Ch. 10 - The Foreign Exchange Market

1/41

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

42 Terms

Foreign Exchange Market

Market for converting the currency of one country into that of another country

Exchange rate

the rate at which one currency is converted into another

2 functions of the Foreign Exchange Market

Enables conversion of the currency of one country into the currency of another.

Provides some insurance against foreign exchange risk

Foreign Exchange Risk

the adverse consequences of unpredictable changes in exchange rates

Currency Conversion is used to:

convert export receipts, income received from foreign investments or income received from licensing agreements.

To pay a foreign company for products or services.

To invest spare cash for short terms in money markets

Currency Speculation

short-term movement of funds from one currency to another in hopes of profiting from shifts in exchange rates

Carry Trade

borrows one currency where interest rates are low and invests these in another currency where interest rates are high

Hedging

A firm that protects itself against foreign exchange risk

What are ways the market performs hedging

Spot exchange rates.

Forward exchange rates.

Currency swaps.

Spot Exchange Rates

Rate at which a foreign exchange dealer converts one currency into another currency on a particular day

How are spot exchange rates determined?

by the interaction between supply and demand

Forward exchange rates

two parties agree to exchange currency and execute the deal at some specific date in the future (usually quoted 30, 90, or 180 days)

Currency Swap

Simultaneous purchase and sale of a given amount of foreign exchange for two different value dates

When are currency swaps used?

when it is desirable to move out of one currency into another for a limited period without incurring foreign exchange rate risk

Arbitrage

process of buying a currency low and selling it high

What are Important Factors Impacting Future Exchange Rate Movements?

A country’s price inflation.

A country’s interest rate.

Market psychology.

Law of One Price

identical products sold in different countries must sell for the same price when the price is in the same currency

what does Purchasing Power Parity do in efficient markets?

predicts that changes in relative prices result in changes in exchange rates

efficient markets

markets in which few impediments to international trade and investment exist—the price of a “basket of goods” should be roughly equivalent in each country

If we can predict inflation rates

we can predict how a currency’s value might change

Growth of a country’s money supply determines

its likely future inflation rate

inflation occurs

When the growth in the money supply is greater than the growth in output

Empirical Tests of P P P Theory

Indicates it is not completely accurate in estimating exchange rate changes in the short run but relatively accurate in the long run

The purchasing power parity puzzle

Assumes away transportation costs and barriers to trade.

Governments routinely intervene in trade and foreign exchange market.

Investor psychology plays a role on exchange rate movements

Fisher effect

a country’s nominal interest rate (i) is the sum of the required real rate of interest (r) and the expected rate of inflation over the period for which the funds are to be lent (I)

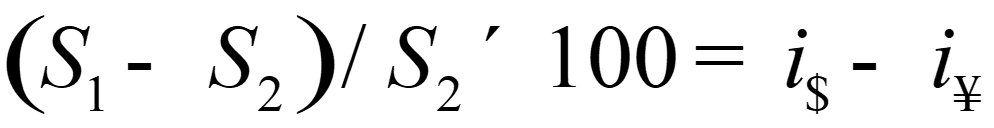

International Fisher effect (IFE)

for any two countries, the spot exchange rate should change in an equal amount but in the opposite direction to the difference in nominal interest rates between the two countries.

Bandwagon effect

occurs when expectations on the part of traders turn into self-fulfilling prophecies, and traders join the bandwagon and move exchange rates based on group expectations. gov can intervene

The Efficient Market School

prices reflect all available information.

Forward exchange rates are the best predictors of future spot exchange rates.

Investing in forecasting services is a waste of money

The Inefficient Market School

prices do not reflect all available information.

Forward exchange rates are not the best predictors of future spot exchange rates.

Companies should invest in forecasting services.

Approaches to Forecasting

Fundamental and Technical Analysis

Fundamental analysis

Draws upon economic factors like interest rates, monetary policy, inflation rates, or balance of payments information to predict exchange rates

Technical analysis

Uses price and volume data to determine past trends that are expected to continue

Freely convertible

both residents and nonresidents can purchase unlimited amounts of foreign currency with the domestic currency

Externally convertible

only nonresidents can convert their holdings of domestic currency into a foreign currency

Nonconvertible

both residents and nonresidents are prohibited from converting their holdings of domestic currency into a foreign currency

capital flight

when residents and nonresidents rush to convert their holdings of domestic currency into a foreign currency.

countertrade

barter-like agreements by which goods and services can be traded for other goods and services—to facilitate international trade

Transaction exposure

extent to which the income from individual transactions is affected by fluctuations in foreign exchange values

Translation exposure

impact of currency exchange rate changes on the reported financial statements of a company

Economic exposure

extent to which a firm’s future international earning power is affected by changes in exchange rates.

Lead strategy

collecting foreign currency receivables early when a foreign currency is expected to depreciate and paying foreign currency payables before they are due when a currency is expected to appreciate

Lag strategy

delaying collecting foreign currency receivables if the currency is expected to appreciate and delaying payables if the currency is expected to depreciate