Week 5 - Foreign Direct Investment; Regional Economic Integration

1/26

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

27 Terms

What is FDI?

Foreign Direct Investment (FDI): Purchase of physical assets or significant amount of ownership of a company in another country to gain some measure of management control.

FDI vs. Portfolio investment: By contrast, portfolio investment does not involve obtaining a degree of control in a company.

Judgement criteria: whether has a degree of control

Some governments/regulations have specific quantitative standard to differentiate FDI vs.Portfolio

What is FDI?: Some Concepts

Greenfield vs. M&A

Greenfield FDI is when a company builds a new production facility abroad.

Brownfield FDI (or cross-border mergers and acquisitions) is when a domestic firm buys a controlling stake in a foreign firm.

Many cross-border M&A (merging and acquisitions) deals are driven by the desire of companies to:

Get a foothold in a new geographic market

Increase a firm’s global competitiveness

Fill gaps in companies’ product lines in a global industry

Reduce costs of research and development, production, distribution, and so forth

Home country vs. host country

Host country: a country that acquires production, distribution or marketing facilities as a result of FDI.

Home country: a country that invests across borders in FDI

Why Governments Intervene in FDI

A nation will often intervene in the flow of FDI in order to protect its cultural heritage, domestic companies, and jobs.

It can enact laws, create regulations, or construct administrative hurdles that companies from other nations must overcome if they want to invest in the nation.

Yet competitive pressures can force nations to compete against each other to attract investment from multinational companies.

Cultural example:

For example, South American nations with strong cultural ties to a European heritage (such as Argentina) are generally enthusiastic about investment received from European nations

Balance of Payments

A country’s balance of payments is a national accounting system that records all receipts coming into the nation and all payments to entities in other countries

The two major accounts in the balance of payments are the current account and the capital account.

The current account is a national account that records transactions involving the export and import of goods and services, income receipts on assets abroad, and income payments on foreign assets inside the country

Positive contributions to the current account involve financial flows into a nation:

earnings from exports of goods and services, and income received on assets held abroad—such as when a US company’s subsidiary abroad remits profits back to the US parent

Subtractions from the current account involve financial flows out of a nation:

payment for imports of goods and services, and payments abroad for income earned by

foreign-owned assets in a country—such as when a US subsidiary of a Canadian company remits profits to its parent company in Canada

All current account transactions are then added together to arrive at either a positive or a negative current account balance

The capital account is a national account that records transactions involving the purchase and sale of assets.

Suppose a Mexican company makes a foreign direct investment by buying a company in the United States. The transaction creates a financial inflow and contributes positively to the US capital account.

8.4.2 Reasons for Intervention by the Host Country

Host nation governments (those that receive investment) intervene in inflows of FDI for a number of reasons.

to control the balance of payments

to obtain resources and benefits.

Reasons for Intervention by the Home Country

Home nations (those from which international companies launch their investments) may seek to encourage or discourage outflows of FDI for a variety of reasons

INFLUENCE BALANCE OF PAYMENTS

PROTECT JOBS

IMPROVE COMPETITIVENESS

Government Intervention in FDI: Host Country Tools

Host Country Promotion Methods:

Financial incentives

Low or waived taxes

Low-interest loans

The downside of these types of incentives is that the cost to taxpayers of attracting FDI can be several times what the actual jobs themselves pay

Infrastructure benefits

Better seaports, roads, and telecom networks

To encourage participation in its new Silk Road, as it is called, China offers host nations debt financing and other incentives to build massive infrastructure projects

Government Intervention in FDI: Host Country Tools 2

Host Country Restriction Methods

Performance demands

Local content requirements

Export targets

Technology transfers

Performance demands include ensuring that a portion of the product’s content originates locally,

Ownership restrictions

Prohibit investment in industries or businesses

Such prohibitions typically apply to businesses in cultural industries and companies vital to national security.

Government Intervention in FDI: Home Country - Promotion Methods Tools

Insurance on assets abroad

Loans and loan guarantees

Tax breaks on profits earned abroad

Offer tax breaks on profits earned abroad that are repatriated

Special tax treaties

Persuade other nations to accept FDI

Apply political pressure on other nations to get them to relax their restrictions on inbound FDI

Government Intervention in FDI: Home Country- Restriction Methods Tools

Higher taxes on foreign income

A home nation might dissuade companies from engaging in outward FDI by imposing differential tax rates that charge income from earnings abroad at a higher rate than domestic earnings.

Sanctions that prohibit investing

Home countries might also impose outright sanctions that prohibit domestic firms from making investments in all or only certain nations.

Worldwide Flows of FDI

A common way to measure foreign direct investment is to calculate the FDI that flows into all countries over a one-year period

Historically, developed nations have been the biggest recipients of FDI but hey now attract a smaller share of the world’s total FDI flows

Developed nations are also the long-time sources of most FDI (outward flows of FDI).

The data also reflect the fact that the values of M&A deals in developed

nations are often many times larger than the values of those in developing countries

Developing countries are increasingly becoming sources of FDI. Their outflows are rising as the strong, homegrown competitors in these nations, particularly China, seek growth and market share worldwide.

This is only natural as these economies continue to develop, eliminate poverty, improve standards of living, and hone their business acumen.

What is Regional Economic Integration and Why?

Regional economic integration is countries of a region cooperating to reduce or eliminate barriers to the international flow of products, people, or capital.

Why is there regional economic integration?

Perfect world of Global Economy and International Business

Free international business-free flow of goods, services and capital

Second best solution- regional economic integration

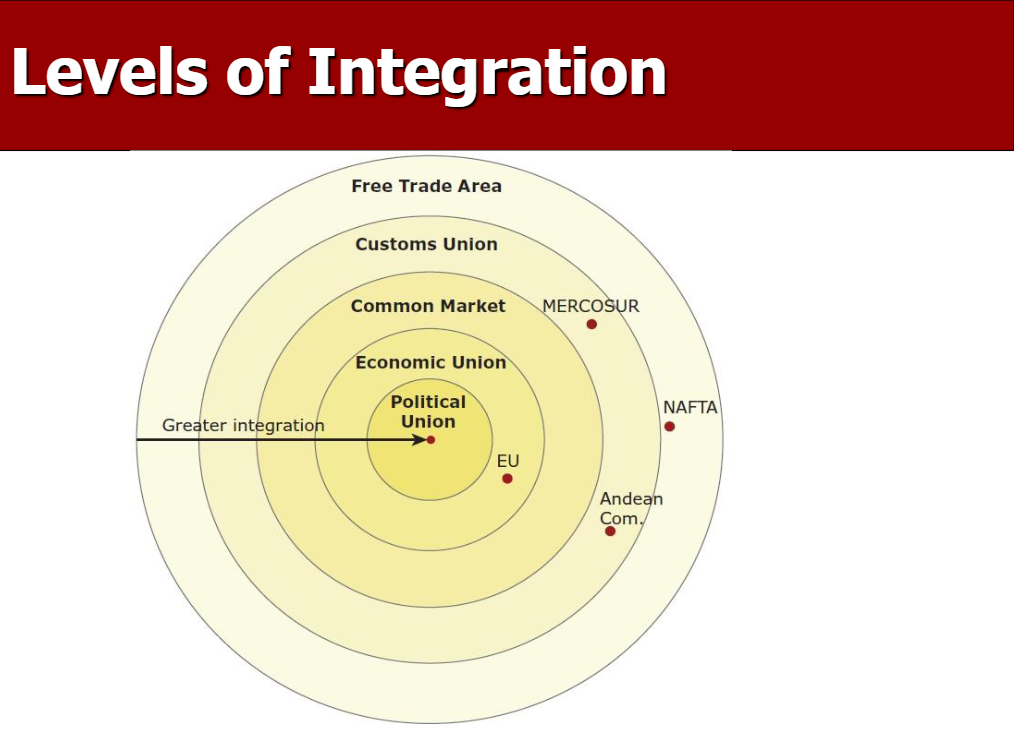

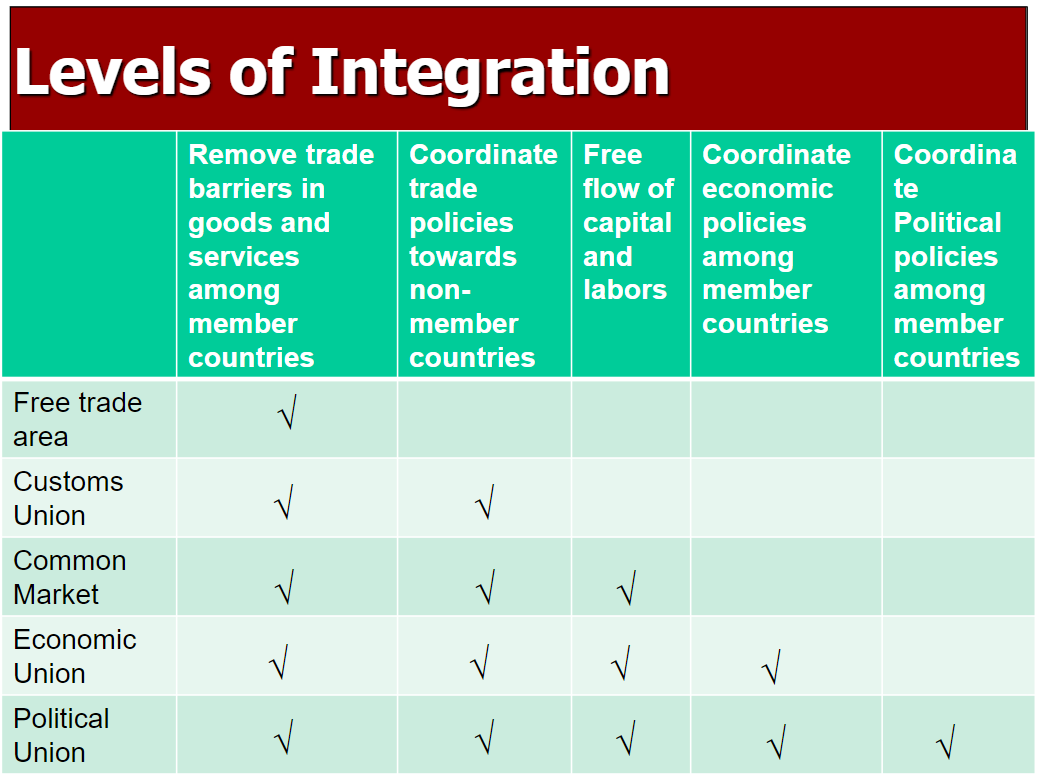

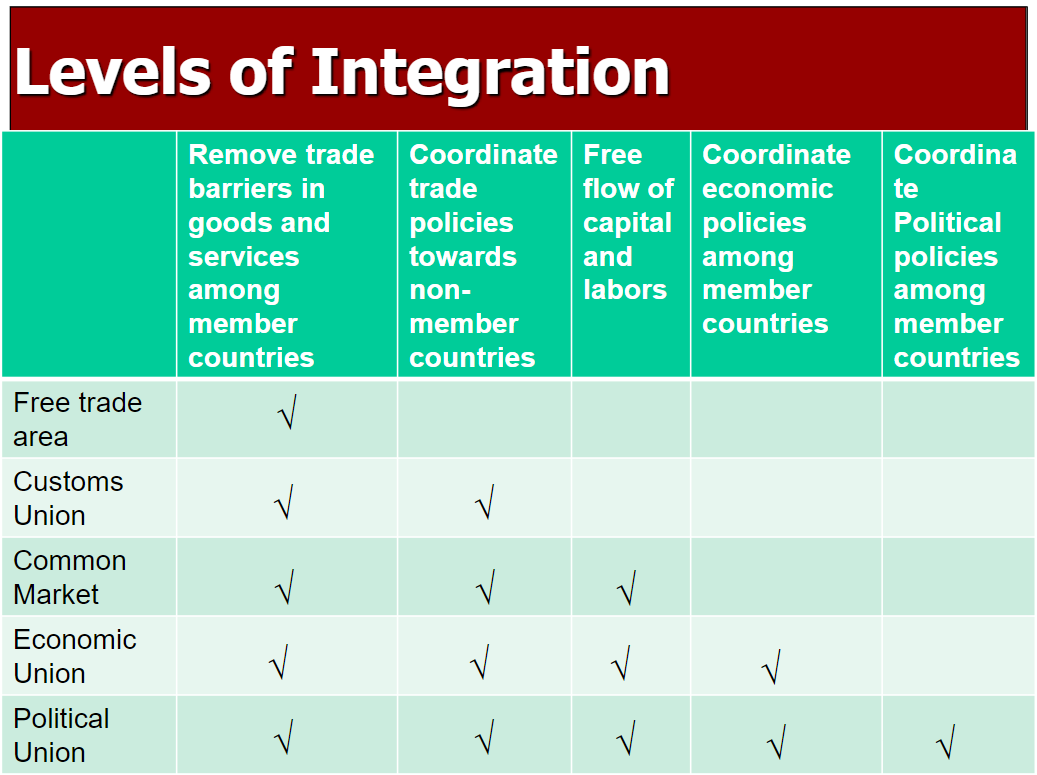

Levels of Integration

Free Trade Area

Removes all barriers to trade among members with each nation determining its own barriers against nonmembers

Customs Union

Adds the requirement that all members set a common trade policy against nonmembers

Countries belonging to a customs union might also negotiate as a single entity with other supranational organizations, such as the World Trade Organization (WTO).

Common Market

Adds the free movement of labor and capital and sets a common trade policy against nonmembers

A common market integrates the elements of free trade areas and customs unions and adds the free movement of important factors of production—people and cross-border investment.

Levels of Integration

Economic Union:

Requires members to harmonize their tax, monetary, and fiscal policies, create a common currency, and concede some sovereignty to the larger organization

An economic union goes beyond the demands of a common market by requiring member nations to harmonize their tax, monetary, and fiscal policies and to create a common currency

Political Union:

Requires members to coordinate their economic and political policies against nonmembers, with a few exceptions

Member nations to accept a common stance on economic and political matters regarding nonmember nations.

However, nations are allowed a degree of freedom in setting certain political

and economic policies within their territorie

e European Union

Benefits and Drawbacks of Integration

What are several potential benefits of regional economic integration and several potential drawbacks of integration?

Benefits:

Trade creation: Increase in the level of trade between nations that results from regional economic integration.

Greater consensus

eThe benefit of trying to

eliminate trade barriers in smaller groups of countries is that it can be easier to gain consensus

from fewer members as opposed to, say, the 164 countries that comprise the WTO.

Political cooperation

A group of nations can have significantly greater political weight than each nation has individually

Creates jobs

by enabling people to move from one country to another to find work or to earn a higher wage.

Corporate savings

Drawbacks:

Trade diversion: the diversion of trade away from nations not belonging to a trading bloc and toward member nations

Shifting employment

Industries requiring mostly unskilled labor, for example, tend to respond to the formation of a trading bloc by shifting production to a lower-wage nation within the bloc

Lost sovereignty

Some people argue that they will lose their unique national identity if their nation cooperates too much with others

Integration in the Americas: USMCA (Formerly NAFTA)

Pop: 450 million

GDP: $18 trillion

Members: 3

Free-Trade Area

Began: 1994

Former NAFTA: Background

Canada-U.S. Free Trade Agreement, signed in 1988

and came into effect in 1989

• In 1991, Canada requested a trilateral agreement

• NAFTA was signed by President George H.W. Bush,

Mexican President Salinas, and Canadian Prime

Minister Brian Mulroney in 1992

• NAFTA entered into force on January 1, 1994.

• After more than a year and many rounds of

renegotiation, US, Canada and Mexico agreed to a

revised trade deal on Nov. 30, 2018

• The United States-Mexico-Canada Agreement

(USMCA) entered into force on July 1, 2020

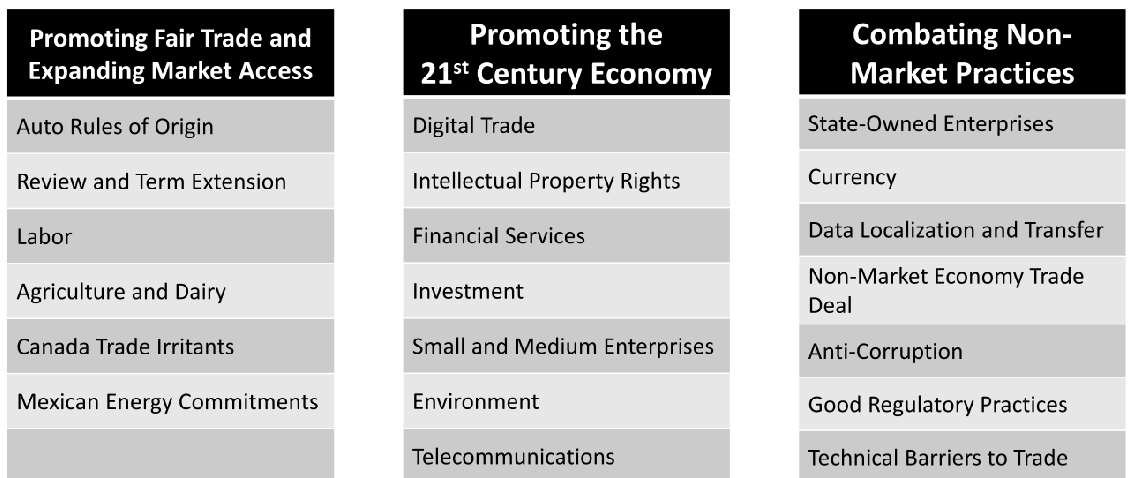

USMCA

34 chapters, along with annexes and side letters

Three Key goals:

Promoting fair trade and expanding market access

Promoting the 21st century economy

Combating non-market practices

USMCA 2

USMCA’s major changes from NAFTA important for Canada

Auto

Stricter Rules of Origin: 75% of auto parts must be made in North America (up from 62.5% under NAFTA).

Labour Requirements: 40-45% of vehicle parts must be made by workers earning at least $16/hour, benefiting Canadian workers.

Agriculture

Canada has opened up a part of its agricultural market to the United States, including chicken, turkey, and eggs, dairy market

Chapter 19 from NAFTA is preserved

allows Canada to challenge unfair U.S. trade duties through independent panels.

Energy & Environment: Stronger Commitments

Strengthened environmental and labor standards

Environmental Initiatives: Commits more than $600 million to environmental initiatives

Canada retained tariff-free access to the U.S.

energy market.

USMCA 3

Digital Trade & Intellectual Property (IP) Protection

Stronger copyright & patent protections,

More protection for digital trade, e-commerce, and cross-border data flows.

Sunset Clause: Built-in Uncertainty

USMCA automatically expires after 16 years unless all parties agree to renew.

A review occurs every 6 years, allowing renegotiations.

EU Early Years

S A war-torn Europe emerged from the Second World War in 1945 facing two

challenges: (1) It needed to rebuild itself and avoid further armed conflict, and (2) it needed to increase its industrial strength to stay competitive with an increasingly powerful United States. So, they needed to work together

the Treaty of Paris in 1951, creating the European Coal and Steel Community

The members of the European Coal and Steel Community signed the Treaty of Rome in 1957, creating the European Economic Community

Two important milestones contributed to the continued progress of the EU: the Single European Act and the Maastricht Treaty (1993)

the Single European Act and the Maastricht Treaty (1993). European monetary union

The goal was to remove remaining barriers, increase harmonization, and thereby enhance the competitiveness of European companies. The proposals became the Single European Act (SEA), which went into effect in 1987.

Maastricht Treaty: Some members of the EU wanted to take European integration further still. in 1993

European monetary union: European Union plan that established its own central bank and currency:

EU 2

Management Implications of the Euro

First, the euro reduces transaction costs by eliminating charges for converting one currency into

another.

Second, business owners need not worry about potential losses due to shifting exchange rates on cross-border deals

Third, the euro makes prices between markets more transparent, making it difficult to charge different prices in adjoining markets.

Trade and Cooperation Agreement

The EU and the UK created a new Trade and Cooperation Agreement (TCA) to govern their relationship going forward

EU Enlargement

These Copenhagen Criteria, as they are called, require each country to demonstrate that it:

Has stable institutions that guarantee democracy, the rule of law, human rights, and respect for and protection of minorities.

Has a functioning market economy capable of coping with competitive pressures and market forces within the EU.

Is able to assume the obligations of membership, including adherence to the aims of economic, monetary, and political union.

Has the ability to adopt the rules and regulations of the community, the rulings of the European Court of Justice, and the EU treaties.

Structure of EU

- European Parliament

- Elected every five years by member nations.

- Represents constituents' political views on EU matters.

- Debates and amends legislation proposed by the European Commission.

- Exercises political supervision over EU institutions, including commissioner appointments.

- Has veto power over some laws and the EU’s annual budget.

- Calls for increased democratization by strengthening Parliament.

- Operates in Brussels (Belgium), Strasbourg (France), and Luxembourg.

- European Council

- Highest level of political cooperation among EU countries.

- Comprises heads of EU countries, the European Council President, and the European Commission President.

- Meets four times a year (plus additional meetings for urgent matters).

- Elects its president for a 2.5-year term, who represents the EU externally.

- Decides overall foreign and security policy but does not pass laws.

- Appoints candidates to EU-level roles (e.g., European Central Bank).

- Headquartered in Brussels, Belgium.

- Council of the EU

- Legislative body of the EU, composed of ministers from member states based on the topic (e.g., agriculture, finance).

- Votes proposed legislation into law; sensitive issues require unanimous votes, while others need a simple majority.

- Concludes international agreements on behalf of the EU.

- Headquartered in Brussels, Belgium.

- European Commission

- Executive body of the EU, with one commissioner from each member country.

- President and commissioners appointed by member governments and approved by the European Parliament.

- Drafts legislation, implements policies, and monitors compliance with EU law.

- Commissioners act in the EU’s interest, not their home country’s.

- Headquartered in Brussels, Belgium.

- Court of Justice

- EU’s court of appeals, divided into the Court of Justice and the General Court.

- Judges from each member nation serve renewable six-year terms.

- Hears cases involving treaty violations or institutional responsibilities.

- Judges act in the EU’s interest, not their home country’s.

- Located in Luxembourg.

- European Central Bank (ECB)

- Central bank of the eurozone.

- Primary objective: stabilize prices and safeguard the euro’s value.

- Sets interest rates, controls money supply, and manages inflation.

- Oversees foreign currency reserves and exchange rate balancing.

- Conducts banking supervision in cooperation with national authorities.

- Located in Frankfurt am Main, Germany.

European Free Trade Association (EFTA)

In 1960, several countries banded together and formed the European Free Trade Association (EFTA) to focus on trade in industrial, not consumer, goods.

today the group consists of Iceland, Liechtenstein, Norway, and Switzerland

The EFTA and the EU created the European Economic Area (EEA) to cooperate on matters such as the free movement of goods, persons, services, and capital among member

nations.

Integration in the Americas

CAFTA-DR: The Central American Free Trade Agreement (CAFTA-DR) was

established in 2006 between the United States and Costa Rica, El Salvador, Guatemala, Honduras,

Nicaragua, and, later, the Dominican Republic

Andean Community (CAN): Formed in 1969, the Andean Community (in Spanish Comunidad Andina de Naciones, or CAN)

includes four South American countries located in the Andes Mountain range—Bolivia, Colombia,

Ecuador, and Peru

Southern Common Market (MERCOSUR): The Southern Common Market (in Spanish El Mercado Comun del Sur, or MERCOSUR) was established in 1988 between Argentina and Brazil but expanded to include Paraguay, Uruguay,

and Venezuela

Central America and the Caribbean: Attempts at economic integration in Central America and the Caribbean basin are much more modest than efforts elsewhere in the Americas. The Caribbean Community and Common Market

(CARICOM) was formed in 1973. There are 15 full members in CARICOM

Central American Common Market (CACM) was formed in 1961. Today, its members

are Costa Rica, El Salvador, Guatemala, Honduras, and Nicaragua.