Managerial Accounting Ch. C

1/47

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

48 Terms

How are financial statements used to analyze a business: Purpose of analysis

How are financial statements used to analyze a business: The 3 main ways to analyze financial statements

Horizontal analysis

vertical analysis

ratio analysis

How are financial statements used to analyze a business: Horizontal analysis

Year to year comparison

How are financial statements used to analyze a business: vertical analysis

provides a way to compare companies of different sizes

How are financial statements used to analyze a business: Ratio analysis

used most effectively to measure a company against other companies in the same industry

How are financial statements used to analyze a business: Corporate financial reports has to?

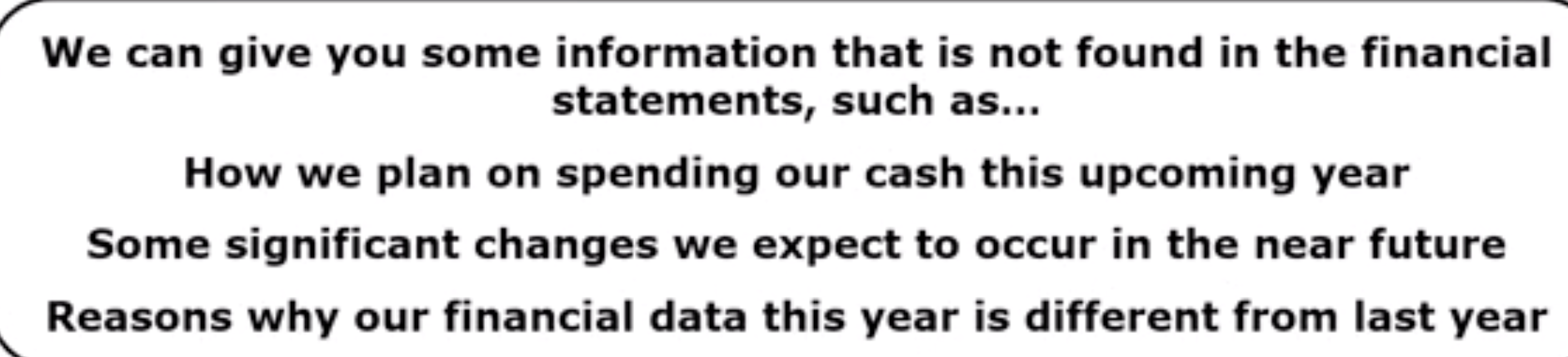

Final an annual reports each year known has 10k and quarterly reports known as 10-Q.

How are financial statements used to analyze a business: Annual report

How are financial statements used to analyze a business:

Let us explain to you what happened this past fiscal year.

How are financial statements used to analyze a business: MD&A

The section of the annual report that is intended to help investors understand the results of operations and the financial condition of the company. Might be a little biased and subjective.

How are financial statements used to analyze a business:

How are financial statements used to analyze a business: The balance sheet is often called a

Statement of financial position

How are financial statements used to analyze a business: The income statement is often called a

Statement of operations

How are financial statements used to analyze a business: Corporations are required to report multiple- period info for all financial statements

How are financial statements used to analyze a business: Notes to financial statements

How are financial statements used to analyze a business:

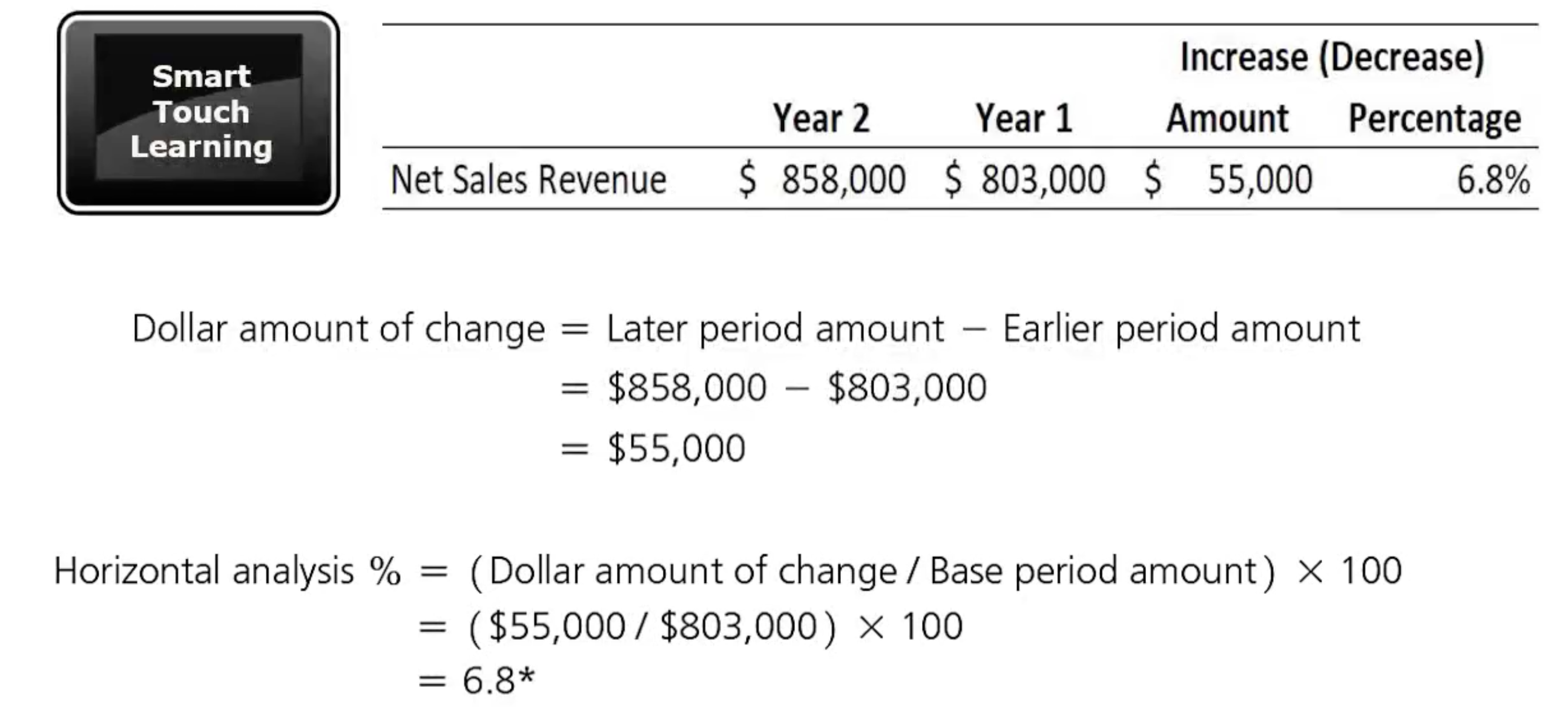

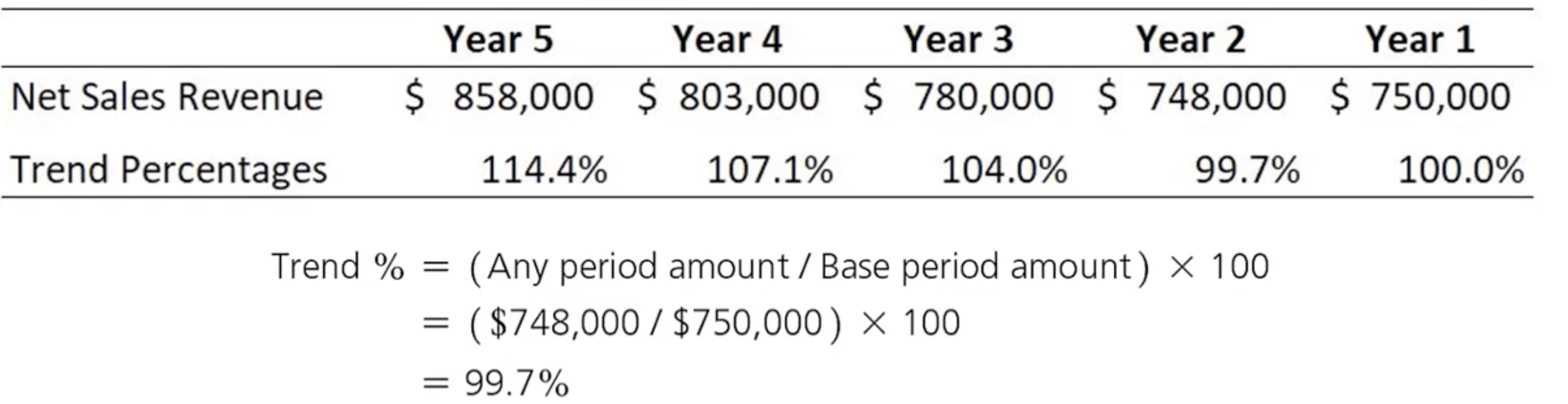

How do we use horizontal analysis to analyze a business: Horizontal analysis

The study of percentage changes in comparative financial statements

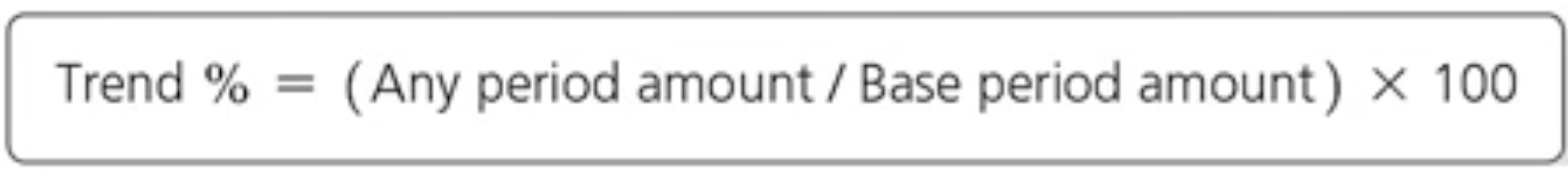

How do we use horizontal analysis to analyze a business: Trend analysis

How do we use horizontal analysis to analyze a business: Trend analysis example

How do we use horizontal analysis to analyze a business: diff between horizontal and trend analysis

How do we use vertical analysis to analyze a business: Vertical analysis

An analysis of a financial statement that reveals the relationship of each statement item to its base amount.

Income statement = Net sales

Balance sheet = Total assets

How do we use vertical analysis to analyze a business: Common- size statement

A financial statements that reports only percentages and no dollar amounts and removes dollar value bias.

How do we use vertical analysis to analyze a business: Dollar value bias

The bias one see from comparing numbers in absolute (dollars) rather than relative (percentage) terms

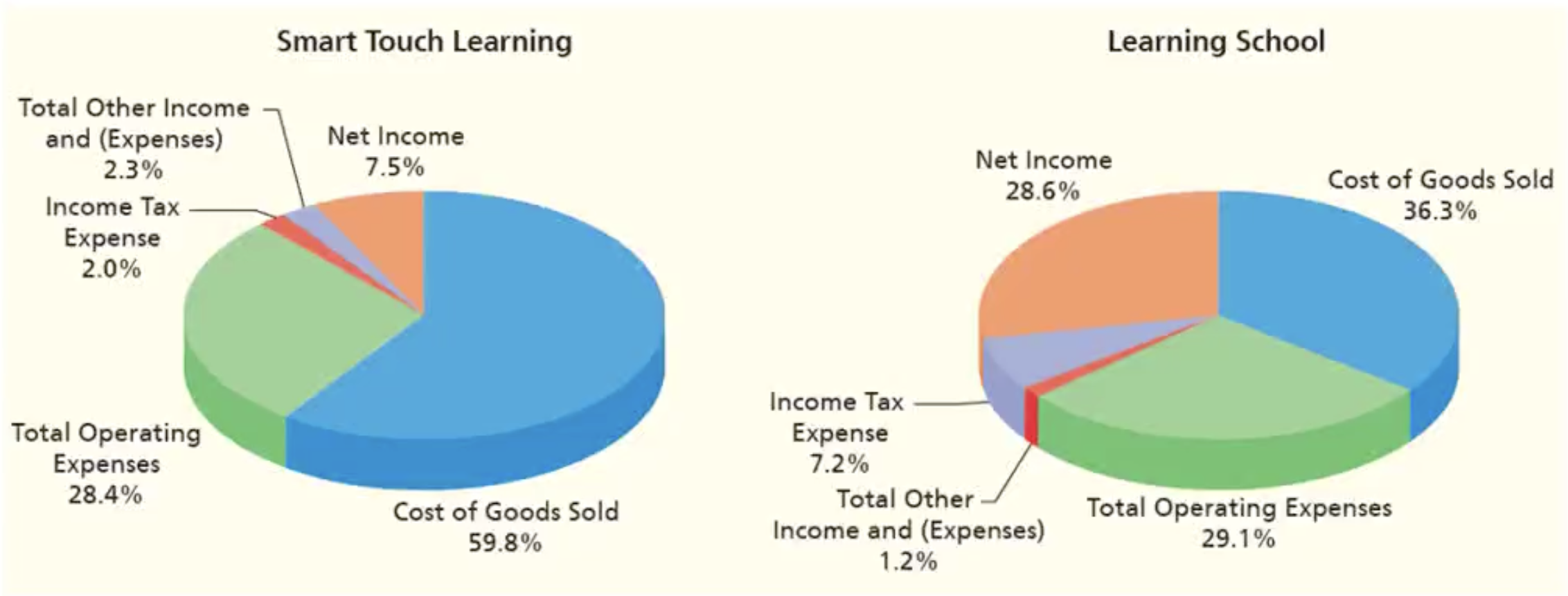

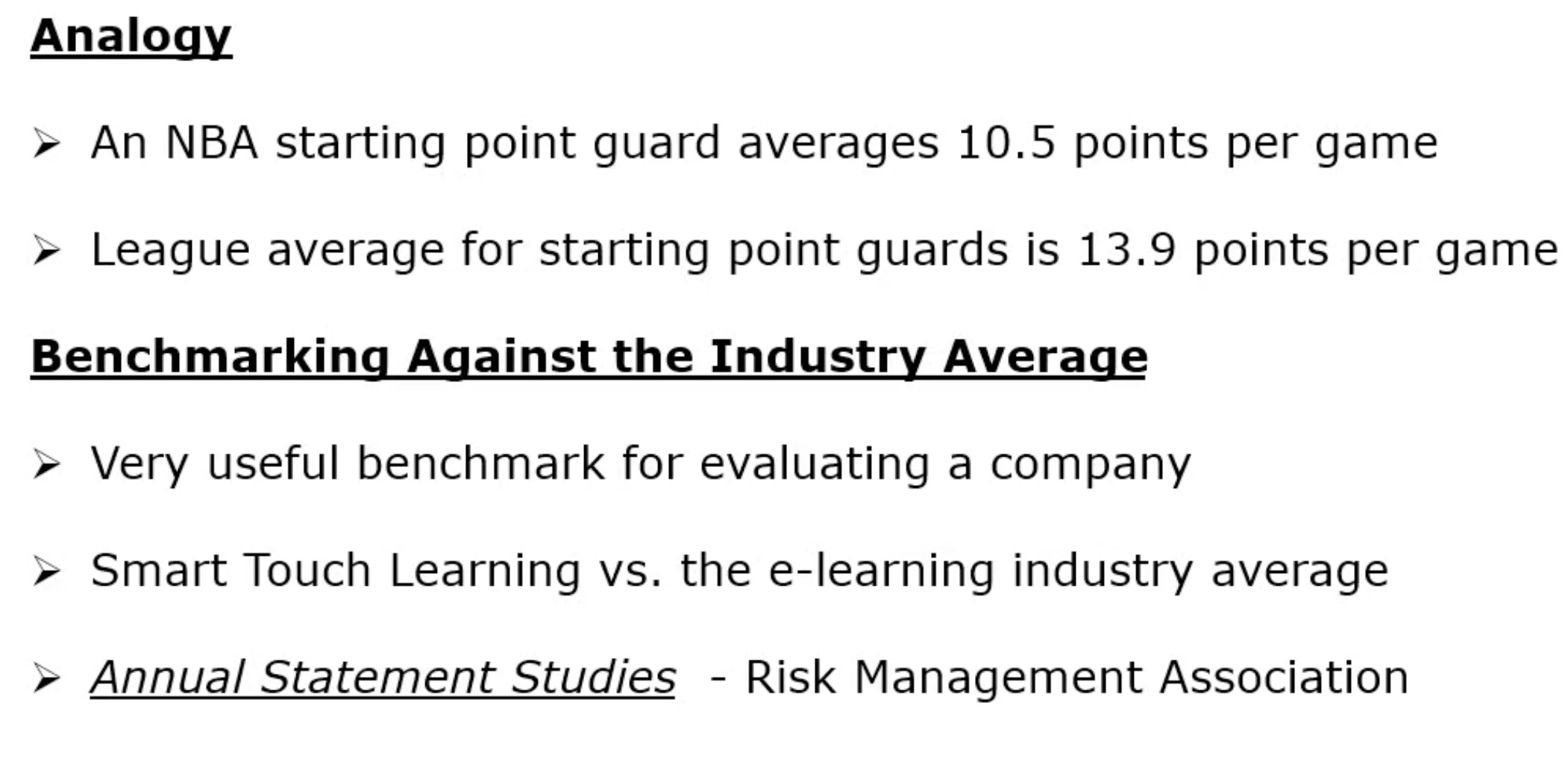

How do we use vertical analysis to analyze a business: Benchmarking

The practice of comparing a company with other leading companies

How do we use vertical analysis to analyze a business: benchmarking against a key competitor

How do we use vertical analysis to analyze a business: benchmarking against the industry average

How do we use ratio to analyze a business: Classification of ratio— evaluation of

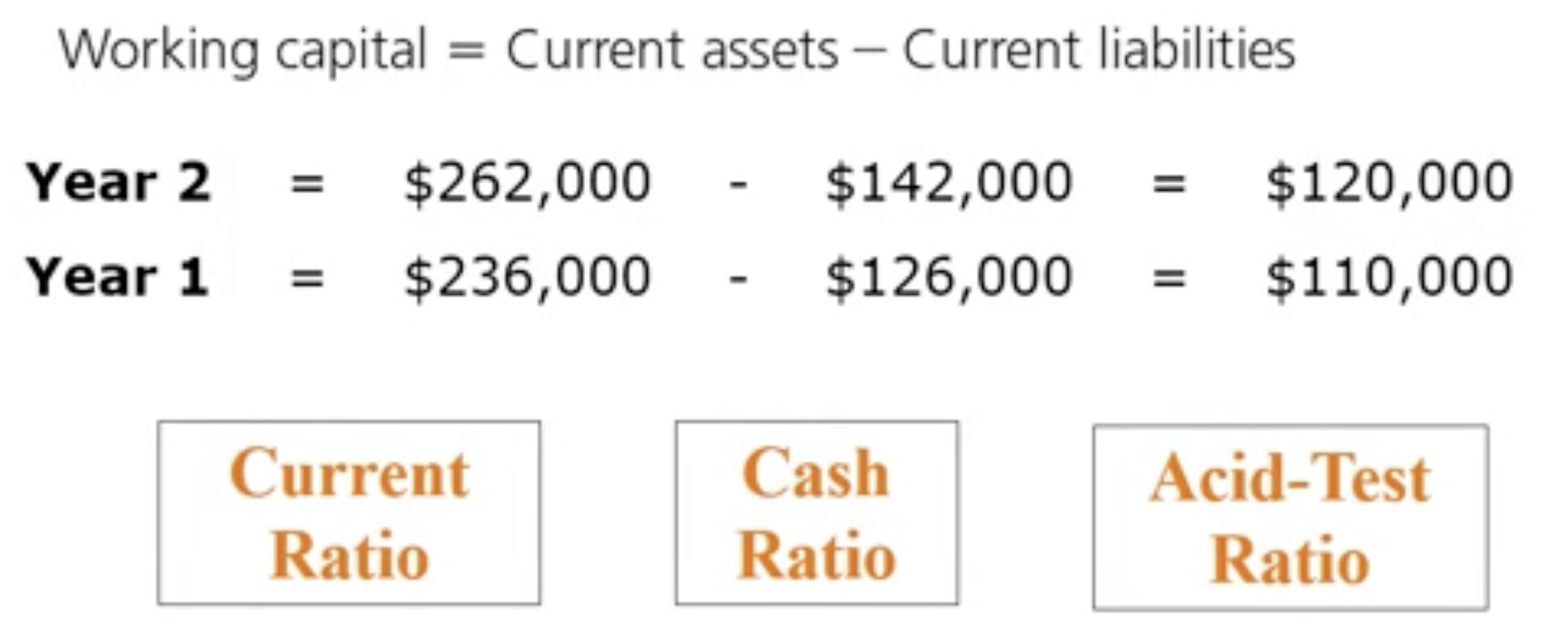

How do we use ratio to analyze a business: Working capital

a measure of a business’s ability to meet its short- term obligations with its current assets

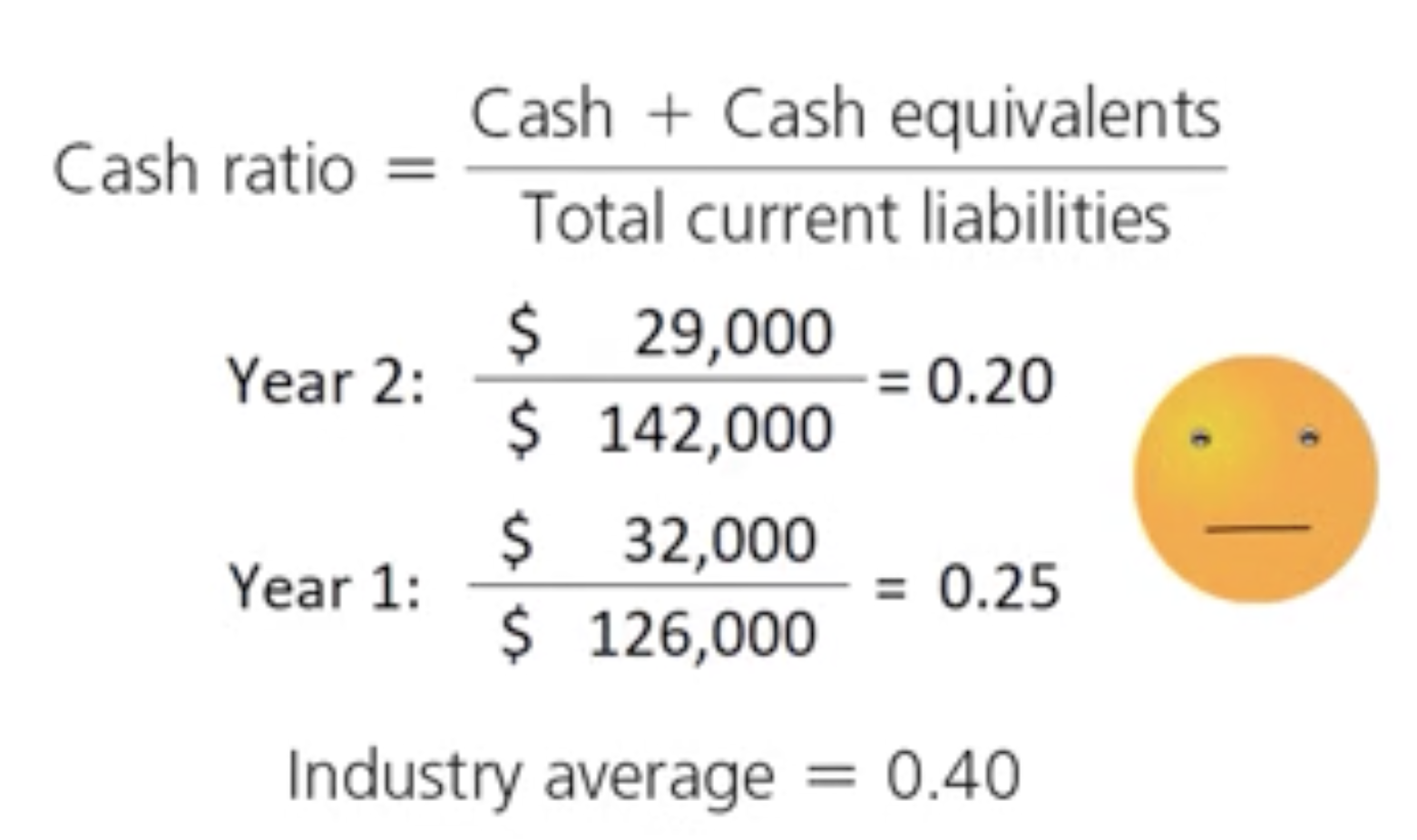

How do we use ratio to analyze a business: Cash ratio

A measure of a company’s ability to pay current liabilities from cash and cash equivalents

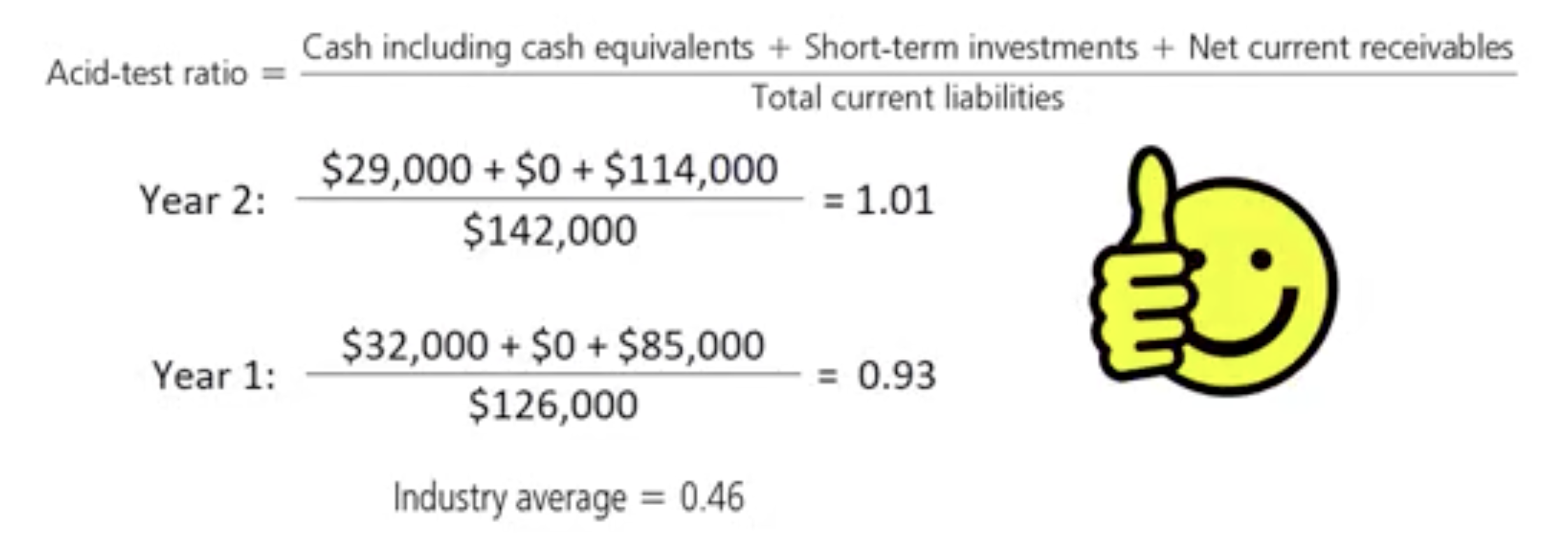

How do we use ratio to analyze a business: Acid- Test ratio

A measure of a company’s ability to pay all its current liabilities if they came due immediately

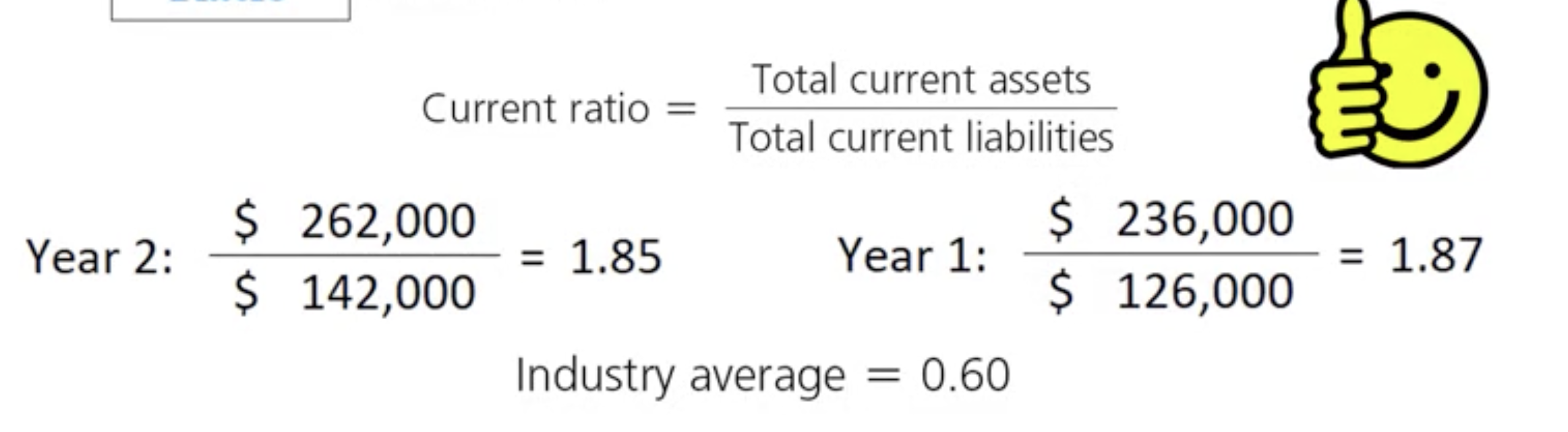

How do we use ratio to analyze a business: Current ratio

Measure the company’s ability to pay current liabilities from current assets

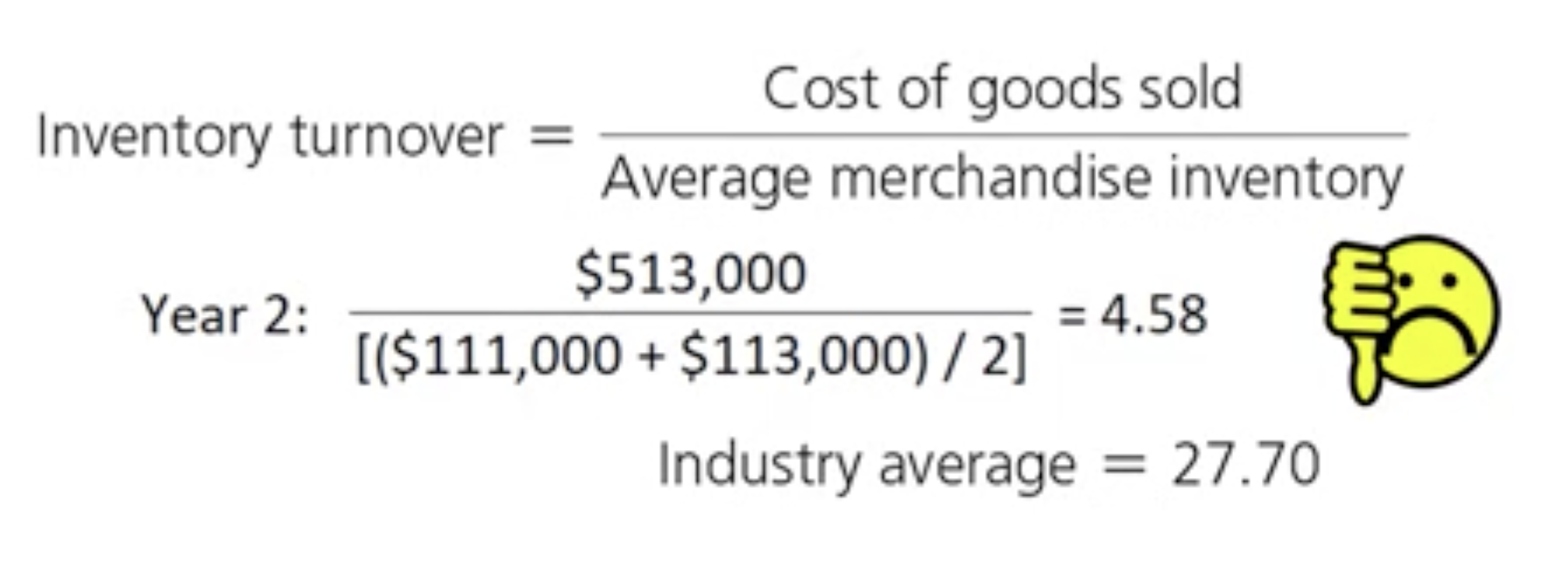

How do we use ratio to analyze a business: Evaluating the ability to sell merchandise inventory and collect receivables— Inventory turnover?

Measure the number of times a company sells its average level of merchandise inventory during a period

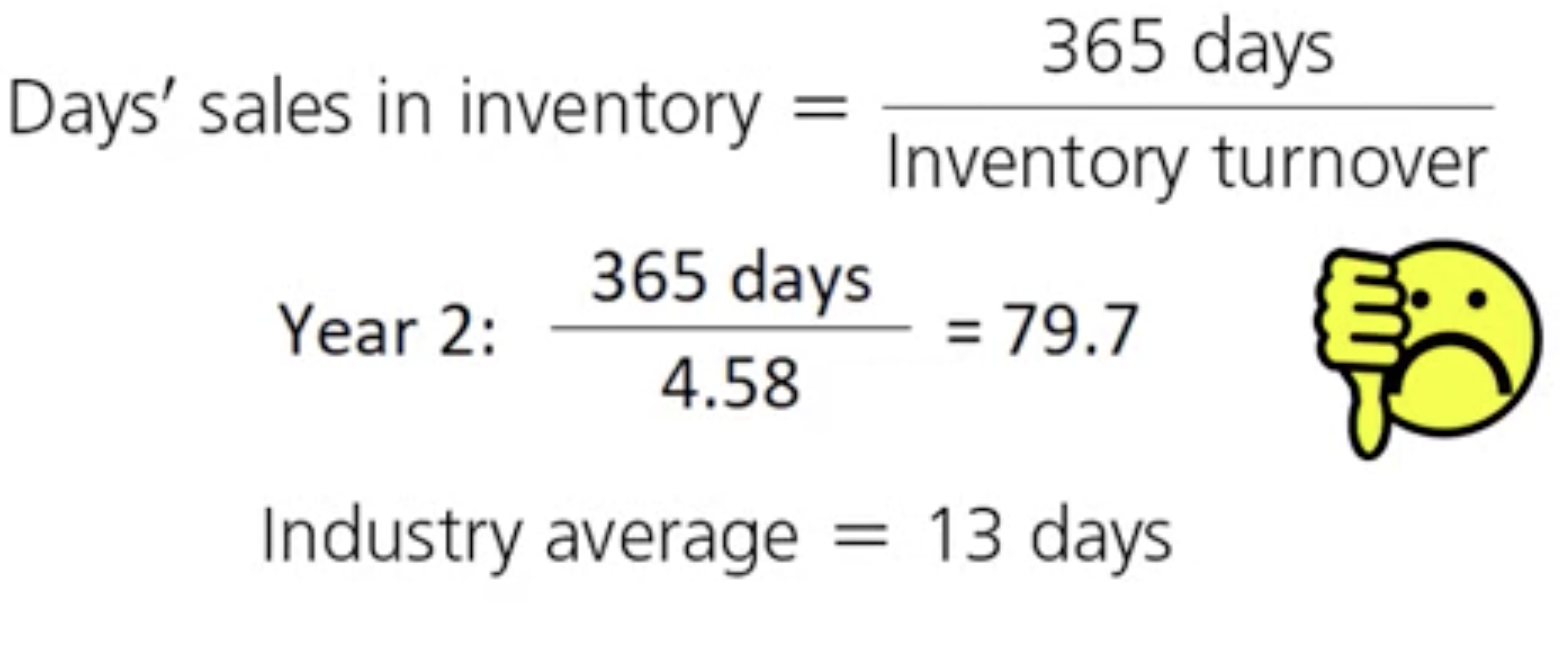

How do we use ratio to analyze a business: Days sales in inventory

Measures the average number of days that inventory is held by a company

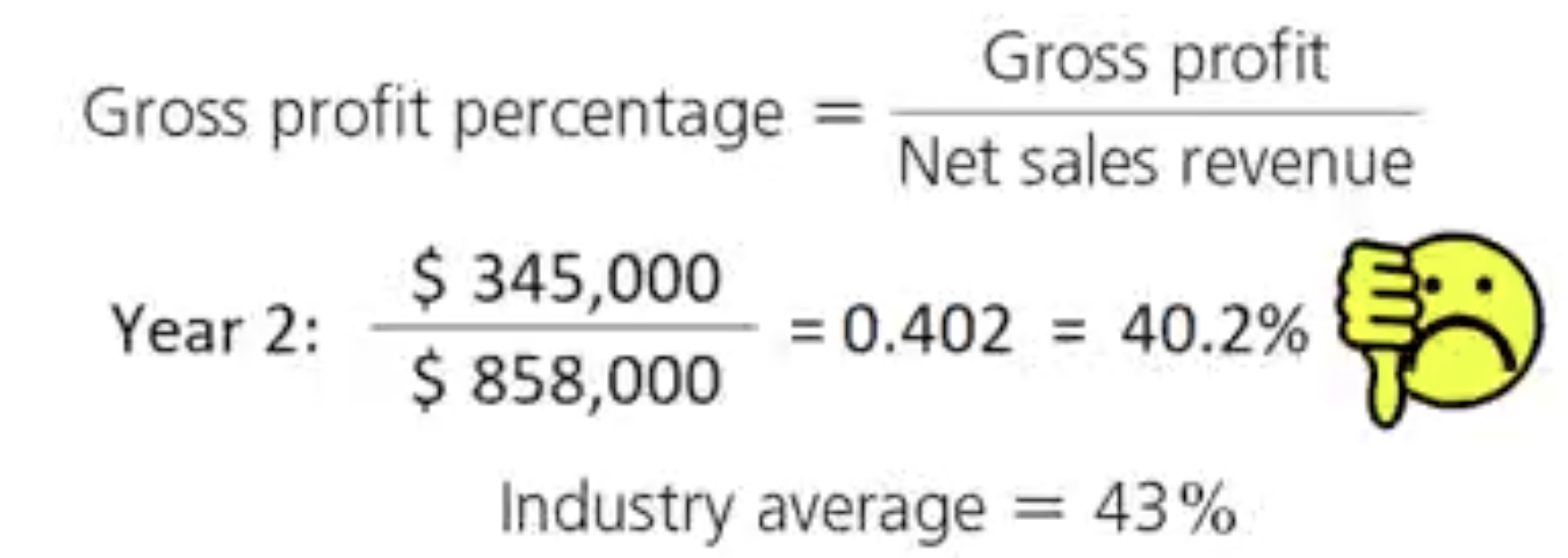

How do we use ratio to analyze a business: Gross profit percentage

Measures the profitability of each sale above the cost of goods sold

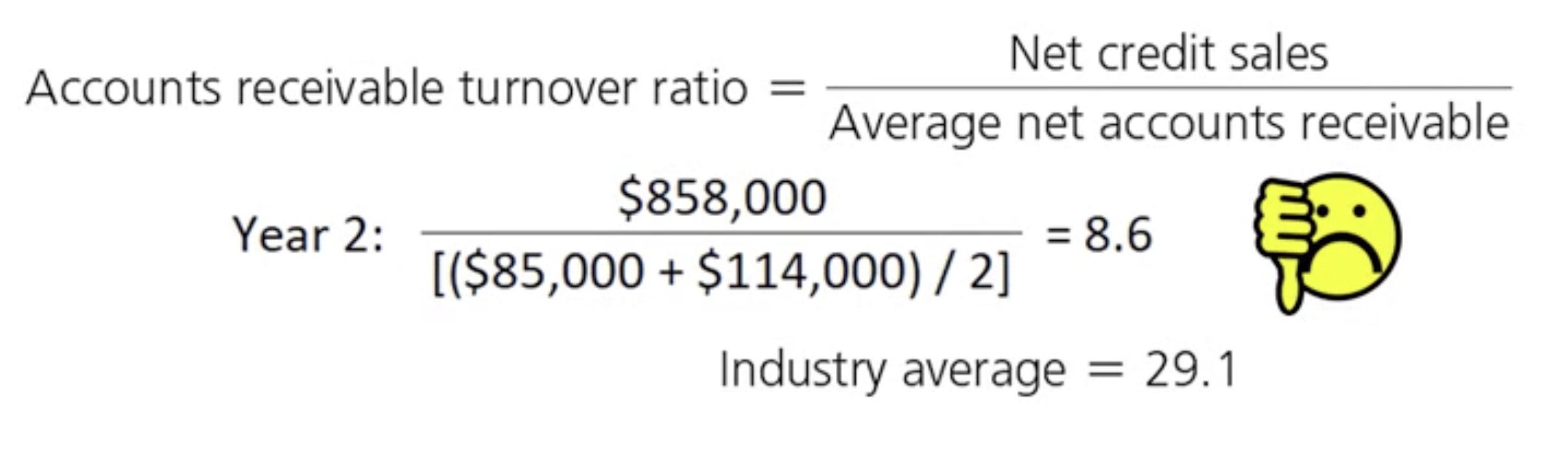

How do we use ratio to analyze a business: Accounts receivable turnover ratio

Measures the number of times the company collects the average accounts receivable balance in a year

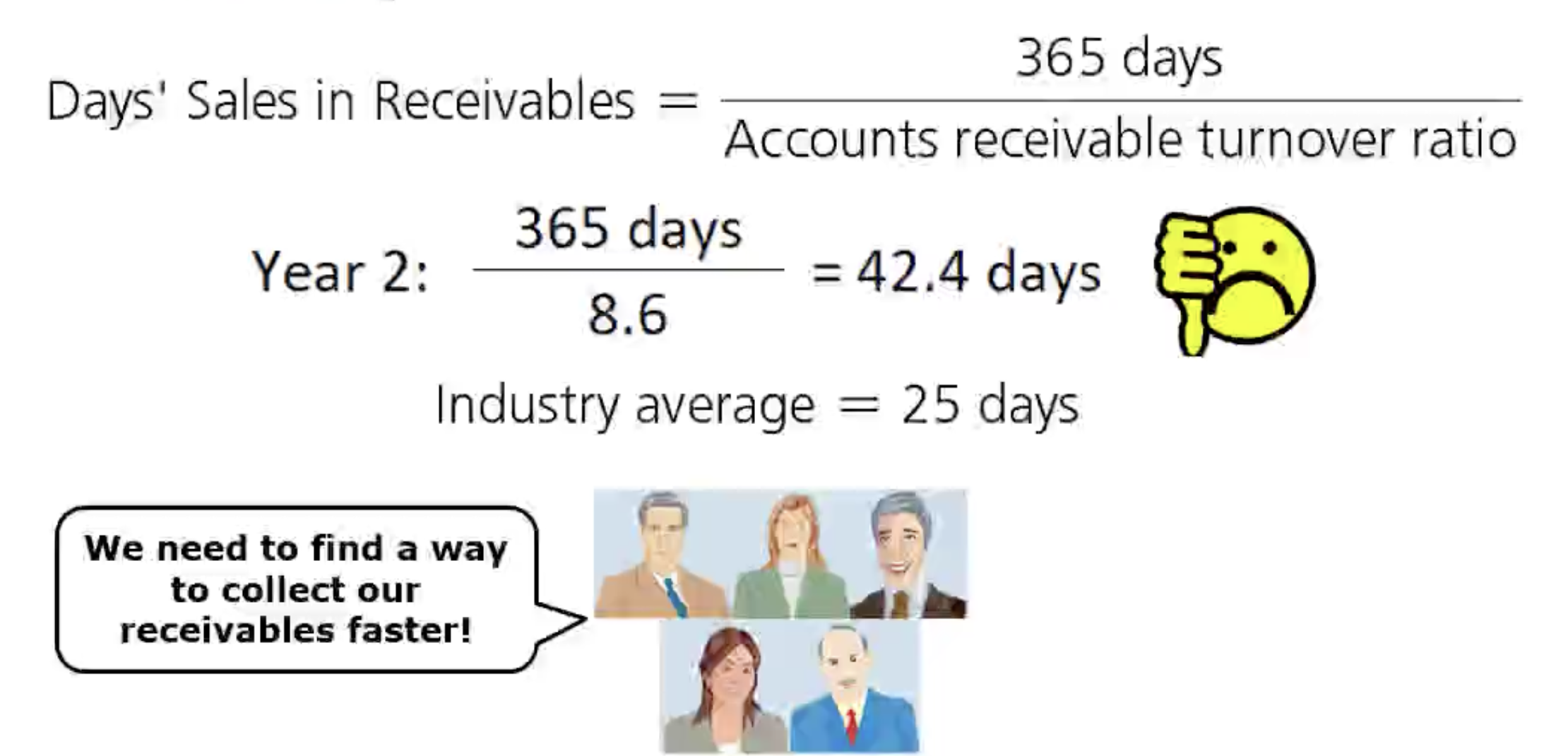

How do we use ratio to analyze a business: Days sales in receivables

Measures how many days it takes to collect the average level of accounts receivables

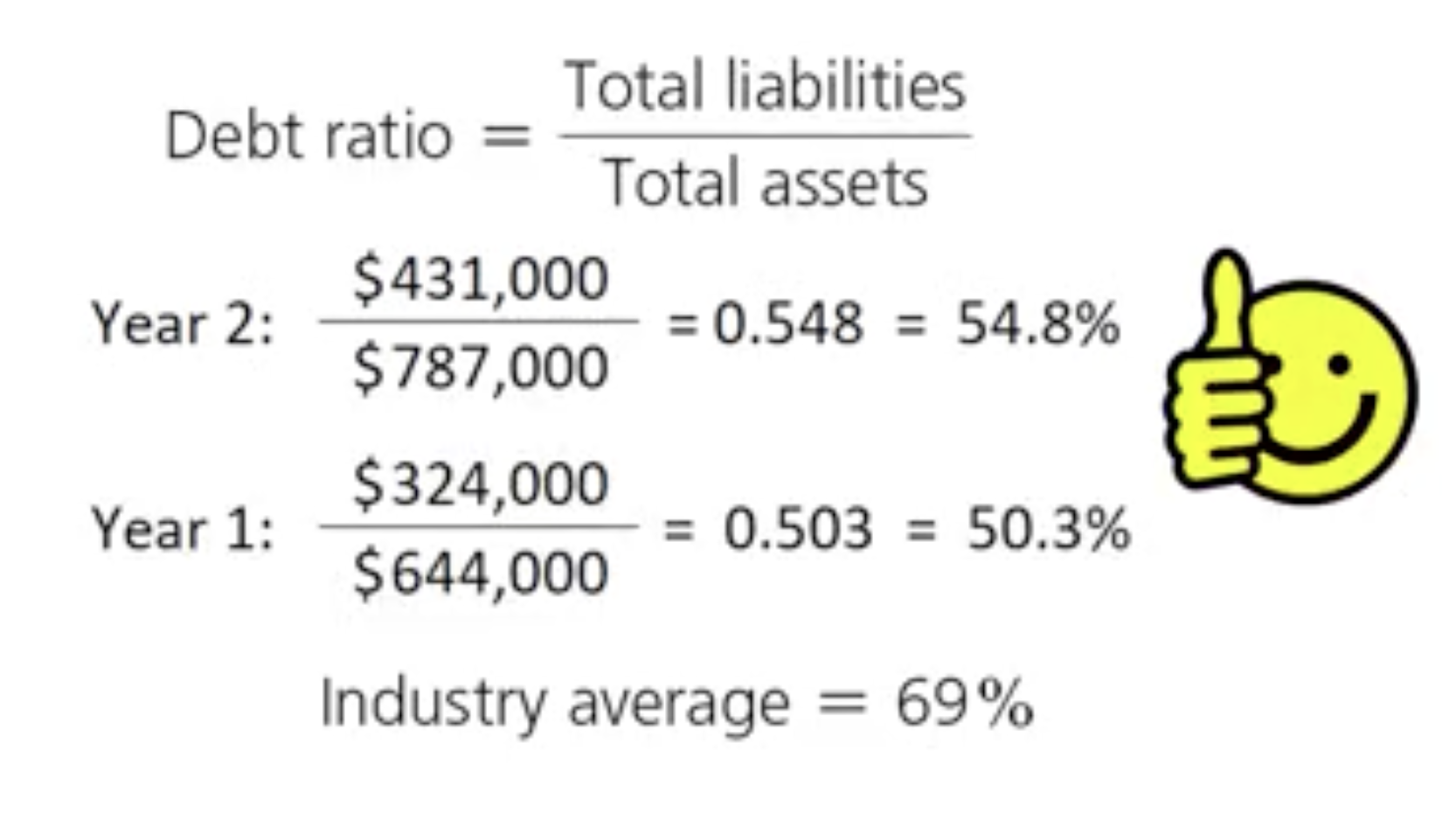

How do we use ratio to analyze a business: Evaluating the ability to pay long term debt— Debt ratio?

Shows the proportion of assets with debt

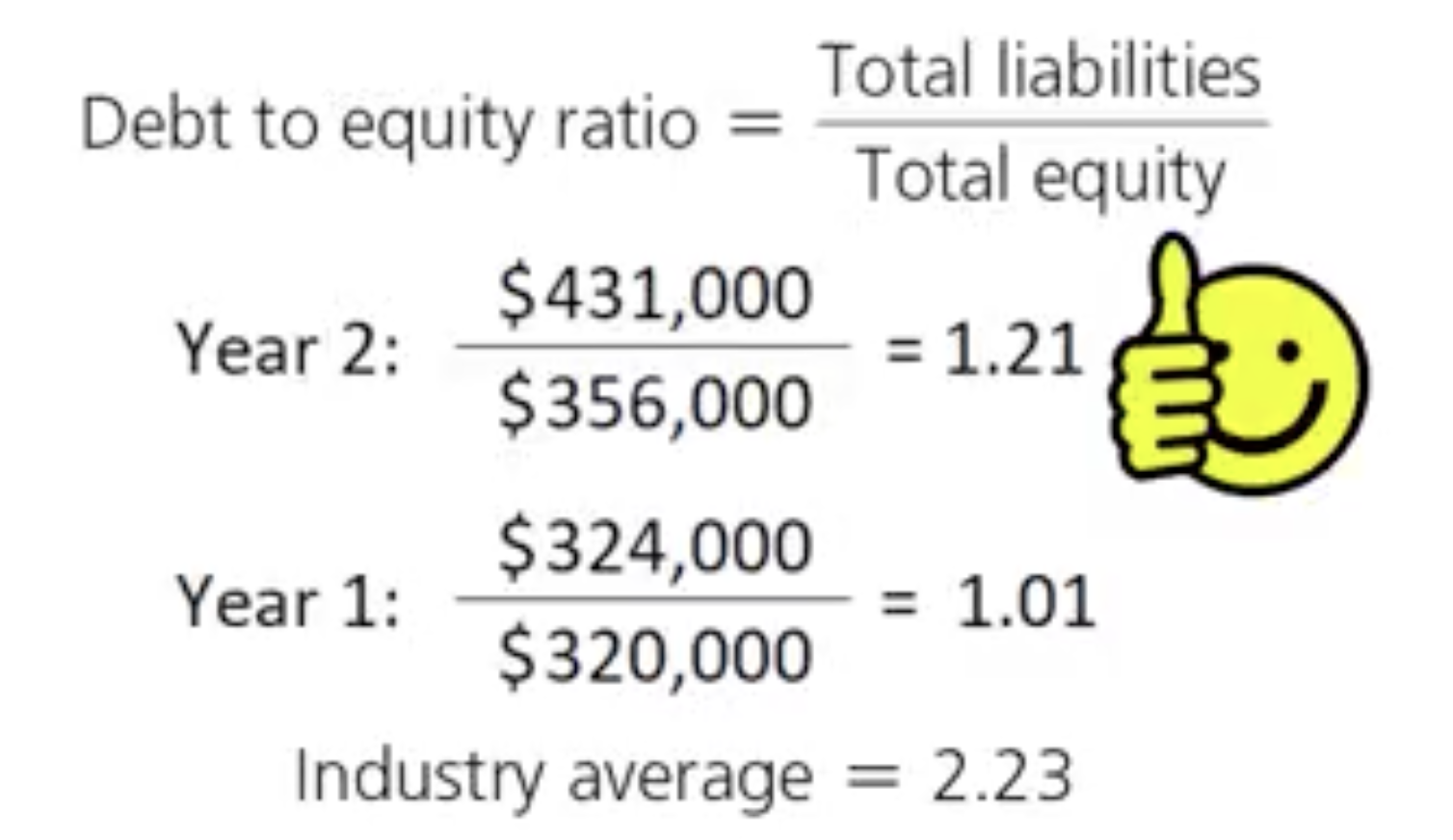

How do we use ratio to analyze a business: Dent to equity ratio

Measures the proportion of total liabilities relative to total equity

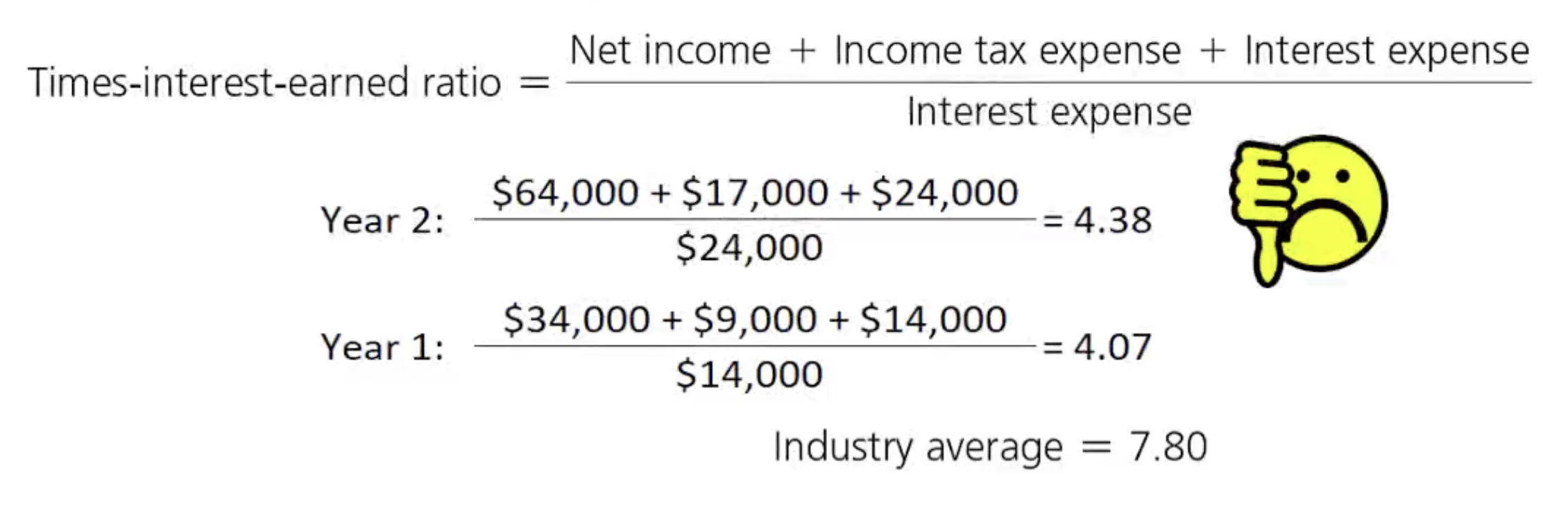

How do we use ratio to analyze a business: Times- interest- earned ratio

Evaluates a business’s ability to pay interest expense

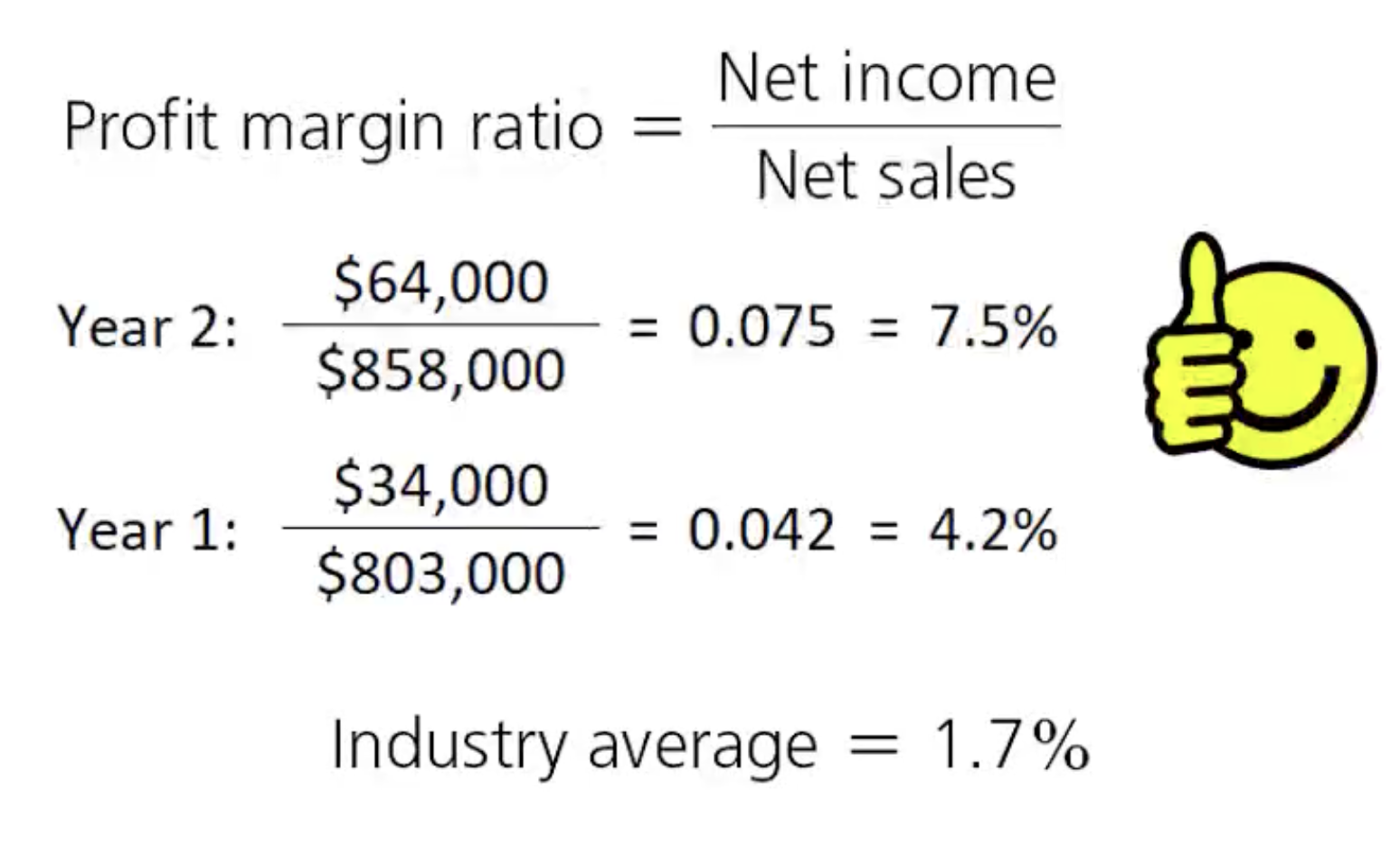

How do we use ratio to analyze a business: Evaluating Profitability— Profit Margin ratio?

A measure that shows how much net income is earned on every dollar of net sales

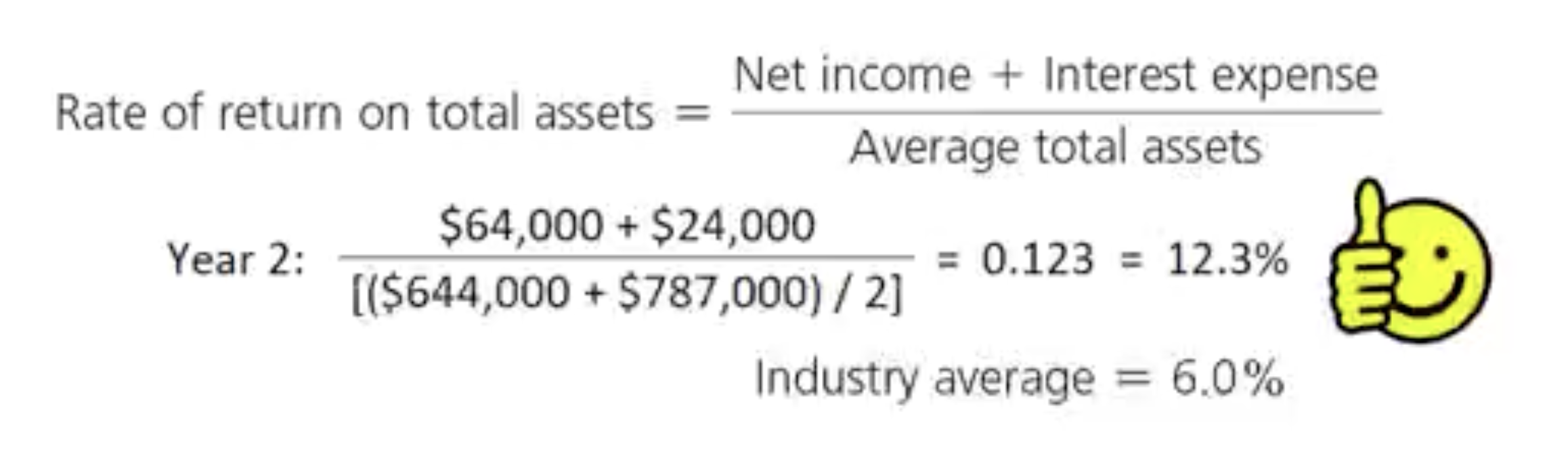

How do we use ratio to analyze a business: Rate of return on total assets

Measures the success a company has in using its assets to earn income

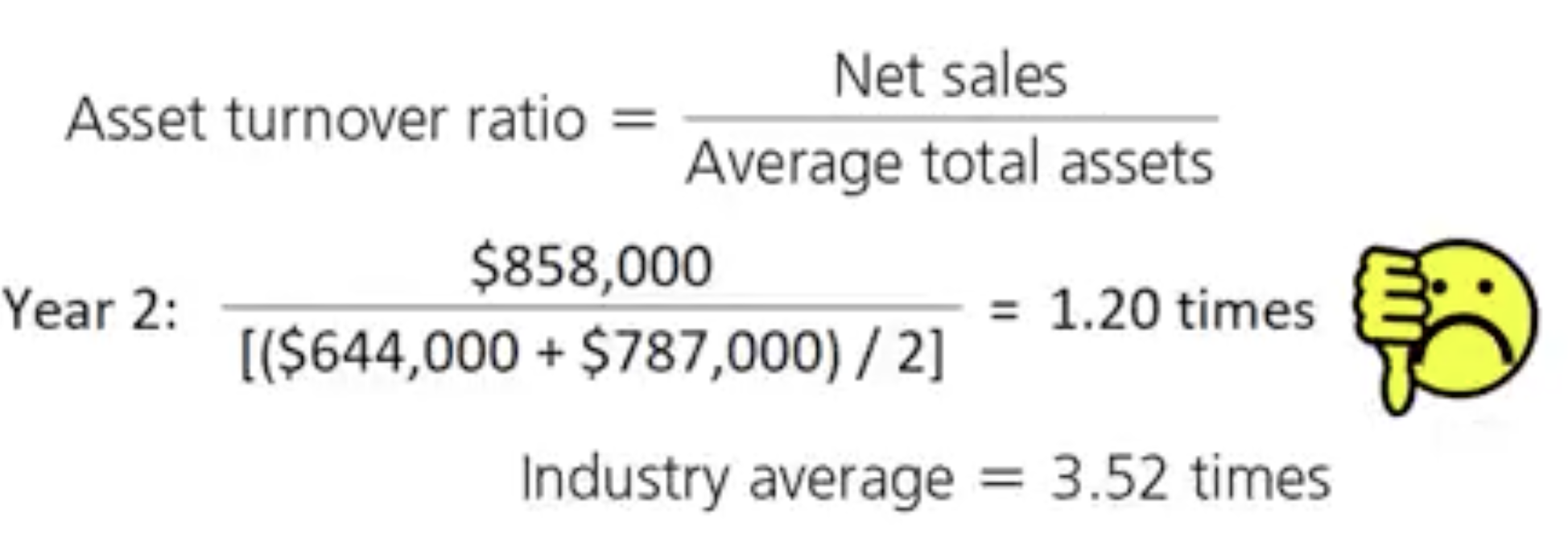

How do we use ratio to analyze a business: Asset turnover ratio

Measures how efficiently a business uses its average total assets to generate sales

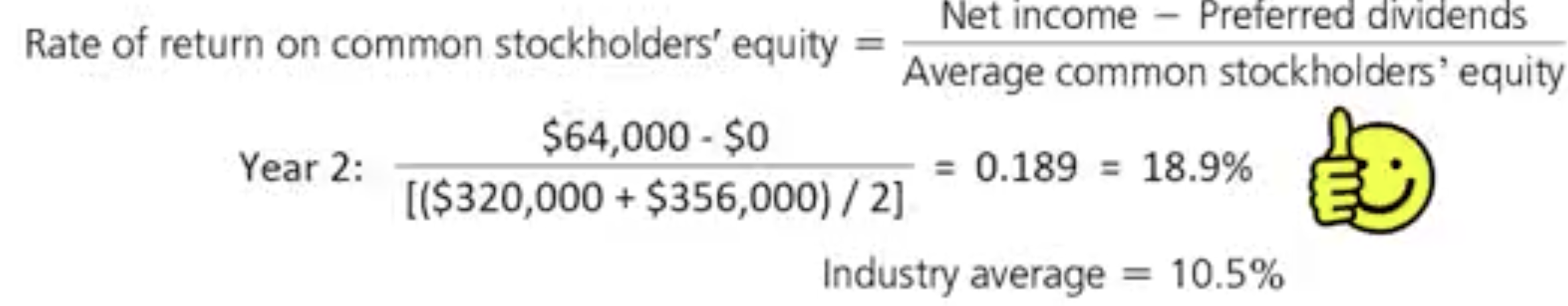

How do we use ratio to analyze a business: Rate of return on common stockholder equity

Shows the relationship between net income available to common stockholders and their average common equity invested in the company

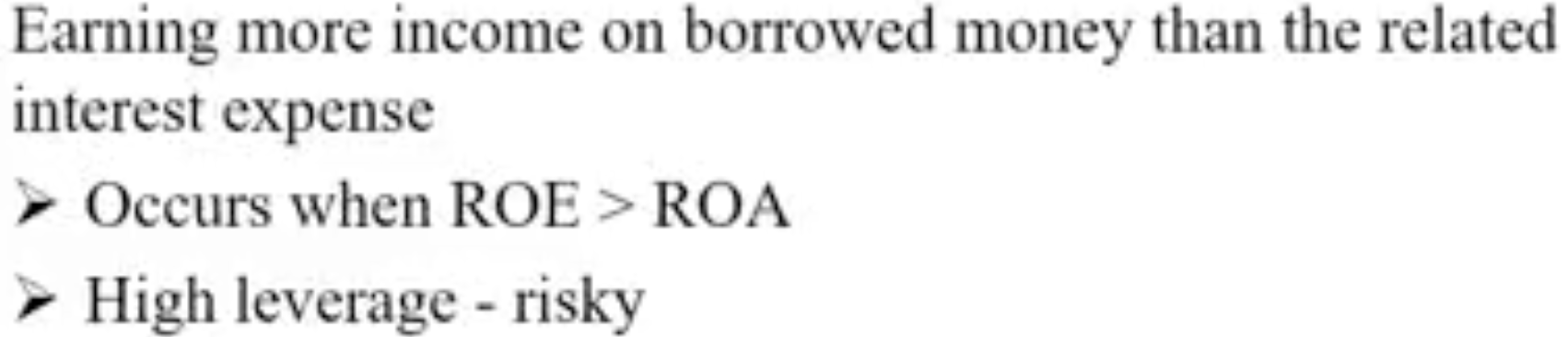

How do we use ratio to analyze a business: Trading on the equity

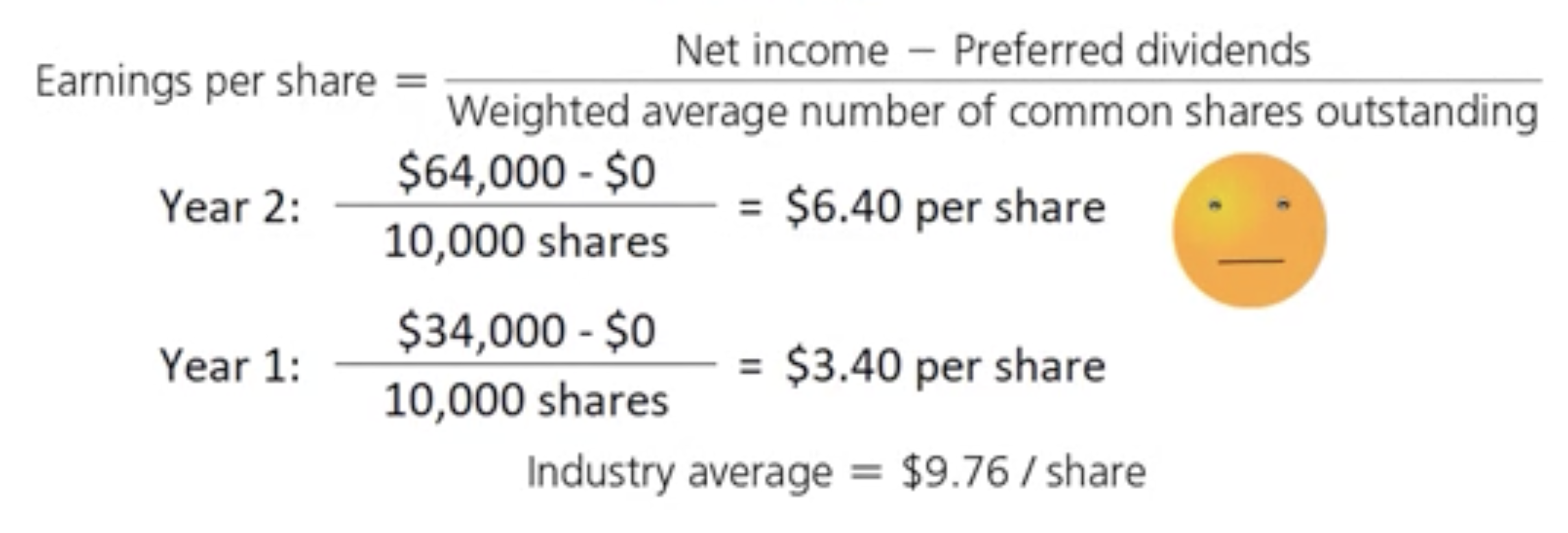

How do we use ratio to analyze a business: Earnings Per Share (EPS)

Amount of a company’s net income (loss) for each share of its outstanding common stock

Only ratio that must appear on the financial statements

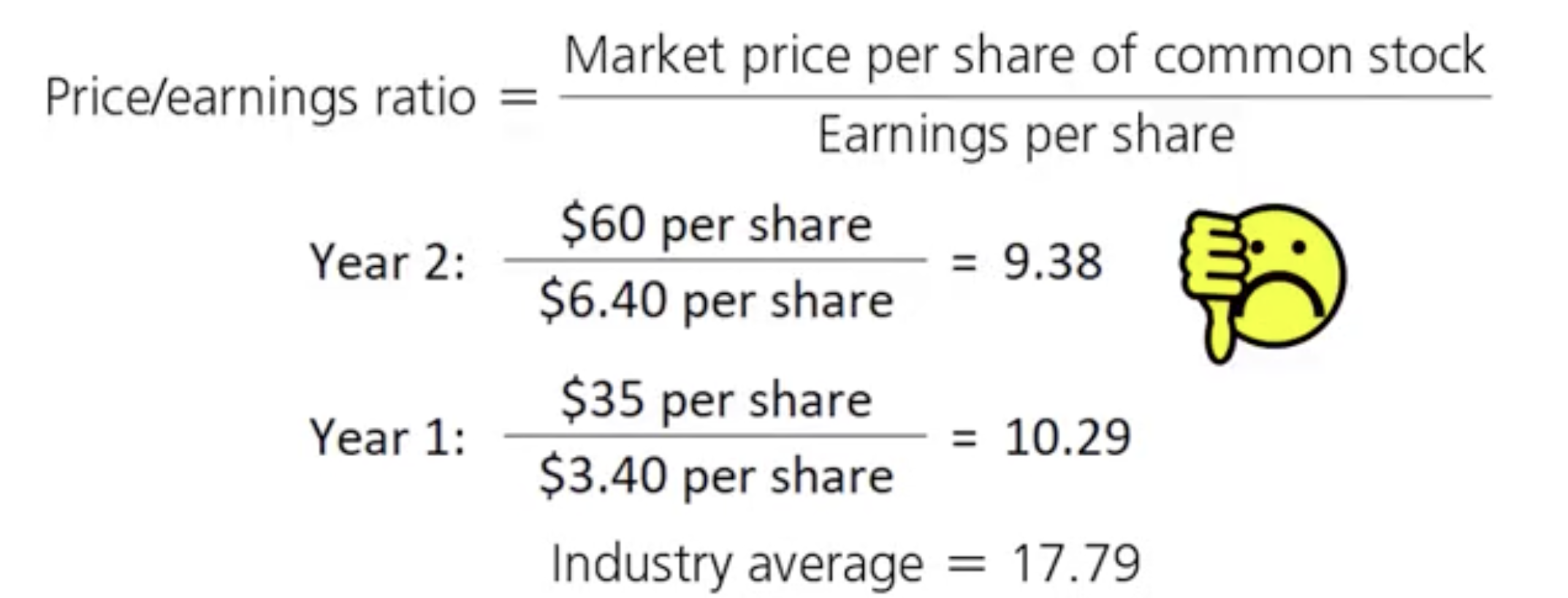

How do we use ratio to analyze a business: Evaluating stock as an investment— Price/ earnings ratio?

The ratio of the market price of a share of common stock to the company’s earnings per share

Shows the market price of $1 of earnings

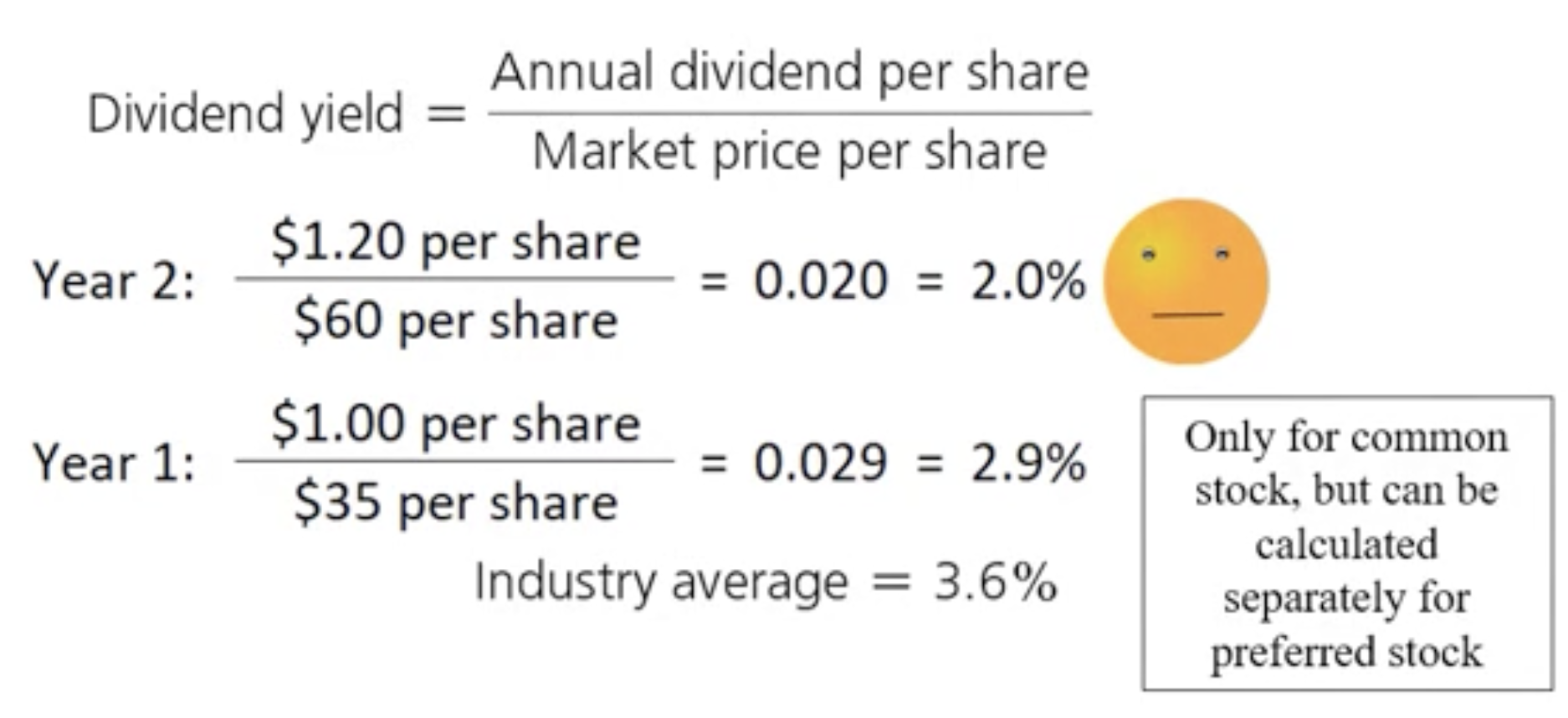

How do we use ratio to analyze a business: Dividend yield

Measures the percentage of a stock markets value that is returned annually as dividend to stockholders

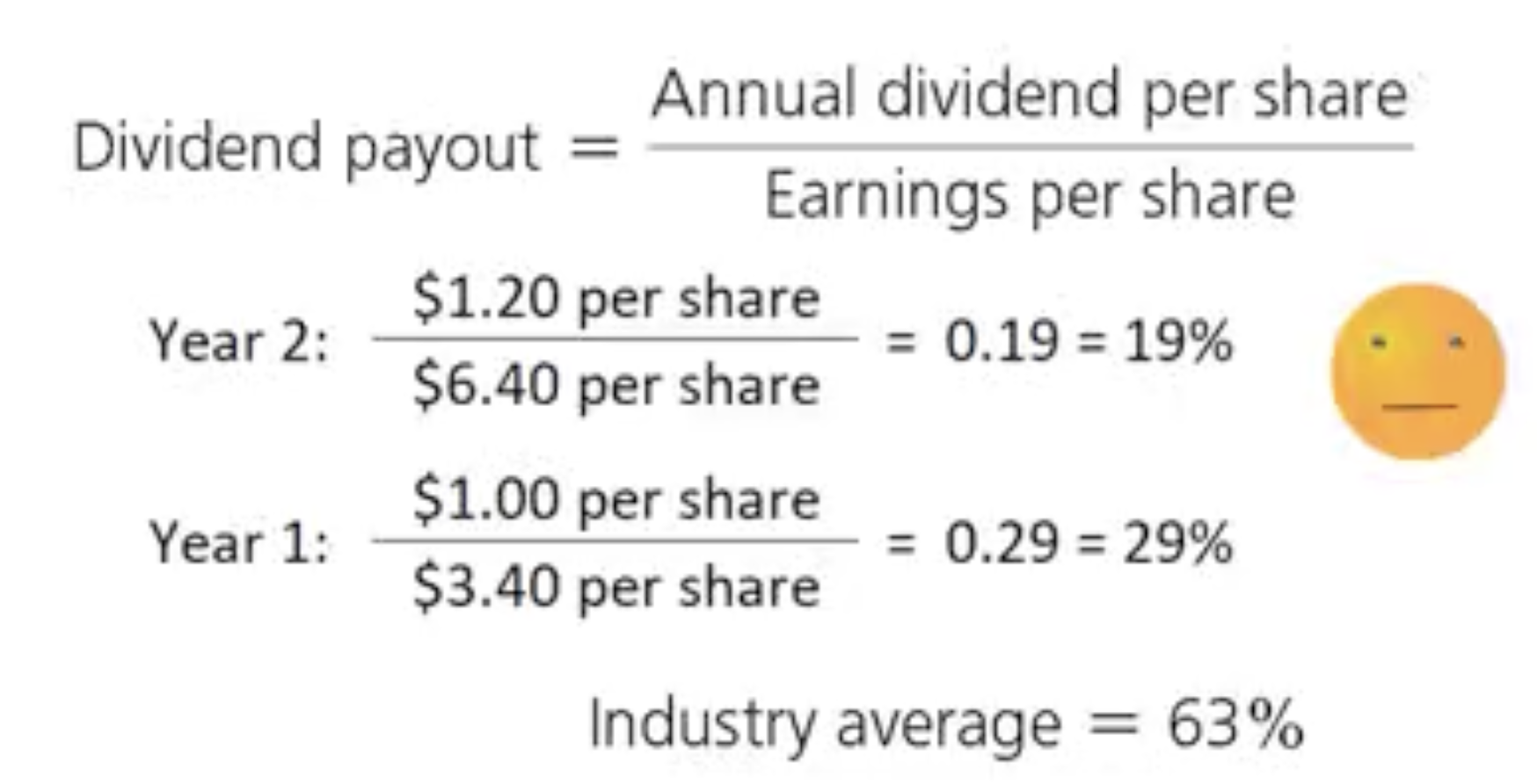

How do we use ratio to analyze a business: Dividend payout

Measures the percentage of earnings paid annually to common shareholders as cash dividends

How do we use ratio to analyze a business: Red flags in financial statements analyses