Chapter 6- Long run economic Growth- Macro Theory

1/37

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

38 Terms

What is the Production function used to measure economic growth?

Economic growth is measured by the production function Y= AF(N,K)

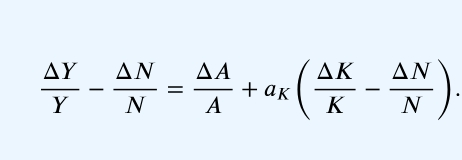

What is the growth accounting equation?

This is the equation that takes factors of the economy that lead to economic growth

What does elasticity of output w/respect to capital refer to?

This refers to the percentage change increase in output resulting from a 1% increase in capital.

What does elasticity of output with respect to labor refer to?

This refers to the percentage change in output resulting from a 1% increase in labor.

How does an increase in productivity affect output?

An increase in productivity will always result in an increase in output by the same amount (i.e. 10% increase in productivity will lead to a 10% increase in output).

How do we solve for productivity in the growth accounting equation?

We use the measures of output, capital and labor, estimate the elasticities if they aren’t given- (US aK= 0.3 and aN = 0.7).

How much does total output typically grow by?

Total output typically grows exponentially over time, like the total output in 1948 is 2.54 times the total output of 1929. (As depicted by the table below)

How does total factor productivity correlate with labor productivity?

Labor productivity and total factor productivity are positively correlated, as depicted by the graph below, this is because labor productivity can add to total factor productivity and even sometimes be greater than total factor productivity.

How do we find labor productivity without knowing the elasticity of output with respect to labor? How do we find the growth rate of average labor productivity?

We can then use the above equation to derive the equation below by subtracting 1-aK times labor growth

This equation will give us the growth of output over labor.

What is the equation of the average growth rate of productivity equal to?

The average growth rate of productivity (the left side of the equation) is equal to the equation of total labor productivity (the right side of the equation)

Why is labor productivity sometimes greater than total factor productivity?

This is because the growth rate of labor productivity increases with capital (workers become more productive with more capital), as capital per worker is generally upwards sloping. Since capital and labor are constantly growing, labor productivity can be higher than total factor productivity. This also implies that capital growth creates the gap between total factor productivity and the growth rate of average labor productivity.

What are the two questions that the Solow model examines?

What is the relationship between a nation’s long run standard of living and fundamental factors such as its saving rate, its population growth rate, and its technical progress?

How does a nation’s rate of economic growth evolve over time? Will economic growth stablize, accelerate, or stop?

What does the Solow model assume about total output, aggregate consumption and total capital stock?

The Solow model assumes that output, consumption and capital grow with the labor force, with this the model also assumes that the population and work force grow at the same fixed rate.

What is the per worker production function?

This is the production function used by the Solow model to determine output based on capital stock and labor ratio. Represented by the equation below.

The graph of the per worker production function is represented by the graph below, it flattens from the left to the right because capital has diminishing marginal productivity even if a worker is skilled. (Because you need enough people to man the machines).

What is a steady state in a economy?

A steady state is a state of the economy when the capital per labor ratio, output per worker ratio and consumption per worker ratio are all held constant. Investment is the only factor that is being affected in a steady state, in which saving has to equal investment in order for this state to be reached.

What are gross investments equal to (again)?

Gross investment, even in a steady state, is equal to net investments plus capital depreciation.

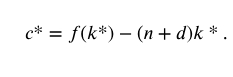

How is consumption in a steady state calculated?

Consumption in a steady state is equal to output minus investments in a steady state.

What is the effect of an increase in the capital-labor ratio in a steady state on consumption per worker?

An increase in the steady state capital-labor ratio will raise the amount of output per worker, so consumption will rise. (As depicted by the graph below)

What is another effect of an increase in the steady state capital-labor ratio on consumption per worker?

An increase in the steady state capital-labor ratio will raise the amount of output per worker devoted to investment, which lead to less consumption per worker. (Also depicted by the graph below)

This is depicted by the graph because we can see that if investment rises, there will be less consumption per worker.

Why are there two opposing effects on consumption of rising the capital-labor ratio in a stead state? What is the golden rule capital-labor ratio?

The golden rule capital-labor ratio is the amount of capital to labor required to have the highest possible amount of consumption in a steady state. If capital starts at a point higher than the golden rule, then capital labor increases will lead to a drop in consumption per worker, because firms will have invested more into capital than necessary, leaving less revenue for wages. If capital starts at a point lower than the golden rule, then increases in the capital labor ratio will rise consumption per worker.

How does the golden rule of capital play into policymakers forming the living standards of a country?

Policymakers can use the interest rate to stimulate saving and investment to reach a living standard, but if they lower the interest rate to encourage investment into capital beyond the golden rule of capital, then they will lower the living standard because workers won’t be able to consume as much as before.

What do we assume about saving in a steady state?

We assume saving is proportional to income, we also assume that solow model isn’t affected by factors that would affect national saving, like real interest rate.

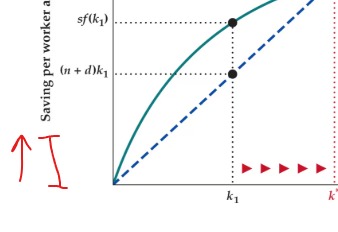

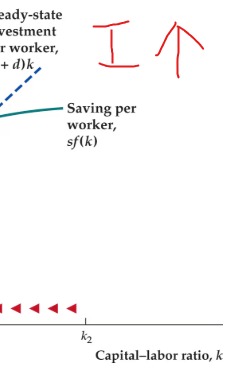

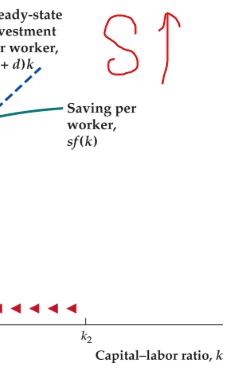

What condition must be met in the solow model to reach the steady state?

Saving must be equal to investment in order for the economy to be in a steady state for the solow model.

Saving curve is lower than output because some of that output will be consumed, in that event, k* represents the amount of capital per labor that allows investment per worker to be equal to saving per worker.

Why does the steady state condition require saving to be equal to investment?

Saving must be equal to investment to ensure that the amount of investment into capital per worker is justified by the amount of saving. k* in the graphs from before represent the amount of capital necessary for saving to equal investment. (This is represented by the equation) The output at k* minus investment at k* will yield c*, the amount of consumption at steady state (theoretically this is the indicator of the highest possible living standard). Theory goes that once the economy reaches k*, then it will stay there forever.

What would happen if capital per labor were to start below k*? How would we reach steady state from a lower capital per labor ratio?

The solution is higher investment into capital per labor, this way there will be more capital per labor and the returns on investment will become higher until they reach the steady state.

What would happen if capital per labor were to start above k*? How would we reach steady state from a higher capital per labor ratio?

The solution would once again be to continue investment, while this may seem counterintuitive- we would have to continue investing because the amount of saving (even though it’s lower than investment) that has to be done is less than the amount of investment that will be necessary to maintain the capital-labor ratio.

What would happen if instead of starting at a level of capital above k*, we were just there by nature- how would we get to steady state from there?

Then we could assume that the solution is to continue saving to maintain investment, as opposed to our solution for when we start at k* to keep investing.

What is perhaps the biggest assumption within the solow model?

We assume no productivity growth in economy while using Solow’s model. This would imply that living conditions cannot improve beyond the steady state.

What would happen to long-run output, consumption per worker and capital per worker if the saving rate were to increase?

If the saving rate increases, then there will be more investment into capital, which will allow for more capital stock per labor, which will allow for more output per labor and thus, more consumption per labor.

What would happen to long run output, consumption and capital per labor if the rate of population growth were to increase?

Long run output would plummet if the population would grow because the population is said to grow with the labor force, if there are more workers than the capital per labor ratio would fall because part of capital stock will be devoted to those new workers; Less capital stock per worker makes workers less productive and they would produce less output. If workers produce less output than before, then they won’t be able to consume as much.

What would happen to long-run output, consumption and capital per worker if productivity were to increase?

If productivity rises, then long run output will rise, this will cause capital per worker ratio will rise as firms will be able to maximize profit off more capital per worker. With the increase in output, workers will be able to consume more.

Why does a high saving rate of a country indicate a country is wealthy?

This is because a high saving rate implies a higher investment into capital.

What is an exogenous variable?

This is a variable that is taken as given in an economic model.

What is an endogenous variable?

This is a variable that is decided by the equilibrium condition.

What is the endogenous growth theory?

This is the theory that explains why productivity grows through an economic model, the model states that saving is dependent on growth as opposed to capital. Specifically that saving times a positive constant minus depreciating capital will lead to long run output over time.

This is under the assumption that output is proportion to capital stock

What are some policies that would raise the long-run living standards of a country?

Policies that affect the saving rate (specifically to increase saving), policies that could raise productivity growth such as improving infrastructure, building human capital, encouraging research and development.

What is the Lorenz curve ?

This is a curve that measures the distribution of income within a country using income per capita as opposed to GDP per capita. (Big green line)

The above graph is a lorenz curve for 1967 and 2020, the more straight the lorenz curve is, the more evenly income is distributed, in 1967 income was more evenly distributed than in 2020

What is a Gini coefficient?

This is a number that measures the income distribution within a country, it is known as the area between the lorenz curve of a country and the 45-degree line and divide that area by the area under the 45-degree line. The higher a gini coefficient, the more unevenly income is being distributed.

The graph above indicates the current gini coefficient, an economy with rising income inequality will cause more division between education and employment opportunities, increased inequality can be self-perpetuating