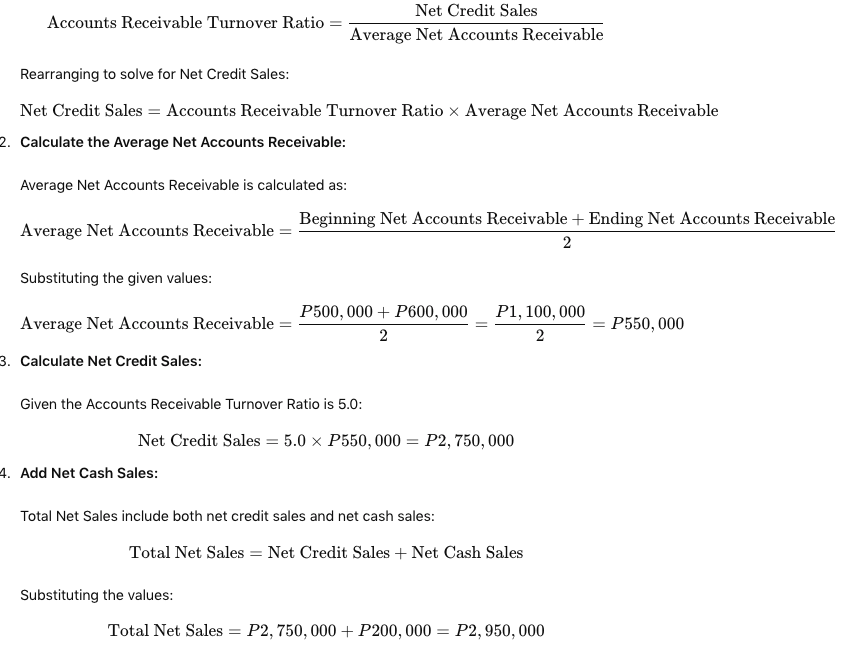

C) 4.4 times

During the year, a company purchased P2,000,000 of inventory. The cost of goofs sold for 2017 was P2,200,000 and the ending inventory at December 41, 2017 was P400,000. What was the inventory turnover for the year?

A) 4.0 times

B) 5.5 times

C) 4.4 times

D) 11.0 times